Brand Reawakening (SILVER)

Client Credits: Stonemill Bakehouse

President: Gottfried Boehringer

Director of Sales: Gary Luisser

Consultant: Phil Donne

Agency Credits: Mass Minority

Chief Creative Officer: Brett Channer

Managing Director: Christine McArthur

Chief Strategic Officer: Esmé Rottschafer

Creative Director: Tyler Serr

Director of Art & Content: Gary Holme

Copywriter: Roya Hakami

Art Director: Marina Khouzam

Designer: Marina Khouzam

Designer: John Tisdale

Developer: Jacoub Bondre

Developer: Robbie Barnett-Kemper

Integrated Producer: Chris Taylor

Integrated Producer: Jack Taylor

Integrated Producer: Leah Burnside

Illustrator: John Coburn

Director: Sean Frewer

Director of Photography: Blair Locke

CGI & Digital Imaging: Pierre Bourjo

Campaign Manager: Kelly Radke

Campaign Services Intern: Harriet Abbott

Media Agency: Mass Minority

Chief Media Architect: Julie Myers

Chief Data Scientist: Jeremy Chrystman

Media Technologist: Jerry Teo

Social Media Manager: Sneha Salke

Section I — CASE PARAMETERS

| Business Results Period (Consecutive Months): | August 2016 – March, 2017 |

| Start of Advertising/Communication Effort: | August 2016 |

| Base Period as a Benchmark: | August 2015 – July 2016 |

| Geographic Area: | Ontario |

| Budget for this effort: | $500,000 – $1 million |

Section IA — CASE OVERVIEW

Why should this case win in the category (ies) you have entered?

By proving that where fast bread dominated, slow crafted bread could prevail –Stonemill was able to turn around from a brand that was losing share in a declining category to a robust brand with dramatic sales increases.

Whether you’re reading the headlines from the UK, USA, or Canada, the bottom-line is the same – the bread category has been in decline unable to replace volume losses in sliced bread. In an industry looking for its new normal– Stonemill Bakehouse proved that where fast bread dominated, slow bread could prevail. By understanding and authentically aligning to shifting consumer values and new expectations around food, and by refocusing the brand on its core equity as a slowly, naturally fermented bread maker, we unlocked new value in the bread aisle – slow crafted bread. Within the campaign period, Stonemill saw a total $ sales increase of 23% without harming its margins or compromising its product. Stonemill was so successful in shaking up the bread aisle that, in less than a year, the brand increased its enterprise value significantly, attracting the attention of Grupo Bimbo resulting in a sale that would allow the brand to go National; all this with a total marketing investment of less than $1 million.

Section II — THE CLIENT’s BUSINESS ISSUES/OPPORTUNITIES

a) Describe the Client’s business, competition and relevant history:

Stonemill had been baking high quality bread the European way for three generations but it wasn’t top of mind in the bread aisle – business was beginning to decline.

- Confined by functional hard health propositions and claims that were out of pace with evolving food values

- Loyal, older buyer with low volume consumption and motivated by food restriction

- Unsuccessful past product marketing efforts had hurt the brand and ignited a decline in share of market

- At risk of being swallowed up by category offering similar looking ingredient SKUs and wheat alternatives with health claims

- Competitive, fragmented category trying to solve volume problem with an annual growth rate of 1.9% (IBIS 2012-2017)

- Focus on gluten, carbohydrates and wheat had reduced category consumption and given bread a bad wrap

b) Describe the Client’s Business Issues/Opportunities to be addressed by the campaign:

Stonemill had the potential to replace volume in sliced bread with a category development approach based on a gap we discovered between artisanal bakery bread and mass manufactured sliced bread that was being under-serviced in the bread aisle for a whole new generation of millennial shoppers with different values and expectations around food.

- Aligning with new customer values and expectations in lifestyle will increase category interaction and brand attraction and loyalty

- In a competitive and fragmented category that has been shrinking year over year in volume we can attract a larger share of market at higher margin and attract the millennial family that was not as engaged in the bread category

- And a category that demands a significant proportion of store footprint within a grocery store environment

c) Resulting Business Objectives: Include how these will be measured:

- Set-up Stonemill up for significant growth ($ and unit volume) by creating new value in the bread aisle.

- Get food conscious people, who buy sliced bread, to rethink the choices they make in the bread aisle to gain share in the sliced bread segment.

- Increase sales volume by at least 10% to current sales in the sliced bread segment by Q2 2017 in Ontario

- Build back demand with key retailers that could open the brand up to national sales

Section III — YOUR STRATEGIC THINKING

a) What new learnings/insights did you uncover?

Bread isn’t inherently unhealthy. ‘Fast’ bread made with industrial practices was taking the nutrition out of bread, giving bread a bad name, and taking money out of the category. In fact, there is a great deal of discussion around the correlation between fast made processed breads that started in the 50’s and problems with gluten and other bread related digestive health issues. It’s this information in market that is driving sales volume of the category down.

People care about bread but there’s no loyalty in the bread aisle. People are almost as involved with bread as they are with milk in consideration and choice. Sliced bread may be considered a low involvement category but it isn’t because people don’t care about bread – they just aren’t finding the kind of brands they are looking for. They don’t want industrial bread masquerading as artisanal or healthy and they spend time to ensure they don’t buy one that is.

Millennials are food conscious not food pretentious. Millennials have a different relationship with food. They want healthier, more natural food choices focused on real food and quality, not luxury or hard health. They grew up during the obesity crisis, the beginning of the slow food movement, local and craft movements. They don’t want to compromise between every day food that’s nutritious and premium food that tastes good – and aren’t always sure when they are compromising their values for convenience in the grocery aisle. They celebrate the values of home, farming, and a simpler approach to life. They are willing to pay more for brands that reinforce their lifestyle values and in practical terms, they represent a higher average per day bread consumption opportunity.

The category had a gap. When we looked at other millennially engaged categories, like craft beer, we noticed that in comparison, bread had no equivalent concept. The category was trying to force fit artisanal equities and mass together instead of understanding the new value construct between mass and artisanal. Many of the motivations and rewards that have fueled the craft movement are reflected in the new shared values on food that Boomers, Generation X and Millennials share as a common mind-set.

The post-industrial era of meaningful consumption goes against fast. “It is a cultural revolution against the notion that faster is always better. Doing everything as well as possible, instead of as fast as possible. It’s about quality over quantity in everything from work to food to parenting.” Carl Honoré, In Praise of Slow

Fermentation time is the key to nutritious bread. Stonemill had taken for granted its European approach to bread-making and its fundamentals of old cultures, letting fermentation happen naturally over time, and using good, non-GMO, all natural ingredients. It had been focused on hard health benefits and claims.

Stonemill equity attributes were already aligned with new values. It had the products and capabilities to fill the category gap between mass and artisanal to grow share with motivated food conscious millennials that were being under-served by the category.

We solidified these insights into a category development brand strategy; uncompromisingly slow crafted bread made for everyday enjoyment.

b) What was your Big Idea?

You can’t hurry slow because better bread take time. Stonemill Slow Crafted breads takes all the hurry out of the process and the ingredients. What’s left is naturally nutritious, great tasting bread that doesn’t have preservatives, GMO’s or additives.

c) How did your Communication strategy evolve?

We reframed the Stonemill brand by tapping into the truth of the brand and the shared values of the craft movement to attract and motivate the “millennial” mind-set and the way they choose brands starting at shelf with new packaging and the repositioning throughout all communication platforms, including sales presentations, web, social, and targeted mass media.

Fast is not as good as slow. For launch, our big idea needed to communicate the value of slow crafted bread by comparing the compromises of fast with the benefits of slow. “You can’t hurry slow”, gave us a versatile and memorable construct to dial up functional and emotional benefits as needed. Making ‘fast’ the antagonist was the fastest way to land our slow proposition, because people already believed it.

- Create category breakthrough high impact packaging to signal new value at shelf

- Engage millennial moms in the benefits and enjoyment of the slow crafted

- Build credibility through information transparency and commitment and truth of the brand

- Illustrate the short-cuts and compromises of fast

d) How did you anticipate the communication would achieve the Business Objectives?

We didn’t just reposition a bread brand with declining sales. We found a new category segment of value for the brand to authentically own that retailers and people could get behind – that also challenged category norms to appeal to a “millennial” mind-set attracted to real, crafted food choices and lifestyle values. Third party research indicated that this white space for slow crafted that we had identified between mass and artisanal, was appealing but untapped. Packaging concepts that clearly communicated the slow crafted proposition scored top box for being both appealing and persuasive. Stonemill had an 85% positive response to rebranding, and a 78% positive purchase consideration. Scores that had never been achieved in grocery before.

(Source: Q.I. Value Systems Inc. 2016)

Section IV — THE WORK

a) How, where and when did you execute it?

The launch time frame took advantage of two key behaviors, i) higher organic search propensity around bread, ii) the back to school time-frame when aisle interaction would be higher. We knew by starting in the bread aisle where people make their choices most often we would drive the biggest impact for people and retailers alike.

We amplified the meaning and value of slow crafted by exploiting the tension between fast and slow in a variety of ways across channels.

New packaging inspired by other craft categories communicates, ‘better bread takes time’.

The business showed uncompromising commitment to the new strategy by baking slow crafted right into its name – Stonemill Slow Crafted Bakehouse. New packaging design prominently communicated slow crafted with the key message of, ‘better bread takes time’ which highlighted the value and benefits associated with fermentation. Colour and pattern – not seen in the category before, disrupted at shelf to attract food conscious shoppers with craft values. Shelf placement was varied which ultimately increased exposure and standout from category. High demand also led to unique permanent stand-alone shelving – not easy to achieve in retail.

Video introduces people to the concept of slow crafted and explains why, You can’t hurry slow.

“Until then, I wait.” Whether in the field, the greenhouse or, the bakery, our down to earth Stonemill Baker explains why there is no fast way to make slow crafted bread. He romances the product attributes that support the slow crafted proposition in settings that take you away from industrial bread and into authentic craft cues.

A crafty new website brings lifestyle to the slow crafted bread proposition.

The website is an important channel for developing ownership of the slow crafted space and differentiate from industrial bread. Using a “handmade digital” style – inspired by the quaint economy and maker culture- the website is designed to serve-up information in a relatable and enjoyable way. The site creates a free flowing, story-based interaction which feels decidedly alive. You’ll also find our Stonemill Baker hard at work on the FAQ page, where he answers questions in video format when you ask him (type in) a question related to why you can’t hurry slow.

Search takes advantage of organic bread interaction to drive to site.

Paid search directed relevant search traffic to the newly launched Stonemill website, specifically product pages (i.e., bread SKUs), campaign pages (i.e., Ask Us Anything) and the home page via relevant keywords that correlated to this new food conscious mindset.

Blogger partnerships reinforced, You can’t hurry slow with influencers and like-minded moms.

We partnered with Cat & Nat to capitalize on a community of like-minded moms who tune in daily to re-write the paradigm of ‘the perfect mom’ to promote Stonemill’s relatable slow crafted values and to promote trial.

A low-cost marathon sponsorship and documentary film to celebrate and reinforce, You can’t hurry slow that attracted over 2 million views to the brand.

Stonemill had some fun with the expectation of fast by celebrating the slowest participant at the Around the Bay marathon in Hamilton to increase novel exposure to the slow proposition.

Slow crafted love notes created an emotional connection to, You can’t hurry slow.

Packs of Stonemill slow crafted love notes inspired by the packaging encouraged moms to take a little time to add some slow to their loved ones’ lunches. These were used as social rewards for CGC and promoted with Grocery Gateway orders that purchased Stonemill bread.

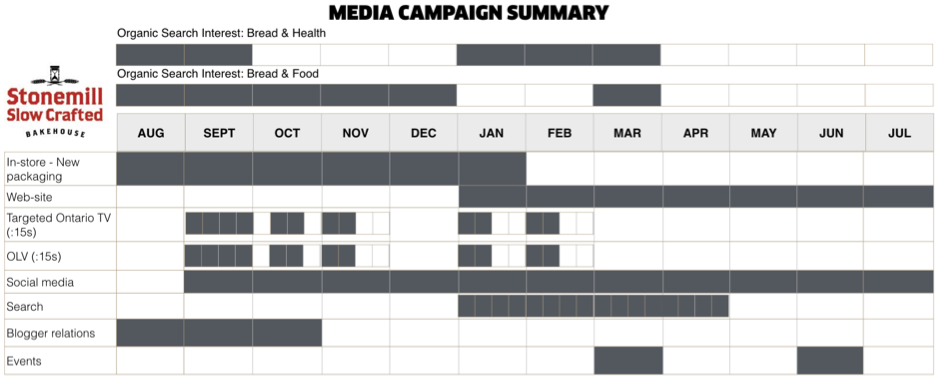

c) Media Plan Summary

The media plan supported a shelf back approach to launch. It focused on high value exposure to the new brand proposition and supporting brand recognition at shelf. The launch time frame took advantage of higher organic search propensity around bread and the back to school time-frame when bread aisle interaction would be higher. We targeted millennial-minded moms evaluating media and program selection using data filters congruent with this audience using social data as our starting point in order to increase message receptivity on TV and in OLV placements. (Sources; Numeris, Facebook)

Section V — THE RESULTS

a) How did the work impact attitudes and behaviour?

Stonemill Slow Crafted Bakehouse broadened its appeal from a health bread to an everyday nutritious bread, converting food conscious category shoppers to Stonemill SKUs from fast bread competitors. Web traffic analytics indicate that the brand has dramatically increased its consideration among women 25-40 (Source: Google analytics)

b) What Business Results did the work achieve for the client?

The brand saw unprecedented sales lift for modest investment;

- Year over year sales for the same period resulted in a total $ sales increase of +22.8% and a total unit sales increase of +15.1%

c) Other Pertinent Results

- Stonemill has now been able to expand distribution to more doors, make more SKUs profitable by confidently making the case for greater share of shelf, and sales performance is making it attractive to new retailers like Walmart who want to offer customers unique brands that can play a profit and volume role in their portfolio.

- A dramatic increase of corporate valuation based on sales performance and ability to grow share of market lead to the sale of the company to Grupo Bimbo. As a result, Stonemill now has the opportunity to grow nationally.

d) What was the campaign’s Return on Investment?

For 5% of category spend (including packaging and website investment), Stonemill increased sales by 23% in a declining category. The campaign achieved unprecedented ROI due to values-based targeting that increased message receptivity, achieving a CPM of $8.83 which is two-thirds less than the national average;

- OLV beat industry benchmarks with 3x the completion rates

- TV boosted exposure with 21.5% more targeted impressions delivered than planned

- Social media earned impressions lifted total campaign impressions by 25% through active sharing

- Search generated more relevant click-through far exceeding paid search campaign benchmarks – average CTR 2.2x above benchmark (4.23% versus 1.91%) at average CPC 3.5x below benchmark ($0.83 versus $2.89)

- When the website went live in January, during the period TV and OLV was also in-market (versus previous period) shows that site visits increased by 15x (64K versus 4.3K) and page views increased by 9x (73K versus 8.2K), thus showing the appeal of the new site coupled with the effectiveness of the OLV campaigns.

Sources: NMR, Numeris, Google, Facebook, Youtube, hubspot, wordstream, Stonemill

Section VI — Proof of Campaign Effectiveness

a) Illustrate the direct cause and effect between the campaign and the results

Having historically represented less than 1% of category spend with a brand that had narrow appeal, the business results can be directly attributed to the brand re-set activities and compelling communications that marked the increase in sales during this same period with focused yet competitive in-market activity. (source: NMR)

b) Prove the results were not driven by other factors

Campaign spend vs. history and competition:

Stonemill did very little to support its products previously and was considered a tier 3 specialty health bread. In 2015 Stonemill’s share of category spend was less than 1% with Grupo Bimbo brands and Weston brands outspending Stonemill ninety to one. (source: NMR)

Pre-existing Brand momentum:

Stonemill did very little to support its products previously and was considered a tier 3 specialty health bread. In 2015 Stonemill’s share of category spend was less than 1% with Grupo Bimbo brands and Weston brands outspending Stonemill ninety to one. (source: NMR)

Pricing:

Premium priced to a segment with declining volume, Stonemill SKUs pricing remained the same as previous year.

Changes in Distribution/Availability:

Going into the re-launch distribution of Stonemill SKUs remained the same as previous years.

Unusual Promotional Activity:

There were no other factors that would account for the growth in business. No competitors dropped out of category and category spending did not decrease.

Any other factors:

There were no other factors that would account for the growth in business. No competitors dropped out of category while spending in category increased.