Capitalising on Curveballs (BRONZE)

Seasonal (SILVER)

Client Credits: Sobeys Inc.

Paul Flinton, VP, Brand Marketing and Communications (Sobeys National)

Talke Krauskopf, Director, Integrated Brand Marketing (Sobeys National)

Ryan Shantz, Brand Manager (Sobeys National)

Alec Rahimi, Manager, Digital Marketing (Sobeys National)

Evan Slinger, Manager, Digital Marketing (Sobeys National)

Michael Belanger, Specialist, Digital Marketing (Sobeys National)

Jason Tutty, Director of Marketing (Sobeys Atlantic)

Cynthia Thompson, Director, Communications & Corp Affairs (Sobeys Atlantic)

Shauna Selig, Manager, Communications Atlantic (Sobeys Atlantic)

Katie MacNevin, Communications Specialist Atlantic (Sobeys Atlantic)

Michelle MacLean, Event Marketing Coordinator (Sobeys Atlantic)

Donalda Buckingham, Advertising Manager (Sobeys Atlantic)

Agency Credits: Gravity Partners Ltd.

Leigh Himel, Strategic Lead / Co-CEO (Gravity Partners Ltd)

Megan Pratt, Strategic Planner (Gravity Partners Ltd)

Mark Holden, Executive Creative Director (Gravity Partners Ltd)

Melanie Cote, Associate Creative Director (Gravity Partners Ltd)

Jill Simmonds, Community Manager (Gravity Partners Ltd)

Francine Boldovitch, Group Account Director (Gravity Partners Ltd)

Tasneem Mulji, Account Executive (Gravity Partners Ltd)

Sara Thomas, Producer (Gravity Partners Ltd)

Samantha Catherwood, Director, Connections Planning (UM)

Courtney Smith, Supervisor, Connections (UM)

Tara Wickwire, Director (National Public Relations)

Ali Hemraj, CEO (TruInc.)

Suneeva Films (Production Company)

Married to Giants (Post Production Company)

Silent Joe (Audio House)

Section I — CASE PARAMETERS

| Business Results Period (Consecutive Months): | November 2016 – January 2017 |

| Start of Advertising/Communication Effort: | November 2016 |

| Base Period as a Benchmark: | November 2015 – January 2016 |

| Geographic Area: | Atlantic Canada |

| Budget for this effort: | $200,000 – $500,000 |

Section IA — CASE OVERVIEW

Why should this case win in the category (ies) you have entered?

Sobeys is a national grocery retailer with strong Atlantic roots. After almost 110 years in communities across Atlantic Canada, Sobeys faced a significant competitive threat and needed a program that was authentically Sobeys. To defend against an aggressive competitor in Sobeys’ home market, a beloved brand asset was revived and reinterpreted. This increased brand presence during a financially and symbolically important season, measured by overall brand performance, brand affinity, emotional response, purchase intent, and gap to market.

“Star of Christmas” is a Sobeys brand asset shot in 1987 that resonated with customers so much that it aired in various formats until 2004. For 17 years, the song written for “Star of Christmas” signaled the start of the holiday season in Atlantic Canada. It was featured in school Christmas concerts and quickly became integrated into the Christmas celebrations of Atlantic Canadians. Research revealed that nostalgia had the power to drive behaviour, and it became clear that Sobeys needed to bring “Star of Christmas” back to reestablish an emotional connection with customers.

The “Star of Christmas” campaign is being submitted as an entry for the Brand Reawakening and Seasonal categories because of its focus on reversing a trend of declining performance through an emotional connection with customers that depended on strong associations between Christmas, family, and the Sobeys brand.

Section II — THE CLIENT’s BUSINESS ISSUES/OPPORTUNITIES

a) Describe the Client’s business, competition and relevant history:

A longstanding Canadian brand, Sobeys originated in Nova Scotia when Frank H. Sobey persuaded his father to expand his business from meat delivery into a full line of groceries in 1924. Sobeys became such an integral part of the lives of Atlantic Canadians that “The Dictionary of Canadianisms on Historical Principles” includes “Sobeys bag” as a unique Maritimer term used to describe plastic bags1.

It is no surprise that Sobeys commanded the highest market share in Atlantic Canada for decades; however, this began to change in 2013.

In addition to increasing pressure from the Real Atlantic Superstore, in 2013 Walmart converted 9 stores into supercentres in Atlantic Canada2. By 2014, Walmart was steadily gaining market share, Sobeys market share was declining, and the Real Atlantic Superstore had taken the lead.

In 2016 Sobeys faced a new crisis. For the holiday season of 2016, Walmart was taking an aggressive stance on price cutting:

“I said it before and I will say it again: We will win the season on price — on Black Friday, on Cyber Monday, and every day before and after” – Walmart Chief Merchandising Officer3

Walmart’s lower prices campaign began in the fall of 2016 immediately before the holiday season, one of the most significant seasons for Sobeys in terms of sales metrics. Sobeys had planned their conventional holiday campaign, but it became clear that it wouldn’t be enough to retain their customers. They needed to do something different. They needed to remind Atlantic Canadians of their connection with the Sobeys brand.

The connection between Sobeys and Atlantic Canadians was strongest before the brand became national in 1998. Looking at brand assets before national expansion, one clearly stood above the rest: “Star of Christmas”. “Star of Christmas” was nothing short of a sensation. Sobeys shot the commercial in 1987 and it aired annually in various formats until 2004, becoming integrated into the cultural fabric of Christmas in Atlantic Canada.

“Star of Christmas” changed how people experienced and celebrated the holiday season. Even today, schools use the song written for “Star of Christmas” in their Christmas concerts. “Star of Christmas” connected Sobeys to its customers, and in 2016 that connection was more important than ever. So, it was brought back.

b) Describe the Client’s Business Issues/Opportunities to be addressed by the campaign:

After a period of stabilization, Sobeys’ growth began a rapid descent when Walmart launched its lower prices campaign with sales declining -4.1% at a time when the market grew 0.8% from September to the end of October 2016. This -4.9% gap to market could not be allowed to continue.

Fighting a price war with Walmart was not a viable strategy, Sobeys needed to rely on brand. The problem was existing plans for the holiday season focused on key products and in-store activities, and not deepening its connection with customers. Sobeys needed to course correct, and quickly, by leveraging assets that Walmart couldn’t match including:

- An authentic heritage of community presence and involvement;

- Decades of family holiday memories connected to Sobeys’ locations and products; and

- A brand asset that reflects the spirit of Christmas.

By re-activating “Star of Christmas”, Sobeys had the opportunity to connect with customers and the community.

c) Resulting Business Objectives: Include how these will be measured:

Sobeys’ business objective was to decrease the gap to market in November and December 2016, reversing the downward trend.

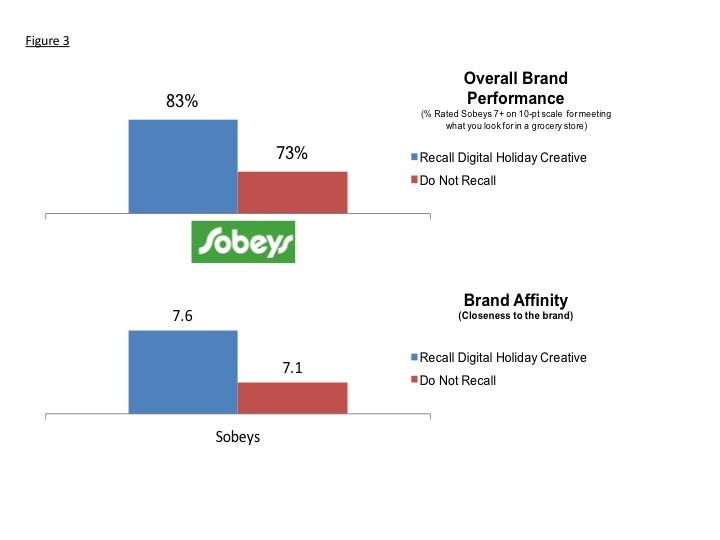

To do this Sobeys needed to focus on brand, as measured by a significant improvement for those that recalled the ad, in overall brand performance (the percentage that rate Sobeys 7+ on a 10-pt scale for meeting what you look for in a grocery store) and brand affinity (rating on a 10-pt scale for how close do you feel to the brand).

This meant Sobeys needed to reach customers and influence their behavior. Sobeys’ goal was to increase reach as measured by generating more clicks from video view rates than the 12,500 industry benchmark and increasing Sobeys’ web traffic above the 15,000 benchmark. To influence behaviour the ad needed to generate a positive emotional response (the percentage of people who agree that they enjoyed the ad and the percentage of people that agreed the ad gave them a good feeling about the store) and purchase intent (the percentage of people who agree the ad made them want to shop at Sobeys).

1. http://www.cbc.ca/news/canada/nova-scotia/maritime-dictionary-slang-canadian-english-scribbler-1.4040334;

2. CBC, July 26, 2013: http://www.cbc.ca/news/canada/nova-scotia/wal-mart-supercentre-opens-in-halifax-marks-atlantic-first-1.1329746;

3. http://www.businessinsider.com/walmart-black-friday-deals-launch-immediately-2016-11

Section III — YOUR STRATEGIC THINKING

a) What new learnings/insights did you uncover?

The prediction was that nostalgia generated by “Star of Christmas” would be powerful and research revealed that nostalgia can drive people to action:

“Nostalgia …blends both positive and wistful features, and it is this longing that makes it a more active emotion than amusement or satisfaction, inspiring people to want to revisit or protect the things that trigger it.” – Dr. R. Tim Wildschut, Associate Professor, Psychology, University of Southampton

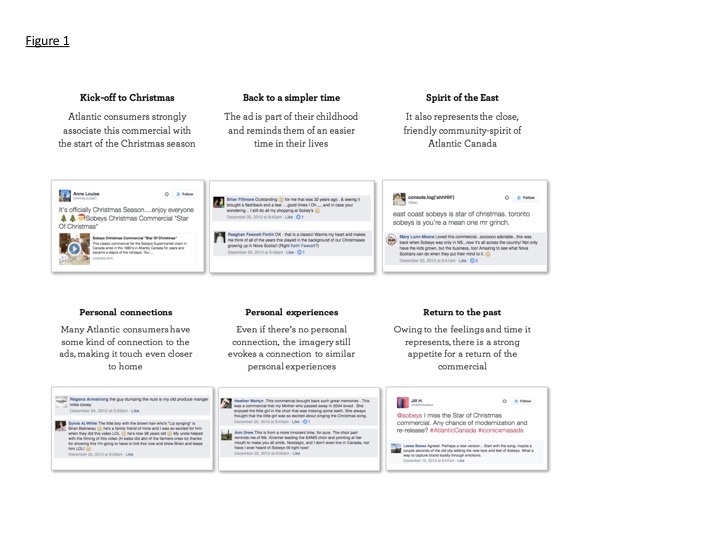

Next, the extent that people felt nostalgia for “Star of Christmas” was investigated. Social listening revealed that the original “Star of Christmas” campaign was present in social conversations nearly a decade after it completed. People associated childhood memories with the ad, it reminded them of time spent with family, and it brought them together as a community. There were even calls to bring back the ad with a more modern twist (Figure 1).

b) What was your Big Idea?

The anticipation of the season’s traditions is the best part of Christmas. “Star of Christmas” unleashes those feelings unlike anything else for Atlantic Canadians, and reminds them that Sobeys is a part of Christmas.

c) How did your Communication strategy evolve?

Research revealed that triggers of nostalgia included familiar images and music that tapped into cherished personal moments. To maximize these triggers, the campaign included the original song, visuals of a children’s choir singing and the Sobeys store being prepared for Christmas, and previous cast members.

The new “Star of Christmas” campaign needed to go beyond remaking the commercial to become part of Atlantic Canadian’s Christmas traditions again. In addition to the media campaign, the community was involved through events and charitable activities. It wasn’t enough to remind people of the emotional connection they had with the previous “Star of Christmas” campaign, a new emotional connection needed to be created.

d) How did you anticipate the communication would achieve the Business Objectives?

The target audience was adults aged 35-55, who would have experienced “Star of Christmas” either as children or when they were starting to build their families. This group feels connected to their local community, which includes Sobeys, but in terms of shopping their basket sizes were declining and they were open to exploring options outside of Sobeys. The new “Star of Christmas” campaign was designed to remind them of spending Christmas with their family over the years and give them an opportunity to pass down their traditions to the next generation.

The goal was to make Sobeys part of Atlantic Canadian’s Christmas traditions again. This meant showing them that Sobeys was an active member of their community and could help them prepare for their celebrations. Creating this positive emotion through “Star of Christmas” would align with Atlantic Canadian’s feelings around Christmas and help insulate Sobeys from Walmart’s pricing tactic in a way that a more rational, or direct, response wouldn’t.

Section IV — THE WORK

a) How, where and when did you execute it?

The “Star of Christmas” campaign included three main components:

1. Pre-launch event: To build excitement prior to the release of paid media, the local community, store employees, the Sobey family, and some of the original cast members from “Star of Christmas” were invited to a pre-launch community event. Store employees participated in decorating the store (including putting up 30,000 lights on 100 Christmas trees), kids participated in cookie decorating, and over 350 people participated in singing “Star of Christmas”. In addition, an online media outlet in Nova Scotia, Haligonia, provided a sneak peak of the ad on Facebook before the release, which received an impressive 172,000 views, 2,925 shares, and 177 comments

2. Social campaign and paid media: An omni-channel marketing approach was employed including a TV commercial, brand radio spots, YouTube buy, local radio sponsorship, and social videos on Facebook. To increase opportunities for engagement a landing page was created with expanded content including behind-the-scenes event videos, interviews with previous cast members, ring-tone downloads with donations to local charities, a karaoke video, and sheet music of the song

3. In-store and community activation: A variety of events were used to create employee and community engagement. All Sobeys and Foodland stores were asked to participate in National Gingerbread Decorating day, held on December 10th. Employees also volunteered to participate in one of the largest Christmas parades in Atlantic Canada, the Halifax Parade of Lights, where the Sobeys Model T truck was decorated for Christmas and played the “Star of Christmas” song. In terms of community engagement, several initiatives contributed to food banks across Atlantic Canada

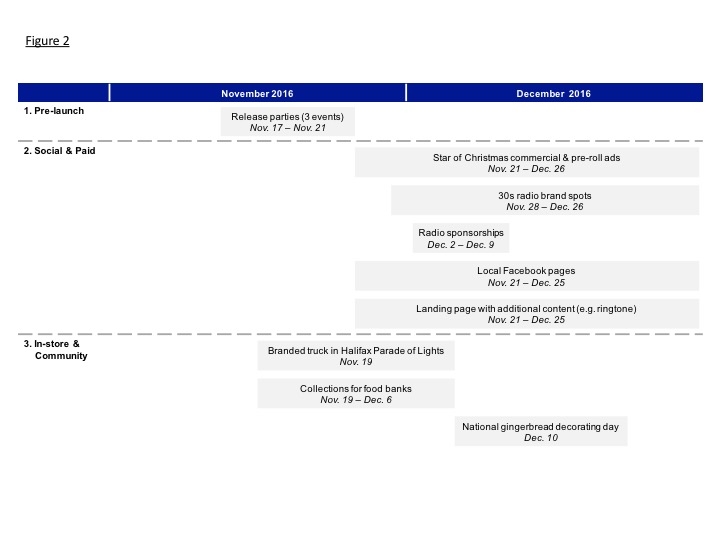

c) Media Plan Summary

All media activities occurred between mid-November and late-December 2016 (Figure 2). The “Star of Christmas” commercial ran on CTV, CTV Two, Global, and CBC in Halifax, Charlottetown, Sydney, and Saint John / Moncton regions. Pre-roll ads were part of paid media through YouTube and social videos were posted on Facebook. Seven radio broadcasters hosted local radio contests.

Section V — THE RESULTS

a) How did the work impact attitudes and behaviour?

Attitudes

The return of a beloved Christmas tradition struck an emotional chord. Of people who saw the ad on TV or heard the ad on radio 85% and 90% agreed, respectively, that “Star of Christmas” was very enjoyable. This enjoyment translated into a positive perception of Sobeys with 85% of TV viewers and 92% of radio listeners agreeing that “Star of Christmas” gave them a good feeling about the store.

The positive perception of “Star of Christmas” correlated with a direct impact on brand image. There was a significant lift on image statements for those who recalled seeing the campaign, including: affordable prices on private label / store brands; makes me feel good about my food purchases; and overall good value for money. There was also an increase in overall brand performance and brand affinity for those who recalled the campaign (Figure 3). Behaviours

Behaviours

The 6.5MM+ paid impressions and 2MM+ video views generated 55K+ clicks; 400% more than the 12.5K planned. Sobeys’ web traffic increased by 25%+ above the 15K benchmark, with 43% engaging with content (>2x past performance), and 13%+ downloading song sheets and music. Video view rates exceeded industry benchmarks (35%+), over-delivering on views and digital impressions 165% with a 95%+ positive sentiment in the campaign’s social reach of >1.59MM.

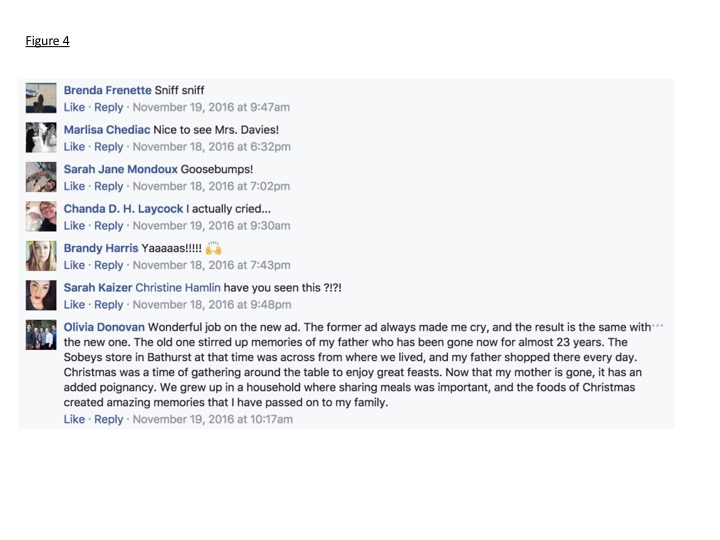

When the ad was launched on YouTube, it was the only advertisement among Canada’s top trending videos, placing at #12 before paid support was applied. An amazing result given that the ad was tailored for consumers in Atlantic Canada. Viewers even created tributes, reactions, and mash-up videos in response to the campaign and were not shy about sharing their emotional reactions in comments (Figure 4).

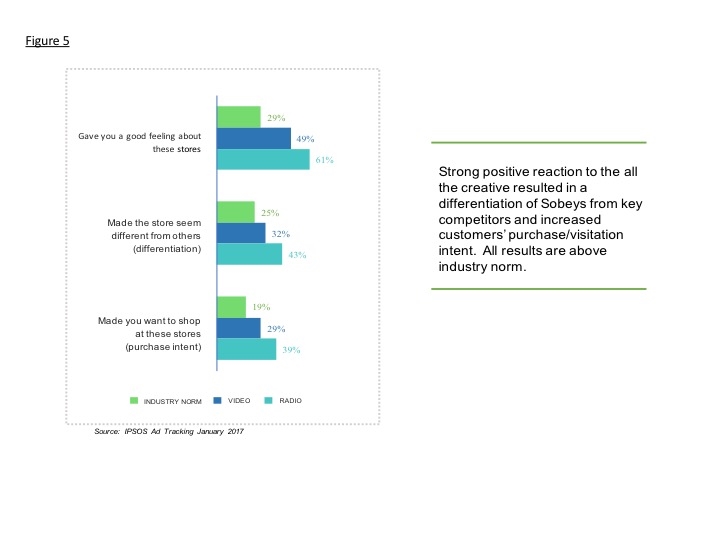

Equally impressive, the emotional connection correlated with purchase intent. Over 70% of people who experienced the campaign agreed that “Star of Christmas” made them want to shop at Sobeys (71% of TV viewers and 79% of radio listeners). Even when looking only at the respondents with the strongest reaction (who selected strongly agreed), “Star of Christmas” results were above the industry norm (Figure 5).

b) What Business Results did the work achieve for the client?

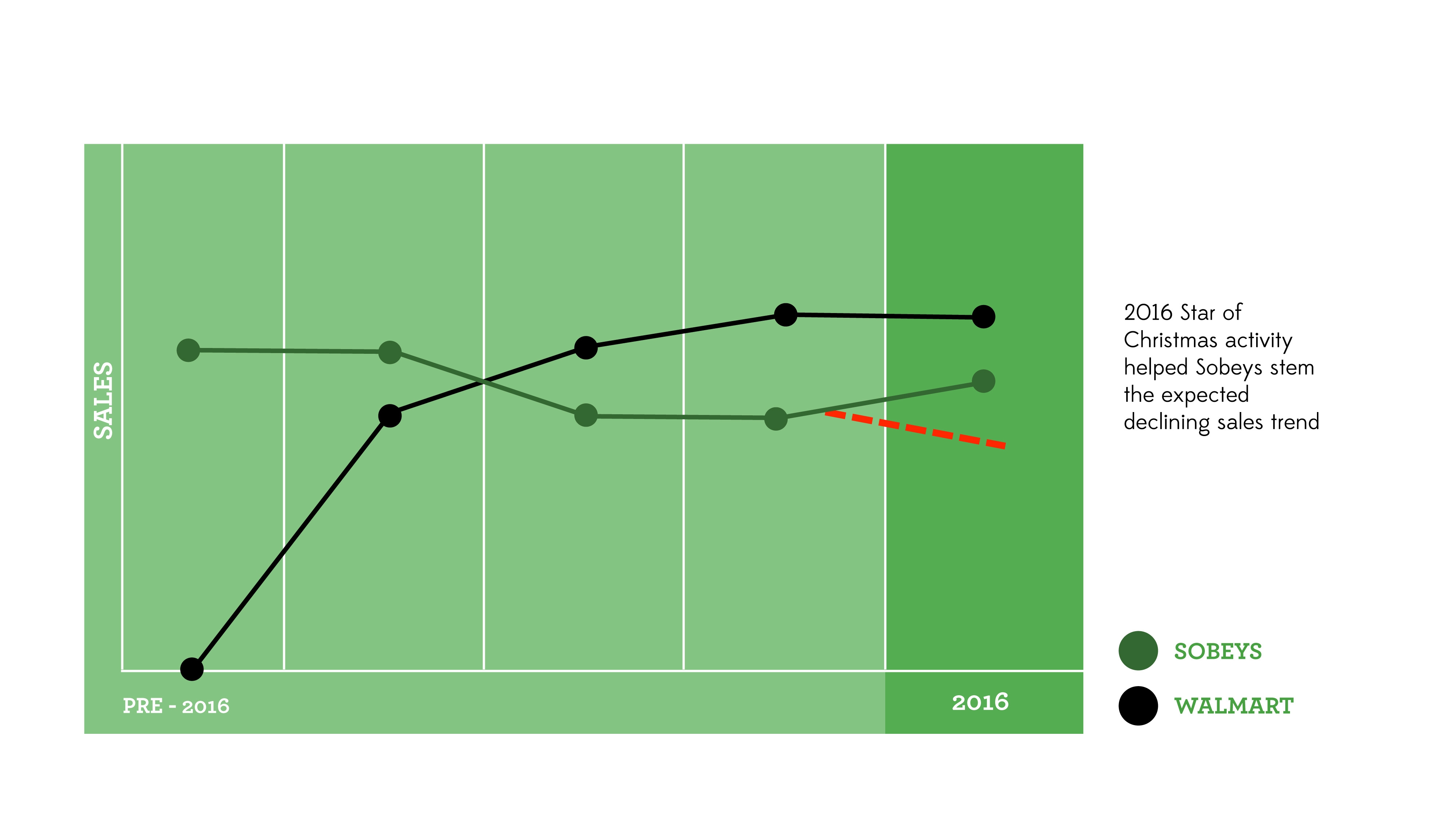

Prior to the launch of “Star of Christmas”, in October and November 2016 Sobeys sales declined -4.1% while the market grew +0.8%. This means that just before the launch of “Star of Christmas”, the gap to market was -4.9% points. The risk was that this -4.9% point gap to market would continue through November and December 2016. Based on the +0.2% market growth rate in this timeframe, that would have put Sobeys at -4.7% sales growth. Instead, following the launch of “Star of Christmas” the trend was reversed and Sobeys performance improved by 2.5% points in November and December 2016.

c) Other Pertinent Results

In terms of PR, 26 stories were shared online, in the newspaper, on TV, and the radio, including 4 broadcast segments on CTV Atlantic. “Star of Christmas” also received national attention and was captured in Canadian Grocer and Marketing Magazine.

The exceptional response to “Star of Christmas” was not limited to customers. Employee engagement also benefitted from the campaign. Store employees went above and beyond by creating unique in-store experiences for their customers to amplify the campaign, for example the staff at Sobeys Extra Clayton Park in Halifax created a 12-foot giant gingerbread man at their store to celebrate.

d) What was the campaign’s Return on Investment?

Based on average Sobeys sales in Atlantic Canada in 2016 and media, agency, and production fees for “Star of Christmas”, a 2.5% improvement in sales growth resulted in a significant Return on Investment of 395%

Section VI — Proof of Campaign Effectiveness

a) Illustrate the direct cause and effect between the campaign and the results

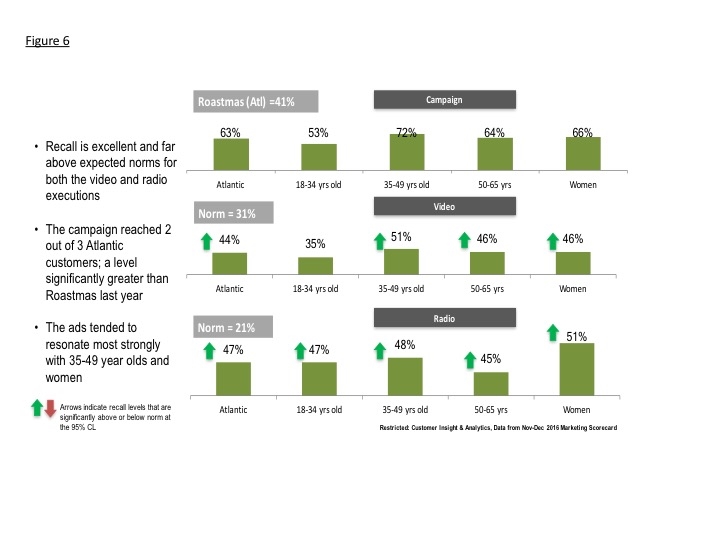

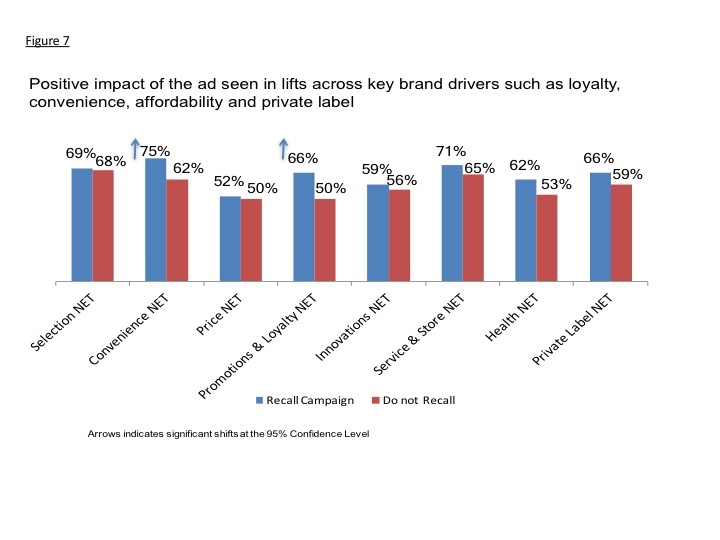

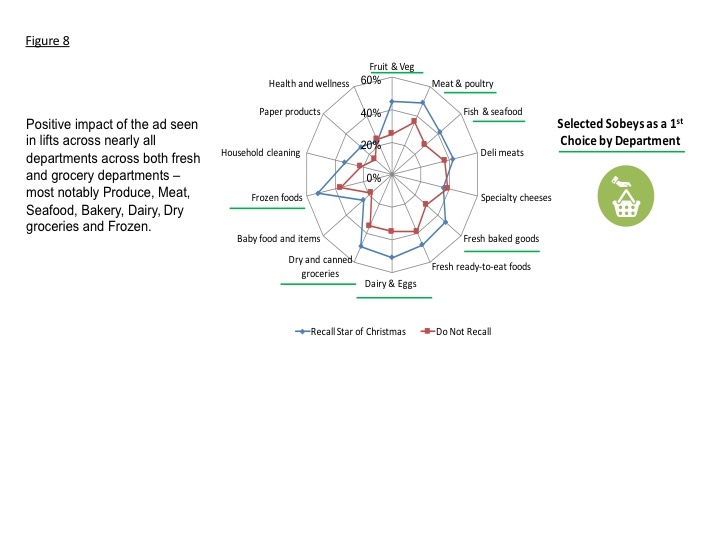

Strong recall of “Star of Christmas”, coupled with improvements in key metrics for people who recalled the campaign, shows that there is a direct link between the campaign and results. Recall of “Star of Christmas” was higher than the Sobeys holiday campaign in the previous year and industry norms for both radio and video (Figure 6). Furthermore, lift was seen across key brand drivers for those who recalled the ad, with a significant impact on convenience and promotions / loyalty (Figure 7). This lift in key brand drivers is consistent with the finding that those who recalled the campaign were more likely to select Sobeys as their first choice across the majority of departments (Figure 8).

b) Prove the results were not driven by other factors

Campaign spend vs. history and competition:

Other factors that did not drive the results include:

- Campaign spend: One of the drivers for this campaign was that Sobeys did not plan incremental media spend in October when Walmart launched its low prices campaign. In October 2016, Walmart spent nearly double (1.83x) on media compared to Sobeys. As a result, Sobeys decided to launch “Star of Christmas” in November and December 2016 and needed to increase their media spend, which was 1.56x compared to Walmart. Despite this increase, Sobeys still spent significantly less media than Weston stores (which includes Atlantic Superstores, Real Canadian Superstore, etc.). Weston spent more than double (2.2x) on media than Sobeys in November and December 2016

Pre-existing Brand momentum:

- Pre-existing brand momentum: Prior to “Star of Christmas”, Sobeys was experiencing a decline in sales with an increasing gap to market. Therefore, the results are not a continuation of prior performance

Pricing:

- Pricing: An affordability program was launched in October 2016, but was limited to a small proportion of SKUs, prices were not reduced below the competition (generally prices were 10% higher), and no incremental media campaigns advertised the changes

Changes in Distribution/Availability:

- Changes in distribution / availability: There were no unusual changes to distribution or availability

Unusual Promotional Activity:

- Unusual promotional activity: There was no unusual promotional activity.

Any other factors:

- Other activities were in market at the same time as “Star of Christmas”, but did not impact the results of the campaign:

-

- #MadeByMe (influencer campaign)

- Total > 19,572 pageviews / impressions

- Approximately 13% of traffic came from Atlantic Canada, no paid media was applied

- ‘Gather’ Magazine (hosted on Better Food For All)

- Total > 1,756 pageviews / impressions

- Approximately 25% of total traffic came from Atlantic Canada, no paid media was applied

- Online entertaining promo

- Total > 393,676 impressions in the Atlantic region with $2,000 media spend

- Other

- Promotional elements consist of the flyer, eFyler, eNewsletter and direct to customer offers rema

- #MadeByMe (influencer campaign)