Building Brand Equity (BRONZE)

New Brand Positioning (BRONZE)

Client Credits: Leon’s

Marketing Manager: Lewis Leon

Marketing Manager: Andrea Graham

Content Marketing Manager: Autumn Hachey

Agency Credits: TAXI

General Manager: Haneen Davies

Chief Creative Officer: Jeff MacEachern

Group Account Director: Karlee Bedford

Associate Creative Directors:Marc Levesque, Dan Cantelon, Mike Blackmore

Art Directors: Stefan D’Aversa, Alyssa Graff, Damon Crate

Copy Writers: Phil Coulter, Dana Ciani, Mitch Robertson, Siobhan Dempsey

VP, Head of Strategy: Christine Maw

Account Supervisor: Casey Mendoza

Media Agency: OMD

Strategy Supervisor (OMD): Jennifer Weston

Business Director (OMD): Laura Lewandowski

Section I — CASE PARAMETERS

| Business Results Period (Consecutive Months): | March 2016 to July 2017 |

| Start of Advertising/Communication Effort: | March 2016 |

| Base Period as a Benchmark: | March 2015 to March 2016 |

| Geographic Area: | National, English and French |

| Budget for this effort: | Over $5 million |

Section IA — CASE OVERVIEW

Why should this case win in the category (ies) you have entered?

After 100 years of business in Canada, there are few people with a home to furnish who are unaware of Leon’s. With showrooms across the country, and a history of significant marketing spending, Leon’s is one of Canada’s better-known retailers. That’s the positive part. The not-so-positive part is that Canadians associate the brand with oversized sofa sets, outdated styles, and never-ending promotional events.

Leon’s prospered in an era when people had fewer accessible design options and less disposable income. The business emphasized function and affordability over style and quality. But in today’s market, where the average person appreciates design, more options are widely available, and people are willing to spend more on their homes, this positioning limited growth. While Leon’s was working hard at updating their offering, the perception remained that they were the home of always-on-sale big, brown couches. In today’s market, Leon’s was not right for the times.

Our mandate was to reposition the Leon’s brand to engage a new generation of home shoppers – and to help close the perceptual gap. Our “Part of the Family” brand platform achieved quantifiable results by capturing attention for all the right reasons – initiating the hard work of repositioning a brand that is deeply steeped in legacy. Here’s how we did it:

New Brand Positioning: After decades of price-promo positioning, our new platform put authentic emotion at the centre of the brand. This, along with featuring a level of design not expected from Leon’s, presented the brand in a new light.

Building Brand Equity: By shifting the focus on promotions to the deeper role furnishings play in people’s lives, we created an equity that defines Leon’s – not just the furniture they sell.

We needed to find a distinct voice for the brand if we were going to stand out. Instead of focusing on “inspiration,” we went deeper and talked about the role furnishings play in family life. This resulted in a reappraisal of the brand as measured by an increase in new customers, increased web traffic, and a significant lift in sales in a flat* furnishings market.

Key to our success was a family-centric view of furniture, which helped us form a deeper emotional connection with a new generation of shoppers

Section II — THE CLIENT’s BUSINESS ISSUES/OPPORTUNITIES

a) Describe the Client’s business, competition and relevant history:

Over the years, Leon’s has built a long-lasting business by targeting mainstream Canadian shoppers. Its large-scale locations are a familiar sight to many. With 80 stores across the country, offering a mix of furniture, appliances, mattresses, and electronics, Leon’s established itself as a reliable source for the home-furnishing needs of middle-class Canadians.

Early in the company’s history, it recognized the impact marketing could have on the business, and investment in advertising was consistently high over the years. It was heavily focused on promotional advertising, an approach that unquestionably drove store traffic but also entrenched some long-held views about the brand. The Leon’s brand was known for the kinds of messages it most frequently supports: discounts, payment plans, and furniture with dated styles and of questionable quality.

The furniture category represents approximately $10 billion in annual sales in Canada. Leon’s competes with a long list of retailers, starting with large-format stores like Ikea and The Brick (which is owned by Leon’s); mass merchandisers like Costco; department stores such as Hudson’s Bay and Sears Home; specialty stores like HomeSense, Home Outfitters, Sleep Country and La-Z-Boy; along with a growing number of design-oriented brands such as Pottery Barn, Urban Barn, West Elm, CB2, and Structube. Online retailers such as Wayfair and Amazon are adding a new layer of competition.

A trend that affects all retailers is consumers’ increased interest in design, driven by the explosion of design media (TV, magazines, online), which provides consumers with creative ideas and inspiration. The perception of Leon’s offering was at the wrong end of this trend, with a significant portion of the potential customer base believing the store’s offering was dated and traditional.

Another trend reinforcing the importance of design is how Canadians are focusing on their homes. The growth in real estate prices has turned this into a constant topic of conversation, which extends to the furnishing we put in them. With all this going on, the category conditions were very positive, but Leon’s brand perceptions meant the company wasn’t poised to take advantage of them.

b) Describe the Client’s Business Issues/Opportunities to be addressed by the campaign:

Leon’s needed to reposition for future growth.

Leon’s had relied heavily on price promotions for years, and though their product has improved significantly of late, little investment had been made to shift perceptions about the brand beyond pricing. On top of that, they faced more competition than ever before.

In order to grow, Leon’s loyal, but aging consumer base needed to be augmented with younger shoppers who were moving into their prime furniture buying years. This group perceives Leon’s as a store that’s quite out of step with the times.

This group has different – and higher – expectations for home furnishings than shoppers in previous decades. While value is still important, they’re not willing to forgo style and quality. They’ve grown up in a new age of accessible design and won’t trade off style for value. If we couldn’t challenge the perception that Leon’s was the store of brown puffy couches, we’d never make it onto their list.

So, we needed to evolve the brand, to challenge deeply held perceptions, in order to be relevant with this new generation of consumers. We needed to move beyond promotions and build deeper emotional connections. But we knew we couldn’t win on style or inspiration alone – we needed to find a distinct point of view for the brand.

This needed to be expressed through a brand platform that could support a broad range of products (people primarily associated Leon’s with furniture – we needed to stretch the brand to include mattresses, appliances, outdoor furniture, and beyond). It had to work at high-level brand messaging, support specific product messaging, drive tactical promotions, and work across all media channels.

c) Resulting Business Objectives: Include how these will be measured:

The business metrics we established reflect the desired sales and customer behaviour we wanted the campaign to create.

2016: Create momentum

- Show sales growth VYA

- Increase in-store traffic

- Attract new customers

- Likelihood to recommend

- Likelihood to shop

- Likelihood to consider

- Past 12-month visits

2017: Increase growth rate above 2016 (target 3.75% VYA)

Additionally, brand health metrics were a key priority. Leon’s had never previously tracked brand health. Tracking research was initiated when the campaign started to measure how equity attributes grew over time. Without historical precedent as a baseline, the objective was to see overall improvement in the measured attributes, rather than a specific numeric goal.

The brand metrics we prioritized reflect the need to increase brand appeal and relevance.

- Overall brand rating

- Brand I trust

- Brand for people like me

- Contemporary styles

- Understands real life

Section III — YOUR STRATEGIC THINKING

a) What new learnings/insights did you uncover?

Home is a very personal place, and we wanted to deeply understand the meaning and importance of “home” and our target’s approach to creating their own styles at home. To gain these insights, we started our strategic development process with cross-country qualitative and ethnographic research.

What facts did you discover?

We began research by asking respondents to share photos of their homes and to describe their feelings about their homes. Some interesting insights arose. We learned that our audience feel attached to their homes and want to create homes that feel personal and comfortable. But, as much as they’re attracted to design, they can also feel overwhelmed and intimidated by it all.

Home is for living. The meaning of home for our target was very clear – and it wasn’t just about furniture or fine design. Participants told us that although they are interested in design, their homes would never be a temple to design. For them, the priority for their home is family and the life they live in it. That meant it needed to be welcoming and comfortable, a place where children’s art could go on the wall, and the toys wouldn’t always be neatly tucked away. For them, that isn’t a compromise – it’s their preference.

Design culture is intimidating. The design culture that surrounds them provides plenty of inspiration; yet, the endless stream of beautiful imagery can result in the opposite effect: uncertainty and inertia. For many, design is a source of stress – a tension exists between the “perfect” homes they see depicted everywhere and the look of their own homes. Their houses (as evidenced by the photos we received) were not impeccably coordinated. Although attracted to design, they told us they felt excluded from it, highlighting an interesting emotional tension: the place in which they should feel most comfortable was in fact causing anxiety.

We also accompanied them for “shop-alongs” (at Leon’s and competitive retailers), and another tension emerged. While shopping at competitors known for accessories, like Ikea or HomeSense, can be perceived as fun, trips to stores offering more “enduring” furniture (Leon’s core business) were stressful. Items like sofas, beds, and appliances stay in your home for a long time. Price points are significant, durability is required, and style is a requirement but also a gamble – will I still like this in a decade? Real commitment is involved. Unlike the incidental and low-risk items found at a HomeSense or Ikea, this type of furniture will stay in the home for a long time and affect how you live. It’s a considered – and stressful – choice.

Insight

We don’t want precious design – we want homes that are styled for real life.

And the things we buy aren’t just furniture, they become part of our family’s life.

Why is this relevant?

Our new consumer is looking for guidance on design but does not want to be held hostage by it. While we certainly had to improve the perceptions of our style credentials with them, we also knew a “precious” attitude toward style and design wouldn’t be right. They want a home where they can build a rich and interesting life, not a perfect (or perfectly fake) magazine spread, but a home where real life happens, where they can regroup, recharge, rejuvenate, and feel utterly at home.

b) What was your Big Idea?

The things we choose to furnish our homes with aren’t just objects – they play a deeper role in our family’s life. As a family-owned company, Leon’s gets that, and offers furniture that becomes part of the family.

c) How did your Communication strategy evolve?

Our campaign couldn’t simply be a homage to the styles available at Leon’s. It had to present furniture in a light that aligned with our target’s desire to have a stylish home that could be lived in by real people, in all theirimperfect glory. That led to a few key requirements in the brief.

First, it’s not style or real life – it’s both. The products Leon’s offers bridge those worlds, and we needed to establish that Leon’s can provide what consumers need on both measures.

Second, show real-world homes and people, not fake magazine spreads.

Third, depict a breadth of living scenarios, such as a first home, a family room, or backyard living.

Fourth, feature a breadth of our product assortment – beyond furniture to include mattresses, appliances, accessories, outdoor furniture, and more.

Lastly, we believed the idea should not be limited to mass-market communications. “Part of the Family” was introduced into every part of the business, from in-store signage and employee training to the way the phones were answered throughout the organization. All aspects of the brand experience were aligned to help demonstrate that we understand real family life.

d) How did you anticipate the communication would achieve the Business Objectives?

By putting furniture at the very heart of the story, by presenting it in an unexpected way that spoke to how people live, rather than just price point or style, we believed our target would – in a good way – be surprised Leon’s was the brand behind the various elements of the campaign. By challenging their perceptions of design and how the brand looks at the role of furniture in our lives, we would earn a spot on their list of retailers they’d consider for their next purchase.

Of course, promotional work was still a part of our plan, but we believed by re-allocating funds to new communications that focused on emotional storytelling, we were better positioned for future success. We believed this fundamental pivot would be a powerful driver of reappraisal for the brand.

From a business-impact perspective, we anticipated the first waves of the campaign would drive brand health first and that sales would soon follow. The purchase cycle for furniture is long, so our early goal was to shift perceptions to get on the consideration set for consumers’ upcoming purchases, and then see a subsequent uptick in store traffic and sales.

Section IV — THE WORK

a) How, where and when did you execute it?

The campaign began with a modernized visual language that would be deployed across all touch points.

In March 2016, we launched the new positioning with a highly emotive campaign, featuring hero pieces of furniture playing almost human roles in the lives of the families they’re part of. This ran in broadcast, social, print, and in-store.

Next in 2017 we created a series of product-focused campaigns featuring products people don’t typically associate with Leon’s, such as custom-colour sofas, outdoor furniture, and mattresses. These campaigns continue the emotional storytelling approach, creating personal connections between the products Leon’s offers and aspects of their lives.

To reinforce our connection with families, for Family Day 2017, we developed an innovative program that tracked the number of hours family members spent together on their living-room sofa as a means to demonstrate the importance of spending time together.

As a demonstration of the creative and business potential of the brand idea, the thinking and language of “Part of the Family” has been applied across all touch points and throughout the organization. It’s reflected in the in-store experience, the way the company answers the phone, in training videos, promo work, flyers, and all other owned assets. Beyond just a tag line, positioning is embraced and reflected in everything Leon’s does.

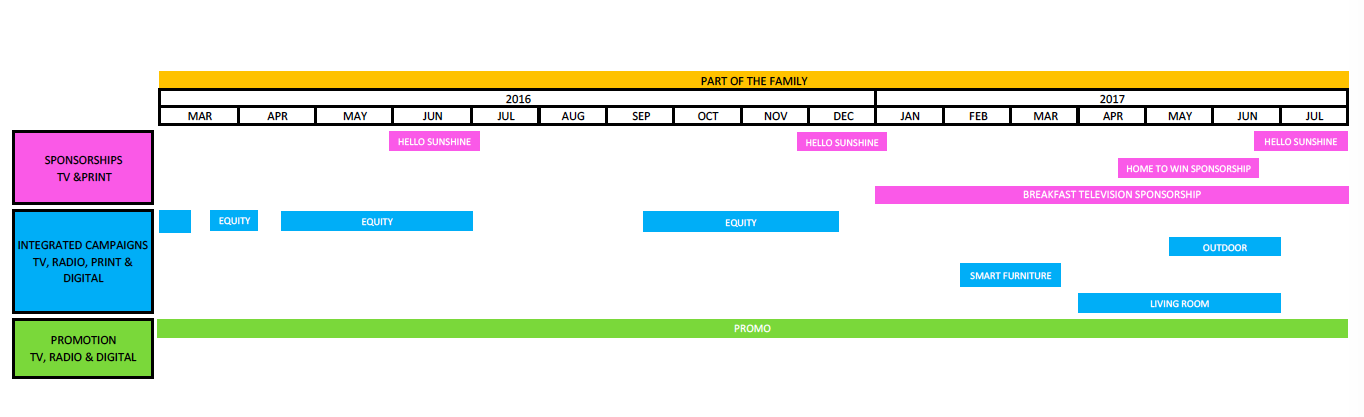

c) Media Plan Summary

Section V — THE RESULTS

a) How did the work impact attitudes and behaviour?

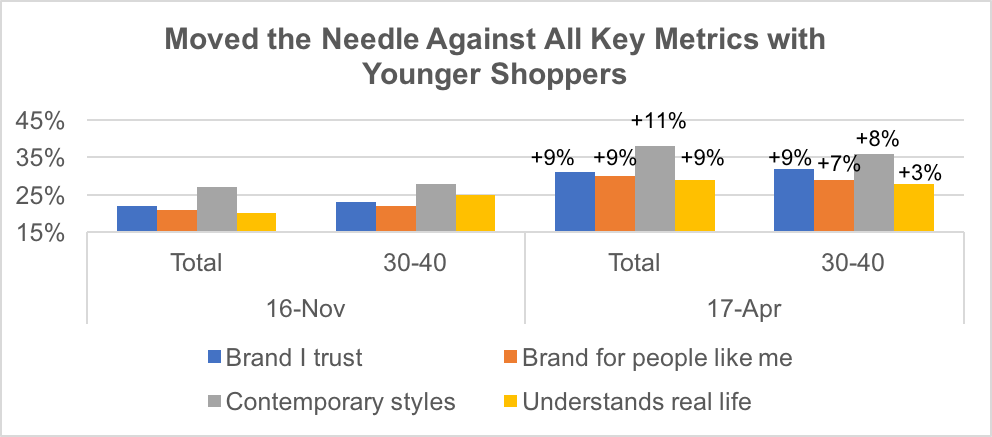

Brand metrics have definitively improved since the launch of the campaign.

Source: Leon’s Brand Tracking

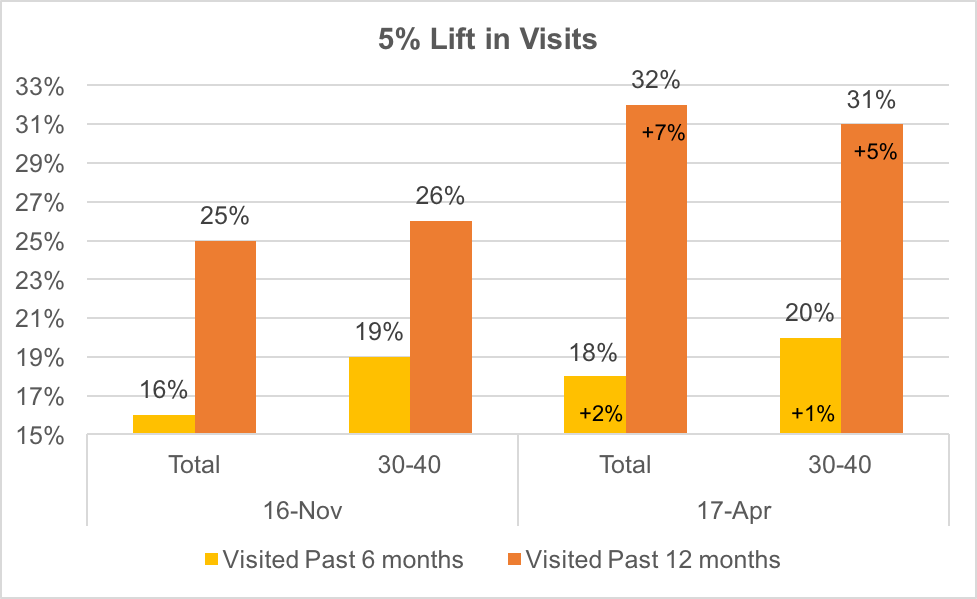

Tracking scores related to behaviour also demonstrate improvement in the time period of the campaign.

Source: Leon’s Brand Tracking

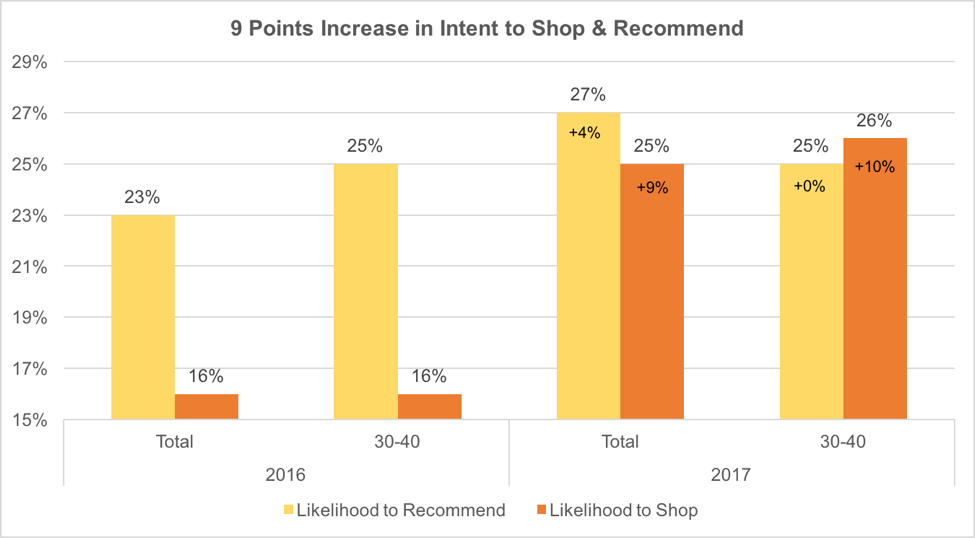

As of November, tracking, and intent to shop and recommend were broken out by age group to help evaluate the impact of the campaign by demographic. Likelihood to recommend, which arguably requires more personal experience when a brand is less familiar, has remained constant for 30–40 year olds, but all other scores have gained.

Source: Leon’s Brand Tracking

b) What Business Results did the work achieve for the client?

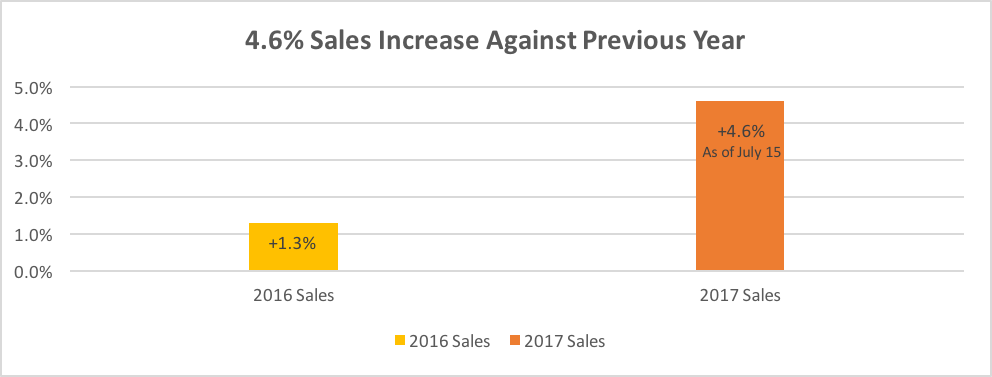

The increase in key metrics occurred quite quickly, with sales following a few months later as people entered the purchase cycle. Sales began to show momentum in 2016 and continued to grow in 2017. They are currently tracking considerably ahead of 2016 and our 3.75% target.

Source: Leon’s Brand Tracking

c) Other Pertinent Results

d) What was the campaign’s Return on Investment?

As the campaign has become established, incremental media investment is more than paying back. Uniting all the communications under the “Part of the Family” platform has resulted in sales increases that are considerably larger than the growth in media spend.

| Year | Increase in Media Spend VYA | Increase in Sales VYA |

| 2016 | +$3.9 million | +$21 million |

| 2017 | +$3.2 million | +$23 million |

Section VI — Proof of Campaign Effectiveness

a) Illustrate the direct cause and effect between the campaign and the results

Quantitative creative evaluation was initiated after the campaign was in market. Two of the three television executions were tested to determine performance relative to existing promotional creative. Using the existing work as a baseline, the brand campaign clearly lifted brand equity metrics:

Likeability of ad:

Promotional creative 100%

Launch TV spot 131%

Living room spot 137%

Uniqueness of ad:

Promotional creative 100%

Launch TV spot 180%

Living room spot 220%

Positive impact on brand:

Promotional creative 100%

Launch TV spot 130%

Living room spot 135%

Source: Advertising Testing Study, April 2017.

b) Prove the results were not driven by other factors

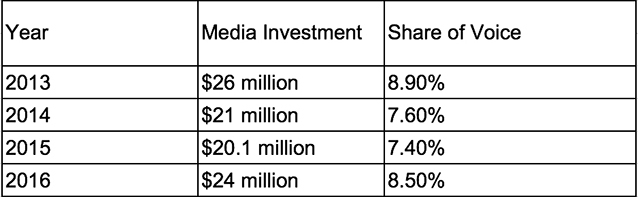

Campaign spend vs. history and competition:

Funding for the campaign came from sources within the existing annual budget, diverting funds away from established annual pricing and promotion activity.

Leon’s share of voice in the furniture category in the past four years has not varied more than 1.5%.

Pre-existing Brand momentum:

Business development research initiated prior to the campaign identified significant brand vulnerability, not momentum. This concern was the impetus for investment in the brand.

Pricing:

The perception of low pricing and promotions has been long established in consumers’ understanding of the brand. This was a key part of the challenge the campaign had to overcome. Leon’s promotional calendar in the campaign period mirrored historical activities. If anything, low pricing was a barrier, not a help.

Changes in Distribution/Availability:

Leon’s opened several new stores in BC; however, all results are based on same-store sales figures, not total stores sales figures.

Unusual Promotional Activity:

NA

Any other factors:

NA