Sustained Success (SILVER)

Client Credits: DanoneWave Canada

Pauline Vargas: Vice-President Marketing

Julie de Prittwitz: Vice-President Marketing

Mélanie Robitaille: Marketing Director

Arthur Sylvestre: Brand Manager

Fanny Thibault: Brand Manager

Marie-Claire Forget: Assistant Brand Manager

Philippe Tremblay: Lead Media and Digital Strategy

Emmanuelle Rougeot: Senior Media, Digital and CRM Manager

Audrée Morin-Berthiaume: Digital Marketing Manager

Agency Credits: Publicité TAXI Montréal Inc.

Jacques Labelle: President, TAXI

Maryse Sauvé: Strategic Planner, TAXI

Ariane-Andrée Beaudet: Account Director, TAXI

Catherine Lapointe: Account Executive, TAXI

Cynthia Côté: Account Executive, TAXI

Pierre Nolin: Executive Creative Director, TAXI

Geneviève Vincent: Copywriter, TAXI

Martin Snape: Copywriter, TAXI

Jacinthe Archambault: Art Director, TAXI

Mathieu Lacombe: Art Director, TAXI

Sokphea Pes: Art Director, TAXI

Emilie Trudeau-Rabinowicz: Head of Broadcast Production, TAXI

Jacques Latreille: Director of Operations, TAXI

Jean-Christophe Alié: MAC Artist, TAXI

Carat: Media Planning and Buying

4ZERO1: Production House

Apollo Studios: Music and Sound Design

BAM Strategy: Digital Agency

Mirum: Digital Agency

Carl Connexion: Social Media Agency

Geometry: Shopper Agency

National : PR Agency

Publicis: CRM Agency

Rodeo Production: Photography

Section I — CASE PARAMETERS

| Business Results Period (Consecutive Months): | January 2015 to April 2017 |

| Start of Advertising/Communication Effort: | January 2015 |

| Base Period as a Benchmark: | January 2015 to April 2017 |

| Geographic Area: | Canada (FR + ENG markets) |

| Budget for this effort: | $2 – $3 million |

Section IA — CASE OVERVIEW

Why should this case win in the category (ies) you have entered?

OIKOS, the category leader in Greek yogurt since its launch in 2011, was heavily challenged by its main competitor but also by category newcomers, entering the market with heavy promotional activities. Becoming the leader is hard but staying there is sometimes even harder. We needed to create long-term differentiation and engagement in that fast-evolving segment in order to ensure the sustainable growth for the brand. Quite a challenge for a Greek yogurt that cannot leverage a clear and significant product differentiator.

In order to break through the clutter and build a unique stance for our brand, we devised a strong umbrella strategy and campaign grounded in, and based on, thorough research and consumer understanding. In finding unique ways to connect with the target, we clearly broke the codes of yogurt category, resulting in brand leadership and dominance, as measured by not only tracking results but sustained sales, a strong and healthy baseline as well as growing market shares.

This strategy and creative approach generated results beyond our expectations from the start. What’s more, we were able to sustain growth in an ever-changing landscape while maintaining our leadership, making OIKOS the undisputed leader in the Greek yogurt segment. This story is a sustained success dream come true!

Section II — THE CLIENT’s BUSINESS ISSUES/OPPORTUNITIES

a) Describe the Client’s business, competition and relevant history:

Almost unknown a few years ago, Greek yogurt has become the largest earning segment in the yogurt category, growing exponentially from a 15.6-dollar share in 2012 to a 27.3-dollar share in 2014.1 By then, an extraordinarily wide array of new players, from national to private labels, had entered the market, hoping to get a piece of the cake. The stakes in the level of advertising had never been so high, iögo entering the market with an unprecedented advertising budget for yogurt ($50M) and Liberté, OIKOS’s main competitor, also unveiling a large-scale brand campaign. OIKOS, the number one brand in the yogurt segment, was stagnating.

Furthermore, Greek yogurt was reaching a certain degree of maturity. Its price tag being higher than that of most other types of yogurt, it created a barrier to achieving more growth in an extremely fierce segment. Another important fact was that most Greek yogurt brands communicated on functional benefits. OIKOS had one advantage, it had taken the route of authenticity by taking over the Greek territory. But it did not seem to be enough to create long-term differentiation and engagement in that fast-evolving segment.

b) Describe the Client’s Business Issues/Opportunities to be addressed by the campaign:

OIKOS, the number one Greek yogurt in Canada2 since 2012, saw its market share decreasing in 2014.3

In order to remain the segment leader and get back to growing its dollar share, we had to revitalize OIKOS brand positioning, reassess our target’s potential and respond to the market changes with a proposition that would be perceived as different and superior from its competitors and give us the possibility to launch new product lines.

c) Resulting Business Objectives: Include how these will be measured:

- Solidify a leadership position across Canada by earning 5 points of market share by the end of 2015 and 4 points of market share at the end of 2016. Maintain $ market share above 41.5 in 2017, and growing vs. 2016.

- Reach a volume increase of 3% in 2015, 10% in 2016, and 5% in 2017

- Reinforce the uniqueness of the brand identity to differentiate it from competing brands

- Increase target engagement with the brand

1. Nielsen Market Track, period ending July 22, 2017

2. Idem.

3. Idem.

Section III — YOUR STRATEGIC THINKING

a) What new learnings/insights did you uncover?

When OIKOS was launched, our target group was, due to the product’s higher price point, focused on an older clientele with a large disposable income. With the popularity of Greek yogurt, global health and nutrition trends, we realized that our product had a strong potential for growth amongst a younger clientele. With its texture and its high level of protein, it could also appeal to men, a clientele that was traditionally left aside by the yogurt category. So we looked at the “late millennials” segment (W 58%-M 42% | AGE: 29-39). They are hungry for life, health means feeling good to them, they are connected, and their motivation is to seek new experiences.

The fit seemed very promising, so we did qualitative and ethnographic research in our key markets (Toronto, Montreal and British Columbia) in order to discuss different topics with them.

Authenticity equals originality

We found that, although they value authenticity and quality, in their mind, the “real thing” also needs to rhyme with originality.4 It can’t be boring or same old old! There has to be a dimension of novelty to the brand/product. Defined by technology, this generation is confident, wants to have fun and they just LOVE brands and products that promote this feeling.

Functionally, OIKOS and Liberté are both seen as very good and high-quality brands. So differentiation needed to come from originality.5

Authenticity can be modern too

Through research, we also identified OIKOS’s points of differentiation:

- The perception that it is the most authentic brand – as supported by its name, the Greek-inspired design of the blue and white packaging as well as its past advertising campaigns (the Mediterranean setting, the tone and manner of the spots).

- The fact that it offers unusual flavours, i.e. OIKOS goes beyond the basics.

There did not seem to be any hard barriers to the brand. However, the brand’s image and character were lacking modernity.

From an ingredient to a satisfying snack

Our findings also revealed a third important element. The snacking moments and opportunities shared by our target audience also aligned with what we had learned in our research into snacking habits.6 Snacking was a big, growing trend. The use of Greek yogurt had changed. Starting out as a versatile ingredient used in many recipes, it was now mostly consumed as a snack. Focusing our efforts to position OIKOS specifically as a snack could make the brand appear even more relevant to consumers – especially considering that snacking was not only a function of hunger but also of emotions and mind. (“I snack for physical, emotional, and psychological reasons.”7)

As functionality gave us no strong point of differentiation, we decided to focus on the emotional level. And as the area of snacking was so promising, it had to be at the centre of our efforts.

So the question is: How could we apply all of those learnings to the simple act of eating yogurt? We summarized our insight as follows:

“For me, eating is one of the BEST PLEASURES IN LIFE. So much so that even snacking has to be an experience.”

b) What was your Big Idea?

Opening a cup of OIKOS is an experience in itself. It’s a little moment of escape frozen in time. The first mouthful takes us elsewhere. The scratching noise of the spoon that scrapes the bottom of the empty pot brings us back to reality. OIKOS is THE dream snack.

c) How did your Communication strategy evolve?

Since the launch of the brand, we fed our target audience’s curiosity about the origin and the story in which the benefits of OIKOS are embedded. We wanted to do it in a renewed way.

OIKOS thus fills more than your cravings; it also satisfies your hunger for escape, the time of a break. Our brand positioning would then follow the same path as our insight, putting OIKOS at the centre of the proposition:

“OIKOS, THE dream snack, inspired by the authentic Greek art of living well.”

We already owned authenticity but wanted to infuse our communications with a more light-hearted tone. The OIKOS dream equals pure enjoyment but it is not realistic, it’s using humour to showcase situations that are unlikely to happen.

And as there was a strong potential for the brand to launch different products within the OIKOS franchise, we needed to make sure that we would have a strong umbrella strategy and campaign but at the same time be able to extend the Dream to different product lines that could have their own Dream territory in order to demonstrate each product’s specific characteristics without falling in strict product functionality.

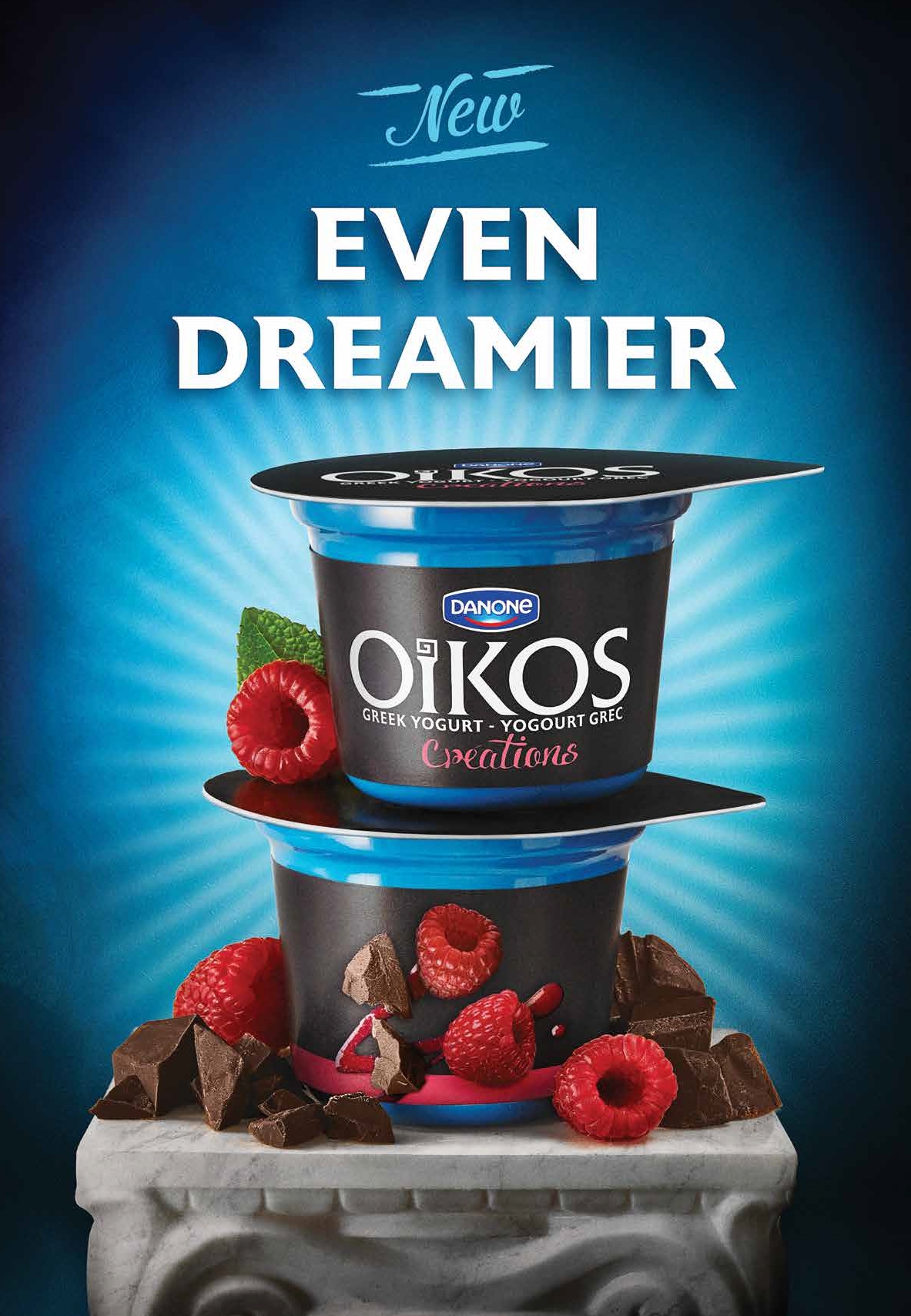

For the launch of OIKOS Creations – the first sub-brand launched that is more indulgent than the regular OIKOS – we identified a creative dreamlike territory of its own. Not only meant to be surprising, it was intended to be dreamier than the dream itself. The fun aspect of the brand’s world rising to a new level.

And on to the launch of the SuperGrains sub-brand as well. Being a morning staple that will tide you over until lunch time, the dream that is closely related to the product extends itself in time… for an even more satisfying dream. THE DREAM. FULFILLED.

d) How did you anticipate the communication would achieve the Business Objectives?

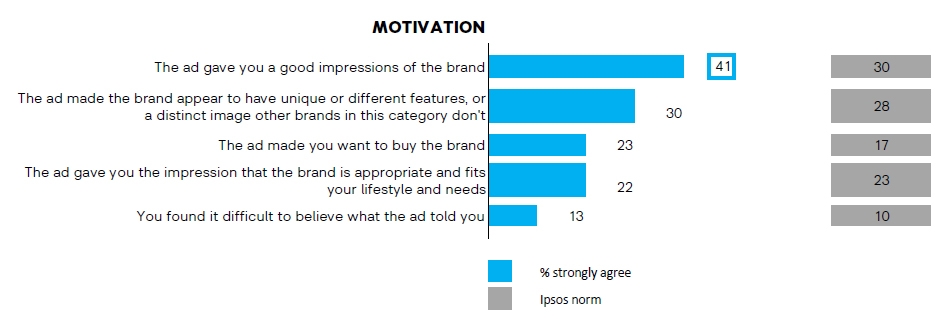

By playing with the Greek stereotypes in a very surprising way, we knew that we would break through the clutter of the category. Our pretests told us that we had a strong idea and that the campaign had the potential of achieving great awareness levels and increase significantly the intention to purchase OIKOS (non-users).8 The campaign also positively reinforced the modernity of the brand and the consumers’ proximity feeling with it.9

4. Ipsos Next Quali, August 2014.

5. Idem.

6. IPSOS, PROJECT OIKOS BONDS & BARRIERS, Qualitative Report, May 2014.

7. Idem.

8. IPSOS – OIKOS “Dream Snack” Advertising Post-Test Research report, April 2015

9. Idem.

Section IV — THE WORK

a) How, where and when did you execute it?

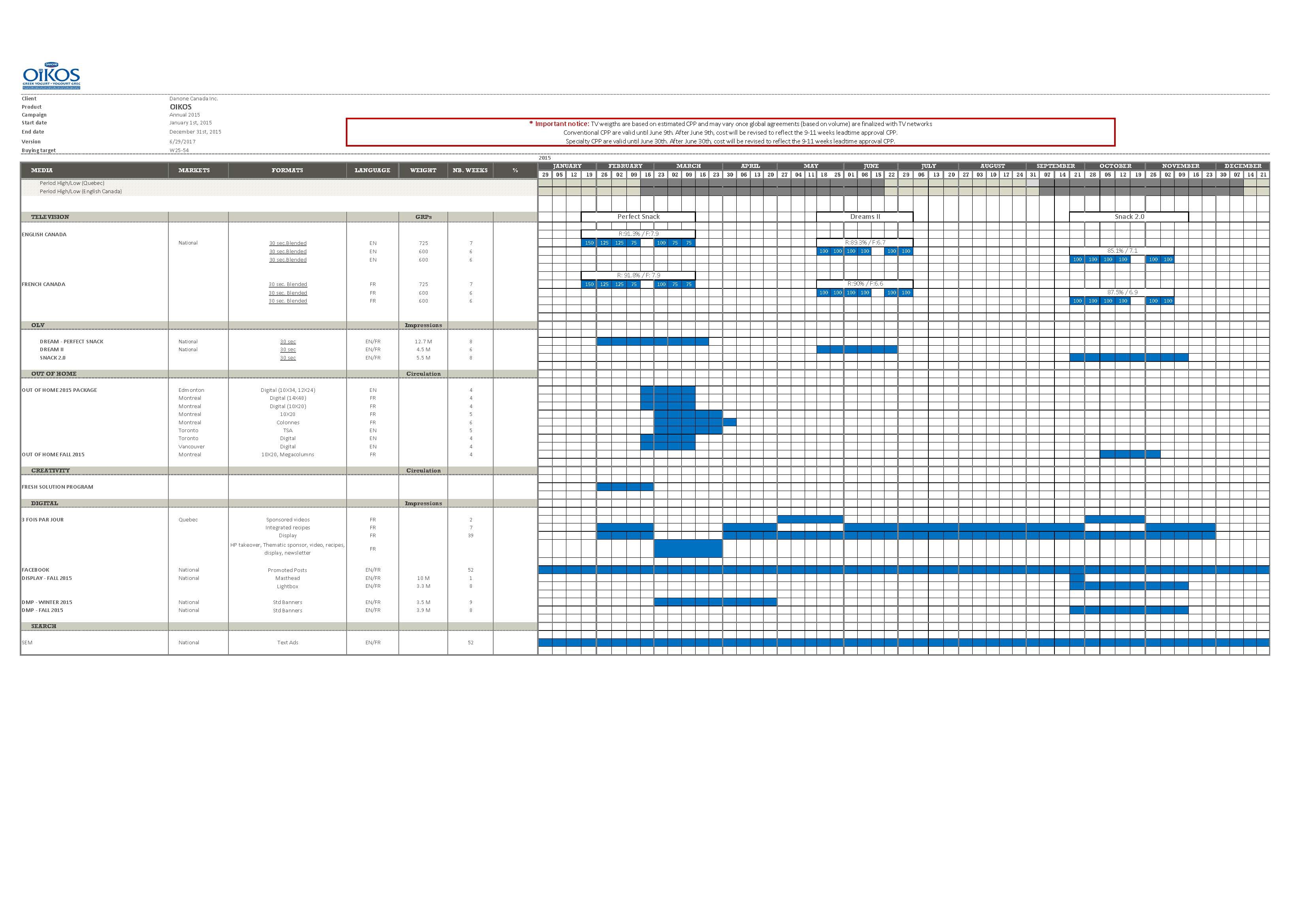

DREAM CAMPAIGN DEPLOYMENT (2015)

Videos

To quickly build reach and impact, we developed a series of videos in the new OIKOS Dream territory. The first being a TV spot with national reach featured a man eating yogurt and getting seduced by a beautiful young woman, with Greece as a backdrop. The illusion is shattered when it is revealed that it was just a daydream brought on by OIKOS. The man reached for another yogurt, but instead of finding his beautiful companion, he is confronted with another Greek stereotype as he is being sculpted, while partially naked, by an old man. To engage with our target audience, consumers became part of the story with 11 different “alternative endings” on YouTube, all anchored in Greek mythology and culture (including everything from Icarus falling from the sky to Poseidon standing on a beach). There is also a discount coupon hidden within the different endings for the consumers to find to get free OIKOS. The most popular endings are also later crafted as online videos.

OOH

To showcase the different available flavours (important purchase drivers for the consumers), we displayed the different formats on OOH executions along with creative headlines that tied in with the campaign.

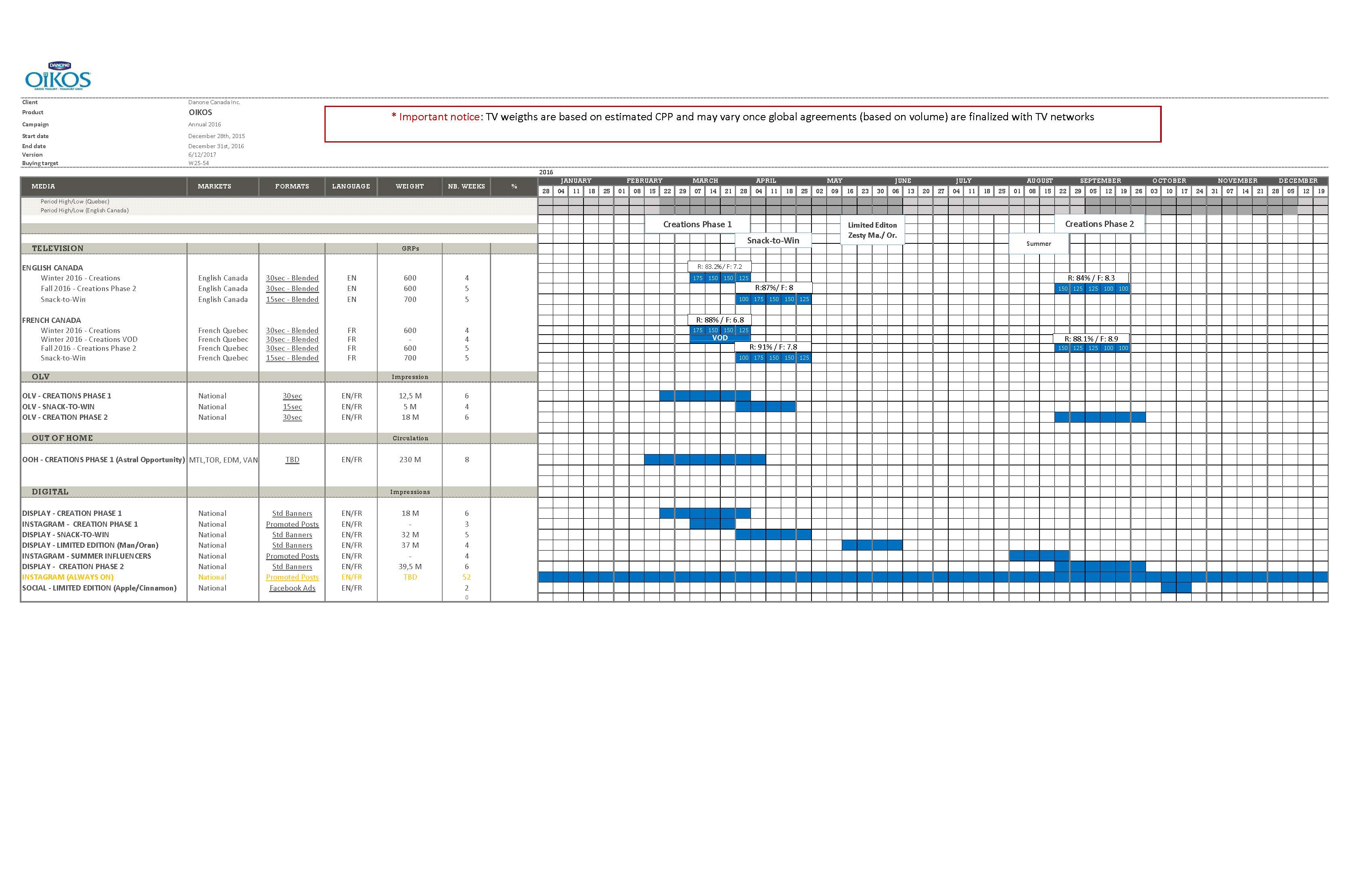

CREATIONS CAMPAIGN DEPLOYMENT (2016)

Videos

To launch the new indulgent product line called OIKOS Creations, we developed a video that was aired on TV and a specific OLV to show the range of flavours. It follows the same big idea but its dream territory is even dreamier than the dream itself to reflect the decadent flavours and texture. It features the same main character getting seduced but now by an even dreamier version of the girl of his dreams: a mermaid with a twin sister!

Instagram experience

Through direct tagging, we invited people to navigate from one Instagram account to the next to live an adventure in which they are the hero (Choose your own adventure), making them discover the four flavours of OIKOS Creations. Those who succeeded in completing the adventure could enter an exclusive contest for a chance to win a trip to Greece.

OOH

To extend reach, we displayed the dreamier version of OIKOS on OOH executions across Canada.

SUPERGRAINS CAMPAIGN DEPLOYMENT (2017)

Videos

To launch the new OIKOS SuperGrains product line, we followed the same big idea for our TV spot, but this time our hero is able to continue his dream for a longer period of time as he eats this new OIKOS that is more satisfying and filling.

For our OLV we decided to play with the fact that nothing will stop you from dreaming with the new OIKOS SuperGrains. So we put our ad in forced online video BUT gave viewers the possibility to skip the OIKOS ad to keep on dreaming. A clever way to play with the specific product benefit and the media.

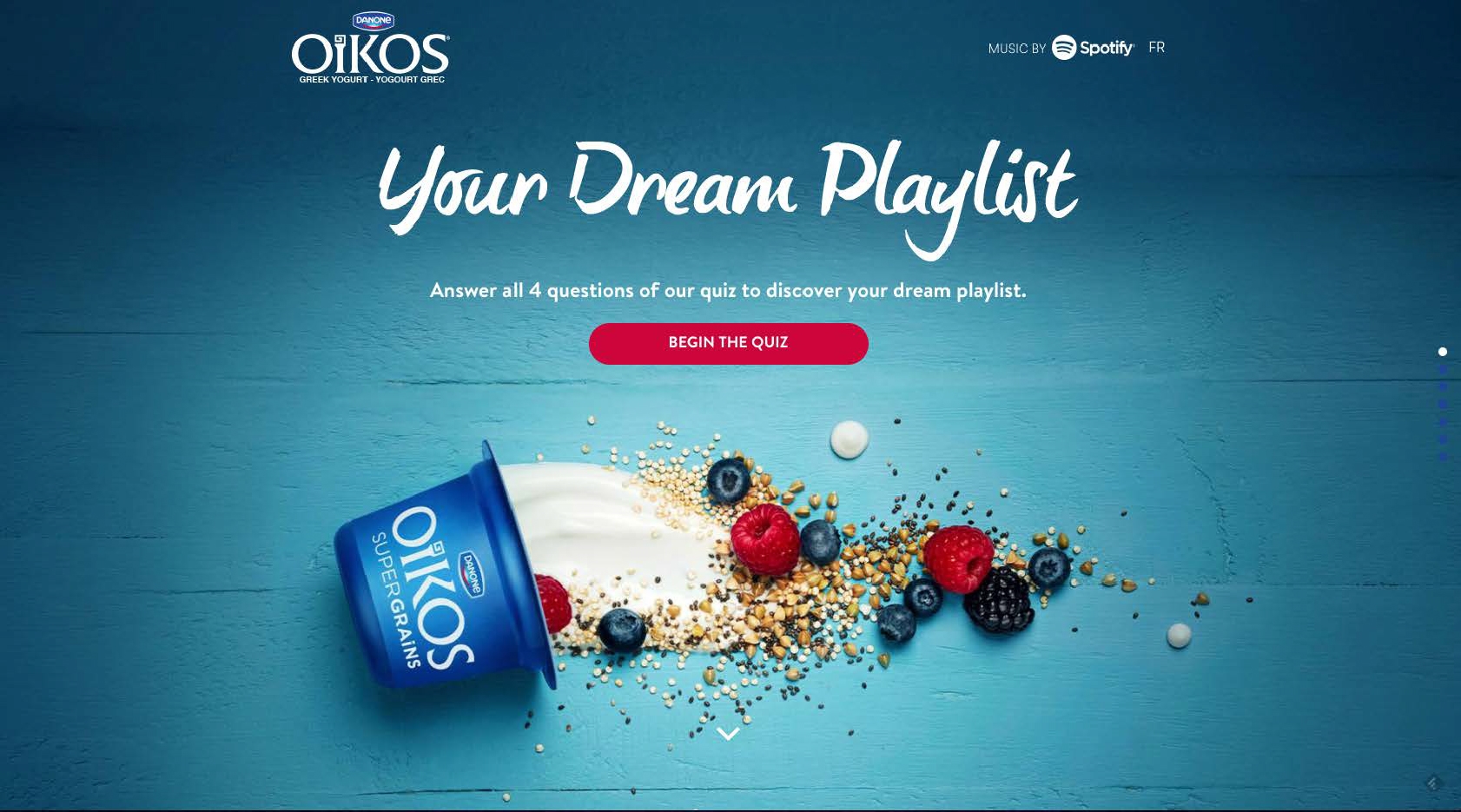

Spotify

We decided to soundtrack the launch of OIKOS SuperGrains on Spotify through different branded playlists (4 playlists, one by flavour). By answering a couple of humoristic questions, the consumers discovered the playlist that fits their personality and fulfills their dream. A different way to connect with our younger target in a new environment.

OOH

A poster campaign was deployed in 5 major urban centres for the launch of OIKOS new sub-range. The idea was to show at a glance the delicious texture of the new OIKOS SuperGrains but also the delicious combination of fruit and grains.

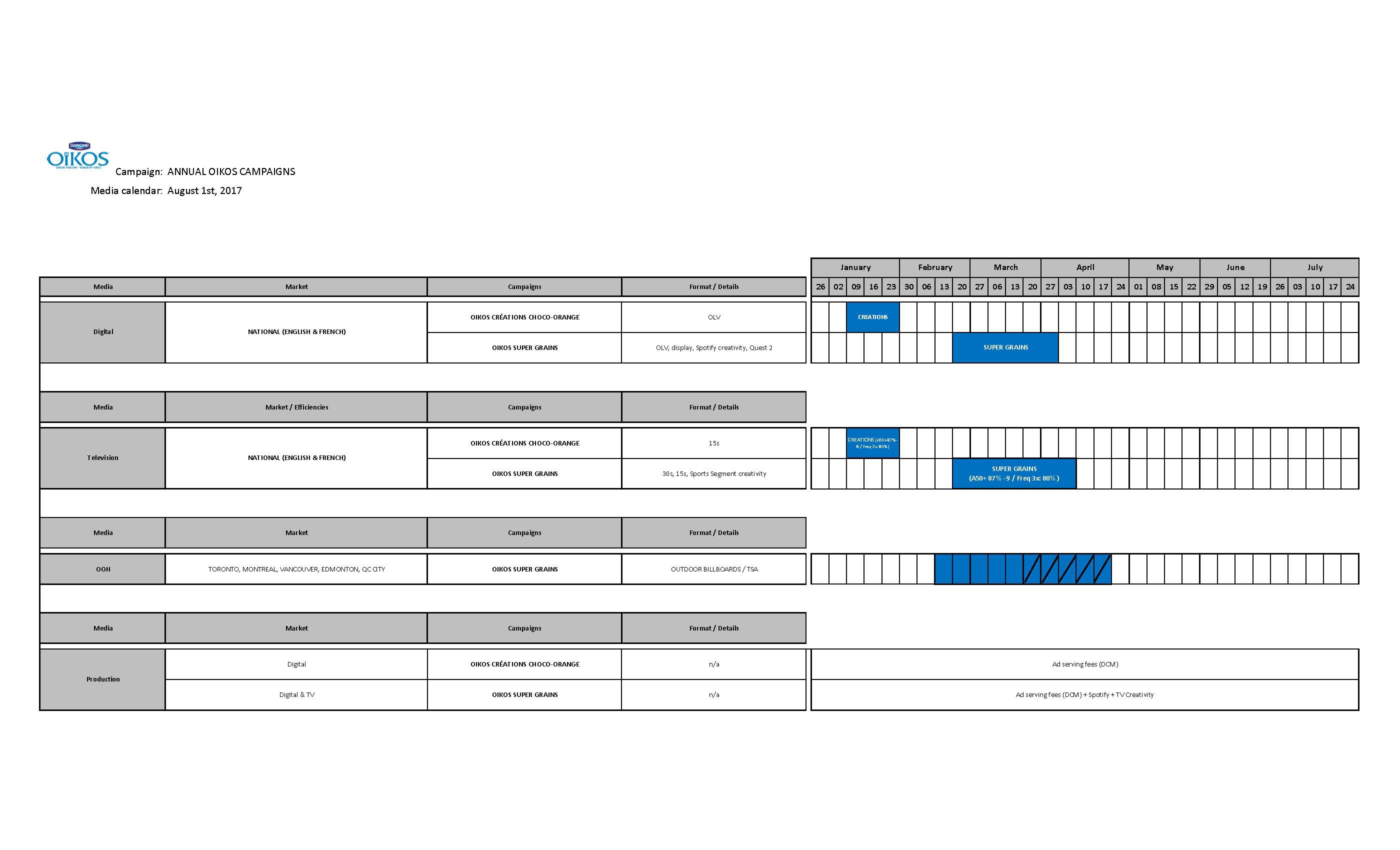

c) Media Plan Summary

Section V — THE RESULTS

a) How did the work impact attitudes and behaviour?

Post-test results following the 2015 Dream Campaign show that the campaign contributed to an increase in awareness levels. Significantly above the norm, it also contributed to giving a good impression of the brand and generating a stronger intention to purchase OIKOS.10 The campaign also positively reinforced the consumers’ proximity feeling with the brand as the TV ad was very enjoyable to watch.

OIKOS “Dream Snack”, Advertising Post-Test – Research Report – April 2015 10. Continuous tracking Ipsos TL 2015+Q1 2016

b) What Business Results did the work achieve for the client?

The results speak for themselves as we surpassed all of our aggressive objectives.

- Earning 5.2 points in market share at the end of 2015 and 4,6 pts in 2016, and 0,8 pts in YTD 201711

- + 18% higher sales volume at the end of 2015 and +16% in 2016, and +5% in YTD 201712

- Over 5 million views of our alternative endings on YouTube and a 1.5% interaction rate on alternative endings (versus 1% YouTube benchmark)13

- + 73% of the number of OIKOS account’s subscribers on Instagram during the Quest for the dream snack14

AOL

- We observed a total of 2,824,151 engagements and nearly 50% of users skipped to access their content directly15

- CTR: 0.86% (benchmark 0,27%) = higher than the Canadian pre-roll benchmark16

SPOTIFY

- Total of 15,824 clicks17

- Drove qualified traffic – an average of 02:45 spent on oikos.ca18

- CTR: 0.55% (benchmark of 0.10%)19

c) Other Pertinent Results

Given the success of this brand platform, Danone Canada has become the worldwide leader for OIKOS communications. Other countries have picked up and adapted Canada’s work for their local markets (such as Italy that is experiencing the same excellent results on all metrics).

d) What was the campaign’s Return on Investment?

Volume gains stemming from the campaign have been tremendous and have grown steadily since the beginning of this initiative. We saw an increase of 14% by the end of 2015 (vs. 2014), 16.1% by the end of 2016, and are currently at +13% YTD. The average TV profit ROI for this campaign is $0.73 (vs Canadian norm of $0.65).20

10. IPSOS – OIKOS “Dream Snack” Advertising Post-Test Research report, April 2015

11. Nielsen Market Track, TL Nat. GB+DR+MM, TL Greek, ending July 23, 2016

12. Idem.

13. Google Analytics Figures, 2015

14. Facebook Analytics, 2016

15. AOL & DoubleClick, April 2017

16. Idem.

17. Spotify & DoubleClick, April 2017

18. Google Analytics, April 2017

19. Spotify & DoubleClick, April 2017

20. Nielsen Marketing Mix Evaluation, June 2017

Section VI — Proof of Campaign Effectiveness

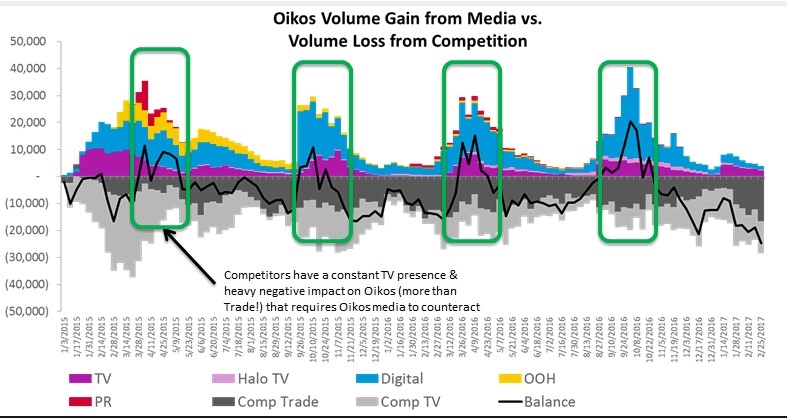

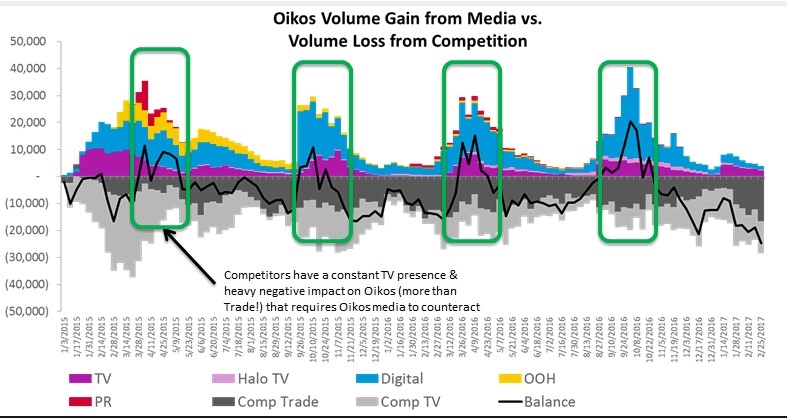

a) Illustrate the direct cause and effect between the campaign and the results

As the graph demonstrates, it is clear that our advertising presence has a direct and positive effect on OIKOS sales results. With competitors ensuring a very aggressive and constant media presence, our campaign efforts not only countered the negative effect generated by their spend, but reversed the trend yielding us positive effects every time.

REACHING THE HIGHEST MARKET SHARE WITH EFFECTIVE CAMPAIGNS

Following an 8-point loss in market share in 2014, the OIKOS Dream campaign enabled the brand to regain shares and even earn its highest market share to date.

MARKET LEADER AND STILL EARNING BIG $ SHARE

Knowing that each point gain is harder to get when you are already the market leader, results are exceptional. OIKOS gained more than 5 points in the Greek market during both campaigns. We went from 33.1 (P1, 2015) to 42.3 (P13, 2016) to 42.9 (P4, 2017).

b) Prove the results were not driven by other factors

Campaign spend vs. history and competition:

The campaign has been in the market for three years now, with the similar annual spending levels (please refer to Media Plan Summary, in section IV). As our competitors are spending year round, OIKOS focuses on key moments in the year.

Pre-existing Brand momentum:

As before mentionned, OIKOS was loosing ground and market shares because of an increasingly fragmented market. With the Dream Campaign, we succeeded to reverse the trend.

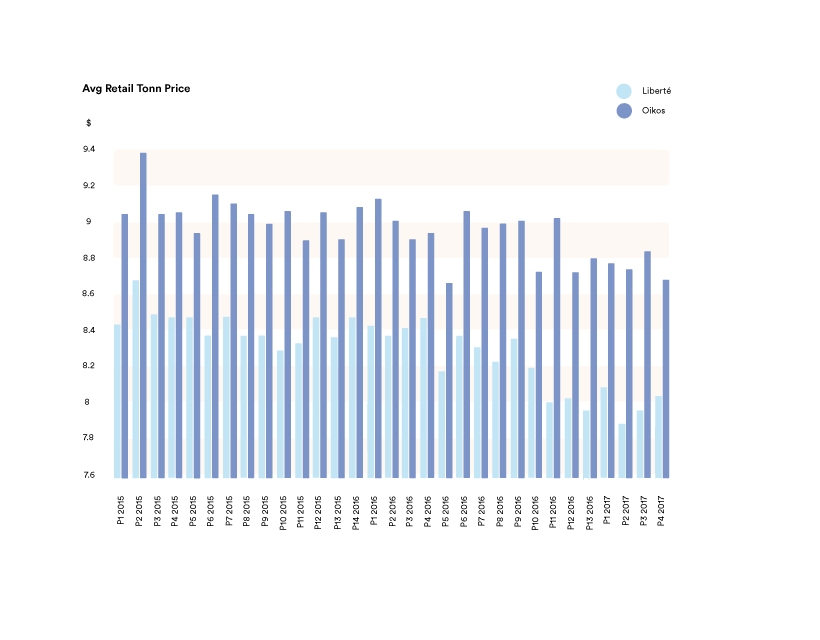

Pricing:

CONSUMERS’ BETTER PERCEPTION OF THE BRAND BREAKING THE PRICE BARRIER

Regarding the price, we notice that OIKOS is still bringing growth to the segment while keeping a higher price than its closest competitor, Liberté, whose average price is $9.06/kg versus $9.74/kg for OIKOS. Therefore indicating that the campaign improved the perception that OIKOS is worth paying more for and has a better value for the price paid.

Changes in Distribution/Availability:

There was no significant change in the distribution.

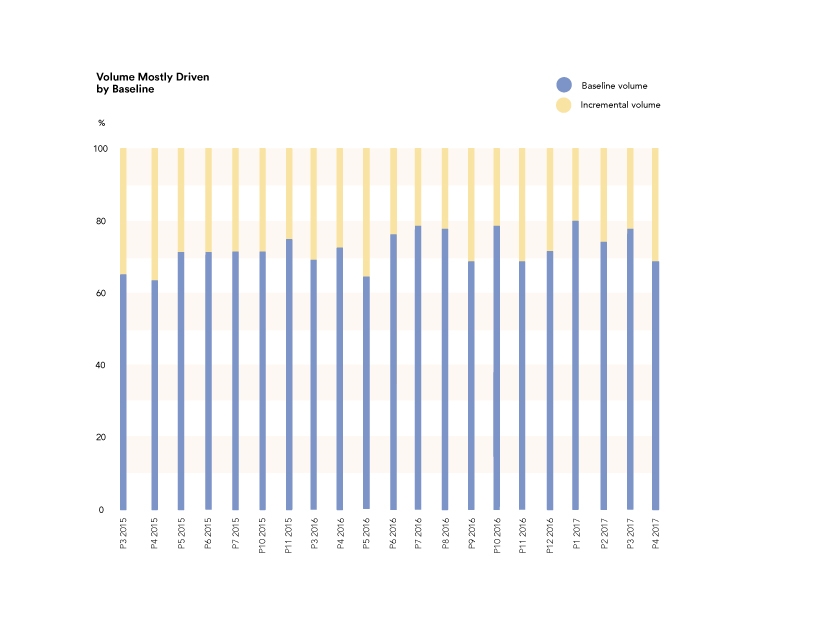

Unusual Promotional Activity:

VOLUME MOSTLY DRIVEN BY BASELINE

Promotions are heavily used by all brands in the yogurt category. A brand like Liberté is offered at a discount price 50 out of 52 weeks every year. However, OIKOS sales results show that most of our market share gains were within baseline, therefore indicating that our increase in sales was not linked to any promotional/discounting/couponing or other price tactics, but rather the result of our campaign efforts.

Any other factors:

No other factors affected performace or results.

Graph “Volume Gain”: Danone Canada

Graph “Market Share”: Nielsen Answers Canada, Period Ending April 1, 2017

Graph “Volume Baseline”: Idem.

Graph “Tonn Price”: Idem.