DEWmocracy

Events, Seasonal and Short-Term (BRONZE)

Client Credits: PepsiCo Beverages Canada

Vice President of Marketing, PepsiCo Beverages Canada: Sassan Jahan

Director of Marketing, PepsiCo Beverages Canada: Ryan Collis

Marketing Manager, Mountain Dew: Ronit Soroksky

Assistant Marketing Manager, Mountain Dew: Alexandra Collins

Agency Credits: BBDO Toronto

SVP, Executive Creative Director: Peter Ignazi / Carlos Moreno

Art Director: Craig Brandon / Danny Bang

Writer: Johnny Pavacic

Agency Producer: Beatrice Bodogh

SVP, Executive Managing Director: Paul Reilly

VP, Account Director: Jennifer Jones

Account Supervisor: Tania Montemarano

Group Digital Director: Mark Carpenter

Director of Digital Strategy: Nicole Polivka

Associate Creative Director: Jaimes Zentil

Account Coordinator: Haliey Scott

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | April 1 – June 1 2013 |

| Start of Advertising/Communication Effort: | April 1st, 2013 |

| Base Period as a Benchmark: | 2012 (entire year) |

Section II — SITUATION ANALYSIS

a) Overall Assessment

After a decade of declining growth, in 2012 we successfully put Mountain Dew back on the consideration list of young Canadian millennials with a bold TV spot, new packaging, sampling and a launch event. We launched on Facebook with a Canadian fan page and gained a fan base of over 300,000 Canadians. Our National Dollar Share increased by 1.0 share points (from 0.6 to 1.6), which was impressive growth for a small brand in the very competitive Canadian carbonated soft drink (CSD) category. Even with all of our success, by the end of 2012, only 13% of Canadian millennials, our key target group, had consumed a Mountain Dew in the past 4 weeks.

In 2013, we wanted to build upon the momentum we had achieved and continue to grow market share, trial and engagement amongst our key target group of millennial males, aged 16-24. We were challenged to do this in a highly competitive CSD category that has been suffering annual declines, is stagnant and lacks innovation.

b) Resulting Business Objectives

Our business objectives were the following:

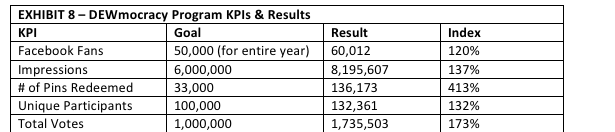

- Increase volume of 8oz cases by 2 million (+36.5%) versus year ago (VYA) by selling 7.6 million cases by year end (versus 5.6 million cases in 2012)

- Increase National Dollar Share points by +0.2 share points (from 1.6 to 1.8) by year end

- Keep Mountain Dew within the top 10 single serve CSDs at Convenience & Gas (we ended 2012 in 8th place), where our millennial target primarily shops.

- Gain 50,000 Facebook fans by year end

- Get 100,000 unique participants

- Generate 6 million organic impressions

- Receive 1,000,000 votes

- Redeem 33,000 product pins (included under the cap)

We set our sights high especially considering that we had just re-launched Mountain Dew in Canada last year and prior to that, the brand hadn’t been supported in Canada since 2006. We knew we needed a big push to get our target excited about the brand and surpass the success we saw last year.

c) Annual Media Budget

Over $5 million

d) Geographic Area

Canada – National

Section III — STRATEGIC THINKING

a) Analysis and Insight

Mountain Dew’s core target market in Canada is 16-24 year-old males (with a bull’s eye of 18). Mountain Dew is a niche brand in Canada compared to the US where it has 60 years of heritage and significant marketing support. Here in Canada, the brand had not been supported since 2006, however prior to that, there were several years of support including TV, transit, OOH, re-branding and grassroots activities which failed to move the needle in terms of sales. One thing that is consistent on either side of the border though, is that Mountain Dew fans are an extremely passionate group of enthusiasts.

Since starting a Canadian Facebook fan page in early 2012, we have been bombarded with requests for US flavours. This passion for our brand sparked our insight; our male target of 16-24 year olds yearn to be part of the decisions their favourite brands make. Our consumers demanded action and we gave it to them.

In 2013, we created a bold program called DEWmocracy. Instead of following a traditional consumer packaged goods approach by launching a new flavour every year, which would have only maintained our success, if at all, we decided to build upon Mountain Dew’s momentum and launched 4 of the top US flavours at the same time. This was a bold move for a small brand like Mountain Dew, especially in such a tough category to get shelf space in. We wanted to make a splash by introducing 4 flavours at once to avoid having the brand fall off the radar. Mountain Dew’s passionate fans would be critical in helping to achieve this and therefore at the center of everything we did.

b) Communication Strategy

Our campaign was comprised of three key phases.

In Phase 1, we built hype for the upcoming DEWmocracy campaign by offering our Facebook fans an exclusive opportunity. We created a teaser kit, which included the 4 new flavours in limited edition cans and an insert teasing the campaign, before they hit shelves. Our fans went crazy. Our initial run of 600 kits was gone in minutes, so we doubled our order to 1,200. Social media chatter erupted with fans posting pictures and ‘video unboxings’ of their DEW sample kits. This phase generated more than 20,000 new Facebook fans. More importantly, consumers started the conversation for us and created excitement for what was to come.

In Phase 2, DEWmocracy launched with 4 new flavours supported by an adrenaline-pumping TV spot, a digital campaign and in-store displays urging Canadians to vote for their favourite flavour, which would stay on Canadian shelves permanently. In the launch ad, the 4 flavours were packed in crates at a secret base in the US and loaded onto a plane. Once over Canada, the crates were pushed out of the plane by a team of skydivers. The spot ends on a cliffhanger, asking fans to vote for their favourite flavour as they watch them dramatically fall through the air.

To keep our target engaged throughout the campaign and coming back to vote every day, every vote was a chance to win $50,000 and tons of daily prizes. Knowing that our target is always on the move, we made voting easy. They could vote via text and at DEWmocracy.ca on Facebook. For extra votes and chances to win, consumers could enter pins found on product, which helped to drive sales. They could also download flavour-themed Facebook cover photos which were refreshed weekly for 5 extra votes. To help drive engagement and spread the word further, we used Open Graph technology within Facebook so that each time someone voted, it was published to their Facebook news feed for friends to see and engage with. A secondary contest was also created for our DEW fanatics: create a video and tell us which new flavour you like most for a chance to win 1% of its net sales for two years!

Phase 3 revealed the winning flavour in a follow-up TV spot. The winning flavour’s parachute deployed saving it, while the other three hit the ground causing epic flavour explosions. As an added treat to our Facebook fans, we released the final spot on Facebook in advance, making them the first to find out which flavour won. The winning flavour eventually hit shelves with ‘Voted by Fans’ written on its packaging.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

- TV

- Digital Pre-Roll

- Facebook Banners & In-Game Ads

- Mobile Banners

- Ads within Xbox platform

- Standard Flash Banners

- Search Engine Advertising

Media In-Market: April 1st – May 26th 2013.

b)Creative Discussion

When it came time to launch the DEWmocracy program, we knew it would take a kickass spot to breakthrough and resonate with our target. We needed a story that dialed up the urgency of voting and communicated the prizing up for grabs, all in a Mountain Dew tone and manner. We were asked to create 2 TV spots, one to launch the DEWmocracy program and the second to launch the winning flavour.

So we thought – what if it was a cliffhanger in 2 parts? What if the flavours themselves were in danger, and only fans could save them? And in true DEW fashion, how could we turn all of that into a visually thrilling, adrenaline pumping stunt?

The solution: we brought the 4 flavours to Canada from a secret base in the US desert, pushed them out of a cargo plane with a team of skydivers, and let fans pick which parachute deployed therefore saving that flavour, and which ones were left to hit the ground at terminal velocity.

The overall campaign had a distinct look and feel that combined visual elements of the 4 DEW flavours with a rugged, secret-ops look inspired by the military. Together, they created a seamless virtual experience for consumers to engage with.

c)Media Discussion

The digital buying goal for media was to create a multi-media, cross platform campaign and be wherever millennials are across the entire digital landscape. We needed to drive constant engagement and participation amongst our key target group. To help achieve this, we utilized key digital media suppliers relevant to millennials such as Facebook and Xbox to maximize brand experiences and awareness. Mobile was also well represented using social-conversation targeted messaging and in-game incentives.

TV was purchased across demographically relevant networks and programs to get the efficient reach required. Specific programming included: The MTV Movie Awards, Jimmy Fallon, Jimmy Kimmel, New Girl, Rookie Blue, Glee and Wipeout.

The TV ad also ran in pre-roll video format on websites that millennials frequent such as Much Music, Comedy, MTV, YouTube, MSN, College Humour, Spike and Funny or Die.

Section V — BUSINESS RESULTS

a) Sales/Share Results

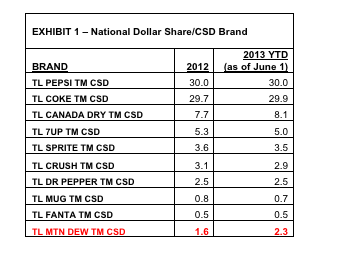

In 2012, Mountain Dew’s average National Dollar Share was 1.6. YTD it has an average of 2.3 Dollar Share (an increase of +0.7 share points), indexing at 128% of the goal. Please refer to Exhibit 1 (National Dollar Share / CSD Brand).

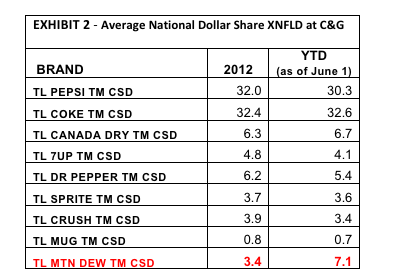

If we look at the Average National Dollar Share at Convenience & Gas specifically (which is where our target makes the majority of their purchases), Mountain Dew’s share has more than doubled YTD, increasing by +109% to 7.1 Dollar Share versus 3.4 in 2012. Please refer to Exhibit 2 (Average National Dollar Share XNFLD at C&G).

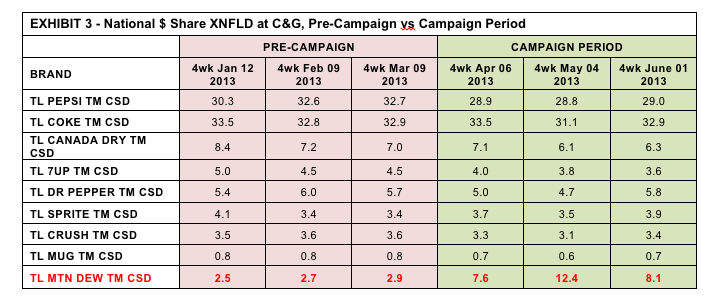

If we look at Dollar Share by month, we see that Dollar Share at C&G reached a high of 12.4 in May which caused a decrease in the Dollar Share in every other CSD brand that month. During the campaign period (April – June), Dollar Share for DEW more than tripled to 9.4 on average versus 2.7 prior to campaign launch (Jan – March), an increase of +248%. Please refer to Exhibit 3 (National Dollar Share XNFLD at C&G per Month 2013 YTD).

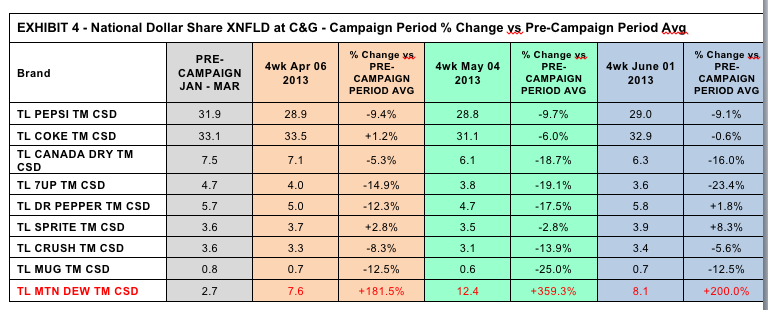

If we isolate the results even further and look at the results monthly during the campaign period only in comparison to the pre-campaign average (Jan – Mar), it is clear that the campaign caused a significant increase in Dollar Share at C&G increasing by +181.5% in April, +359.3% in May and +200% in June. Please refer to Exhibit 4 (National Dollar Share XNFLD at C&G – Campaign Period, % Change vs Pre-Campaign Period Avg).

Sales to Date since Campaign Launch

Nationally, YTD (Jan – June) sales have already delivered 62% of total 2012 sales ($17,726,334 vs $28,819,879)[1] [footnote 1].

At C&G, YTD (Jan – June) sales of 591ml bottles have already delivered 87% of total 2012 sales ($5,825,904 versus $6,708,312) in just 6 months[2] [footnote 2].

During the 12-week campaign specifically, sales amounted to 66% of total 2012 sales ($4,404,687 versus $6,708,312)[3] [footnote 3], in only 23% of the time.

National unit volume sales have increased +37% VYA during the 12 week program and +30% year-to-date VYA[4] [footnote 4].

At C&G, unit volume sales have increased +47% VYA during the 12 week program[5] [footnote 5] and +22% year-to-date VYA[6] [footnote 6]. 78% of YTD unit volume was achieved during the program alone (in 46% of the time), proving that it was successful at driving sales amongst our key target group.

[1] Footnote 1: AC Nielsen, 2013 YTD ending June 29, 2013

[2] Footnote 2: AC Nielsen, 2013 YTD ending June 29, 2013

[3] Footnote 3: AC Nielsen, March 17 – June 8, 2013

[4] Footnote 4: AC Nielsen, March 17 – June 8, 2013

[5] Footnote 5: AC Nielsen, March 17 – June 8, 2013

[6] Footnote 6: 2013 YTD ending June 29, 2013

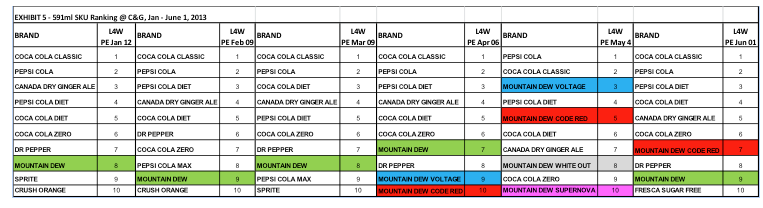

In terms of SKU ranking, we’ve kept at least one Mountain Dew SKU within the top 10 list of 591ml bottles sold at C&G. Midway through the campaign (May), all 4 new flavours made the top 10 (with Regular Mountain Dew ranked 11th). As June approached and the campaign end neared, Regular Mountain Dew & Code Red were in the top 10 as other flavours had started to sell out nationally[1] [footnote 7]. Please refer to Exhibit 5 (591ml SKU ranking at C&G YTD).

[1] Footnote 7; AC Nielsen, 2013 YTD ending June 01, 2013

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

The launch TV ad scored 46% amongst Canadians for Branding (the norm is 32%) – you couldn’t help but remember it was for Mountain Dew.

The ad also scored 44% for ad recognition (norm is 39%). The spot was easily linked back to Mountain Dew.

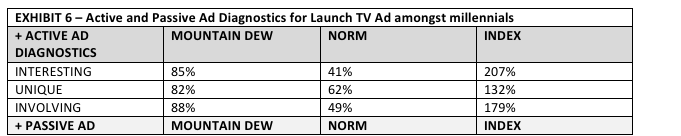

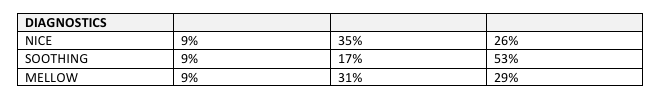

All positive ACTIVE ad diagnostics for the launch TV commercial tracked WELL above the norms while the positive PASSIVE ad diagnostics under-indexed, which was expected as our advertising depicted a stunt that was meant to depict adventure, risk, and suspense. Please refer to Exhibit 6 (Active and Passive Ad Diagnostics for Launch TV Ad amongst millennials).

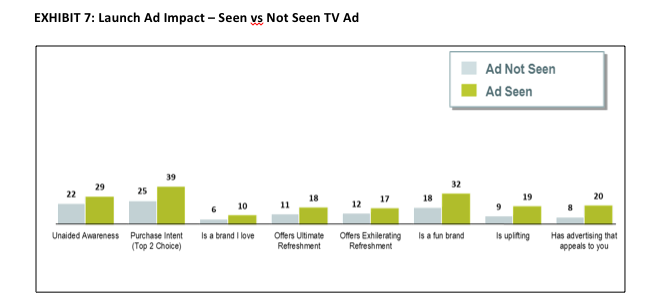

In terms of Ad Impact, the launch TV ad had a positive impact on Mountain Dew overall. Those who had seen the ad were significantly more likely to consider Mountain Dew (purchase intent), viewed Mountain Dew as a fun & uplifting brand and felt that the brand had advertising that appealed to them. Please refer to EXHIBIT 7 (Launch Ad Impact – Seen vs Not Seen TV Ad).

Our spot garnered 565,373 total views through pre-roll and received a CTR average of 3.93% for the :15 version & 7.1% for the :30 version – vastly surpassing the CPG average of 0.82%[1] [footnote 8] – indexing at 479% and 866% respectively. This demonstrates the value of having both elements in our plan.

By the end of the campaign, all program Key Performance Indicators (KPIs) had been well-surpassed. Please refer to Exhibit 8 (DEWmocracy program KPIs & Results).

Flavour Fan Pages were also created on Facebook and one of the video submissions got multiple articles written about it by local media.

b)Excluding Other Factors

Spending Levels:

2013 YTD media spend (Jan – June) is only 3% higher than 2012 spend in the first half of the year. Clearly, media spend was not a factor.

Note – 36% of YTD media spend did not support the DEWmocracy campaign and was used to support regular Mountain Dew in January & February.

Pricing:

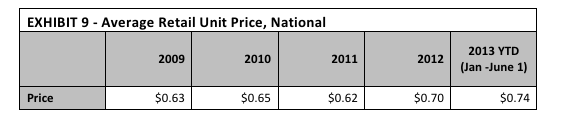

Prices have steadily increased in three of the last four years (the exception being 2011, which saw a slight decrease). In 2012, the average retail unit price was $0.70. In the first 5 months of 2013, the average retail unit price was $0.74. There was a slight increase in price in 2013 but not enough to deliver our results. Please refer to Exhibit 9 (Average Retail Unit Price, National)

Distribution Changes:

Since we launched 4 flavours at once, thereby increasing the number of Mountain Dew options from 2 (Regular & Diet) to 6, there was a natural lift in product availability due to more flavour options for the consumer. However, Mountain Dew already had high distribution levels and distribution only increased from 96 to 99.

Unusual Promotional Activity:

Promotional activity, outside of the ad campaign, was reduced in 2013 versus 2012. In 2012, PR and mass sampling supported the campaign. For DEWmocracy, there was no sampling program in market for the 4 new flavours nor was their PR support.

The campaign was supported in-store with retail displays however the in-store promotional activity mirrored the same level as last year when DEW re-launched in Canada.

Promotional activity was not a factor either.

Other Potential Causes:

N/A

Footnote 6: 2013 YTD ending June 29, 2013

Footnote 7; AC Nielsen, 2013 YTD ending June 01, 2013

Footnote 8: According to Brightroll, average CTR’s for the CPG category sit at approximately 0.82% for in-stream video.