Our Food. Your Questions [McDonald’s]

Off to a Good Start (GOLD)

Best Integrated Program (GOLD)

Client Credits: McDonald’s Canada

Joel Yashinsky: Chief Marketing Officer

Hope Bagozzi: Director of Advertising

Michelle McIlmoyle: Senior Marketing Manager

Agency Credits: Tribal Worldwide, a division of DDB

Andrew McCartney: Managing Director

Louis-Philippe Tremblay: Creative Director

Miles Savage: Account Director

Ian Mackenzie: Senior Copy Writer

Derek Blais: Senior Art Director

Kara Wark: Art Director

Amy French: Art Director

Benson Ngo: Art Director

Sanya Grujicic: Copy Writer

Tiffany Chung: Copy Writer

Ryan Lawrence: Copy Writer

Jason Chaney: Strategist

Parker Mason: Strategist

Kevin McHugh: Strategist

Melanie Chiriboga-Gomez: Account Executive; Kevin Jones: Group Account Director

Melanie Lambertsen: Agency Producer

Andrew Shulze: Agency Producer

Stef Fabich: Agency Producer

Ed Lee: Social Media Director

Peter Borell: Lead Designer

Jean-Lou Renoux: Designer

Neem Ba Ha: Executive Producer

Joe Dee: Director of Technology

Paul Jara: Developer

Paul Sham: Developer

OMD: Media Buyer; Production Company: Family Style – John Weiman and Torey Kohara: Director(s)

Harland Weiss, Donovan Boden: Executive Producer(s); Liz Dussault: Line Producer

School Editing: Post-Production Company; Brian Wells, Various: Editor(s)

RMW: Audio House

Igniter: Developers

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | July 1, 2012 – December 31, 2012 |

| Start of Advertising/Communication Effort: | May 28, 2012 |

| Base Period as a Benchmark: | January 1, 2011 – June 30, 2012 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

A conversation McDonald’s wasn’t taking part in.

With consumers and media more knowledgeable about methods of food production, a critical new battleground for the Quick Service Restaurant (QSR) industry had emerged around “perceptions of food quality”. As the #1 driver of long term sales growth for McDonald’s, low food quality scores meant that consumers were 3 times less likely to eat at there because of it.

A quick Google search of McDonald’s food related terms revealed a slew of myths about the quality and origins of its food. They ranged from accusations of ‘pink goop’ in McNuggets to McDonald’s owning a company called “100% Pure Beef.” Despite the fact that none of the myths were true, they had gained veracity among consumers and media online. These myths represented 45% of the online conversation about McDonald’s; a conversation McDonald’s wasn’t taking part in.

Despite telling its food quality story for years through persistent advertising McDonald’s still had the lowest food quality perception scores in a competitive set that included Subway, Tim Horton’s and Wendy’s — all of whom were touting consistent ‘fresh’ messaging with ‘Eat Fresh’, ‘Brewed Fresh’ and ‘Fresh, never frozen’. To make a real impact McDonald’s needed to address the problem head on and do so in the digital space where the myths were so pervasive.

b) Resulting Business Objectives

The goal to increase brand perception wasn’t about driving short-term sales goals, but improving food quality perception scores that directly correlate with long terms sales growth and lifetime value of customers.

- Specifically to increase food quality perception scores ‘Food I Feel Good about eating’ +14pts by 2014

c) Annual Media Budget

Confidential

d) Geographic Area

National Canada

Section III — STRATEGIC THINKING

a) Analysis and Insight

Listen to consumers. Then tell the truth.

A social media listening audit revealed that the highly crafted food quality advertising in market had been fuelling negative perceptions online. We identified that instead of targeting McDonald’s “lovers” (20% of the population) through traditional TV, there was a need to target and engage those who actively question the quality and nutritional value of their McDonald’s experience. We called them “fencesitters”: those in the middle who eat at McDonald’s from time-to-time, but who also feel a host of negative association with the brand, ranging from shame to anger. This target represented 60% of the total market and the best opportunity to address the issue and challenge of increasing food quality perception scores.

Our insight was simple: Canadians have questions about McDonald’s food. We have answers. Good ones. But the only way people will start listening to us is if we started by listening to them.

We needed to connect with Canadians, participate in a conversation, and tell the same food quality story we always had, but in a way that consumers wanted to engage and one that wasn’t just talking about ourselves.

b) Communication Strategy

A radical transparency platform

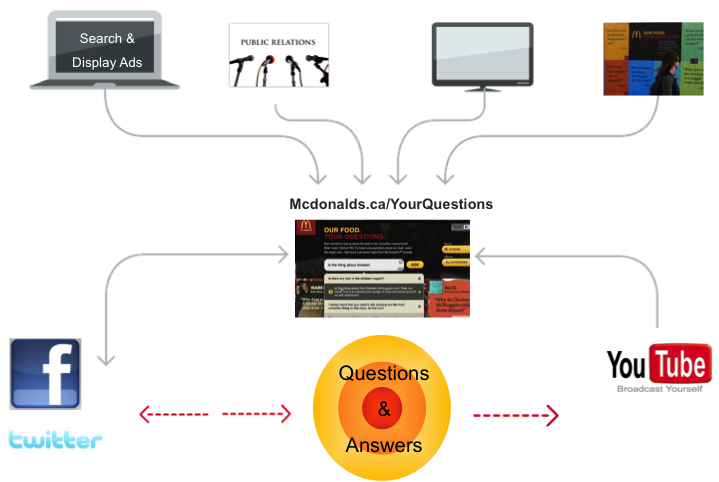

Our job was not to say something new, but to tell the story about McDonald’s food quality in a way that would stop people in their tracks. We created a platform that gave consumers unfettered and unfiltered access to the McDonald’s brand. “Our Food. Your Questions” allowed Canadians to ask McDonald’s any question they had about the food. No question was too tough or raw for McDonald’s to answer. Each question and answer would serve a myriad of functions: a personal connection to the brand, a sign McDonald’s was listening, and a piece of content designed to displace the existing inaccurate or negative information on the web.

Every single question received a personal response from our dedicated team, and these responses were posted publicly on McDonalds.ca/YourQuestions for other Canadians to browse and read. By owning the truth and telling it in an authentic way we disarmed the myths, appealed to the ‘fence-sitters’ and validated our lovers.

This approach to transparency would live or die on our ability to answer every question we received — and to do so quickly and personally. So we created a 10-person Response Team tasked with answering every question with text, image or video answers, the sum of which became the voice of the platform. In many cases, detailed research was needed to provide complete and accurate answers, requiring engagement and input from all levels and functions of the McDonald’s organization, from suppliers to front-line crew, right up the President and CEO.

And instead of hiding the toughest, most negative sounding questions, we did the opposite and put the full weight of McDonald’s media behind them. Real consumer questions became the advertising for the platform and were brought to life with online videos, banner ads, wild postings and subway station takeovers. It was a clear signal that McDonald’s was listening and ready for transparent discussion.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

- Website

- Platform Answers

- Text

- Image

- Video

- Online

- Pre-Roll video

- Standard Banner Ads

- Rich – YouTube masthead Banners

- Activated all ‘owned assets’

- McDonald’s.ca homepage

- Facebook – Our Food. Your Questions tab

- YouTube – branded channel

- Social

- Facebook Ads

- Facebook posts

- YouTube Channel

- TV

- :30 English and French

- OOH

- Wildpostings

- Station Takeovers

- Projections

b)Creative Discussion

The Our Food. Your Questions platform was radically different from anything McDonald’s had done before and so it made sense that the creative look and feel would break this mold as well. The design put consumers and their questions at the center of the campaign materials and was brought to life with a vibrant colour palette that stopped consumers in their tracks. It was bold, refreshing and had the break-through required to capture consumer attention.

Website

At the heart of our radical transparency campaign was the Our Food. Your Questions Website. It served as a socially powered FAQ, where consumers could ask anything they wanted about McDonald’s food. In addition to asking questions, consumers could browse, search, follow and share from the ever-growing content base of text, image and video answers.

The website embraced social sharing at every opportunity through users having to connect via Facebook connect or Twitter. This ensured questions and answers were amplified back out to the askers’ social network.

Platform Answers

The answers were the fuel for the platform. They inspired additional consumer questions, and most importantly, were designed to displace the negative content being perpetuated on the Internet.

Text Answers

Text addressed the majority of questions that were received. Personalized, direct responses were designed to answer the questions being asked and to dispel any myths that were at the core of the question.

Image Answers

Image Answers provided greater impact visually on the website and were used in social channels to displace the plethora of negative perceptions generated by the simplest of Google searches.

Video Answers

Video Answers went viral online and in the media generating millions of views with no paid media. They were open, honest and fully transparent responses that went head to head with some of the most pervasive myths about McDonald’s food. Video Answers addressed notable food quality perception issues including:

- Why doesn’t your food look like it does in advertising? (8,000,000+ views)

- Why are the eggs so round? (200,000+ views)

- Is there a company called 100% pure beef? (95,000+ views)

- Is there ‘Pink Goop’ in the Chicken McNuggets? (150,000+ views)

- What is in the secret sauce? (2,700,000+ views)

- How do you grill your patties? (100,000+ views)

- How are the patties made? (300,000+ views)

- Where does McDonald’s get their hamburger patties from? (65,000+ views)

- How does McDonald’s make their World Famous French Fries? (2,200,000+ views)

Pre Roll – ‘Streeters’

To launch the campaign we took to the streets and interviewed real people to see what questions they had for McDonald’s. We filmed every question and edited a :30 Pre Roll video designed to create awareness of the platform and to solicit new questions from people online.

Online Banner Ads

Paid online banners took real consumer questions and used them as the advertising for the platform. This bold approach demonstrated that McDonald’s was listening, but most importantly, that the company was prepared to own the truth. Online media units allowed consumers to ask questions right in the banners. They were bright, engaging – and they worked. Our YouTube masthead was the most successful Canadian YouTube banner of the year, with a click-through rate of .93% – 3 times industry average – a testament to the stopping power of a simple idea executed flawlessly.

Owned Assets

McDonald’s had a number of owned assets in the digital space including Facebook page, YouTube channel and the McDonald’s.ca homepage. We activated all of these owned channels to feature the many questions and answers that were the fuel behind the platform. Using a ‘spotlight’ API we were able to surface the most commonly asked questions and address those that were doing the most damage. The richer the assets the more impactful they would be to consumers so image answers and video were key.

Social Media

Many of the myths and misinformation that were doing the most damage to food quality perception scores existed and were being perpetuated in the social space. This channel was a key battleground for us to use the rich image and video answers as content and demonstrate our transparency message.

The Facebook and Youtube channels were used as content distribution hubs and enabled our extensive fan base of engaged ‘lovers’ to share our content for us. By owning the truth and validating their love for us they became even stronger advocates.

Television

We had listened, answered and now we needed to drive awareness through the use of television. By leveraging the most compelling video content, our 30-second TV spot introduced a mass audience to a braver, more genuine McDonald’s. It also drove our target online to find, follow, share and ask their own questions.

OOH

Colourful. Engaging. Stop-you-in-your-tracks provocative. Our out-of-home brought the spirit of the campaign alive on streets across the country. More than 60 unique executions – each featuring a real question – made sure consumers had lots to sink their teeth into.

c)Media Discussion

The Our Food. Your Questions platform launched in two distinct phases. We couldn’t just tell customers our story… it was critical that we demonstrated action first and then advertised what we were doing to maintain the authenticity of the platform.

While no one individual campaign element was strong enough to improve consumer perceptions on its own, the eco-system we created was a cohesive and powerful tool that was harnessed to drive perception change. The Website was the core conversion tool and so all media was used to drive traffic to the site.

Phase 1: ASK and ANSWER

Knowing the Internet is a conductor for myths, we carefully staged our initial battle wholly within the digital arena and used it as a conductor for our answers. We leveraged the discoverability of digital media by using social, display, mobile, and video. XML banners utilizing real questions pulled users into the experience where they could peruse all questions and answers and ask their own.

Phase 2: THEN AMPLIFY

During the “amplification” phase we took the conversation to the streets in unexpected ways. Instead of keeping the tough questions hidden, McDonald’s made them even louder through mainstream media including TV and multiple OOH touch-points. Ultimately this drove 3X the interest and engagement online.

Section V — BUSINESS RESULTS

a) Sales/Share Results

We knew Canadians had questions and had anticipated 5000 over the course of the campaign. Clearly the authentic and transparent approach resonated with our ‘fence-sitters’ as we received and answered more than 20,000 questions in the first 6 months, exceeding the year one target by 400%.

Over 2 million website visits generated more than 10 million interactions, visitors were not only coming to the site to have their questions answered but were engaging with, on average, 5 pieces of content per visit. Engagement time on site was over 4 minutes or 18% longer than the QSR average.

The role of social media and the social content we created generated a groundswell of interest around the brand and the platform. Our social channels saw a 65% increase in Facebook fans and a 2175% increase in YouTube subscribers’, thanks largely to the viral nature of the video content that garnered more than 14 million views on YouTube.

Most impressive were the increase in Food Quality and Brand perception scores in a short 6 month period. Metrics that had remained flat since 2009 saw a dramatic uptick off the back of the platform. Key measures included:

- Has good quality food +17%

- Food I feel good about eating +22%

- Good quality ingredients +24%

- A company I trust +12%

During the same time period we saw that while QSR visit frequency had remained flat, McDonald’s saw an increase of +36% and +14% against customers who visit weekly and monthly respectively. This translated into a 50% increase in monthly store visits. Thus demonstrating the parallel between consumers feeling good about the food and their likelihood to eat there because of it.

McDonald’s brave and bold approach to this long term business and brand health problem has been recognized on both local and international award circuits with wins at: One Show, Clios, Webby’s and Cannes Lions. The success of the platform has also led to its adoption in 5 countries around the world starting in 2013-2014.

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

In just the first 6 months of this platform McDonald’s has received Global recognition and dramatically improved quality perception scores.

With coverage in the Globe and Mail, The Toronto Star, CTV, Forbes, LA Times, ABC Evening News, The Huffington Post, CBS Morning News, The Daily Mirror, The Telegraph, and countless other national and international media outlets, the campaign has received near unanimous recognition for its “brave” and innovative approach to consumer response through social media and transparency. Totaling 500+ media hits and delivering 51 million impressions the approach created an entirely unexpected and credible channel to which our key target ‘fence-sitters’ was exposed.

Over the past 3 years Food Quality perception scores have remained virtually flat, despite premium food quality advertising in the market place. With no other ‘quality’ messaging driving perception change the impact of Our Food. Your Questions saw the single largest increase in pre and post perception scores for an advertising campaign at McDonald’s.

An independent study by Environics Research showed that exposure to the campaign saw the top three measures for food quality perception improved by 73%, 61% and 48% respectively. Most impressively in testament to the power of transparency, we saw a 46% increase in the metric “company I trust”, the single biggest improvement on this score ever seen by research or McDonald’s.

b)Excluding Other Factors

Spending Levels:

During the campaign period there were other product campaigns in market from McDonald’s, but nothing directly targeting Brand or Food Quality. Historically, none of the numerous Food Quality initiatives from McDonald’s have had a lasting impact on perception scores. From a media perspective no more weight was put behind this campaign vs any other calendar window. What was different was the approach, the medium and the content that broke through to the right target audience.

Pricing:

Due to the nature of the campaign and the brand/food perception scores we were trying to impact, in store product pricing had no effect.

Distribution Changes:

N/A

Unusual Promotional Activity:

N/A

Other Potential Causes:

N/A