RESL 2013 Campaign

Events, Seasonal and Short-Term (SILVER)

Client Credits: TD Bank

Noah Vardon, Advertising Manager

Anne Kerekes, Sr Advertising Manager

Brocke Weir, Marketing Planning RESL

Elizabeth Walford, AVP Field Marketing & Branch Banking

Jahnet Brown, Associate Manager In Branch Merc

Mary Anne McEvoy, Associate Advertising Manager

Kent Hadfield, Manager Marketing

Nick Hinsperger, Associate Manager Marketing

Kim Warren, Sr Manager In-Branch Merch

Anna Hannem, Manager Marketing

Andy Wood, Marketing Research

Keith Laing, Associate Manager Marketing

Ruben Jurik, Sr Manager Marketing Research

Agency Credits: Leo Burnett Company

Judy John, Chief Creative Officer

Stefan Wegner, Creative Director

Sean Barlow, Copywriter

Paul Giannetta, Art Producer

Barry Durocher, Print Producer

Emma DuBoisson, Broadcast Producer

Sarah Colman, Account Executive

Chris Saunders, Account Supervisor

Lori Davison, SVP Group Account Director

Brent Nelson, SVP Director of Strategic Planning

Jason Last, Planner

Laurie Filgiano, Art Producer

Arash Moallemi, Photographer

Christine Wilson, SVP

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | March 4 2013 – May 10 2013 |

| Start of Advertising/Communication Effort: | March 4 2013 |

| Base Period as a Benchmark: | March 4 2013 – May 10 2013 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

To Buy or Not To Buy?

In the aftermath of the global financial crisis of 2008-2009, it seemed like every Canadian and their neighbour had something positive to say about the resilience of Canada’s housing market.

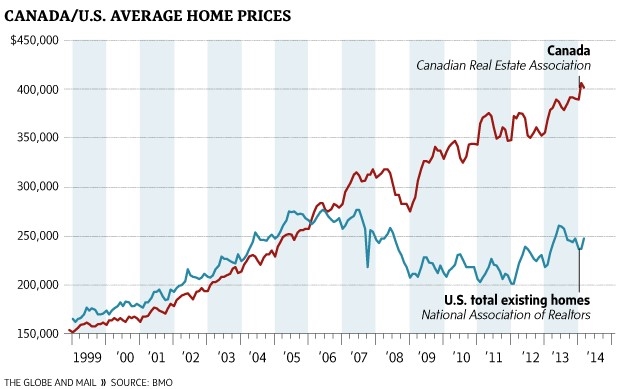

And for good reason: with American real estate having lost nearly 30% of its value between 2007 and 2011, there was something comforting about the fact that the average price of a Canadian house had risen over 100% since 2000. [Footnote 1,2]

But by 2013, sentiment surrounding Canadian real estate was beginning to shift.

Thought-leaders like The Economist and Maclean’s began publishing dire warnings on the threat of a Canadian housing bubble. A study by Deustch Bank suggested that Canadian real estate was the most overvalued in the world, and that prices were as much as 60% too high. And Mark Carney (then-Governor of the Bank of Canada) warned that Canadians’ record level of household indebtedness posed the single biggest threat to the economy at the time. [Footnote 3,4,5,6]

For TD Bank, this context was ominous: the spring housing market represents a key mortgage acquisition period and one of the most significant opportunities in the fiscal year for the bank’s profit and business growth. If potential first-time homebuyers were scared about the future of Canadian real estate, we could reasonably expect that some would step out of the market. Fewer buyers meant decreased demand for mortgages. And decreased demand for mortgages meant trouble for TD.

The prospect of a slow down in home-buying activity meant that TD would need to compete harder than ever for their share of available mortgage deals in the spring of 2013. And we would need to help them do so when each of their Big Bank competitors were set to invest heavily in mortgage advertising over the same 10-week period.

The “mortgage wars”, as they were later dubbed in the Canadian media, were about to begin.

b) Resulting Business Objectives

Given this environmental backdrop, our business objective was simple but aggressive:

1) Generate a 1.58% lift in year-over-year in entered mortgage deals

This objective had to be achieved without leaning on a superior interest rate offer to drive consideration, and at a time when bank forecasts suggested fewer potential buyers would be in the marketplace than in previous years.

c) Annual Media Budget

$4 – $5 million

d) Geographic Area

National Canada

Footnote 1: Chris Isidore, “America’s Lost Trillions”, CNN Money, 9 June 2011.

Footnote 2: Tim Shufelt, “How Low Will House Prices Go?”, Canadian Business, 15, Feb. 2013.

Footnote 3: “Canada’s Housing Market: Look Out Below”, The Economist, 4 Feb. 2012.

Footnote 4: Tamsin McMahon, “Time To Panic About the Housing Market”, Maclean’s, 28 Feb. 2012.

Footnote 5: “Canadian Real Estate Most Overvalued in the World, Study Says”, CBC News, 12 Dec. 2013.

Footnote 6: Gordon Isfeld, “Containing Canada’s Household Debt Problem Requires ‘Vigilance’ By All, Says Bank’s Carney”, Financial Post, 30 Oct. 2012.

Section III — STRATEGIC THINKING

a) Analysis and Insight

A Better House, Yes. But A Better Mortgage? Really?

To ensure that a decreasing pool of first-time homebuyers put a TD mortgage at the top of their consideration lists, we had to overcome the prevalent consumer perceptions that all mortgage products were the same, and that interest rates were the only reason to choose one bank’s mortgage over another’s.

These perceptions drove our two key communication challenges:

1) Make TD mortgages stand apart from competitive offers.

2) Demonstrate that a TD mortgage could reinforce the brand’s purpose of making lives more comfortable.

To start addressing these challenges, TD had identified a key mortgage feature – called a “Mortgage Payment Vacation” – that could be used as the foundation of a differentiated story for TD mortgages. A Payment Vacation from TD allowed homeowners to plan ahead and take up to a 4-month “break” from their mortgage payments. TD’s competitors had introduced a similar feature of their own by 2013, but no one else was communicating it – despite the fact that quantitative research suggested Payment Vacations were a motivating and compelling feature to our first-time homebuyer target.

So TD’s Payment Vacation feature gave us a starting point. But we still needed to turn that feature into a compelling story. What did a Payment Vacation really represent for first-time homebuyers? Why would they care? And how could we grab their attention amidst a sea of mortgage advertising?

Gaining a Fresh Perspective on First-Time Homebuyers

We needed to determine the role that a TD Payment Vacation could play for first-time homebuyers, so we conducted a cultural scan to understand the forces affecting their lives. This cultural research gave us a fresh perspective on the mindsets of first-time homebuyers, who found themselves in a bit of a pickle as the Canadian housing market soared to new heights in early 2013.

On the one hand this target group had parents encouraging them to buy a house and to stop “throwing away money on rent”. They faced the reality of a popular culture obsessed with the details surrounding home-ownership: bidding wars, renos, HGTV, and that amazing new restaurant around the corner that got rave reviews. They had the mainstream media and real estate agents subtly reinforcing the threat that young people would be priced out of the market forever if they didn’t act soon. And they had their own innate human desire to truly “own” a piece of property.

But on the other hand, they faced the reality of steep home prices that would require steep mortgage payments. And they worried that those mortgage payments would restrict them from acting on their other plans in life. What about that career change they were hoping to make? Or that family they were hoping to start? Or that major trip they’d been planning forever to take?

Sure, they wanted to own a home, but not if it meant sacrificing their lifestyles. After all, these were the same people flocking to services like Zipcar and BIXI in urban centres, because they valued their flexibility and spontaneity as much as the perceived status tied to ownership. If we wanted to encourage them to get off the fence and into a TD mortgage, we needed to address this key insight into their perception of home ownership.

The Insight:

First-time homebuyers fear that owning a home will eliminate their flexibility in life and make them a slave to their mortgage.

With this insight in mind, we had the fuel we needed to position TD mortgages distinctly. We now saw that a Payment Vacation from TD could represent so much more than just a flexible mortgage feature; it could represent the opportunity to redefine the very relationship that first-time homebuyers would have with their mortgage.

b) Communication Strategy

Choose A Mortgage As Unique As Your Dreams.

Our “Dear Mortgage” campaign idea was created on the foundation of our strategic insight: First-time homebuyers fear that owning a home will eliminate their flexibility in life and make them a slave to their mortgage. While all the other big banks flogged their mortgage interest rates, TD would occupy the emotional high ground with a national campaign that spoke directly to the mindset of first-time homebuyers.

The idea was to showcase homebuyers writing “Dear John” letters to their potential mortgages. “Dear Mortgage” would demonstrate all the different ways that homeowners could take time off from their mortgage payments to explore other things in life, and how they could redefine their relationship with their mortgage in doing so.

The “Dear Mortgage” campaign would show first-time homebuyers that a mortgage was about more than just an interest rate. With Payment Vacations from TD, it was about having the flexibility to own a home and make their other dreams a reality, too.

Section IV — KEY EXECUTIONAL ELEMENTS

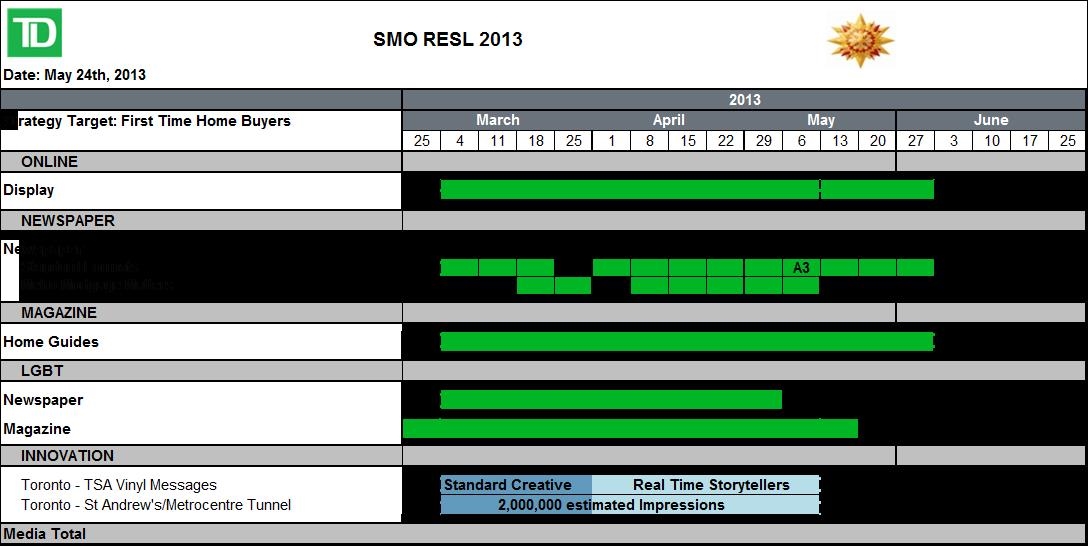

a)Media Used

Awareness

- Standard and Specialty Print

- OOH

- In-branch Merchandising

- High-impact and Standard Online Banners

Engagement

- Interactive OOH

- Online Video

Media was selected to ensure that we were reaching the first time homebuyer target during the home search and consideration stages. Target was reached through Newspaper, OOH and Digital placements that were contextually relevant but also allowed TD to stand apart from the competition and reinforce the brand’s purpose of making lives more comfortable.

b)Creative Discussion

Each of the goals and aspirations we featured across our ‘Dear Mortgage’ creative was extracted from research findings to ensure that each and every emotional benefit we chose to highlight was gender and generationally relevant across media.

Standard Print, OOH, Standard Online Banners and In-branch Merchandising

To launch the “Dear Mortgage” campaign, we created a series of Print, OOH, Standard Online Banners and In-branch ads that depicted young homebuyers who had used a TD Payment Vacation to re-frame their relationship with their mortgage. From engagements to honeymoons to growing families, the ads reinforced that a TD mortgages could make homeowners’ lives more comfortable by letting them “take time off” to achieve their goals and aspirations.

High-Impact Online Banners

A rich, interactive online banner was created to engage homeowners as a way of helping they them get prepared for a mortgage vacation. Based on current or anticipated monthly mortgage payment and the desired payment vacation time, the calculator would tell consumers how much more they would need to add to their monthly mortgage payments in order to achieve their desired mortgage break.

Specialty Print

Newspaper inserts took a unique and arresting “scrapbook” approach to documenting different TD Payment Vacation scenarios. Each scenerio was different and ultimately served as inspiration for people who may be thinking about getting a mortgage or taking time off their mortgage.

Interactive OOH

We supported Dear Mortgages “real stories” by creating our own Dear Mortgage act through a real time, live artist writing on an interactive OOH 130 foot domination in the Metrocentre/St Andrew’s Tunnel. Leveraging people’s attraction to spectacle, we used the path to visually dominate and provide opportunities for the target to engage with the writer to find out more information about what he was doing and what TD has to offer. Then we strategically selected 10 outside facing, high traffic TSAs throughout Toronto’s downtown core – again placed in areas where we could intercept the target – to maximize reach and consumer engagement with that very same content.

Online Video

A long form video was created to document both the Interactive OOH initiative. The video was created to further drive awareness and consumer engagement in social channels such as YouTube and TD’s Facebook page. Consumers were encouraged to watch and share the video as well as write their own “Dear Mortgage” letter on TD’s Facebook page.

Social

The “First Home” program was a TD Mortgage brand page on Huffington Post Living. It was an editorial series which curated a rich content experience of relevant, sharable stories, 15 Custom Slideshows covering homes in 5 major Canadian markets as well as standard engagement units. In addition, The Huffington post and Aol.ca content platforms hosted a TD branded home selector tool.

Content Partnership

We partnered with Metro newspaper to create a 10 week content series called “Mortgage Matters” to educate readers on the first time home buying process and consideration. Fresh content ran every Monday in 4 major markets; the content ran adjacent to a Dear Mortgage brand ad. An 8 page glossy insert was also run to showcase the freedom a flexible mortgage could offer.

c)Media Discussion

Media delivered more than 36.5 million impressions with the sponsored home slideshows receiving more than 49,000 page views. Over 9 million visitors engaged with the branded TD home selector tool on the Aol.ca and the HuffPost Homepages.

To make TD mortgages stand apart from competitive offers and demonstrate how a TD Mortgage could help demonstrate the brands purpose (making lives more comfortable) we used the following media:

Section V — BUSINESS RESULTS

a) Sales/Share Results

As a result of the “Dear Mortgage” campaign, total mortgage entered deals exceeded forecast at 115% over 13 weeks [Footnote 7].

Mobile Mortgage Specialist entered deals were above forecast at 102% over the campaign [Footnote 8].

The campaign outperformed all competitors in the market place on brand recall by 6% or higher as well as brand link by 13% or higher [Footnote 9].

In addition, the campaign outperformed all competitors in the market place on generating incremental traffic among non-customers by 1.3% or higher

[Footnote 10].

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Footnote 7: SMO 2012 Research Report, Oct 2011

Footnote 8: SMO 2013 Campaign Reporting, April 2013

Footnote 9: SMO RESL 2013 Campaign Tracker, July 2013

Footnote 10: SMO RESL 2013 Campaign Tracker, July 2013

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

There are a couple ways to connect the advertising with the sales results:

1) The mortgage market experienced a decline of 30% in April and 7% in May, compared to 2012 [Footnote 11]. Despite a declining mortgage market, TD had an increase of entered deals by 23% in April and 6% in May, compared to 2012 [Footnote 12].

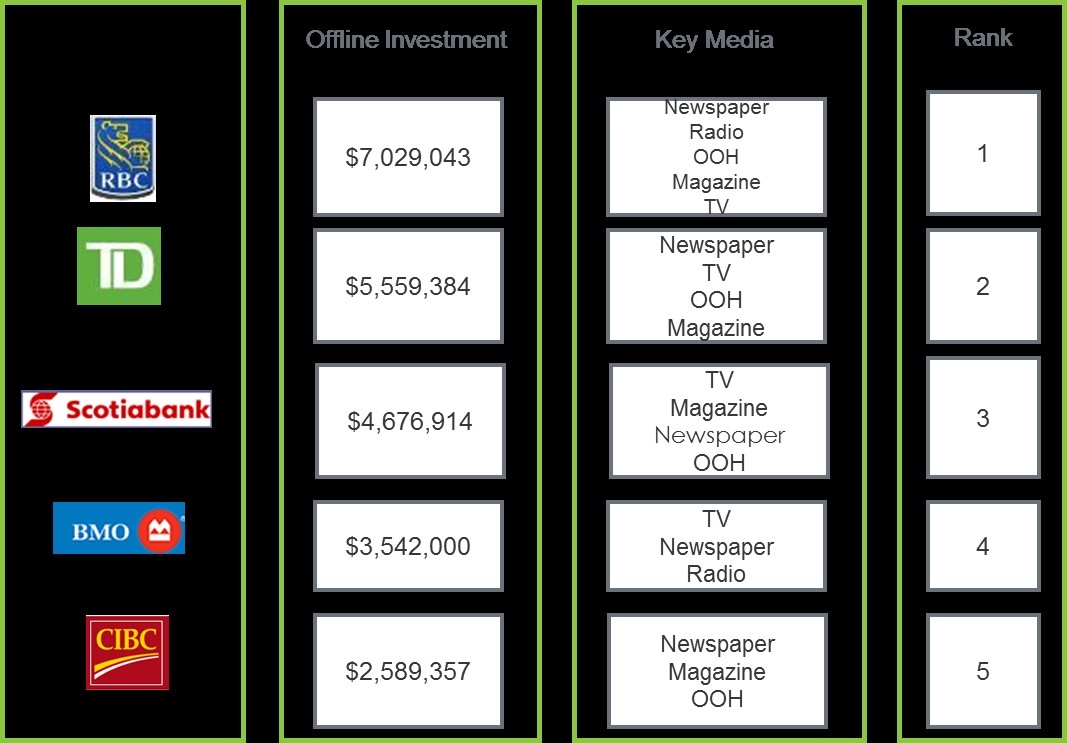

2) Although TD was consistently outspent by their competitors in both Q1 (4th in offline spending) and Q2 (3rd in offline spending) [Footnote 13], TD managed to increase Offline SOV from 15.6% to 17%, between Q1 and Q2 [Footnote 14].

b)Excluding Other Factors

Spending Levels:

Spending levels: The total spend of $5.5M, which included all production work, was not the highest FI in the category. TD was significantly outspent by RBC.

Pricing:

No unusual pricing activity versus previous years or versus the competition. In fact, BMO offered the lowest rate during the same campaign period (2.99% 5-year fixed-rate). While CIBC offered a cash back mortgage where you could get up to 3% cash back.

Distribution Changes:

No unusual growth in distribution or geographic coverage vs. the competition vs. year ago.

Unusual Promotional Activity:

No unusual promotional activity versus previous years or versus the competition. In fact, BMO offered the lowest rate during the same campaign period (2.99% 5-year fixed-rate). While CIBC offered a cash back mortgage where you could get up to 3% cash back.

Other Potential Causes:

n/a

Footnote 11: Canada Mortgage and Housing Corporation, 2013 housing starts in Canada

Footnote 12: SMO 2013 Entered Deals and Origination Result

Footnote 13: Nielsen Media Research

Footnote 14: Nielsen Media Research