Nissan Conquer All Conditions

Automotive (SILVER)

Sustained Success (GOLD)

Client Credits: Nissan

Nissan Canada Inc.

Director of Marketing, Steve Rhind

Senior Marketing Manager, Mary McNeil

Radke Films, Production House

Leigh Marling, Director

Chris Soos, DOP

Miriana DiQuinzio, Executive Producer

Ed Callaghan, Line Producer

Saints Editorial, Editing House

Ross Birchall, Editor

The Embassy, Animation House

Winton Helgason, Animation Director

Eggplant, Music House

Adam Damelin, Music Director

The Vanity, On-Line Facility

Alter Ego, Transfer

Agency Credits: Juniper Park\TBWA

Juniper Park\TBWA

Terry Drummond, CCO

Alan Madill, CCO

Barry Quinn, CCO

Rodger Eyre, Group Creative Director

Gerald Kugler, Group Creative Director

Susie Lee, Associate Creative Director

Marco Buchar, Copywriter

Leo Gonzalez, Art Director

Nadya MacNeil, Agency Producer

Janice Bisson, Agency Producer

Calvin Daniels, Head of Client Services

Section I — CASE PARAMETERS

| Business Results Period (Consecutive Months): | Jan to Mar 2014, Oct to Mar 2015, Oct to Mar 2016 |

| Start of Advertising/Communication Effort: | January 2014 |

| Base Period as a Benchmark: | December 2013 to December 2013 |

| Geographic Area: | Canada |

| Budget for this effort: | $1 – $2 million |

Section IA — CASE OVERVIEW

Why should this case win in the category (ies) you have entered?

What do you do if you have a new product that is good but not great – or rather not one that delivers an appreciably better experience than your better-known (and frankly, better-respected) competitors? In a world of increasing substitutable products with truly marginal differences, this is a situation that faces us all more often than perhaps we would like.

This is the story of how Nissan and its agency, Juniper Park\TBWA, responded to just such a challenge and developed the #conquerallconditions campaign initially for the Nissan Rogue, then for its range of Cross Over Utility Vehicles (CUVs). This quickly became one of the best-known and best-loved Canadian car campaigns of recent years; we will argue that it is also one of the most successful.

It’s also the story of how that success has continued to this day and how its strategic foundations, built on a deep understanding of the distinctive Canadian psyche, have led the brand from a position of relative weakness to one of great strength in what has become the most important segment of the car market in the country.

Section II — THE CLIENT’s BUSINESS ISSUES/OPPORTUNITIES

a) Describe the Client’s business, competition and relevant history:

By the end of 2013, Nissan – historically better known as a car manufacturer – was in danger of missing out on a major shift that was happening in the Canadian car market. Over the preceding few years, CUVs had become the biggest sellers in Canada, primarily driven by consumers wanting more space and versatility in their vehicles.

The problem was that Nissan CUVs were only on the consideration lists of 40% of Canadians, while its key competitors (Honda, Toyota and Hyundai) were on pretty much everyone’s. As a result, Nissan’s total CUV market share was stuck at 8.2%. Not promising.

Nissan Canada were well aware that their marketing focus had to switch urgently from cars to CUVs to ensure continued business success. But the company faced a number of challenges in its desire to become a real player in the CUV space:

- The segment was crowded with nearly 90 similar offerings;

- The Nissan All-Wheel Drive (AWD) system, while good, was not superior to the main competition;

- The brand itself scored less well in research on the quality, durability and reliability that CUV buyers sought;

- Each of the ‘Big Three’ mentioned earlier had twice as much to spend as Nissan in this category.

b) Describe the Client’s Business Issues/Opportunities to be addressed by the campaign:

By late 2013, the Nissan Rogue had been available in Canada market for nearly seven years. A small CUV, the Rogue significantly lagged behind key competitors such as the Honda CR-V, Toyota Rav4, Ford Escape and Hyundai Santa Fe, not only in sales performance, but also basic intermediate brand ‘purchase funnel’ measures such as awareness (Rogue: 78, competitive set average: 89) and familiarity (Rogue: 27, competitive set average: 49).[1]

In fact, despite receiving consistent mass media advertising support since its launch, the Rogue was the only one of Nissan’s core models that had an awareness score below its segment average.

In January 2014, Nissan was set to launch a new Rogue into the Canadian market. This was, of course, a big event but the really big challenge was that this model, while undeniably new, would have nothing about it would make it really stand out from the already successful competition. As if this wasn’t enough, this new model would also be the basis for Nissan’s attempt to grab its fair share of the fast-growing CUV segment. Quite a challenge.

Though the Rogue was in fact AWD, it was not held in the same esteem as its competitors. Previous globally-sourced advertising campaigns had focused on the vehicle’s style and cargo space, rather than its off-road credentials. Recent consumer research had revealed exactly why this was holding the Nissan Rogue back from greater sales success in the Canadian market. The research had thrown up an intriguing finding: although Canadian CUV drivers rarely take them off-road in the real world, the perception of off-road capability had, paradoxically, become a key driver of purchase consideration.

As a result, we decided that an all-new, Canadian-specific campaign was needed, one that tackled this problem of the Rogue’s poor performance perception head-on.

c) Resulting Business Objectives: Include how these will be measured:

Nissan had an aggressive growth strategy for 2014 and it all hinged on the successful launch of the new Rogue. In particular, it depended on establishing it as the company’s #1 source of volume with annual unit sales averaging over 20,000 for its lifecycle. This was because Nissan’s ambitions stretched beyond the initial launch period and well into the future: despite the model’s less than stellar history in Canada, the company wanted to increase Rogue’s share of the small CUV segment dramatically, with a stretch target of an 8% share in 2016. (To put this in context, in 2013, Rogue had a 5.2% share of its segment, a figure that was in fact lower than it had achieved in its first full year on the market in 2008.) [2]

Since Nissan’s share objective was a long-term one, it was clearly important to build genuine demand by way of a real preference for the new Rogue, not just buy share using price discounts (a common tactic in the car market).

In sum, our business objectives for the new model were both clear and somewhat daunting.

[1] Awareness and attitude data sourced from Millward Brown’s Automotive Purchasing Dynamics monthly reports.

[2] All sales data throughout the case is taken from Polk sales and registrations data.

Section III — YOUR STRATEGIC THINKING

a) What new learnings/insights did you uncover?

Our target for the new campaign was a dual-income, suburban couple in their mid-30s who didn’t yet have children. They were self-reliant, open-minded, altruistic, and kept calm regardless of what life threw at them. They were – and are – the prime target for CUVs in Canada; their shift away from more traditional compact and mid-size cars to the versatility offered by CUVs has to a very large degree driven the growth of the segment. (As the campaign has developed over the last two and a half years, we have kept them as our core audience.)

The research finding that was the starting point for our thinking was that Canadian CUV drivers purchase these vehicles specifically because of the all-wheel-drive capability (despite almost never taking them off-road). It turns out that this is because it allows them to drive confidently in pretty much any adverse on-road conditions – including the often brutal Canadian winter – ensuring both their own safety and that of their passengers. Most interestingly – and this proved to be the pivotal insight – it instills in them a real sense of pride as they enjoy being relied upon when driving conditions are at their worst.

b) What was your Big Idea?

We would show Canadian drivers that they too could be winter heroes if they drove a Nissan Rogue. And so the #conquerallconditions campaign was born.

c) How did your Communication strategy evolve?

Recognizing the importance of establishing off-road credentials – and knowing that the campaign would run during the winter – we knew early on that the campaign would need to focus on winter driving. Although there are – famously – many aspects of winter that Canadians enjoy, when it comes to driving they have an essentially combative relationship with it.

Going deeper, we saw that when driving conditions become perilous, you’re only as strong as your vehicle. This is when Canadians turn to those vehicles that can be trusted to reach destinations safely, whether it’s work, dinner with friends, hockey practice or the hospital. When winter does its worst, our trust in a capable AWD vehicle provides us with great peace of mind – irrespective of whether we actually ever use its off-road capabilities.

We believed that a communications strategy built around this idea of ‘pride in the face of adversity’ would set us apart from our competitors who were all positioning their CUVs as versatile family vehicles, and communicating in a warm, folksy tone. In contrast, we deliberately chose to create work with a more aggressive, almost masculine tone to position the Nissan Rogue and its drivers as capable of taking on winter and winning.

d) How did you anticipate the communication would achieve the Business Objectives?

In a nutshell, we needed to do two things with our work for the launch of the 2014 Rogue. (These imperatives have also informed all our subsequent #conquerallconditions work.)

The first was to develop a creative approach that would stand out in a way that, to be honest, the car itself didn’t. This went beyond just being noticed in a crowded market: it was vital that we were truly distinctive.

The second was to create something that created a genuinely compelling emotional connection with Canadians drivers – whether or not they were in the market for a CUV in the immediate term. We wanted to achieve real long-term resonance in the market and make our substantial but smaller budget work as hard as it could.

This was the genesis of the first commercial, ‘Winter Warrior’. (Each winter since, we have created another new piece of copy to essentially the same brief. These have run alongside the original spot and we now have five CUV commercials in total.)

Section IV — THE WORK

a) How, where and when did you execute it?

‘Winter Warrior’ launched in January 2014 and ran through March. Casting winter as the villain, personified by sinister marauding snowmen in a snowy city streetscape, it starred the Rogue car and drivers as the heroes who between them rescue helpless civilians from the besieged city.

The campaign stood out from other automotive advertising because the primary broadcast execution quite deliberately had the look and feel of a Hollywood blockbuster film trailer: it built suspense and intrigue for the first half of the execution before the vehicle and driver were introduced as the hero figures.

Media worked together to build a coherent, single-minded story focusing not only on Rogue itself, but also on the conflict with winter: behind-the-scenes interviews with the evil snowmen and the heroic driver were shared across social channels; the snowmen posed for photos at auto shows; and digital content was all tailored around the same message and look and feel as the primary broadcast execution.

We repeated this approach in the two following winters; we just started rather earlier in both years (November as opposed to January). TV always led the way, because of its high impact emotional heft and unparalleled reach – often featuring programming that was ‘appointment to view’ thus giving us very high 1+ cover, such as The Super Bowl, the Grey Cup and major hockey games. Wrapped around this core, digital and social media were deployed in ways that evolved over the course of the campaign as new opportunities arose to engage our potential buyers via established and emerging platforms.

As the campaign really bedded in, we also starting featuring other models alongside Rogue. For the next winter (2014-15) we developed another execution called ‘Icy Bridge’ that featured the Murano. This then ran alongside ‘Winter Warrior’. Our 2015-16 campaign followed a similar pattern. In a sense, the hero was no longer just Rogue itself, but Nissan’s ‘intuitive all-wheel-drive’ system, common across its CUV range.

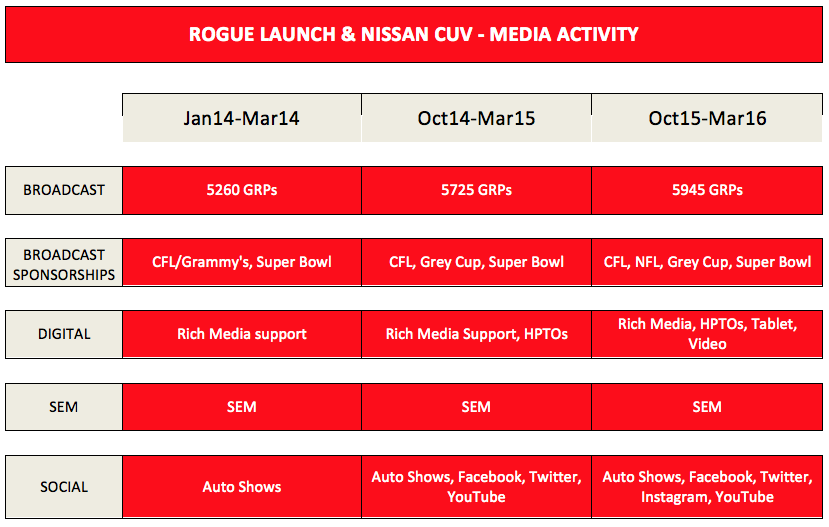

c) Media Plan Summary

Section V — THE RESULTS

a) How did the work impact attitudes and behaviour?

Sales for Rogue responded immediately to the advertising. Unit sales in that first January were up more than 125% on the same month the previous year; over the three months of winter as a whole, sales were up 77%. In the end we blew through the sales target for the year by early September and the total sales for the calendar year set a (then) record for the model of 28,827. The effect of the new approach seemed dramatic.

b) What Business Results did the work achieve for the client?

In terms of the business, the key result was the effect on market share.

On this front, the results have been little short of spectacular. (We are well aware that effectiveness cases often make assertions like this, but rarely is it as justified as here.)

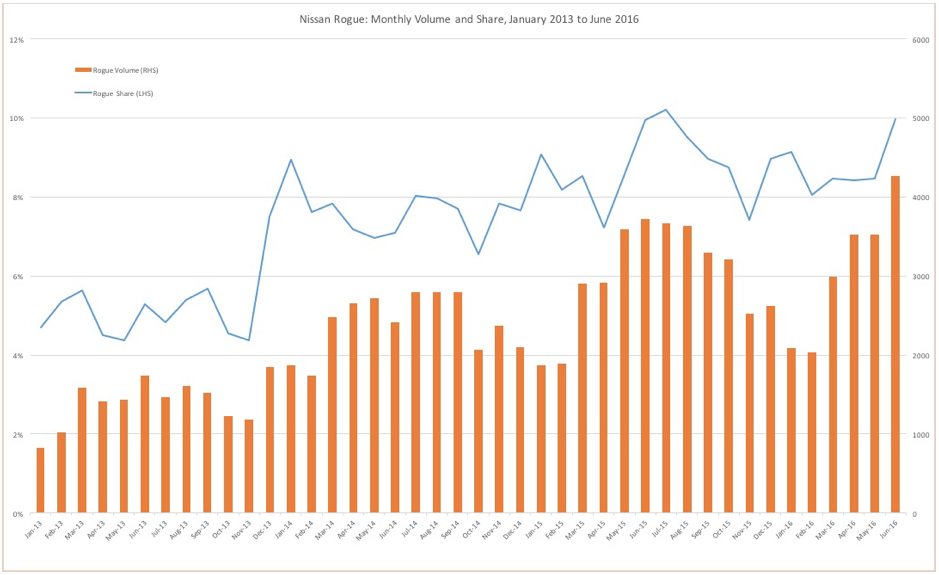

When ‘Winter Warrior’ aired for the first time in January 2014, Rogue’s share leapt to an all-time monthly high of 8.9%.[3]

Gratifying as this was, this campaign was always about the longer term and establishing truly defensible brand equity. In fact, in 2014, every single month saw Rogue break its share record for that month. As a result, its share for the year also set a record, ending at 7.6%.

And share has continued to grow: to 8.8% in 2015 and 9.1% for the Nissan fiscal year ended March 2106. In fact, there is no sign of this momentum abating: over the last twelve months, Rogue has set monthly share records in eight of them. And the effect on other smaller-selling CUVs in the range is also impressive.

c) Other Pertinent Results

- The campaign was picked up and used as the CUV campaign for the US – the first time this has ever happened to a Canadian-originated Nissan campaign.

- The campaign also played a large part in Nissan being recognized by the industry as the ‘Fastest-Growing Automotive Brand in Canada’.[4]

d) What was the campaign’s Return on Investment?

While unfortunately no formal econometric modelling has been done on the campaign, it would however be true to say that Nissan Canada is very happy with the way that the campaign has performed in business terms. This is evidenced by its imminent continuation for another (i.e. fourth) winter.

[3] Full disclosure: Rogue sales in December 2013 were also up substantially. This was because – for obvious reasons – the new model was available for sale in showrooms ahead of the campaign launch. This high volume is partly due to suppressed demand with drivers of the old Rogue waiting for the new model to arrive so they can upgrade; but it also sets a useful baseline for ‘natural’ demand for the new Rogue, i.e. unmediated by the advertising. What is striking is that each December since, the figures (both volume and share) have been very substantially higher – despite the product being essentially unchanged.

[4] Based on full-line brands, MAT unit sales.

Section VI — Proof of Campaign Effectiveness

a) Illustrate the direct cause and effect between the campaign and the results

The chart of Rogue sales below sets out the clear impact of the #conquerallconditions campaign in graphic detail, impact that has now been sustained for the last two and a half years and that shows no sign of stopping. In a world where more and more marketing activity seems to focus on the short-term, we are particularly pleased to have had such a positive effect and truly sustained success.

Our view is that the figures speak for themselves; the sales and share data just keep improving month by month and year by year. Given that that the new vehicle a) wasn’t really innovative or different in the first place and b) has essentially stayed the same since its launch, you would expect demand to flatten off quickly when the novelty wore off. This clearly hasn’t happened.

In addition, Murano sales provide a similar picture, albeit on a smaller scale:[5]

Simply put, we believe we achieved what we set out to do: create truly sustainable brand distinctiveness and emotional resonance for the Nissan Rogue (and Nissan’s CUVS more broadly). We did this by successfully tapping into a truth deep in the Canadian psyche about driving in that most Canadian of all seasons, the winter.

b) Prove the results were not driven by other factors

Campaign spend vs. history and competition:

Throughout the period under discussion, the budgets available to Nissan have been consistently smaller than those of its main competitors in this space, both generally and for the #conquerallconditions campaign.

Pre-existing Brand momentum:

The whole premise for this campaign was that in its nearly seven years in Canada, Rogue had generated no real momentum. Bluntly, it was stuck in a rut. We believe that this campaign successfully addressed this. Indeed, there is considerable evidence that one of the broader effects of the #conquerallconditions campaign has been to generate momentum for the Nissan marque in Canada as whole (e.g. the aforementioned industry award).

Pricing:

Over the course of the period under discussion there were price fluctuations of the kind often seen in a fiercely competitive marketplace. Rogue was never the least expensive but it was never the most expensive either – we needed to be competitive, particularly with Honda, Toyota, and Ford.

Changes in Distribution/Availability:

There were no distribution changes of any significance during the period under discussion. Availability was good across the country.

Unusual Promotional Activity:

There were no unusual or overly generous promotions for Nissan CUVs during the period under discussion. (You will recall that one of the important factors behind our approach was to reduce the need for such things by making the brand’s emotional appeal more compelling.)

Any other factors:

In the car market, this would typically be the competitive launch of a completely new model or a massive update of an existing one. Nothing like that happened in the period under discussion. There were no other factors at play

[5] Murano is seen as being in a different CUV segment, hence the higher share figures on lower volume than Rogue. The Murano itself did not feature in the TV advertising until November 2014.