Kraft Canada – MiO

Packaged Goods–Beverage (GOLD)

Best Launch (GOLD)

Client Credits: Kraft Canada

Senior Director, Marketing: Leisha Roche

Director, Marketing: Kristi Murl

Associate Brand Manager: Lindsay Rogers

Agency Credits: TAXI Canada Ltd.

Executive Creative Director: Lance Martin

Creative Director: Jeff MacEachern

Art Director: Mike Lee

Writer: Alexis Bronstorph, Mike Blackmore, Mike Shuman, Troy Palmer

French Writer: Tanya Henri

VP, Integrated Production: Cynthia Heyd

Group Account Director: Daniel Shearer

Account Director: Shazeen Pirani

Account Manager: Zak Usher, Andrea Wong

Digital Strategist: Zach Klein

Agency Producer: Ben Sharpe

French Agency Producer: Anick Rozon

Post Production Manager: Athena Kouverianos

Production Company: Steam Films

Editorial Company: Posterboy Edit

Colour Facility: Alter Ego

Post Production: The Vanity

Audio House: RMW Music, Eggplant Collective

Music Licensing: Girth Music

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | March 2012–July 2013 |

| Start of Advertising/Communication Effort: | March 2012 |

| Base Period as a Benchmark: | N/A – product launch |

Section II — SITUATION ANALYSIS

a) Overall Assessment

In 2012, Kraft Canada launched MiO, a first-of-its-kind concentrated liquid water enhancer. MiO represented a lot of firsts for the beverage world. There’s the move from powder to liquid – a significant leap in a market where innovation is typically incremental. Plus, MiO borrows liberally from the best of its category. It’s like flavoured waters, but conveniently sized. It’s like a powder packet, but mess-free and resealable. It’s like bottled pop and juice, but better, because consumers can decide how much or little flavour they want.

There’s a lot to love about MiO, but we had one huge challenge – to make our young and highly sought-after target care enough about MiO’s advantages to put down their bottles of Pepsi, Vitamin Water, and Nestea, and try MiO instead.

Simply put, we had a delightfully disruptive product, a massive job to do, and not a lot of money to do it with.

b) Resulting Business Objectives

The objectives were typical of a CPG launch. In order to be successful, we needed to quickly generate significant awareness and drive mass trial. Given our portfolio strategy, we also needed to bring a new user into the category in order to not cannibalize our other Kraft brands.

Overall objectives:

* Meet aggressive sales target (specific number can’t be shared as results are represented as a percentage of forecast)

* Grow the Canadian beverage mix category, a category that had been in decline since 2007, and bring in new users to avoid simply cannibalizing existing Kraft brands in the category

* Quickly build brand equity and establish a differentiated tone and personality for the brand

c) Annual Media Budget

$2 – $3 million

d) Geographic Area

National

Section III — STRATEGIC THINKING

a) Analysis and Insight

We needed a target. We began by looking at the Kraft portfolio of water enhancers to mine for a user that was currently underserved and would represent an incremental consumer to Kraft. We also took the long view, optimistically betting that, should MiO’s launch be successful, we would want to expand this format innovation across other similar Kraft brands, like Crystal Light and Kool-Aid.

The logical conclusion was to target male millennials – 18- to 34-year-old guys who are willing to try new things and are often the tastemakers of culture, and who would be completely incremental to the overall Kraft water enhancer portfolio.

While this target would be a clear win for Kraft if we were able to bring them onside, they came with one key challenge – they were already sought out by most beverage brands. From soda to water and from sports drinks to energy drinks, a dizzying array of options is offered to our target every day. And to heighten our challenge, he was satisfied with what was already out there. In fact, he was beyond satisfied and often overwhelmed by the options available to him.

Our insight came from an unassailable product truth: MiO changes water.

And it changes it in some really interesting ways, with unique colours, shades, patterns, and of course, delicious flavours, all of which you control. The amount of change is in the palm of your hands.

We quickly realized this product truth was one that perfectly aligned with a value held dear by our millennial-guy target. If there’s anything this group craves, it’s change. Our guy gets bored when things stay the same for too long; changing things up is the way he keeps his world fresh and interesting. It’s true of the music he listens to, the clothes he wears, and the way he communicates. Why couldn’t it be true of the water he drinks, too?

This wasn’t simply a target insight, but one that perfectly aligned with MiO’s key functional benefit: the ability to make your drinking water less boring.

So we decided to make MiO stand for change. If ever there was a product that could bring change to a tired category, it was MiO. And if ever there was a target who would care, it would be male millennials.

b) Communication Strategy

Our communication strategy had three key prongs:

1. Intrigue them

The product itself was unique and quirky, even a little odd. And given our small budget, we needed to stand out and make an impact. We needed to define and carve out a personality that would allow us to bring something new and unique to a wildly crowded category. And we needed to be interesting enough that our target would be compelled to seek us out, as male millennials simply don’t shop in our section of the store – they keep to the pop and water aisle, not the powdered beverage section.

2. Educate them

This format had never existed before. We needed to educate our consumer, not only on what we were but how we worked, and most importantly, our benefits. Every piece of the marketing mix would need to help demonstrate the innovation – how, where, and why to use it.

3. Leverage them

We needed to make our content interesting and, most importantly, shareable. With a relatively small paid media budget, earned media would be key to bolstering our share of voice within the category. We also knew that no endorsement is as important to this group as that of a friend, so we strived to make the kind of brand communication that would be shared organically.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

TV

YouTube content

Digital Media and Pre-roll

b)Creative Discussion

We began with the belief that change is good. And we turned that belief into an epic campaign – one that was unexpected enough to sustain our target’s interest, effective enough to drive massive sales, and flexible enough to support the eventual launch of MiO Sport. We also introduced the cheeky, provocative tagline “Squirt some” as a way to both celebrate the user experience and educate our consumer on how to use the product.

Our 30-second launch spot, “Changes,” used more than 100 visual changes, big and small, to dramatize MiO’s role as an agent of change. The spot took off almost immediately, quickly surpassing 1,000,000 views on YouTube. It was shared, mimicked, quoted, and loved by our target.

We then partnered with the male millennial YouTube phenomenon known as Dude Perfect, a basketball trick-shot crew. Dude Perfect swapped their usual trick shots for trick squirts to create a unique branded content experience. The content quickly hit over 500,000 views and showed our target a new side of the brand. We also took the crew on a one-day media blitz that garnered over 18,000,000 media impressions.

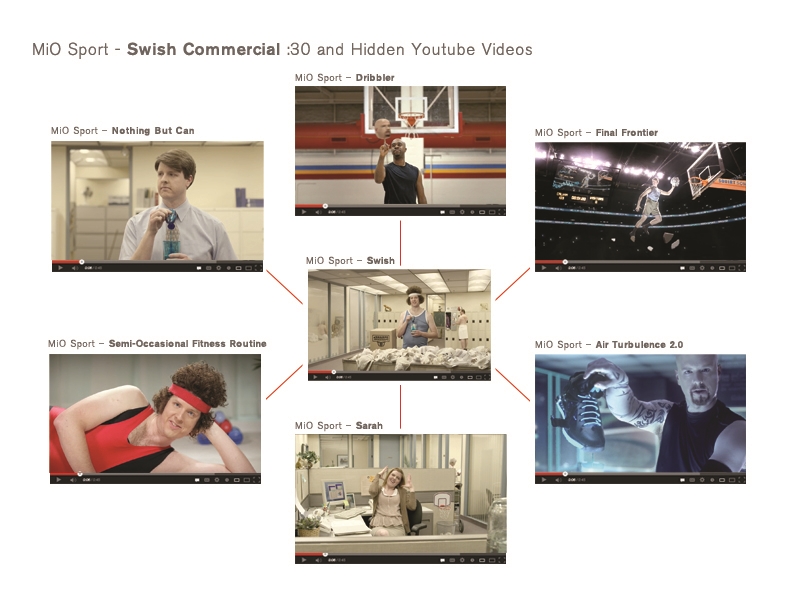

Next, we built brand momentum with “Swish,” a spot supporting MiO Sport, MiO’s electrolyte-packed sub-brand. Although it was set in the same office and featured the same hero character as MiO’s launch spot, it was a far cry from a typical follow-up spot. We learned from the massive engagement we saw with the launch spot and used annotations to create a choose-your-own-adventure-style experience on MiO’s branded YouTube channel. Every scene within “Swish” was clickable and took the viewer to six additional secret content pieces.

“Eye of the Squirter,” the final spot in MiO’s “Changes” campaign, is MiO’s boldest ad of all – an irreverent takedown of the over-the-top, juiced-up world of sports-drink marketing. And by changing our hero’s persona more than a dozen times in 30 seconds, “Eye of the Squirter” remained faithful to MiO’s change-themed positioning.

c)Media Discussion

For launch, our approach to media was one of “fewer, bigger, better.” For this target, content is king, so we leaned on both TV as mass awareness, with digital amplification playing a key role. Knowing that our content would be sought out by our target, we employed a substantial digital buy to ensure it could be found and shared easily.

As the campaign continued, we started to shift the focus from a TV-led buy to an even richer digital experience. Building from our second spot, “Swish,” our secret content was designed to reside on YouTube but spread well beyond that single platform. Our goal was to take one view of our TV spot and turn it into three through annotated content. Digital drivers were placed within key millennial passion-point media properties, such as sports and humour, to drive our target into the experience. And from there, the experience drove itself.

Section V — BUSINESS RESULTS

a) Sales/Share Results

March 2012–June 2013

Sales

Month after month, MiO’s sales massively outpaced Kraft’s objectives. The brand ended 2012 with sales 350% greater than Kraft’s original forecast, and as of July 2013, MiO sales were already 130% higher than they were last year.

All eight MiO SKUs are in the top 10 of the entire category, with sales velocity doubling the category average.

Share and Category Growth

Sixteen months ago, MiO didn’t exist. Today, the brand comprises 26.3% of the dollar share of the category. But we haven’t won only by stealing share from MiO’s competitors or by cannibalizing the other beverage brands in Kraft’s portfolio – we’ve succeeded at bringing new users into the category. MiO was the primary driver of growing the category 18.7% in its first year and an additional 14.5% year-to-date. Notably, since launch, more than half a dozen competitors have entered the category with carbon-copy offerings – the big guns took notice of our success. And still, we led the category.

Brand Health

Additionally, after just one year in market, MiO boasted brand health metrics just below those of established, blue-chip brands in the category, most of which have been around for years and often for decades. After just five months, MiO’s Brand Health Index Score was 70, compared to Vitamin Water’s 81 and Red Bull’s 90. Even the combined behemoth of Coke and Diet Coke sat at only 118. This was a true testament to carving out a unique and ownable personality.

Virality

Our success didn’t stop with the accountants. The social media sphere loves MiO, and the view counts of our YouTube channel content continue to climb. Each of the three spots has been viewed well over 1,000,000 times, with our most recent spot, “Eye of the Squirter” hitting 1,000,000 views in just 12 days.

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

Simply put, MiO was a brand built from the ground up, overnight. In the crowded and competitive beverage category, our advertising built a category, quickly established a unique and ownable brand personality, educated our consumer on the how and why of MiO, and drove people to stores to buy it.

The post-campaign tracking on the advertising further supports the relationship between the work and the results we saw. Of individuals recalling the ad, 75% link it to MiO, matching the performance of the top 5% of all ads ever tested and successfully driving both trial and awareness. Additionally, it drove results well above norm in driving interest in the brand (31%) and in making our consumer want to buy the brand (24%).

Our YouTube strategy has been successful in reaching our target very specifically, with 99% of our views being Canadian and 92% being male – all translating into further awareness and trial.

b)Excluding Other Factors

Spending Levels:

There was no significant unusual pricing or promotional activity. As this was a new product launch, we have no benchmarks to compare our results to.

Additionally, a whopping 80% of our sales have been baseline (vs. incremental), showing healthy brand growth that has not relied on promotional activity or deep discounts for success.

Pricing:

Not Applicable.

Distribution Changes:

Not applicable.

Unusual Promotional Activity:

Not applicable.

Other Potential Causes:

Not applicable.