Huggies – No Baby Unhugged

GRAND PRIX

Packaged Goods (GOLD)

Building Brand Equity (SILVER)

Client Credits: Ogilvy & Mather

Kimberly Clark

Brian Clayton – Baby and Child Care Director

Paul Scott – Sr. Brand Manager

Mitch Faigan – IMP Director

Michael Hurt – Baby and Child Care Director

Ali Ruffo – Social and Digital Marketing Manager

Alicia Cameron – Shopper Marketing Lead

Lauren Wong – Associate Marketing Manager

Agency Credits: Ogilvy & Mather

Creative Agency: Ogilvy & Mather

Ian MacKellar – Chief Creative Officer

Chris Dacyshyn – Associate Creative Director

Julie Markle – Associate Creative Director

Laurie Young – Managing Director

Aviva Groll – Group Account Director, Sr VP

Kennedy Crawford – Account Executive

Robyn Hutman – Digital Strategic Planner

Michelle Lee – Planning Director

Charmion Brathwaite – Digital Project Manager

Leslie Warren – eCRM Director

Asha Davis – Digital Strategic Planner

Amy Brash – Account Supervisor

Doug Potwin – Planning Director

AnneMarie Martignago – Producer

Media Agency: Mindshare

Section I — CASE PARAMETERS

| Business Results Period (Consecutive Months): | June 2015 – May 2016 |

| Start of Advertising/Communication Effort: | Late May 2015 |

| Base Period as a Benchmark: | June 2014 – May 2015 |

| Geographic Area: | Canada (national including Quebec) |

| Budget for this effort: | Over $5 million |

Section IA — CASE OVERVIEW

Why should this case win in the category (ies) you have entered?

Over ten years ago, Huggies was the leading brand in the diaper category. But in recent years it had lost its focus, with Canadian marketing efforts subsumed to a North American approach. In 2015, we developed a Canada-specific program which didn’t just communicate a new philosophy, but actually put it into practice in Canadian hospitals, changing the way newborn babies are cared for.

Our No Baby Unhugged campaign positioned our brand as an extension of a mother’s hug, and the champion of the emerging science of hugging. Through our hospital hugging programs, and by educating Moms about all the ways hugs help newborns thrive, we capitalized on our brand’s emotional equity while adding medical authority. In doing so, we engaged our target at a deeper level and elevated diaper choice from a functional to an emotional decision, increasing Huggies Newborn diaper sales almost 20%, and stealing 2.3 share points from market leader Pampers – remarkable results in a mature category with almost flat birth rates.

Section II — THE CLIENT’s BUSINESS ISSUES/OPPORTUNITIES

a) Describe the Client’s business, competition and relevant history:

If you asked moms to imagine Canada’s two leading diaper brands as a person, they would see Pampers as a doctor and Huggies as a mom. Great for Huggies, you might think, to own the more human side of this space? Well, yes and no.

The problem with the diaper category is that while expectant Moms are focused on creating an idyllic experience for her baby, diapers are not considered as an active part of this preparation. This soon-to-be new mom is feverishly feathering her nest, preparing her nursery, her hospital bag, her mind, her body and her whole world for the most anticipated arrival of her life. It’s no surprise that choosing her baby’s diaper, a simple “pee and poo catcher”, is a less important matter. It was easy and even prudent for her to default to authority. And authority meant Pampers, with its long history of clinical product performance demos, decades of hospital endorsement along with hospital-green graphics, and a 60% share of market – almost twice that of Huggies (Source: AC Nielsen MarketTrack).

b) Describe the Client’s Business Issues/Opportunities to be addressed by the campaign:

Winning with new moms is essential to build long-term diaper loyalty (Actual numbers held confidentially by brand team. Source: AC Nielsen Disaggregated Study). Given that the relationship with a diaper brand lasts years, the lifetime value of one mom can be as high as $2600 per child (Source: AC Nielsen MarketTrack). There are therefore huge rewards to be reaped for being the first diaper brand to land in expectant mom’s shopping cart. While Canadians spend approximately $400 million a year on diapers (Source: AC Nielsen MarketTrack), the lifetime value of 390,000 moms, the average number of new babies born in Canada in the last two years as measured by Stats Canada, is actually closer to $1 billion per year.

With Pampers being the default choice, the only way Huggies could win was to pre-empt that default by getting Mom to make her diaper choice actively, carefully, consciously. To do that, we had to switch the conversation from functional to emotional, while also building our authority. We needed to get Mom to see Huggies as a vital part of the uncompromising care she hoped to provide for her new baby.

c) Resulting Business Objectives: Include how these will be measured:

Business Objective: Grow Huggies Newborn $ volume.

Goal: +10% Huggies Newborn diaper $ volume.

DO THIS BY:

Marketing Objective 1:Build equity in brand perception that Huggies is better for newborns than other brands.

Goal: +5 point agreement that “Huggies is better for newborns than other brands”.

Marketing Objective 2:Get new mothers to sign up for Huggies database.

Goal: Double the number of sign ups of new mothers to Huggies database.

(Notes: Newborn diapers are for babies up to 10lbs.)

The category is growing very modestly in line with the birth rate increase of 1% a year. In this context, a 10% sales increase is ambitious.

Sourced in case.

AC Nielsen MarketTrack

AC Nielsen Disaggregated Study

Stats Canada

Section III — YOUR STRATEGIC THINKING

a) What new learnings/insights did you uncover?

We couldn’t simply throw on a lab coat and declare Huggies was now a doctor. We would never beat Pampers directly at that game, and we’d be squandering our own brand equity of warmth and human connection. We had to find a way to build our medical authority that was true to our own brand.

A new idea was emerging in the world of pediatric science, one that we were perfectly positioned to champion. Since the 1960s the dominant model of birth in North America has been a strictly medical one, in which the mother’s instinct was handed over to professionals who drugged her as they saw fit, told her when to push, and had no qualms about whisking the newborn baby out of her arms and into the supposedly superior care of nurses and incubators. Both mother and baby were seen as passive players in the clinical, doctor-run process of birth. A mother’s primal urge simply to hold her baby close was de-prioritized, leaving her arms aching and her maternal confidence shaken.

Through consultation with some of the world’s foremost neonatal experts, including CAPHC (Canadian Association of Pediatric Health Centres), and through clinical medical studies unearthed by the agency, we learned there is mounting evidence that mom’s instincts was right all along. For a newborn baby, being held isn’t just something that feels good – it is a powerful and medically necessary developmental stimulus. There is now irrefutable medical evidence that skin-to-skin contact with a newborn via hugging helps regulate body temperature, stabilize vital signs, build immune systems, promote weight gain, ward off chronic illness and improve brain development. And that’s just the beginning.

b) What was your Big Idea?

No Baby Unhugged: A Huggies initiative that helps all Moms understand the power of hugs, and helps all babies get the hugs they need – even if Moms can’t be there to give them.

c) How did your Communication strategy evolve?

Huggies has always known that a hug is more than just a hug. Now it was time to restore mom’s confidence in her instincts by sharing the good news: Loving hugs are medicine.

By positioning our brand as the champion of hugging and everything hugs can achieve for newborns, we would capitalize on our brand’s emotional equity while adding medical authority, thus undermining Pampers.

It was 100% in sync with our own brand DNA. Huggies has always designed our diaper to be an extension of a mother’s embrace. After all, there’s not just a “hug” in our name, but every diaper we make is inspired by a mother’s hug.

d) How did you anticipate the communication would achieve the Business Objectives?

By aligning Huggies with the science of hugs, we would build a different, more emotional, more human kind of authority than Pampers. We believed this would connect with mothers more deeply, and cause them to actively trust and choose us rather than defaulting to Pampers.

n/a

Section IV — THE WORK

a) How, where and when did you execute it?

We pledged to leave no baby unhugged.

We created a campaign to celebrate the medically-proven power of hugs, and position Huggies as an extension of a mother’s hug. But there was a danger here. Today’s mothers already feel unprecedented levels of guilt about their perceived failure to manage the endless maternal duties society expects of them*. If Huggies started telling everyone about the almost magical power of hugs, how would it feel for the mothers who were unable to hug their babies? Mothers who were recovering from C-sections, or who had to leave their baby in the NICU to return home to their other children? We would be compounding their guilt and pain. We realized that simply celebrating hugs was not enough – we needed to take real-world action to help mothers and babies in that situation. We needed to leave no baby unhugged.

We created surrogate hugging programs.

We met with the Canadian Association Pediatric Hospitals (CAPHC) to discuss our idea. Were we crazy, or was there scientific merit in the idea of providing surrogate huggers for babies whose mothers couldn’t hug them? Through a hospital survey conducted by CAPHC, we determined that 75% of participating hospitals wanted help providing hugging programs for their Neonatal Intensive Care Units. Together with CAPHC, we developed and helped fund programs in which highly-screened volunteers would come into special units at the hospital, relax in ergonomic hugging chairs, and administer the hours upon hours of hugs to needy newborns. At the time of writing, these programs are up and running in two Canadian hospitals, and about to launch in two more.

We invited mothers to show support and share emotions.

From there, our communications campaign became an invitation for mothers and mothers-to-be to join our initiative to leave No Baby Unhugged. We started spreading the word to the world on Mother’s Day, launching with the emotionally-charged “Power of Hugs” online video in English and in French. Over the following weeks and months, three additional documentary-style videos showcased our initiative to create Hugging Programs in hospital NICUs across Canada. To mark Father’s Day, we made a video to spread the message of the power of hugs to Dads, and got new and expecting dads to tell us how it felt to be celebrating their first Father’s Day.

We chronicled how Huggies was helping.

We ran online advertising (Hospital, Prepare, Initiative and Product) via digital partnerships on Babycentre and Mamanpourlavie. All click throughs drove to the No Baby Unhugged website, which housed our white paper, ancillary information on the science of human touch and the long form online film, “Here’s what Hugs Can Do”. This creative chronicled moms’ experiences with a baby hugging programmes, what it meant to know that their infant was being cared for, testimony from health care providers about the power of hugging, and the set-up of our first No Baby Unhugged hospital. All our videos were released on Facebook and YouTube, and we have additional media partnerships with HGTV, WNetwork, Global 7, and CTVGo.

We inspired Mom to sign up with Huggies.

The site also invited women to upload a photo of themselves hugging their babies or their pregnant bellies in a show of support for No Baby Unhugged for a $5 donation to the hospital hugging program. We also rewarded new moms for their support with a free pack of Huggies diapers. All of the many thousands of Moms who participated in this process were automatically registered to our reward program, meaning we got to start building a long-term relationship with them.

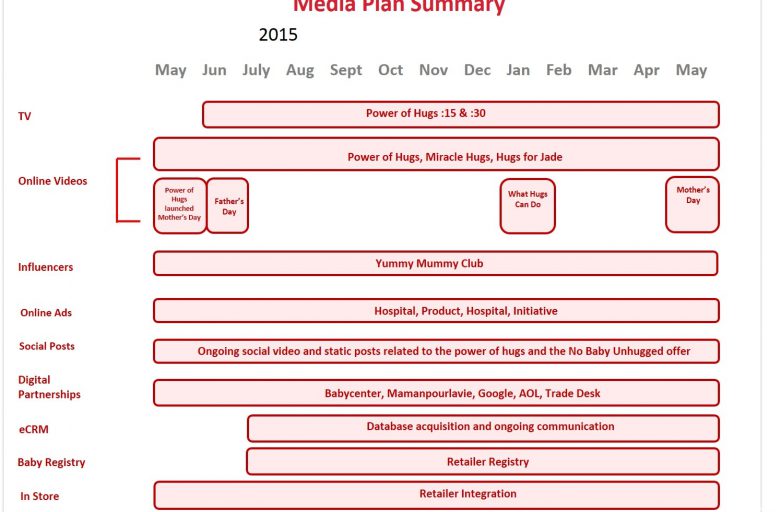

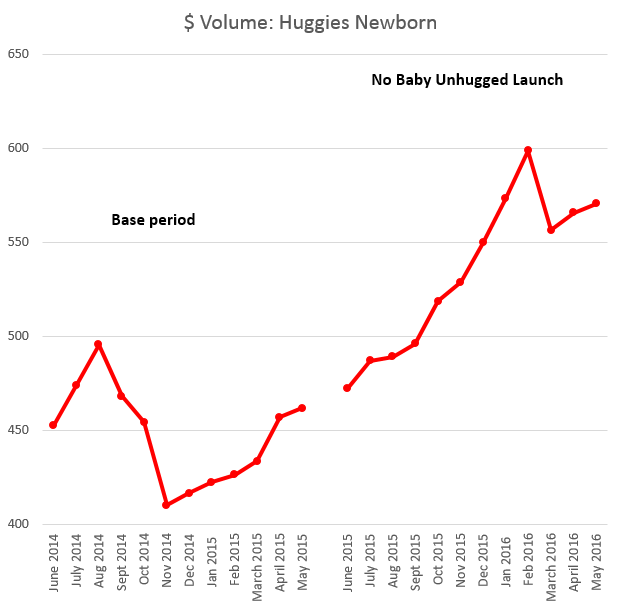

c) Media Plan Summary

*A Baby Center survey found that 94% of moms felt guilty about many issues, including how much time they spend with their kids.

Section V — THE RESULTS

a) How did the work impact attitudes and behaviour?

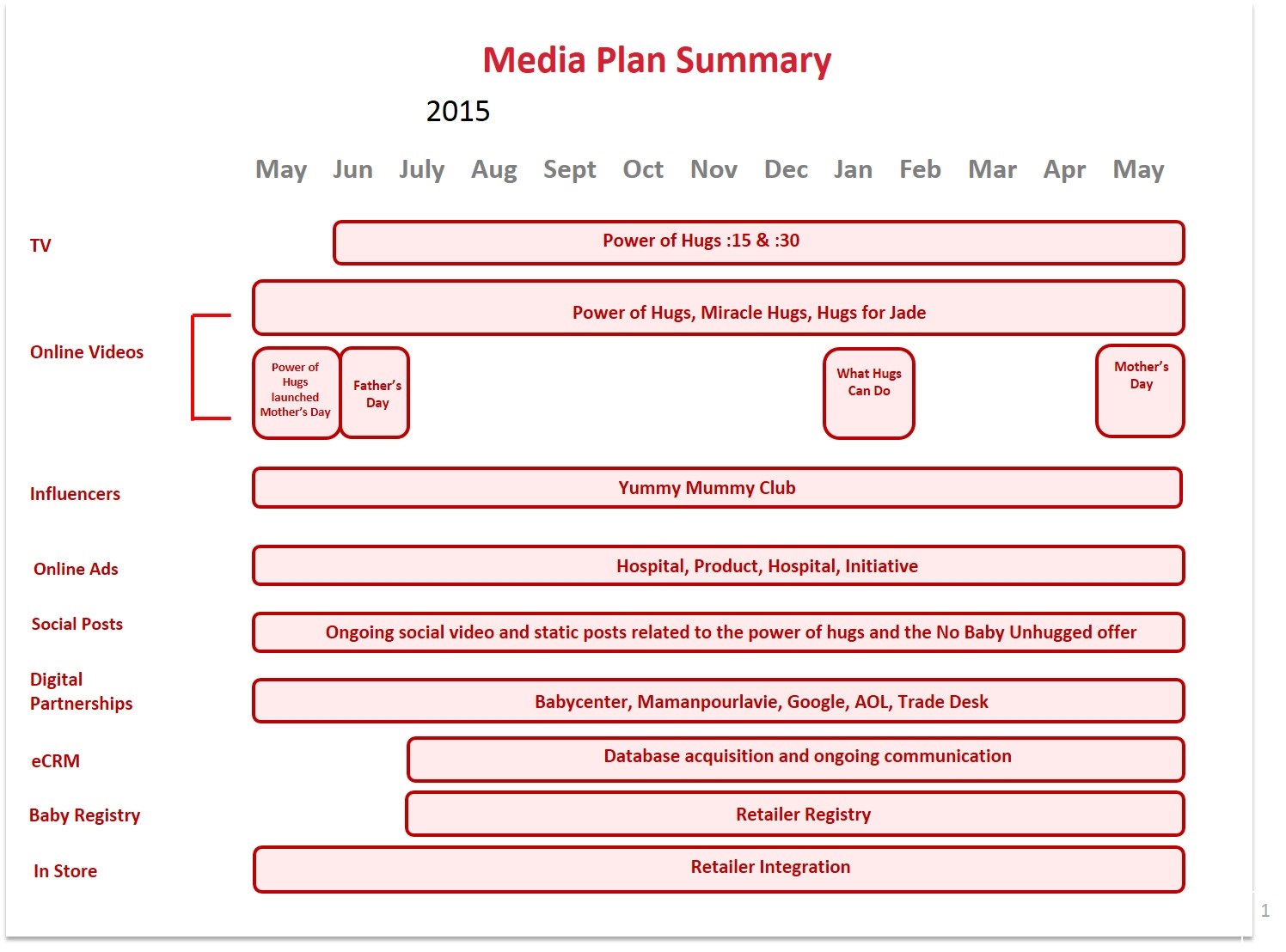

Marketing Objective 1: Build perception that Huggies is better for newborns than other brands.

We smashed our goal of a 5 point increase, achieving a 10 point increase, stolen directly from Pampers equity. Furthermore, this contributed to a 5 point increase in the Huggies Newborn Power Score (Source: Millward Brown Huggies 2015 Brand Equity Report).

Marketing Objective 2: Get new mothers to sign up for Huggies database

We were looking to double the numbers of new mothers signing up, but client data shows that in fact we more than tripled them. (Unfortunately we cannot report absolute numbers due to client confidentiality)

Additional evidence of campaign’s impact on consumers

Our online advertising achieved a click thru rate as high as 12x industry benchmarks. Social media was the highest driver of database sign-ups, with the campaign achieving over 3 million likes, comments, shares and re-tweets, and an engagement rate well above industry benchmarks, sometimes by as much as 300%. Emotionally engaged Moms left us comments on our post expressing support for the campaign, such as this one:

“I love being able to hug and squeeze my little girl. Being a mom has allowed me to open my eyes in a whole new world. All babies deserve to be hugged, loved and cared for unconditionally. With that pure love, we will raise a generation of fantastic individuals! Thank you, Huggies, for such a thoughtful campaign. No baby should go unhugged. Hug it out, everyone!”

b) What Business Results did the work achieve for the client?

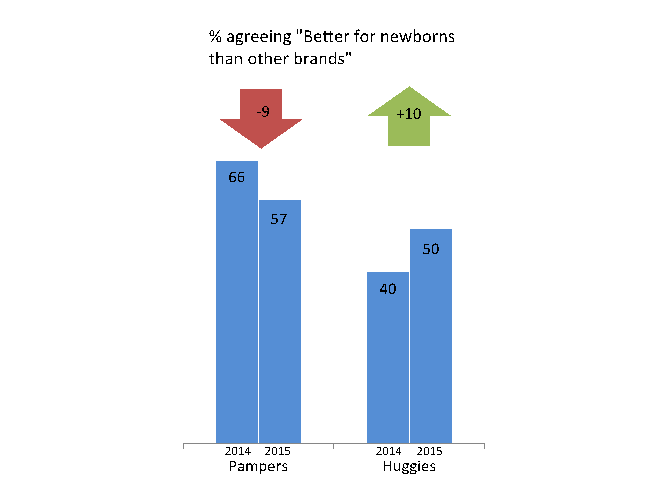

Huggies Newborn diaper $ volume grew 19.2% from the launch of No Baby Unhugged to YTD (May 2016) – nearly double our 10% goal (Source: AC Nielsen MarketTrack).

This increase came at the direct expense of our main rival Pampers, from whom we stole 2.3 Newborn share points (average share across campaign period vs across base period).

c) Other Pertinent Results

Since this campaign was focused on business growth, all relevant results are reported above in section b.

d) What was the campaign’s Return on Investment?

A Nielsen Marketing Mix Study across 2015 calculated total Net Sales ROI of the No Baby Unhugged Program as $2.76 return for every dollar invested, driven by an outstanding TV Net Sales ROI of $4.67, which Nielsen described as “very strong”.

Sourced in case.

Millward Brown Huggies 2015 Brand Equity Report

AC Nielsen MarketTrack

Nielsen Marketing Mix Study 2015

Section VI — Proof of Campaign Effectiveness

a) Illustrate the direct cause and effect between the campaign and the results

We know our campaign was effective against our target, because we can link it directly to a more than 3x growth in database sign-ups among new Moms. As stated above, analysis by Nielsen found the No Baby Unhugged program – and the TV work in particular – generated strong payback. It is also instructive to compare sales of other sizes of Huggies diapers with our newborn product. Although Huggies sales were up significantly across the board during the campaign period (a halo effect we would expect with a strong brand campaign) the sales increases for newborn diapers were around 2x higher than other diaper sizes. As detailed below, no other factor can explain this except our newborn-focused campaign.

b) Prove the results were not driven by other factors

Campaign spend vs. history and competition:

Although our media spend in 2015 was higher than in the previous year, our share of voice remained much lower than Pampers, yet we stole 2 share points from them (Source: Brand A&CP budget and AC Nielsen MarketTrack).

Pre-existing Brand momentum:

Huggies sales/share has been on a flat to declining trend, since average share in 2012 was 36.6%, 2013 was 36% and 2014 was 34.9%, so the results were not a continuation of trends that existed prior to No Baby Unhugged (Source: AC Nielsen MarketTrack).

Pricing:

Pricing was flat for both Huggies and Pampers from 2014 thru 2015, so this cannot account for Huggies success (Source: AC Nielsen MarketTrack).

Changes in Distribution/Availability:

Distribution:

During the report period, Huggies newborn diapers actually lost 3.6% distribution points vs previous year, while Pampers newborn gained 2.4% distribution point (Source: AC Nielsen MarketTrack). Therefore, distribution cannot account for Huggies success.

Availability:

Pampers Newborn diapers experienced some stock shortages in Nov and Dec 2015. This undoubtedly contributed to Huggies sales in those two months. However, an analysis of the 12 months of dollar volume results between Jun 2015 and May 2016 shows a clear upward trend even when we statistically remove any artificial boost by flat-lining those two months (Source: AC Nielsen MarketTrack).

Unusual Promotional Activity:

Huggies newborn share of promotional $ volume was 38.9% versus Pampers newborn share at 60.5% (Source Nielsen Market Drive) during the reported period. As such Pampers promotional activity was more than 1.5x that of Huggies, which is similar to previous years.

Any other factors:

Category growth:

The category is in very slight growth, increasing 1% a year in 2014 and again in 2015. However, this clearly cannot account for a 19.2% increase in newborn sales, nor for stealing 2.3% share from Pampers.

Seasonality:

There is no seasonality to diaper usage and we have shown results for an entire 52 weeks, further demonstrating seasonality is not a factor to our success.

Final Words:

Due to its success in Canada, No Baby Unhugged is being picked up by more and more countries every day, including the USA, Asia, Latin America, India, and Australia. A great testament and ultimate compliment to the success of the program.

Sourced in case.

Brand A&CP; budget

AC Nielsen MarketTrack