Del Monte U.S. “Garden Quality”

Cdn Success Outside Canada (BRONZE)

Client Credits: Del Monte Foods-USA (Canned Fruits & Vegetables)

Brian Ng – Director of Marketing, Brand Strategy & Trademark Development

Matt Miller – General Manager, Consumer Products

Jina Osumi – Brand Manager, Brand Strategy & Trademark Development

Agency Credits: Juniper Park

Alan Madill (Executive Creative Director, Partner)

Barry Quinn (Executive Creative Director, Partner)

Terry Drummond (Executive Creative Director, Partner)

Jill Nykoliation (President, Partner)

Lesley Bedard (VP Strategy)

Shelly-Ann Scott (VP, Group Account Director)

Chris Marrone (Account Supervisor)

Hart Togman (Account Executive)

Deniz Melen (Account Executive)

Anne Marie Martignago (Broadcast Producer)

Toby Sime (Print Producer)

Laura Felstiner (Digital Producer)

John Bloise (Digital Producer)

Hylton Mann (Creative Director, Art Director)

Andy Linardatos (Creative Director, Art Director)

Louis Duarte (Designer)

Erin Askew (Designer)

Michael DePippo (Designer)

Bev Spritzer (Copywriter)

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | November 2012-May 2013 |

| Start of Advertising/Communication Effort: | November 2012 |

| Base Period as a Benchmark: | November 2011-May 2012 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

This is the story of an iconic, but stagnant brand, turning its business around to achieve significant growth in only 6 months. This is the story of how the iconic Del Monte Brand of Canned Fruits & Vegetables’ re-established its relevance and distinction as a premium quality brand in the US.

In the United States, Del Monte Canned Fruits & Vegetables was suffering from year-over-year sales declines (-5% CAGR, 2009-2012). 1. Brand equity scores for taste, quality and nutrition, had steadily declined, and only 20% of consumers believed that Del Monte was worth paying more for.2

The canned fruit & vegetable category had transitioned steadily and significantly to private label. Why? Because canned fruits & vegetables had long become seen as a “practical” choice: convenient, reliable, lower in cost, and believed to be a sacrifice in quality and taste vs. fresh or frozen.

Consumers no longer believed there was any discernable difference between canned fruit & vegetable brands vs. private label – “a canned green bean is a canned green bean, right?” – so they tended to make their purchase decision based on price. In a highly commoditized category filled with consumer apathy, Del Monte had lost relevance.

But the fact is that Del Monte canned fruit & vegetables are superior to its competitors – but because it had not invested in brand communication for ten years, this fact had been long dismissed. In spring 2012, Del Monte made the decision to reinvest in the brand in order to reclaim the share that private label had been steadily taking.

Given the deeply ingrained negative brand perceptions, and our modest marketing investment, we needed to define a razor sharp strategy and breakthrough creative that could return Del Monte to a relevant, premium growth brand.

b) Resulting Business Objectives

Business goals within the period of Nov 2012 to May 2013:

- Grow Del Monte base volume by 5% vs. prior year

- Raise brand equity scores by 20% for each key metric

c) Annual Media Budget

Over $5 million

d) Geographic Area

United States

1.Nielsen, 2009-2012

2.Del Monte Brand Equity Scorecard 2009-2012

Section III — STRATEGIC THINKING

a) Analysis and Insight

Our target consumer is the Healthy Explorer. She is passionate about food, and believes that “when you eat healthy, you feel healthy”, enabling you to be active and enjoy time with friends and family. She believes a colourful life requires a colourful plate, so she is always looking for new ways to incorporate fruits & vegetables in her family’s meals. If we were to sum up our core consumer insight in one phrase, it would be:

“What you get out of life is determined by what you put into it”

In essence, she is cultivating a healthy lifestyle for her family and quality is an important part of that. This was the crux of our challenge; consumers’ deeply ingrained belief that canned fruits & vegetables = a compromise in quality. And while she does use canned fruits & vegetables, she does so as a practical choice, not an emotional one:

- Only 25% believe canned fruits & vegetables are truly healthy (vs. 85% for fresh/frozen) 3

- Only 20% of consumers believe Del Monte is worth paying more for 3

But these deep seeded beliefs were untrue. Del Monte is a premium quality brand:

Del Monte canned fruits & vegetables are:

- Grown in the best growing regions across America

- Picked at the precise days of ripeness

- Majority packed within 48 hours of being picked

- Preserved using the classic canning method our grandmothers used

- Have the same essential nutrients as fresh when cooked

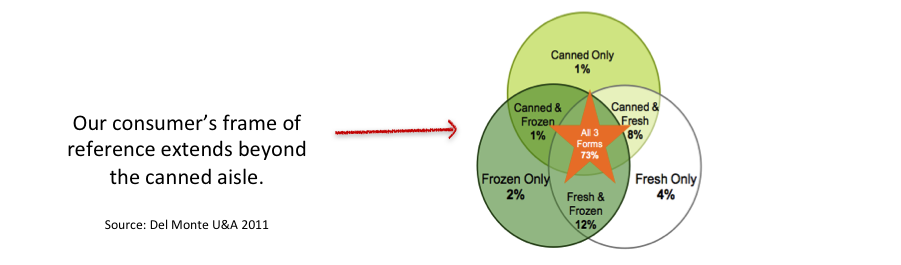

We needed a game changing idea to overturn her perceptions. A major unlock came when we stopped looking at the category so literally, i.e. “Canned F&V”. When we stepped back, we found an important fact that lay buried in one of the usage studies: 73% of consumers use all three forms of fruits & vegetables.3 Looking at from this lens, we realized the true consumer frame of reference was format-neutral. The ideal standard for fruits & vegetables is garden quality fruits and vegetables. THIS is what our Healthy Explorer was ultimately seeking from fruits & vegetables.

This realization was a solid match to the 100 year-old truth of Del Monte canned fruits & vegetables – they were garden quality!

ZMET consumer research confirmed that “garden” was both a powerful word and visual metaphor for consumers. The garden is a place of cultivation – of both quality produce, and quality of life. Furthermore, garden imagery was in wonderful contrast to the “large-scale farm” imagery that the rest of our competitive set used, which to consumers conveyed “industrial”. 4

We needed to make our brand authentically synonymous with backyard garden quality.

b) Communication Strategy

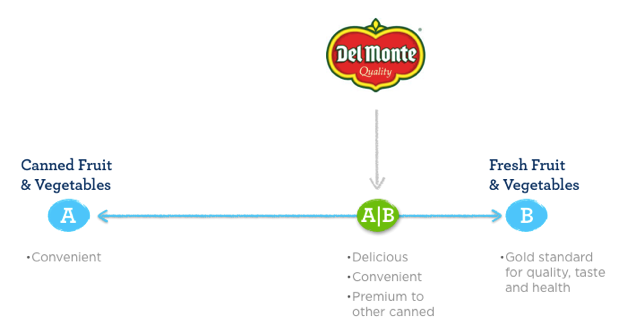

To reposition Del Monte canned fruits & vegetables as a premium brand, our communication strategy deliberately borrowed equities from the ultimate garden quality fruits & vegetables. We would visually anchor our brand in the aesthetic of fresh; reinforce our quality credentials; and make the link to a healthy lifestyle overt.

This informed the 3 pillars of our communication strategy:

1. Functionally establish Del Monte as premium “Garden Quality” fruits and vegetables

2. Tell the larger functional/emotional story of Del Monte, showcasing the transformation from “Garden Quality” to “Healthy Lifestyle”

3. Drive consumption of Del Monte once it is in her pantry to preclude it from becoming “dusty” once again

3.Del Monte A&U;, 2011

4.ZMET study, May 2012

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

- TV

- Digital

b)Creative Discussion

Our creative idea married the Healthy Explorer’s zest for a healthy life with the “Garden Quality” credentials of our brand:

Our big idea: Bursting with Life!

Del Monte cultivates Garden Quality fruits & vegetables,

and when you eat them, you cultivate a healthy lifestyle.

Creative was developed against each our of three communication pillars:

1. We established Del Monte as a premium brand of “Garden Quality” fruits and vegetables through a visually arresting print campaign.

Our simple yet premium imagery showcased our fruit or vegetable falling straight from the vine into the can. The beautiful imagery is paired with copy that expresses the functional truths of the product:

“Grown in America. Picked and packed at the peak of ripeness. Same essential nutrients as fresh.”

The tagline represents the big idea and transcends both the product and consumer benefit:

“Bursting with Life.”

The visual image serves as a powerful metaphor that reinforces how every Del Monte product is truly straight from our garden. The concept enables consumers to see the honest product inside, while allowing the Del Monte can to proudly be central to the concept, making the brand heroic.

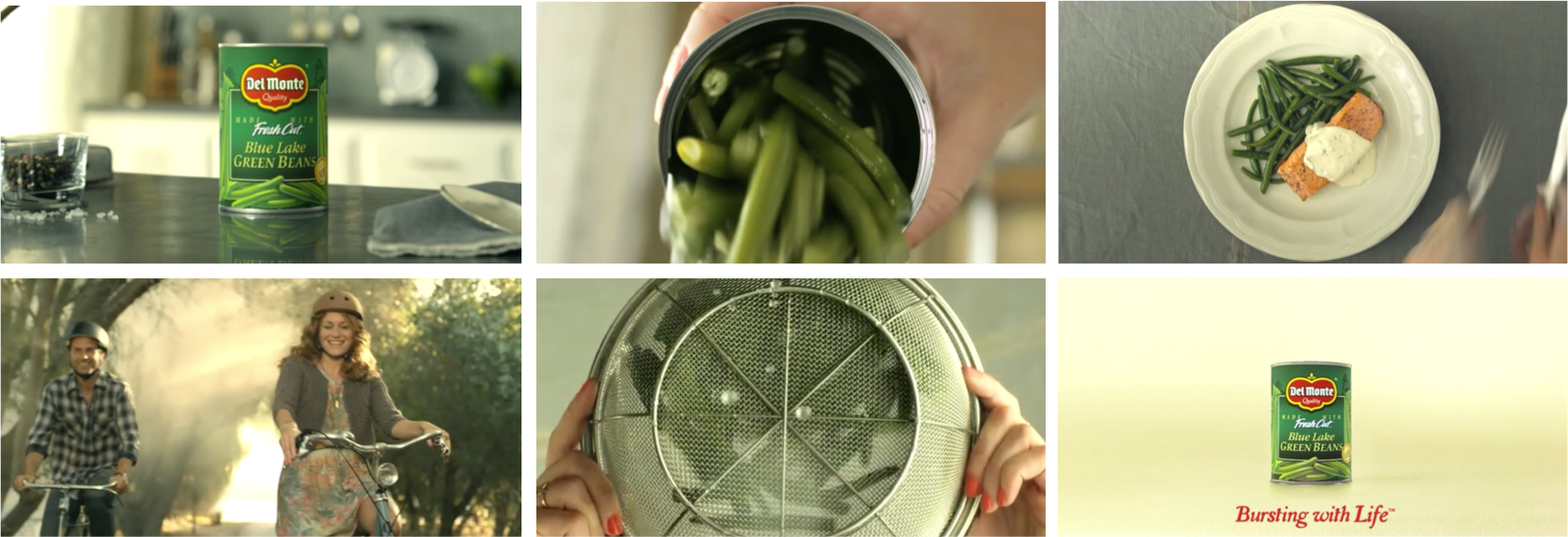

2. We shared the larger functional/emotional story of Del Monte through TV, showcasing the transformation from “Garden Quality” to “Healthy Lifestyle”.

We used a common construct for the two TV ads, each commencing with the provocative question, “What’s in a can of Del Monte?” We took inspiration from the shape of our can, using circles as the visual device throughout the story, along with lyrical music to form a narrative that speaks equally to the products’ functional benefits and the brand’s emotional benefits. The end mnemonic leverages the same arresting imagery from the print campaign.

TV: Green Beans

TV: Peaches

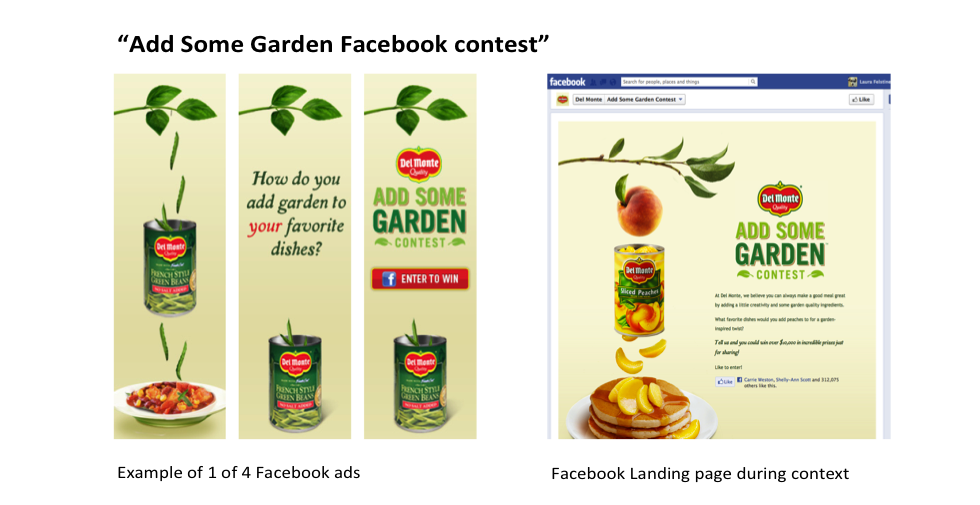

3. We used the Facebook platform to deepen engagement and drive consumption.

Getting consumers to purchase Del Monte canned fruits & vegetables vs. private label was not the only challenge we had. We need them to also use it once they were home because if the cans sat on the pantry shelf, Del Monte would quickly revert back to being a dusty brand again – literally.

Our inspiration came from the insight that our Healthy Explorer wants to include more fruits & vegetables in her family’s diet. Adding a can of Del Monte is like “adding some garden” to your meals – making your meal more flavorful, more colorful, more interesting and more healthy.

We created the “Add Some Garden” promotion to drive home the message that incorporating more fruits & vegetables into your meals is as simple as adding a can of Del Monte to whatever she is already making. For example: when making chicken, bake it in canned peaches; when making chili, add a can of green beans, etc. The ideas don’t require a recipe; rather they were all “mental cookbook ideas” – which is key to getting into her weekday meal repertoire.

Facebook ads invited consumers to share what they add Del Monte canned fruits & vegetables to, which in turn provides inspiration to other consumers. Each week we focused on a different fruit or vegetable – eg. Week 1: “What do you add canned green beans to?”; Week 2: “What do you add canned pears to?”, and so on.

The Facebook imagery leveraged the same arresting imagery as the print and TV elements.

4. The 100+ year old Del Monte logo was redesigned to include “Garden Quality” right into the iconic brandmark.

For over 100 years, the Del Monte logo included “quality” as a descriptor under the brand name. However, Del Monte is more than just quality, it is “Garden Quality”. Therefore, the iconic brand mark was redesigned to reflect this important distinction.

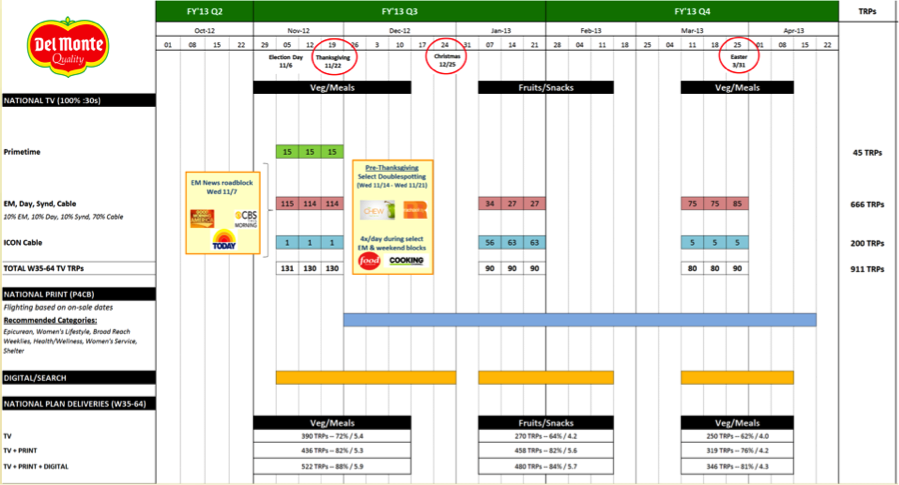

c)Media Discussion

Given our limited budget, we had to be highly selective with our media plan.

i. TV: 9 weeks, 911 TRPs, 64% of budget

- 2 x :30 second TV ads showcased how Del Monte’s Garden Quality contributes to a “Healthy Lifestyle

ii. Print: 300 TRPs, 14% of budget

- 3 x print ads focused on establishing Del Monte as a premium “Garden Quality” brand

iii. Digital: 135 TRPs, 12% of budget

- 4 x Facebook ads invited consumers to participate in Del Monte’s “Add Some Garden” contest

Section V — BUSINESS RESULTS

a) Sales/Share Results

The Del Monte campaign made an immediate impact on all measures: volume, equity and engagement.

1. Del Monte base volume gains have significantly outpaced the category. 5

- Del Monte base brand volume +8% vs. category +3% (and vs. our goal of 5%)

- This is a total growth of +13%, as Del Monte volume was -5%

- Growth was achieved by both vegetable and fruit sub-categories: 5

- Del Monte Vegetable base volume +11% vs. category +4%

- Del Monte Fruit base volume +3% vs. category +2%

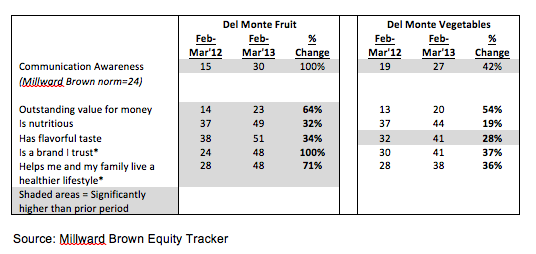

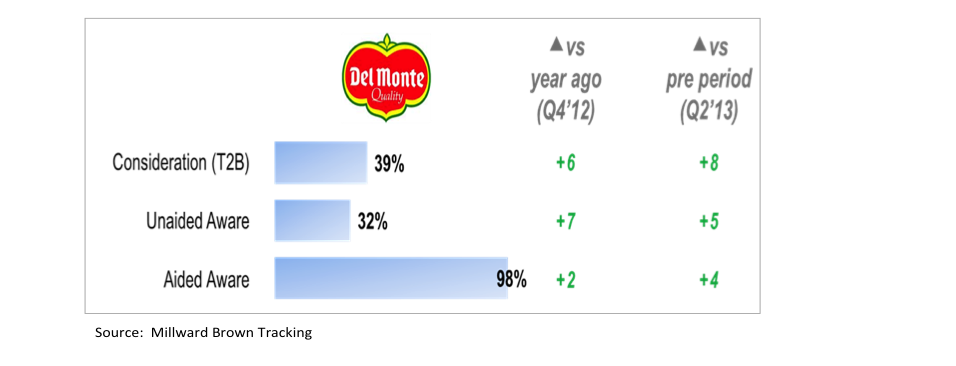

2. Brand equity metrics have significantly improved, and far exceed the original goal of 20% increase for each metric. Source: Millward Brown Equity Tracker

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

5.Nielsen, Nov ’12-May ’13

6.Nielsen, Nov ’12-Apr ‘13

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

1. Creative scored significantly above norms across all methodologies:

The creative was placed into a multitude of quantitative testing to evaluate its performance on both strategic and creative measures. The creative significantly exceeded all norms, across every methodology.

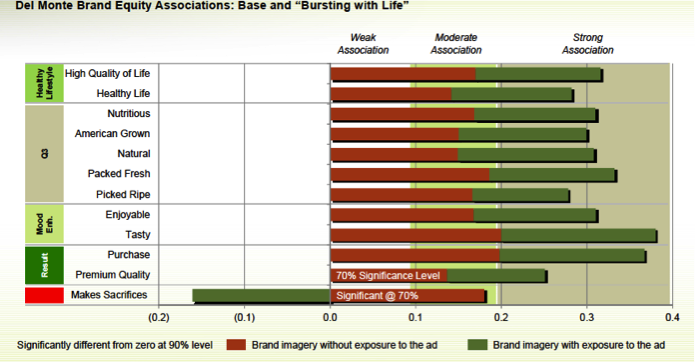

2. Implicit Association Evaluator ™: measures how strongly an ad activates the meanings in the consumer’s mind that are most strategically important to the brand and links them to the brand.

Del Monte’s advertising scored significantly ahead of all norms on every attribute.

(Source: Implicit Association Evaluator, Oct 2012)

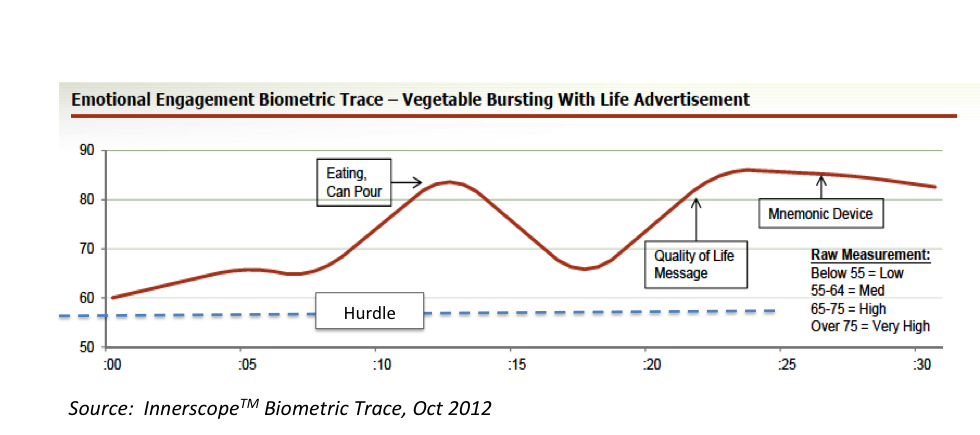

Innerscope™: This methodology measures engagement and emotional resonance.

Del Monte’s advertising scored well above hurdle – right from the beginning of the ad through to the end, with engagement significantly held through the entire branding sequence at the end.

“The new “Bursting with Life” advertising is unquestionably exceptional

in its delivery on every dimension – strategic and creative – with excellence.”

– Bob Woodard, Partner, Deep Marketing Alliance, LLC, Del Monte’s Strategic Analytics Firm

3. Despite a limited marketing investment, there is exceptional awareness of the new campaign, which has translated into increased consideration.

4. Consumer engagement for “Add Some Garden” exceeded all expectations for exposure, participation, engagement and advocacy.

- 114 million media impressions

- 9 million social impressions

We significantly deepened our relationship with our Facebook community:

- 523,028 click-throughs to Facebook page 7

- 136,676 total Add Some Garden FB Tab views (15% more than prior program) 8

- 37,410 average PTA (“people talking about”) during heaviest campaign months (3.3x average monthly PTA) 8

- 73,385 new fans 8

- 16,183 ‘Likes’ 8

- 6,380 Unique Contest Entrants 9

- 19,293 meal idea entries (45x more than prior program) 9

- 9,660 votes submitted 9

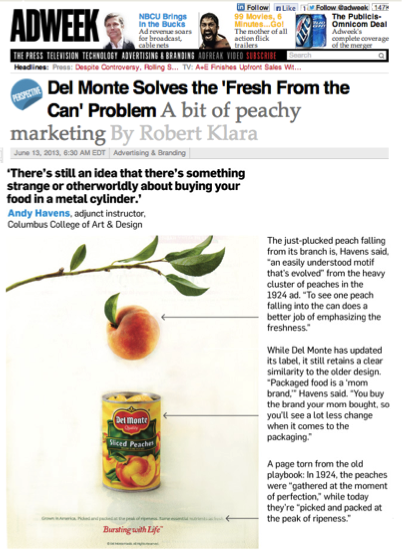

5. Marketing Industry Success

- The US press ran 3159 articles about Del Monte’s new “Bursting with Life” campaign including USA Today, Business Week, AdWeek, resulting 127 million media impressions! (Source: Coyne PR, Del Monte’s PR agency)

Example: An excerpt from AdWeek’s feature article on new campaign, June 13, 2013

- In addition, Del Monte’s “Bursting with Life” campaign is being featured in a Marketing Textbook, “Marketing: An Introduction; Edition 12” by Gary Armstrong/Andrew Kotler, $146, which will be published in 2014.

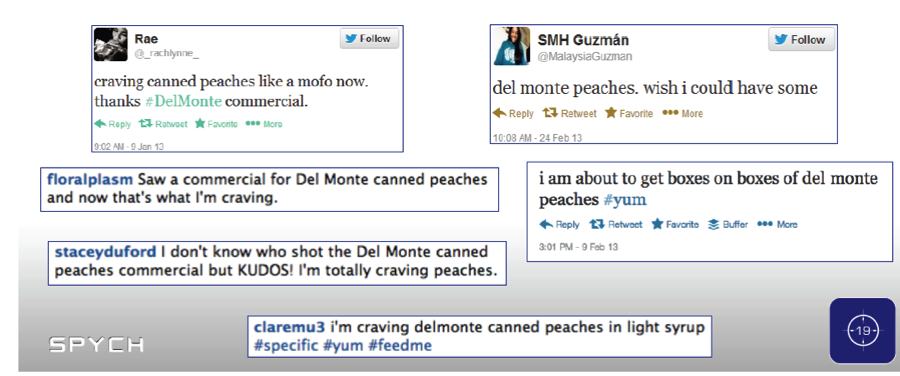

6. Consumer adoration for the creative work came unsolicited through our Facebook, Twitter and Call-Center!

- Call-Center volume spiked in January with compliments for the new advertising.

- Facebook and Twitter comments rolled in. For example:

b)Excluding Other Factors

Spending Levels:

While 2013 was the first time in ten years that Del Monte had any significant investment in the brand, it still only equated to 9 weeks of TV, 6 months of print insertions, and a small digital promotion supported by banner ads.

Pricing:

- Del Monte actually increased its average price as part of its goal to move from a price focused commoditized position to premium value position. The intent was to sell more products at full price versus discounted.

Distribution Changes:

- Distribution Changes – Del Monte’s distribution of 81% for Vegetable and 83% for Fruit remained consistent with prior years.

Unusual Promotional Activity:

- Unusual Promotional Activity – In line with its strategy to sell its products at prices that better reflect our premium positioning, Del Monte decreased its promotional activity.

- Vegetable % Volume “Not on Promotion” increased 6 pts from 60% to 66% 10

- MS Fruit % Volume “Not on Promotion” increased 7 pts from 65% to 72% 10

Other Potential Causes:

- There are no other potential causes.

Sources:

1.Nielsen, 2009-2012

2.Del Monte Brand Equity Scorecard 2009-2012

3.Del Monte A&U;, 2011

4.ZMET study, May 2012

5.Nielsen, Nov ’12-May ’13

6.Nielsen, Nov ’12-Apr ‘13

7.Starcom Media, Del Monte’s Media agency

8.Facebook Insights

9.IC Group

10.Internal sales data and Nielsen data