Classico Second Only to Yours

Packaged Goods (BRONZE)

Client Credits: Kraft Heinz

Chief Marketing Officer: Brian Kerr

Director of Marketing: Jenna Zylber

Sector Lead: Samantha Taylor

Consumer Insights: Milena Shillow

Agency Credits: TAXI

Chief Creative Officer: Jeff MacEachern

Associate Creative Director: Shawn James

Writer: Dana Ciana

Art Director: Nicole Grimshaw

VP, Head of Strategy: Christine Maw

Strategy Director: Thomas Kenny

Group Account Director: Stephanie Santiago

Account Supervisor: Heather Maclaren

Executive Producer: Steve Emmens

Producer: Christine Michalejko

Section I — CASE PARAMETERS

| Business Results Period (Consecutive Months): | September 19, 2016 to March 19, 2017 |

| Start of Advertising/Communication Effort: | September 19, 2016 |

| Base Period as a Benchmark: | 19/09/2014 – 19/03/2015 + 19/09/2015 – 19/03/2016 |

| Geographic Area: | Canada |

| Budget for this effort: | Over $5 million |

Section IA — CASE OVERVIEW

Why should this case win in the category (ies) you have entered?

No new flavours. No new packaging. A 30-year-old brand with more competition than it’s ever had. That might not sound like a recipe for success, but sometimes the toughest challenges bring out the best thinking. That was the case for Classico pasta sauces.

Our “Second Best” campaign presented Classico in a way that recognized the brand’s long-standing positioning of Italian heritage, but updated it with gusto. It also gave food lovers permission to embrace a prepared pasta sauce, as they had always seen store-bought pasta sauce as a compromise of their high standards. By positioning the brand in a way that confirmed its quality versus homemade sauce without overstating it, we were able to give unprecedented momentum to the brand.

In order to drive sales based on brand appeal rather than price promotion in a commoditized, highly saturated and stagnant category, we created a new indicator of product quality: comparing Classico to homemade instead of to the competition. This resulted in a lift in premium credentials (for a long-established brand) as measured by increases in sales and share, household penetration, brand awareness, and brand-health metrics.

The key to our success was an unexpectedly and refreshingly honest approach to positioning that created a new way for the target to feel good about the role Classico can play in their cooking repertoire, when they don’t have time to make homemade sauce.

Section II — THE CLIENT’s BUSINESS ISSUES/OPPORTUNITIES

a) Describe the Client’s business, competition and relevant history:

Prepared pasta sauce is one of the most established consumer-packaged-goods categories for Canadian grocery retailers. Annual sales for the past few years have been in the $250 million range. Yet, for its size and importance to the retail grocery business, it’s a category that hasn’t seen a lot of mass-market support or innovation in the past few years. Despite the category having a 75% household penetration, it’s been a quiet section of the grocery store for awhile. In other words, it was ripe for a bit of a shakeup.

Classico is the category leader. At the outset of our campaign, it had a 34.3 share of a highly fragmented market. There are four distinctive segments within the category, each with multiple entrants:

Value – Hunt’s, Unico

Mainstream – RAGÚ, Prego

Premium – Classico, President’s Choice

Super Premium – Rao’s, Mario Batali

As a household staple, prepared pasta sauce is a category that is very responsive to pricing and promotions. For several years, these had been the primary ways in which the category and the brand had been supported. That resulted in business performance that was steady and predictable, but it wasn’t driving long-term sustainable growth or brand preference. For that to happen, investment in the brand was required.

It was more than a decade since Classico had above-the-line support. For many years, the brand was positioned on what was then a differentiating stance: recipes inspired by the regions of Italy. There were several varieties within the brand, each reflecting the flavours of a distinct region, and all sold in mason jars. When Classico launched, its appearance and story were very unique, and it was unquestionably the most premium sauce available in the market. However, recent entrants, like PC Black Label and Rao’s, had taken that position, leaving Classico in the middle of the market – a tough place to be in a category that was competing largely on price.

b) Describe the Client’s Business Issues/Opportunities to be addressed by the campaign:

As the category became more fragmented and commoditized, consumers had come to think of all store-bought pasta sauce as convenient and largely the same, but ultimately a compromise of their high standards. Classico was having a hard time separating itself from value and mainstream players, and was forced to compete on price more often. Classico needed to make people believe that it was a brand that was different and worthy of the higher price.

Most Canadians will have a jar or two of pasta sauce in their cupboards and it’s an item that is likely to appear on their shopping list every week. In spite of the frequency of their purchases, and their reliance on prepared pasta sauce for days when they don’t have time to cook from scratch, most consumers see purchased pasta sauces as a compromise to homemade sauce, something that falls into the “good enough” camp. The Italian heritage that had built the brand was no longer differentiating or sufficient to give consumers reason to buy Classico every time, regardless of price. It was time to reclaim brand consideration in a sea of “good enough” store-bought pasta sauces competing on low prices.

The job to be done: increase consumers’ perceptions of the quality of Classico and lift its premium credentials to grow share and be the top choice of store-bought pasta sauce.

c) Resulting Business Objectives: Include how these will be measured:

The campaign was scheduled for September 19, 2016 to March 19, 2017.

We expected this activity to deliver the following results:

Business Objective:

- Increase dollar share to 36.7% (+0.6 points)

Communication Goals:

- Drive trial to achieve a household penetration increase of +1 point

- Entice target to choose Classico more often than other jarred pasta sauces for a purchase loyalty increase of +2 points

In addition to our business and communications objectives, we set out KPIs as follows:

- Mixed-marketing-modelling results at or above Kraft Heinz norms of 57% ROI

- Noticeable improvement (at least +5%) to the following brand-health metrics:

- “Tastes more like homemade”

- “Is a brand for me”

Section III — YOUR STRATEGIC THINKING

a) What new learnings/insights did you uncover?

Our target likes to cook. As obvious as that sounds, the more we dug into this, the more we realized our answer lies within in this fact.

Based on segmentation research, we knew two core consumer segments were at the heart of the Classico brand. The first group unabashedly seeks convenience. They love great taste, but they lack the skills to attempt anything beyond quick, easy meals. Classico is a perfect product for this segment, because it delivers on their taste expectations while requiring minimal effort or skill on their part. This segment is a stable one and was not the group we needed to persuade with our campaign.

The group that needed a little more from the brand – our growth consumer whom we call the “authentic epicurean” – had a very different attitude than our convenience seekers. This group loves cooking and has very strong opinions about food quality and the level of effort that is required to achieve a meal to be proud of. Ironically, the ease that Classico offers them is the very thing that causes angst. In qualitative research, we learned that this group regularly makes homemade pasta sauces on the weekend when they have time to cook, because they view this as the gold standard. As a result, they firmly believe no store-bought pasta sauce could live up to sauce made from scratch.

Unfortunately, few have the time to make homemade sauce during the week. Our research revealed that even though our target accepts the fact that there are days when convenience takes the lead over all other considerations, they still feel the sting of not doing the best they can. A choice that should have been making life, or at least dinner, a bit easier for them was actually a bit of a problem.

The insight: For people who love to cook, weekend cooking is a pleasure. It’s relaxing and fun and the end product is deliciously satisfying and something to be proud of. Weekday cooking is the opposite. The demands of daily life mean it’s all about convenience – and that involves compromise. But even when they are rushed, they don’t want to compromise their high standards, as making a good meal is important to them.

If their own good cooking is the standard they want to achieve, being the best of prepared sauces isn’t the measure of success – being the next best thing to homemade is.

We believed we would be able to achieve our goals of creating a defined brand position and elevating quality perceptions by taking a bold and honest point of view – positioning Classico as the pasta sauce that is almost as good as their own cooking. One of the core challenges was to get Classico out of the middle ground and distance it from store-bought sauces in the value and mainstream segment. A powerful way to do this would be to establish Classico’s point of comparison, not as other packaged sauces but, rather, homemade sauce. If you’re known by the company you keep, who we compared ourselves to would say a lot.

Additionally, we felt the honesty of acknowledging that our sauce was almost but not quite as good as their homemade sauce would break through. We confronted our consumers’ inner turmoil and, rather than trying to convince our target that Classico pasta sauce is just as good as their homemade sauce, we chose to be honest and humble, admitting that, while we may not be homemade, we are a close second. In a mature and commoditized market, the challenge this represents can’t be overstated. Selling but not overselling the product was a surprising approach – and one that proved to be highly effective.

b) What was your Big Idea?

Classico pasta sauce is second only to yours.

c) How did your Communication strategy evolve?

Our research on the target’s attitudes to cooking and to pasta sauce gave us some very important clues about the approach the campaign would take.

We had to demonstrate that we have very high standards. If the crux of the problem was a belief that prepared pasta sauce was all the same and was lacking in quality, we had to prove the opposite.

The hero had to be Classico itself, not just great food. Because our target was food lovers, the communications had to be about what Classico brought to the table, not just about an appreciation of great food. The product had to be undeniably front and centre.

We had to respect the target’s skill in the kitchen. We knew we were talking to good cooks, people who know the difference between a great meal and a so-so one. Being honest by recognizing that their recipes are the gold standard and acknowledging their overall discernment would make them more open to our message.

d) How did you anticipate the communication would achieve the Business Objectives?

Our target has a very clear hierarchy of food quality. Homemade will always beat store bought, and we believed that embracing this fact, rather than trying to persuade discerning cooks otherwise, would not just create breakthrough food advertising but would also allow us to maintain credibility with our target. Classico is undeniably a quality product, but it’s also not homemade. Leaning into this truth in an engaging, food-loving way was the only approach with the right ingredients.

By establishing Classico as the “second best” option our target could choose, we would establish beliefs that would increase their openness to Classico and their purchase frequency:

- We validated their discernment and reinforced their belief that their cooking will always be the best.

- We gave them permission to believe they didn’t have to cook every single meal from scratch.

- We demonstrated a shared belief in the love of good food.

All these factors would contribute to our target choosing Classico for those occasions when cooking from scratch simply wasn’t an option. We had no intention to dissuade them from homemade cooking when they had the time to do it. The occasions we were after were the ones where life demanded a convenient approach and that made reaching for a jar of prepared sauce the only viable option. We were making sure that the jar they reached for was Classico.

Section IV — THE WORK

a) How, where and when did you execute it?

We created a bold, new brand platform, “Second Only to Yours,” that broke convention by celebrating being “Number Two.” This platform acknowledged the fact that homemade pasta sauce will always win, while proudly celebrating Classico finishing second, right behind the best. At Classico, being number two means we are someone’s first choice after their own. Admitting defeat is not an ordinary stance for any brand to take. We therefore needed to ensure our creative was anything but ordinary. We needed a creative foil that best represented the true gold standard in homemade pasta sauce.

If we were going to position Classico pasta sauce as being second only to your own homemade version, we also needed an unarguable symbol of quality as the reference point for homemade. As a pasta sauce inspired by the regions of Italy, there was little debate about who would take that role.

Meet Nonna. Actually, meet a brigade of Nonnas. If there is anyone whom everyone would agree makes a mean pasta sauce, it’s an Italian grandmother. Contrary to the packaged-goods norm of brands trying to establish product superiority versus the competition, Classico was quite willing to acknowledge that these ladies rule the world of pasta sauces.

The core of the campaign was a 30-second TV spot set in a pasta-sauce competition. There’s no doubt who the competition’s front runners are – the squad of Nonnas very quickly asserts superiority over everyone, including the team from Classico who are awarded second prize.

The competitive spirit of the Nonnas is undeniable – their take-no-prisoner attitude makes it clear they know their sauce is the best. If Classico had to lose to someone, they were okay with losing to the Nonnas.

Fifteen and 30-second spots aired nationally across specialty and conventional networks, accompanied by online banners and targeted social media posts.

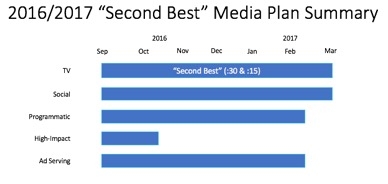

c) Media Plan Summary

Section V — THE RESULTS

a) How did the work impact attitudes and behaviour?

The campaign has demonstrably improved consumers’ attitudes about Classico’s quality, based on the measure that matters most to our target.

During the campaign, there was a 32.5% increase (goal was +5%) in the equity score for “Tastes more like homemade.”1

Not surprisingly, with the above gains in quality perceptions, Classico’s relevance to our target also increased.

During the campaign, there was an 18.9% increase (goal was +5%) in the equity score for “Is a brand for me/my family.” 1

b) What Business Results did the work achieve for the client?

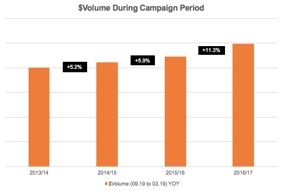

The campaign led unprecedented sales growth for the period of September 19, 2016 to March 19, 2017, as evidenced by comparing year-over-year numbers for the same time period during the previous three years.

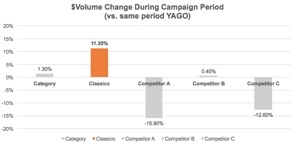

This growth of 11.3% was particularly impressive, as the category during this period was relatively flat (+1.3%).

Source: Nielsen Marketplace Data (September 19 to March 19, 2013 to 2017).

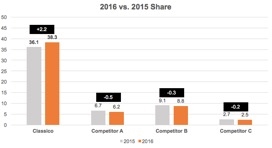

The campaign also led to stronger-than-usual increases in share.

Source: Nielsen Marketplace Data (September 19 to March 19, 2013 to 2017)

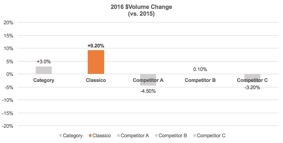

Sales and share metrics demonstrate strong growth on an annualized basis.

Source: Nielsen Marketplace Data (last 52 weeks, ending December 31, 2016)

Source: Nielsen Marketplace Data (last 52 weeks, ending December 31, 2016)

Sales and share metrics demonstrate even stronger growth during the campaign period.

Source: Nielsen Marketplace Data (September 19, 2015 to March 19, 2016, and September 19, 2016 to March 19, 2017)

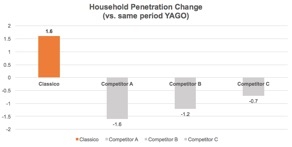

The campaign also managed to grow household penetration by +1.6 points (vs. a target of +1.0 points), while the competition saw declines.

Source: Nielsen Homescan National Data (last 52 weeks, ending April 1, 2017)

Our campaign helped drive loyalty increases by enticing our target to choose Classico more often over other store-bought sauces. Our loyalty metric increased by +2.4 points (exceeding our target of +2.0 points), while the competition saw declines.

Source: Nielsen Homescan National Data (last 52 weeks, ending April 1, 2017)

c) Other Pertinent Results

N/A

d) What was the campaign’s Return on Investment?

Our campaign increased campaign ROI for the brand, as measured with marketing-mix-modelling results, by +5% to 60% (versus our goal of at least 57% ROI).

1Sources: Ipsos BVC Brand Health, November 16, 2016, and KHC Equity Tracker, KHC Blind Panel, May 12, 2016.

Section VI — Proof of Campaign Effectiveness

a) Illustrate the direct cause and effect between the campaign and the results

The “Second Only to Yours” campaign delivered results that Classico had never experienced before. The timing of business and brand results correlates directly with the in-market campaign.

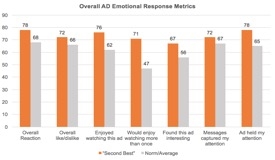

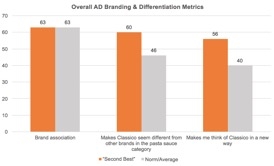

Our strong in-market performance was predicted by AdLab testing results that suggested our positioning of Classico as number two was going to lead to a successful campaign (with strong breakthrough potential and purchase intent scores).

Source: Ipsos Classico AdLab (August 8, 2016)

Source: Ipsos Classico AdLab (August 8, 2016)

b) Prove the results were not driven by other factors

Campaign spend vs. history and competition:

After many years of largely investing in promotional activity, in a highly commoditized category, the decision was made to reinvest in brand-building, above-the-line activity, to unlock incremental growth. And this strategic shift away from promotional spending to brand building activity paid-off, as share and volume growth out-paced historic and category levels.

Pre-existing Brand momentum:

While there was dollar volume growth for the same period in the previous two years (5.2% and 5.9%, respectively), it wasn’t nearly as strong as the 11.3% increase during our campaign.

Source: Nielsen Marketplace Data (September 19 to March 19, 2013 to 2017)

Pricing:

Classico pricing was relatively flat vs. the prior year (-4.1% or -$0.11), so it is unlikely that it accounted for Classico’s success.

Changes in Distribution/Availability:

Distribution was flat (-0.5% for a total of 97.2%) during our campaign period.

Source: Nielsen Marketplace Data (September 19, 2015 to March 19, 2016, and September 19, 2016 to March 19, 2017)

Unusual Promotional Activity:

When comparing year over year for our campaign period, units sold during promotions was up only 3.1%.

Source: Nielsen Marketplace Data (September 19, 2015 to March 19, 2016, and September 19, 2016 to March 19, 2017)

Any other factors:

Category growth:

Compared to Classico’s dollar volume increase of 11.3% (vs. a year ago), the category grew by only 1.3%.

Seasonality:

We have compared year-over-year changes to a specific time of year; therefore, seasonality is not a factor in our success.

Pricing Source: Nielsen Marketplace Data (September 19, 2015 to March 19, 2016, and September 19, 2016 to March 19, 2017

Other Factors Source: Nielsen Marketplace Data (September 19, 2015 to March 19, 2016, and September 19, 2016 to March 19, 2017)