Long Live The Home – IKEA

Off to a Good Start (BRONZE)

Client Credits: IKEA

Deputy Marketing Manager – Hilary Lloyd

Jungle Media – Connection Planning Director – Brooke Leland

Jungle Media – Media Buying Supervisor – Krystal Seymour

Production Company – Soft Citizen, Suneeva

Director – Arni Thor Jonsson, Mike Long

Director of Photography – Martin Hill, Chris Mably, Eric Tremi

Editor – Panic & Bob – Michelle Czukar, David Findlay

Editor – Poster Boy – Brian Williams, Mitch Finn

Music – Eggplant

Agency Credits: Leo Burnett, Toronto

Chief Creative Officer – Judy John

Cretive Director – Judy John, Lisa Greenberg

Group Creative Director – David Federico, Morgan Kurchak

Digital Associate Creative Director – Ian Kay

Copywriter – Morgan Kurchak, Stephen Stahl, Marcus Sagar, Matt Williamson, Andrew Caie,Marty Hoefkes

Art Director – David Federico, Mike Cook, Noreel Asuro, Monique Kelley, Noel Fenn, Mike Morelli

Digital Copywriter – Len Preskow

Digital Art Director – Sean Perkins, Trevor Bell, Ian Kay

Designer – David Federico, Lisa Greenberg

Photographer – Arash Moallemi, Stacey Brandford

Art Buyer – Leila Courey

Broadcast Producer – Franca Piacente, Melanie Palmer

Print Producer – Anne Peck, David Eades

Director, Creative Technology – Felix Wardene

Developer – David Freedman

Group Account Director – David Kennedy

Digital Account Director – Joseph Meyers

Account Director – Jennifer Kelly, Natasha Dagenais

Account Supervisor – Kirk Round, Danielle Iozzo

Account Executive – Kristin Meier, Allison Tang

Planner – Brent Nelsen, Dustin Rideout

Social Media Planner – Heather Morrison

Digital Project Manager – Thomas Degez

Project Manager – Lyndsay Cattermole

Crossover Notes:

All winning cases contain lessons that cross over from one case to another. David Rutherford has been identifying these as Crossover Notes since CASSIES 1997. The full set for CASSIES 2013 can be downloaded from the Case Library section at www.cassies.ca.

Crossover Note 1. What a Brand Stands For.

Crossover Note 2. Brand Truths.

Crossover Note 16. When a campaign stumbles.

To see creative, click on the links that are embedded in the case.

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | August 2011 – January 2012 |

| Start of Advertising/Communication Effort: | August 22 2011 |

| Base Period as a Benchmark: | August 2010 – January 2011 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

Recapturing the hearts and wallets of more Canadians… more often

Despite being one of the world’s most iconic brands, a 34-year love affair with Canadians and a historically successful brand purpose – to create a better everyday for the many people – IKEA began to see signs of concern. Quantitative research showed that flattening brand awareness, decreasing product range awareness, negative visitor development, and increasing competition across core home product categories were becoming real roadblocks to continued stellar success. [Crossover Note 16]

Where once IKEA was the décor default, today IKEA is one of many destinations. Mega brands like Home Depot, The Brick, Sears, Canadian Tire, Wal-Mart, HomeSense, The Bay, Braulte & Martineau and 10 others aggressively compete day to day for people’s precious décor dollars. The top three competitors average 234 stores compared to IKEA’s total 11, and invest 1.4 – 3 times more advertising dollars than IKEA does.

To reverse these declines – for a brand as iconic, successful, loved and creatively awarded as IKEA – required an answer to two fundamental questions: firstly, do we know what has worked or not worked previously and why? Secondly, what don’t we know about people and their home but need to if we are going to change people’s behaviour? Two deceptively simple questions that would require powerful human understanding, and anything but ordinary research to drive a new business and brand-building creative idea.

b) Resulting Business Objectives

- Get more people thinking IKEA when thinking the home: Increase TOM awareness VYA

- Get more people to visit the store more often: Increase Store Visitation VYA

- Encourage people to buy more: Increase Total Sales VYA

- Inspire people to furnish with the IKEA product

Source: IKEA Communications Strategy FY12

c) Annual Media Budget

Confidential

d) Geographic Area

National (Canada), including Quebec

Section III — STRATEGIC THINKING

a) Analysis and Insight

Home is Where the Insight Is

In research, we immersed ourselves in people’s lives at home – not only to understand their deep, unique relationship with core areas of the home (living room, bedroom, bathroom, and kitchen) – but also to identify an emblematic halo that connects all people to their whole home. To displace a vast and varied set of competitors (Home Depot, The Brick, Leon’s, Rona, etc) – who typically only specialize in specific rooms – our findings identified ways to not only sharpen IKEA’s superiority across each core area of the home, but also elevate the brand above all others in a way that no other furnishing retailer had done before.

To uncover insightful and creatively inspiring human truths for each room – and the whole home – we created an anthropological framework. To avoid token, flat, one-dimensional responses, participants were taken on a journey to construct an anthropomorphic profile for each room as if it were a real person they might be in a relationship with. The outcome was a humanistic view into people’s true relationship with each room, forming a unique approach to creative development guided by:

- Human Truths: The role of the room in her daily life, her definition of a quality relationship, how she feels when it’s not working, and the triggers that propel her to look elsewhere.

- Relationship With IKEA: Her loves and fears, what she knows about us or sometimes hears from others, uncertainties and hesitations in our relationship, the prospects for future dating and what’s needed to take our relationship to the next level.

- The Way Forward: Where are we in our relationship, her relationship desire, what’s getting in the way of relationship bliss, and what she needs to hear to achieve endless love.

IKEA had long been a brand noted worldwide for Style, Price, and Quality: the holy trinity that guides the organization. [Crossover Note 1] However we found that over time the emphasis on superior style and unbelievable pricing had begun to erode IKEA’s quality perception across every room in the home and especially among the 35+. Although IKEA had continued to evolve its product portfolio with ‘noble materials’ such as metals, hardwoods and stone surfaces, and category expansions such as complete kitchens, the holy trinity had become unbalanced.

The McConaughey-Clooney Correction – Style With Substance

We discovered that when it came to the home quality said as much, if not more, about the inhabitant as did style. To equalize the imbalance, we needed people to see IKEA in 3D; not just the stylish and great prices people knew us for, but all that plus depth of quality. To achieve all four campaign objectives, simultaneously, we defined our strategic insight as the McConaughey-Clooney Correction. The brand could continue to be like Matthew McConaughey – handsome, stylish, intriguing, eye-candy: the physical reference for women every time he takes his shirt off. Or we could be a bit more like George Clooney – suave, cultured, envied, timeless: the man women want and the man men want to be like. One can have style; few can achieve Style With Substance.

b) Communication Strategy

The Most Important Place On Earth

To understand how best to do that, we synthesized people’s relationship with reach room of the home into a single universal truth that could connect all people with the whole home. The most exciting and salient point was a universal truth that the home – and we mean every last bit of it – is the most important place on earth. [Crossover Note 2] Regardless of age, gender, geography, or the unique relationship dynamics people have with each room – the sum importance of the whole home is unequaled in peoples’ lives. We used this insight to not only build connection with each core area of the home, but also inform a powerful and compelling new creative idea that connected people, the whole home, and quality with IKEA.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

60-second, 30-second, 15-second TV, crawlers and sponsorships

Radio :30s & Radio remotes

OOH (static and Digital OOH)

Ambient & events

Magazine & magazine iPad sponsorship

Newspaper

DM

Digital pre-roll

Digital banners & impact units

Social Media

Search

Mobile ads

b)Creative Discussion

1) A New Whole Home Position: Our campaign launched with a 60-second anthem, running nationally during prime-time premieres to reestablish the holy trinity of style, price and quality. We ditched the old tagline – “Any Space Can Be Beautiful” – a nod to only the style pillar – and adopted a big, celebratory new theme line “Long Live The Home.” This is a universal celebration that IKEA is for the whole home and everything stylish, high quality and well priced that make it the most important place on earth.

2) A Connected Room Story: The launch spot was followed by a series of multimedia executions for each core room of the home – following the brand’s commercial and promotional calendar. TV was supported by 30-second national spots for each core room: bedroom – signifying me at my core, living room – signifying the best of me/us at the moment, and kitchen – signifying us as we are. These 30-second spots not only highlighted the style, price AND quality to be found in each room, but also reflected the relationship and meaning people had with each room. 15-second spots accompanied the national buy with a specific room promotional offer, driving consumers to visit their local IKEA store. Tactical support was developed for each room and commercial initiative in the form of direct mail flyers, newspaper, OOH, national radio, and a rigorous social media calendar across all owned channels.

3) Act vs. Ads: In addition to commercial executions for the core areas of the home, a variety of ambient acts were developed throughout the year based on the human truths for each room gained through research. This included a large integrated campaign for the launch of the new IKEA catalogue (based on an understanding of how women stalk and hunt décor retail), the launch of the new and largest IKEA store in the country (based on people’s desire to show others how smart and savvy they are in home enhancement), and a regional initiative for “Moving Day” in Quebec (based on an understanding of what people want most during moving chaos).

c)Media Discussion

In order to get more people shopping more often at IKEA we needed media to not only increase top-of-mind awareness, consideration and visitation but also to do that in a highly creative and innovative way. (Remember, IKEA has the 2nd lowest share-of-voice amongst its competitors.)

To combat the challenges, we increased spend in awareness media. (Specifically, :60 & :30 second brand TV and magazine spreads to continuously communicate the IKEA holy trinity of style, quality and price.) Traffic-driving media (15-second TV spots, radio and newspaper) was reduced and used for key event support only. Awareness is great! But we’re talking retail here, so “call to action media” was used to support events and drive footfall. Despite issues in previous years with the effectiveness of :15 spots, this year :15s were used exclusively because of the creative quality. Radio was also applied to secondary events.

To ensure we maintained IKEA’s creative leadership we focused on marrying medium and message more overtly by creating innovative media executions: integration with top design shows (Sarah’s House, Marilyn Dennis), front-of-magazine gatefolds in top design publications, and innovative standout outdoor and brand acts.

Section V — BUSINESS RESULTS

a) Sales/Share Results

GETTING FIRMLY INTO THE HEADS, HEARTS AND WALLETS OF CANADIANS

The campaign has realized the following results as of January 22, 2012, all achieved with no increase in total media spend.

Sales and Visitation:

- Total Visitor results VYA over-achieved goals

- Total same-store sales results VYA over-achieved goals

- Kitchen, Bedroom and Living Room sales over-achieved goals VYA for the advertised period

- During the period of IKEA Catalogue support (August 8th – Sept 4th 2011), sales over-achieved goals VYA

Source: IKEA Canada

Brand Health and Tracking:

- Top-of-mind awareness has increased by 3% Jan 2012 vs. Aug 2011*

- Spontaneous awareness has increased 9% over the same period *

- IKEA has achieved the highest level of aided awareness versus top competitors *

- IKEA has achieved the highest brand consideration amongst all competitors, and is the store the highest number of shoppers have purchased from, having increased 4% Jan 2012 vs. Aug 2011*

- Range perception has increased 4% Jan 2012 vs. Aug 2011 (Q – “IKEA has things I need for all areas of the home”)*

- Net Value (Style, Price, Quality) has increase 2% overall VYA and +6% among lapsed customers VYA *

* Source – IKEA Brand Tracker 2011/12

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

BEHAVIOUR CHANGE CONTRARY TO KEY INDICATORS

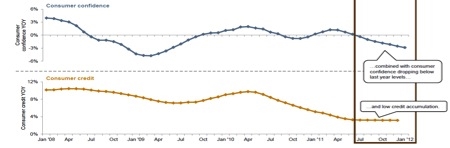

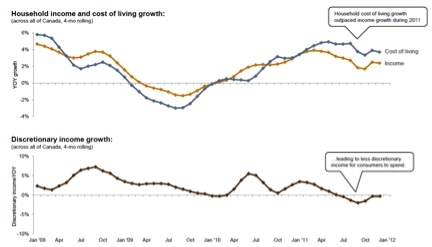

Despite record low and declining Canadian consumer confidence, credit accumulation levels, discretionary income levels and incomes lagging the cost of living, IKEA sales results for the case period showed positive growth in the opposite direction to the aggregate consumer behavioural indicators.

Source: Statistics Canada Rolling Monthly Tracking – National Data

IKEA AWARENESS INCREASING AT THE EXPENSE OF OTHERS:

Despite facing competitive SOV levels 1.4 – 3 times higher than IKEA, TOM awareness has shown continuous increases over successive months, while competitors’ awareness levels have decreased. Source: IKEA’s TV GRPs from IKEA Canada; % of consumers noticing IKEA’s TV ads from Fusion Retail Analytics, March 2012.

THE HOLY TRINITY MOVING BACK INTO BALANCE:

IKEA’s brand perception around quality increased positively vs. competitors as did range perception VYA. The only significant variable during that time would have been the campaign and its focus on quality and IKEA range of product. Source: Fusion Retail Analytics, November 2011.

b)Excluding Other Factors

Spending Levels:

All results reflected in the case were achieved without any increase in marketing, advertising or promotional spending. Total budgets were flat VYA and consistent with previous year’s investment levels.

Pricing:

All results reflected in the case are not a result of price changes. No change in product pricing occurred during the period of this case. Pricing of all IKEA products was consistent with previous year’s price points.

All results were achieved without extraordinary discounting. Any discounting of product in annual IKEA flyers or promotional offers tied to events (e.g. gift cards) was applied to similar merchandise at consistent price points and values as previous year’s.

Distribution Changes:

All sales results reflected in the case are for comparable stores only and do not reflect pent up market demand from new store openings (e.g. Richmond B.C., and Ottawa, ON).

Unusual Promotional Activity:

n/a

Other Potential Causes:

All sales results reflected in the case were achieved with SOV level well below the competition. IKEA has the 2nd lowest SOV amongst the key competitors.

Testing: IKEA does not pre-test its creative, so no learnings are available for this case. However, results across the business, movement in brand equity and health measures would strongly suggest the copy was highly effective despite the lack of testing.