MINI

Sustained Success (SILVER)

Client Credits: MINI Canada

Adam Shaver: Director, MINI Canada

Steve Ambeau: Brand Communications Manager

Adam Wexler: Sales and Marketing Coordinator

Agency Credits: TAXI Canada

Lance Martin, Dominique Trudeau: Executive Creative Director

Tina Tieu, Pascale St-Amand, Jared Stein, Daryn Sutherland, Caleb Goodman: Account Director

Julie McGregor: Account Manager

Kareem Boulos: Director of Account Planning

Jolene Macleod: Supervisor of Account Planning

Daniel Mak: Account Planner

Jenna Bowie: Account Planner

Crossover Notes:

All winning cases contain lessons that cross over from one case to another. David Rutherford has been identifying these as Crossover Notes since CASSIES 1997. The full set for CASSIES 2013 can be downloaded from the Case Library section at www.cassies.ca.

Crossover Note 1. What a Brand Stands For.

Crossover Note 4. Business Strategy dictated by the Brand Positioning.

Crossover Note 5. The Total Brand Experience.

Crossover Note 10. Conventional Wisdom—should it be challenged?

Crossover Note 14. Refreshing a continuing campaign.

Crossover Note 30. Reach and Frequency versus Large-Space Impact.

Crossover Note 33. Changing the Target Audience.

To see creative, click on the links that are embedded in the case.

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | March 2002–March 2012 |

| Start of Advertising/Communication Effort: | March 2002 |

| Base Period as a Benchmark: | Historical Comparisons |

Section II — SITUATION ANALYSIS

a) Overall Assessment

The Volkswagen Beetle served as a cautionary tale for BMW as they prepared to launch the MINI in Canada 10 years ago. Whereas the Beetle ultimately suffered from being too “cute” in the segment and a fad of the moment, the ambition for the MINI was obviously quite different.

MINI had little history or brand awareness in Canada. Most people remembered it as a quirky, cute, and trendy compact car from the UK. Our challenge was to change this perception and create the conditions for not just a successful launch, but a successful long-term future for the brand in Canada. And so the journey began in March 2002, when MINI first set its tires down on Canadian soil.

Although the end of the story is already quite well known, it is important to acknowledge that the odds have always been stacked against us. MINI’s decade of success is a testament to how well we have deftly manoeuvred the brand around all roadblocks and obstacles that have come its way.[Crossover Note 4]

The automotive business is a game in which only the fittest survive. And without the benefit of either deep pockets or a breadth of models on its roster, MINI needed to continuously find ways to showcase itself as the forever “it” car in order to compete. “New” and “shiny” model launches of other luxury compact cars, like the Mercedes-Benz smart car and the Fiat 500, have crossed our path over the last ten years and set out to steal the spotlight.

At every battle, we were out-gunned. Marketing budgets are based on the number of units sold and our competitors had significantly deeper pockets. We had to outsmart not outspend the competition.

From the outset, we decided that our car might be small, but our defiant, sh*t-disturber attitude would always be big – and that spirit has been at the heart of our positioning since launch. We have consistently defied category conventions and built the brand through owned and paid media traditionally considered by the automotive category as support. [Crossover Note 1]

Our strategy favoured impact, amplification, and talk value over tonnage. We focused on the in-dealer experience, the new driver welcome kits, and the high-involvement OOH and interactive pieces to create a relationship with prospective buyers. [Crossover Note 5]

Make no mistake, a critical part of MINI’s success has come from being truly unconventional, but ensuring that each and every consumer across Canada experienced the same look, feel, and personality in every campaign, dealer communication, and piece of collateral that has gone out the door over the past decade has contributed as well. [Crossover Note 14]

b) Resulting Business Objectives

1. Year-over-year sales increase. Even through recessionary economic times, the bar was always set high.

2. Create “harder-working” advertising. Our budgets would always be challenged by the competition’s, so it was critical to get the most exposure possible for each initiative.

c) Annual Media Budget

$3 – $4 million

d) Geographic Area

National – Canada, with major markets being Vancouver, Toronto, and Montreal

Section III — STRATEGIC THINKING

a) Analysis and Insight

Arguably the most significant strategic decision we made out of the gate was to overtly target men. [Crossover Note 33]

Through an in-depth category and consumer investigation, we identified that small cars run the risk of being considered cute, and therefore a chick car that guys won’t go near. Cute also assumes the role of a fashion trend, which can be short lived. Long-term sales are assured by male purchasers, who base their purchasing decisions on attributes, not fashion.

So, within that, who were we specifically going after?

There was no one simple demographic profile that could characterize our MINI driver. These were guys who defied age through attitude, interests, and lifestyle. They were confident, individualistic, and non-conformist – much like the MINI. They were sophisticated risk takers attracted to people and things that challenge the status quo. The car would need to embody that spirit at every turn.

Lastly, knowing the realities of our small budget, it was critical for us to make smart decisions on how to go to market. Being a niche brand, MINI’s goal was to maximize the available dollars and make a big impact without spending big bucks – outsmart versus outspend – and consistently deliver impact pieces that generate buzz and PR and gain maximum exposure to keep MINI relevant in the public eye year after year.

b) Communication Strategy

There were four pillars that have been at the core of MINI since launch [Crossover Note 10]:

Be ballsy

Though MINI may be small in size, its identity would always need to be larger than life and hypermasculine. We set out to own this irreverent, ballsy attitude to make our mark as the little sh*t disturber that leads and never follows. This led to boundary-pushing creative work, as well as innovative and bold media choices.

Be current

In our quest to stay topical and relevant with consumers, we were always on the lookout for inspiration in current events and culture to add to conversations that were already happening in the world.

Be ruthlessly consistent

From the welcome kit to the dealer experience to the advertising and every other encounter, consumers can rely on experiencing the same look, feel, and most importantly, personality that has made MINI infamous.

Be fun

In addition to its unique exterior, MINI’s go-kart handling and agility make it easily the most fun one can have on four wheels. Our work needed to reek of this fun and have it come through at all points of connection.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

- TV

- OOH

- Washroom boards

- Online

- Stunts

b)Creative Discussion

The launch campaign played on the male’s love for the underdog. We introduced MINI as the little car with a big, ballsy attitude. We also backed up this attitude by focusing on MINI’s power and performance, removing “cute” from its vernacular.

It is this cheeky and irreverent attitude that has endured for 10 years and has allowed us to produce some of the most innovative and impactful media expressions of any brand in the category.

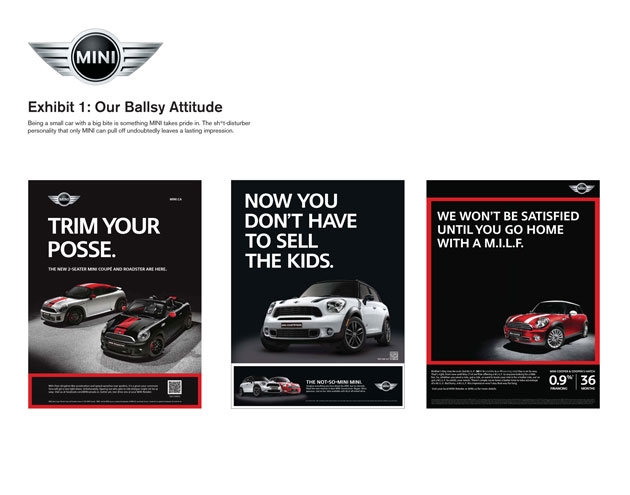

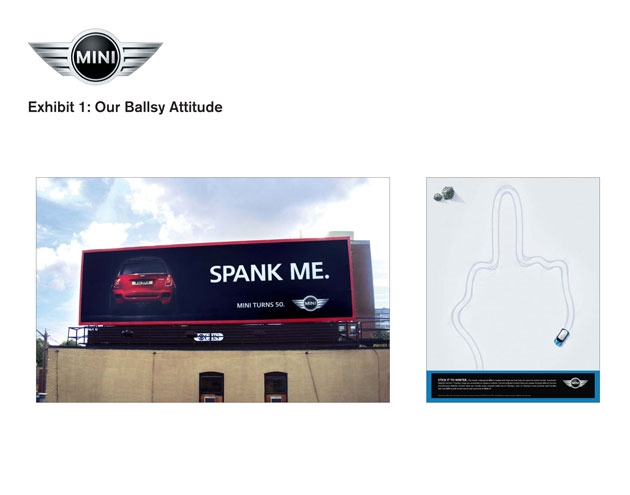

Our ballsy attitude (see Exhibit 1)

Being a small car with a big bite is something MINI takes pride in. The sh*t-disturber personality that only MINI can pull off undoubtedly leaves a lasting impression.

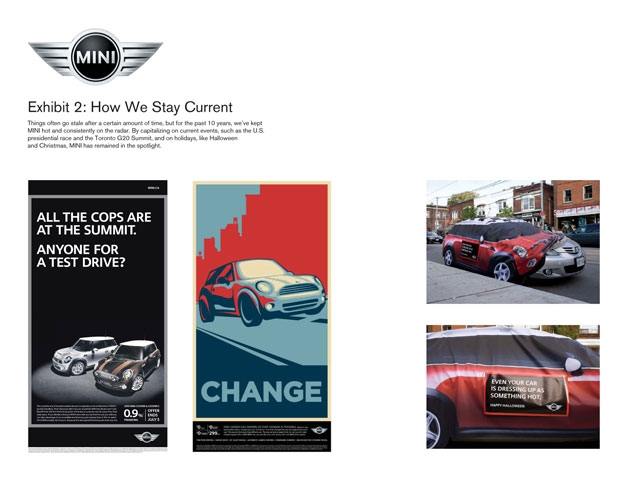

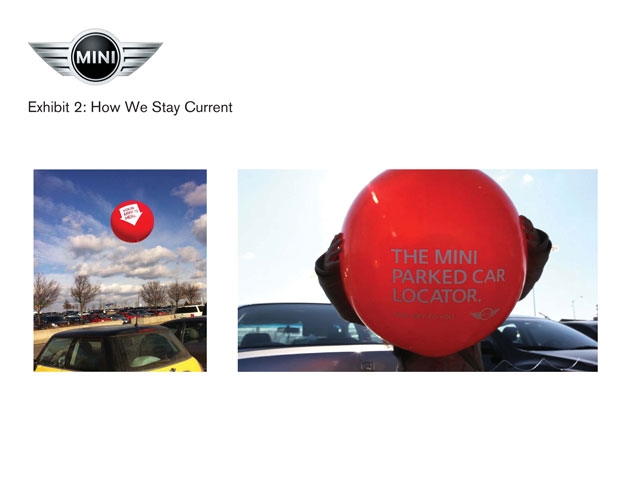

How we stay current (see Exhibit 2)

Things often go stale after a certain amount of time, but for the past 10 years we’ve kept MINI hot and consistently on the radar. By capitalizing on current events, such as the U.S. presidential race and the Toronto G20 Summit, and on holidays, like dressing up non-MINI cars on Halloween and helping MINI drivers easily locate their cars in busy mall parking lots at Christmas time, MINI has remained in the spotlight.

Our unwavering consistency (see Exhibit 3)

Across all touch points, MINI’s tone, look, and feel are unmistakable. Whether it’s large billboards, print ads, point-of-sale communications, retailer packages, or simple handouts, consistent branding and style shows clearly that you’re in the presence of none other than MINI.

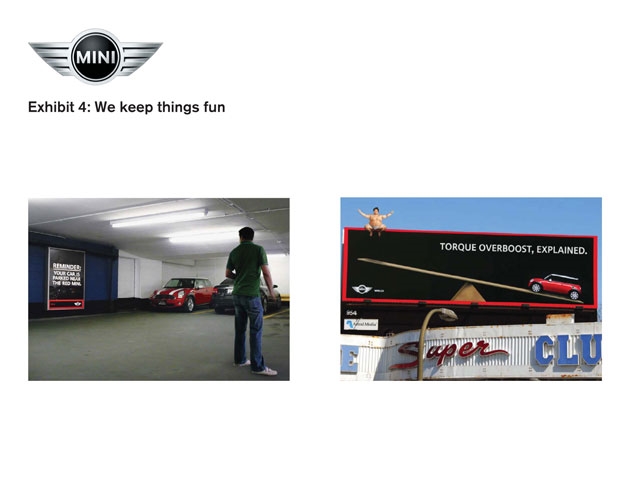

We keep things fun (see Exhibit 4)

In true MINI spirit, we continue to showcase MINI’s playful personality through unexpected stunts that will leave people smiling.

c)Media Discussion

Our strategy favoured impact, amplification, and talk value over tonnage. By deliberately choosing environments that made the most sense for our message, we increased the likelihood that our pieces would be shared and effective. [Crossover Note 30]

Section V — BUSINESS RESULTS

a) Sales/Share Results

It’s been ten years since launch and MINI still stands as one of the most distinct and potent brands in the Canadian automotive market. With sales that have consistently exceeded quarterly and yearly targets, MINI has endured the test of time.

MINI Canada sales have shown steady performance and consistent growth year over year, with nine out of ten years showing positive growth!

|

Time Period |

Achieved Retail |

|

Launch Year |

2,102 |

|

2003 |

2,708 |

|

2004 |

2,800 |

|

2005 |

3,401 |

|

2006 |

3,410 |

|

2007 |

3,703 |

|

2008 |

4,905 |

|

2009 |

4,251 |

|

2010 |

4,501 |

|

2011 |

5,155 |

|

2012 |

YTD 2,321

|

| 2003 vs. 2002

|

+29% (March–December 2003 compared to March–December 2002) |

| 2004 vs. 2003

|

+3% (January–December 2004 compared to January–December 2003) |

| 2005 vs. 2004

|

+21% (January–December 2005 compared to January–December 2004) |

|

2006 vs. 2005 |

+0.2% (January–December 2006 compared to January–December 2005) |

|

2007 vs. 2006 |

+9% (January–December 2007 compared to January–December 2006) |

|

2008 vs. 2007 |

+32% (January–December 2009 compared to January–December 2008) |

|

2010 vs. 2009 |

+6% (January–December 2010 compared to January–December 2009) |

|

2011 vs. 2010 |

+15% (January–December 2011 compared to January–December 2010) |

|

2012 vs. 2011 |

+34% (January–March Q1 2012 compared to January–March Q1 2011) |

MINI Canada also stands out at an international level:

- MINI international headquarters in Munich recognized the Canadian launch of the MINI as one of the most successful international launches

- Despite MINI Canada’s small budgets, it is currently the tenth-biggest market in the world, according to MINI sales volume

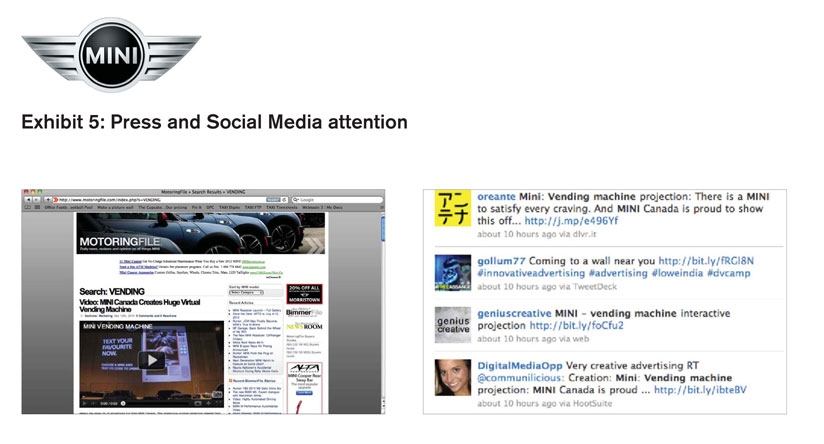

Additionally, further success is evident in the decade of unpaid media we have garnered for the brand, including press clippings and buzz on social media websites (see Exhibit 5).

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

While other cars have come and gone MINI has been able to anticipate the market and develop a long-term sustainable brand proposition that continues to resonate with consumers.

The proof lies not only in the consistent sales growth we’ve seen throughout the past ten years, but also in the brand identity that MINI Canada has so strongly developed and maintained.

b)Excluding Other Factors

Spending Levels:

Since launch, MINI Canada has been challenged with having to sell a higher volume of cars each year, with spending budgets that have remained the same or have declined consistently.

Pricing:

2011 was the first year MINI made substantial adjustments to their pricing. For the previous nine consecutive years, MINI upheld a stable price point without any significant repositioning.

Distribution Changes:

Although MINI has added more models to their lineup, overall spend has remained consistent.

Unusual Promotional Activity:

With the exception of the last three years, MINI has been able to maintain a price premium even in the most difficult of financial times. Not having a “sales event” in the first seven years (in a marketplace where automotive deals and incentives are common) was a part of the sales strategy.

Other Potential Causes:

None