TD Bank: Everyday Banking

Sustained Success (BRONZE)

Client Credits: TD Bank

Richard Kwong, Sr. Manager Marketing

Alicia DeLaurio, Manager Marketing

Agency Credits: Mosaic Sales Solutions

Chad Grenier, VP CPG

Alan Palmer, Director

Adam Bloom, Sr. Account Manager

Kim Tarlo, Associate Creative Director

Jennifer Lalonde, Account Manager

Crossover Notes:

All winning cases contain lessons that cross over from one case to another. David Rutherford has been identifying these as Crossover Notes since CASSIES 1997. The full set for CASSIES 2013 can be downloaded from the Case Library section at www.cassies.ca.

Crossover Note 1. What a Brand Stands For.

Crossover Note 5. The Total Brand Experience.

Crossover Note 10. Conventional Wisdom—should it be challenged?

Crossover Note 14. Refreshing a continuing campaign.

Crossover Note 21. Likeability.

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | January 2007 – December 2012 |

| Start of Advertising/Communication Effort: | November 2007 |

| Base Period as a Benchmark: | 2004 – 2006 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

The TD Canada Trust story shows how, when consistency is combined with insight, creativity and innovation, it can be incredibly powerful. And it’s that combination that helped to create one of the more remarkable stories in Canadian marketing: how a number two bank, operating in a category of overwhelmingly parity offerings, became not only the number one FI brand, but the most valuable brand in Canada. [Footnote 1] [Crossover Note 5]

Background:

TD Canada Trust was built on the vision of “Making banking comfortable” by putting customers first.

Over time, TD’s promise was linked to convenience, primarily longer retail branch hours. Predictably, this drove other banks to extend their hours, introducing parity in an area where TD once had undisputed ownership. At the same time, consumer needs were broadening, and while we had a number of initiatives that expanded our definition of comfort, we weren’t getting credit for them.

We needed to build awareness and brand linkage for all the other things we were doing to make banking comfortable, to show that TD was adapting to consumer needs in multiple ways. At the same time, we needed to maintain our historical credentials in longer hours. [Crossover Note 1]

b) Resulting Business Objectives

- Expand awareness for proof points that demonstrate that TD Canada Trust is the ‘bank of comfort’ (2008 on).

- Re-establish that TD had longer hours – even longer hours than consumers realized (2007)

- Launch Sunday banking (2011)

Additionally, for product or service executions (like Mobile Mortgage Specialists and Personal Assessment), business results were expected to exceed campaign objectives.

The ultimate goal was to drive annual revenue and profit growth while positioning the brand for long term success.

c) Annual Media Budget

Over $5 million

d) Geographic Area

Canada

Footnote 1: Interbrand 2012 Canadian Brand Report

Section III — STRATEGIC THINKING

a) Analysis and Insight

Most service categories had changed to reflect consumer lifestyles and needs. You could have groceries delivered to your home. You could have a burger your way. You could choose a cell phone plan that was right for you, and consume media on your terms.

But the banking category was stuck in the past. Banks had rules and you were forced to live by them. They were inflexible. Bankers’ Hours were by definition not your hours. It’s no wonder that Canadians loved to hate banks. [Crossover Note 10]

b) Communication Strategy

The exception was TD Canada Trust. They were seen to be different. They cared about their customers. In a category that was dated and stuck in the past, they were operationalizing a number of initiatives to make banking more comfortable for Canadians.

Our job was to reinforce this in an engaging and differentiated way. The creative idea was to juxtapose the kind of service one could expect from TD Canada Trust with what one might have traditionally expected from a bank. But in a unique new way.

The first challenge

To convince consumers we offered proof points in addition to longer hours. And to do it in a new way that drove consumer attention and competitive differentiation.

The second challenge

With a strongly entrenched perception that TD already had longer hours, we needed to make consumers notice that something had changed in order to defend against imitators.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

With approximately 1 in 3 Canadians banking at TD, we had to ensure broad appeal of our message. Given a mass audience, TV and online video were selected as the core media for our campaign, but these channels were expanded to include other online media and in-branch communications, both conventional and digital.

b)Creative Discussion

The campaign needed to shake things up – to communicate that we had something new to say. So we made a big decision – we were going to start a conversation about TD’s new offerings – and we were going to start that conversation on a park bench.

Between two extremely old men.

The more people age, the more they tend to be resistant to change and suspicious of innovation. “The good old days” is whatever age you grew up in, and complaining about its passing is the right of every senior citizen. It could be said that complaining about new ways of doing things goes with old age like sweater vests, plaid pants and eating dinner at 5 o’clock.

The “Grumpy Old Men” would allow us to be implicitly competitive while still retaining the folksy charm of the TD Canada Trust brand. Stuck in the past, they would represent the ‘old way’ – the traditional view of banks, their service levels and their attitudes towards consumers. They didn’t see what was wrong with ‘the old way’ – the way the other banks continued to serve customers. [Crossover Note 14]

We let them speak their minds, in a way that Canadians found endearing, and demonstrably persuasive. [Crossover Note 21]

(There weren’t actually two grumpy old men – there were six: two for English Canada, two for Quebec, and two that starred in executions in Mandarin and Cantonese. This was the first time in the Canadian FI category that a major TV and video campaign had been created simultaneously in 4 languages.)

In essence, the Grumpy Old Men acted as a foil against which we measured TD Canada Trust’s progress in bringing comfort to the consumer.

Defending Extended Hours – Launch: November 2007

We needed to defend our established position in longer hours against competitive infringements, so we created new TV creative to reinforce the full scope of our extended hours.

Beyond Longer Hours: 2008 – 2012

We developed a series of executions using our Grumpy Old Men to support broader initiatives we had in place, specifically:

- Mobile Mortgage Specialists, who met customers wherever they wanted, including their home, to provide them with advice and support for their mortgage needs.

- No Appointment Service, which supported consumers’ ability to drop in to a branch and see an advisor, without an appointment

Sunday banking: 2011

TD Canada Trust had led the charge when it came to longer hours. As yet another example of putting customers first TD introduced Sunday banking in 2011, and the ‘Grumpy Old Men’ campaign was used to support this news as well.

TV (English and French :30/:15s)

- Even Longer Hours (:30)

- Weekend Hours (:30)

- Mobile Mortgage Specialists (:30)

- Advice (:30)

- No Appointment Service (:30)

- Advice #2 (:30)

- Sunday banking (:30)

- Sunday banking1 (:15)

- Sunday banking2 (:15)

- Sunday banking3 (:15)

- Sunday banking4 (:30)

- Advice2 (:30)

- Mortgage Vacation (:30)

In-Branch Digital (LCD Screens)

- Simply Save

- Longer Hours

- Advice

- General ‘Comfort’ Message

- Sunday banking

- Advice2

Online (English and French Video)

- Mobile Mortgage Specialists

- No Appointment Service

- Advice

- Longer Hours

- Simply Save

- JD Power & Associates Win

- Sunday banking

- Branch locator

c)Media Discussion

The media plan was developed to maximize reach and frequency.

TV

The spots ran nationally, and supported key sponsorships like HGTV’s First Timer Mondays and Toronto Blue Jays programming.

Online

We used online video, rich media units and page takeovers on sites targeted against lifestyle, entertainment and news to add stopping power to our message.

In-Branch Digital

We took advantage of our most powerful POS channel with custom content, optimized for relevance and cross-selling.

Section V — BUSINESS RESULTS

a) Sales/Share Results

On every conceivable measure, the TD Grumpy Old Men campaign has been a phenomenal advertising success story, one of the most significant in Canadian FI history.

1. Brand Value, as measured through Interbrand’s ‘Best Canadian Brands’ ranking:

In 2012 TD was named the #1 brand in Canada (not just #1 financial brand), ahead of such icons as Tim Hortons, RBS and Thomson Reuters, and up from #3 in 2008. [Footnote 2]

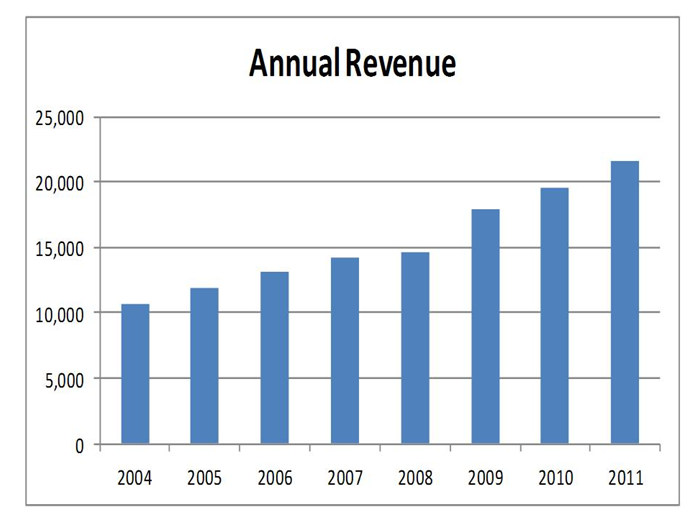

2. Revenue & Growth: TD has had an enviable track record of growth in Canada, a growth that has been recognized by the markets, and that has been chiefly driven by retail, the sole banking segment this case is focussing on.

Retail performance: Net revenue for the bank rose 6% in 2008, 7% in 2009, 9.6% in 2010 and 10.4% in 2011. In the most recent period (Q2 2012) TD’s revenue is up 14% VYA, with 80% of adjusted earnings from retail.

Stock Performance: TD has performed better than the other 4 major banks in terms of share price, with an increase of over 35% between 2007 and 2012, a period that included a major recession and prolonged financial uncertainty. Again, it’s important to note that 80% of adjusted earnings are contributed by retail, a ratio that has been increasing over the last two years. [Footnote 3]

Other Indicators of Success

3. Advertising Performance – The campaign struck a powerful chord. In a category that was often ignored by consumers, we had re-positioned the competition as ‘old and dated’ while presenting TD as progressive and customer focused.

The tongue-in-cheek executions supporting extended hours were tremendously successful. But even better, benefits beyond our established convenience messaging also performed extremely well, particularly mortgages and personal assessments. This was an acid test for the campaign.

Mortgages – Mobile Mortgage Specialists

- ‘Likelihood to consider TD’ for a mortgage scored at 16% above TD norms, which are higher than category norms (concept testing)

- This translated to in-market sales which were 139% of objective and 165% vs. previous year (despite an extremely uncertain economic climate)

- In 2009, according to Ipsos ASI’s in-market research, the spot’s Net Effectiveness Score (a composite measure of recall, branding and persuasion) was 351. It was one of the top Ipsos ASI tracked ads in market in all of 2009,

- The online ad unit with custom video achieved almost 2 million video plays with an interaction rate of 11% (vs. an industry average of just over 2%)

Advice – Personal Assessment

- ‘Likelihood to consider TD’ for a mortgage scored at 16% above TD norms, which are higher than category norms (concept testing)

- The ‘intent’ translated to action, with a 70% increase in Personal Assessments vs. previous year. Net sales were 1020% of targets (not a typo!)

Average click-through rate for the online executions was at 1.08% vs. the norm of the financial industry of 0.11%. [Footnote 4]

4. Brand Reputation – in 2010, Reader’s Digest named TD Canada Trust (tied for first place with RBC) as the most trusted Bank/Credit Union in Canada. This was based on a survey of 1,500 Canadians in 2009. It’s important to note that while the two banks were tied on reputation, RBC significantly outspends TD (media investment), consistent with the competitive advertising breakthrough analysis in Section VI. [Footnote 5]

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Footnote 2: Interbrand “Best Canadian Brands” Reports, July 2012 & 2008

Footnote 3: Morningstar Equity research Report, May 25, 2012; TD Investor Overview, May 2012, TD Investor Quick Facts Reports, 2008 and 2009, TSX Data

Footnote 4: Ipsos Reid Tracking Data

Footnote 5: Readers Digest Canada study, April 1, 2010

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

TD Canada Trust’s ‘Grumpy Old Men’ campaign has become one of the most successful, talked-about campaigns in their history, and arguably in Canadian banking history. Here’s how we measured up against the objectives:

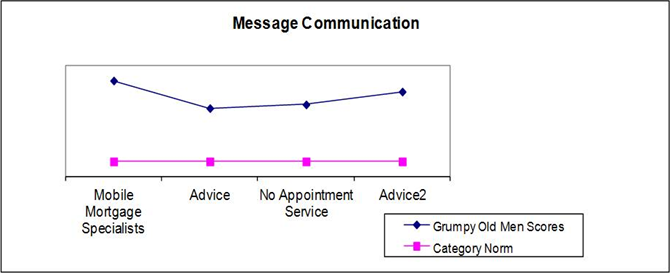

1. Expand awareness of proof points in addition to ‘longer hours’

- Beyond the stellar results we’ve shared in section 5 for Mortgages and Advice, we were able to achieve awareness of the new proof points through the new campaign:

2. Clearly communicate that TD Canada Trust had ‘longer’ hours than before

- In concept testing, 95% agreed that ‘TD is now open even longer hours’

- Compared to TD’s historical benchmark, the message that ‘TD is now open earlier and later than before’ indexed of 131.

- In finished ad testing, compared to TD’s historical benchmark, consumers also agreed that ‘TD branches are open longer hours than before,’ at an index of 116.

3. Launch Sunday banking

- Message communication indexed at 147 vs. GOM (Grumpy Old Men) norms, which were higher than the category norms.

- Incremental traffic flow indexed at 250 vs. average

- The digital campaign drove just under 489M visits to TD.com and over 200M activities on the site.

- Branch locator generated an interaction rate of 8.79%, surpassing the Financial Services benchmark for expandable non-video banners by over 500%

- Expandable GOM video ads generated 6.6M activities and an expansion rate of over 900% vs. the Financial Services benchmark.

In addition, we were able to achieve some remarkable results beyond the three immediate objectives:

- A proven campaign effect – in the launch timing, we were able to see that viewers who had seen both ads had 7% higher recall of the ads than viewers who had seen just one.

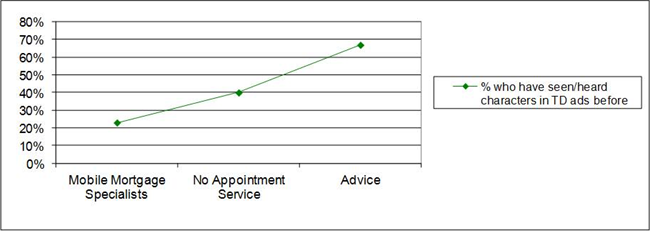

- An increase in equity behind our characters, as proven by stated recall of the Grumpy Old Men:

In-Market Tracking

Ipsos ASI conducts a continuous Brand and Communication Ad*Graph study for TD. The Grumpy Old Men ads had very strong break through – recall and branding for each of the creative executions has been significantly higher than expected levels (Ipsos ASI Norms) given their individual media support. The ‘Grumpy Old Men’ equity had successfully transferred onto the new executions, which were now communicating new proof points beyond ‘longer hours.’

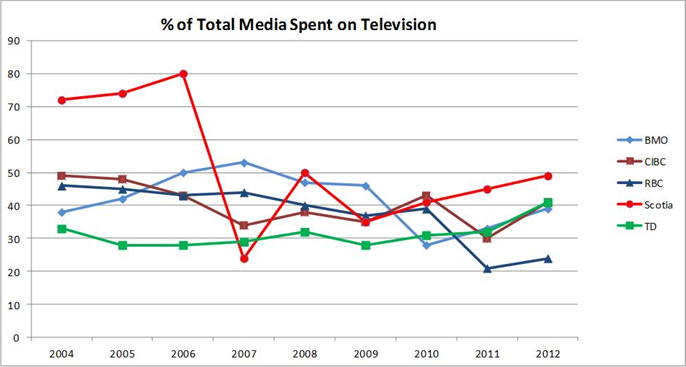

Advertising Break Through

One of the most remarkable things about the Grumpy Old Men campaign is that it has allowed us to break through better than the competition, despite the fact that TD has not allocated as high a percentage of their overall media investment to television (where the investment behind the Grumpy Old Men is primarily focused). Despite this fact, TD has not only held the #1 position in claimed ad awareness since the campaign launched in 2007 but that metric has also increased year after year.

Cultural Recognition of the Campaign

With the launch of the Grumpy Old Men campaign, the interest of the general public was engaged like never before, and when, in 2011, it became the subject of an elaborate segment on the Rick Mercer Report (Canada’s number one Comedy show) its status as a part of Canadian popular culture was confirmed.

b)Excluding Other Factors

Spending Levels:

- TD has maintained a consistent relative spend level vs. the competition with TV spending holding at either a #2 or #3 level.

Pricing:

- Prices of annual fees among the Big 5 banks have remained competitive and differences are nominal. There has been no significant pricing activity among the Big 5 banks during the period in question.

Distribution Changes:

- While TD continues to expand its retail footprint, this expansion rate is unchanged from previous years, and also is largely unchanged vs. competition, reflecting an industry trend to reinvest in bricks and mortar.

Unusual Promotional Activity:

- The banks are nothing if not predictable – most Big 5 banks have one major promotion a year, every year.

Other Potential Causes:

- While Canada experienced an economic recession in 2008 and 2009, this impact was felt by all Canadian banks and if anything would trend results down vs. up, so would not impact the positive results we have seen since 2007.