Koodo El Tabador

Best Integrated Program (GOLD)

Client Credits: Koodo Mobile

Kevin Banderk: Chief Koodo Officer

Lise Doucet: VP Marketing Communications

Dragana Simao: Manager, Marketing Communications

Nathan Roth: Manager, Digital Marketing Communications

Jennifer Robertson: Directrice générale, communications et marketing Koodo Mobile

Agency Credits: TAXI 2

Lance Martin: Executive Creative Director

Partick Chaubet: French Creative Director

Alex Gadois: French Creative Director

Dave Watson: Design Creative Director

Jeff MacEachern, Mike Lee, Craig Ferguson, Jordan Dunlop: Art Directors

Caleb Goodman, Natalie Calderon: Group Account Directors

Pascale St-Amand: Montreal Account Director

Katie Trainor, Steve Waugh, Sherrie Reynolds, Kirstin Bojanowski: Account Managers

Krista Cressman, Julie MacGregor: Account Managers

Media Agency: Cossette Media

Production House: BENT Image Lab

Mike Blackmore, Tal Wagman, Alexis Bronstorph, Marko Pandza : Writers

Josianne Cossette: French Writer

Tanya Henri: French Writer

Mike Blain: Designer

Kammy Singh: Designer

Tyler Smith: Designer

Jennifer Cursio, Ben Sharpe, Kevin Saffer, Brie Gowans, Anick Rozon: Broadcast Producers

Tara Greguric, Charlene Leong, Jen Shapiro: Print Producers

Brian Coughlin, Dave Kinsella, Dayle Sheward, Lorin Altomonte: Mac Artists

Susan Carswell, Dwayne-Mark Aranha: Mac Artists

Alex Chung, Andrew O’Driscoll: Retouchers

Gaetano Carpino, Patrick Elia, Jennifer Simpson, Joyce King, Hanna Bratt: Interactive Producers

Matt Burtch, Bob Blevins, Ryan Johnson, Carson Shold: Interactive Programming

Cory Pelletier, Nicole Polivka, Zach Klein: Digital Strategy

Crossover Notes:

All winning cases contain lessons that cross over from one case to another. David Rutherford has been identifying these as Crossover Notes since CASSIES 1997. The full set for CASSIES 2013 can be downloaded from the Case Library section at www.cassies.ca.

Crossover Note 1. What a Brand Stands For.

Crossover Note 2. Brand Truths.

Crossover Note 10. Conventional Wisdom—should it be challenged?

Crossover Note 14. Refreshing a continuing campaign.

Crossover Note 21. Likeability.

To see creative, click on the links that are embedded in the case.

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | March 2010 – May2012 |

| Start of Advertising/Communication Effort: | March 2010 |

| Base Period as a Benchmark: | March 2008-February 2010 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

Koodo is a brand that knows how to get noticed. It debuted in early 2008 with a look as bold as its proposition: affordable mobility on the customer’s terms. It cast aside the pricey rate plans, extra fees, and long-term contracts that characterized the incumbent players in the category. When Koodo arrived, its Gen Y target finally had an alternative that matched their budget and their irreverent attitude. The result? Koodo was the most successful wireless launch in Canadian history.

In 2008 and 2009, campaigns with eye-popping colours and quirky pop-culture references had firmly established Koodo as a brand that was different – one that was all about value.

But in the fast-paced wireless industry, it was only a matter of time before Koodo’s competitors caught on to their winning model. By the end of 2009, Koodo’s value offering had been matched almost across the board. And without any groundbreaking new rate plans or phones, we looked to the strength of the brand and set out to win by selling a belief system. [Crossover Note 1]

Our not-so-secret weapon was the “Tab,” Koodo’s unique and exclusive alternative to contracts and pricing. [Crossover Note 2] Instead of a fixed-term contract, the Koodo Tab gives customers the ability to get a $0 phone without a contract. Koodo’s Tab system was the first of its kind in the category and has been a cornerstone of the Koodo offering since the brand launched in 2008.

While the Tab had been featured in communications since Koodo’s launch, it had never been used as the singular focus of a campaign. And research told us it was still largely unknown or misunderstood by their customers, despite the fact that “no contract” was one of the primary reasons they chose Koodo in the first place.

We decided that 2010 would be the year of the Tab. In addition to being Koodo’s most differentiating feature, the Tab was also the best embodiment of what the brand had stood for since the beginning: innovation, challenging convention, and championing the consumer – all this in a category in which most folks were resigned to being taken advantage of.

b) Resulting Business Objectives

When we launched Koodo in 2008, the objective was simple: to capture as many new subscribers as possible in the growing value segment by challenging the norms of the Canadian wireless category.[Crossover Note 10]

While we can’t disclose hard numbers due to confidentiality, business objectives since then have been no different: to defend Koodo’s position in the market and lead the value segment by continuing to champion and fight for today’s Gen Y consumer. With this in mind, we set out to drive Tab subscriptions and use this positive momentum to gain additional distribution at retail.

c) Annual Media Budget

Over $5 million

d) Geographic Area

National Canada

Section III — STRATEGIC THINKING

a) Analysis and Insight

Critical to the brand’s sustained success has been our ability to keep up with the evolving wireless market. When Koodo first launched, it was positioned as the smart alternative to the competition at that time (Bell/Solo, Rogers/Fido, Virgin, TELUS). With a value proposition made up of industry-first features like “no system access fee,” “no fixed-term contracts,” and “$15 plans,” Koodo broke the mould and gave consumers a refreshing new option in mobility. However, beginning in late 2009 with the arrival of three new value entrants (Wind, Public, and Mobilicity), many of the features that made up their core proposition would soon be matched.

It was clear that we could no longer hang our hats on the basics. What’s more, the very basics themselves had changed – smartphone use was becoming widespread and data was no longer just for executives. We needed to evolve our approach and develop an ownable, higher-level, consumer benefit. In other words, we needed to zero in on the “so what.”

Our “so what” came from the insight that the majority of Gen Y consumers were completely dissatisfied with their mobile phone provider. Few believed there was a provider that wouldn’t take advantage of them. They wanted to get the straight goods. They needed to hear loud and clear that someone was listening and understood what they were going through.

The Tab was our answer. We made a deliberate choice to stand apart by focusing on its benefits. The Tab is more than just an affordable collection of features; it’s a stance that Koodo has taken. It’s a belief that people shouldn’t be locked into contracts in order to get a good price on a phone. It’s a call for phone freedom. [Crossover Note 14]

b) Communication Strategy

1. Don’t just sell the product, sell a belief system.

Our communication objective was simple: to drive consistent, mass awareness of Koodo’s core beliefs through their innovative Tab offering.

2. Bring their personality to life in a relevant way.

While we needed to evolve our message to keep pace with the market, we knew we didn’t want to deviate from the personality we had already established. The tone of this campaign had to fully embody Koodo’s straightforward, transparent, and feisty attitude in a way that was relevant to our Gen Y target.

3. Create cultural currency.

To turn the Tab, which at its core is a billing option, into something of interest, we needed to bring it to life. We looked to pop culture and found the perfect platform to represent a brand as spirited as Koodo. In a move that combined great branding with the cultural phenomenon of the luchador (an iconic style of Mexican wrestler made popular by Jack Black in the movie Nacho Libre, a hit among our target), we created El Tabador, a character that would lead the fight for phone freedom. [Crossover Note 21]

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

A mass, national TV, outdoor, newspaper, point-of-sale, digital, and social campaign was launched in key urban areas. The campaign had three major phases: launch, tactical, and messaging sustainment.

b)Creative Discussion

The campaign officially launched in early 2010 when a four-inch-tall animated luchador named El Tabador stepped in the ring. Known for high-flying manoeuvres and pinning opponents to the mat, this spandex-loving character was the perfect mascot to describe the battleground of the value-based telco industry – and the fight for phone freedom.

The campaign cut straight to the goods: the Tab. We created the tagline “Tab in for phone freedom,” while continuing to leverage the visual language we had built since Koodo launched.

While other mobile companies were matching each other’s offers, this creative platform gave us the opportunity to raise a competitive edge in a fun and entertaining way, while leading the revolution for Canadians who were fed up with contracts.

El Tabador not only became a spokescharacter for the Tab, but also an icon that today is one of the most recognized in the category and continues to deepen brand affinity.

Launch Messaging

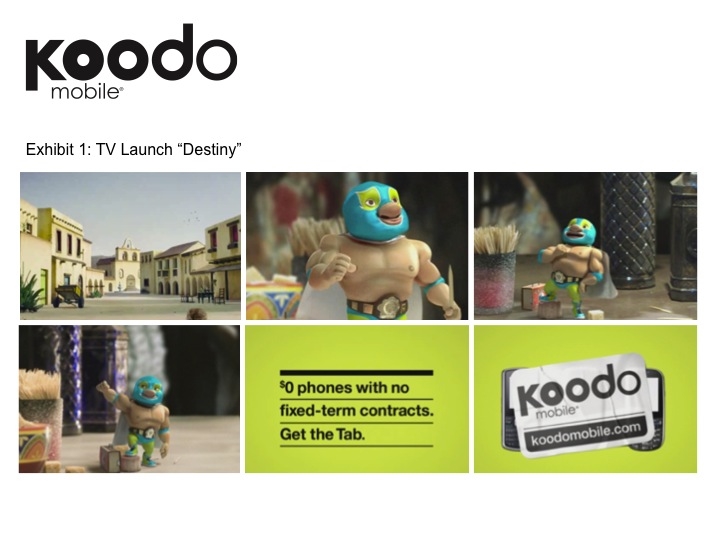

The first step was to set the story for our freedom fighter by introducing his purpose. In March 2010, a 30-second launch spot aired on national television and showed El Tabador saying adios to his small Latin village to fulfill his destiny of saving customers from the injustice of long-term contracts with $0 phones (see Exhibit 1).

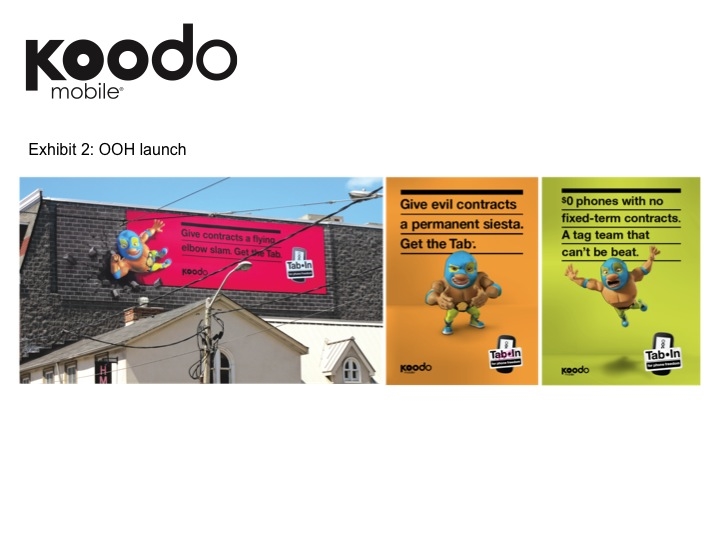

Additional cinema, TV, and outdoor advertising worked to layer in the Tab’s key consumer benefits of living commitment-free and saving (see Exhibit 2).

OOH also worked to keep the brand irreverent, with urban wild postings and unique placements in Toronto, including a billboard built in a cage, which gave visual dimension to the line “Challenge contracts to a cage match” (see Exhibit 3).

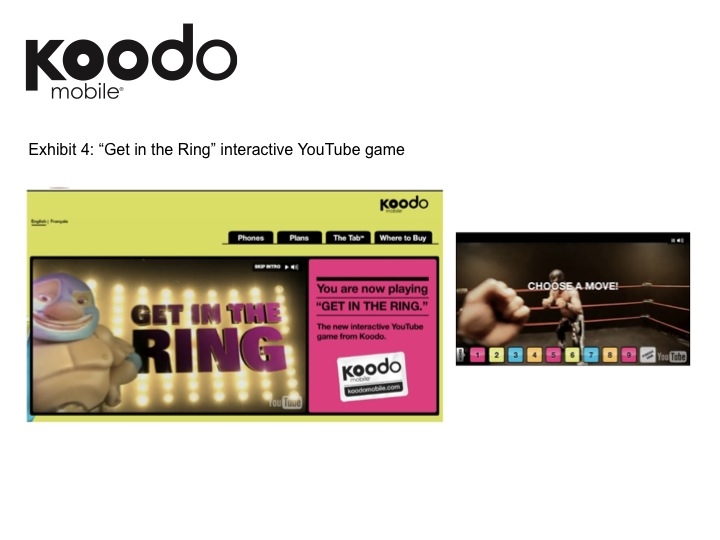

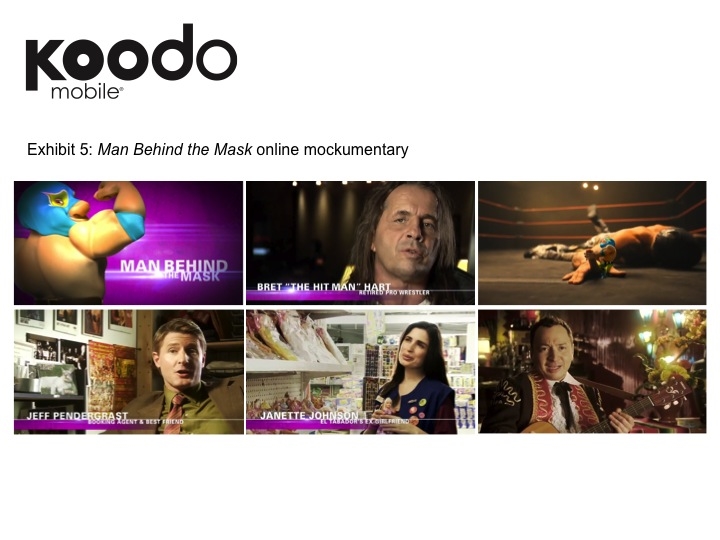

We created a YouTube channel and, using new technology, launched an interactive game called “Get in the Ring,” which allowed visitors to take the point of view of El Tabador and wrestle against his opponent Bloatimus Contractimus (see Exhibit 4). We also developed an online mockumentary called Man Behind the Mask, with well-known icon Bret “Hitman” Hart recounting his memories of a past encounter with El Tabador (see Exhibit 5).

Tactical Messaging

Starting in the second half of 2010, El Tabador began to communicate a series of harder-hitting sale offers and new plan announcements, proving the campaign’s ability to deliver a more tactical message. National television, outdoor, mall, and campus media helped to drive awareness (see Exhibit 6).

In an effort to step up the fight and add some extra punch to a good cause, we created mini muchacho action figures, literally putting El Tabador into the hands of our target and creating a seamless connection between our mass communications and the retail environment. Available in four poses, the mini muchacho figurines were free with the purchase of any Koodo phone or available for $8 online and in-store. All sale proceeds, totalling $75,000, were donated to Food Banks Canada (see Exhibit 7).

Messaging Sustainment

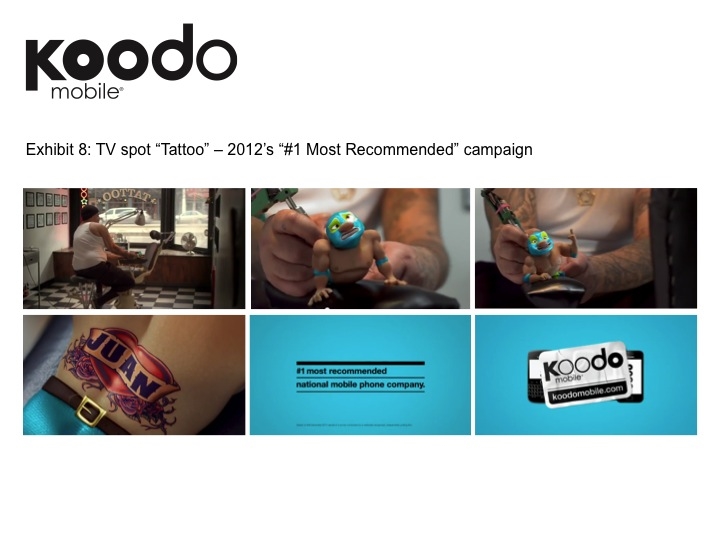

In 2012 we launched a second wave of brand communication, this time evolving our core message to reinforce Koodo as a brand that can be counted on. Our initial launch and tactical communications proved that Koodo was fun and different; it was now time to dispel any lingering misconceptions regarding Koodo’s credibility as a dependable provider. And what better way to demonstrate this than to showcase the love and trust we had earned from our existing customers. According to Ipsos Reid, 87% of their customers say they’re likely to recommend Koodo – that’s higher than any other national provider in Canada. Once again we looked to El Tabador to spread the news (see Exhibit 8).

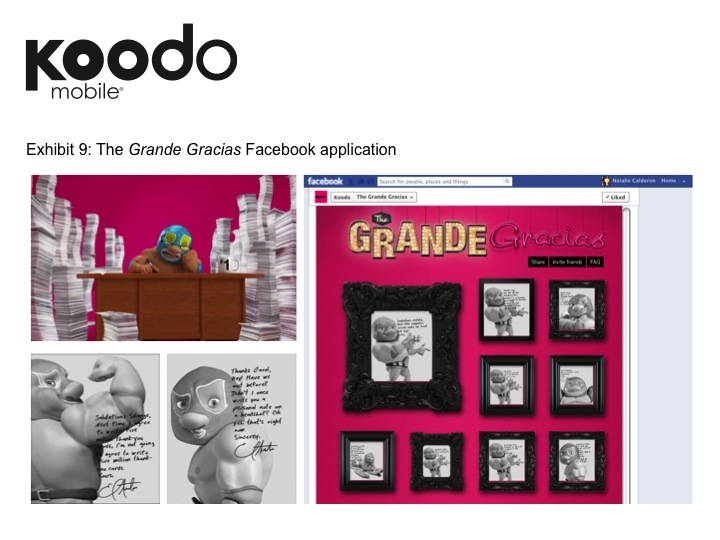

We also wanted to bring this message to life in the digital space and give back to the fans. The Koodo Facebook community of over 150,000 strong was the perfect platform on which to engage them. And so the Grande Gracias was born, a Facebook application where each of their fans received a personalized thank you from El Tabador himself.

Upon entry, users were greeted with a video of the tiny wrestler feverishly signing headshots. Each photo was personally addressed to the user along with a message that could then be shared across Facebook, downloaded for printing, or viewed in the gallery (see Exhibit 9).

c)Media Discussion

Unlike their competitors, we knew we wouldn’t have the budget to blanket the country with messaging. In order to stand out with our target, we opted to focus our media attention on their key day-to-day surroundings: where they live, work, and play. We were able to amplify the message and achieve a domination effect disproportionate to our spend, making every dollar work twice as hard.

Section V — BUSINESS RESULTS

a) Sales/Share Results

1. Sales/Activations

Koodo had the most successful postpaid wireless launch year in Canadian history and this momentum has continued. Between March 2009 and February 2010, gross activations increased significantly versus the year prior, and despite an increasingly competitive environment and the onslaught of new choices in the market they managed to hold flat between March 2010 and February 2011 (compared to the previous year). And by February 2012, year-over-year gross activations had again increased significantly.

2. Tab Subscribers

By the end of 2010, approximately 70% of Koodo’s subscriber base had signed up for the Tab. By May 2012, this number had increased further to 80%.

3. Brand Awareness

Koodo’s brand awareness scores after its initial launch were remarkable, with 89% of our target audience (18 to 34 years old) having heard the name after the first year alone. At the end of 2010, Koodo became the youngest brand ever to be named Brand of Year by Strategy magazine. Brand awareness has continued to grow and is now at 99% with our target audience and 96% among the mass population, blowing through all awareness targets.

4. Retail Performance

Following the brand’s initial 2008 launch, Koodo became the #1 postpaid provider at Future Shop, Best Buy, Walmart, and London Drugs. This was an unprecedented achievement by any brand in the Canadian marketplace, let alone a new one up against multiple established, big-budget marketers. Koodo has continued to perform extremely well in this critical sales channel, receiving numerous accolades from top retailers. In 2010, Koodo was named Vendor of the Year by Future Shop, as well as 2010 Electronics Vendor of the Year by London Drugs. Koodo has maintained its #1 position well into 2012 and remains the top postpaid provider with each of its major national retail partners.

5. Customer Satisfaction

Koodo is the wireless brand with the strongest reputation for being customer focused, honest, and most affordable. In 2008, they ranked “Highest in Customer Satisfaction With Postpaid Wireless Service” by J.D. Power and Associates in its annual Canadian Wireless Customer Satisfaction Study. In 2011, J.D. Power and Associates ranked Koodo #1 in Ontario and in 2012, they again ranked “Highest in Customer Satisfaction With Stand-Alone Wireless Service,” further cementing their status as one of Canada’s leading brands.

With the competition offering the same product, in many cases for less and without a contract, keeping customers in their funnel is critical to long-term, continued success. Coupled with all of the measures noted above, Koodo has clearly proven itself as a national wireless powerhouse that’s here to stay.

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

El Tabador was initially created to promote the Tab, but he has since evolved to become synonymous with Koodo’s brand stance; he is the champion of phone freedom. We’ve battled the perception that Koodo’s offers and phones aren’t the cheapest or greatest, but because of El Tabador, we have been able to sustain the initial launch success and continue to build momentum for the brand.

Competitive Reaction

It didn’t take long for the success of El Tabador to cause an industry stir. As the saying goes, imitation is the sincerest form of flattery, and within months of El Tabador’s debut, the tab wars had begun.

In August 2010, Virgin Mobile launched the “SuperTab,” its own version of the Koodo Tab. In November 2010, Wind Mobile followed suit by introducing “WINDtab,” yet another copycat offering. And in February 2011, Fido launched a national anti-tab campaign, comparing tabs to contracts and attempting to highlight the disadvantages of the tab system – an offering Fido doesn’t have (see Exhibit 10).

The relationship between Koodo’s advertising effort and the response from the industry is clear. El Tabador is a force to be reckoned with and the success of our effort poses a serious threat. These new competitive offerings simply didn’t exist before El Tabador, and it’s unlikely these carriers would have followed suit had we chosen to focus our communication on something other than the Tab.

Consumer Response

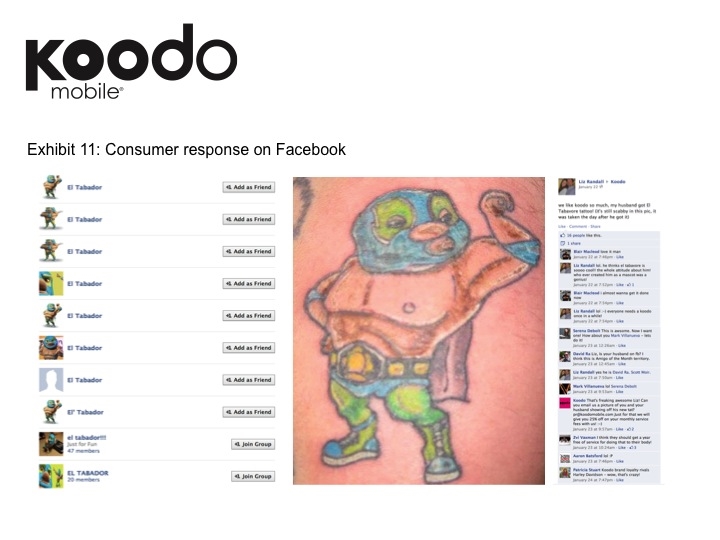

Our competitors weren’t the only ones who took notice of El Tabador. The response from our target was immediate, with consumers demanding to see more almost overnight.

By March 30, 2010, our Koodo YouTube channel had already become the #1 most-subscribed-to sponsored channel in Canada, and consumers couldn’t stop talking. El Tabador received hundreds of mentions on Twitter and more than 10 unofficial El Tabador profile pages created by our fans popped up on Facebook. Unprompted, users started creating and submitting their own content to show how much they loved El Tabador, including video parodies of existing El Tabador commercials and one fan who submitted a photo of his new El Tabador tattoo. By March 2012, the Koodo Facebook page had become the fastest-growing fan page of any mobile company in Canada (see Exhibit 11).

b)Excluding Other Factors

Spending Levels:

Koodo’s media budgets and corresponding share of voice were much smaller than that of the competition, especially compared to the major carriers. Every media dollar spent needed to work extra hard in order to break through the clutter.

Pricing:

As stated, many new value entrants have entered the category and are operating under similar business models. Some of these carriers are offering more for less, so our brand communications were crucial in winning over our value-seeking demographic.

Distribution Changes:

While Koodo’s retail presence has grown since the brand first launched, overall distribution is still low compared to other major wireless carriers.

Unusual Promotional Activity:

The wireless category is extremely competitive and aggressive promotional activity is the norm.

Other Potential Causes:

Many still view Koodo’s lineup of handsets as less sophisticated than that of the competition, so their product and service offerings can also be ruled out as an influencing factor. The iPhone, for example, was only available to Koodo customers two years after its initial launch, a huge disadvantage compared to other major carriers.

Koodo has continued to stand out and challenge the norms of the category. The brand was created to stand for something different, and El Tabador has successfully allowed us to keep doing just that in a way that’s fresh and engaging to our target. The success of El Tabador has, in turn, allowed us to succeed in delivering sustained results, forever changing the face of the Canadian wireless industry and leading the fight for phone freedom.