Hellmann’s

Packaged Goods–Food/Other (SILVER)

Sustained Success (SILVER)

Client Credits: Unilever

Sharon MacLeod – V.P Marketing

Alison Leung – Director of Marketing, Foods

Stephanie Cox – Senior, Brand Building Manager

Mindy Perlmutter – Assistant Brand Building Manager

Michelle Wu – Assistant Brand Building Manager

Client Credits Past:

Geoff Craig – VP Marketing

Jon Affleck – Marketing Director

Juanita Pelaez – Brand Manager

Ian Busch – Brand Manager

Monica Palit – Assistant Brand Manager

Christopher Luxon – General Manager

Agency Credits: Ogilvy

Ian MacKellar – Chief Creative Officer

Laurie Young – Managing Director

Aviva Groll – Senior Partner, Group Account Director

Daniel Koppenol – Account Supervisor

Chris Dacyshyn – Writer

Julie Markle – Art Director

Julie Caniglia – Broadcast Producer

Doug Potwin – Planning

Agency Credits Past:

Jane Murray – Copywriter

Sarah Kostecki – Account Supervisor

Stasha Poznan – Account Supervisor

Coby Shuman – Account Executive

Terri Mattucci – Account Executive

Mandi Lee – Account Supervisor

Siobhan Dempsey – Copywriter

Jennifer McLeod – Account Supervisor

Janet Kestin – Chief Creative Officer

Nancy Vonk – Chief Creative Officer

Inter-Agency Partners:

Harbinger Ideas; Mindshare Canada; Dashboard; OgilvyAction; PHD; Segal

Crossover Notes:

All winning cases contain lessons that cross over from one case to another. David Rutherford has been identifying these as Crossover Notes since CASSIES 1997. The full set for CASSIES 2013 can be downloaded from the Case Library section at www.cassies.ca.

Crossover Note 1. What a Brand Stands For.

Crossover Note 6. Should the product be improved?

Crossover Note 8. Classic Rivalries.

Crossover Note 10. Conventional Wisdom—should it be challenged?

Crossover Note 19. Great minds think alike.

To see creative, click on the links that are embedded in the case.

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | January 2007 – June 2012 (YTD) |

| Start of Advertising/Communication Effort: | April 2007 |

| Base Period as a Benchmark: | 2006 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

Hellmann’s has been enjoyed in Canada since the 1950s. Whether it was used on sandwiches or in salads, it was loved for transforming good foods into deliciously yummy foods because of its inherent versatility.

Around the beginning of 2005, versatility was losing relevance as consumers applied a more critical eye to everything they ate, and questioned their reliance on cheaper, artificial convenience foods with questionable nutritional values. Unfortunately, they started to question Hellmann’s along with this. In fact, a study by the brand found that 75% of consumers perceived it to be unhealthy – essentially “junk in a jar”. [Crossover Note 6]

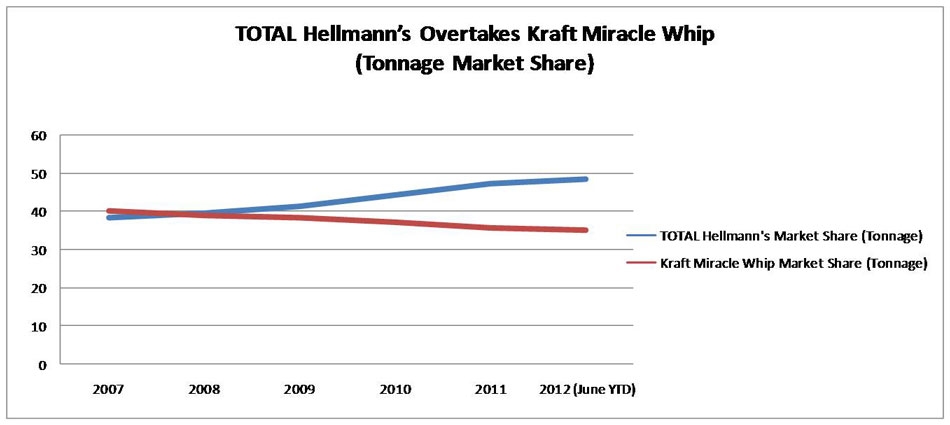

In order for Hellmann’s to grow, it had to tackle the negative perception associated with it and give consumers permission to enjoy it again. Especially, if we were going to catch up to key competitor and perennial category leader, Kraft Miracle Whip.This was, in fact, achieved, as discussed in Section VI. [Crossover Note 8]

Luckily, at the core of Hellmann’s are three, real, wholesome ingredients: eggs, oil, and vinegar. From this little known fact, the Hellmann’s Real Food Movement was born in 2007. This has produced extraordinary results over its lifespan, and it won the CASSIES Grand Prix in 2010. [Crossover Note 1]

Well, we’re back. Because, as this case will prove, the next chapter of Hellmann’s Real Food Movement has continued to produce real results.

b) Resulting Business Objectives

We needed to get light and moderate Hellmann’s users to use Hellmann’s more often and Kraft Miracle Whip users to switch. This entailed:

> Growing Hellmann’s market share vs. the previous year

> Growing Hellmann’s dollar and tonnage sales vs. the previous year

> Improving tracking ratings for “Made from real simple ingredients” and “It fits with the way I want to eat.”

c) Annual Media Budget

$2 – $3 million

d) Geographic Area

National Canada

Section III — STRATEGIC THINKING

a) Analysis and Insight

The foundations of the Hellmann’s Real Food Movement was that an increasingly health-conscious public around the world was equating fresh with better taste, more nutrition and better health. In the process, they were moving away from pre-packaged, chemical laden foods towards real foods with unadulterated, easily recognized ingredients. [Crossover Note 19]

In Canada however, this trend had yet to fully take hold and start influencing consumer behavior. A point illuminated for us when 92% of Canadians said consuming real food is important to them, yet only 6% of Canadians with kids were consuming all of their meals using only real ingredients. Given Hellmann’s itself is made with real ingredients it could help close this gap, but we knew an ingredient story alone would not be persuasive enough.

We needed a higher sense of purpose. A purpose that could start by tackling the suspect nutritional habits of the nation on broad scale: and for 2007-2010 this was the Hellmann’s Real Food Movement. [Crossover Note 10]

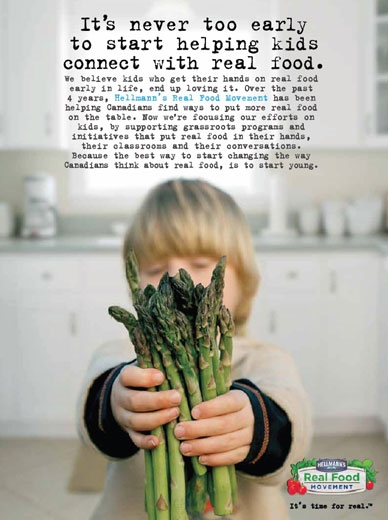

In 2011 we stepped back to connect with our target via a research deep dive to understand the emotional motivation behind eating REAL. It became clear that the wellbeing of her family was at the heart of everything she does, and ultimately how she defines her success as a mom. So, if we could help her ensure her family was eating well by educating her kids we could connect with her on a deeper level and ultimately strengthen her loyalty with the brand. Our vehicle with which to do this was the Hellmann’s Real Food Grant Program.

b) Communication Strategy

By tapping into the trend away from pre-packaged, chemical laden foods towards those made with un-adulterated, easily recognized ingredients, Hellmann’s had the opportunity to ignite a passion for Canadians to eat more real foods and bring Hellmann’s along with them. To accomplish that, we developed three imperatives the Real Food Movement needed to address:

The first ‘setting the table’: promoting accessibility and helping make eating real food easy for Canadian families.

The second ‘building advocacy’: shining a spotlight on issues and barriers around eating real food.

The third ‘proving we belong’: making Hellman’s part of enjoying more real food.

Over the years, we have had different degrees of emphasis, depending on marketing objectives, product news and the consumer & cultural context.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

From 2007 to 2011 each year’s programs were brought to life using a combination of awareness-driving TV (Conventional and Specialty) with overlays of media partnerships in TV and print.

In 2012, we amplified the Real Food Grant Program on-line by creating a highly engaging and shareable film.

b)Creative Discussion

For over five years now, Hellmann’s Real Food Movement, has been helping Canadians eat real. It’s a journey that started as a plot of dirt for city dwellers to cultivate and grow their own real food and has grown into its current focus of helping inspire the next generation of Canadian kids to eat healthy and eat real.

Setting the table

It all began in 2007 when we ‘set the table’ by introducing the Real Food Movement to Canadians in a way that gave them easier access to real food. We created Hellmann’s Urban Gardens in five cities across Canada – an area of workable land that was divided into 12 plots. We offered them free of charge for worthy applicants.

Over 500 applications were received for 60 plots – including a single mother of three, a Girl Guide chapter, and a retirement home.

Building advocacy

In 2009 our thrust was to ‘build advocacy.’ Through desktop research we learned some unsettling truths: with prime farmland being paved over and cheap imports soaring, Canadians were losing their ability to eat Canadian. We believed Hellmann’s could be a voice heard by the masses, and at the same time underscore the product’s real Canadian ingredients story. We developed a mini-documentary on-line film “Family Dinner” and micro-site which shone a light on food facts and educated Canadians on the alarming truths of the Canadian food system, with a rallying cry to eat more real foods, by eating local.

Reaction was swift. The on-line film generated thousands of views and extensive coverage in the blogger community and mainstream press.

Prove that we belong

In 2010, we needed to ‘prove that Hellmann’s belonged.’ While we were encouraging Canadians to eat more real, we needed to ensure our product was as good as it could be. Hellmann’s made the bold step to make their product even more real by switching to free-run eggs. Our efforts focused on building awareness of this in TV; via emails; on Facebook, via recipe dissemination and product sampling across the country.

In 2011 and 2012, Hellmann’s needed to once again ‘set the table’ and help more Canadians eat real. With the vast array of quick, easy and cheap fast food options, eating with real ingredients is a daily challenge. We had already gained the trust and support of Canadian adults, and now saw the opportunity to foster the next generation of Canadian’s to eat real.

We launched the Hellmann’s Real Food Grant Program. This makes over $100,000 available to individuals and organizations that help families and kids connect with real food.

One application stood out. A school in Alberta wanted to change how its students were eating. Like most Canadian cafeterias, theirs was serving over-processed junk food. To give you an example, one of their menu items went by the name “Taco in a Bag.” The school applied for a $25,000 grant to update their kitchen appliances so they could provide healthier options.

Recognizing the power of a school wanting to create real change, Hellmann’s went beyond awarding a grant and helped revamp the kitchen, transforming the cafeteria’s menu with the help of celebrity chef Chuck Hughes and getting rid of the school’s deep fat fryer.

Then to celebrate the school’s commitment to becoming part of the Real Food Movement, we crushed the offending fryer under the wheels of a monster truck.

The transformation of the school cafeteria was documented in an on-line film called “Bye Bye Deep Fryer”. Since its release, the video has generated significant interest in the Real Food Movement, the Real Food Grant Program and, of course, Hellmann’s. It has garnered over 1,440,000 views since its release in mid-May 2012. Other schools have also been requesting copies of the video to share with their kids, their faculty and their administrators.

c)Media Discussion

Over the lifespan of the campaign the Real Food Movement has used a multi-channel multi-media approach all the while consistently targeting principal grocery-shopping women. Each year’s programs have been brought to life using media and channels appropriate to their objectives.

Section V — BUSINESS RESULTS

a) Sales/Share Results

Since the launch of the Real Food Movement (RFM), Hellmann’s has had consistently strong business results:

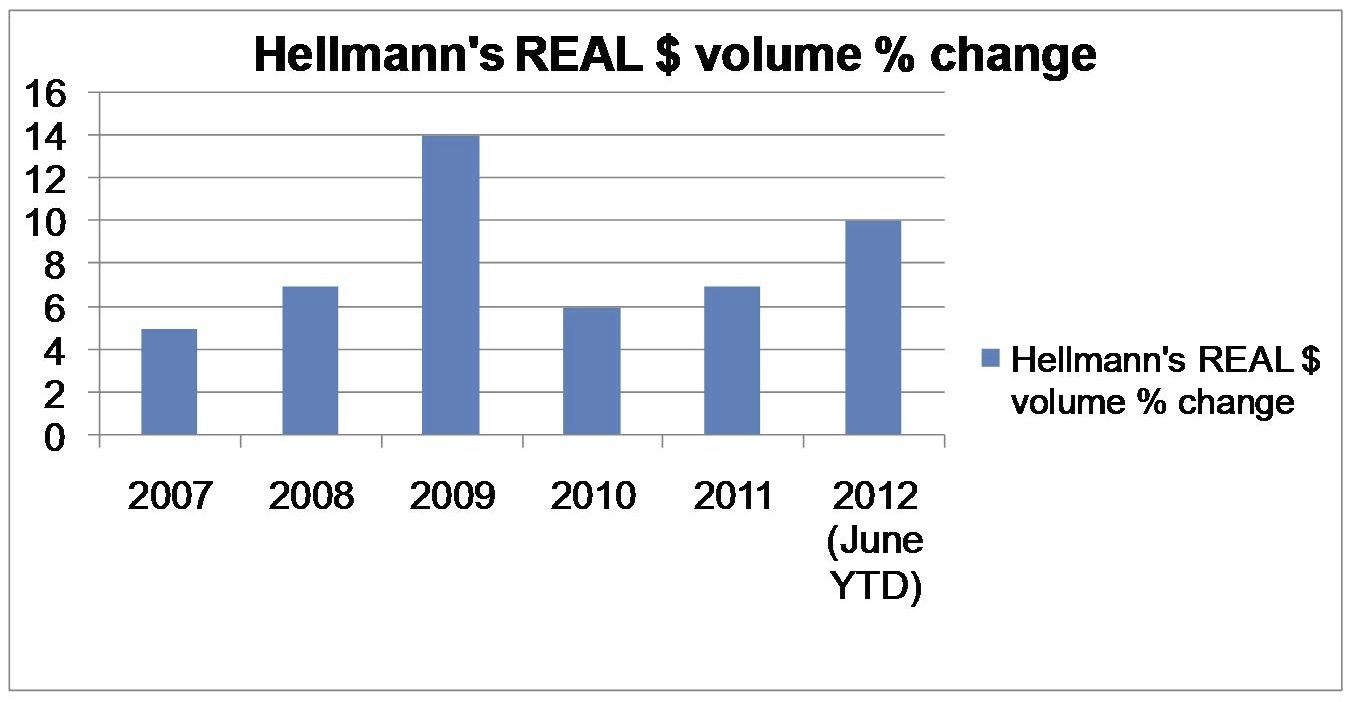

Hellmann’s REAL dollar volume has grown year over year: +5% in 2007; +7% in 2008; +14% in 2009; +6% in 2010; +7% in 2011 and +10% for June YTD in 2012.

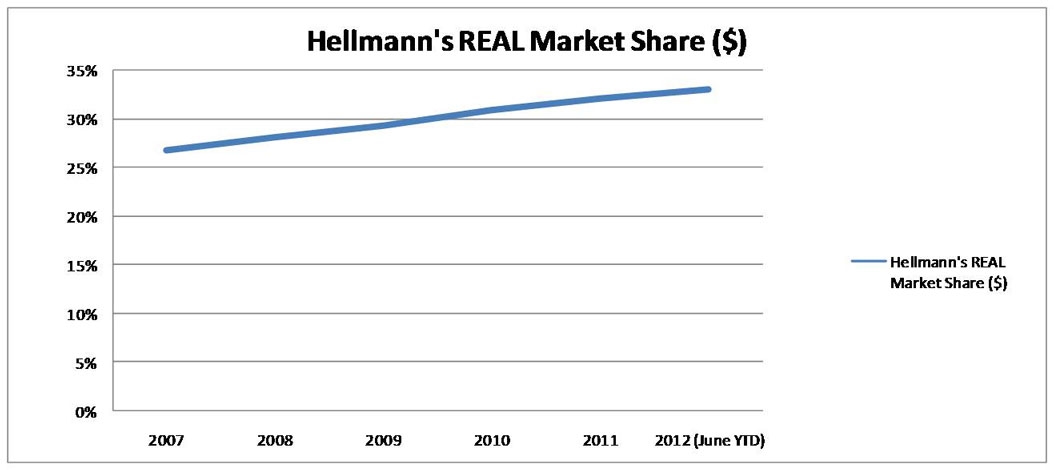

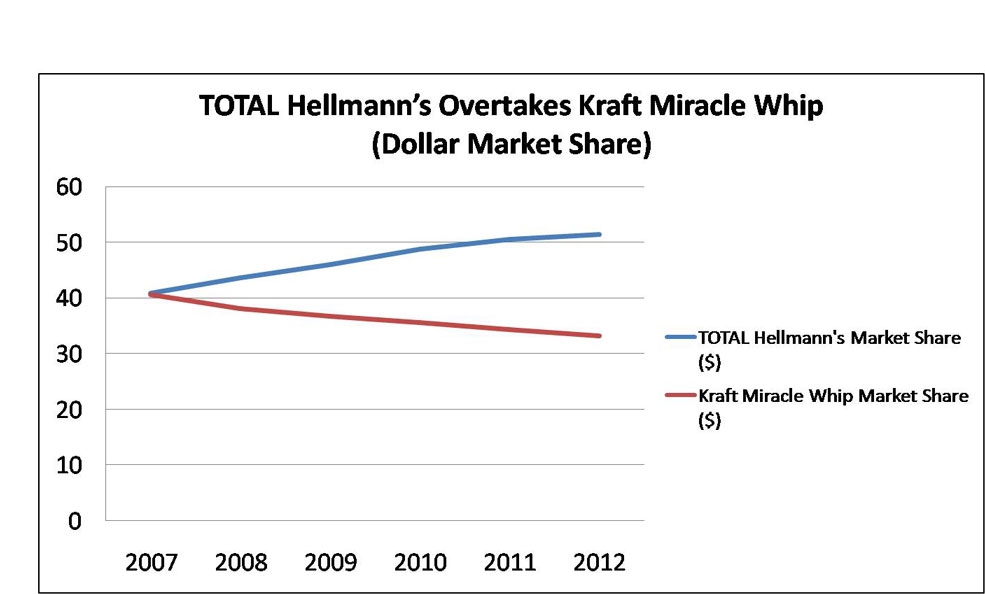

Hellmann’s REAL market shares (dollars) grew from 26.8 % in 2007 to 28.1% in 2008; 29.4% in 2009; 30.9% in 2010 and 32.3% in 2011 and June YTD its market share is at 33.1% as seen below in AC Nielsen data.

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

Hellmann’s Real Food Movement (RFM) over its lifespan has contributed to the growth of the business without question.

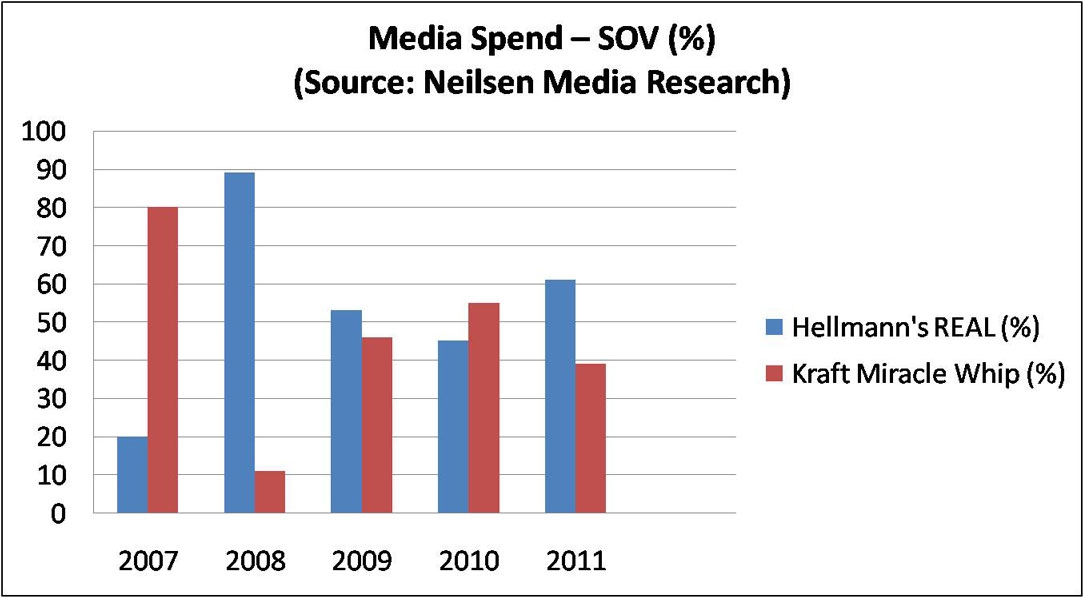

Media Spending:

A competitive spend and SOV analysis reveals a highly inconsistent spending pattern by Hellmann’s REAL over the past 6 years indicating ad spending has not been a factor in the campaign’s success.

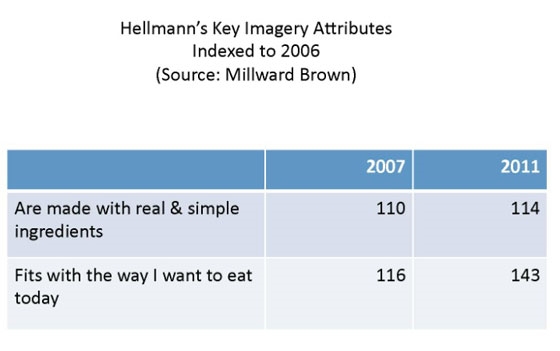

Brand Image Scores:

Millward Brown tracking data shows Hellmann’s real food messaging is helping drive perception and behaviour. These gains are significant given the brand legacy image of “junk in a jar”. Consumers are strongly associating Hellmann’s with “Made with real and simple ingredients” and “Fits with the way I want to eat” and ratings on these measures are solid.

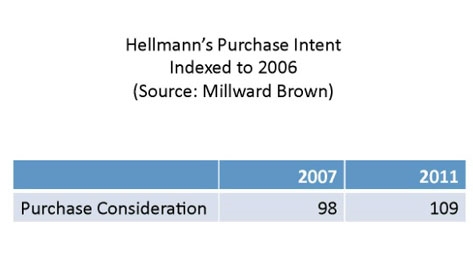

Purchase Consideration:

These perceptions are driving strong purchase consideration for Hellmann’s on both on Top 2 Box.

Most gratifying of all, the Real Food Movement has had a positive halo on Hellmann’s total business (Hellmann’s REAL and 1/2 FAT products). TOTAL Hellmann’s has overtaken Kraft Miracle Whip in both dollar and tonnage market share over the duration of the campaign.

b) Excluding Other Factors

Spending Levels:

As discussed above, due to their inconsistency over the years, spending levels have not been a factor in Hellmann’s business success.

Pricing:

Hellmann’s took a 7.5 % price increase in August 2011; Kraft Miracle Whip did not follow. This left a larger price gap between the two brands further emphasizing the need to strengthen our relevance and loyalty to command a premium.

Distribution Changes:

Hellmann’s distribution has remained stable at 98% across Canada over 2007-2012 (June YTD).

Unusual Promotional Activity:

Hellmann’s has reduced the number of weeks it has been on promotion in 2012 versus previous year. Despite the reduction, the brand has seen a baseline business growth of +3% (June YTD) even though there was an expectation that there would be a decline after the major price increase. Obviously, Hellmann’s customers are not driven completely by pricing activities and care about what the brand stands for and is doing.

Other Potential Causes:

In the words of a consumer after a Real Food Movement event:

“…it will be brands like this that help make real change… I am a Miracle Whip customer no longer!”.

Source: Hellmann’s Real Food survey. IPSOS Canadian Online Omnibus. Feb 11-14, 2010