Mountain Dew – The Wrecking Ball of Dew

Events, Seasonal and Short-Term (BRONZE)

Client Credits: PepsiCo Beverages Canada

Greg Lyons, VP Marketing

Ryan Collis, Marketing Director

Ronit Soroksky, Brand Manager

Alexandra Collins, Assistant Marketing Manager

Agency Credits: BBDO Canada Corp.

Carlos Moreno, SVP, Executive Creative Director

Peter Ignazi, SVP, Executive Creative Director

Jason Perdue, Writer

Jeff Cheung, Art Director

Ariel Vinizki, Account Director

Tania Montemarano, Account Supervisor

Beatrice Bodogh, VP, Head of Broadcast Production

The Cornerstore, Production Company

Jennie Montford/Tom Lowe, Production Co-Producer

Steve Hudson, Director

Marcelo Durst, Cinematographer

Panic & Bob, Editing House

Michelle Czukar, Editor

RMW Music, Music/Sound

Notch, Billy Ferwerda, Colour Correction

Ricochet Post, Online

Crossover Notes:

All winning cases contain lessons that cross over from one case to another. David Rutherford has been identifying these as Crossover Notes since CASSIES 1997. The full set for CASSIES 2013 can be downloaded from the Case Library section at www.cassies.ca.

Crossover Note 1. What a Brand Stands For.

Crossover Note 6. Should the product be improved?

Crossover Note 9. Turnarounds.

Crossover Note 16. When a campaign stumbles.

To see creative, click on the links that are embedded in the case.

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | March 2012 – June 2012 |

| Start of Advertising/Communication Effort: | March 11, 2012 |

| Base Period as a Benchmark: | January 2011- February 2012 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

Prior to 2012, sales of carbonated soft drinks (CSDs) in Canada have been declining at a rate of 8% a year. Much of this reflects a new generation of drinkers gravitating to alternatives like enhanced waters and energy drinks. PepsiCo needed to get their portfolio back to growth and appeal to this younger demographic.

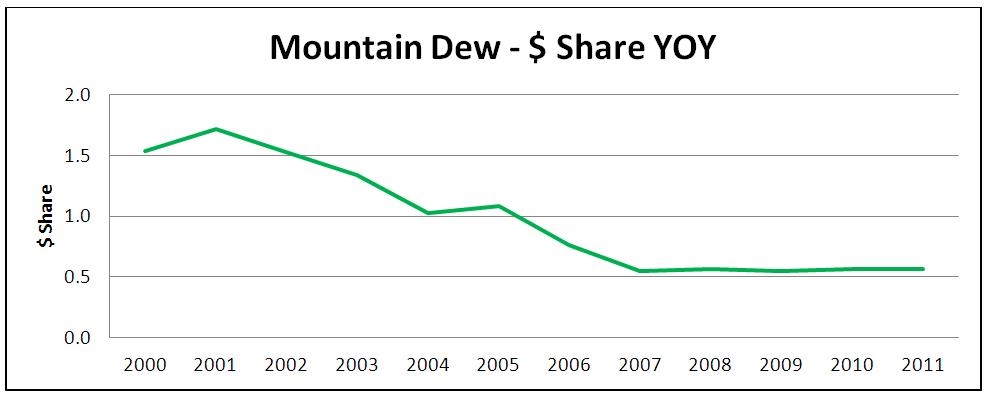

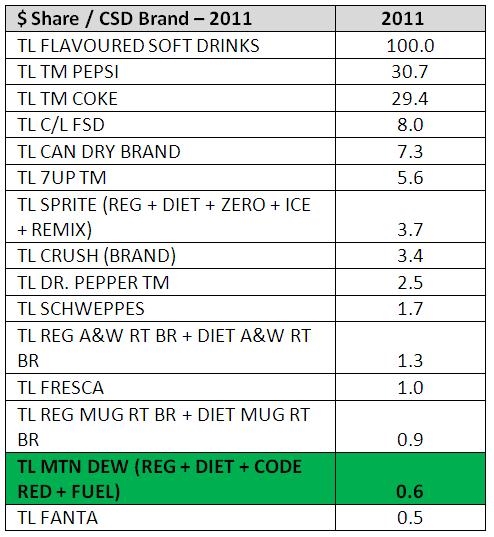

The Mountain Dew business in Canada has declined by 80% over the past decade. Despite being the best-selling non-cola soft drink in the US, Mountain Dew didn’t even crack the top 10 here in Canada.

The brand had not been supported since 2006, however prior to that, there were several years of support including TV, Transit, OOH, rebranding and grassroots activities depending on the campaign and still the brand did not positively respond. [Crossover Note 16]

While the brand had 84% awareness last year, people were unable to recall or describe its flavor – the brand was being completely ignored! Footnote 1

The Canadian formula lacked the caffeine content the US had due to regulations that limited caffeine inclusion to cola soft drinks only. It wasn’t until 2010 that Health Canada authorized the use of caffeine in all carbonated soft drinks. In 2012, PepsiCo would bring the US formula to the Canadian market. [Crossover Note 6]

b) Resulting Business Objectives

With this campaign, we were looking to achieve the following:

- Double volume of 8 oz cases versus a year ago by selling 5.96 million cases versus 2.98 million cases

- Double tonnage share versus a year ago by achieving 1.0 share versus 0.5 share, and double tonnage dollar share from 0.6 to 1.2

- Achieve 2.0 dollar share points in National Convenience & Gas (0.8 share points prior to campaign)

- Make the Top 10 Convenience & Gas CSD SKU ranking (in 16th place prior to campaign)

- Improve on the following brand health trackers:

-

- Grow Millennial awareness from 84% to 87%

- Increase Ever Drank to Drank in the Last 4 weeks from 10% to greater than 15%

- Increase trial by +5 pts (from 78% to 83%)

- Gain 150,000 Facebook fans on the Mountain Dew Canada page

- Achieve 250,000 total video views

We set our sights high, especially considering the decline in business over the past decade. We knew we needed a big push to get our target excited about the brand again and replicate the success in the U.S.

c) Annual Media Budget

$3 – $4 million

d) Geographic Area

Canada – National

Footnote 1: Research & Insights, iTrac Brand Health Tracking Study

Section III — STRATEGIC THINKING

a) Analysis and Insight

Mountain Dew has greatest appeal to guys (16-24 years old; bull’s eye 18) but we knew that to really connect we would need to define a subset of this demo as our core target. With such a small share in Canada, we needed to do something that would generate lots of attention and be telegraphic in who we were speaking to – in our case, guys who embrace the unexpected, enjoy adventure, and like to be the first amongst their friends to find something new and different. These are not guys that want to play it safe and fit in – Mountain Dew drinkers want to live on the edge. The reformulated Mountain Dew has a bold and intense Citrus Charge flavour, the perfect accompaniment to exhilarating experiences. [Crossover Note 1]

b) Communication Strategy

We wanted to match the intensity of the Citrus Charge taste using a truly exhilarating metaphor. And we needed to drive engagement. Because our target loves being the first to know and values social currency, we needed a campaign that would make them sit up and take notice.

TV would allow us reach, as well as affording us the opportunity to embody the brand and give our target a sense of what chugging a Mountain Dew felt like. We also wanted to create a spot that these digital natives would feel is share-worthy. And we wanted to create a spot that can be watched again and again, so we needed to make sure that it ran where the target would see it frequently.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

- TV

- Pre-Roll

- YouTube

b)Creative Discussion

We wanted to match the intensity of the Citrus Charge taste using a truly exhilarating metaphor to get the message across that Mountain Dew is being re-launched with a new Citrus Charge formula. We positioned two tall cranes face to face. From one crane hung a gigantic balloon filled with Mountain Dew. From the other crane hung our daredevil who launched himself straight toward the balloon. The collision resulted in a massive Mountain Dew splash.

c)Media Discussion

We were looking to make Dew cool again, and in the process generate buzz and reward our target with the social currency that they desire, the little things that put them in the know, that they can be the first to share with their friends.

Our digital plan would drive engagement and shareability. We also wanted to create ongoing conversations with our target, so we started a Facebook page a few months before we launched the creative. We wanted to find hardcore Mountain Dew fans to help us generate some early campaign buzz. To achieve our goals, we knew we were going to need a lot of support, so we set a goal of acquiring 150K fans.

A few days before the spot aired on TV we teased our Facebook fans by posting a screenshot of the stunt on our page to build hype. As an added treat, we released the final spot on Facebook in advance of it being on air.

The ad was also posted on YouTube and amplified by a custom-designed masthead, which was featured on the YouTube homepage as a takeover. The spot also ran in video format on websites that millennials frequent such as Push.ca, MTV.ca, CollegeHumor.com & Yahoo.

We leveraged TV to get the efficient reach needed, but selected specific programming to hit our target like the Billboard Music Awards, the NBA finals, the NHL Playoffs, UFC Fighting, Crashed Ice and Sportsnet’s Extreme Sports Rotation.

Section V — BUSINESS RESULTS

a) Sales/Share Results

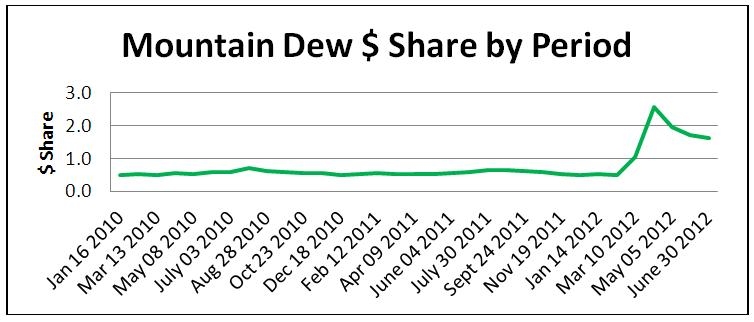

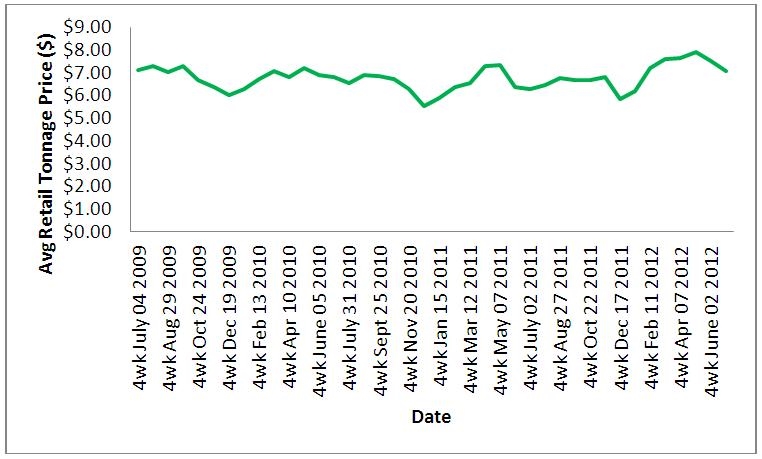

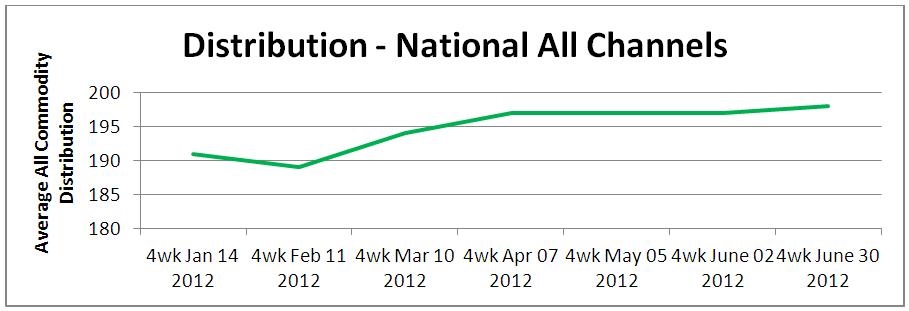

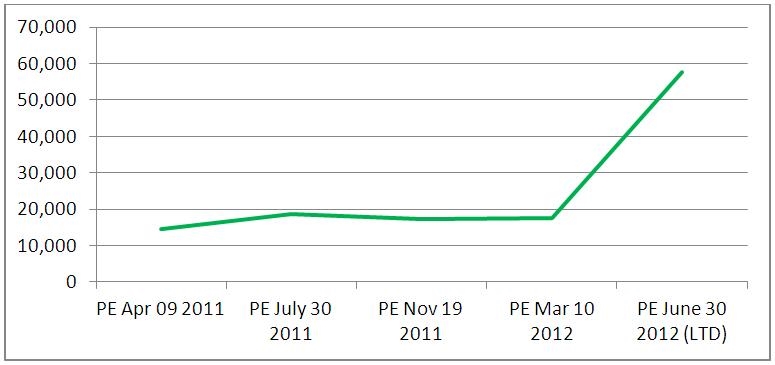

In 2011, Mountain Dew’s share was 0.6. Since our campaign launched, share has more than doubled to 1.6. [Crossover Note 9] Net revenue has also more than doubled – going from $9.3 million in 2011 to $22.2 million in January – July 2012 alone. Pricing has remained consistent over the past 4 years, with an average retail unit price between $1.73 & $2.01 (see chart below for reference).

Activity was centered on the first four weeks of launch to create impact upfront. From there, growth leveled out due to the lowering GRPs and more stabilized media spend.

- +257% dollar volume or +$8,195,844 dollar volume VYA . Footnote 2

- 4.7 dollar share in National Convenience & Gas (+3.7 VYA) and a $Vol percentage increase of 379% (+ $2,286,786 VYA)

- Launch To Date $Vol is $ 8,242,627 ($24,727,881 annualized) . Footnote 3

- 1.6 dollar share in National Grocery, Drug, and Mass (+1.1 VYA) and a $Vol percentage increase of +234% (+ $5,774,811 VYA)

- Launch To Date $Vol $ 2,889,906 ($8,669,718 annualized) Footnote 4

- Regular Mountain Dew is now ranked 5th Launch to Date in C&G Nationally, up from 16th prior to campaign – behind Pepsi, Coke, Diet Pepsi & Diet Coke . Footnote 5

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Footnote 2: AC Nielsen, Launch to date ending June 30, 2012

Footnote 3: AC Nielsen, Launch to date ending June 30, 2012

Footnote 4: AC Nielsen, Launch to date ending June 30, 2012

Footnote 5: AC Nielsen, Launch to date ending June 30, 2012

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

In just four months, Mountain Dew`s Brand Health & Equity Scores have seen a great improvement.

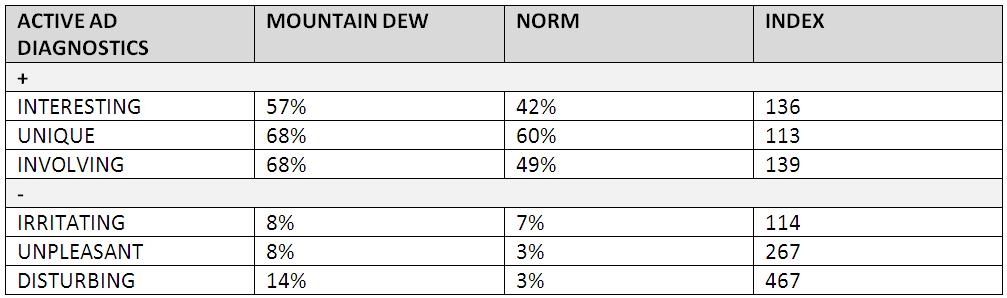

All active ad diagnostics are tracking well above the norms. This includes negative diagnostics, which was expected as our advertising depicted a stunt and was bound to put some people off. But by focusing our efforts against the subset of teens that enjoy adventure, the unexpected, and thrilling experiences, we knew we would exclude some consumers. However, we felt that the benefits that we would gain from the talk and share value of the work would more than offset the risk. Clearly, this worked as proven by our results.

Finally,Mountain Dew has received over 251,000 likes on Facebook (likes = fans), indexing at 160 against the full year goal in five months.

Our spot garnered 1.34 million total views, five times our target. Out of the total views, 590,000 were on the YouTube page and pre-rolls received over 750,000 views, which clicked through to our Facebook page, a CTR of 5.46%, six times the CPG average. Footnote 6. This also demonstrates the value of having both elements in our plan.

b)Excluding Other Factors

Spending Levels:

This was the first year of support for Mountain Dew since 2006. Mountain Dew sales had been declining for a decade, during which time we have supported the brand on a number of occasions with little success.

Pricing:

During the campaign period, pricing followed a similar pattern to the previous few years.

Prices have steadily increased each of the last 4 years. In 2012, our price increased by 19% VYA, but not a significant amount when compared to our overall $ Volume increase of 257%

Distribution Changes:

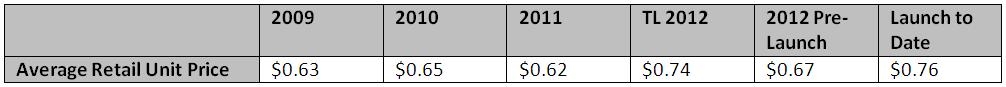

With the new campaign launch, distribution did experience an increase nationally but it was marginal (see below for reference).

CHART goes here 08 Avg Distribution in All Channels

Although we gained 3.5% distribution, dollar sales per point of distribution increased 328%, far outpacing the distribution increase (see below for reference). While distribution contributed, it was not a significant factor in our growth.

Unusual Promotional Activity:

The campaign was supported in-store with retail displays but the product was not being sold at a discount as proven in the earlier pricing section.

Other Potential Causes:

Launch Event:

Mountain Dew held a two-day launch event at Yonge & Dundas Square, where millennials had the opportunity to partake in snowboarding & skiing. It incorporated a competition, a live DJ spinning music, product samples and swag.

Sampling

Mountain Dew gave out 165,000 samples across Canada in 2012.

There has not been any sampling since 2006.

Product Improvement

While the product was improved by the addition of caffeine, our challenge was to communicate the change without making it all about the caffeine as Mountain Dew’s distinct flavor needed to be its primary attribute. The name Citrus Charge allowed us to explain the flavor and allude to the caffeine content.

Footnote 6: According to Brightroll, average CTR’s for the CPG category sit at approximately 0.82% for in-stream video.