Fédération des producteurs de porcs du Québec

Events, Seasonal and Short-Term (BRONZE)

Client Credits: Fédération des producteurs de porcs du Québec

Julie Gélinas, Marketing Director

Agency Credits: lg2

Marc Fortin, Creative Director

Lysa Petraccone, Art Director

François Sauvé, Copywriter

Jennifer Varvaresso, Interactive Creative Director

Marc-André Fafard, Strategic Planner

Julie Dubé, Vice-President Account Services

Annie Tremblay, Account Executive

Claudia Joly, Supervisor – Group Account

Natacha Laflamme, Account Executive

Adurey Dignard, Coordinator – Group Acount

Claudia Lemire, Electronic Production

Jean-François Asselin, Director

André Turpin, Director of Photography

Production House: Cinélande

Post Production House: Technicolor

Sound: Boogie Studio, Denis-Éric Pednault

Music: L’Oreille Cassée

Branding: lg2boutique – Claude Auchu, Serge Côté

Public Relations: Velocity – Claudia Gervais, Patricia Laurence

Media: Carat – Lucie Gauvin, Katia Rassi, Maryse Archambault, Vanessa Julianno, Joëlle Lavigne

Crossover Notes:

All winning cases contain lessons that cross over from one case to another. David Rutherford has been identifying these as Crossover Notes since CASSIES 1997. The full set for CASSIES 2013 can be downloaded from the Case Library section at www.cassies.ca.

Crossover Note 1. What a Brand Stands For.

Crossover Note 2. Brand Truths.

Crossover Note 6. Should the product be improved?

Crossover Note 18. Keeping it Simple.

To see creative, click on the links that are embedded in the case.

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | September 2011 – December 2011 |

| Start of Advertising/Communication Effort: | September 19, 2011 |

| Base Period as a Benchmark: | September 2010 – December 2010 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

The Fédération des producteurs de porcs du Quebec (FPPQ) produces Quebec pork, amongst the finest pork in the world. This is made possible through the producers’ expertise and innovative spirit. As a consequence of breakthrough farming methods, significant animal welfare care and regulated feeding the Quebec pork that you find on grocery shelves nowadays is very different from the meat available 25 years ago.

However, pork isn’t on top of the grocery list. While food habits have radically changed over the years, Quebec consumers’ perception about pork is basically unchanged, making them choose protein sources like chicken, or switch to meatless alternatives.

Pork isn’t a preferred meat

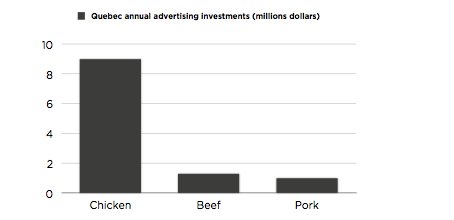

Pork consumption has been slightly depressed over the years (-8% since 1986), while that of chicken has increased significantly (+40% since 1986); beef consumption for its part has decreased (-27% since 1986). However, pork remains the third most consumed meat, behind chicken, first overall, and beef.[Footnote 1] Also, chicken and beef have enjoyed considerable advertising investments. In Quebec, the chicken industry (federation and specialized restaurant chains) invested more than $9 million in 2010, while the beef industry (steakhouse restaurant chains) spent $1.3 million.[Footnote 2] There are no pork-oriented restaurant chains in Quebec, so the only money used to promote pork comes from the producers, falling annually around a million dollars for the past couple of years.

Quebec pork is invisible

To make things worse, while Quebec pork is exported to more than 125 countries because of its excellence, Quebec groceries continue to buy low-end pork from around the globe. In fact, 30% of the pork sold in provincial groceries is imported. These diverse origins don’t allow grocery shoppers to identify the origin of the product on the shelves, thus depriving Quebec pork of the local flavour argument when the time comes for consumers to make a choice.

b) Resulting Business Objectives

The main goal was to increase the consumption of pork, especially Quebec pork. To achieve this, it was necessary to do the following:

- Create a preference for pork over chicken and beef

- Create a preference for Quebec pork versus pork from other origins

- Create awareness among Quebecers about the different qualities/origins of pork cuts

More specifically, vs. the pre-campaign period:

- Increase by 8% the weekly consumption of pork (fresh cuts only)

- Increase by 10% the sales of exclusive Quebec pork cuts (osso buco and racks)

- Increase by 7% Quebecers’ awareness about the fact that the pork they regularly buy does not necessarily come from Quebec

This was not an easy challenge given the fact that pork consumption had slightly declined in Quebec in previous years and that it was impossible in the short term to create a way of identifying Quebec pork in store.

c) Annual Media Budget

$1 – $2 million

d) Geographic Area

Province of Quebec

Footnote 1: L’actualité magazine, March 2012, “Grand dossier : Vivre sans viande?”

Footnote 2: Nielsen, “Restaurants Non Fast Food”, evaluation by Carat Media

Section III — STRATEGIC THINKING

a) Analysis and Insight

Like most food products, Quebec pork has to fight to occupy a prominent place in the grocery cart of our target consumers: 35 to 54-year-old women Primary Grocery Shoppers (PGS). Over the years, their selection criteria have evolved and the health factor is becoming more important than ever when feeding their family. Indeed, 90% of Quebecers think about changing their diet to improve their health. That behaviour explains why chicken consumption has gained in popularity and why 36% of Quebecers have decreased their beef consumption in the last 10 years.[Footnote 1] Could the healthy eating movement be the main reason behind the 8% drop in pork consumption since 1986?

A 2009 CROP survey found that our target’s perception about pork had remained unchanged for years. The survey discovered five principal barriers to pork consumption: [Crossover Note 2]

- Pork is too commonplace

- People avoid cooking pork on special occasions

- People perceive pork as a low-end meat

- Pork is not easy to cook

- Pork is fatty [Footnote 2]

This last belief can be explained, in part, from a socio-cultural perspective. Several colloquial expressions in Quebec French refer to pork in a negative way. Fat people are called “porks.” We refer to people who eat too much as pigs and consider them unhealthy. And bacon, the best known pork part, is basically fat.

However, Quebec pork producers are among the most innovative farmers in Canada. Their expertise confirms that Quebec pork is now considered a lean meat. In fact, fresh pork cuts are approved by the Health Check program, the Heart & Stroke Foundation program regrouping food items that meet nutrient criteria developed by the Foundation’s registered dieticians based on recommendations in Canada’s Food Guide.

Breaking down this barrier became a priority. The gap between consumers’ perception and the reality was tremendous. That’s why we focused all efforts on tackling the fat and caloric perception of pork meat.

b) Communication Strategy

The campaign idea had to rest on the following strategic elements:

- Differentiate Quebec pork from foreign pork by educating people on the superior quality of Quebec pork

- Do this instead of putting forward recipes. (In general, meat advertising presents recipes to consumers. However, with the Internet and proliferation of cooking books and shows, finding inspiration has never been easier. Focusing on the meat, instead of recipes, would differentiate our message.)

- Use a meaningful nutritional fact to reach our target’s rational side.

- Present new pork cuts unique to Quebec pork. Quebec pork is the only pork in the world that is sold as osso buco and racks. Highlighting these exclusive cuts, two of the most expensive fresh pork cuts available, would raise the brand’s prestige and create an organic demand for Quebec pork. [Crossover Note 6]

- Use a call to action in every execution to invite people to ask for Quebec pork at POS. Using a pull strategy put pressure on the retailers to put more Quebec pork on the shelves.

From these strategies, the big idea emerged: to communicate the concept of “change” that has made it possible to improve the product. And the biggest change about Quebec pork is that it now has 30% less fat than 25 years ago. [Crossover Note 1]

Footnote 1: L’actualité magazine, March 2012, “Grand dossier : Vivre sans viande?”

Footnote 2: CROP, “Le Porc du Québec : Étude sur l’image de marque”, March 2009

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

- Television

- Print: magazines

- Print: newspaper stunt

- Online: preroll, web banners and FPPQ official website landing page design

- In-store tactical event

- Branding: logo redesign

- Launch event: “Gourmet Manifestation”

b)Creative Discussion

The campaign used the notion of change as the backbone of all executions. Television, the centerpiece of the campaign, featured endearing characters resistant to novelty who finally evolve thanks to Quebec pork. The other pieces (print, web banners, official website landing page design, POS, newspaper stunt and in-store tactical event) also fit into the concept of change and illustrated a specific moment of evolution in how we live.

All executions communicated a simple but relevant fact: Quebec pork is nearly 30% leaner than 25 years ago. The new line “Quebec pork has changed. Change for pork.” encapsulated the essence of the message and invited people to rediscover Quebec pork.

To amplify the notion of change, a new, more modern logo was also created. The colour blue was used to refer to both the product’s Quebec origins and the grocery’s light blue visual code, which indicates healthy food.

The campaign ran from September 19, 2011, to December 19, 2011. To launch the campaign, an event was organized where consumers and the media had the chance to meet with Quebec pork producers and famous chefs. The “Gourmet Manifestation” was the perfect occasion for around 500 people to celebrate a top-class product by allowing producers’ innovative spirit to shine.

c)Media Discussion

To build an optimal level of awareness, we chose to focus most media efforts in a visual and effective medium. Television was therefore chosen, the ideal medium under the circumstances. Moreover, with a limited budget and the fact that it was essential to stimulate consumers’ interest quickly, the television media dollars were concentrated in a short period of time and the TV spots were broadcast at primetime hours during the most watched television shows. To give our TV spots extra miles, they were also broadcast on the network websites as pre-rolls.

In support to television, magazines were chosen to explain more concretely why Quebec pork had changed. Food-oriented magazines were a perfect match and deciding to be present in their special Holiday editions gave a context to communicate the product’s improvement. A partnership with Ricardo Media, famous chef Ricardo Larrivée’s media company, was also developed to promote Quebec pork on its media properties (magazine, TV, Internet).

Section V — BUSINESS RESULTS

a) Sales/Share Results

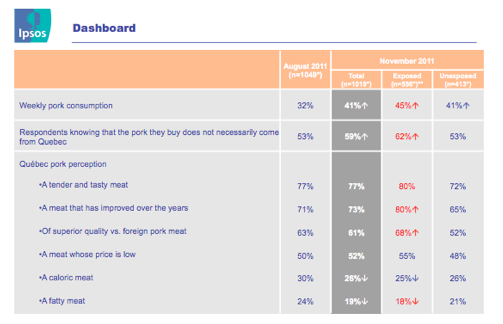

The 12-week campaign surpassed all expectations. Changing the fat perception of pork was the right strategic choice to do. The perception that pork is a lean meat grew by 5 points among Quebecers, a 21% increase (from 19% to 24%).

When comparing the pre-campaign and post-campaign periods,[Footnote 1] we find that:

- The average weekly consumption of pork (fresh cuts only) grew by 9 points among Quebecers, a 28% increase (from 32% to 41%)

- The awareness level in regards to pork meat bought in Quebec not necessarily being Quebec pork grew by 6 points among Quebecers, a 10% increase (from 53% to 59%)

Also, according to Pierre Théroux, Head of Meat Marketing at IGA, the La Presse newspaper stunt, which was the last piece of the integrated campaign and the only media execution running at the time, generated sales growth of 17% of the total pork category compared to the same period the year before. Again according to Mr. Théroux, the tactical event orchestrated at IGA by Quebec pork resulted in a 400% sales lift for pork osso buco and a 350% sales lift for pork racks, the two SKUs targeted during the event.

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Footnote 1: Omnibus Web, Ipsos, December 2011

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

With no other marketing activity or aggressive price promotion running at the time, the campaign is the key to the success of pork sales. According to an Ipsos post-campaign study, the statements directly related to the messages conveyed by the campaign are evaluated more positively by respondents who were exposed to the campaign.[Footnote 1]

b)Excluding Other Factors

Spending Levels:

No other marketing variable changed.

Pricing:

No other marketing variable changed.

Distribution Changes:

No other marketing variable changed.

Unusual Promotional Activity:

No other marketing variable changed.

Other Potential Causes:

No other marketing variable changed.

Footnote 1: Omnibus Web, Ipsos, December 2011