2015 Subaru Outback. Equipped for life’s authentic adventures.

Off to a Good Start (SILVER)

Client Credits: Subaru Canada

Geoff Craig, Director of Marketing

Agency Credits: DDB Canada

Chief Creative Officer: Kevin Davis

Executive Creative Director: Paul Wallace

Creative Director: Rob Sturch

Copywriter: Domenique Raso

Art Director: Rebecca May

Agency Producers: Sue Bell, Marie-Pierre Toure, Tara Greguric, Stefan Fabich, Caroline Clarke

Agency Producers: Catherine Kim

Michael Davidson, SVP, Business Unit Director; Scott Barr, Account Director;

Julia Morris, Account Supervisor; Mike Johnson, Account Executive;

Lindy Scott, Account Executive; Samantha Wanjiru, Account Services Intern

Tony Johnstone, SVP, Director of Strategic Planning; Annie Seyffert, Strategist

Developers: Dana Brousseau

Production Company: The Corner Store

Director: Jorn Haagan

Director of Photography: Jorn Haagen

Line Producer: Jane Thomson

Post-Production Company: Rooster Post

Editor: Marc Langley

Assistant Editor: Nick Greaves

Finishing Facility: Fort York VFX

Flame Artist: Paul Binney

Flame Assistant: James Marin

Colour Facility: Alter Ego

Colourist: Eric Whipp

Audio House: RMW Music

Audio House Producer: Dustin Anstey; Audio House Engineer: Kyle Gudmundson

Print Producer: Tara Greguric, Betty Lyver

Print Production: Jason Taylor, Mac Production Artist; Kirk Broadhead, Mac Production Artist

Photographer: George Simhoni; Retoucher: Mark Tyler

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | August 2014 – March 2015 |

| Start of Advertising/Communication Effort: | August 2014 |

| Base Period as a Benchmark: | August 2013-March 2014 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

Outback has historically defined the Subaru brand for many of their loyal customers. The model began a long decline from 2001-2009 when it went from 28% of brand sales to just 11% in 2008. Outback was very successfully re-launched in 2009 with the MY’10 Outback, spiking sales and share through 2010-12. But with no significant model changes, Outback sales declined by -13.2% in 2013 and was back down to 16.6% of total Subaru sales. With no significant updates to the model on the horizon, something needed to be done to get Outback sales growing again. In many ways, the challenges we faced were similar to those we faced in 2009. Although awareness of Outback was reasonable, familiarity and purchase intent were almost negligible. The model just wasn’t on the consideration list of new Intermediate SUV buyers. With less than 2% brand share-of-voice, we needed to go up against deep-pocketed giants like Honda and Toyota. And Subaru planned to maintain pricing and profit margins, while most in the industry were advertising fire sale prices and incentives.

b) Resulting Business Objectives

We were tasked with launching the new MY’15 Subaru Outback, increasing sales and market share for the model, along with purchase intent, despite no significant changes or improvements from the previous model year—and no special pricing or financing incentives.

Specific campaign objectives were as follows;

- Increase sales by +10% during the campaign period (-16.6% in 2013)

- Increase market share to 5% (from 4.1% in July’13)

- Increase purchase intent from 4.6% to 5%

c) Annual Media Budget

Over $5 million

d) Geographic Area

Canada

Section III — STRATEGIC THINKING

a) Analysis and Insight

Through extensive research and analysis of model and category sales, we discovered that we needed to focus on how the Outback was positioned against other Intermediate SUV’s. Most SUV’s have “off road adventure” as a key part of their selling message. Even though in reality, the vast majority of people never leave the comfort and reassurance of paved roads. Competitive buyers liked the “idea” of being adventurous, but at best, they would indulge in soft adventure, like a trip with friends to the local park.

On the other hand, Subaru buyers were looking for “actual” adventures, like trips deep into real parks like Algonquin. Armed with this insight we decided to ridicule the “faux” versus the “authentic.”

The Subaru Outback is an exceptional mid-sized utility vehicle that has functional capabilities beyond what most vehicles in the category have to offer. It is a unique cross between a station wagon and an SUV, with versatility, cargo capacity and car like refinements. The Subaru Outback is ruggedly stylish, spacious and fuel-efficient. It doesn’t just fit into an active lifestyle—it thrives in it.

b) Communication Strategy

Subaru Out back is, Equipped for life’s authentic adventures.

We targeted ‘real outdoors people’, who appreciate being in the moment. Men and women, 45-69, who are highly educated, have a higher income and a very adventurous spirit. Unlike many Millennials, they don’t just have adventures so they can document and share them with friends. They seek authentic adventures and opportunities to challenge themselves and discover new things. We let them know that the Subaru Outback was a uniquely capable vehicle that could be a true ally and enabler of their adventurous, outdoor lifestyle.

Television played the lead role in the campaign and highlighted 30-year-old Millenials arriving at rural hiking trails and campgrounds, dressed very fashionably and not for real adventure. In one spot, they hurriedly set up a campsite in order to take pictures they could share on social media sites. Once they are done sharing the pictures, they pack everything up and head out—presumably back to the city where they’re more comfortable. As they’re leaving, we see an Outback drive past them with two river kayaks on its roof rack. The Outback continues deeper into the forest, manoeuvring through muddy terrain, finally ending up in the middle of the woods, at the mouth of a river. Unlike the teenagers, who got there and packed up quickly, we see an outdoorsy looking couple unload the kayaks and head off down the gentle rapids. With the car in the background by the river, a voice over announces, “the completely redesigned 2015 Subaru Outback. Equipped for life’s authentic adventures”. A second TV spot followed a similar theme and featured a group of Millenials arriving and leaving a hiking trail hurriedly because they couldn’t get cell phone reception. All while a Subaru Outback was driving by with mountain bikes, going deeper into the woods down a rugged dirt road – eventually arriving at a more remote trail head to go mountain biking on the rugged trails.

The TV campaign was supported by, print, out-of-home and online – all elements reinforcing the proposition that Subaru Outback is equipped for life’s real adventures.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

Media Used: television, cinema, out-of-home, newspaper, magazine, online

b)Creative Discussion

Television played the lead role in the campaign and highlighted 30-year-old Millenials arriving at rural hiking trails and campgrounds, dressed very fashionably and not for real adventure.

In one spot, they hurriedly set up a campsite in order to take pictures they could share on social media sites. Once they are done sharing the pictures, they pack everything up and head out—presumably back to the city where they’re more comfortable. As they’re leaving, we see an Outback drive past them with two river kayaks on its roof rack. The Outback continues deeper into the forest, manoeuvring through muddy terrain, finally ending up in the middle of the woods, at the mouth of a river. Unlike the teenagers, who got there and packed up quickly, we see an outdoorsy looking couple unload the kayaks and head off down the gentle rapids. With the car in the background by the river, a voice over announces, “the completely redesigned 2015 Subaru Outback. Equipped for life’s authentic adventures”.

A second TV spot followed a similar theme and featured a group of Millenials arriving and leaving a hiking trail hurriedly because they couldn’t get cell phone reception.

All while a Subaru Outback was driving by with mountain bikes, going deeper into the woods down a rugged dirt road – eventually arriving at a more remote trail head to go mountain biking on the rugged trails.

The TV campaign was supported by, print, out-of-home and online – all elements reinforcing the proposition that Subaru Outback is equipped for life’s real adventures.

Print:

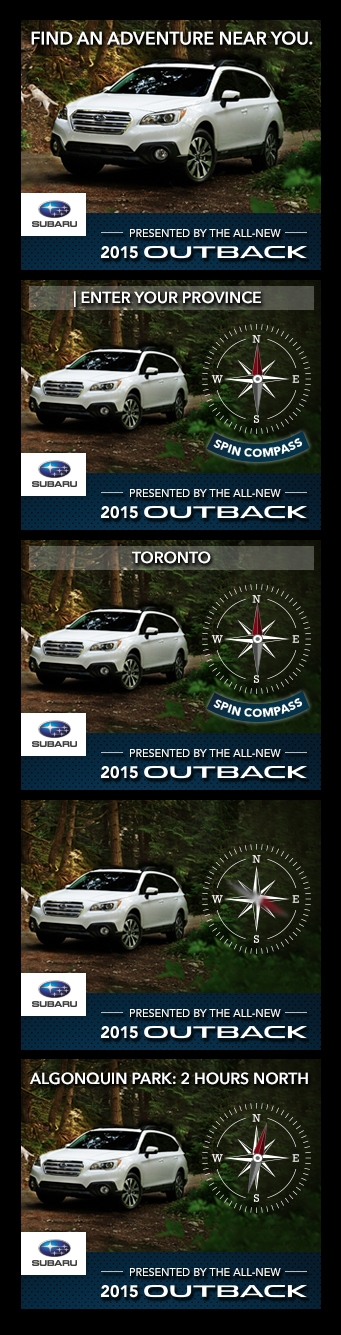

Online Banners:

c)Media Discussion

Television played the lead role in the campaign, along with cinema, out-of-home, newspaper, magazine and on-line. All media focused on our ‘real outdoors people’ target – men and women, 45-69, who are highly educated, have a higher income and a very adventurous spirit. The goal was to build awareness as quickly as possible and drive traffic online and to dealerships to find out more about the MY’15 Outback.

Section V — BUSINESS RESULTS

a) Sales/Share Results

In a very competitive Intermediate segment that increased a marginal 4% while our campaign was in market, results far exceeded historical sales and market share, as well as campaign objectives;

- Unit sales were up +76% vs prior year, far exceeding objectives of +10%

- Market share in the Intermediate SUV segment doubled from 4.1% in Jul’13 before the launch, to 8.2% in February’15, significantly exceeding the target of 5% by 3.2pp

- Monthly sales and market share reached historical high levels during the campaign period, +82% or 1,049 units in October’14 and a market share of 8.5% in November’14 (vs 4.3% in November’13)

- Increase in sales velocity vs PY resulted in an increase in retail sales of over $15million per month during the campaign period

b) Consumption/ Usage Results

c) Other Pertinent Results

Purchase Intent rose from 4.6% in May’13 to 7.4% in December’14 while the campaign was in market (vs objective of 5%)

d) Return on Investment

ROI was through the roof with average retail sales increasing by more than $15M per month during the campaign period and beyond, leading to very happy and profitable dealers across the country.

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

There is very direct linkage between the campaign and business results for Subaru. While the campaign was in market, the Intermediate SUV segment increased very slightly (+4%), while Outback increased unit sales by +76%, doubling market share to 8.2%. Despite no significant model changes, monthly sales velocity increased from 507 units per month (August’13-March’14) to 995 units per month during the campaign period. There were no special pricing incentives during the campaign period, despite much more aggressive promotions by competitors. Subaru continued to hold pricing and profit margins during the campaign period.

b)Excluding Other Factors

Spending Levels:

Historical spending levels were maintained at approximately 2% share-of-voice

Pricing:

Subaru maintained premium/full margin pricing and incentive levels during the launch, despite deep discounting by competitors.

Distribution Changes:

The number of Subaru dealers across the country remained constant at 92.

Unusual Promotional Activity:

Outback net pricing remained unchanged, and at approximately a 10% premium to the competition.

Other Potential Causes:

There were no additional factors or outside influences affecting campaign results.