Doritos Ketchup

Events, Seasonal and Short-Term (SILVER)

Client Credits: PepsiCo Foods Canada

Susan Irving, Sr. Director of Marketing

Matthew Webster, Marketing Manager

Adam Day, Marketing Manager

Telly Carayannakis, Associate Marketing Manager

Carlos Moreno, SVP Executive Creative Director

Peter Ignazi, SVP Executive Creative Director

Derek Blais, Associate Creative Director

Britt Wilen, Copywriter

Bryan Howarth, Art Director

Stephanie Page, VP Group Account Director

Jaya Rizzi, Account Supervisor

Jason Dick, Group Project Director

Sarah Ng, Sr. Project Manager

Darrin Patey, Group Technical Director

Trevor Shaikin, VP User Experience

Nicolas Rivera, Developer

Douglas Glover, Developer

Della Lytle, Sr. QA Analyst

Curtis Rushing, Director, Data Analytics & Insights

Arpan Rai, Data Analyst

Mats Kawana, Strategy Supervisor

Courtney Jones, Sr. Digital Strategist

Agency Credits: BBDO Toronto

Client: PepsiCo Foods Canada

Ad Agency: BBDO Toronto

Digital Agency: Proximity Canada

Media Agency: OMD

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | January, 2015 – March, 2015 |

| Start of Advertising/Communication Effort: | February 12, 2015 |

| Base Period as a Benchmark: | January 2014 – March 2014 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

With the snack category continually adding new brands and new chip-like products, Doritos needed to defend its share of the aisle. A key weapon in the arsenal was limited time flavours.

Historically, limited time flavours created interest at the shelf and drove incremental sales. That tactic worked very well in 2014 when they brought back Ketchup-flavoured Doritos after 10 years. The flavour flew off the shelves and was sold out in 5 weeks – still popular after all those years in hiatus.

We brought back Ketchup in 2015, but based on the success of 2014, expectations – and sales goals – were considerably higher. To achieve our objectives, given the limited dollars available, whatever we did had to be bold to capture the attention of our Millennial target (16-24). Given our target lives online we had a tough job ahead of us – not only were we competing with other salty snack brands but we were also competing with the plethora of digital content that the Canadian millennial is faced with each day online.

Given the short-term nature of promotional flavours, we were restricted to a total budget of $220,000 including production and any supportive media. The program launched on February 12, 2015 and ran for 6 weeks.

b) Resulting Business Objectives

Our business goal was to drive traffic in the chip aisle, using excitement about Doritos Ketchup to lift total sales across all Doritos flavours. Our specific goals are listed below.

Sales Objectives:

- We set out to generate a 3x increase in sales of Ketchup Doritos versus last year.

- For total brand, our 2015 goal was to increase frequency by 0.2 units per year, which would equate to a +5% sales increase. Through the 6-week promotional period, Doritos Ketchup was going to be the sole driver in generating increased brand sales.

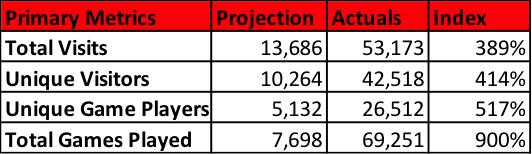

Engagement Objectives:

- Total site visits – 13,686

- Unique visitors – 10, 264

- Unique games players – 5,132

- Total games played – 7,698

Brand Metric Objectives:

Whenever we put communication in market, we look to increase Doritos brand metrics – or Key Performance Indicators (KPIs). Doritos main metrics are below:

- Brand I Love – increase by 10% from 28 to 31

- Advertising That Appeals To Me – increase by 10% from 21 to 23

- Flavours I Like – increase by 10% from 40 to 44

c) Annual Media Budget

$200,000 – $500,000

d) Geographic Area

Canada – National

Section III — STRATEGIC THINKING

a) Analysis and Insight

Our core target of Millennials (ages 16-24) is exposed to more entertainment options than they can possibly consume. To grab their attention, we needed a unique and bold experience that would rise to the top of the mountain of content they face every day.

To create an attention getting idea for Ketchup, we combined channel with insight. We knew we could play on the fact that Doritos Ketchup was a limited time offer — when they’re gone, they’re gone.

We also knew that, with our target, second only to their love of Doritos is their love of their mobile phones. A buzz-worthy mobile idea that reinforced the rarity of Ketchup Doritos became our strategic focus and the smartest way to spend our limited budget.

It’s often said, when you love something, you don’t want to let it go. We applied that truth directly to Doritos Ketchup and we came up with a mobile game called “The Hold Out”. While Doritos Ketchup would soon be gone from the shelves, there would be one bag left on the entire planet. And you could win it. But to do so, you would have to give up the use of your mobile phone.

By incenting people to compete for the world’s last bag of Doritos Ketchup through a bizarre mobile competition, we would create the buzz and attention needed to engage our target and drive traffic to the shelf.

Tensions would run high. What would prevail? Millennials love of their phones or their desire for the world’s last bag of Doritos Ketchup chips? Only time – and engagement with the Doritos “Hold Out” – would tell.

b) Communication Strategy

Our communication strategy was simple and effective. Our target spends more time on the Internet than any other medium; and 81% of them access it via their mobile phone. Based on this information, we did something that no other brand has done before and made our game “mobile only”. If you were lame enough to try and view our site on your computer you’d be redirected to get on your smartphone (Android or iPhone) in order to play.

We intentionally made the game ridiculously simple to play – we didn’t want the experience to be complicated. We also wanted users engaged throughout the campaign, so we held a random daily draw. Your score didn’t matter, we just wanted our target to be engaged with Doritos each day throughout the campaign. The niche group who really wanted that last bag would be the ones that really pushed for the high score.

To build awareness around our campaign we created videos and posts that we shared on both Facebook and Twitter. We also directly tweeted to everyone who expressed their love of Doritos Ketchup in 2014, engaging a group who were pre-disposed to the flavour and could not wait to see it on shelf again.

With a limited media budget we were relying on the power and simplicity of our idea – and the opportunity to win the last bag of Doritos Ketchup in the world – to create buzz and earned media to help us meet and surpass our lofty program objectives.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

Since our target lives online, that is where we committed 100% of our limited budget. We focused on the sites where they spend the majority of their time – Facebook and Twitter – and created sponsored videos and posts. The only other media we used was a partnership with Buzzfeed, another popular and irreverent vehicle that perfectly matches the tone and personality of the Doritos brand.

Media In-Market:

Facebook and Twitter: February 13th – March 30th

Buzzfeed: February 13th – March 10th

b)Creative Discussion

The centerpiece of our campaign was the mobile game, “The Hold Out”.

We know it’s next to impossible to peel our target away from their mobile phone. So we challenged them to prove their love for Doritos Ketchup chips — we created a game where, in order to play, you had to give up the use of your phone.

Social posts directed Android and iPhone users to doritosketchup.ca in order to compete for the world’s last bag of Doritos Ketchup, encased in glass on a mahogany stand. They only needed to do one thing: put their finger on the screen to hold on to that last bag, and hold on to it as long as they could.

We didn’t make it easy. Distractions like a fake phone call from “Work” or a text from “Mom” saying she’s setting them up on a blind date, tried to knock them off balance. If the player was tricked into answering the call or checking the text, it was game over.

Whoever could hold on the longest won the grand prize – the very last bag of Doritos Ketchup and a year’s supply of Doritos. For continued engagement throughout the contest, a random draw each day was awarded with beautiful Doritos Ketchup-branded swag. The swag included items that helped you enjoy Doritos Ketchup while playing “The Hold Out”: wipes for your ketchup-dusted fingers, gloves that allow you to still use your mobile phone, and a screen cleaner.

c)Media Discussion

With a limited budget of 100K for media, we needed to be laser-focused with our dollars.

The media strategy was dual pronged. Through Twitter, we targeted fans who had tweeted about Doritos Ketchup in the previous year. With 1.5 million tweets about the flavour last year, we knew this was an opportunity to get the die-hard Doritos Ketchup fans to be our advocates. They would be the first to play “The Hold Out” and then broadcast their scores; driving earned media and buzz to expand our campaign reach amongst their peer groups.

We then cast a wider net to ensure a greater reach and frequency with the Millennial target with short, fun videos and posts to drive awareness of the campaign via Facebook and Twitter.

Our only other media was the venerable Buzzfeed, which aligned perfectly to the irreverent tone of “The Hold Out”.

Section V — BUSINESS RESULTS

a) Sales/Share Results

In terms of sales volume and measurable behaviours, the Doritos Ketchup “Hold Out” far exceeded all objectives and, being the only Doritos activity in market, was the sole driver of growth.

In terms of business results:

Sales growth Ketchup: Doritos Ketchup sales increased 3.5 times versus 2014. Over-indexing against our goal of tripling sales at 117. Doritos had to add two additional production runs to accommodate the volume above plan.

Sales growth total brand: While the “Hold Out” was focused on Ketchup, it lifted the entire brand. During the promotional window, the only activity in market was the Doritos “Hold Out”. Over this period total Doritos sales volume increased 14.4%, almost tripling our goal of a 5% increase.

b) Consumption/ Usage Results

Our engagement goals were based upon our media buy. Again, the Doritos “Hold Out” surpassed all goals.

Usage metrics: Average game time was an astonishing 6 minutes 45 seconds while the grand prize winner held on for a whopping 337 hours – that’s over two weeks! In total, people spent 2692 hours holding onto the last bag of Doritos Ketchup, the equivalent of 112 days.

c) Other Pertinent Results

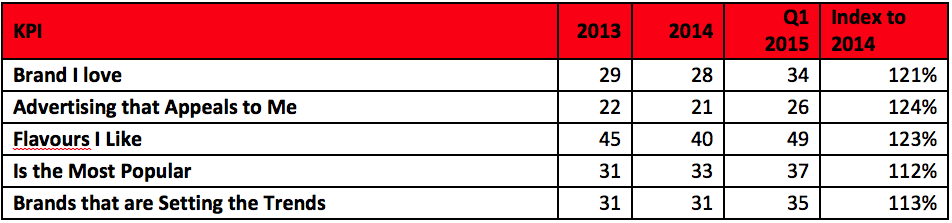

KEY PERFORMANCE INDICATORS (KPI)

The campaign drove significant gains against our key brand metrics as listed below in Exhibit 1. Doritos uses a continuous tracking system so the Q1 results include responses through to the end of March, which is when our campaign ended.

The numbers are outstanding. ‘Favourite Brand’ was up 6 points, leaping from a 28 to 34, ‘Advertising that appeals to me’ was up 5 points, 21 to 26, and ‘Flavours I Like’ was up 9 points from 40 to 49. ‘Is the Most Popular’ and ‘Brands That Are Setting Trends’ show the overall popularity of the brand has increased.

Exhibit 1:

* Millward Brown Equity Tracking

d) Return on Investment

The program delivered $19.51 in Ketchup sales for every dollar invested in marketing. On a total brand basis, Doritos Hold Out delivered $15.34 in incremental sales for every dollar spent.

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

The Doritos “Hold Out” had an immediate and significant impact in the market. We leveraged the limited time offer of a highly desired flavour with a unique promotion offering the world’s last bag to the one person who could give up the use of their phone for the longest period of time.

We outpaced every metric with a limited campaign budget of $220,000.

PREVIOUS FLAVOUR LAUNCH SUCCESS

Exhibit 2 shows that Doritos Ketchup was the highest selling individual flavour compared to the last 4 Limited Time Offers (LTO) launched by the brand.

Doritos Ketchup is the brand’s highest selling LTO ever. In just 16 weeks, Ketchup has sold more than several of our permanent flavours did in all of 2014.

Exhibit 2

*PepsiCo Internal Sales Reporting. First four full periods of each flavour launch.

Exhibit 3 demonstrates that Ketchup outperformed the averages sales for the last 4 LTOs by a margin of more than 3.8:1.

Exhibit 3

*PepsiCo Internal Sales Reporting. First four full periods of each flavour launch.

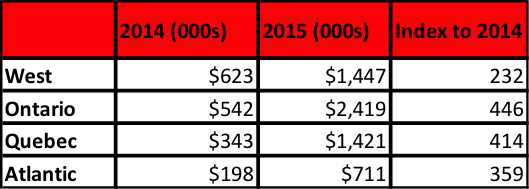

REGIONAL PERFORMANCE

Regional results in Exhibit 4 show that the performance was strong in all regions across the country.

Exhibit 4

*PepsiCo Internal Sales Reporting. Share to TOTAL FTC, National.

b)Excluding Other Factors

Spending Levels:

TRADE SPENDING

Trade spending was not a driving factor either. When compared to the 2014 Ketchup campaign, the same factors affected both years (Crash the Super Bowl campaign; one sale period for Doritos).

CAMPAIGN SPENDING

As previously mentioned, all of this was accomplished with a relatively modest campaign budget of $220,000. While the flavour clearly benefitted from some media support compared to 2014, the overall success of the campaign was not driven by client spending.

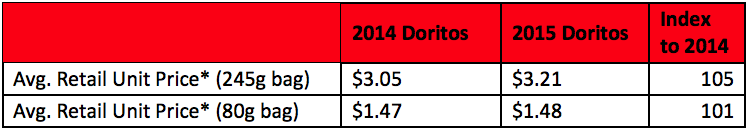

Pricing:

PROMOTIONAL PRICING

Exhibit 5 shows that pricing was also not a factor in the success of the campaign. In fact, compared with 2014, there was an increase in the average retail price.

Exhibit 5

Distribution Changes:

DISTRIBUTION

Distribution levels increased slightly for Doritos Ketchup compared to 2014 to help offset the aggressive sales targets. With only a 16% gain in distribution (71% to 82%*) we achieved a 350% sales increase!

*Nielsen Data, National GDM + GM + WC

Unusual Promotional Activity:

There wasn’t any unusual promotional activity. All variables have been covered in other sections of the case.

Other Potential Causes:

N/A