Nabob – Respect The Bean

Packaged Goods (GOLD)

Client Credits: Kraft Canada

Tony Matta – Chief Marketing Officer

Brian Kerr – VP Marketing (Current)

Doug Pritchard – VP Marketing (Former)

Dana Somerville – Marketing Director

Jamie Sprules – Sr Brand Manager

Heather Fadali – Brand Manager

Mieka Burns – Brand Manager

Jenny Sochnacki – Assistant Brand Manager

Katie Shaw – Brand Assistant

Agency Credits: Ogilvy & Mather

Ian Mackellar – Chief Creative Officer, Ogilvy and Mather

Ian Simpson – Associate Creative Director, Ogilvy and Mather

Catherine Allen – Associate Creative Director, Ogilvy and Mather

Doug Potwin – Strategic Planning Director, Ogilvy and Mather

Jennifer Christen – Group Account Director, Ogilvy and Mather

Connor Ofield – Account Supervisor, Ogilvy and Mather

Matt Coulson – Account Supervisor, Ogilvy and Mather

Starcom Media

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | July 2014 to June 2015 |

| Start of Advertising/Communication Effort: | May 2014 |

| Base Period as a Benchmark: | July 2013 to June 2014 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

A falling star rises again

Once upon a time NABOB Coffee Co. (NABOB) was the #1 premium coffee brand in the country. Starting from humble roots in the Gastown neighbourhood of Vancouver in 1896, Nabob gradually spread across the country. Over the next century it grew to become a true Canadian coffee icon.

But those days were behind it.

Circa 2012 Nabob had fallen on hard times. Sales were in decline. Why? The coffee category had changed dramatically. New competitors were changing the definition of “premium” coffee, and the emergence of coffee shop culture was creating entirely new sensibilities. By comparison, Nabob felt out of touch; it was just a mainstream grocery store brand, devoid of any allure for today’s contemporary premium coffee drinker.

The road to recovery started by breathing life into the product and how it was presented. This began in earnest in 2013 when we launched two new lines, Nabob Whole Bean and Nabob Bold. In tandem with these key new launches, Nabob’s packaging was completely over-hauled and the entire line was transitioned out of tins, a symbol of mainstream coffee yesteryear and, into bags, a symbol of more premium coffees. Shortly after these changes we started to see sales declines stemmed. And, in fact growth restored.

After fixing the product we moved onto fixing the brand. Nabob had meandered from one advertising campaign to the next post the year 2000, leaving consumers wondering what, if anything Nabob stood for anymore. A problem that led to the question we needed to answer: how do we re-establish the Nabob brand and give it a clear point of view within today’s coffee landscape?

Unfortunately time was not on our side, we needed to answer this question and answer it quickly. The premium coffee category was experiencing increased competitive pressure from away from home brands (Second Cup, Tim Hortons, McCafe) and once-regional players (Kicking Horse) entering and proliferating grocery store shelves. This evolving competitive landscape, threatened to wipe out any and all of the gains Nabob had made.

b) Resulting Business Objectives

Hold $ Share Flat

With indications that 10-15% of Nabob’s volume was at risk of bleeding to competitors, accomplishing this would be no small feat.

c) Annual Media Budget

Over $5 million

d) Geographic Area

National, Ex. NFLD

Section III — STRATEGIC THINKING

a) Analysis and Insight

Rallying around common ground

With the McCafé launch looming, apathy toward the Nabob brand had to be overcome. We needed to define the brand point of view in a provocative way…create something people could rally behind…and answer the lingering question, why should I care about Nabob anymore?

The solution started with defining whom the brand was for. Kraft’s coffee segmentation study provided the answer in ‘Bold Bobbies.’ Rationally, they were a segment that drank more than their fair share of coffee at home. Just as important was their value system; in life and in coffee they wholeheartedly believed that substance should always trump style. This became the perfect connection point for a brand that had been making craft coffee without pretence for over 115 years.

b) Communication Strategy

Finding our foil

Practically speaking since Nabob was at its peak a lot had changed. Coffee shops, big and small began had invaded the country. Fast food giants across North America began adding Coffee to their menus (and launching them in grocery stores). And little by little, coffee stopped being coffee. Coffee (and the beans that give birth to its hallowed liquid) started to become merely an ingredient; something to be topped with whipped cream, cinnamon, caramel, even pumpkins! Coffee became iced, blended, frapped, sprinkled upon. And while we didn’t directly compete in this market, the phenomena started getting drinkers to question the value of a simple, pure roast and ground coffee like Nabob.

So we took aim at the frothy and faux universe of what coffee and coffee culture had become: whipped, pumpkin spiced, and drizzled to death. And, filled with absurdity not only in terms of what was being ordered, but how it was being ordered as well – “Venti” anyone? The perfect tension and foil to re-establish the Nabob brand and its belief that coffee is at its best when grown, roasted and ultimately served simply, authentically and unpretentiously.

To make our point the “Respect the Bean” campaign was born. It was at its core, a rallying cry to return to relishing the simple pleasure of a simple unadulterated cup of coffee. And, do it with a cup of Nabob.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

- :30 TV

- Online Pre Roll

- YouTube

- Digital Banners

- Online Web Page Takeovers

- OOH

- Magazine Print

- Buzz Feed

b)Creative Discussion

Crafting a cultural commentary

Respect the Bean was designed to get coffee drinkers to do just that. And while we encouraged that movement in a number of ways, regardless of channel all of the work flowed seamlessly together highlighting and challenging the ridiculous state of what coffee had become and serving up a cup of Nabob as the answer.

The campaign started in the coffee fields of Colombia with a TV campaign featuring real hard-working coffee farmers responding to the ever-changing absurdity of North American coffee culture. They tasted frappuccinos, were introduced to pumpkin spice, and learned about hipster mustaches. Suffice it to say, they weren’t impressed. But they were with Nabob.

As outlined in the media discussion section below eventually, the Respect The Bean campaign took to other forms but always stayed true to its provocative and challenging tone regardless of where and when it lived.

c)Media Discussion

Reach and respond

TV formed the backbone of the launch plan but to really get drinkers re-engaged with the brand we knew the campaign had to be agile and creep into culture when opportune moments arose.

So we introduced response online videos. When someone set the record for most expensive Starbucks drink we had a response from our farmers ready. When coffee shops released their holiday cups, we took action with fresh content. Whenever coffee culture changed, Nabob was there with another video.

Next came out-of-home with creative that directly went up against the giants of coffee culture. Many executions were strategically placed as close as possible to corner coffee shops so we could remind anyone and everyone who disrespected the bean that there was a better option out there.

And finally, always on social media continued Nabob’s anti-pretentious coffee culture stance with daily tweets lampooning outrageous coffee culture and reminding consumers to Respect the Bean.

Section V — BUSINESS RESULTS

a) Sales/Share Results

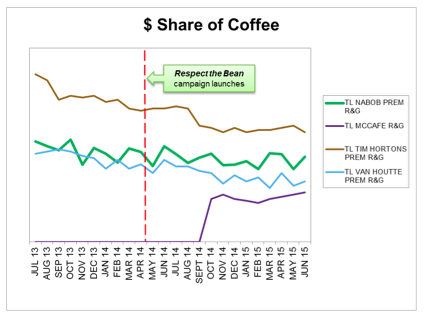

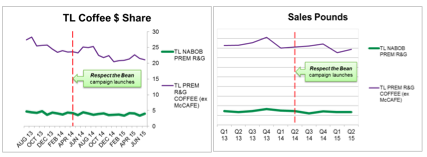

Our objective was hold $ share flat, bucking the consensus that the entrance and momentum of away from home players would source sizable volume from Nabob. As the chart below indicates, we accomplished this goal. Our competitors however did not with both Tim Hortons and Van Houtte losing $ share.[1]

Further confirming Nabob’s ability to defend against the competitive thrust is the spike in loyalty seen in % repeat buyers (+1.1pts), trips per buyer (+0.2), spend per trip (+$1.20) and % volume on deal (-3.9pts).[2]

b) Consumption/ Usage Results

Nabob was also able to defend against the impending competitors by staying flat in both volume per trip and units per buyer. Nabob even grew in trips per buyer +0.2pts and spend per trip +$1.20.[3]

c) Other Pertinent Results

All of the pertinent results are included within this case.

d) Return on Investment

As previously stated, Nabob stood to lose upwards of 2 million dollars in gross sales to away from home brands. To the contrary however, Nabob grew 2 million dollars in consumption during this business results period. Between a) the competitive losses averted, b) defense against the -3% category trend decrease in volume ($1.5 million) and c) the production efficiency driven by multiple years of content developed at one time, the Respect the Bean campaign offered a strong return on investment.

1 Source: AC Nielsen MarketTrack Data

2 Source: AC Nielsen Homescan

3 Source: Nielsen Homescan

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

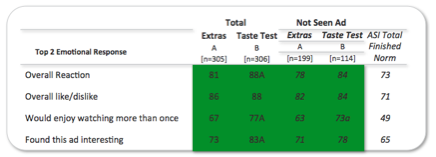

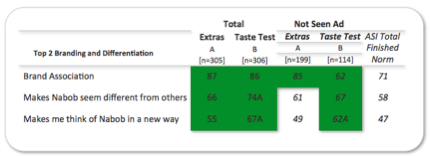

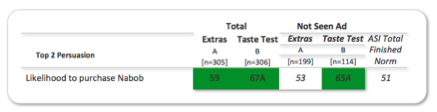

Without a doubt the Respect the Bean campaign is a major contributor to the recent success Nabob has seen. The primary proof point for this is Ipsos ASI creative testing that was done in February of 2015.[4]

As the chart below illustrates, when it came to engagement and emotional response both lead executions in the campaign ‘Taste Test,’ and ‘Extras’ exceeded norms on all key metrics.

They were also well branded, made Nabob stand out and provoked re-appraisal by making the target think of the brand in a new way.

And finally consistent with our in market sales results, they both delivered where they needed to most, increasing likelihood to purchase.

Even more of a testament to the efficacy of the Respect the Bean campaign and the business results achieved during its tenure is the fact that the overall premium roast and ground (R&G) category declined 3% during the year preceding business results period. Consumers were buying and drinking less R&G coffee.

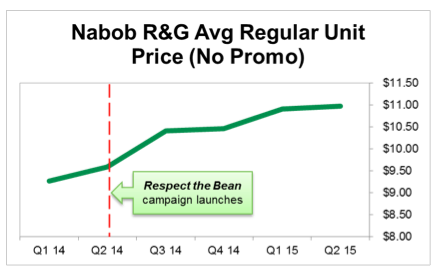

Finally, Respect the Bean was awarded such respect it allowed the business to continue to grow, despite having to execute two commodity-based price increases during the campaign. Current base pricing is 17% higher than pre-campaign.

b)Excluding Other Factors

Spending Levels:

Our spend levels against Nabob R&G during the business results period were comparable to same period in the year prior.

Pricing:

As we mentioned in the cause and affect section, we executed two price increases during the business results period equivalent to a 17% increase to the pre campaign pricing level.

Distribution Changes:

Distribution levels were virtually flat. No increases in National distribution points were achieved during the business results period that could have influenced performance.

Unusual Promotional Activity:

Feature pricing levels during the business results period were no different than they were in prior years. No gains were made through unusual promotional activity.

Other Potential Causes:

None.

4 Source: Ipsos ASI Online Creative Evaluation, February 2015