Credit Counselling Society – Debtman

Off to a Good Start (BRONZE)

Best Insight (BRONZE)

Client Credits: Credit Counselling Society

Scott Hannah, President and CEO

Brad Sherwin, Director of Marketing

Agency Credits: Greystone Creative

Graham Livingstone, Greystone Creative, Creative Director

Allen Jones, Ace Productions, Producer and Director

Jeanette Wassung, JW Media, Media Director

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | February 2014 – January 2015 |

| Start of Advertising/Communication Effort: | January 27, 2014 |

| Base Period as a Benchmark: | Feb 2013 – January 2014 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

Being in debt is an overwhelming and isolating feeling. It takes over every aspect of your life, it’s hard not to think about even for a moment, yet few will talk about it on a personal level.

For nearly 20 years, the Credit Counselling Society (CCS) has been helping people deal with overwhelming debt struggles to become debt free, for good. As a non-profit, charitable service, it provides free access to navigating a path out of debt, from simply answering questions to a free counselling session with an accredited, professional Credit Counsellor.

Most people get into trouble with debt because of circumstances, such as the loss of a job in the family, sickness, short-term layoff or significant unexpected expense. Nearly 2/3 of Canadians report living paycheque to paycheque, so any financial shock has the ability to create debt distress as they try and recover from unexpected expenses.

Depending on the situation, consumers have 4 choices; deal with the debt on their own (by creating a budget, selling assets, reducing expenses and/or increasing income), sign up for a Debt Management Program (DMP) administer by CCS (for a small fee), file a consumer proposal or declare bankruptcy, the latter two conducted by a Trustee in Bankruptcy (a for-profit entity).

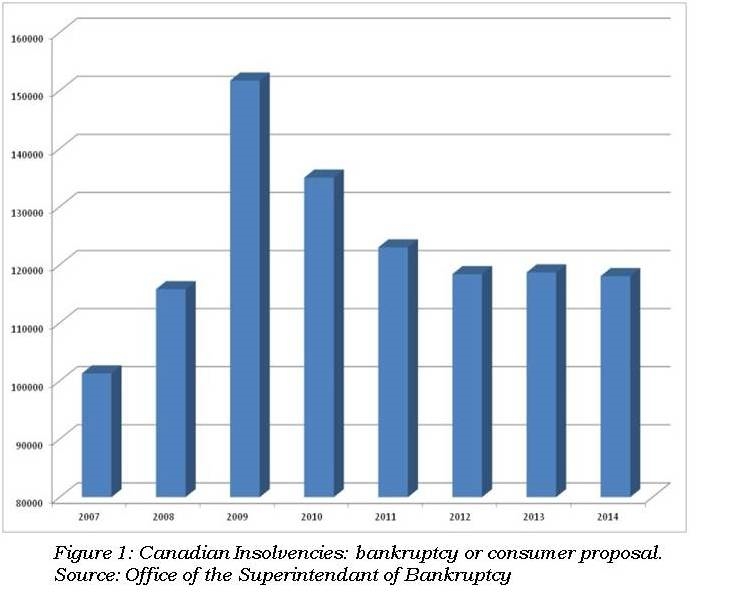

Since the economic collapse of 2008, there has been a steady decline in the number of people requiring help with their debts. Bankruptcies and Consumer Proposals have fallen from a high of 151,700 in 2009 to 118,000 in 2014.

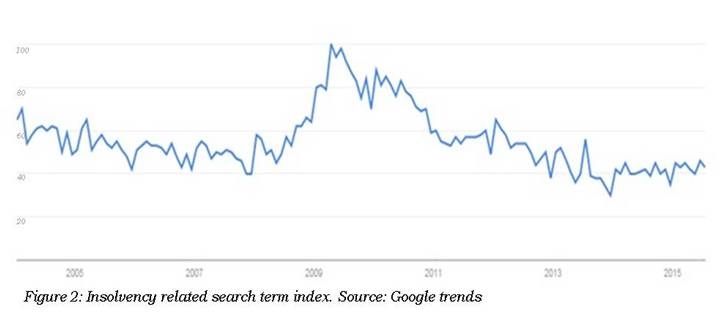

Non-profit and for-profit credit counselling services are not centrally reported. In order to better understand demand for consumer debt related issues, we use an index reported by Google Trends. Search terms such as bankruptcy, consumer proposal, credit counselling, debt help and consolidation loans are used to track consumer interest in finding services to help deal with debt issues. Since peaking in 2009 (index: 100), insolvency related search has dropped to the lowest levels in over 10 years (index: 40).

b) Resulting Business Objectives

We have one measure to determine marketing success – did we conduct more one-on-one counselling sessions (first time appointments) than the year prior. All other marketing measures – phone calls, web searches, appointments booked – feed into that objective.

Credit counselling has two unorthodox marketing challenges – consumer awareness is virtually non-existent until the service is needed, and they will only contact you once – if you do your job right, they will never need your help again. Repeat customers, or recidivism, is a bad thing, but in nearly 20 years of operation, our recidivism rate is less than 0.5%. But that also means you can’t rely on repeat business.

For 2014, our objective was to increase counselled appointments by 25%. An aggressive target, when you consider that every appointment is a new contact. The purchase cycle is once, and only once.

c) Annual Media Budget

$1 – $2 million

d) Geographic Area

Ontario to British Columbia

Section III — STRATEGIC THINKING

a) Analysis and Insight

Being in debt is lonely – few people want to publicly discuss money problems, just as most people don’t want to hear about them. People would admit to sexual dysfunction before discussing a troubling financial situation.

Prior advertising in the category (including by us) was quite rational and direct. Typical ads involved a spokesperson outlining how help was available. Others showed the evidence of your debt – the mail with a past due notice, the movers repossessing your things or the phone call coming in from collectors – to try and scare you into acting. While it worked for some people, it did not motivate many in debt to pick up the phone and ask for help when they needed it, even when help was free.

Drowning in Debt – Credit Canada Debt Solutions

Talking Man – Money Mentors

Debt Suckers – Consolidated Credit

Collection Calls – Credit Counselling Society (2013)

We believed that many people who have been dealing with debt issues had become immune to these advertising messages. Yet many people had become masters at avoiding the symptoms of their debt problem – not answering the phone calls, putting the mail in the drawer or not using the credit card when it might get rejected. But not getting help early only makes the problem worse.

If ignoring the problem was no longer a challenge, ignoring the advertising was even less of one.

b) Communication Strategy

What has been lacking in most communication in the category was an emotional connection to debt – how being in debt made them feel. What we had to do was make debt tangible, personal, unavoidable and cumbersome. In essence, make it real, and make it uncomfortable. Don’t tell me about my debt, show me how it’s affecting my life.

The next challenge was creating advertising that couldn’t be avoided or ignored.

That is when our Debtman was born.

Debtman lives on people’s backs. Dressed in red, he was always there, hanging around and weighing you down. Debtman is always unnoticed by others, smug, oblivious to your problems and completely uncaring to your situation. But definitely felt by the person carrying the burden.

A key element of the strategy was in the delivery – we had to get people to experience the feeling of debt, not the dread of debt, and not through fear. Trying to scare people had not worked well in the past, so we opted to use humour to show the impact debt has on people, but without belittling or judging those who felt a connection to the message.

The other reason for using humour was to relieve the stress associated with debt. If the consumer thought about their debt with a smile on their face, it would lower the barrier to taking action. Further, the consumer would be smiling when the CCS logo was shown, which created a positive association with the organization as well.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

- Television

- OOH – Interior/Exterior Transit, Skytrain Posters (Van)

- Radio

- Other media used but not directly related to the campaign were website search engine optimization (SEO), pay-per-click (PPC) search engine advertising and social media.

b)Creative Discussion

Get Debt off your back.

The creative was simple; show people doing everyday actvities with a man, dressed in red, being carried on their back. The challenge was to make sure it was done in a way that did not belittle the people who felt this burden. It was very easy for the creative to get to a comical state, which was to be avoided at all costs.

Prior to production, a survey was conducted of current CCS clients who were in the process of clearing their debts. A series of scripts were presented via questionnaire, and the feedback received was invaluable. For example, one initial scene was of a man standing in line for a cup of coffee. The feedback was people in debt don’t buy coffee, they make it at home. Something so simple and seemingly inexpensive was easy to overlook, but would send a clear message of a lack of understanding of the situation. The scene was removed, and other, simpler scenes replaced it.

Out of home incorporated a scene from the television creative that showed the misery of carrying around debt, and how lonely it can be. No one else sees it, but the person in debt knows it’s there.

As a very visual campaign, it was more challenging to execute on radio. The solution was to make the debt real and personal, so Debtman just had a simple conversation with the listener. Again, Debtman is smug and unphased by the burden he has created.

Of course, the solution is to call the Credit Counselling Society. All you have to lose is your debt.

c)Media Discussion

As a register charity, the Credit Counselling Society is eligible for PSA status with Telecaster. CCS registered for this status in 2013, and engaged the services of JW Media to take a small budget with big expectations and create a media plan.

Between the PSA status and good negotiation, JW Media was able to secure 2 ½ – 3 times value in all media. The launch of the campaign coincided with the 2014 Winter Olympics, which provided a perfect platform from which to introduce our new message. Further, as a registered charity, JW was able to secure airtime through a program with Shaw Media where CCS ads could be seen on US cable stations broadcast in Western Canada such as AMC, TLC, A&E and others.

Social media proved to be a challenge in this space. People wanted privacy when talking about and dealing with their debt, so the last thing they were willing to do was have a discussion about it with the rest of the world and leave a lasting record of it.

Section V — BUSINESS RESULTS

a) Sales/Share Results

The impact was felt very soon after the launch of the campaign. Phone calls increased dramatically, as did counselling appointments. The biggest challenge became hiring enough people to manage the demand the advertising had created.

Between February 1, 2014 and January 31, 2015, CCS had the following results:

- Phone calls +21%

- Appointments Booked +22%

- Website traffic +33%

- First Time Appointments Counselled + 34.9% (proof that the advertising was reaching people that had an appropriate need, not just generating a message to make the phone ring)

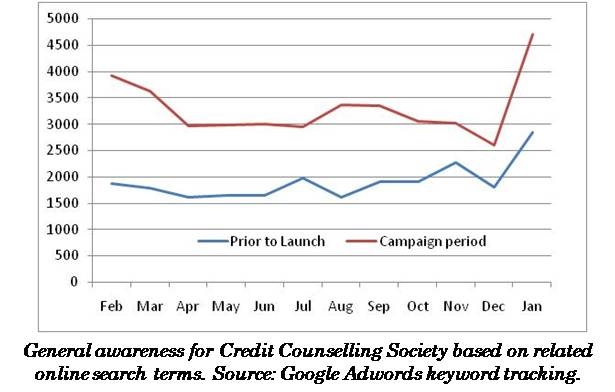

In addition to our business outcomes, we also found over the course of the campaign our general awareness increased by 73%.

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

In the month prior to the advertising launch (January, 2014), phone calls were experiencing a 15.7% increase over the year prior. When the campaign launched in February, calls increased by 49.9% followed by an increase of 40.5% in March. The lowest gain in phone calls over the course of the first year of the campaign was in January 2015, when the campaign had been off-air since November.

The campaign has highlighted two groups of people who contact us – those who know they need help (who find us through online search) and those who know there is a problem but haven’t realized how much it was affecting them (who have found us through our campaign).

For many years leading up to this campaign, there had been a significant increase in online activity due to a concentrated effort to improve website traffic through extensive SEO and pay-per-click activities. However in the year prior to the launch of the campaign, web traffic increased 52%, yet counselled appointments only increased by 10%.

b)Excluding Other Factors

Spending Levels:

The advertising budget increased from $1.5M to $1.8M during this period, an increase of 20%, but insignificant given the geography covered by the organization.

Pricing:

There is no cost for phone calls or counselling appointments prior to or during the campaign period.

Distribution Changes:

Counselling appointments are available in-person or by phone. The coverage area of our service did not change during this time, nor did the market list of our media plan. A one-person counselling office was added in Saskatoon in October, 2014.

Unusual Promotional Activity:

None

Other Potential Causes:

Other outside events that can impact our service include shocks to the economy or increases in interest rates that affect a consumer’s ability to pay their debt. Neither occurred during the period of the campaign.