Kraft Peanut Butter

Off to a Good Start (SILVER)

Client Credits: Kraft Canada

Leisha Roche – Senior Director Grocery Brands

Amy Rawlinson – Brand Director, Kraft Peanut Butter

Aaron Nemoy – Senior Brand Manager

Ananda Smith – Associate Brand Manager

Agency Credits: TAXI

Jeff MacEachern – Executive Creative Director

Kelsey Horne – Associate Creative Director

Alexis Bronstorph – Associate Creative Director

Melissa Zeta – Digital Designer

Cynthia Heyd – VP, Integrated Production

Steve Emmens – Executive Producer

Nicole Poon – Agency Producer

Justine Feron – Senior Brand Planner

Leanne Goldstein – Account Director

Kirstin Bojanowski – Account Director

Stacy Ross – Account Manager

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | April 2014 to December 2014 |

| Start of Advertising/Communication Effort: | April 2014 |

| Base Period as a Benchmark: | January 2013 to December 2013 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

For decades Kraft Peanut Butter (KPB) has been a staple in our pantries with three quarters of Canadians eating it every single week. But despite its long-standing position as market leader, new competitors had regularly begun showing up on shelves and the category was quickly becoming commoditized. In addition to direct competitors, KPB was also losing share to the influx of nut spreads like almond, cashew, and soy nut butters that were barely on the radar just a few years prior. These nut-based spread options were rapidly expanding and KPB was neither the newest, healthiest, nor the cheapest.

Functional offerings like quality, nutrition, and freshness are important to consumers but are also considered cost of entry to the category. So how does a 50-year-old product with no news or functional differentiators drive consumption and brand love? We needed to make a connection with consumers by offering something beyond what our competitors were offering. We needed to show them that we care about the same things they do or we’d risk continuing to fade into the background.

b) Resulting Business Objectives

Given these market challenges, Kraft Peanut Butter was at risk of eventually losing its market-leader position. We were a beloved brand being pushed to the sidelines by new competitors, many of which offered a less expensive but otherwise identical product. Despite these headwinds, our business challenge was to stimulate growth in a mature category driven by price. To realize this very lofty ambition, our priority was to recoup lost penetration. Kraft Peanut Butter was by far the market leader in the category but coming off a year where we’d seen our penetration dip as a result of pressure from competitors. The brand seemed fated to continue ceding share to competition that offered newer, trendier, and often cheaper products, yet we were being challenged to reverse this trend – a tall order.

c) Annual Media Budget

$2 – $3 million

d) Geographic Area

Canada

Section III — STRATEGIC THINKING

a) Analysis and Insight

In order to sell more peanut butter, we needed to figure out a way to stand out next to the competition in a way that was meaningful for our target – millennial parents. From a price and product perspective there was no reason to choose KPB. For just about every functional attribute, we were either at parity or worse than our competition and didn’t have the health credentials of the new nut butters.

We set out to understand how KPB had become a national icon in the first place. So we talked to Canadians and discovered that many saw peanut butter as more than just food. For many, peanut butter brought to mind notions of unity. Many recalled fond memories of their family coming together at the breakfast table over peanut butter. It was a food that our parents fed to us as kids, and it was a food that we in turn fed to our own kids.

Our Insight – KPB was such a beloved food in Canada, precisely because, for years, it had brought families together.

b) Communication Strategy

Our rich heritage as an iconic Canadian brand made Kraft Peanut Butter uniquely positioned to tap into this association. Not only did peanut butter bring families together but KBP was in fact the brand that had been bringing Canadians together for years. We explored the concept of meaningful connections and how it has evolved over the past few decades. We realized that while its importance hadn’t diminished at all, actually coming together to spend quality time with family had become increasingly elusive. We’re travelling farther, working longer, and commuting more. Even when we’re at home, we’re often preoccupied and distracted. We still yearn for things that bring us back and bind us. They’re just getting harder to find.

Our Strategy – Our insight of peanut butter being a Canadian unifier became the inspiration for a new brand purpose for KPB that was equal parts ambitious and distinctive – so we set out to create meaningful connections in Canadians’ lives.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

- TV

- Online video

- Facebook video

- In-store display

b)Creative Discussion

2014 marked the start of a complete brand overhaul for Kraft Peanut Butter, leveraging the iconic bears from our logo and elevating the brand purpose to tell a story of how Kraft Peanut Butter helps Canadians come together. The name of the campaign and its tagline was “Stick Together.”

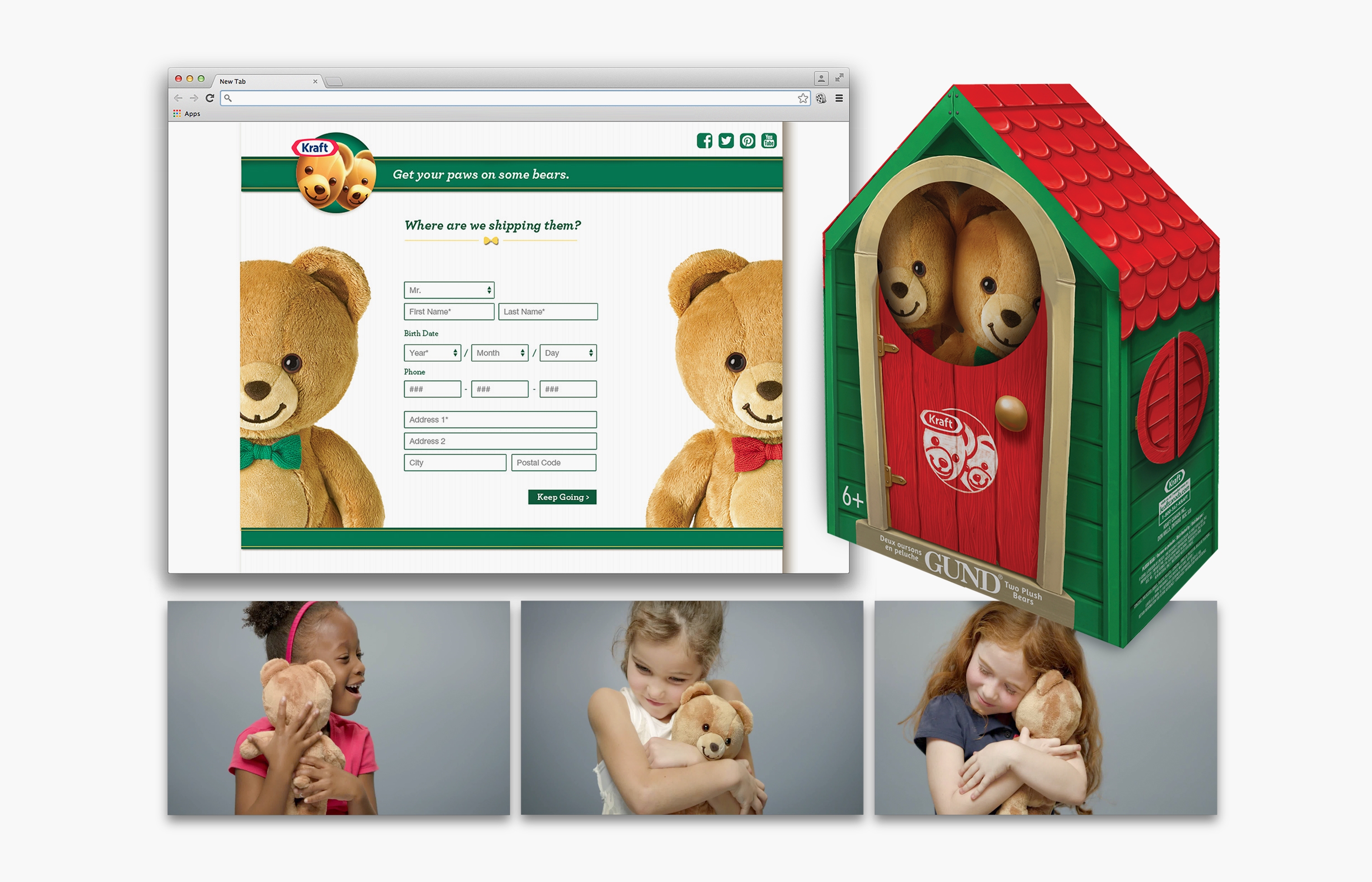

“Stick Together” brought Kraft’s much-loved teddy bears from the jar and put them front and centre to serve as our icons of togetherness. Our hero TV spot Lifelong Love utilized the Kraft bears to tell a story of human connections. It tells the story of growing up and the importance of staying connected to the ones we love through the years. After its launch, the Kraft Peanut Butter community was ignited with love for the bears and questions about where they could buy them.

“Lifelong Love”

We responded to this enthusiasm by creating Crunchy and Smoothy – two soft GUND plush replicas of the Kraft bears. With these bears we had two tangible representatives of the brand and a conduit of meaningful connections right in the hands of our consumers. We followed Lifelong Love with Friends Forever, a short video announcing to Canadians that they could now get their own bears. The video showed the slow-motion, elated reactions of children as they met the Kraft bears for the first time. The video linked directly to Kraft Canada’s e-retail site where consumers could purchase Crunchy and Smoothy.

E-Retail Site & Priceless Reactions

c)Media Discussion

We developed a three-pronged media strategy to deliver our message of togetherness and meaningful connections to Canadians:

- Establish our purpose – The role of this stream was to make Canadians aware of our new point of view and the tension we committed to help resolve. To do so, we would leverage a national TV and online video buy to ensure proven breakthrough levels for creative in order to accelerate awareness of our brand purpose.

- Drive to hub – In this stream, we would leverage digital display and paid search to allow people to meaningfully connect to our message by inviting them to visit our hub from environments where they consume similar content.

Social always on – Here we would use promoted social content on Facebook and Twitter to consistently share our point of view and encourage Canadians to create their own meaningful connections through a year-long presence on the platforms where our target spends considerable time.

Section V — BUSINESS RESULTS

a) Sales/Share Results

We achieved our objective of reversing a declining penetration rate for KPB within the category. Following a year when KPB had lost share to our competitors, we were able to turn the business around and achieve the brand’s highest penetration ever, with an increase of 1.6 percentage points. Even more impressively, we were able to achieve this growth in a year where overall category penetration went down.

Not only did penetration improve but we also saw a significant increase in volume sales as a result of the “Stick Together” campaign. During this same period, we generated a 4.5% increase in baseline volume compared to the previous year.

b) Consumption/ Usage Results

Our launch spot Lifelong Love, which introduced our new brand purpose to Canadians, clearly struck a chord with our target. In testing, it generated above norm levels of enjoyment (78%) and ability to hold consumers’ attention (71%). Once on TV, Lifelong Love far surpassed industry norms on several key metrics including driving a 91% purchase intent and an outstanding 89% ROI (vs. industry average of 54%).

c) Other Pertinent Results

During the first six months of our campaign, we saw a 275% increase in engagement rate on Facebook compared to the previous six-month period. The Friends Forever digital video was viewed over 530,000 times, and the campaign garnered over 8,600,500 impressions over 127,000 unique user engagements across our social platforms. The video successfully announced the arrival of the KPB plush teddy bears, and we quickly sold all of the 7,500 Crunchy and Smoothy bears available online – and an additional 80,000 bears in-store.

d) Return on Investment

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

The impressive social metrics and testing results indicate that the “Stick Together” campaign strongly resonated with Canadians. But it did much more than simply tug on their heartstrings, it persuaded them to buy more peanut butter. Given KPB’s long-standing position as market leader and the influx of new competitors, an increase of 1.6 percentage points in penetration is a major achievement. This increase took a brand that had been around for over five decades to its highest-ever penetration at a time when one would expect KPB to be giving up share to competitors. Perhaps equally impressive is that during this time period not only did more people buy KPB, but those who did also bought more often with a volume increase of 4.5 percentage points compared to the previous year.

b)Excluding Other Factors

Spending Levels:

N/A

Pricing:

N/A

Distribution Changes:

N/A

Unusual Promotional Activity:

N/A

Other Potential Causes:

N/A