Tim Hortons Dark Roast

Off to a Good Start (SILVER)

Client Credits: Tim Hortons

Peter Nowlan, Chief Brand and Marketing Officer

Glenn Hollis, VP, Brand Strategy and Guest Experience

Dave McKay, VP, Category Marketing

Dana Brochu, Senior Director, Beverages

Karen Paradine, Senior Manager, Marketing Communications

Joanne Stewart, Director, Marketing Communications

Agency Credits: J. Walter Thompson

Brent Choi, Chief Creative & Integration Officer

Ryan Spelliscy, SVP, Creative Director

Matt Syberg-Olsen, VP, Creative Director

Paul Wales, Creative Director

Dan Bache, Art Director

Henry Park, Copywriter

Elana Olavesen, Senior Producer

Darrell Hurst, EVP, Managing Director

Renee Ray, Account Director

Cameron Stark, Account Supervisor

Director: Neil Tardio

Production Company: Partners Film Company

Post-Production: Alter Ego

Editing: Married to Giants (Geoff Ashenhurst)

Music: Tattoo Sound & Music (Tyson Kuteyi)

Media Agency: Mindshare

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | August 2014 through to July 2015 (12 months) |

| Start of Advertising/Communication Effort: | August 2014 |

| Base Period as a Benchmark: | 2013 Calendar Year |

Section II — SITUATION ANALYSIS

a) Overall Assessment

Tim Hortons sold over three quarters of the coffees sold to Canadians outside their home every day. In many categories, that would be reason to celebrate. The problem was, that number used to be in the eighties. In that last seven years, our share had been slowly but consistently eroding.

There were two clear problems:

1. Brewed coffee consumption in Canada was flat, with more and more competitors coming into the market, both in retail and foodservice.

2. Canadians’ coffee tastes were changing. The average Canadian was not just asking for the ‘Double Double’ anymore. They had become accustomed to drinking more than one blend. Relentless competition from Starbucks and the influx of smaller craft coffee houses had introduced a new language around and appreciation for coffee that piqued consumers’ interests and taste buds.

On top of that, McDonald’s continued to actively court those same consumers with aggressive promotional offers (e.g. $1 coffee, free coffee – 14 times!) all in an attempt to win that coveted morning coffee ritual. McDonald’s recognized that winning with coffee would strengthen their valuable breakfast program. With the re-launch of their coffee program in April 2009, McDonald’s was able to more than double their share – 4% to 11% – supported by a sustained marketing plan consisting of awareness and trial drive activities, quality messaging and brand building.

Consumers who had once passionately stuck with one coffee brand were now exploring, seeking out different tastes for different days, moods and times. Consumer loyalty to one of Canada’s most trusted and iconic brands was being challenged.

The simple solution would be to just start introducing frothy, fancy, exotic coffee options to our consumers and get all of those occasions back. But that wasn’t going to be so easy. With the landscape changing, our greatest strength – our consistent, never wavering, always-there-for-you cup of good old Tims – was now a potential impediment. We’d been making the same blend of coffee for 50 years. There was no denying, it was a great cup o’ Joe. Even more than that, we embodied the “Every-Canadian,” steady, hardworking, reliable and honest. Great qualities, to be sure, but could a company that had been doing the same thing for 50 years all of a sudden do more? And more importantly, SHOULD they?

We knew there was a huge opportunity to rise up and meet the evolving consumer tastes, but we were going to be deliberate and purposeful. We elected to launch a Dark Roast blend for two reasons. First, it was the most popular and growing blend trend in the market, and second, it was the most logical taste evolution for our brand. This Dark Roast had to be designed to deliver on the consumer expectations of a Dark Roast, while being relevant and appealing to the mainstream coffee drinker. A roast with an overwhelming bold and bitter taste would not appeal to everyday coffee drinkers from coast to coast, from big cities to small towns. The Dark Roast had to be rich and full flavoured, with a smooth finish. The research and development team at Tim Hortons developed the perfect Dark Roast for the Canadian coffee drinker.

Our challenge would be to introduce our new blend in a way that was in keeping with our brand values, but at the same time, signalled a significant change in our offering. With the reputation of Canada’s favourite coffee on the line, Tim Hortons knew this launch needed to excite consumers, and prove that the brand’s passion, expertise and leadership in coffee could extend beyond one blend.

b) Resulting Business Objectives

Our Dark Roast launch goals were ambitious, but straightforward:

- To reverse our share decline trend, delivering at the very least share stability YOY.

- To become a significant part of our coffee family, contributing at least 10% of the volume to our coffee portfolio. This would make it a sustainable offering that could become a permanent fixture on our menu boards.

- To set the foundation for the brand’s coffee leadership for years to come by credibly broadening our coffee offering.

c) Annual Media Budget

Over $5 million

d) Geographic Area

National Canada

Section III — STRATEGIC THINKING

a) Analysis and Insight

Right from the start, we understood who our consumer was. While there were very few rejecters of the Tim Hortons brand in Canada, our goal wasn’t to convert those who saw themselves as true coffee aficionados, but rather, we wanted to talk to those just starting out on their coffee taste adventure. There was a large group of consumers who, while they loved the idea of new and unique tasting coffee, were still a bit reluctant to try something new for fear of the flavour being overwhelming. These were the folks that most often described Starbucks coffee as tasting and smelling “burnt.”

Like so many other categories, our consumer was looking for a “safe adventure.” If we could get our flavour profile right, Tim Hortons was perfectly positioned, as one of Canada’s most trusted brands, to deliver just that.

A sensory taste test let us know we had a winner. Our new blend was seen as a rich, bold flavour offering, but with a much smoother finish than most Dark Roast offerings in the market.

With a winning product in hand, we went back to our challenge. How does a brand that has been doing coffee one way for 50 years, convince people we have a great new product? In many ways, tasting was going to be, believing.

We went back to school for our insight, playing off the scientific fact that when you remove one of your five senses, you heighten your other ones. For the Tim Hortons Dark Roast launch, we were going to take away people’s sense of sight to enhance the core ‘coffee senses’ of taste and smell.

b) Communication Strategy

Finding the right balance between letting our consumers know we had something new and exciting to offer, and letting them know it was coming from a brand that valued the trust they’d put in it over the years, wasn’t going to be easy. Traditional advertising could certainly play a role – after all, it was still an incredibly efficient way to reach all of Canada – but we wanted this launch to feel like news. We wanted our consumers to know this was a big deal for us; that we were really doing something different.

Creatively, we wanted to make something authentic. Over the years, our True Stories campaign had delivered that authenticity but we wanted to take it a step further, and decided to leverage our insight around the senses by giving actual consumers a chance to try our product. IN THE DARK.

The content we created coming out of that activation would become the foundation for the fully integrated launch of the product. For the first time in the brand’s history, the product’s launch to the media leveraged our creative content as a core element of the storyline. We leveraged the media themselves to help us share that content through social channels. For two weeks prior to the full national launch, the conversation focused on the unique way we brought this product to market. Once the broader campaign began, all channels (TV, OOH, sampling booths, in-store signage, digital) aligned under the “Embrace the Dark” call to action.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

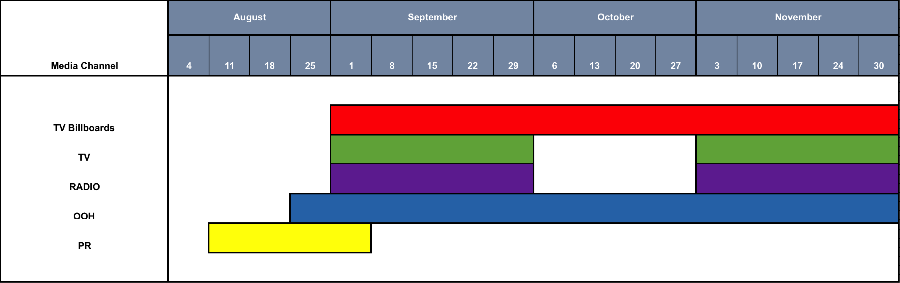

Blocking Chart:

b)Creative Discussion

As mentioned above, we wanted the launch of our first new blend in 50 years to still align with the brand’s values, but also create a sense of buzz-worthiness. We knew we could take our authentic tone to a whole new level. We set out to conduct a unique taste test experiment in complete darkness as our first step in building trial and awareness. With the help, commitment and trust of one of the chain’s owners, we wrapped a Tim Hortons restaurant all in black. And, as customers gathered with their curiosity piqued, we invited some of our braver guests inside. The restaurant’s pitch-black, sight-stealing interior provided the perfect platform to test Dark Roast’s taste profile – rich, with a smooth flavour, and an aroma to match.

The result was both real and in real-time, with consumer reactions captured, filmed and released online the same day the product was launched in-store and to the media. We invited consumers to “Embrace the Dark,” perfectly meeting their need for something intriguing, but in a way (and from a brand) they could trust. We also established easy product vernacular on social media by creating the #TimsDark hashtag so our consumers were able to find our content and stories, as well as share their own after they, too had tried the new blend.

c)Media Discussion

While broad awareness of the product was critical, the first two weeks of the campaign became the cornerstone of the brand’s demonstration that we were still just the same old coffee shop. We wanted conversation to focus on our new product but we invited the chatter about HOW we introduced Dark Roast. The power of the brand came through loud and clear in those early days, as consumers loved seeing the image of such an iconic brand in such a unique way, with a full store blacked-out from head to toe. We supported the launch on our own social channels to help our consumers discover the story. We complemented those efforts with a small investment in paid views on broader social channels as a way of further fostering the organic discovery.

Once the campaign launched in full force, we kept the messaging simple. While :30s TV continued to deliver the Dark Roast story through our Dark Store activation coverage, :15s and :10s became more product focused, as did our OOH and in-store messaging. Our sampling program also leveraged the Dark Store imagery as a mini extension of the broader stunt that kept the fun tone, while getting our product into consumers’ hands.

Section V — BUSINESS RESULTS

a) Sales/Share Results

Since the beginning of the Dark Roast launch:

- We have sold over 85 million cups of the coffee, which is particularly impressive in a country with less than 35 million people.

- Dark Roast sales, as part of our overall coffee portfolio, have surpassed our initial volume objective of 10%, now representing over 13% of the mix. At that level, the brand is able to effectively sustain Dark Roast as an important offering and now can boast a true “coffee family” of products.

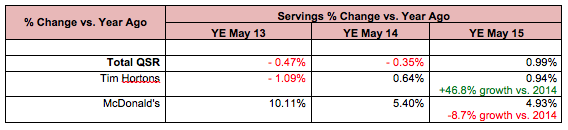

Perhaps most importantly, the launch of Dark Roast breathed new life into the out-of-home coffee market, as it showed its first positive gain (.99%) in over two years. Per Tim Hortons data, the Tim Hortons coffee portfolio had a +46.8% gain in volume over 2014, which seemed to come at the expense of McDonald’s as their share gain momentum slowed by almost half a point (-0.47%), a decline in growth rate of -8.7%. The net gain versus 2014 for Tims is the equivalent of over 4,000,000 servings of coffee annually.

b) Consumption/ Usage Results

N/A

c) Other Pertinent Results

With a goal of not just building awareness but actually creating conversation, by all accounts, our Dark Roast launch was a success. Right from the outset we had people talking. #TimsDark was the number two trending hashtag in Canada on its launch day.

The combined PR/campaign launch earned more than 91 million total media impressions and our hero #TimsDark video received more than 2.9 million views on YouTube in the first four months. In fact, the #TimsDark video was the most viewed YouTube video in Canada during its launch month in August 2014.

d) Return on Investment

With a share point representing approximately 14 million cups of coffee (at approximately $2 per cup), the brand’s return on its initial investment is significant. The brand had momentum back in its favour. After years of flat category and brand growth, the Dark Roast launch represented an increase in the brand’s share gain momentum, and helped to blunt the ongoing growth of our most aggressive and significant competitor, McDonald’s.

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

While the short-term sales results speak for themselves, the effect of the Dark Roast campaign will be seen down the road, as the coffee category continues to fragment, with new offerings, brands, flavours and blends being introduced at a more rapid pace. What we do know is that Dark Roast has made an impression on Canadian coffee consumers and the advertising campaign helped to bring this brand to their attention with over 80% of consumers having heard of the product (an incredible number for a new product) and over 60% having noticed the advertising in English Canada and 70% in French Canada.

b)Excluding Other Factors

Spending Levels:

While Dark Roast represented a significant launch for the Tim Hortons brand, the investment in the program was not significantly different than any other product launch the brand has had over the years. Whether it’s a breakfast sandwich, a new soup offering, a cold summer beverage – or a new coffee blend – the investment level is fairly consistent. In addition, the brand’s overall investment in coffee support remained very stable versus previous years.

From a competitive spending standpoint, McDonald’s represents our most active competitor. They have, over the years, significantly outspent Tim Hortons in the coffee category and 2014 was no difference with McDonald’s coffee spend tracking a whopping +29.4% higher that Tim Hortons’ spend. That significant media investment in the coffee category, along with aggressive pricing, has led to their share growth and momentum over the past few years.

Pricing:

Pricing was in line with our regular coffee. While McDonald’s will often put their coffee on promotion with either $1 coffee, coffee-and-muffin combo offers or free coffee programs, Tim Hortons has always shied away from discounting their coffee and the Dark Roast launch was no different.

Distribution Changes:

Distribution on a national product covers the full store network of over 3,500 stores. While McDonald’s has over 1,400 stores across the country (a ratio of 0.4 to 1), our Dark Roast sales alone during the first full year of launch represents over HALF of all McDonalds coffee sales. Most importantly, our gap in total coffee servings has grown for the first time since 2012 and we now sell over 6.5 times as many servings of coffee as our nearest competitor.

Unusual Promotional Activity:

N/A

Other Potential Causes:

N/A