Interac Be In The Black

Services (SILVER)

Best Launch (BRONZE)

Client Credits: Interac Association

INTERAC Association: Barry Campbell; Vice-President, Client Management and Marketing

INTERAC Association: Andrea Danovitch; Director, Marketing and Brand Strategy

INTERAC Association: Jennifer Lee; Senior Marketing Manager

INTERAC Association: Hizola Toovi; Marketing Specialist

INTERAC Association: Lauren McKay; Marketing Coordinator

Agency Credits: Zulu Alpha Kilo

Advertising Agency: Zulu Alpha Kilo

Chief Creative Officer: Zak Mroueh

Executive Creative Director: Ron Smrczek

Art Director: Allan Mah; Shawn James; Grant Cleland

Writer: Nick Asik; David Horovitch; Atkinson; George Ault

Producer: Jennifer Cursio; Kari Macknight Dearborn; Tara Handley; Kate Spencer

Account Team: Rob Feightner; Laura Robinson; Adrian Goodgoll; Kait Babin

Strategic Planner: Ebrahim El Kalza

Media Agency: Media Experts

Media Team: Richard Ivey; Phil Borisenko; Jenna Piirto; Lauren Rosenbloom; Daniel Mak

Production Company: Sons and Daughters

Director: Quinn,David Hicks

Production House Producer: Joan Bell; Rita Popielak; Sons & Daughters

Sound Production House: Vapor Music

Visual Effects & Online: Topix

Recording Studio: Pirate Radio

Audio Director: Chris Tait

Production Company: Marianne Klein; Brahaus Productions

Locations: Daniel Kaplan; Dank

Photographer: Jamie Morren; Zulu Alpha Kilo

Video Post Facility / Editing Company: Saints Editorial

Editor: Brian Williams

Compositor / Online: James Andrews/AXYZ

Colourist/Transfer: Alter Ego

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | March 2014 – June 2015 |

| Start of Advertising/Communication Effort: | March 3, 2014 |

| Base Period as a Benchmark: | March 2013 – June 2014 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

For 28 years, Interac has been synonymous with debit acceptance in Canada. Canadians rely on Interac 12 million times a day to pay, be paid, withdraw cash and transfer funds electronically.

But despite enjoying near universal brand recognition, consumers struggled to explain what Interac is or what it does. (Is it a product? A service? A company? A brand?) That’s because they don’t actively choose to use Interac – anyone with a bankcard is automatically enrolled. People were, essentially, taking it for granted.

It isn’t widely known that Canada is the last bastion on earth for low-cost debit – Interac’s debit system is not-for-profit. In virtually every developed country, debit systems have been co-opted by the likes of Visa and MasterCard. They lure in merchants and consumers with rewards just long enough to gain a dominant share of the market, only to increase prices of all goods and literally tax an entire nation’s goods and services economy.

Much like gravity, or oxygen, the only circumstance most of us would have to care about Interac would be its absence. But by then it would be too late.

In early 2014, a confluence of factors were setting to drastically change the landscape and threaten Interac’s core business:

- Shift in public attitude toward credit card use: It used to be taboo to put essentials like groceries and small items like coffee or gum on credit. With the proliferation of loyalty programs and cash back cards, more and more consumers are putting everything on plastic in order to maximize their points.

- New competitive threats in the category: Niche players such as Square, PayPal and Crinkle are making a strong push to upend the payment space through technical innovation. Visa, MasterCard and AMEX – through initiatives like #smallenfreuden, co-branded debit cards and prepaid credit – are encroaching on Interac’s territory.

- Visa launches a debit product: Visa Debit, in particular, was setting the stage for a direct attack against Interac’s core business – a move that would ultimately create even further consumer confusion and potentially push Interac Debit out of the Canadian market altogether.

As a result of these forces, the brand was experiencing a year-over-year trend of decreasing share of mind – it had to act as a matter of survival. It needed to define its role in the minds of consumers and reinvent itself with a meaningful point of view that would give Interac leverage in an increasingly cluttered payment space.

b) Resulting Business Objectives

The brand needed to re-launch in a way that (a) defined what Interac is and what it provides; (b) differentiated Interac vs. credit cards; and (c) gave Interac “cultural currency” and relevance to today’s consumer.

With the intensifying competitive threats, Interac was anticipating a decline in debit transaction volume growth. They had managed in the previous period of capturing 4.2% growth of an overall growing transaction market, however this year was going to present an enormous challenge. They set a lower, yet still aggressive, goal of 3% volume lift in recognition of the trends and factors working against them. With no new product development or offering, we needed the new platform and advertising to do the heavy lifting. We needed improved advertising awareness, brand link, relevance and motivation.

c) Annual Media Budget

Over $5 million

d) Geographic Area

Canada, National

Section III — STRATEGIC THINKING

a) Analysis and Insight

Household debt in Canada is at an all-time high, totaling $505 billion this year alone – a 64% jump in just over a decade. In fact, 1 in 8 Canadian households is now heavily indebted with debts greater than 250% of disposable income.

The increasing proliferation of credit cards is one of the main reasons for this ballooning debt. Consumers have become dependent on them, often financially overextending themselves until they spiral out of control. This is particularly true of our core target segment, “Angels and Demons,” who start off each month wanting to be “good” financially. They say to themselves, “This is the month I’m going to do better,” only to fall off half way through and crash into the emotional downside of being in debt at month’s end.

Unlike credit cards, Interac gives Canadians the easiest and most familiar way to pay with their own real money – so they don’t go into debt with each purchase. That means never paying a cent of interest, or ever receiving a bill.

Our discussions with consumers revealed that people who use Interac in their daily lives feel more on top of their money. They feel more confident and in control of their finances, and as a result, feel more relaxed, capable and optimistic in the rest of their lives. And, they have fewer feelings of anxiety, which often come with heavy credit card usage and debt.

In a nutshell, our insights boiled down to the idea that life feels better when you use your own money (instead of credit). It was a truth that strongly resonated, giving the Interac brand an emotional benefit beyond its functional use, something truly meaningful to stand for and own; a purpose that could fuel the entire organization and connect with an increasingly debt-ridden public.

And the best part was that in spite of Visa’s foray into the debit space, it was a positioning that Visa (nor any of its credit card competitors) could encroach upon, because their brands are fundamentally anchored in credit and debt. In other words, a credit card company could never credibly take a stand against debt.

b) Communication Strategy

Recognizing that Interac would be outspent media-wise by global behemoths (Visa, Mastercard and American Express), we knew that radical change was needed: A full 360-degree rebrand that would touch every part of the organization and influence a bold new creative platform for the category.

The communication strategy set out to empower consumers to use the money they have for everyday purchases – from coffee to gas to shoes for the kids – in order to feel better about and more on top of their daily spending. And it would involve going after the credit cards head on, with their high interest rates and the debt that ensues, recognizing that this was an approach the Visa’s and MasterCard’s of the world would never do with their debit card offerings. We would position Interac as the everyman’s antidote to credit cards and debt.

Section IV — KEY EXECUTIONAL ELEMENTS

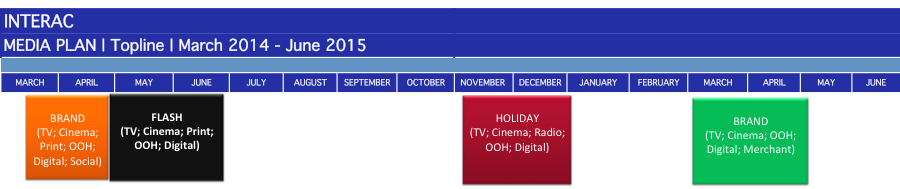

a)Media Used

b)Creative Discussion

Flipping the debt-laden phrase “in the red” on its head, we coined the statement Be in the Black as a memorable rallying cry calling for Canadians to be financially responsible, to choose to use their own money, and to feel amazing for doing it.

Be in the Black became a compelling call-to-action to re-energize the entire Interac organization. It inspired a new, more contemporary visual identity to ensure the Interac brand would consistently stand out at every unique touch point, fueled product development plans, re-framed employee behaviours and drove the rebranding of a new B2B product.

Launch Creative: We launched our new brand platform March 3, 2014 in mass media with a 60-second television spot celebrating Canadians making the choice to “Be in the Black.” In the commercial, everyone who chooses to pay with Interac is made to feel like a true rock star, backed up by the AC/DC track “Back in Black,” to reflect a hipper, more upbeat personality for the brand.

Knowing that the vast majority of method-of-payment decisions are made in the moments leading up to the purchase, we reinforced our narrative with thought-provoking and proximity-based OOH that gave consumers further reason to pay with Interac. Headlines like: “Reduce stress by 19.7% a month,” “No interest in paying interest?” and “Make a payment. Not payments” served as nudges in busy shopping districts, reminding consumer of the costs of using credit, without coming off as preachy or patronizing.

Building on the consumer tendency to capture and share pictures of their most recent purchases, we amplified the new Interac Be in the Black campaign launch with a Twitter and Instagram social promotion that encouraged people to share a picture of their Interac Debit purchases with #IntheBlack. A weekly winner would receive $500 and get a personal shout-out through Interac’s various social channels.

Retail Creative: On the heels of the brand launch, we shifted to product-specific executions for Interac Flash – a contactless way to use Interac that we dubbed “the faster way to pay with your own money.” Expanding the Be in the Black creative platform, we created humourous 15-second spots where Interac Flash empowers our hero to buy whatever item he/she needs as quickly as possible, resulting in his/her guilt-free relief. By dramatizing Interac Flash making life “feels better,” the spots served as a light-hearted metaphor for the relief that comes from being debt free.

We leveraged Interac’s key retailer partnerships, including 7-Eleven to reach a younger demographic. An online video featured the hidden-camera reactions of customers receiving a surprise Flash Dance performance after paying with Interac Flash, and was extended through frosh week at select universities. The subtext was that every step one takes toward being debt-free is worthy of celebrating.

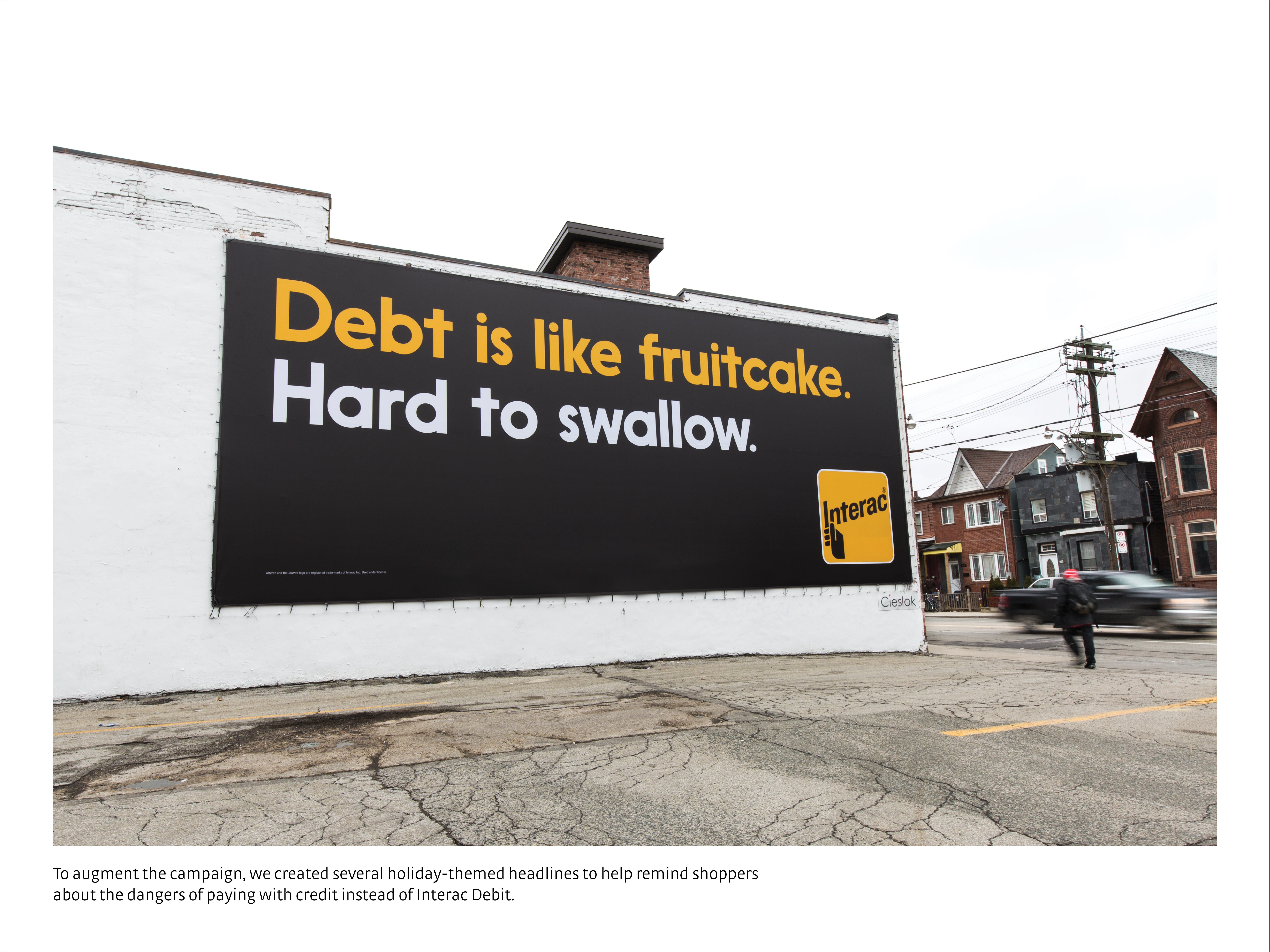

Holiday Creative: Then, in the lead up to the year’s busiest retail period, we personified the angst and stress of the nasty January credit card statement by introducing “Holiday Bill” – a large, annoying man dressed up as a giant credit card bill. TV and radio spots depicted him as a monkey on the back of over-spenders. These were paired with provocative OOH and digital ran headlines such as “Debt is like fruitcake. Hard to swallow.” “Have a merry January,” and “Ho, ho, ho. Not owe, owe, owe.”

For added impact, we used ambient installations at key shopping districts within Toronto, including a giant snowball made of real credit card bills with the headline “Don’t let debt snowball.”

Sustaining Creative: Most recently this spring, we re-deployed proximity based creative to continue to reinforce the stress of credit card debt.

c)Media Discussion

Our channel and media strategy was to dominate key markets to get our message across on a mass level, with a specific focus on reaching consumers when and where it mattered most – in front of retailers and at point of purchase – encouraging them to make a more responsible payment choice. Consumers were quite literally surrounded by single-minded, bold messaging that could not be ignored while making everyday purchases like gas, groceries, coffee and clothing. It was our job to get them thinking about Interac as a choice – the feel better choice – every time they open up their wallet to pay.

Section V — BUSINESS RESULTS

a) Sales/Share Results

In spite of the forces working against us – the growing trend of people using credit cards for even small purchases and the increasing thunder of competitive threats, including the launch of Visa Debit – Interac not only beat it’s 3% transaction volume growth goal over the campaign period, but it overachieved last year’s period of 4.2% growth.

Remarkably, Interac achieved 5.2% transaction volume growth from March 2014 – June 2015, an increase in growth of 24% over last year same period and 73% over their business goal.

For the first 12 months in market, the Interac rebrand has played a critical role in influencing payment choice, with consumers conducting an impressive 235 million more Interac transactions than the same period before launch. From March to May 2015, transactions continue to grow at a rate of +5.7.

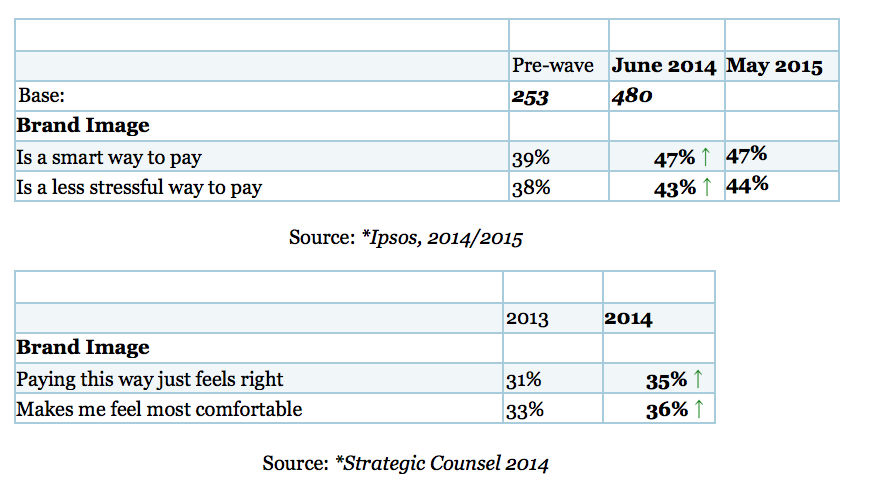

In addition, there was a marked increase in important brand image measures that were maintained over the course of the campaign period. These image measures are relevant to the new positioning, and key to creating a stronger emotional connection to the brand.

b) Consumption/ Usage Results

See above

c) Other Pertinent Results

See above

d) Return on Investment

See above

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

Throughout the campaign, there is strong evidence the advertising broke through and impacted perceptions and behaviour.

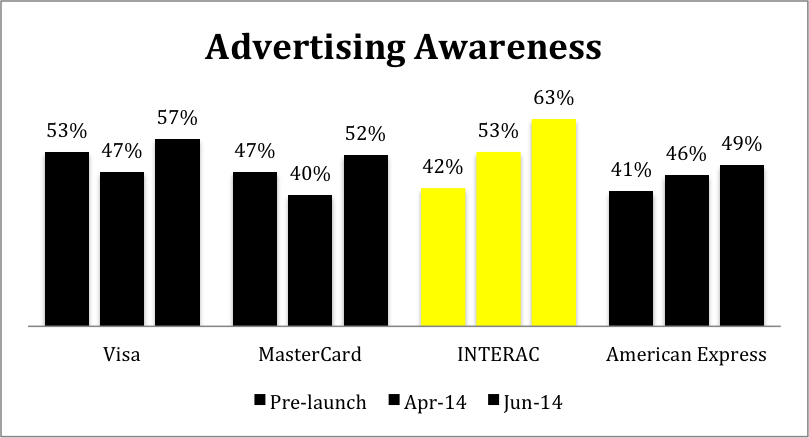

Ad Awareness: Over the launch and retail phase, advertising awareness for Interac increased by 50% from pre-launch levels and outperformed our key credit card rivals. Additional tracking waves at holiday and Spring 2015 continued to show Interac maintaining ad awareness leadership in the category, in spite of being grossly outspent.

Source: *Ipsos, 2014/2015

Branded Breakthrough: Not only was awareness strong, consumers were correctly associating the advertising with Interac. Strong branding cues within the entire “Be in the Black” campaign resulted in strong brand link right from the start, outperforming the Ipsos norm (0.79 vs 0.53). Branded recall maintained high levels throughout the year, with 2014 holiday achieving a 0.72 brand link ratio vs. 0.32 for the previous year’s holiday advertising.

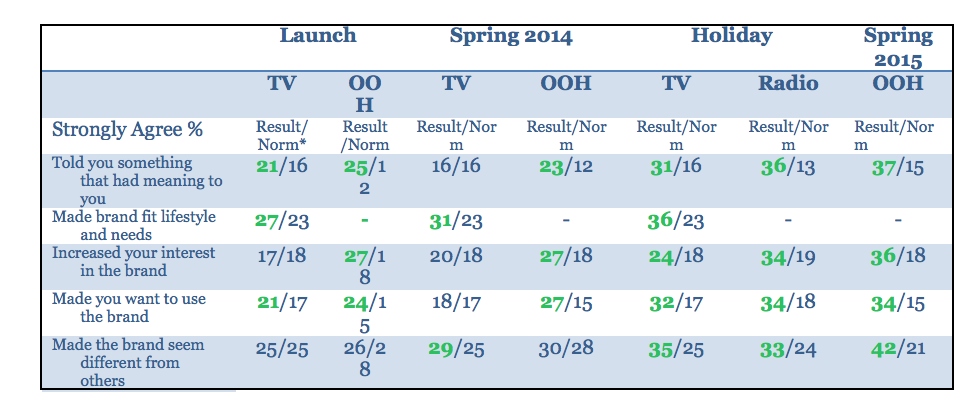

Message Effectiveness: Among those who recalled the advertising, it was highly effective at impacting relevance, motivation to use, and uniqueness. Rather than subsiding over time, it grew even stronger over the course of the year.

*Note: Norms vary by media and weight levels

Source: *Ipsos, 2014/2015

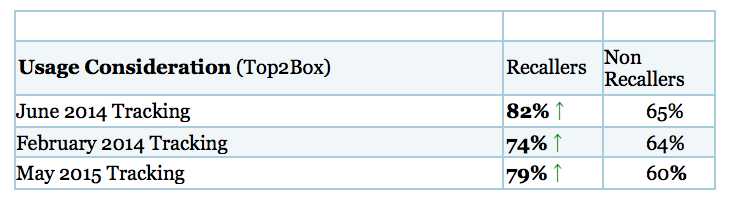

The advertising also significantly impacted Usage Consideration among those who recalled any element of the campaign.

Source: *Ipsos, 2014/2015

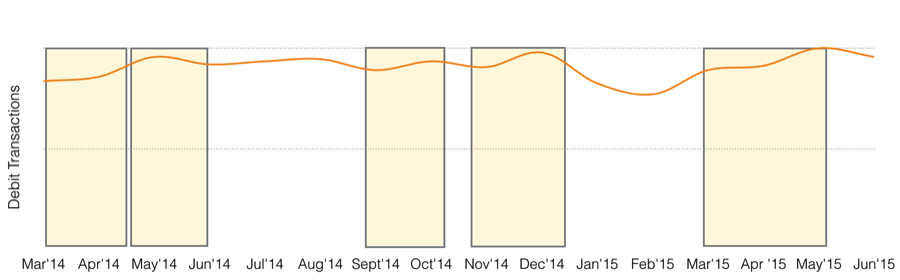

Impact on Behaviour: Finally, to demonstrate advertising’s effect on actual behaviour, this chart depicts the campaign flighting (orange bars) relative to debit transaction volume (orange line).

b)Excluding Other Factors

Spending Levels:

Spend level of media and production was consistent YOY (for same period) at $10M.

Pricing:

There was no discount or cash incentive offered to consumers for choosing to pay with Interac. However, it is worth noting that most banks raised the price they charged most customers for using ATM machines and Interac debit, from $1.00 to up to $3.00 in some markets. The banks set and keep 100% of these fees. Interac debit’s prices remained steady and are non-profit as stipulated in the payment Code of Conduct.

Distribution Changes:

Distribution has never been an issue for Interac as it has always been available on all Banking Debit Cards in Canada. There was no change to this (positive or negative) during the campaign period.

Unusual Promotional Activity:

There was no special promotional activity during the campaign period.

Other Potential Causes:

This Interac case is based on an existing (unchanged) product. There were no new product innovations or enhancements to the product during the campaign period.