Dry Spray Launch (Unilever Canada)

Off to a Good Start (BRONZE)

Client Credits: Unilever Canada

Ricardo Martin, VP Brand Building, Canada

Jessica Grigoriou, Director – Hair Care and Deodorants

Meghan Jones, SBM Brand Building, Dove & Degree Deodorants

Amanda D’Ortenzio, Senior ABBM Brand Building, Degree Deodorants

Jordan Gleed, ABBM Brand Building, Degree Deodorants

Sarah Zargarpour, Senior ABBM Brand Building, Dove Deodorants

Lynn Caiger, Shopper Marketing Team Lead

Melissa Kang, Shopper Marketing Manager

Toula Stathopoulos, Shopper Marketing Manager

Stephanie Lombardi, Shopper Marketing Manager

Izabela Kvesic, Shopper Marketing Manager

Caroline Forcier, Shopper Marketing Manager

Agency Credits: Ariad Communications

Tracy Smith, Vice-President

Sofia Costa, Senior Account Director

Jeff Lynch, Senior Account Director

Kim Yong-Set, Account Manager

Caitlin Hines, Senior Project Manager

Trevor Schoenfeld, Creative Director

Neil Woodley, Creative Director

Jeff MacGregor, Associate Creative Director

Radoslav Ratkovic, Head of Digital Design

Marianne Lau, Head of Design

Andrew DeAngelis, Copywriter

Damien Northmore, Senior Designer

Henry Eugenio, Senior Production Designer

Media Agency: Mindshare

PR Agency: Harbinger

Shopper Marketing Agency: Integrated

Shopper Marketing Quebec Agency: BOB Agence

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | January – June 2015 |

| Start of Advertising/Communication Effort: | January 5, 2015 |

| Base Period as a Benchmark: | January – June 2014 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

A complacent market

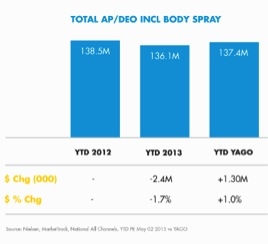

The anti-perspirant/deodorant (AP/DEO) category is highly commoditized. People shop the category on auto-pilot, often buying the same brand/format out of routine or switching due to price. There is little news or compelling innovation to jolt them out of this behaviour. This is a historically flat category with little incremental growth – and little to talk about.

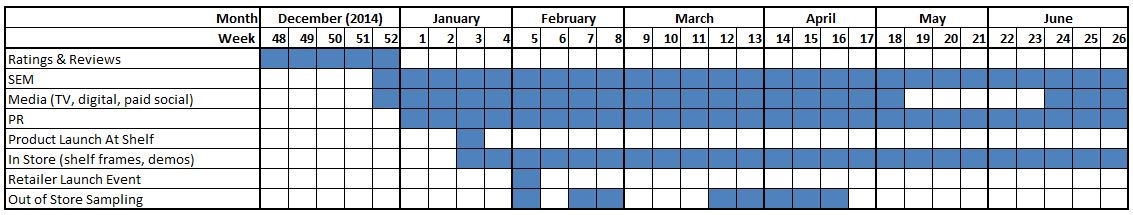

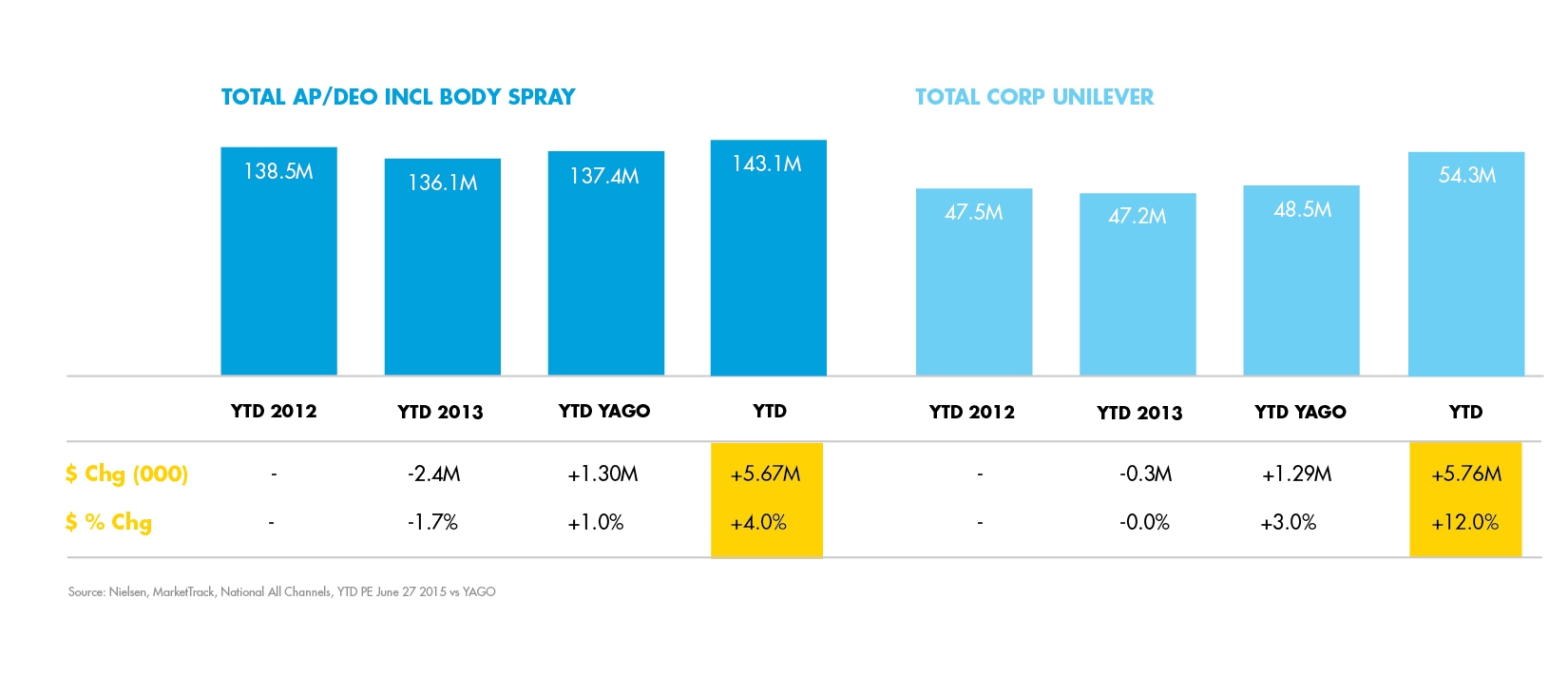

Total AP/DEO Sales for Last Three Years

Where format matters

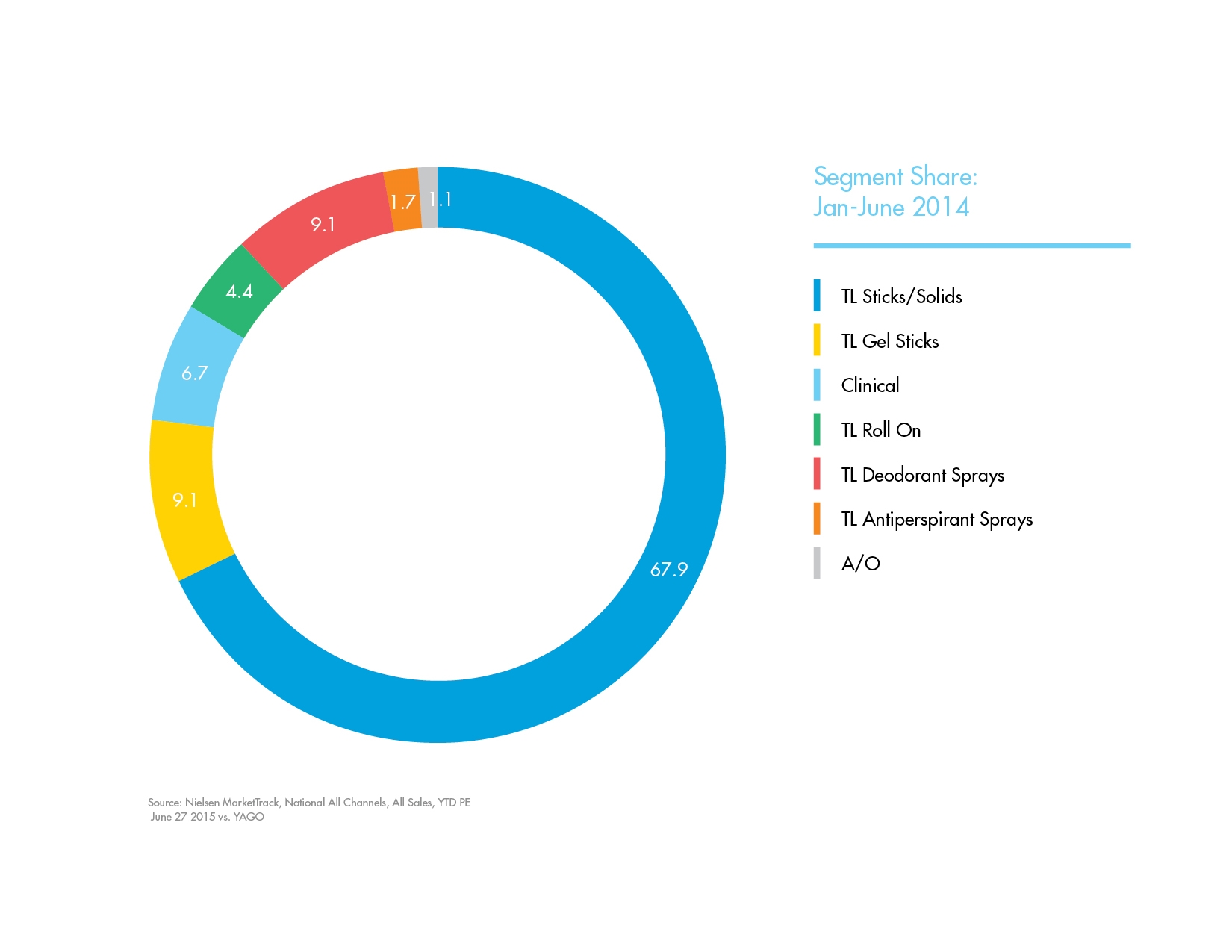

For decades, no manufacturer had a significant advantage in the AP/DEO category, which was comprised of sticks/solids, gels, roll-ons, and body sprays. Together, these made up 98% of the market share with sticks leading at 68%. Compare that to the global market (outside North America), where sprays dominated at 65%. Why the difference? While Canada only had traditional “wet” sprays, the rest of the world had an innovative Dry Spray format which went on instantly dry. Unilever saw potential in bringing this to Canada.

Big risk

The potential was big, and so was the risk. This was a massive step change for the category and Unilever went all in, launching 17 SKUs across 5 brands, including Degree Men, Degree Women, Dove, Dove Men +Care and AXE. It required major sales efforts and partnership with retail customers, who would need to overhaul the aisle to accommodate a new Dry Spray block at shelf. Amongst all of this, the launch required a change in consumer behaviour. We needed to generate attention, educate and drive consideration within a category no one really cared about. A failed launch would have major repercussions.

Big reward

However, a successful launch was a huge opportunity for a number of reasons. First, Unilever was the sole manufacturer of this format in Canada. Neither P&G nor Colgate had the technology. Secondly, due to Dry Spray’s compact size and premium pricing, Unilever had the opportunity to grow their own share as well as the category from both a volume and dollar share perspective.

Coming to a store near you

So with its compelling proposition, along with the chance to unlock unprecedented growth in the market, Dry Sprays poised Unilever for its best year yet. It was time for Dry Spray to come to Canada.

b) Resulting Business Objectives

Get men and women 27-34 years old (the “Discerning Millennial”) to trade up to new Dry Sprays by convincing them that this new format delivered a better experience than anything they had used before.

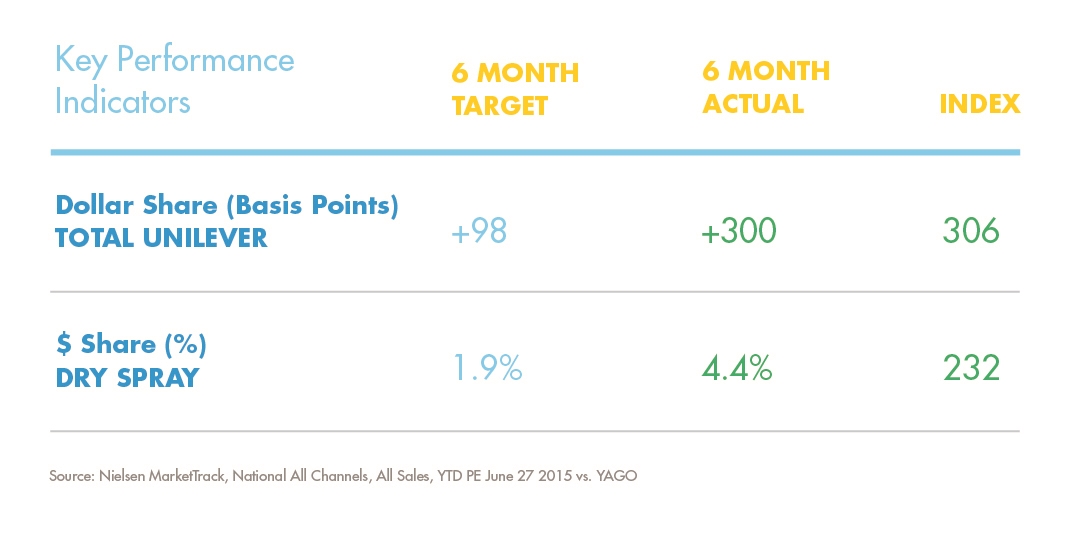

Specifically, we were measuring success against the following KPIs:

- Dollar Share Basis Points (Total Unilever): +98

- Dollar Share (Dry Spray): 1.9%

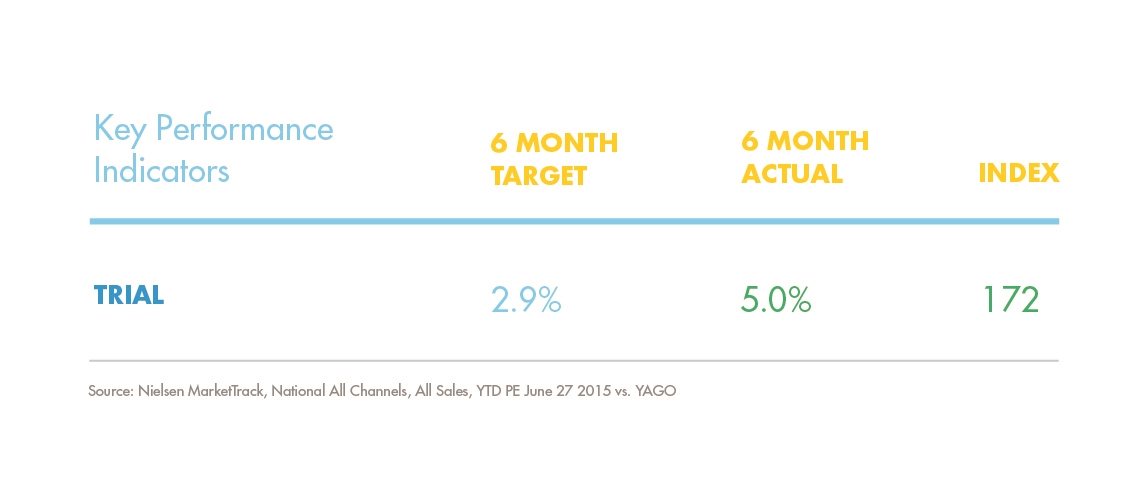

- Trial: 2.9%

- Repeat: 8.4%

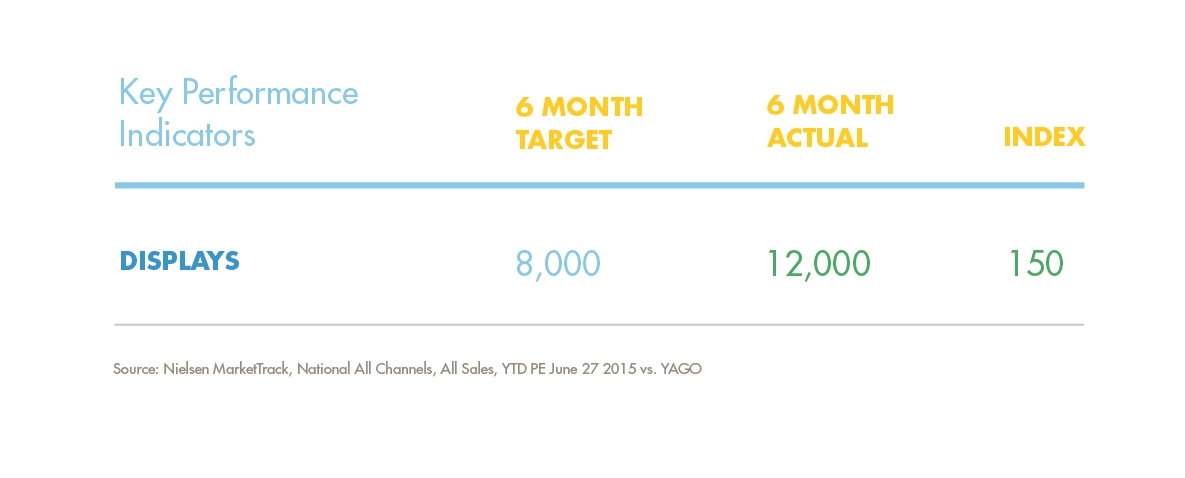

- # of displays: 8,000

c) Annual Media Budget

Over $5 million

d) Geographic Area

National Canada

Note:

The above are the targets for the first 6 months post-launch (January-June, 2015)

Section III — STRATEGIC THINKING

a) Analysis and Insight

People haven’t paid much attention to antiperspirant. But that doesn’t mean they were satisfied either. Sticks were known to create white marks while gels left a wet and sticky feeling. With Dry Sprays these were non-issues. But we needed to prove it.

To do so we developed a strategy laser-focused on awareness and trial. Awareness was a priority to announce that the category had tangible, innovative news, jolting our target out of complacency. Trial would allow them to experience the difference and superiority of Dry Sprays first hand.

For this strategy to be successful, relevancy was key. Following workshops with our target, we learned they had a tendency to wistfully reflect on when they first left home, had their first apartment, their first job, their first house. They had achieved many ‘firsts’ in life, and now sought that excitement elsewhere. They were early adopters, staying connected and current with the latest and greatest, while being open to a worthy value exchange and willing to pay for quality when they find it. These insights guided our communication strategy.

b) Communication Strategy

Creating excitement in a low-interest category

We needed to inspire our target to try and buy this new antiperspirant. Tapping into our consumer insight, we invited them to “Be the First” to experience Dry Sprays across all touch points. They were the first to see and learn about Dry Sprays through an innovative approach to media while through trial we invited them to be the first to #TryDry.

This included a pre-launch invitation-only seeding program, targeted media leveraging the combined strength of our individual brands, retailer activations and experiences customized by account, and sampling in contextually relevant areas where our target was. Everything we did was about driving awareness and trial, as fast as possible.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

- Ratings and Reviews

- Search

- Social

- PR

- Television

- Digital

- Retail Events

- In-Store Demos

- Out-of-Store Sampling

- Point-of-Sale and Displayers

b)Creative Discussion

Literally The First

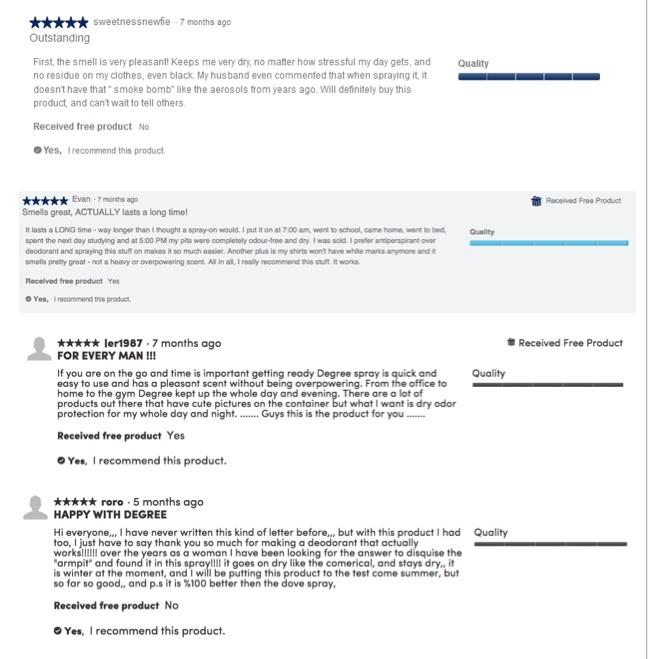

Pre-launch, we invited brand loyalists to be the first to try Dry Sprays in Canada. This allowed us to reward our consumers, collect reviews for our site and launch with instant credibility. Before we even went to market, Dry Sprays garnered a positive average rating of 4.7/5.

YouTube Takeover

At launch, we executed a YouTube Masthead takeover leveraging creative from the Degree brand. The Masthead generated immediate awareness as it received ~16M impressions and a click-through rate of 0.21%, outperforming benchmarks and garnering over 51K hours of brand exposure.

Own The Night

In the first two weeks of launch, we maximized awareness with a first-of-its-kind dual-screen activation that leveraged the power of popular mid-season premiers. On TV, we used Dove to own key primetime blocks so our target was the first to see it. At the same time, social listening allowed us to identify who was watching, and serve them contextually relevant tweets – with the opportunity to receive a sample. This blend of awareness with personalized content allowed for immediate impact generating over 1.17 million impressions and a campaign engagement rate of 3.25%, exceeding the industry benchmark (Source: Twitter Canada).

GRAMMYs Sponsorship

Once again, we generated a blend of awareness and engagement, this time through a sponsorship of the GRAMMYs in February. The broadcast component included traditional brand sell spots, snipes, billboards and bumpers, while online we implemented the first ever GRAMMY social hub for Canada. This allowed us to reach and engage with millennials directly, to generate upwards of 15M impressions from the sponsorship.

Launch Event

As the product hit market, we launched with a Walmart-exclusive event at Square One Shopping Centre – the largest mall in Ontario. The invitation: Be the first to #TryDry for a chance to meet Toronto Raptor, Kyle Lowry. Our in-mall sampling teams drove over 6,000 trials and excitement throughout the week leading up to the event.

The timing was critical to driving momentum as it allowed us to capitalize on the Raptors’ recent success. At maximum capacity, more than 1,000 fans had the chance to see our host, TSN’s Kate Beirness, and Kyle talk about the Raptors season and new Dry Sprays. To prove its benefits, Kyle conducted a compelling live comparison of Dry Sprays vs. gel antiperspirant using a basketball. The event was live tweeted and amplified in real-time.

The event was a resounding success with over 600 entries in the two-hour contest window, over 1,200 event impressions, 3.8M social impressions and 8.7M media impressions. Most importantly, our retail partner saw a 700% sales lift for Dry Spays on event day.

Driving Trial in the Winter

Throughout the winter and spring, we dominated malls across the country with sampling teams, strategically located outside key retail partners: Shoppers Drug Mart and Jean Coutu. We opted not to distribute traditional samples, and instead had ambassadors engage and spray millennials on their hand or forearm, to control the experience while educating the consumer. Being in malls allowed us to reach our target, and have them experience the product during the cold winter and spring months – crucial for establishing a good start.

Our footprint was bold, beautiful and clearly communicated our product benefits. A 360° design allowed us to set up in any location with maximum visibility. Our portable trays allowed our ambassadors to be fully mobile, showcasing all 5 Dry Spray brands, and enabled quick trial. Coupons were offered to drive purchase at nearby retail locations. Creatively, our booth, trays and collateral matched our in-store POS, ensuring consistent branding both in and out-of-store.

Unmistakable in-store

Nationally, we continued to build momentum through unprecedented retailer support to ensure consumers saw and engaged with Dry Sprays first, no matter where they shopped. We over-delivered our distribution goal by quickly reaching >70% distribution (Source: Nielsen MarketTrack, National All Channels, All Sales, YTD PE May 02 2015 vs. YAGO vs. 2 YAGO) well within our 90-day launch window with premium eye level placement at shelf.

Across all major retail customers constituting >80% retail coverage, we created semi-permanent shelf signage to drive visibility and communicate our point of difference. Out of section, we ensured high traffic placement with premium display units, reaching historical shipment levels for Unilever with over 12K displayers shipped within the first 6 months.

We supported four major retailers with national product demonstrations in-store. Again, brand ambassadors invited consumers to #TryDry, rewarding the first adopters with a retailer-specific offer to convert to purchase.

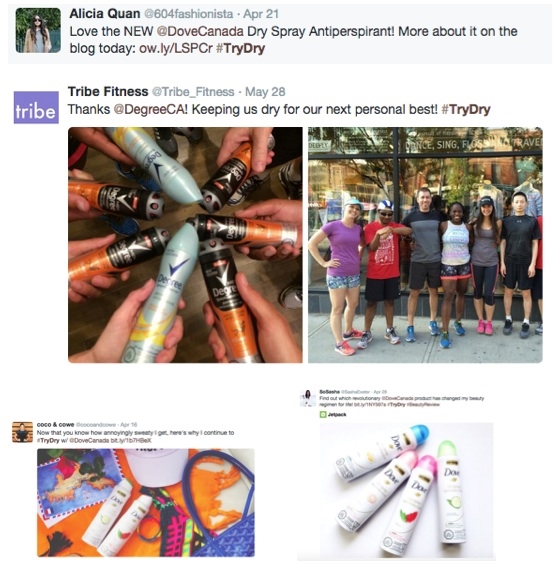

Strong Social

Throughout the launch, we engaged consumers using the Dove and Degree Twitter channels leveraging the #TryDry hashtag. We began the discussion before Dry Spray hit shelves, to generate early awareness. Throughout launch, we used our social channels to amplify efforts including our media activations, Walmart event, and out-of-store sampling. We also leveraged the power of key influencers, allowing them to be the first to engage their audience with Dry Sprays. In total, we generated over 24,909,400 impressions and engaged 267,000 consumers directly.

c)Media Discussion

In addition to the media activations noted above, we executed a media buy to ensure immediate impact in market. We took a unique approach to get a head start by starting the social discussion and launching TV spots three weeks prior to the product being available on shelves, creating awareness and demand.

On TV, we used the combined strength of the Dove, Degree Men and Degree Women brands for consistent awareness for 17 weeks. We deviated from standard practice and purchased top 10 programming throughout launch.

We leveraged these same brands to drive awareness in digital, investing 50% of our digital budget behind mobile, understanding the importance of this channel to our target.

Section V — BUSINESS RESULTS

a) Sales/Share Results

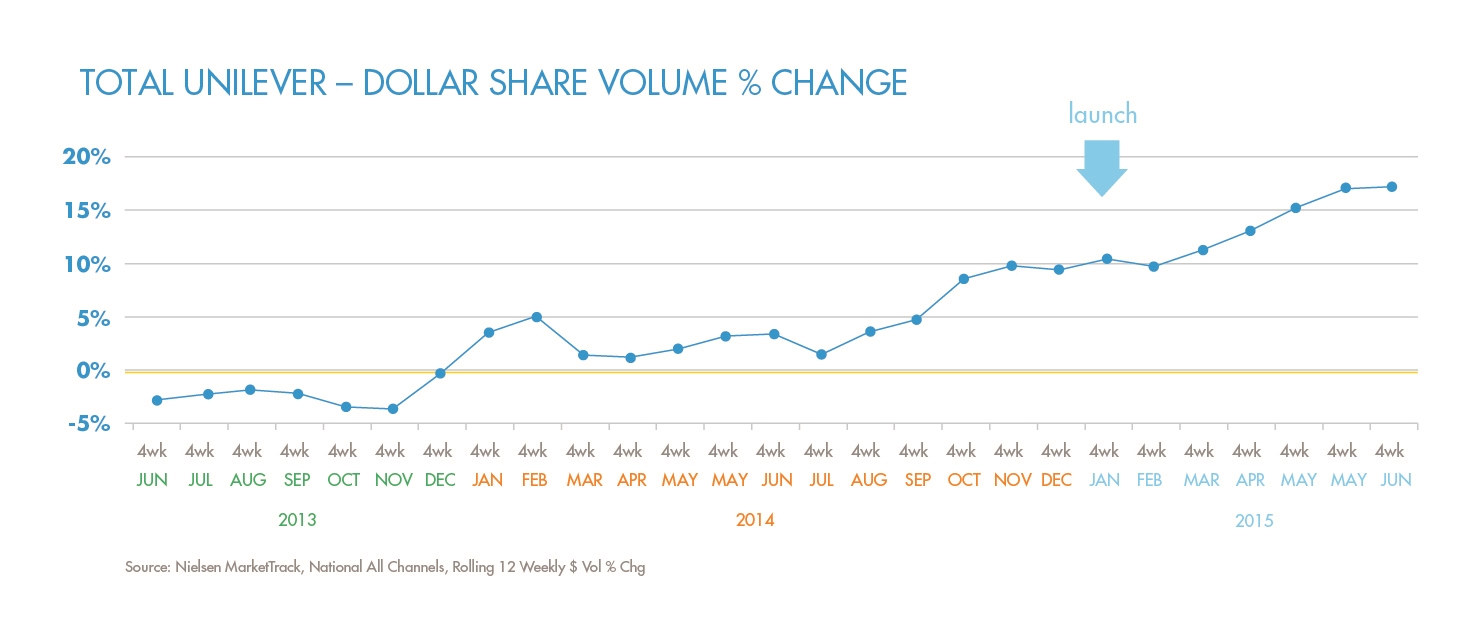

At the six-month post-launch mark, Unilever is shattering its share targets. In fact, because of Dry Spray, Unilever has achieved its highest category dollar share EVER at 38.5 $ Share.

The launch has also generated and sustained $ Volume growth for Unilever to levels the company had not seen before.

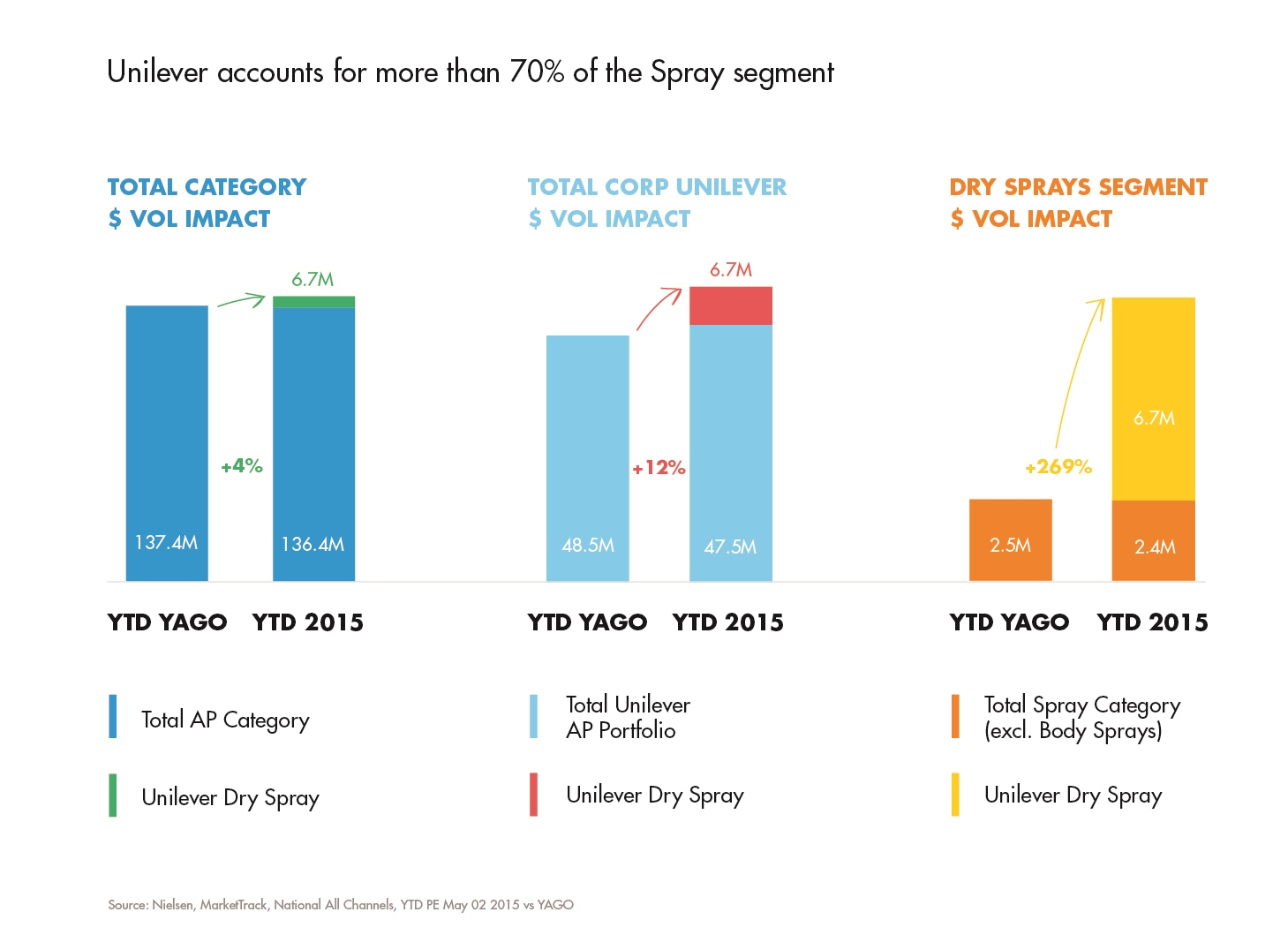

The Dry Spray launch not only resulted in growth for Unilever, but contributed to substantial category impact – a tremendous feat in this commoditized and developed category.

b) Consumption/ Usage Results

Much like share results, Dry Sprays are seeing exceptional results for trial metrics, showing consumers are interested in the unique proposition.

c) Other Pertinent Results

Customer Support

The launch established unprecedented customer support whereby out-of-section displayer shipments exceeded targets by 150%.

Awareness

Our launch plan was focused on driving immediate impact and awareness – specifically with our millennials. It was essential they were the first to learn about this new innovative format. This drive resulted in:

- TV GRPs: 4,500+

- Digital impressions (inc. iAd): 83M

- Search impressions: 1M

- Traditional PR impressions: 33M

- Paid social impressions: 24M

- Influencer-led impressions: 5M

d) Return on Investment

Unilever increased the full year category advertising budget by $3.5M to support the Dry Spray launch, prorated at $2M for the first six months of the year. Within these first six months, Unilever delivered $6.7M in POS revenue, specifically driven by Dry Sprays.

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

We launched an unknown personal care format in a flat category during an off-season without unusual discounting, yet consumers are trying it and buying it. The early share, category growth and retailer support speak to the demand we’ve triggered for consumers and the momentum we’ve created, while strong trial results are the quantitative proof that our focus on awareness and trial worked.

At the same time, Dry Spray also launched in the U.S. There, more traditional launch tactics were used: buying media with a more standardized Unilever approach and distributing 1oz samples. Sampling allowed for quicker, mass interactions, but sacrificed control of the initial spray experience and the potential to educate consumers. Within the first six months, Canada is outpacing the US in terms of dollar volume share (5.5 vs. 3.9), trial (3.0% vs. 2.3%)* and awareness scores (25.5 vs. 22).*

In Canada, both Unilever and the category are winning, with strong year-to-date dollar volume growth of 12% and 4% respectively.

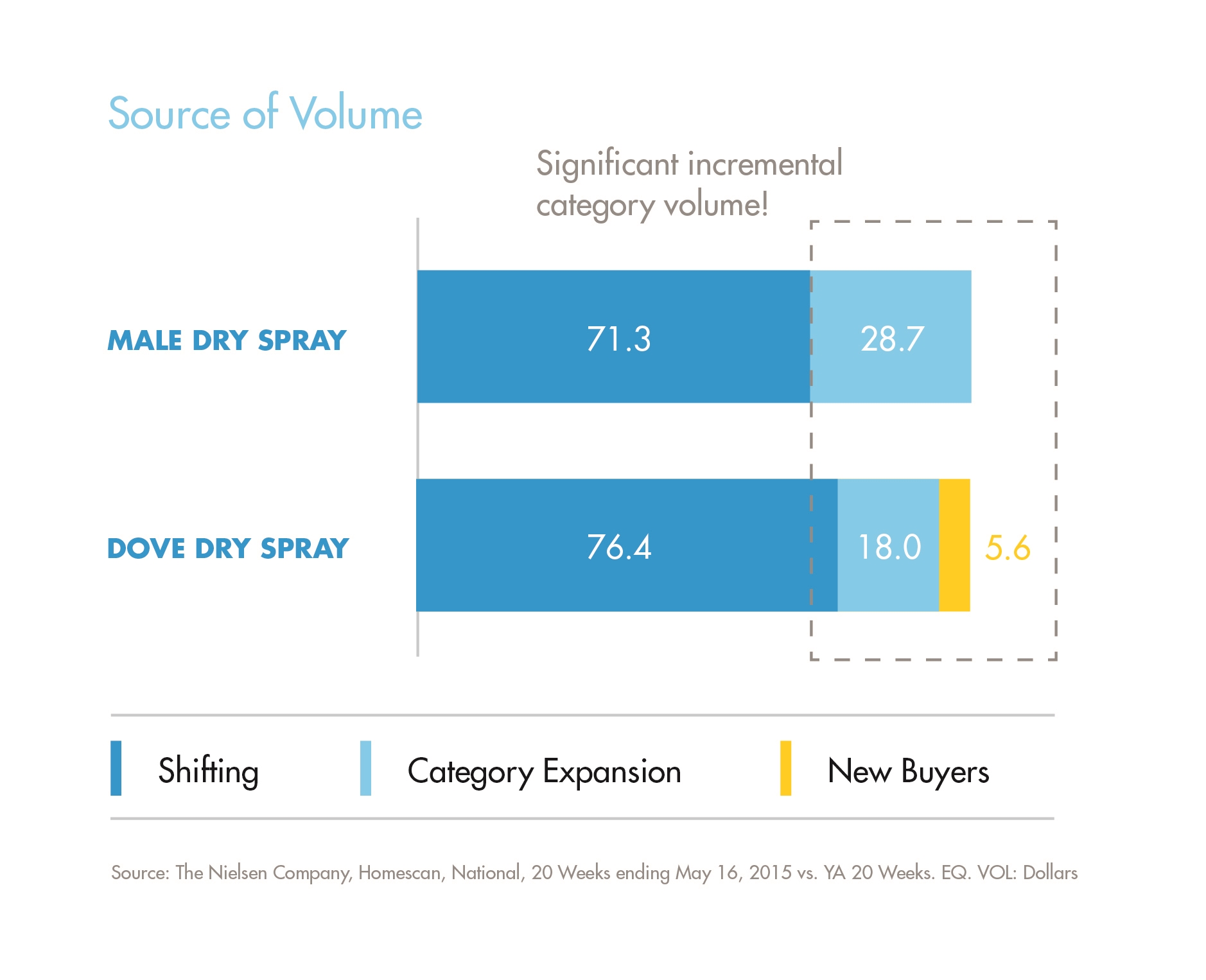

We have generated significant incremental volume in the category through new buyers and expansion, and have driven consumers to shift and trade up to the new format in a big way. As this was a brand new format, unchallenged in the market, in an extremely consistent and conservative growth category year over year, we can say with certainty that these results were attributed to our launch campaign.

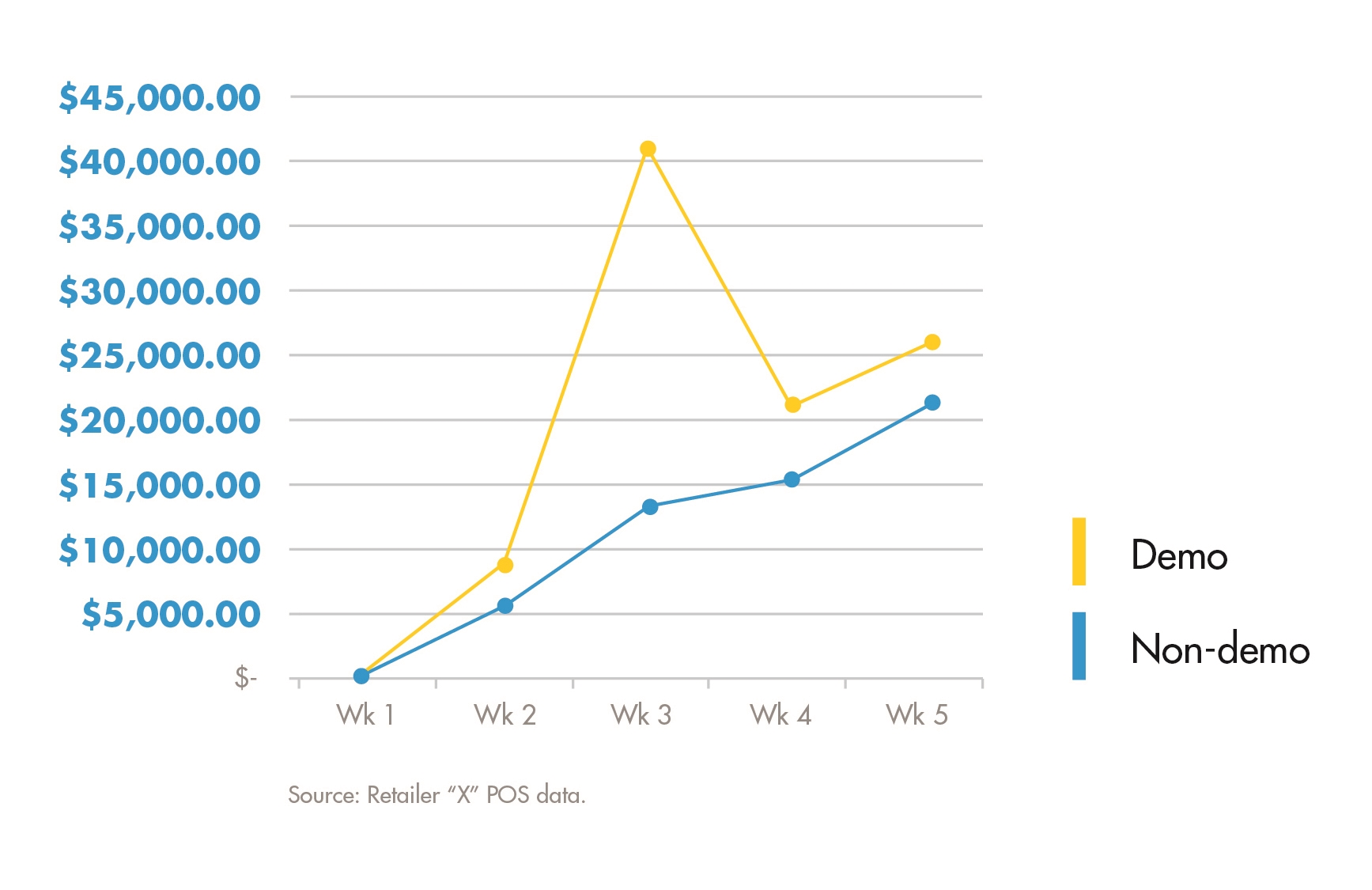

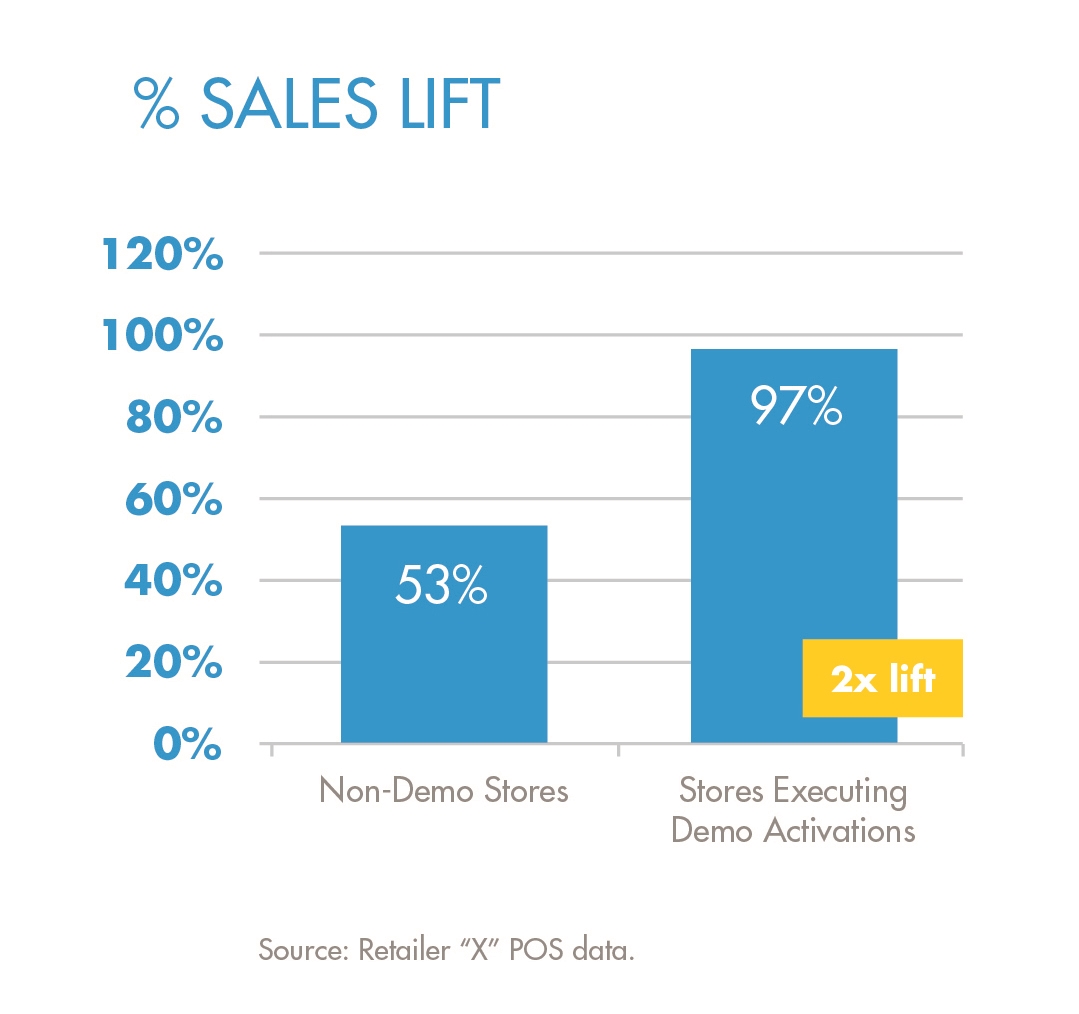

Finally, research shows the positive effect our retail efforts are having on launch. Controlled tests show a significant increase in sales at retailers that executed sampling demo events, versus those that did not. Having executed over 400 retail demos nationally, inviting consumers to directly #TryDry made an immediate impact.

b)Excluding Other Factors

Spending Levels:

Unilever increased the full year category advertising budget by $3.5M to support the Dry Spray launch, prorated at $2M for the first six months of the year. Within these first six months, Unilever delivered $6.7M in POS revenue, specifically driven by Dry Sprays. We are outpacing our investment.

Pricing:

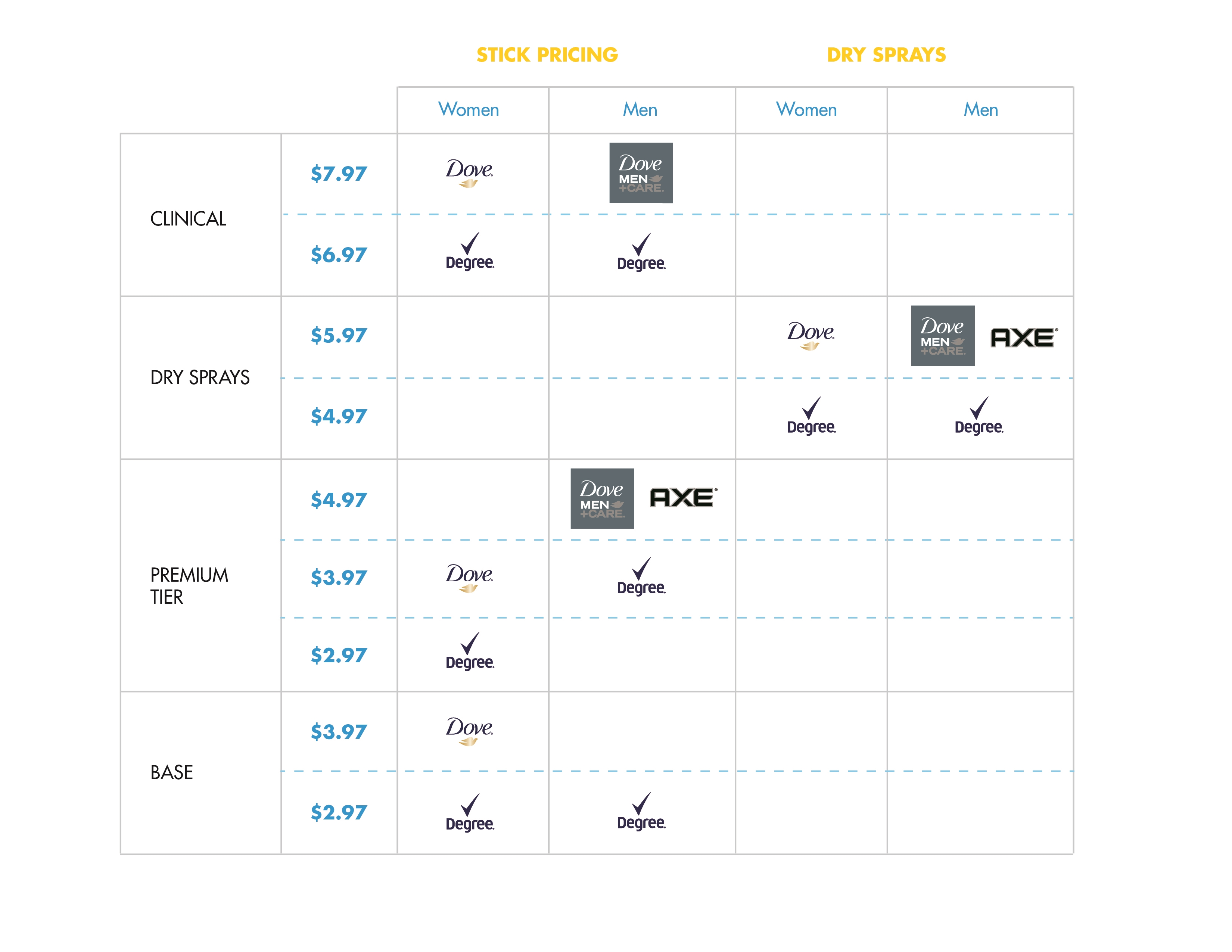

Pricing efforts did not play a role in driving purchase. In fact, Dry Sprays’ premium price (as reflected in the graphic below) could have been a barrier, especially within a traditionally low-involvement category. However, believing in the unique proposition and the performance of the product, we didn’t discount the price at all following the first 30 days of launch. After that period, any discounting resulted in Dry Sprays being on par or higher priced than the most premium stick.

Distribution Changes:

To accommodate the launch of 17 Dry Sprays SKUs, Unilever discontinued 4 SKUs – resulting in 13 incremental listings total. Because Dry Sprays have a smaller packaging footprint than sticks, the increase in share of shelf (linear feet) was minimal (+2%). While distribution increased overall, Dry Sprays are ultimately a new format that relied on advertising to generate awareness, consideration and purchase.

Unusual Promotional Activity:

See above.

Other Potential Causes:

Seasonality is a factor that must be considered. The AP/Deo category is seasonal and typically declines during the winter months when sweat protection is not top-of-mind. Launching in January, this was a huge potential barrier, yet we managed to achieve many of our full-year targets even before entering the peak summer season. Reaching our core target with a compelling message and a product that performed allowed us to overcome this barrier and drove our success regardless of season.

* Comparative results are for female brands only due to sample size

Sources:

$ Shr & Trial – Nielsen, All Channels, P5 Post launch 2015

Awareness – Millward Brown, Brand Health Check, Jan-May 2015