Newfoundland and Labrador – Find Yourself

Long Term Success (BRONZE)

Client Credits: Newfoundland and Labrador Tourism

Carmela Murphy, Assistant Deputy Minister, Tourism

Andrea Peddle, Director of Tourism Marketing

Carol Ann Carter, Manager, Advertising and Communications

Andrew Weir, Advertising Officer

Amy Fisher, Internet Marketing Specialist – Social Media

Shelley Magnusson, Internet Marketing Officer – Website

Agency Credits: Target

Tom Murphy, Creative Director

Randy Diplock, Creative Group Head

Kev Kalyan, Creative Group Head

Dave Sullivan, Writer

Matt Tucker, Digital Lead

Trevor Kearsey, Digital Developer

Ryan Strickland, Digital Developer

Dejan Vuchichevic, Digital Imaging Artist

Catherine Kelly, Director of Account Management

Ernie Brake, Account Director

Alaina Collins, Account Manager

Allison Daley, Account Executive

Heikki Kuld, Agency Producer

Cindy Wadden, Production Manager

Jef Combdon, Director of Media

Kelly Reddigan, Media Manager

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | January 2012 to July 2015 |

| Start of Advertising/Communication Effort: | January 2012 |

| Base Period as a Benchmark: | 2011 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

Around here, there’s no such thing as an accidental tourist. Confronted by real and perceptual barriers of travel distance, time, and cost, it takes deliberate planning and a determined effort to visit Newfoundland and Labrador (NL) – the most easterly point in North America.

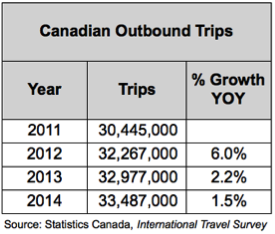

Up against a large number of well-known, well-funded national and international tourism destinations, the challenge to engage and lure travellers to this off-the-beaten-path location is, shall we say, daunting. In the face of fierce domestic competition, increasing outbound travel (i.e., Canadian residents travelling outside the country), and declining budgets, winning the hearts and minds of the audience, year after year, has never been so critical.

NL Tourism has established a distinctive, much admired, and sometimes copied long-term advertising campaign that romances the experience of visiting this extraordinary place. Each new story reveals a little more about our people, culture, and natural environment. As detailed under Section V Business Results, the campaign has been enormously successful from a financial point of view, returning many times the investment in media dollar terms.

The following factors had to be considered:

Barriers to Travel. Distance, time, cost, and access are significant travel barriers for visitors. The only way to get to the island of Newfoundland is via air or sea. Add to that a short tourism season of ~75 days (June to August), capacity constraints during peak season, and the increasing cost of travel. Also, negative perceptions of the weather in NL can be a deterrent for leisure travel.

Competitive Landscape. Domestic travel within Canada accounts for more than 80% of total industry demand[1]; this is even more pronounced for NL, where 88.4% of visitors arrive from other parts of the country. The environment has become increasingly competitive due to a greater focus on marketing Canadian destinations to Canadians, particularly in NL Tourism’s primary market of Ontario. A growing number of global destinations that are well-funded, heavily advertised, and already well-known are also vying for travellers’ attention and their discretionary income.

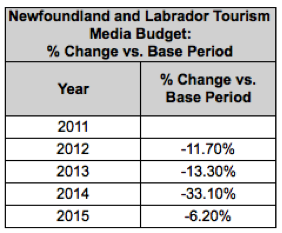

Break Through Despite a Decreasing Budget. Overall awareness is rising, but NL still ranks behind most Canadian, US, and international travel destinations. According to the Non-Resident Travel Attitudes and Motivations Survey (2013), BC is tops in Canada, followed by Ontario, Quebec, Alberta, and Nova Scotia; NL ranks 8th in destination awareness. The priority target in Ontario is bombarded with vacation advertising far exceeding NL’s annual media budget, which decreased three consecutive years following the Base Period (BP) 2011. Refer to Section VI Cause and Effect for declining budget figures.

Timing. Media scheduling: NL Tourism’s annual brand advertising campaign has to be in market from January to June (approx.) to ensure the province appears early enough in the travellers’ consideration set as a vacation destination.

Consumer Behaviour. Media targeting: Travellers who arrive in the province by air are the single most important source of non-resident visitation and spending, accounting for more than 76% of visits and 82% of spending.

b) Resulting Business Objectives

- Increase annual non-resident airline visitation year-over-year above the 335,600 level in the 2011 BP.

- Increase annual spending resulting from non-resident air travel year-over-year above the $327,500,000 level in the 2011 BP.

- Increase audience engagement with the NL Tourism brand, and interest in NL as a travel destination, using owned digital and social media channels – NewfoundlandLabrador.com, Facebook, and Twitter.

c) Annual Media Budget

$4 – $5 million

d) Geographic Area

Canada, with emphasis on Ontario.

[1] 2014 Gateway to Growth Annual Report on Canadian Tourism – Tourism Industry Association of Canada

Section III — STRATEGIC THINKING

a) Analysis and Insight

As we considered the reasons not to pick NL as a destination, it became clear that the well-trodden ‘tourist’ path of places to go, sights to see, and things to do would not be the answer.

G.K. Chesterton once said, “The traveller sees what he sees, the tourist sees what he has come to see.” This sparked what has become a deep and abiding insight: NL is for the traveller, not the tourist.

Our biggest opportunity group doesn’t see themselves as tourists, but as increasingly sophisticated travellers seeking more unusual places and experiences off the beaten track.

They are looking for an antidote to the stress and plastic composition of urban life and modern times, and interested in discovering an unspoiled natural environment. They are curious people, in search of unexpected, intriguing, and authentic destinations versus contrived, commercial ‘tourist’ destinations.

We focused on two groups: 45+ (skewed) and 25-34 years of age. They tend to be singles / couples with no children living at home (e.g., pre-nest / empty-nest) with above-average household income, with a higher-than-average proportion who are university educated.

The primary focus was Ontario (GTA / Ottawa), while secondary markets included Calgary, Halifax, and English-speaking Montreal.

Unlike competing tourist destinations, our campaign romances the deeply moving experience of being in NL versus the aforementioned inventory of places to go, sights to see, and things to do. The deeper the emotions and feeling prospects have about a place, the stronger the motivation to find out more and to visit.

That’s the difference in securing a powerful and enduring competitive advantage.

And that’s why NL is for the traveller, not the tourist.

b) Communication Strategy

We have a target audience clearly differentiated by the ‘traveller’ mindset. Knowing this, our strategy becomes simple: romance and express that mindset in everything we say and do. With intelligence and wit, and an engaging sense of humour. Because no one ever bored anyone into buying anything. Because it’s true to who we really are. Because it’s an antidote to the stress and plastic composition of urban life and modern times. And because it will continue to strongly differentiate NL from competitive tourism destinations – steeped in our natural differences, and etched in the three brand pillars of our people, culture, and natural environment.

It is our strongest and most unassailable unique selling proposition.

Everything we do and say should focus on how we see things differently. NL is a surprisingly exotic place that goes far beyond the packaged, programmed kind of tourism other places offer. Our rugged landscape comes with 29,000 kilometres of dramatic coastline, infused with rich icons of whales, icebergs, and wildlife. It is a place teetering on the edge of the continent, with its very own half-hour time zone, a vibrant spirit, an engaging culture, and an ancient history. And our brand personality gives us the creative licence to not take ourselves too seriously.

The platform is designed to seduce and persuade consumers that a visit here is a chance to discover an unexpectedly different place, off the beaten path. Perhaps more importantly, a visit to NL is an opportunity for visitors to discover something inside themselves.

Section IV — KEY EXECUTIONAL ELEMENTS

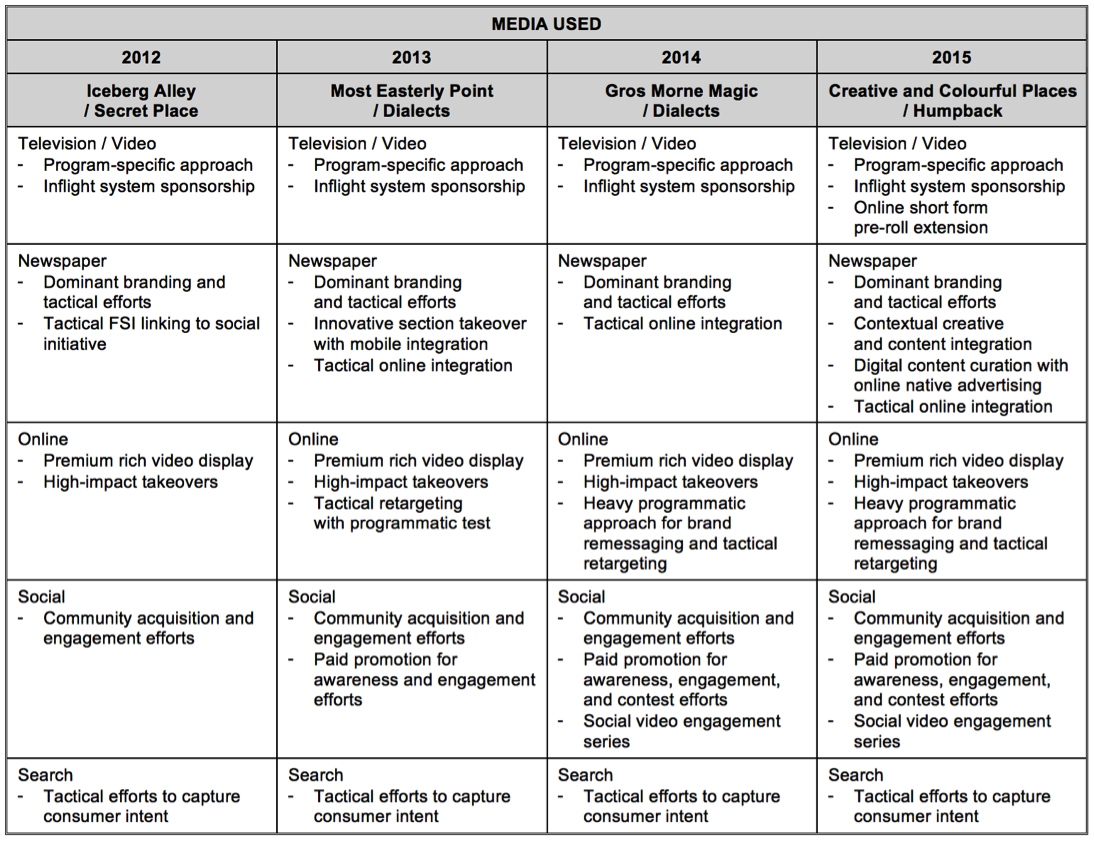

a)Media Used

b)Creative Discussion

Each platform launched during the BRP represents a big idea that can direct marketing efforts through all stages of the purchase continuum – by capturing the imagination and interest of potential travellers and moving them through the decision-making process. Each continues to evolve NL’s brand positioning and personality, bringing to life the authentic beauty, real character, and natural creativity of the province. And each continues to differentiate NL from other tourism destinations in a surprising, compelling, and memorable way.

Iceberg Alley (2012). NL is naturally beautiful. Travellers can lose themselves in 29,000 kilometres of coastline and freshly carved icebergs. Not to mention an abundance of fresh sea air. Here, you’ll be sheltered from the distractions of modern life, leaving you open to intellectual stimulation, cultural curiosity, and authentic human connections.

Secret Place (2012). Find 565-million-year-old fossils trapped in volcanic ash, some of the earliest evidence of life on the planet. The story (in a tongue-in-cheek way) demonstrates how very different we are; how the strange and terrible beauty of the landscape contrasts with the ‘plastic’ landscapes shown in other tourism ads.

Most Easterly Point (2013). NL is an exotic, one-of-a-kind destination; as far east as you can possibly go – without getting wet. Our location perfectly positions us as one of those bucket-list mandatories. After all, when you’re standing at the ends of the earth, where the sun rises first, this place has the ability to make a morning person out of just about anyone.

Dialects (2013/2014). Shaped over centuries, the language of NL is our most irresistible quality. A fascinating mosaic of words, phrases, and accents make our speech as colourful as the land where it is spoken. There are hundreds of English dialects found here – more than anywhere else in the world, and enough to merit our very own dictionary. While the art of conversation has long been forgotten elsewhere, it thrives in NL.

Gros Morne Magic (2014). NL is a place of contrasts and wonders. ‘Magic’ tells a story of landscapes formed over nearly half a billion years; of truly unbelievable sights and majesty, such as the rusting rocks of the Tablelands – one of the few places in the world where you can actually walk on the earth’s mantle. The ad features intimate moments, and the undeniable impact this ancient, mysterious land weaves on those who visit.

Creative and Colourful Places (2015). In a world oddly bent on conformity, there’s something strangely encouraging about a place that’s anything but. In NL, we are surrounded by a kaleidoscopic palette of music, architecture, and imagination. It’s in the songs we sing, in the stories we tell – it’s even in the names of the towns we live in. The unexpected names of the places that travellers will find here is largely a reflection of our unique and vibrant culture, and the creativity of our people. Inspired by the pristine landscape, food, homelands of early settlers, and even body parts, the names of our places all have one thing in common – you’ll never hear them anywhere else in the world.

Humpback (2015). NL boasts the world’s largest population of humpback whales. Around here, you’ll see more species of marine mammals, more often, and in more places than anywhere else in Canada. Funny thing about this place… You’d be hard-pressed to take a simple picture without some humpback spoiling it for you.

During the BRP, television acted as the cornerstone of all marketing initiatives. Sixty- and thirty-second ads romanced and expressed our unique brand positioning and personality. National and regional newspaper provided support in key markets, addressing travel barriers and further romancing the stories being told on television – moving the audience further along the decision-making continuum and closer to booking travel. Through airline partnerships with WestJet and Air Canada, relevant airfares from target departure cities were highlighted.

The approach to digital marketing evolved during the BRP, as there was a dramatic shift in how people were consuming media for communication versus information. People live online and have developed an insatiable appetite for engaging, interactive content. Used well, digital content and social media are powerful conversion tools that help consumers navigate the decision-making process. An engaging destination site was just the beginning. The goal was to gain consumer attention, without disrupting their online journey, by creating and connecting meaningful content. And that’s exactly what we did. Complementing paid online advertising, digital media including campaign pages, video, contests, special events, and a consistent brand presence (on Facebook, Twitter, YouTube, and Flickr) had to seduce and persuade the audience that a visit to NL is a chance to discover a naturally exotic and unexpectedly different place. Creative messaging was strategically aligned with in-market media to extend and enrich the brand story, presenting the audience with multiple options to learn more about the destination and book travel. For metrics, see Section V Business Results.

c)Media Discussion

Media is planned and executed in a continually evolving fashion, with complete integration across paid, owned, and earned media channels to strategically move the consumer closer to purchase.

Television is meticulously planned and purchased to align with our consumers’ psychographic profile and interests, and to connect with them during optimal times. Now considered simply as ‘video’, we continually connect and build upon the narrative we have created with our consumer via multiple devices and video channels – including television, inflight, rich online video display ads, digital video pre-roll, mobile, and social video – all carefully timed and placed, with each playing a critical role in moving the consumer closer to purchase.

This evolutionary approach applies to each and every media channel in the campaign:

- Newsprint has evolved from simply running an impactful display ad, to fully integrating our ad copy within its surrounding editorial environment; or leveraging the power of emerging native advertising with the advocacy of carefully curated earned media stories to create a digital launch pad for online branding and tactical efforts within our newspaper partners’ sites.

- Digital media has evolved considerably from branding and engagement display efforts, to growing and engaging with a strong social community. At the same time, the audience is remessaged with real-time airline fares and package travel offers when they are predisposed and ready to act on the interest created by the campaign. For metrics, see Section V Business Results.

In search of a critical competitive advantage, NL Tourism strives to lead the market and our competitors in the adoption of new media technologies, ever evolving our approach to media (e.g., embracing and leveraging programmatic buying).

Section V — BUSINESS RESULTS

a) Sales/Share Results

Facing fierce domestic competition, increasing outbound travel, and a declining media budget, NL Tourism accomplished each of the previously outlined business objectives.

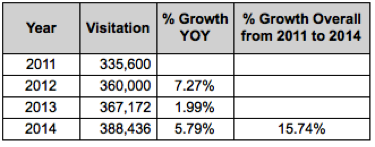

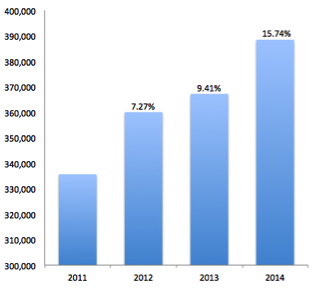

Objective 1. Non-resident airline visitation to NL increased year-over-year (YOY) subsequent to the BP. From 2012 to 2014, 1,115,608 visitors came to the province by air:

At the time of writing, January to June non-resident airline visitation year-to-date (YTD) is on par with 2014 – i.e., 129,366 in 2015 versus 129,481 in 2014. Note: Peak travel season occurs from June to August.

The steady YOY growth is also clearly seen graphically, with percentages indicating how the non-resident visitation compares to the BP:

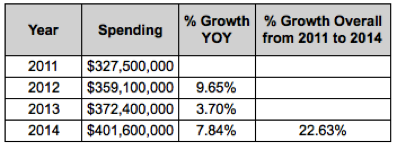

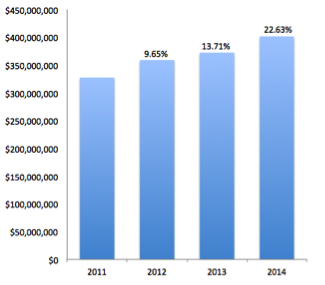

Objective 2. Non-resident airline spending increased YOY subsequent to the BP. 2014 was the first time non-resident air travellers eclipsed $400,000,000 in annual spending:

Again, the growth can be seen graphically, with steadily increasing growth compared to the BP:

At the time of writing, preliminary estimates indicate that spending (YTD January to June 2015) by non-resident visitors by air is at similar levels as it was in 2014 (i.e., $133.9 million). According to Hospitality Newfoundland and Labrador (the NL tourism industry association), bookings are up or on par with 2014 YTD.

Objective 3. Audience engagement with the NL Tourism brand and interest in NL as a travel destination increased substantially.

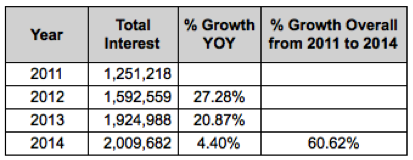

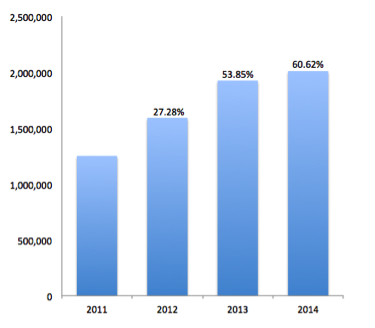

Interest in NL. Total interest in NL as a travel destination increased YOY subsequent to the BP. 2014 was the first time this metric eclipsed the 2,000,000 mark:

Compared to the BP, total interest grew annually as shown in the graph below:

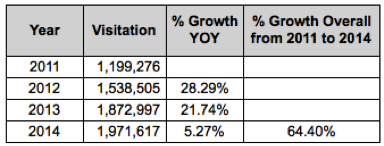

NewfoundlandLabrador.com. Visitation rose from 1,199,617 in 2011 to 1,971,617 in 2014 – an increase of 64.4% and more than three quarters of a million annual visits (772,341):

Time on site increased YOY, growing 22.87% from 2011 to 2014; unique visitors also increased YOY, rising 55.37% from 2011 to 2014.

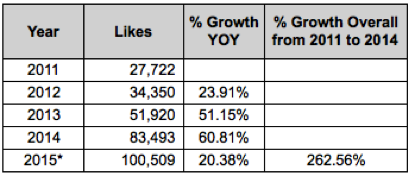

Facebook. Likes increased YOY following the BP, eclipsing 100,000 in July 2015*:

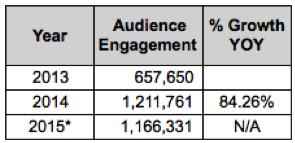

Audience engagement – i.e., audience activity in response to brand posts – has grown exponentially, increasing 84% in 2014:

The upward trend continues in 2015, as we’ve nearly eclipsed 2014’s total in just over six months (1,166,331 engagements).[1] 2015 growth YTD versus 2014 is +48%.

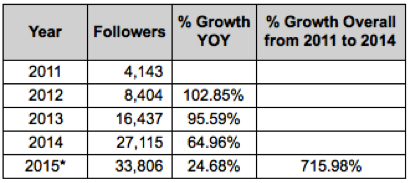

Twitter. Followers increased YOY subsequent to the BP:

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

These figures also allow an ROI examination, with significant results. The cumulative growth of spending by non-resident visitors by air between 2012 and 2014 was $42.5 million – well in excess of the corresponding media spend, which was just over $13 million. This equates to an ROI on the media spend of 326% or 3.3.

[1] Note: 2015 is the first year where engagements include Facebook video views.

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

NL Tourism’s advertising campaign has been instrumental in driving significant and sustained business results.

Peak travel season falls between June to August each year; hence, the in-market timing of the campaign has remained consistent YOY compared to the BP.

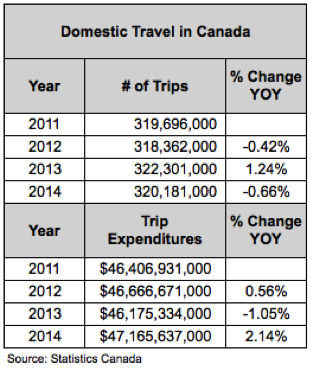

1. Since 2011, NL has outperformed the Canadian tourism industry. Nationally, the country has performed well. That said, overnight trips and spending within the country have been relatively flat (or decreasing) since the BP:

2. NL’s non-resident visitation by air and spending continue to increase, despite Canadian travellers choosing to spend disposable income travelling abroad:

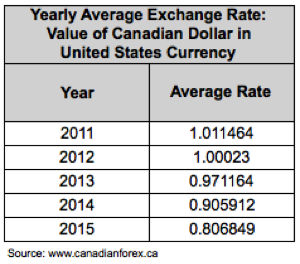

3. The exchange rate has, for the most part, been at par, or favourable to domestic travel, but as shown by the table above, this has not deterred Canadians from travelling abroad:

4. Feedback has been overwhelming:

- “You make a person homesick for a place they’ve never been.”

- “The provincial marketing campaign has had a tremendous impact on driving demand for tourism and travel and has helped increase the value our industry adds to economic diversification and the people of NL.” – Hospitality NL

- “NL is right now running an absurdly successful campaign, featuring stunning images of its most famous landmarks. There’s nothing contrived about it: no quasi-clever slogans, no confusing graphics, no mixed messages. It does what the best advertising requires: It tells the plain truth about its product, elegantly and compellingly.” – www.brucescribe.com

b)Excluding Other Factors

Spending Levels:

NL Tourism’s Media Budget decreased three consecutive years following the BP. When it did rebound in 2015, annual spend was still 6.2% lower than it had been in 2011:

Pricing:

There was no unusual price discounting on travel to NL during the BRP by travel providers or provincial tourism operators.

Distribution Changes:

Targeted geographic markets were consistent during the BRP. When the media budget decreased, Halifax and English-speaking Montreal were removed as secondary markets.

Unusual Promotional Activity:

As media budgets were in decline, there was no such activity during the BRP; therefore, there was a direct correlation between the campaign and the positive business response.

Other Potential Causes:

NA