IKEA House Rules

Events, Seasonal and Short-Term (GOLD)

Client Credits: IKEA Canada

Hilary Lloyd, Country Marketing Manager

Kirsten Ryan, Advertising Manager

Jonelle Ricketts, Advertising Specialist

Agency Credits: Leo Burnett

Chief Creative Officer, Judy John

Group Creative Directors,Morgan Kurchak, David Federico

Copywriter,Morgan Kurchak

Art Director,David Federico

Digital Art Director, David Federico, Trevor Bell

Designer,David Federico, Trevor Bell, Karen Porges

Web Developers Jacqueline Adediji, David Freedman, Matthew Rependa, Margaret Beck

SVP, General Manager,David Kennedy

Account Supervisors,Allison Tang, Danielle Iozzo

Planner, Director,Brent Nelsen

Strategic Planner,Lisa Hart

Social Media Planner,Heather Morrison, Michael McDonald-Beraskow

Director, Creative Technology, Felix Wardene

Digital Project Manager,Thomas Degez

Agency Producer,Franca Piacente

VP. Media Connection Planning,Brooke Leland

Media Broadcast Planners,Krystal Seymour

Media Non-Broadcast Planner,Janet Xi

Media Company: Jungle Media

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | March – May 2014 |

| Start of Advertising/Communication Effort: | March 2014 |

| Base Period as a Benchmark: | Equivalent year ago period – March – May 2013 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

A long-term problem

IKEA has a problem it can’t seem to shake. While Canadians love the brand in their 20s and 30s, when they start thinking about and having families of their own, as they progress in their own lifestyle, as tastes and budgets evolve…they reach a point where they believe they’ve outgrown IKEA. And IKEA comes off their consideration list.

Mega brands like Home Depot, The Brick, Sears, Canadian Tire, Wal-Mart, HomeSense, The Bay, Braulte & Martineau and 10 others aggressively compete day to day for people’s precious décor dollars. And with the growth of independent urban specialty retailers, specialty chains, and even bookstores selling home décor, these 35+ year-old Canadians are confronted with new and perceptually more sophisticated and mature home décor opportunities at every turn.

And yet this 35+ group was the key to growth: IKEA was already highly penetrated in the younger demo of 18 – 35, so there was little upside there. Getting business from 35+ shoppers, by contrast, represented significant incremental volume. Appeal, consideration and actual shopping amongst the 35+ target was key to the continual growth of the IKEA business in Canada.

We had one big question to address in our 2014 Brand campaign:

How do you get Canadians who feel they’ve outgrown you to realize that IKEA has actually grown right along side you in terms of quality and style, and shop you again?

This case illustrates how IKEA was able to re-connect with the hard-to-hit 35+ target by starting a meaningful conversation about Canadians and their homes, driving already successful sales even higher.

b) Resulting Business Objectives

Reclaiming the home

Our objectives were to:

- Increase sales versus 2013 amongst the 35+ shoppers

- Move key brand metrics with the 35+ age target

- Get Canadians of all ages thinking of IKEA when thinking the home

This wasn’t going to be easy. In the past, where IKEA was once the lone authority in style and home décor, today IKEA competes in a massively popular décor-tainment culture, where décor items and design advice are everywhere, and many retailers had largely copied IKEA’s visual language and storytelling approach.

To succeed, IKEA needed to reinforce it was the true leader in understanding life at home, better than any other retailer. They needed to show 35+ year olds that they’ve always been there for them room by room, always continued to understand their tastes, styles and lifestyles as they’ve evolved over time, and actually have exactly what they want but just don’t know about.

The resulting communication objectives were set to get our target to connect with us on a deeper level and rediscover a part of IKEA they had forgotten about or never met:

- Create a campaign that generates conversations about IKEA

- Get our target to spend time on IKEA.ca

c) Annual Media Budget

$2 – $3 million

d) Geographic Area

Canada

Section III — STRATEGIC THINKING

a) Analysis and Insight

As home decor shoppers change and grow, what typically happens is that they reevaluate their lives and wonder if IKEA is right for them, and if they are right for IKEA. They ask themselves “does IKEA really understand me and what I want now?” As a result, these shoppers more often than not, cast their eyes towards other home decor retailers they believe have more ‘sophisticated, mature, and adult appropriate’ home furnishings and accessories. From research, we knew the root cause behind this behavior was simply a lack of understanding between the realities of what IKEA today vs. the IKEA they remember shopping from their salad days. For the 35+ shopper, the image of IKEA remained locked in time and misperception vs. reality. Little did they know that as their life needs, lifestyles, tastes and style dial changed at home, so did IKEA’s design, design solutions and product offerings. After all IKEA is the world’s leading company in home décor!

To truly demonstrate that IKEA understood how the home evolved with it the age, life and lifestyle of it occupants, we dug deep into the home through cultural analysis and conversation, thinking of it as a whole as well as each room separately, to find truths about how 35+ Canadians viewed and spend their time in the most important place in the world: their houses.

While casting for another IKEA job with the exact target we needed to reach – the 35+ décor shopper- an often-overlooked truth literally emerged during casual conversation: that every home has its own unique behaviour. We knew we hit the nail on the head: when asking those on set what some of these unique behaviours in their homes were, we got hundreds in just a few minutes. People naturally wanted to share their ‘house rules’ and learn about the rules in other homes.

By celebrating the unwritten rules of every home, we could reassert IKEA’s relevance for not only Canadians of every age but also the 35+ shopper by showing we truly understood their real, everyday life at home. If we could connect with them on this more personally interesting level, we knew could get back on their décor-shopping list.

b) Communication Strategy

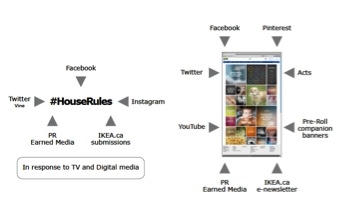

Get Canada sharing, talking about, and reading all the interesting #HouseRules that make our houses our homes.

If we could do that, and show that IKEA understands your life at home, we could connect again with the 35+ target.

Coming out of this insight and strategy, IKEA #HouseRules was created – and the floodgates were opened to receive and share all of the unique and interesting ways Canadians live at home.

We wanted to facilitate the sharing of all of Canada’s house rules at every touch point in the campaign. Our communications would focus on receiving, organizing, and sharing back the wonderful rules that we received. And to make it easy, we created a space that would pull in rules from all social spaces, as opposed to confining to just a few.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

TV

OOH

Social

Promoted posts on Facebook and Twitter

e-Newsletter

Microsite

Digital ads

b)Creative Discussion

A cross-platform conversation about Canada’s House Rules, celebrating all of the rules that make each and every home special.

#HouseRules launched with a :60 spot and kicked off the conversation, encouraging Canadians to share their House Rules with us.

We then collected these House Rules from every social space, visualized them beautifully online, and organized them by each room in the home, making it easy to read others and submit your own.

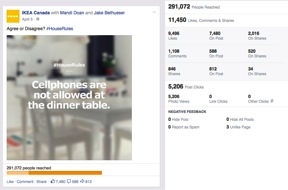

The voyeurism of reading others’ House Rules is irresistible, so we took the most popular and most liked rules into our mass advertising, sharing the rules that most Canadians could relate to. On our social platforms, we posted the most debated House Rules, asking Canadians how they felt about them and, of course, to share their own. We surprised some of those who shared with us by sending them little IKEA gifts that connected with their personal House Rules, showing the role of IKEA in their day-to-day lives.

We took the conversation to offline media too, live-tweeting the House Rules of popular TV shows during their season finales, and inviting people to enter radio contests by calling in and sharing, the old fashioned way.

We even used House Rules to connect the brand to a cultural moment. When Drake pulled out a lint roller during Game 5 of the Toronto Raptors’ playoff game, we turned it into real-time content claiming, “Our house is a lint-free zone” and giving out IKEA lint rollers at the ACC, another way to connect with our target and what they found interesting and important.

c)Media Discussion

There were two phases to the House Rules campaign.

In the first phase, we asked Canadians to share their #HouseRules with us, and collected and visualized them on IKEA.ca. We scraped all social channels for the hashtag to ensure we were getting rules from wherever our target wanted to share them.

In the second phase, we took the most popular, interesting, and creative rules and shared them out, using them in our digital OOH, on our social channels, and in our e-newsletters. In each case we were constantly driving back to ikea.ca/houserules to generate more content. Sharing back the popular House Rules was what lead to our most engaging social posts to date.

Section V — BUSINESS RESULTS

a) Sales/Share Results

House Rules was a Home Run

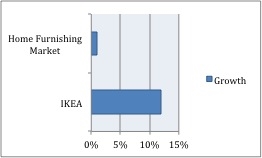

The House Rules cross-platform campaign generated a massive +12% same-store-sales increase versus the same period a year earlier. By comparison, the home furnishings and furniture category saw a mere 1% increase during this time. [Footnote 1]

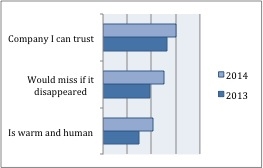

But most importantly, key brand metrics amongst the 35+ year old group hit a turning point with key brand intent scores indexing at 110 versus the previous year. IKEA Canada constantly tracks its brand measurements throughout the year, and this increase in brand intent scores is an obvious correlation to the campaign period. The most notable metrics were “Company I can trust” +7%, “Would miss if it disappeared” +11%, and “Is warm and human” +11%. [Footnote 2]

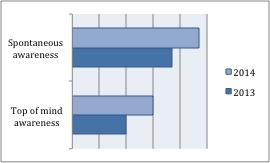

Top of mind and spontaneous awareness for the IKEA brand was also up +10% versus a year ago, with an increase of +12% claiming they had bought from IKEA recently, proving that Canadians were thinking IKEA when thinking of their homes. [Footnote 3]

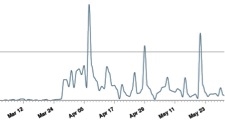

The communication objectives were achieved as well. The site generated 26,613 House Rules, with visitors to the site spending 3.5 minutes on average reading, enjoying, and learning the House Rules of other Canadians. Previous to our campaign there was little to no conversation around #HouseRules on Twitter in Canada. [Footnote 4]

House Rules generated the most engagement of any social campaign IKEA Canada has run to date, with our most engaging post (“Cellphones are not allowed at the dinner table”) reaching nearly 300,000 people. The lint roller execution alone generated a total of 26.8 million earned impressions, which is worth $300,000 in media.

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Footnote 1: Statistics Canada, March/April 2014

Footnote 2,3: IKEA Consumer Tracker, 2014 vs. 2013

Footnote 4: Sysomos data, March – May 2014

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

All of the conversation around the House Rules campaign has been overwhelmingly positive, including ancedotally described at IKEA global as “one of the best IKEA brand campaigns to date”.

b)Excluding Other Factors

Spending Levels:

These extraordinary results were achieved without any increase in total advertising budget dollars verses the pervious year.

Pricing:

Pricing of all IKEA products remained unchanged from previous years, and no extraordinary discounting was applied.

Distribution Changes:

IKEA’s distribution remained the same as the previous year and all results are for same-store-sales.

Unusual Promotional Activity:

IKEA’s promotional calendar remained the same as the previous year, so no discounting was placed into the market to stimulate brand consideration, store visitation or sales.

Other Potential Causes:

Although there clearly is a significant interest in home and home décor, that interest effect cannot be correlated to any demand against a particular retailer like IKEA.