Scotiabank SCENE

Sustained Success (BRONZE)

Client Credits: Scotiabank

Jeff Marshall – VP Marketing, Personal Banking

Lisa Hartley -Director & Head, Brand & Media Strategy | Marketing Planning

Agency Credits: Bensimon Byrne

Joseph Bonnici – Creative Director

Chris Harrison – Associate Creative Director

Hayes Steinberg – Associate Creative Director

Steve Groh – Group Account Director

Amanda Burgess – Business Lead

Jordan Lane – Project Manager

Jeffrey Gougeon – Project Manager

Leanne Plummer – Media Planner

Angie Genovese – Media Planner

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | Nov 1/11 – Oct. 31/12/Nov. 1/12 – Oct 31/13 |

| Start of Advertising/Communication Effort: | June 18, 2012 and June 17, 2013 |

| Base Period as a Benchmark: | November 2010 – October 2011 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

Launched in 2007 as a co-venture with Cineplex, the SCENE program is the first – and only – movie loyalty rewards program in the Canadian market. The Scotiabank SCENE debit and VISA cards allow consumers to earn points on everyday purchases, redeemable for free movies, movie snacks and more. Today, with over 1.5 million SCENE debit and VISA cardholders, the program has delivered significant customer and account growth for Scotiabank, and has successfully attracted younger consumers (ages 18 to 34) to the bank.

Younger customers are integral to the bank’s future growth, because product penetration increases dramatically as consumer life stages evolve. Given their younger age, these new customers have fewer ties to major financial institutions, and thus switching behaviour is higher among this demo.

While the co-branded SCENE program has high brand awareness in the Canadian market, it is largely attributed to Cineplex – most notably the free and easy-to-attain “black card,” which has no annual fee, no qualification requirements, no ties to a bank, and can be sent through the mail. Historically, this has resulted in comparatively low awareness for Scotiabank’s affiliation, the product value propositions of the SCENE debit and VISA cards – and, due to a dismal ROI, Scotiabank seriously contemplated whether its significant investment of time, money and resources in this program was worth it.

b) Resulting Business Objectives

In 2012 and 2013, Scotiabank set an aggressive goal to incrementally increase the total number of day-to-day banking accounts by a 6-12% each year. Based on average year “run rate” this would mean that during the campaign period we would need to increase SCENE debit by 42% and SCENE VISA by 88%.

For both years, the focus was on acquiring new-to-bank customers, particularly among the coveted 18-34 demo.

To meet aggressive targets, the campaign’s communication objectives were to:

- Increase awareness and attribution for Scotiabank’s SCENE products

- Increase awareness of the SCENE products’ value proposition (you may never pay for a movie again) and generate consumer desire for the products

c) Annual Media Budget

Confidential

d) Geographic Area

Canada (except for Atlantic region)

Section III — STRATEGIC THINKING

a) Analysis and Insight

There were many rabbit holes we could have – and did – run down before we uncovered what we felt was the most compelling way to market the SCENE program. Should we focus on debit or credit? Do we highlight the free stuff you can earn, the discounts you receive, the places you can earn points, the rich earn rate, the promotional offer? We were spoiled for choice, but with so much competitive clutter, our task was to find the ultimate core motivating benefit that would make Scotiabank’s products the heroes within the SCENE portfolio of cards.

In an attention economy, there’s nothing more motivating to consumers than free. It’s a very powerful reward, on both a functional and emotional level. For many consumers, rewards programs lose their appeal due to the time and effort it takes to earn enough points to redeem for rewards with high value as perceived by consumers. People love free, but are skeptical of it – they assume that something “free” will come with strings attached and want to feel like they’ve earned whatever they’re getting.

The point of differentiation between Cineplex’s black cards and Scotiabank’s debit and VISA cards lies in the earn rate and where you can earn points. Research determined that consumers see the SCENE debit and VISA cards as “upgrades” to the black card – products that will get them more free movies, more often. We needed to focus on the benefit of the higher earn rate – you may never pay for a movie again. This is a unique, motivating and compelling value proposition for anyone who enjoys movies.

Although only Scotiabank offers both a SCENE debit and credit card, we chose to feature the debit card as the campaign hero for the following reasons:

- Debit rewards are still relatively rare in the Canadian market, thus further increasing differentiation; and

- Debit as a payment vehicle is appealing to a younger audience because of the ongoing earning power of day-to-day purchases, and younger age qualification restrictions.

From a bank perspective, debit cards have greater usage, provide non-interest revenues, and are key to customer retention.

b) Communication Strategy

Products and services offered in the heavily regulated financial services category are largely commoditized, making it difficult for banks to offer distinct competitive advantages in terms of products, offers, or messaging. In the rewards card segment, FIs attempt to outshout one another by targeting a component of their product’s earn/burn value proposition – the most miles, no blackouts or restrictions, the maximum cash-back rebate, the highest earn rate. SCENE was already differentiated as it is Canada’s only national movie reward program. However, the basic Cineplex black card is free, easy to sign up for, and not tied to a bank. We needed to demonstrate the added value Scotiabank brought to the product.

Consumers want a simple, clear message that tells them exactly what they get. More, they want to feel invested in that message – it must appeal to them on both a functional and higher-order emotional level. For our campaign to connect with and motivate consumers, we needed to capture and dimensionalise the emotional component of ‘free.’

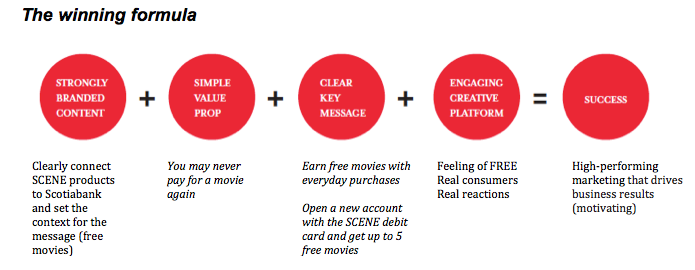

In assessing our 2012 campaign – which broke previous Scotiabank records for SCENE campaign business results and overall TV spot brand attribution – we codified the winning formula that would inform our communication strategy for the 2013 campaign. Strongly branded content that also helps set the context for the communication – for example, opening a TV or cinema spot with a shot of the Scotiabank Theatre marquee – paired with a simple product value proposition (you may never pay for a movie again), an attainable customer benefit (earn free movies on everyday purchases) and a motivating offer (open a new account with the SCENE debit card and get up to five free movies) create a clean and powerful creative canvas for communicating the emotional side of free.

To break through the clutter in the promotions-rich summer season, we needed to develop a campaign that appealed to this fickle consumer segment. It wasn’t good enough to simply tell consumers about the promise of this rewards-based debit card – you may never have to pay for a movie again – we needed to show them, and on a scale grand enough to make an emotional impact on our target.

For two years in a row, we focused campaign communication on a single, unifying idea rooted in Scotiabank’s “You’re richer than you think” brand idea. A movie is a rich, emotional experience – a free movie even more so. The external expression of that? Richness Is: The feeling of FREE.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

b)Creative Discussion

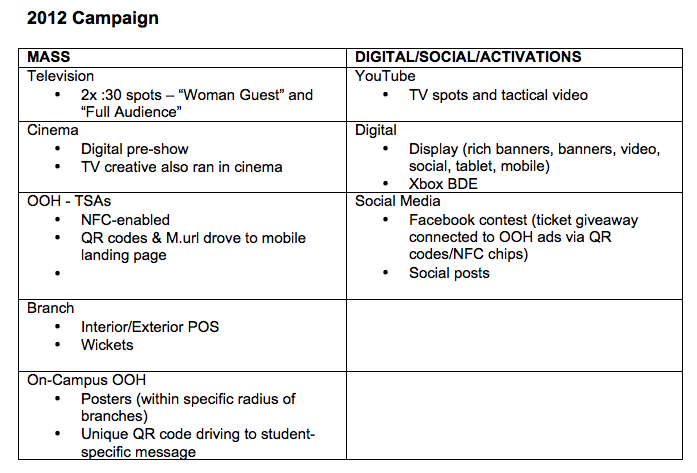

2012 Campaign

To bring SCENE’s value proposition to life, we bought out a multiplex – every seat, bag of popcorn, box of candy, and drink – for the premiere of The Avengers. Since authentic communication is a key pillar of Scotiabank’s marketing strategy, we didn’t hire actors or let moviegoers in on the surprise right away.

We positioned 20 hidden cameras at all points of purchase. When moviegoers went to pay for their tickets or order snacks, they were told their transaction would be free. Reactions ranged from confusion to surprise. We finally let moviegoers in on what was happening before the movie started by letting them know – via the big screen – that Scotiabank was behind their night at the movies. This was met with a big round of applause, every time.

From the hidden camera footage, we developed two TV spots and two preroll videos that shared the rich experience – and the benefits of SCENE – with a broader audience. Out-of-home, print and POS excutions focused on contextual in-theatre moments featuring moviegoers enjoying their experience, with headlines ranging from Richness Is: 120 minutes of escape to Richness Is: A 2 hour study break.

Scotiabank hosted a daily movie ticket giveaway on Facebook, creating a connection between offline and online tactics by driving consumers to the contest via NFC chips on transit shelters – a first for a Canadian Financial Insitution.

The digital buy for this campaign also included innovative Xbox and Connected TV placements that allowed us to reach our target in contextually relevant ways.

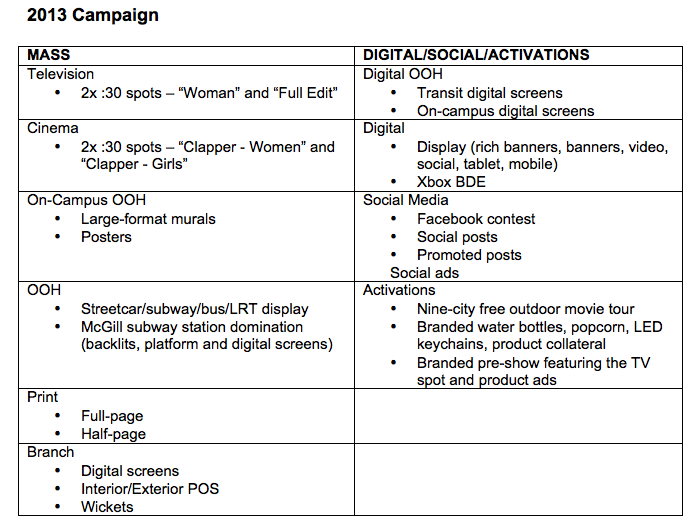

2013 campaign

Based on the breakthrough success of our 2012 broadcast spots, which scored well above norm for brand link and prompted recall, we decided to reversion them with new edits in 2013. To create campaign consistency, we invited the unsuspecting moviegoers we surprised with free movies at the point of sale in 2012 to an in-cinema photography shoot, with the shots leveraged across branch POS, OOH, print and digital.

To evolve the campaign idea and generate new content for cinema and preroll, brought moviegoers even closer to the movie action – literally putting them into the scene. We once again took over a multiplex for an evening and surprised unsuspecting moviegoers at the ticket point of purchase. When they attempted to pay for their movie, a full movie crew – including a director, actor, makeup, lighting and audio person – descended on shocked customers, adjusting their hair and make-up and giving direction to the “Cineplex employee” to adjust their line to “that will be free.” With each interaction, consumers felt as though they were part of a movie about the Feeling the Free.

From the surprise and delight shot at this activation, we developed content for two cinema spots and two digital pre-roll videos. The digital buy included hardworking mobile units and innovative Xbox and Connected TV placements that allowed us to reach our target in contextually relevant ways.

To extend the Feeling of Free beyond mass, we brought the Summer of Free – a national movie tour that screened free movies in unique outdoor venues – across Canada from Quebec to British Columbia. We chose outdoor movies to differentiate our program from in-theatre campaigns run by Cineplex and increase brand attribution to Scotiabank.

To create social media engagement and campaign integration, a Facebook contest asked Canadians to vote weekly on a selection of three movies thematically tied to a location for an opportunity to win free movie passes and a grand prize of free movies for a year. The movie that received the most votes was screened at the next week’s event, with over 1.5 million ballots cast over the campaign run.

We amplified the ‘Feeling of FREE message at live events by treating moviegoers to a free movie on a 40-foot inflatable screen, and providing the first 500 attendees with free popcorn, water and a branded LED keychain. Each event featured a VIP section available to the first 100 Scotiabank SCENE debit and VISA cardholders to show their card. VIPs received special seating, branded fleece blankets and a separate concession stand.

c)Media Discussion

Not Applicable

Section V — BUSINESS RESULTS

a) Sales/Share Results

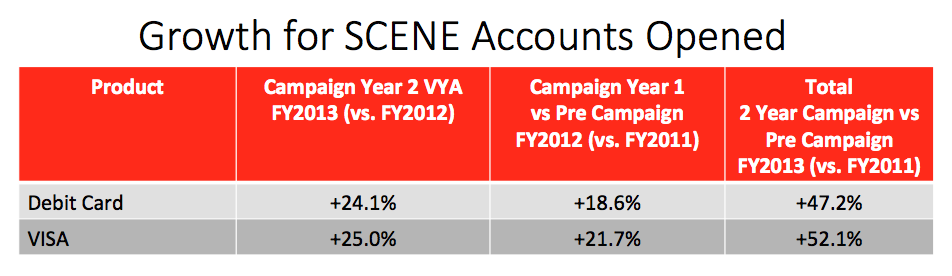

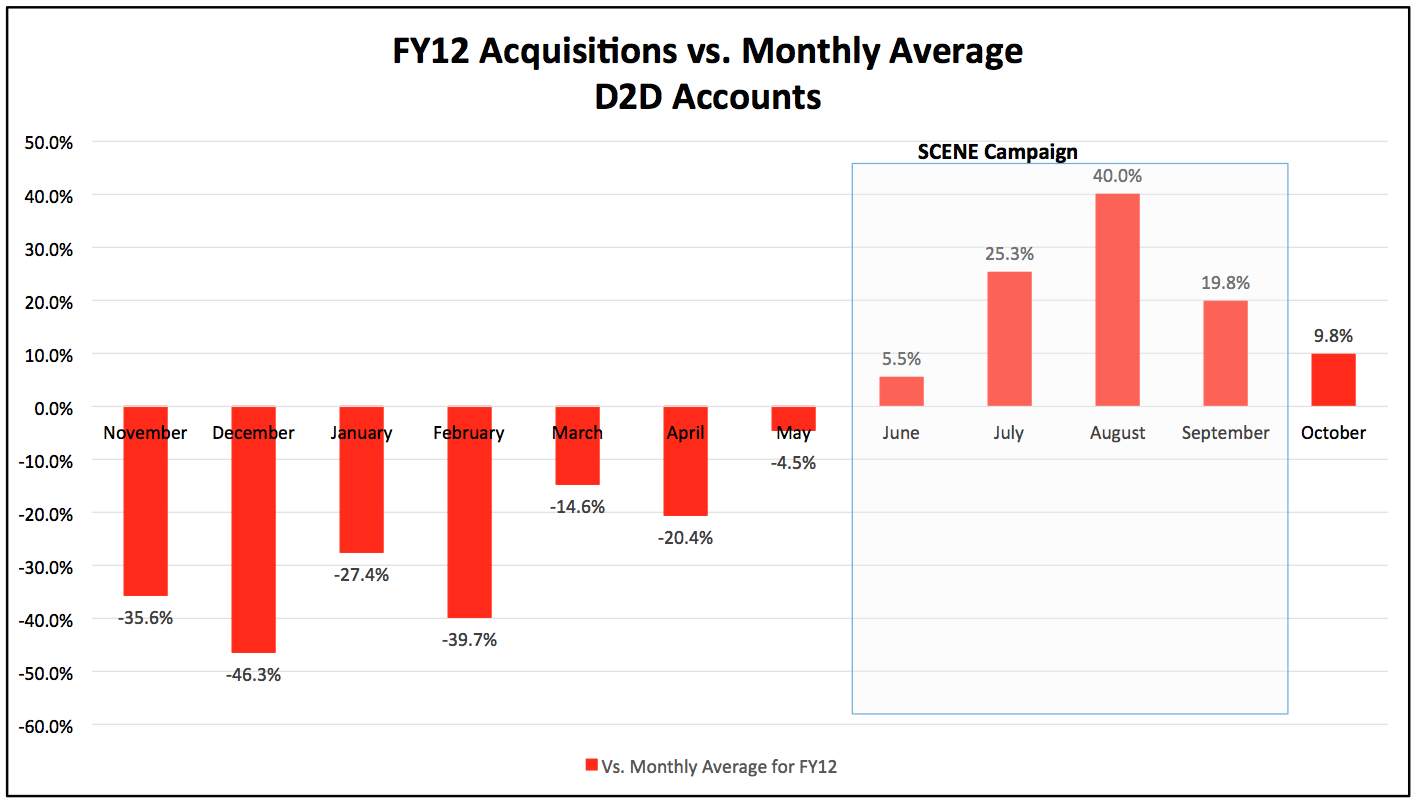

The campaign has over delivered on aggressive acquisition targets for each of the two years in market versus the pre-campaign period FY2011. Since the launch of the campaign, debit card acquisition has increased 47.2% and credit card acquisition has increased an impressive 52.1% versus the pre-campaign period.

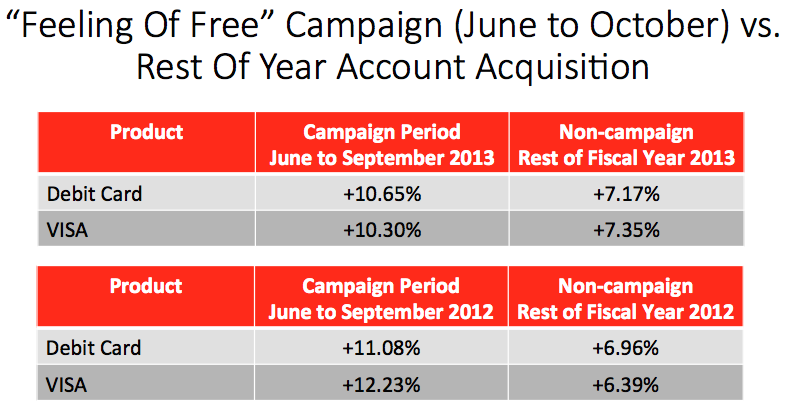

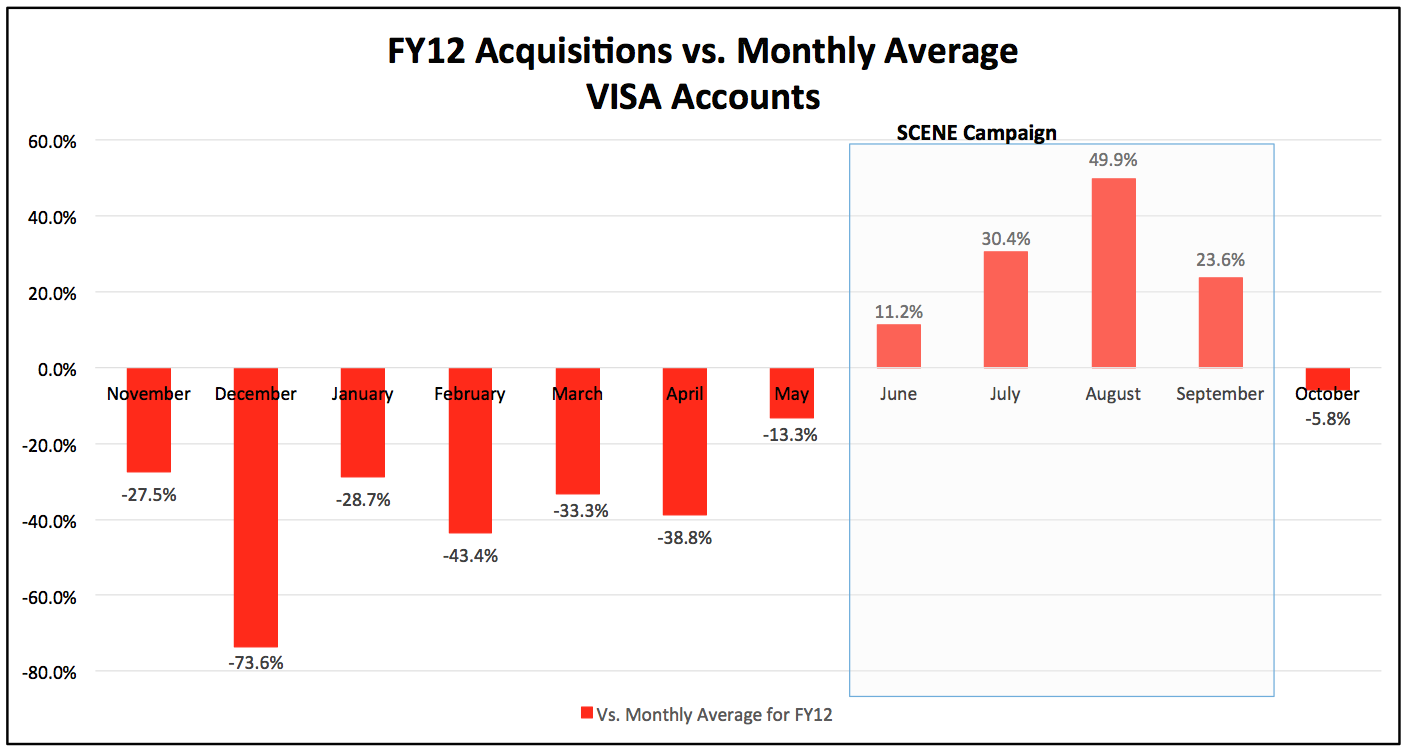

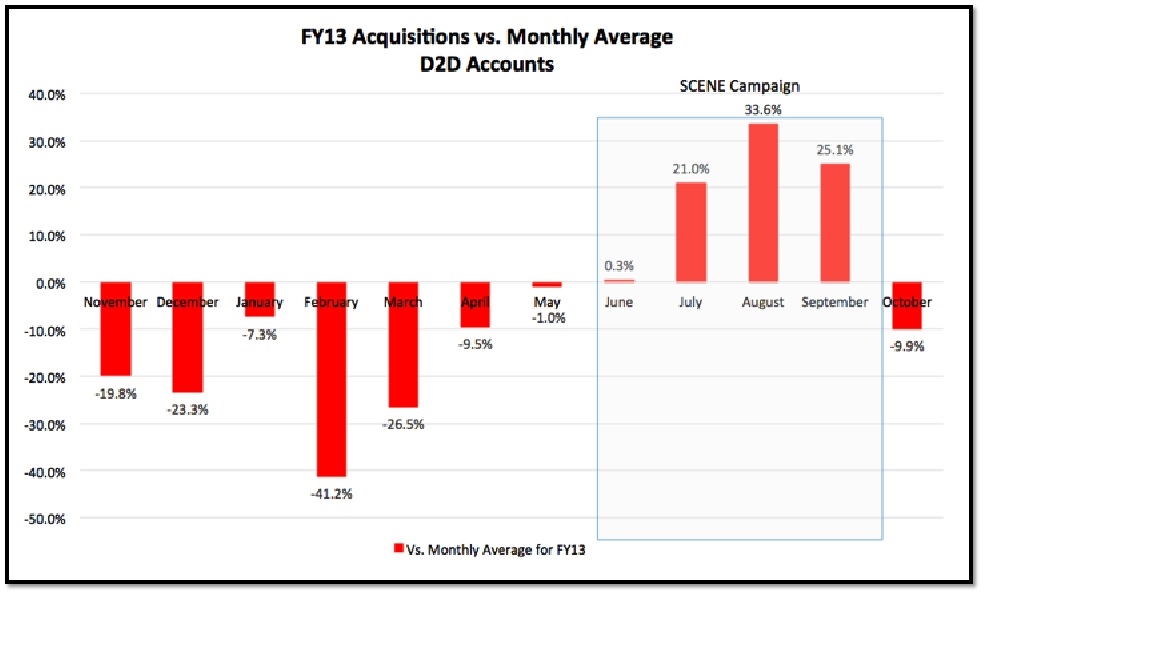

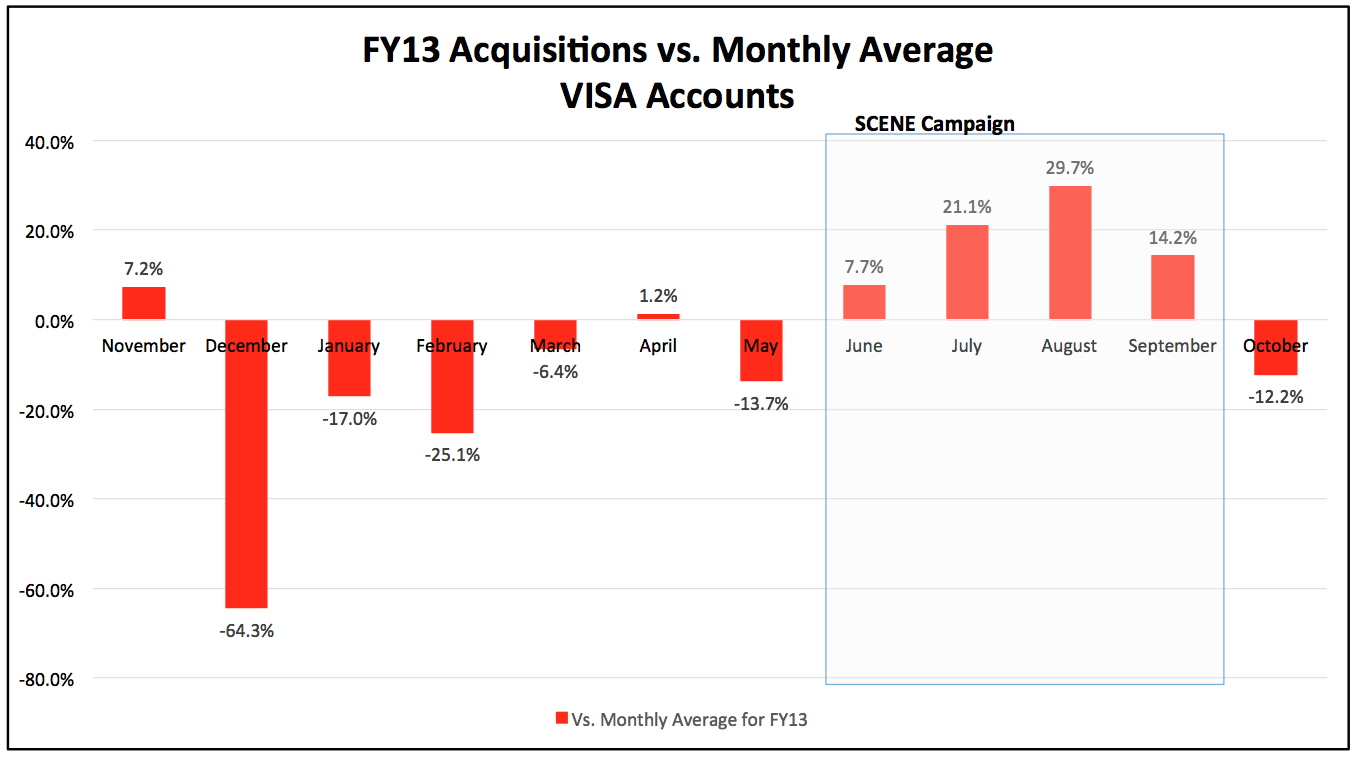

The strong annual growth numbers are driven by the four-month campaign periods (June – September) where on average acquisition increases are approximately10 points higher than the remainder of the year.

Note: full fiscal is November to October

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

Key advertising metrics were to:

- Generate awareness of the SCENE program; and

- Ensure that the SCENE program was attributed to Scotiabank.

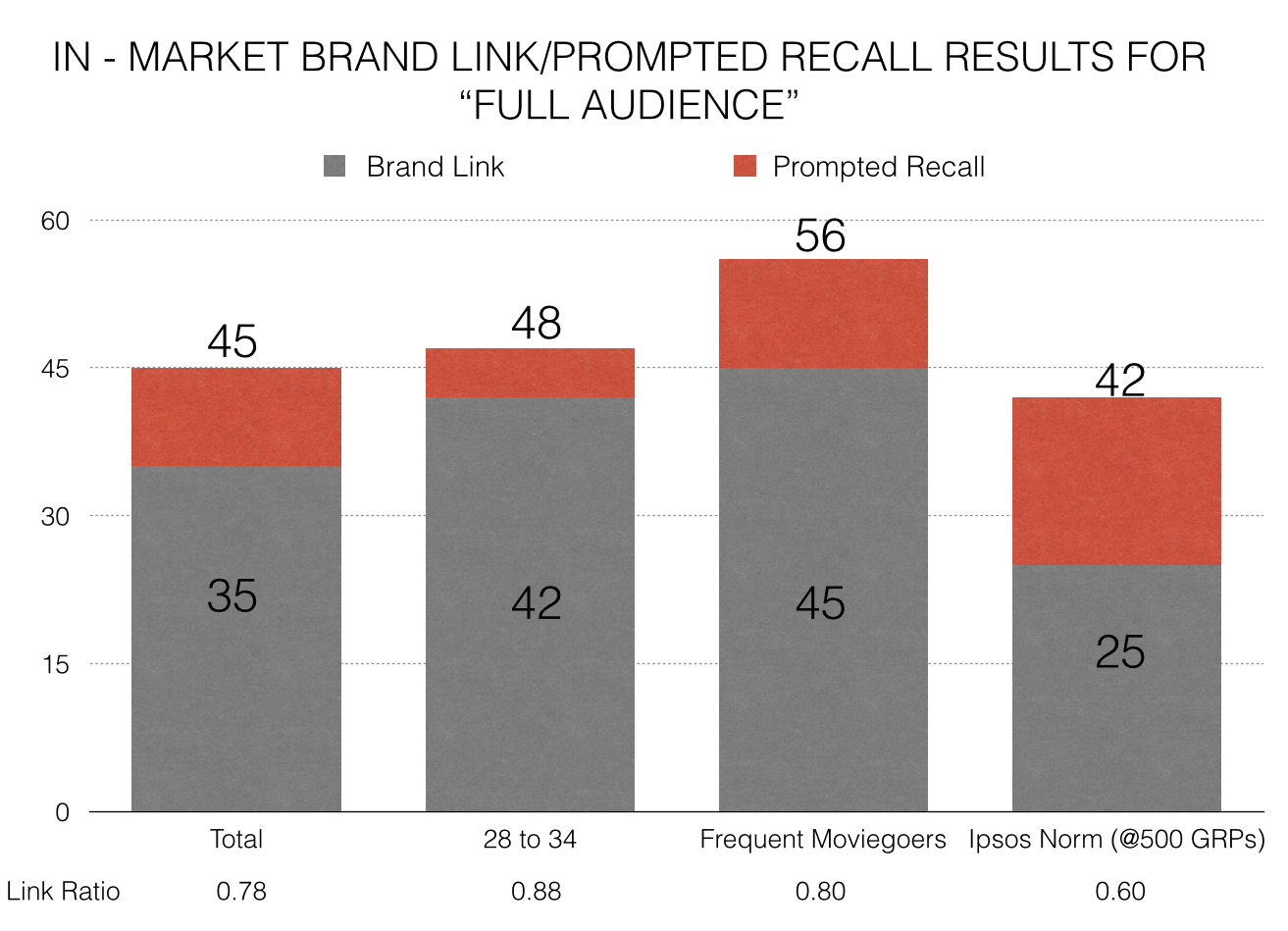

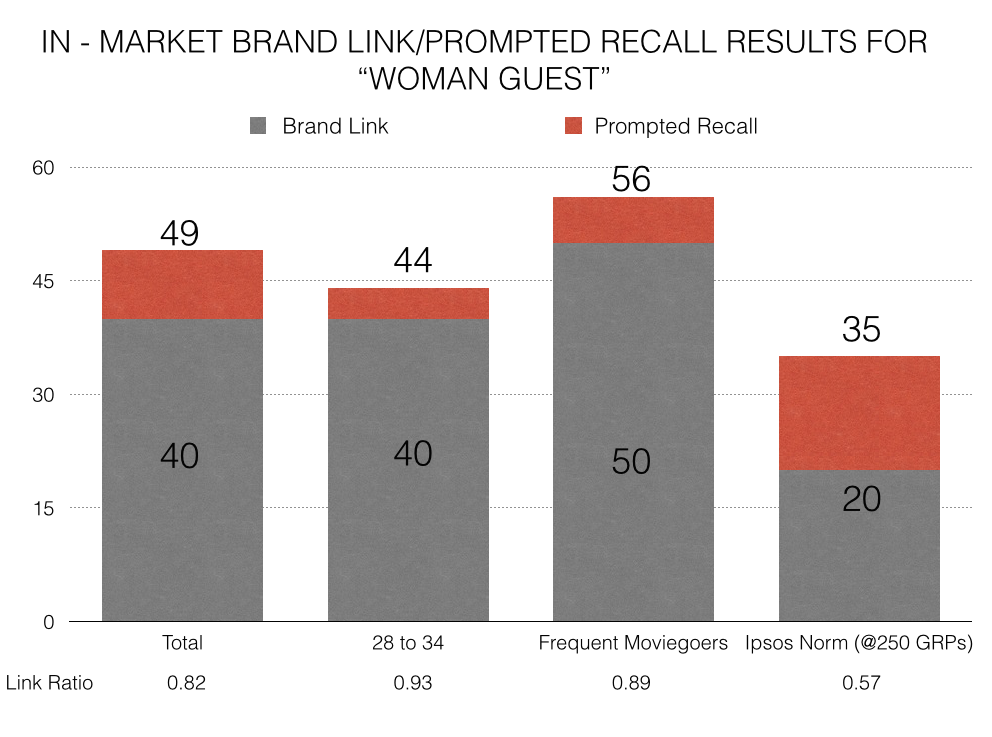

Tracking research proved awareness and the correlation between the brand and the program were very high – significantly higher than IPSOS brand link benchmarks. Overall, both SCENE TVCs in 2012 and 2013 broke through well above Ipsos’ norms and were linked back to Scotiabank at above-norm levels. The results were even stronger with the campaign’s primary target: Frequent moviegoers ages 18 to 34.

“Full Audience”: Prompted Recall with Frequent Moviegoers and 18 to 34-year-olds scored well above Ipsos’ Norms (+33.3% and +14.3% respectively). The spots were also well-branded with Frequent Moviegoers and 18 to 34-year-olds correctly recalling the Scotiabank brand well above Ipsos’ Norms (+80.0% and +68.0% respectively).

“Woman Guest”: Prompted Recall with Frequent Moviegoers and 18 to 34-year-olds scored even higher above Ipsos’ Norms than with “Full Audience” (+60.0% and +25.7% respectively). The spots were also well-branded with Frequent Moviegoers and 18- to 34-year-olds correctly recalling the Scotiabank brand well above Ipsos’ Norms. (+150.0% and +100.0% respectively).

BUSINESS IMPLICATIONS

So the critical question is: Did the advertising specifically drive results? It most certainly did.

During these past two campaigns, the top six months for account acquisition in the seven-year history of the SCENE program have been during our campaign periods: July – September (2012 & 2013). The timing of the increases in account sales directly correlates to the time these campaigns were in market. These increases can be directly attributed to the advertising as there were no price promotions, increased distribution or creative effort for Cineplex SCENE running during these periods. Additionally, marketers typically eschew advertising during the summer timeframe as the general fear is that consumers are disengaged with traditional media. This case proves the opposite: if you have a great idea, marketing is effective any time of the year.

This trend stays true for VISA account sales.

This case clearly demonstrates the power of advertising to drive sales when you have a simple resonating idea that is strategically positioned and reimagined flawlessly year over year.

b)Excluding Other Factors

Spending Levels:

Advertising spend levels in the loyalty rewards card category are astronomical. Category is expansive as all types of companies engage in this practice: all credit card issuers (financial institutions and monoline like AMEX and Capital One) have cash back, travel rewards and partner cards (Tim Horton’s, GM), retailers like HSBC, Shoppers Drug Mart, Starbucks, Chapters points programs, airlines, grocery stores and the list goes on. It would be unreasonable to assume that Scotiabank “bought the business” given the competitive nature of this category.

Pricing:

As this is a debit and credit card, no “discounting” or sale was provided as these are “free” services for qualified sign ups.

Distribution Changes:

The rate of additional branches being opened has not changed year over year for the periods in this report. Debit and credit cards for Scotiabank are not issued through the mail and can only be accessed through the bank.

Unusual Promotional Activity:

Normally an additional 4 free movies for sign up is the annual, non-campaign signing bonus. During the campaign period we increased it to 5 free movies.

Other Potential Causes:

There could be a causal relationship between increases in movie attendance during the summer and additional interest in the SCENE program, however, StatsCan had reported the 2012 summer season had reached a new low in summer attendance. This is opposite to the significant increase in sales Scotiabank SCENE had achieved during this time period.

Advertising does have an effect on employee awareness of the program, therefore a portion of the increased sales could be attributed to this focus. However: a) given this is a result of the campaign vs. internal promotions, b) given the significant number of “new to bank” customers this program achieved, the increased sales of SCENE debit and credit cards can be directly linked to the success of the advertising.