Milk Every Moment

Off to a Good Start (BRONZE)

Client Credits: Strategic Milk Alliance

Strategic Milk Alliance

Market Development Manager, Alberta Milk: Katherine Loughlin

Marketing Communications Coordinator, Alberta Milk:

Executive Director, CEO, BC Dairy Association: Dave Eto

Director of Communication and Market Development, BC Dairy Association: Liz Gurszky

Director of Marketing, Dairy Farmers of Canada: Claire Payette

Assistant Director, Marketing, Dairy Farmers of Canada: Genevieve Desrochers

Program Manager, Marketing, Dairy Farmers of Canada: Lindsay Kay

Market Development Director, Dairy Farmers of Manitoba: Jason Brandes

Marketing Manager, SaskMilk: Anita Medl

Agency Credits: DDB Canada / Vancouver

DDB Canada and Tribal Worldwide and Shopper DDB

Executive Creative Director: Dean Lee / Cosmo Campbell

Creative Director: Josh Fehr

Associate Creative Director: Neil Shapiro

Art Director: John Larigakis / Shawn McCann

Copywriter: Neil Shapiro / Jon Mandell

Agency Producer: Karen Brown / Kimberly Billan

Strategist: Rob Newell / Marty Yaskowich

VP, Client Services: Patty Jones

VP, Shopper Marketing: Jason Dubroy

Account Director: Svetlana Connolly

Media Strategist: Erica Bauer / Diana Walter

Media Buyer: M2 Universal

Digital Artist: Laurice Martin

Digital Designer: Shawn McCann

Technology Lead: Justin MacLeod

Developer: Tyson Yau

Information Architect: Kristy Streefkerk

Digital Strategist / Cultivator: Derek Lau

Director: Arni Thor Jonsson

DP/Cinematographer: Adam Richards

Line Producer: Ed Callaghan

Editor: Jon Devries

Colourist: Eric Whipp

Audio House Producer: Yan Dal Santo

Audio House Engineer: Daenan Bramberger / Harry Knazan

Casting Agent: Kirsten DeWolfe

Food Stylist: Becky Paris

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | June 2013 – December 2013 |

| Start of Advertising/Communication Effort: | June 2013 |

| Base Period as a Benchmark: | Q.1 and Q.2. 2013 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

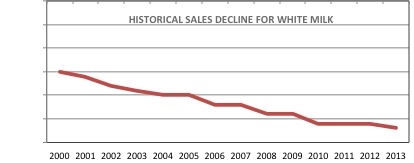

Milk consumption is on a historical decline. Once the preferred beverage at the breakfast and dinner table in most family households, milk now faces tough competition from numerous contenders – coffee, tea, juice, wine and beer. And then there’s water – a major competitor throughout the day.

The Client, the Strategic Milk Alliance (SMA), is a marketing association comprised of five regional organizations that represent producers of fluid white milk in English Canada. Borne out of a united need to increase milk consumption, the SMA banded together in the first ever effort to develop one, nation-wide communications campaign.

Previously targeting only the youth market (age 13-21), we knew that the only way to make large- scale change was to connect with and engage another target audience for milk.

b) Resulting Business Objectives

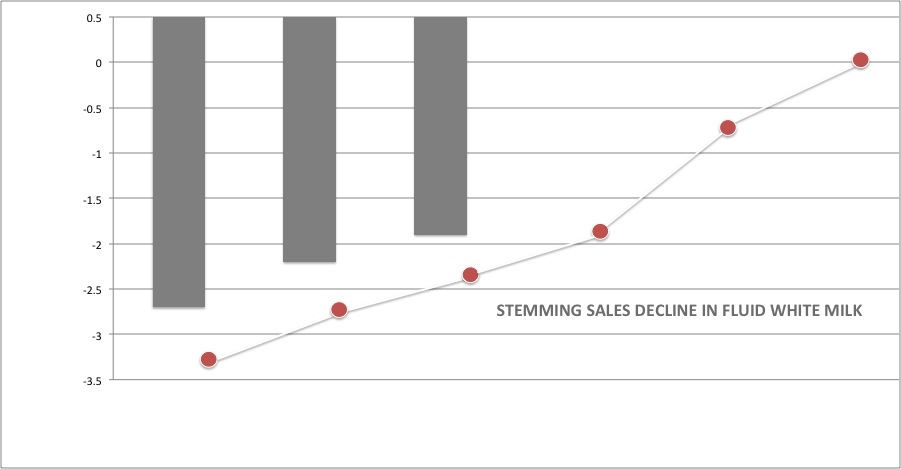

Our primary business objective is to stem the decline in milk consumption by Q3 2016, with annual targets:

Q3 2013 -2.7

Q3 2014 -1.4

Q3 2015 -0.7

Q3 2016 0.0

Considering that overall white milk sales have been declining for over a decade, showing any signs of improvement is a significant achievement and our three-year targets are lofty.

It should be noted that the SMA can only promote the commodity of milk rather than any specific brand. They have no control over the price and packaging of the product, or the retail space in which milk is sold. These are all lead by the milk processors (eg. Lucerne, Saputo, etc.).

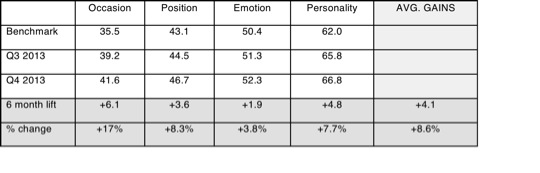

Additionally, brand tracking was implemented across four new KPI’s:

- What emotions milk evokes;

- At what occasion do they choose milk;

- How do they think about/position milk;

- What personality does milk project.

Benchmarks were captured in Q2 2013. Due to category maturity, our expectations were set at a conservative 2% lift after the first year.

c) Annual Media Budget

Confidential

d) Geographic Area

National Canada, excluding Quebec

Section III — STRATEGIC THINKING

a) Analysis and Insight

To achieve the level of consumption increase we desired, we needed to engage with a new audience in addition to youth. Our instincts told us aging seniors might be the most lucrative, but we opted to keep an open mind and undertake morphological research across a large demographic to find our best opportunity. We were surprised and excited about what we had learned:

- On age and sex, we determined that seniors are already over-consuming white milk. But amazingly, parents aged 35-49 were under consuming, especially the women. It wasn’t that they disliked milk – in fact they really enjoy a glass every once in a while – but for a number of varied “rational” reasons they stated, they just weren’t choosing it as much as they used to.

- Because the target was fond of milk, further investigation uncovered that they had great memories of drinking milk as a child. Everyone had a story to tell about milk paired with their favourite foods during their childhood – when, where and how they drank it.

- And no matter how often we raised the nutritional benefits of milk, it was clear that health and nutrition message are no longer motivators to drink more milk. Whether you are a heavy milk drinker or light milk drinker, you already have equal comprehension of the health benefits of milk.

We now knew that we had to move away from talking about health, nutrition, strong bones and teeth and focus solely on making an emotional connection between our target audience (both youth and parents 35-49) and milk. This was about a reigniting a passion for milk through pleasure; back to an impulsive enjoyment of milk.

b) Communication Strategy

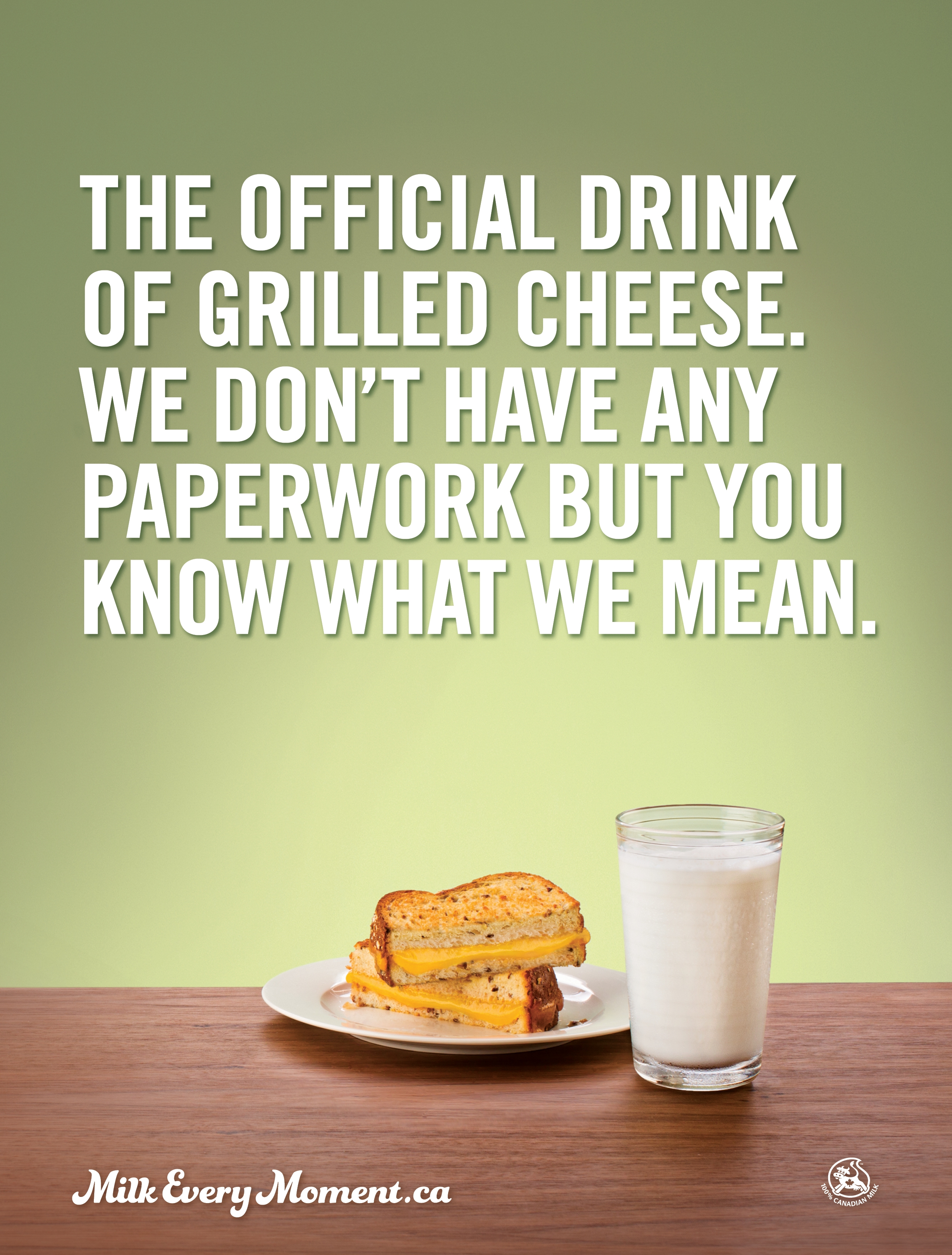

Milk it the perfect sidekick for your favourite foods. Some things are just meant to be. Grab it. Drink it. Enjoy it.

Our strategy was to tap into pleasure factors for milk, specifically around enhancing, complementing and accompanying. Only milk can elevate a taste experience with certain favourite foods such as cookies, cakes, sandwiches. In order to get parents and teens back to the impulsive enjoyment of milk with their favourite foods – we would deliver moments of pleasure.

For the first time, we did not show milk as the hero. It was important for us to be true and authentic about the role that milk plays in our targets lives – it is the sidekick, the enhancer of other foods. This is how milk was introduced to us in our childhood, and the way that we were going to get milk back into the hearts of our audience.

Section IV — KEY EXECUTIONAL ELEMENTS

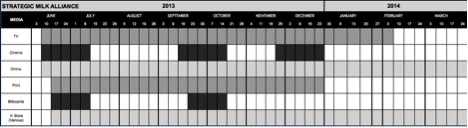

a)Media Used

b)Creative Discussion

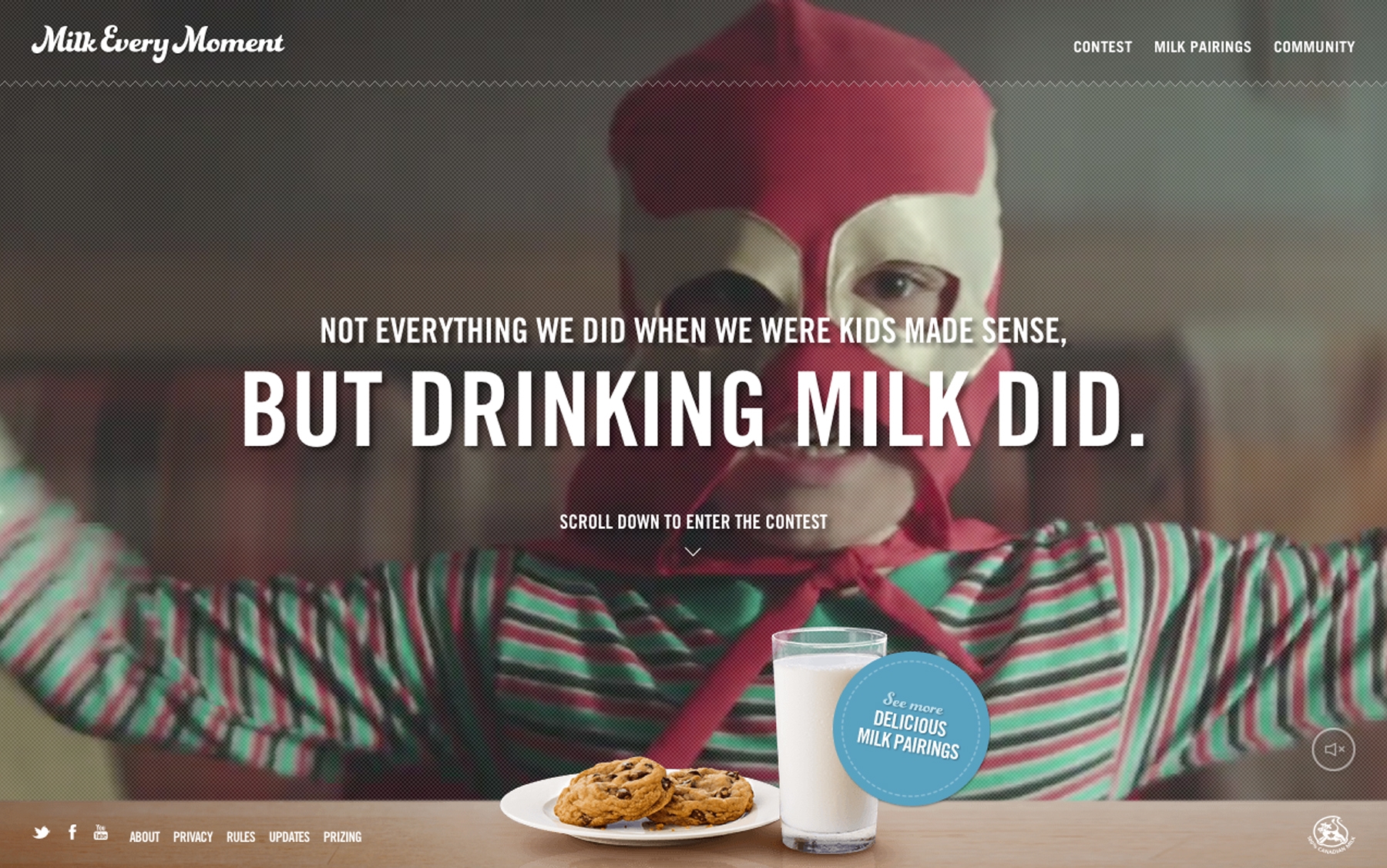

The Milk Every Moment campaign was designed to reawaken that primal enjoyment. Using moments from the past as an emotional catalyst, we wanted to remind our target that when we were kids, we made some odd choices, but we also made some good ones. Milk always accompanied our favourite foods – whether it was cookies, grilled cheese or chocolate cake. For some reason, as we got older, we forgot how good those pairings were. This campaign reminds our target how much we loved milk when we were kids and that it’s still just as delicious as ever. It was good then and good now.

c)Media Discussion

Our first large media strategy change was campaign timing. As our goal was to inspire increased milk consumption of people that have milk in their fridge as a weekly staple, and knowing there’s beverage competition in that same fridge, it was important to sustain a weekly presence and remind consumers how important milk is in their lives. Any breaks and our competition will fill that place in their mind. Thus we moved from a media plan that scheduled periodic bursts at heavy weight, to an always-on schedule at low weekly weight to be most effective.

Further building off our Analysis and Insight, we had three key channel strategies to implement:

- Dual audience targeting driven by common interest – finding aperture moments (programming, content, events, etc.) that were equally shared by both target groups.

- A consumption to purchase path – intercepting primary grocery shoppers in pre-shopping mode when searching for deals/recipes or travelling to the store, prime opportunities to evoke an emotional response just before the opportunity to buy milk.

- Shopper marketing efforts that would close the sale at shelf, an area of marketing that had been grossly underutilized in the past.

From here, the Milk Every Moment idea was implemented in a way that would make the most of the creative message for each channel.

TV and Cinema were used to evoke nostalgic memories of childhood; a time when milk played a much larger role in our lives. We reminded viewers that a lot of things we did when we were kids didn’t make sense, but drinking milk did.

For OOH, Print and Online, we focused on perfect milk pairings to drive taste appeal. Cheeky headlines highlighted milk’s role in enhancing the taste experience of sandwiches, cookies and cake. The message was simple: just grab it and enjoy.

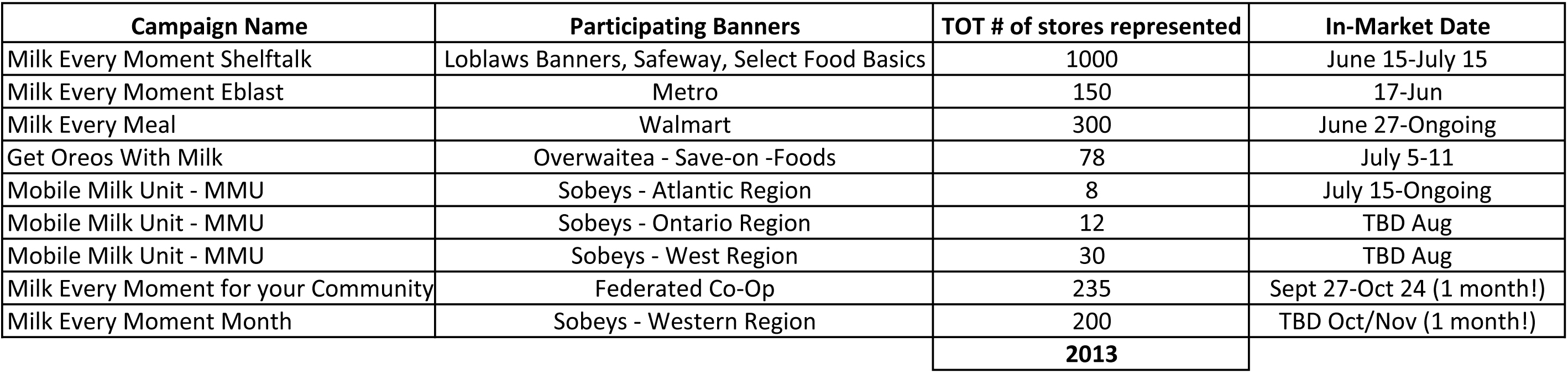

For the first time ever in Canada, a commodity category was given prominence through the entire store. Shelf talkers were placed in almost every aisle of Loblaw’s and Safeway stores next to 24 different foods, reminding you of how great milk will taste when paired with the cookies, cakes, etc. that you are about to purchase.

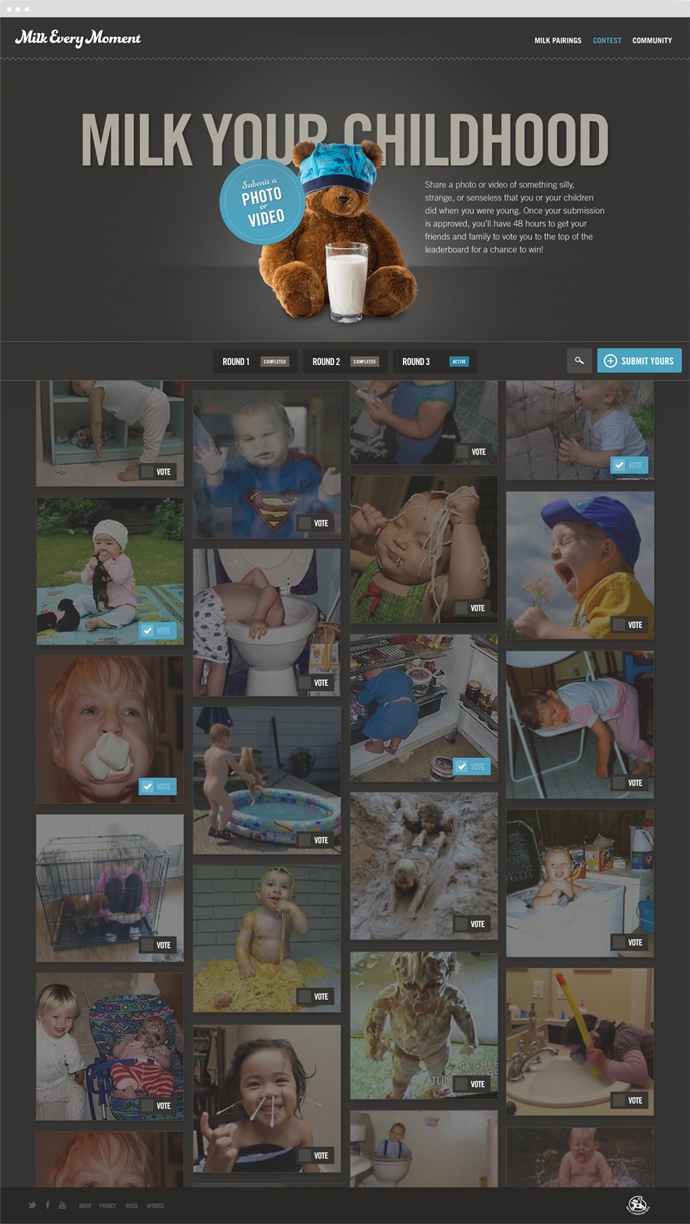

Our website invited consumers to share with our Milk Your Childhood contest. Entering pictures of themselves as children doing silly things provided a chance to win an SLR camera – allowing them to continue to capture favourite, silly moments. The site also housed our TV ads and provided great milk pairing recipes.

OOH:

Print:

Online:

Section V — BUSINESS RESULTS

a) Sales/Share Results

With targets stretched over 3 years, we know reinvigorating a passion for milk will take time. However, we have seen remarkable results within 9 months. Milk decline has moved from -2.7 to -1.9, a difference of over 11 million litres of milk. Huge gains for a beverage that has been on decline for over 10 years.

Our brand metrics saw gains right away, quickly surpassing our 2% YoY target. On average, our 4 key metrics achieved an 8.6% lift within 6 months, clearly indicating that we are changing how and when our target includes milk in their lives.

In store, we saw up to a 5% lift in sales of cartons and jugs versus the previous year with some retailers. One retailer had their shelves completely stripped of milk during a Milk+Oreo promotion.

In store, we saw up to a 5% lift in sales of cartons and jugs versus the previous year with some retailers. One retailer had their shelves completely stripped of milk during a Milk+Oreo promotion.

In 6 months our Facebook community grew by 67%; members rallied together as milk champions, defending the page against milk critics – attracted by our initial paid social posts.

And a consumer reached out to our client with the following email message: “I LOVE, LOVE, LOVE the Milk every Moment commercials! They make me laugh! They can make me cry…they make me feel young again! And, guess what, I am still drinking my milk, every day!”

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

The significance of the 0.8% lift (11,000,000+ million litres) in milk sales since the campaigns launch in June 2013, cannot be understated. A number of new communication opportunities came together to drive this success.

- Uncovering a new target with confirmed understanding on how to engage with them – pleasure.

- Walking away from 20 years of promoting milk with a “health and nutrition” message.

- Being authentic to the role milk plays in our lives, positioning it as the sidekick versus the hero.

- Implementing an always-on media strategy to remind our target everyday to get back to an impulsive enjoyment of milk.

- Developing a large scale, first-time-ever shopper marketing program for milk.

b)Excluding Other Factors

Spending Levels:

At $15,000,000 to produce the entire milk campaign, including media, this campaign was still significantly out-voiced in advertising spend by its competitors – coffee, juice, water, beer – whose combined efforts totalled $142,000,000 in 2013, according to Nielsen. In addition, messaging from many of these brands are augmented by US spill as well as existing digital and earned media.

Pricing:

Other than our short-term, targeted shopper marketing promotions, there was no drop in price, or change of in-store shelf presence, packaging or formatting that occurred in the milk category during the time of our campaign.

Distribution Changes:

There was no change in milk distribution during the period of our campaign.

Unusual Promotional Activity:

Other Potential Causes:

n/a