Hellmann’s Real Food Movement

Long Term Success (GOLD)

Client Credits: Unilever

General Manager; John LeBoullitier, Christopher Luxon

V.P Marketing: Sharon MacLeod; Geoff Craig

Director of Marketing, Foods: Alison Leung; Jon Affleck

Brand Building Manager: Ola Machnowski; Juanita Pelaez, Ian Busch; Stephanie Cox

Assistant Brand Building Manager: Michelle Wu; Monica Palit; Mindy Perlmutter

Agency Credits: Ogilvy & Mather

Chief Creative Officer: Ian MacKellar; Janet Kestin and Nancy Vonk

Managing Director: Laurie Young

Senior Partner, Group Account Director: Aviva Groll

Account Supervisor: Emily Bergeron; Sarah Kostecki, Stasha Poznan; Mandi Lee; Jennifer Mcleod and Da

Account Executive; Alex Pente; Coby Shuman; Terri Matucci

Writer: Brian Quittenton, Chris Dacyshyn

Art Director: Julie Markle; Ivan Pols

Broadcast Producer: Camielle Clark

Harbinger Ideas; Mindshare Canada; Geometry; PHD; Segal

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | Jan. 2007 to Dec. 2013 |

| Start of Advertising/Communication Effort: | April 2007 |

| Base Period as a Benchmark: | 2006 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

It was a two horse race.

The Canadian market for mayonnaise and mayonnaise type dressings is dominated by two long-standing brands – Miracle Whip and Hellmann’s – which together account for over 80% of category sales. Miracle Whip, which had been invented during the Great Depression for the specific purpose of providing a cheaper alternative to mayonnaise, was still seeing success seventy years later with its lower cost platform. In 2006, with 46% share, it was Canada’s market leader (1).

Hellmann’s brand equity was in “versatility”.

Hellmann’s was a solid #2, with 39% share in 2006 (2). The brand had been a Canadian staple since the 1950s, positioned around a benefit of versatility. For years, consumers had been sold Hellmann’s as a handy standby that was always in the refrigerator ready to add to anything you were eating. Great for emergencies, lazy days, and rescuing a mediocre salad or sandwich, it was almost more of a utility than a food.

Versatility platform was losing relevance.

Whether it was used on sandwiches or in salads, Hellmann’s was loved for transforming good foods into deliciously yummy foods because of its inherent versatility. Around the beginning of 2005, the versatility platform was losing relevance as consumers moved into the new millennium with a more vigilant view on what they were eating.

If it wasn’t fresh, it was fake.

Consumers were switching to fresh food options in many categories. An increasingly health-conscious public saw fresh as better tasting, more nutritious and therefore healthier overall. There was a strong trend away from pre-packaged, processed, chemical laden foods towards those with unadulterated, easily recognized ingredients.

Hellmann’s was “junk-in-a-jar”.

Hellmann’s growth was threatened by this trend. By 2005, 75% of consumers thought the product was unhealthy and perceived it as “junk-in-a-jar” (3). The versatility equity didn’t help; the “handy standby” reputation drew attention to the product’s non-fresh status and made it seem a Jack-of-all trades and master-of-none. Miracle Whip’s perceptions were no better, but it did have the benefit of being cheaper. After all, the only thing worse than junk, is overpriced junk.

(1) A.C.Nielsen

(2) A.C.Nielsen

(3) Brand Survey, 2005

b) Resulting Business Objectives

We had one perceptual objective, which was intended to drive two business objectives:

Perceptual objective:

- Change consumers junk-in-a-jar perception of Hellmann’s to “made with real and simple ingredients”.

Business objectives:

- Grow dollar sales.

- Overtake Miracle Whip to become the #1 in the category.

c) Annual Media Budget

$3 – $4 million

d) Geographic Area

National Canada

Section III — STRATEGIC THINKING

a) Analysis and Insight

Canada was having a ‘wake-up moment’ about food.

In the early years of the new millennium, food safety and provenance were starting to have a serious light shined on them, expressed in popular culture through books like Fast Food Nation by Eric Schlosser and The Omnivore’s Dilemma by Michael Pollan and films like Food, Inc. And for good reason. Staggering statistics from the day revealed: 62% of Canadians were overweight or obese; childhood obesity had tripled in the past three decades, and only 40% of Canadians ate the minimum number of recommended five servings of fruit and vegetables a day (4). Society was questioning its reliance on cheaper, artificial convenience foods of dubious nutritional value.

We could own this moment by heroing an overlooked product truth.

The irony about the “junk-in-a-jar” perception is that the very opposite is true. At the heart of Hellmann’s is just three simple, easily recognized and easy to pronounce ingredients – eggs, oil and vinegar. You can’t get much less artificial than that. This was exactly the kind of real, honest food that the new health-conscious consumer was looking for. Our research showed that once people knew about Hellmann’s simple ingredients, the product became much more appealing to them. A story about real ingredients would also give us clear differentiation from Miracle Whip, which was so much a product of science that it had originally launched at the 1933 Chicago World Fair (5).

There was an opportunity to reframe the whole health debate.

Although people needed to hear our product story, research showed they found it hard to believe the truth about Hellmann’s ingredients if we just told them. Instead, we would have to show that we were real food – and show that real food was something we were truly passionate about. We needed to take a stand, get people engaged in a conversation about real food, and let them discover Hellmann’s simple ingredients along the way.

In essence Hellmann’s is the perfect product for the times, but people don’t realize it.

b) Communication Strategy

By tapping into the trend away from pre-packaged, chemical laden foods towards those made with un-adulterated, easily recognized ingredients, Hellmann’s had the opportunity to ignite a passion in Canadians to eat more real foods and bring Hellmann’s along with them. We wanted to put a stake in the ground for everything real, and elevate the idea to a social mission by championing a real food movement.

The Hellmann’s Real Food Movement

is a powerful social marketing campaign

that is executed across many channels.

While it has evolved over the years,

it always utilizes content-heavy, movement-based media

in which people can participate,

which is then amplified in mass media (TV, print and media partnerships)

to spread awareness.

The campaign is targeted at Moms 18-50 years of age. They are their household’s principal grocery shopper. They value authenticity and are skeptical of foods that are artificial.

We developed a strategic framework the Real Food Movement could address:

- Promote accessibility and help make eating real food easy for Canadian families.

- Shine a spotlight on the issues and barriers to eating real food.

- Make Hellmann’s part of enjoying more real food.

Over the years, we have pushed on each of the pillars with different degrees of emphasis, depending on marketing objectives, product news and consumer & cultural context.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

b)Creative Discussion

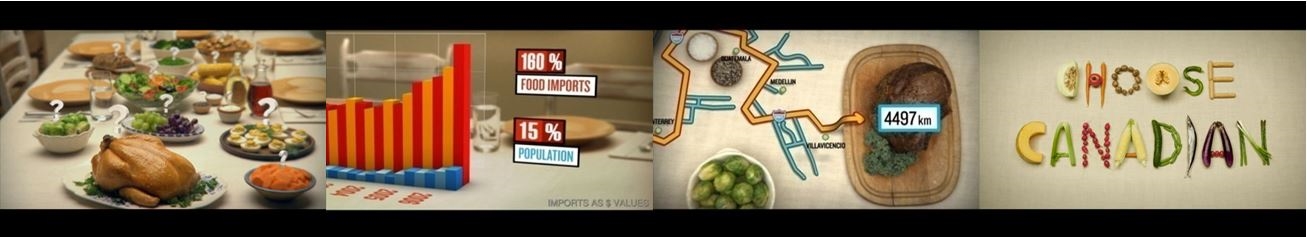

Launch 2007 and 2008:

We made real food accessible for Canadian families.

We didn’t start with ads… we started with dirt. In 2007, we created “Urban Gardens” in five cities across Canada – workable land plots given away to worthy applicants. We went door to door, giving away seeds to invite residents to participate. And we amplified online, creating a toolkit of urban gardening tips with a virtual green space you could watch blossom. TV ads made sure Canadians everywhere knew what Hellmann’s was doing.

2009:

We shone a light on the barriers to eating more real by eating more local.

With prime farmland being paved over and cheaper imports soaring, Canadians are losing the ability to eat Canadian. Hellmann’s exposed this unsettling truth (and at the same time underscored our product’s real Canadian ingredients), with a 2009 mini-documentary called “Family Dinner”. We partnered with CanWest News to make 8 national editorial broadcast news pieces. And we enlisted digital influencers to publicize our website, EatrealEatlocal.ca, which included pledges, petitions and a charity component supporting local food resources.

2010-2013:

We engaged mom through her kids.

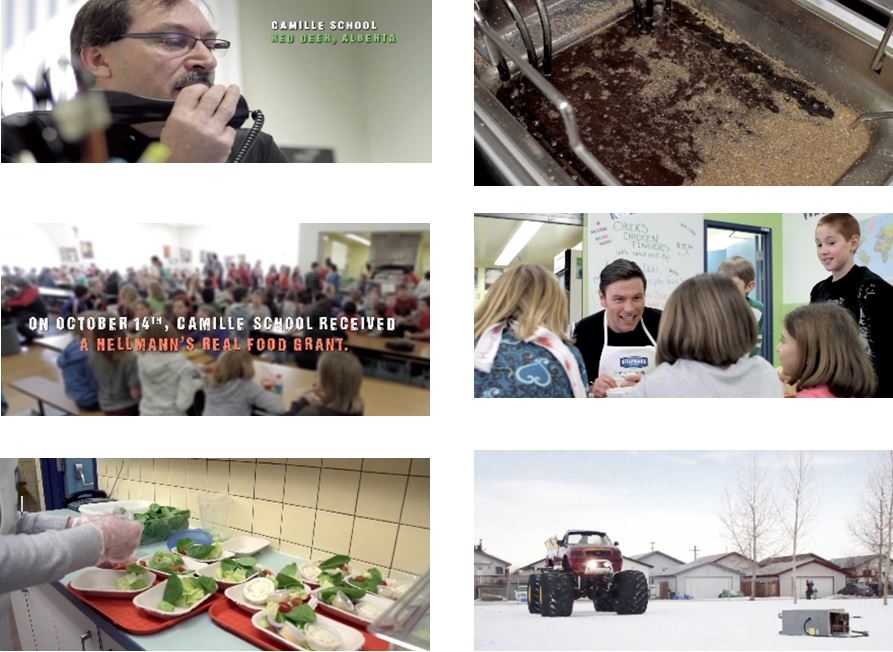

In 2010, we launched the Hellmann’s Real Food Grant Program to fund those who wanted to connect kids with real food. The program made over $100,000 available to individuals and organizations that help families and kids connect with real food.

In 2012, a school cafeteria in Alberta applied for $25,000 to update its kitchens so it could replace the over-processed junk food it was selling (such as “Taco in a Bag”) with healthier options. We decided to go further: Hellmann’s revamped the kitchen, enlisted celebrity chef Chuck Hughes to transform the menu, and brought in a monster truck to ceremoniously crush the school’s deep fat fryer.

Our online film “Bye Bye Deep Fryer” documented the cafeteria‘s transformation.

Hellmann’s survey conducted in August 2012, found that almost a third (31%) of Canadian children admit to having thrown out some of their lunch items. It also found that children who learn about food are less likely to throw out part of their lunches.

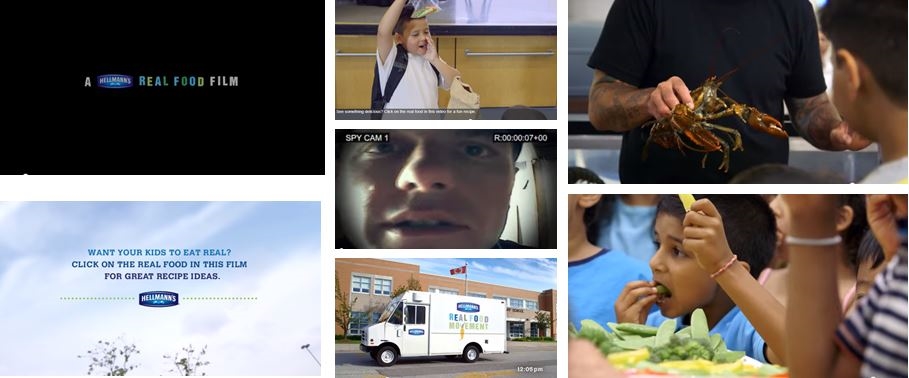

So our most recent program educates on the benefits of eating more real food. In 2013, Hellmann’s partnered with the Field Trip Factory™, a leader in experience-based education, giving schools and other organizations in Ontario a chance to sign up for the free Hellmann’s Real Food Trips™ program held at local grocery stores. Hellmann’s Real Food Trips provided fun, guided, hands-on learning that is consistent with local teaching standards and Canada’s Food Guide. With help from a Registered Dietitian, our experiential program provided a powerful way of helping kids embrace good eating habits which they then bring home to their families.

Our online film “Under Cover Lunch Trader” documented the entire program and allowed us to amplify our real food message further by using YouTube’s newly launched “off-site hidden annotation” technology.

The film showcases a variety of real food that engaged kids on our trip, so we used the new technology to enable parents to click on any of the food in the film for a family-friendly Hellmann’s recipe. Chuck Hughes holds up carrots for the kids? Mom can click on the carrots to get a great dip that kids love.

The use of this technology to embed content has driven thousands of recipe views and incremental views of the film and was showcased by YouTube to other Canadian marketers on inexpensive ways to take awareness video to the next level.

c)Media Discussion

Over the lifespan of the campaign, the Hellmann’s Real Food Movement has utilized a multi-channel multi-media approach all the while consistently targeting principal grocery-shopping women with a 42-year-old bulls-eye. She is someone for whom feeding her family well is a primary concern and her success as Mom is ultimately defined by the well-being of her family.

From 2007 to 2011 each year’s programs were brought to life using a combination of awareness driving TV that employed both a Conventional and Specialty buying strategy, with overlays of media partnerships, whether TV or print, to deepen message delivery and complement the TV.

In 2012 and 2013, the most current iteration of the Real Food Movement, we sought to deepen engagement and amplify Hellmann’s latest stories: the Real Food Grant Program and Real Food Trips online by creating highly engaging and shareable on-line films. In the age of online and social media, we believed the opportunity to best connect with our target would be in the digital realm where the story could be shared by our consumer with her peers.

Section V — BUSINESS RESULTS

a) Sales/Share Results

Our perceptual objective was:

Change consumers junk-in-a-jar perception of Hellmann’s to “made with real and simple ingredients”.

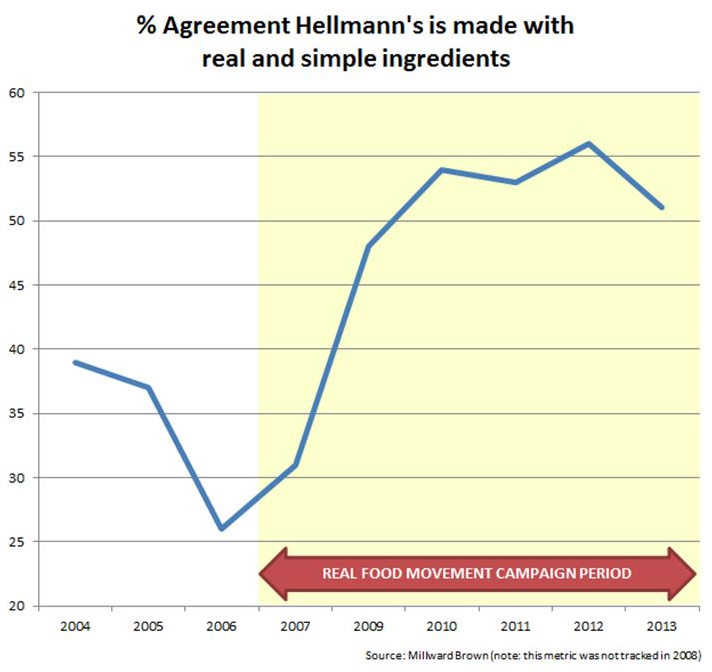

In its first year (2007) the Real Food Movement began to reverse the decline in the “real and simple ingredients” metric, achieving a 5-point increase in agreement (6).

Agreement has continued to grow steadily over the duration of the campaign, reaching an all-time high of 56% by 2012. That means agreement has more than doubled over the 5-year period (6).

Given the strong performance of the creative materials (see below), we can be confident the campaign is responsible for this perceptual shift.

The decline in 2013 to 51% is a result of budget cuts in second half of 2013 and absence of support behind our real food movement activation. (We will discuss this further in greater detail in the Cause & Effect Section).

Our business objectives were:

Grow dollar sales and Overtake Miracle Whip to become the #1 in the category

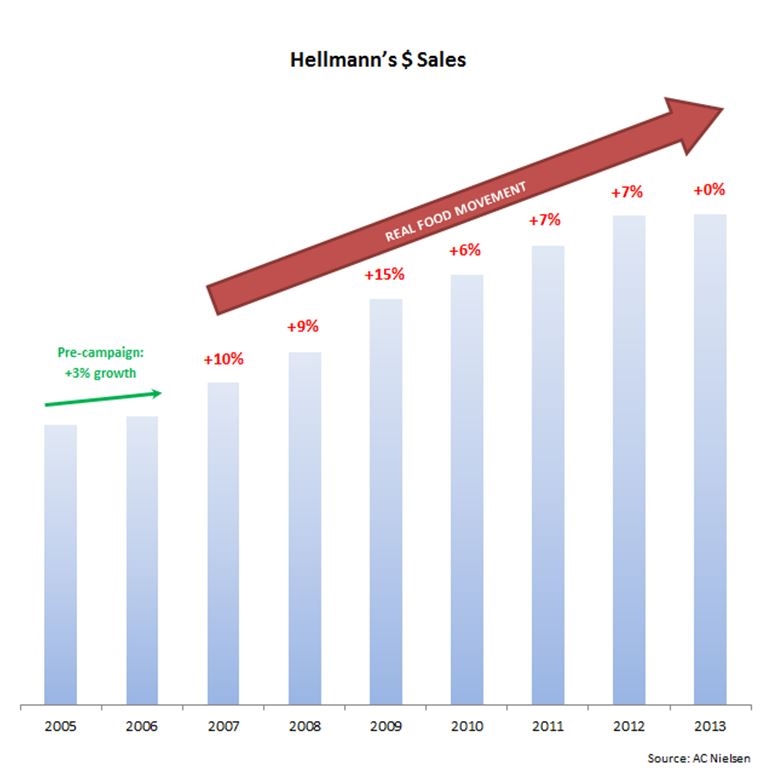

Hellmann’s was growing modestly before the campaign began, with 3% growth in 2006. But in the seven years since the Real Food Movement was launched, Hellmann’s has seen sales increases every single year of between two and five times higher than the pre-campaign figure: +10% in 2007, +9% in 2008 and +15% in 2009; +6% in 2010; +7% in 2011; +7% in 2012.

The business was flat in 2013 due to budget cuts made in the second half of 2013 and the first time in seven years that Hellmann’s didn’t have TV support behind the real food movement. (We will discuss this further in greater detail in the Cause & Effect Section).

Starting from its 39% share in 2006, Hellmann’s has grown dollar share every year, overtaking Miracle Whip in 2008 and then continuing to put distance between the brands. After seven years of the Real Food Movement, Hellmann’s has achieved 53% market share – a full 20 share points ahead of Miracle Whip.

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

Hellmann’s Real Food Movement (RFM) over its lifespan has contributed to the growth for Hellmann’s, without question.

Hellmann’s Real Food Movement has fuelled greater growth for Hellmann’s than its otherwise natural growth would have been.

In 2006, Hellmann’s in Canada was a $67 Million brand, growing at 3% a year. Without the Real Food Movement, it is reasonable to assume growth would have continued at this rate, thereby making Hellmann’s an $82 Million brand by 2013. But in fact, it has become a $113 Million brand by year end 2013. In other words, while natural growth has added $15 Million to annual sales by the end of the seven year period, Hellmann’s Real Food Movement has contributed a further $46 Million to annual sales.

Budget cuts behind Hellmann’s Real Food Movement results in declines.

As discussed in the results section above, budget cuts in second half of 2013, the first time in Hellmann’s Real Food Movement history, had a significant impact on Hellmann’s. First, there was a decline in brand perceptions: agreement with “made with real and simple ingredients” declined from 56% in 2012 to 51% in 2013. Second, baseline sales declined -7% between July-Dec/13 (6). First half 2014 baseline sales are recovering, with the return of Hellmann’s Real Food Movement assets and initiatives in market. This speaks to the importance of Hellmann’s real food message and activations.

(1) A. C. Nielsen Market Track period ending June 28, 2014

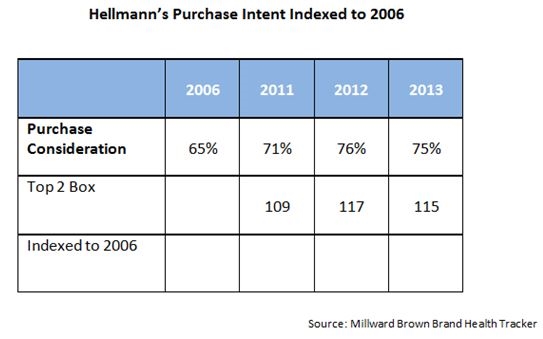

Purchase Consideration:

Hellmann’s Real Food Movement has driven strong purchase consideration for the brand. Since the launch of the campaign in 2007, Top 2 Box Purchase Consideration consistently over-indexes vs. 2006 levels.

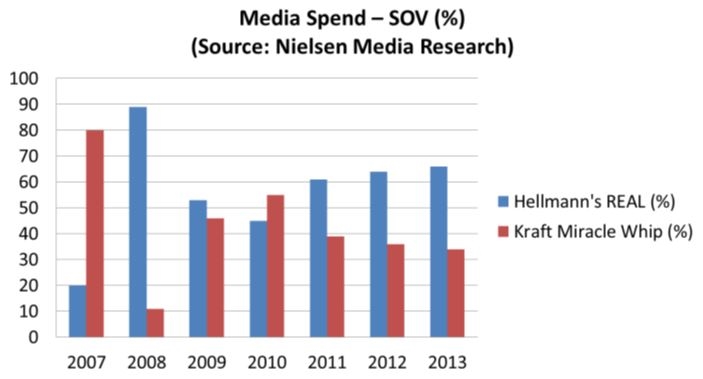

Media Spending:

A competitive spending and SOV analysis reveals a highly inconsistent spending pattern by Hellmann’s over the past seven years indicating ad spending has not been a factor in campaign’s success.

b)Excluding Other Factors

Spending Levels:

We can conclude that the Real Food Movement has been the main driver of growth by discounting other factors:

Media spending levels: These cannot explain Hellmann’s success, since they have not increased significantly over time and have not been consistently higher than Miracle Whip.

Pricing:

Pricing: Hellmann’s price went up 7.5 % in August 2011. That the brand could continue to grow tonnage while commanding this increased premium over Miracle Whip is testament to the campaign and the loyalty it has built.

Distribution Changes:

Distribution: Hellmann’s distribution has remained stable at 98% across Canada over 2007-2013.

Unusual Promotional Activity:

Promotion Activity: This could not be responsible for higher sales. Over the years, Hellmann’s has been actively trying to reduce the number of weeks it is on promotion.

Other Potential Causes:

Product improvements: The switch to free-run eggs will have contributed to increased sales. However, communicating this product news was a major plank of the campaign, so our activity played a key role. Also note that the biggest sales increase (which mirrored the biggest increase in “real and simple ingredients” perceptions) occurred in 2009, while the switch to free-run eggs did not occur until 2010.

This leaves the Real Food Movement to account for Hellmann’s success. This conclusion is supported by the powerful response to the creative work over the years, for instance:

Urban Gardens: the website (2007) had double the visitors spending twice as long vs. Unilever norms.

Eat Real. Eat Local: “Family Dinner” online film (2009) was listed in the Top 6 on The Best of YouTube w/o June 22, on canada.com and in Fast Company’s blog (July 29/09), sending our<