Dove Men+Care “Real Man Challenge”

Off to a Good Start (BRONZE)

Client Credits: Unilever

Sharon MacLeod, VP Marketing

Michelle St. Jacques, Brand Building Director

Gina Kiroff, Senior Brand Building Manager

Andrew Lee, Assistant Brand Manager

Agency Credits: Ogilvy Toronto

Matt Hassell, Chief Creative Officer

Ian MacKellar, Chief Creative Officer

Greg Shortall, Associate Creative Director

Stefan D’Aversa, Art Director

Noah Feferman, Copywriter

Phil Coulter, Copywriter

Mark Forward/Rachel Connell, Group Account Director

Asha Davis/Ken Kircalioglu, Account Supervisor

Nigel Fick, Account Executive

Tess Waisglass, Producer

Maia Spetter, Project Manager

Terri McBay, Executive Director, Social Media

Mindshare

Millward Brown

Harbinger Ideas

In Marketing Services

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | January 2012 –June 2012 |

| Start of Advertising/Communication Effort: | January 31, 2012 |

| Base Period as a Benchmark: | January 2011 – June 2011 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

The problem: Dove is made for women

For the last decade, Dove has achieved critical and commercial success by eschewing the unrealistic images of women used by other brands, and offering the consumer a more truthful picture of herself – one she recognizes, likes, and feels able to aspire to. This success had consolidated Dove’s image as a woman’s brand – which was great news for the main line, but problematic for Dove Men+Care, a range of body washes, shampoos and deodorants, launched in 2010 to target men.

Men weren’t thinking or talking about us

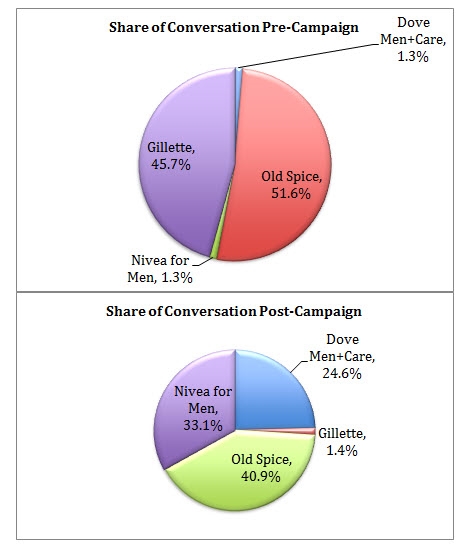

In focus groups, we repeatedly heard things like “I hardly consider Dove as a masculine brand, to me it’s about as feminine as they get” or “It’s not a brand I can really relate to; it’s in my wife’s section of the bathroom, not mine.” Not surprising, then that there was a need to demonstrate that “Dove Men+Care truly understands the needs of men” (18% agreement with this statement among target) and get men to talk about us (just 1.3% share of social conversation in the category). All the engagement – and most of the sales – were going to unapologetically manly brands like Old Spice (2.2% market share and 52% of social conversation) and Gillette (2.2% market share and 46% of social conversation). By contrast, Dove Men+Care had just 1.3% share of both market and conversation, despite comparable media spend and distribution. To get noticed and talked about, Dove would have to “man up”.

b) Resulting Business Objectives

|

Objective |

2011 |

2012 Goals |

|

1. Increase Sales volume by a quarter |

$20 Million |

$25 Million |

|

2. Increase the perception that Dove Men+Care is a brand that “truly understands the needs of men” by 5pts |

18% |

23% |

|

3. Increase Share of Social Conversation seven-fold |

1.3% |

10% |

c) Annual Media Budget

$2 – $3 million

d) Geographic Area

National, Canada

Section III — STRATEGIC THINKING

a) Analysis and Insight

The media stereotypes men too

Despite much talk of the “new man”, stereotypes of the handsome, rugged, omnipotently powerful hero persist. Old Spice might have given the alpha male a 21st century makeover, but the man they portray is still a myth, a fantasy, a superman. While this may be entertaining, it leaves men struggling to reconcile their reality with what they see portrayed. Research revealed that one of the hurdles men face is reconciling their real selves with the portrayal of a “real men” in the media. In fact, almost three-quarters of men globally, and 80% of men in Canada, believe men are stereotyped in advertising as sex crazed, sports stars or ladies men and 67% of men (71% in Canada) find it difficult to relate to men in advertising*.

(*Source: Global Brand report)

Masculinity is changing

The definition of masculinity is changing around the world. Men are balancing traditional notions of masculinity (to protect and provide) with more contemporary, caring ones. This is challenging but ultimately more fulfilling for them.

Additional qualitative research helped us understand that our target was a modern man who balanced the traditional and contemporary qualities of masculinity. A man who was mature, confident, and authentic.

Dove is all about debunking stereotypes

For years, Dove has been reminding women that most images of women don’t reflect reality and shouldn’t be our role models. Although being synonymous with women wasn’t an asset when it came to selling Dove Men+Care, being synonymous with honesty and authenticity certainly could be. A genuine portrayal of a member of their gender was something that men, in their own way, needed just as much as women.

b) Communication Strategy

Dove couldn’t just walk away from “heroes”

Given the perceptions of Dove as a feminine brand, a dose of masculinity was definitely required. And given Dove Men+Care’s weak standing in social media, a bit of borrowed interest was necessary to kick start engagement. We needed to speak to men through outlets they were already engaging with and build brand love by connecting with something that they already loved: hockey. Specifically, we would enlist two ex-NHL athletes: Wendel Clark & Guy Carbonneau.

But we could show those heroes in a new light

Instead of the usual celebrity campaign, we would take these manly men and show that they are more complex, more rounded, more open to trying things outside his comfort zone than stereotypes would suggest. We would celebrate modern masculinity by portraying men as they really are. We would focus on the qualities that consumers concluded described a ‘Real Man’ – someone who cares about his appearance, but doesn’t feel a need to impress. Someone ‘comfortable’ with who he is, both inside and out.

A new kind of naked

When Dove stripped ordinary women down to their underwear, it tackled the biggest barrier to women’s self-esteem: body image. We weren’t about to get Wendel and Guy to take their clothes off, but we did want to tackle the image of the invulnerable hero. We wanted to strip the ‘star’ aura from their personas to reveal more human qualities. We wanted to feature them in natural settings with their families. And we wanted to show them in non-sports situations, facing challenges like the rest of us have to, yet managing to be comfortable in their own skin. This was the kind of man that Dove Men+Care is made for. And so the Real Man Challenge campaign was born.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

The Real Man Challenge integrated campaign ran from January through June 2012 and consisted of:

– :30/:15 TVC in English & :15 TVC in French

– In-stadium advertising

– Digital videos

– Banner advertising

– Social media

– PR media events

b)Creative Discussion

Within the Real Man Challenge campaign, different media and tactics played different roles.

TV was designed to build relevance and land the point that the brand understands what it means to be a real man. And, it did that by featuring Wendel and Guy’s aspirational journeys from hockey legends to proud family men.

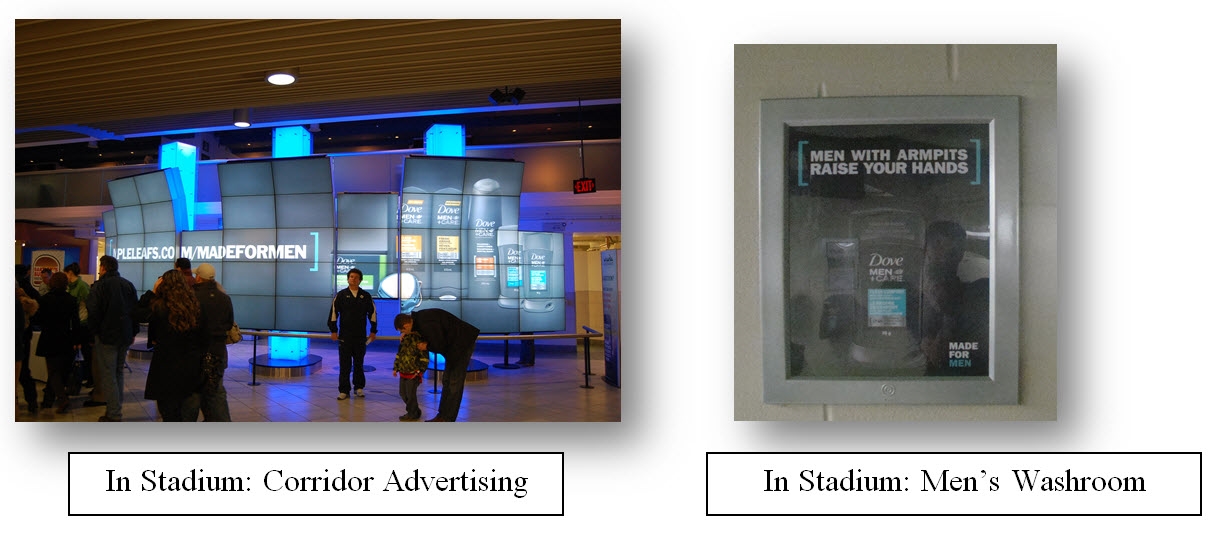

A live Real Men Challenge in-stadium activation was created to see who would “man up” the most in three, live contests. Tasks included: serving thirsty fans during the first intermission rush; selling pre-game programs at a sell-out game and playing the organ live in front of 20,000 fans.

In-stadium ads were created for the Toronto ACC and Montreal Bell Center, including the 360 ring, “jumbotron” and bathrooms ads to build hype for the competition.

Digital videos of all the challenges were posted to YouTube and on our Made For Men microsite on Maple Leafs.com. Tongue-in-cheek banner advertising drove guys there and contributed to over 4MM views for the series of videos.

We tweeted live from the games via our new handle @MadeForMen, while piggy-backing on trending topics, helping to increase relevancy and drive engagement.

A PR media event where the press were invited to meet and interview Wendel & Guy was created to drive awareness and earned media impressions for the campaign.

And, we teamed up with social media influencers, hockey experts with tens of thousands of followers. We even staged real-time Twitter interviews, giving guys a chance to chat live with their hockey idols.

c)Media Discussion

Rather than have the target come to us we wanted to surround them in their natural habitat. In essence, be where they already were – in front of their TV, on Twitter, at the hockey game and on sports websites as a way to contextualize our ‘Made For Men’ message, build relevance and drive engagement.

Section V — BUSINESS RESULTS

a) Sales/Share Results

The Dove Men+Care Real Man Challenge campaign has been the catalyst to help exceed our targets on all levels during the business results period of January to June 2012:

|

Objective |

2011 |

2012 Goals |

2012 Actuals |

|

1. Increase Sales volume by a quarter |

$20 Million |

$25 Million |

$31 Million |

|

2. Increase the perception that Dove Men+Care is a brand that “truly understands the needs of men” by 5pts |

18% |

23% |

24% |

|

3. Increase Share of Social Conversation seven-fold |

1.3% |

10% |

24.6% |

As a result of this 360 campaign Dove Men+Care surpassed all business objectives to achieve impressive results.

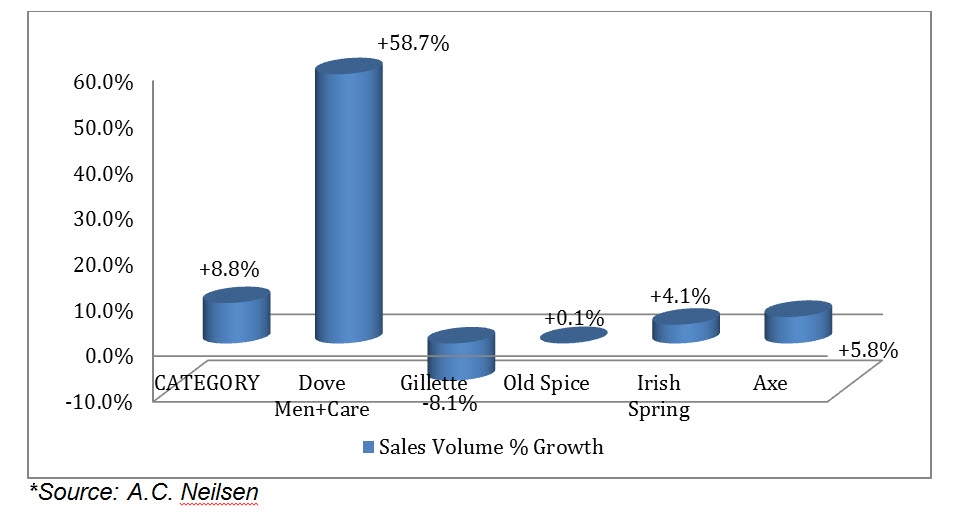

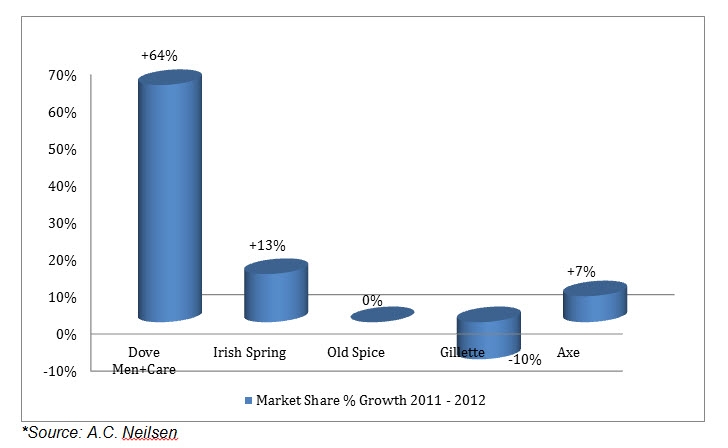

1. Increase Sales

Dove Men + Care increased its sales volume by 58% YOY (a more than $10 Million jump in sales). This was especially noteworthy not only because it was more than double the goal, but also it significantly outpaced the growth of the category overall (+8.8%)

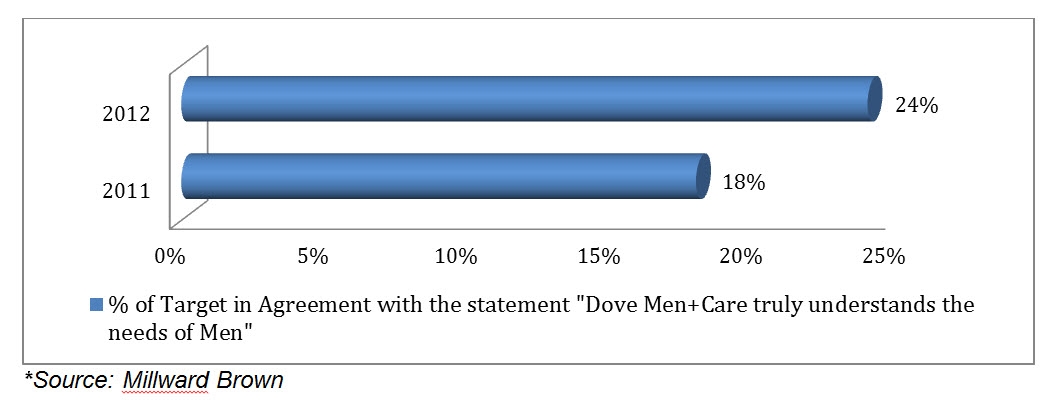

2. Increase the perception that Dove Men+Care is a brand that “truly understands the needs of men” by 5pts

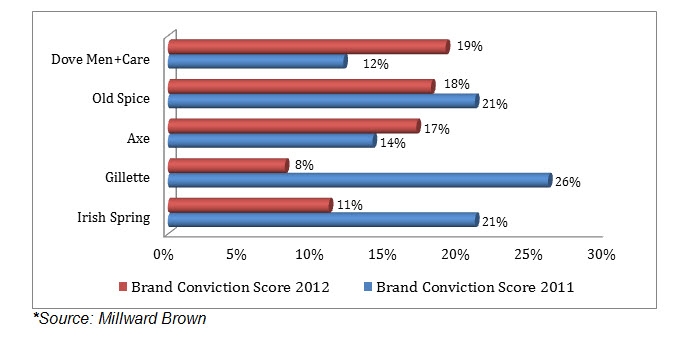

- The Real Man Challenge campaign has allowed Dove Men+Care to successfully demonstrate that it “truly understands the needs of men” and surpass the goal of a 5pt increase among the target’s perception of the brand.

- Millward Brown tracking data shows Dove Men+Care gained significant traction YOY from 2011 – 2012 around perceptions that the brand ‘truly understands the needs of men’ by moving the needle from 18% of the target agreeing with the statement in 2011, to 24% by the end of Q2 2012.

These gains are significant given the Dove brand legacy in the Female personal care space as well as early marketplace challenges centred around the target’s belief that the brand just wasn’t for HIM.

3. Increase Share of Conversation

Dove Men’s share of conversation went from 1.3% to 24.6%, beating our objective by 250%. Conversely, Old Spice’s share of conversation decreased by 17% and Gillette`s share of conversation decreased by 34% indicating that the campaign was effective at stealing social conversation from competitors and building credibility in the online space.

During the campaign, the number of mentions for Dove Men increased by 1,727%. While mentions for Old Spice and Gillette decreased (15% and 32% respectively).

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Note: Business results in this case are confidential and may not be published.

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

The effect of the Real Man Challenge campaign can be classified as a resounding success given the following:

- Dove Men+Care had the highest market share GROWTH of all competitors from 2011 to 2012. No small feat when considering the brand is a mere infant in a sea of competitors who have been building brand equity for decades.

2. Dove Men+Care has emerged as the “brand consumers like the most.”

- After just three years in the marketplace, Millward Brown research indicates that Dove Men+Care has emerged as the brand consumers like the most.

- This is especially noteworthy as scores indicate that the brand moved from 5th place to 1st place in just one year while stealing valuable share from category mainstay’s Gillette and Old Spice.

- The Real Man Challenge campaign was the most significant brand activation in the marketplace over the time period.

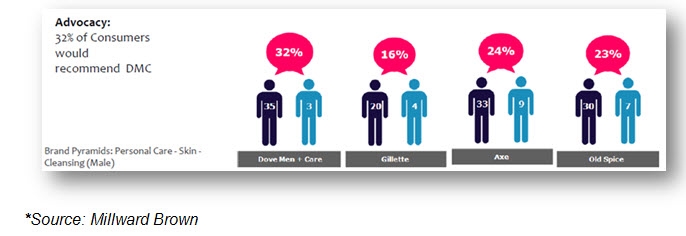

3. Dove Men+Care is now the “brand consumers would recommend the most.”

- Advocacy is certainly a key indicator of success. And with 32% of consumers claiming that they would recommend Dove Men+Care in 2012, the brand sees this as a major win.

- After just 3 years in market, consumers were twice as likely to recommend Dove Men as they were Gillette, a brand that had been in the market since 1901!

- The astounding advocacy results serve as a testament to both the efficacy of the products as well as the positioning/relatability of the brand – further strengthened by the Real Man Challenge campaign.

b)Excluding Other Factors

Spending Levels:

- A competitive spend and SOV analysis indicates that Media spend on DM+C has steadily declined over the past 3 years since launch and is also below that of major competitiors indicating that ad spending has not been a factor in campaign’s success.

Pricing:

- While certain SKU’s are offered at sale prices during various times of the year at selected retailers, overall the average price of the product remained very close to the MSRP for the duration of the campaign period.

Distribution Changes:

- No new distribution or geographic coverage increases occurred during the campaign period.

Unusual Promotional Activity:

- No unusual promotional activity ran during the campaign period.

Other Potential Causes:

N/A