Optik TV [Telus]

Services–General (BRONZE)

Client Credits: TELUS

TELUS

Anne-Marie LaBerge, VP Marketing Communications

Rachael Petersen, Director Marketing Communications

Lara Johnson, Director Marketing Communications

Agency Credits: Taxi Canada Ltd

TAXI Canada Ltd.

Jordan Doucette, Executive Creative Director/General Manager

Kevin Barclay, Executive Creative Director

Matt Bielby, Creative Director

Dave Smith, Associate Creative Director

Nikki Jobson, Writer

Tyler Jones, Writer

Alex Bird, Writer

David Giovando, Writer

Ryan Semeniuk, Art Director

Derek Anderson, Art Director

Tony Hird, Art Director

Darcy Twarog, Art Director

Mike Leslie, Managing Director TELUS

Caroline MacGregor, Group Account Director

Meghan Hawes, Account Director

Stephanie Santiago, Account Director

Johannes Froysaa, Digital Producer

Indre Sakus, Broadcast Producer

Sarah Vingoe, Broadcast Producer

Steve Emmens, Broadcast Producer

Cossette Media

Tim Monaghan, Vice President, Media Director

Sarah Wickers, Group Director

Sarah Morris, Media Planner

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | June (Q2) 2010 to present quarter end (Q1 2013) |

| Start of Advertising/Communication Effort: | June 2010 |

| Base Period as a Benchmark: | January 2008 to June 2010 (prior to launch) |

Section II — SITUATION ANALYSIS

a) Overall Assessment

Executive Summary

In a hyper-competitive cable TV service marketplace where consumer inertia is the norm, we launched TELUS Optik TV and have steadily increased our market share to 20% to the detriment of Shaw Cable, our major competitor and successfully turned profitability around for the Wireline business at TELUS. And we did it with breakthrough creative and consistent storytelling.

Overall Assessment

Since 1996, when both TELUS (Western Telco) and Shaw (Western Cableco) began offering competing high-speed Internet services, there’s been a race to “own the home,” a term used to describe the profitable “triple play” bundling of phone, Internet, and TV services. Triple play bundling often means higher ARPH (Average Revenue Per Household), a longer lifetime value, and decreased customer churn.

Shaw was first to offer triple play services in 2006 with the launch of their VoIP (Voice Over Internet Protocol) digital home phone. This had an immediate negative impact on TELUS’ bottom line as Shaw began to erode the very profitable home phone subscriber base of TELUS.

In late 2007, TELUS finally thought they had their answer. That year TELUS launched the first competitive product to Shaw Cable TV in Western Canada with the launch of TELUS TV. The product was a basic digital TV offering that left consumers wanting more, and soon TELUS was determining a more competitive solution.

In 2010, TELUS re-engaged TAXI to plan the launch of a new, improved TV service. This time around, the service would be superior to both the existing TELUS TV, and Shaw’s cable product. Our communications challenge would be twofold:

1) Overcome the negative perceptions consumers were forming of the original TV service;

2) Convince our very busy demographic of young families to switch in an otherwise complacent category.

Optik TV was launched in summer 2010. Immediate and sustained growth was necessary to justify the billion-dollar-plus investment, accelerate profitability and slow the loss of TELUS’ high-margin home phone customers. Our efforts needed to be disproportionately impactful relative to our investment, tactical enough to communicate our value proposition, and consistent with the TELUS brand, yet differentiated enough to stand out as something new.

b) Resulting Business Objectives

Our core objective was to immediately begin capturing a large number of subscribers and as most consumers already subscribed to television service, growth was predominantly going to come by eroding Shaw’s market share in British Columbia and Alberta.

However, capturing TV subscribers alone would not be a profitable route. In our communications strategy it would be necessary to use Optik TV as a pull strategy for Internet and home phone subscribers, ultimately driving profitable triple play subscribers to TELUS and growing the overall home services customer base. This strategy would ultimately drive overall Wireline growth for TELUS representing the revenue for TELUS’ “landline” services.

c) Annual Media Budget

Over $5 million

d) Geographic Area

British Columbia and Alberta

Section III — STRATEGIC THINKING

a) Analysis and Insight

From the original launch attempts of TELUS TV in 2007, we learned that simply saying you have a TV service isn’t enough. The category is wrought with consumer complacency fuelled by a history of only having one choice pre-wired into your existing home. For many, cable was just there. And it was just fine. The “build it and they will come” approach was not successful.

While we had an improved product to offer in 2010, in many ways we were faced with an even larger communications challenge than the original launch. Not only did we still have to communicate to a complacent consumer, we had to launch a new creative look and feel in order to differentiate the original TELUS TV offering from the new one.

Two things became clear through initial focus group research and joint planning sessions:

1) Seeing would be believing – although we did not have the means to drive trial, it was paramount that consumers had a chance to see and experience the Optik service to overcome the weak perception of the previous service and to demonstrate the product next to Shaw’s. With a consistent stream of new features to roll out over the coming years continued education was key to ensure understanding of the product and features and to demand creation.

2) Give the service a friendly face – for the product to be successfully installed in someone’s home, we knew we had two big fears to overcome: the hassle of switching and the typical “cable guy” installation process.

b) Communication Strategy

Because the category is so complacent and just thinking about switching your cable service is often associated with the pains and efforts of moving your house, we needed consumers to notice what they were missing.

Our strategy employed two overarching concepts:

1) Showcase the product – Because Optik TV requires a labour-intensive installation, simply driving trial is not a possibility. Through our communications we employed a “seeing is believing” approach to showcase and demonstrate the product at as many touch points as necessary. TV advertising has been a corner stone of this strategy as it allows us to showcase the Optik TV product and interface on TV – Shaw Cable TV. In addition, we developed an ongoing web series to showcase our product and features in an entertaining way to immerse our audience in the product before they have a chance to use it.

2) Differentiate our brand – Because we had to overcome the negative perceptions of TELUS TV, we sought to rebrand the new product. While we leveraged core elements of the TELUS brand, we also sought new opportunities to differentiate this product from TELUS’ legacy TV service and even other TELUS messaging, such as Mobility. The campaign took on three different core elements:

- A new name was developed to differentiate the service from the previous TV offering. Optik was born.

- In an evolution for the TELUS brand, a human character was introduced to reinforce our message. “Danny the Installer” was created to introduce and showcase both the TELUS product and the level of service one should expect from their “cable guy,” exploiting a customer service advantage we had over Shaw.

- In typical TELUS fashion, the critter and nature palette helped introduce the service in a simple uncluttered fashion. At launch, the lion cub was chosen to represent leadership and has since been followed by a host of other critters.

The combination of a new name, a new human face, and leveraging the critter and nature palette allowed us to give this new service a fresh start in the marketplace. Also, it is important to note that we made the effort to engage and rally employees behind the new service offerings. Programs and campaigns were directed at staff members at the call centre right through to the installers.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

Since launch, a full multimedia campaign has been rolled out across broadcast, print, OOH, web, mobile, social, experiential, and direct mail.

b)Creative Discussion

Since launch, Danny the Installer has become our consistent vehicle to both differentiate the TELUS brand for Optik TV and to showcase the new features of Optik TV. Danny initially launched in TV, but quickly became a brand element that has extended into nearly all media. Leveraging Danny across all media has helped TELUS increase message comprehension, and build equity in Danny as brand element.

Television:

Danny the Installer launched in TV and has remained a consistent brand element in this media. Through TV, Danny helped personify TELUS as the fun, quirky, installer that you would feel comfortable to have in your home; he made the experience of having ‘cable’ installed in your home, enjoyable. Throughout the campaign he continues to find himself in unique situations, including in the home of Leonard Nimoy where he always brings his customers the best in entertainment.

Please also refer to attached file: Exhibit 1-1 Nimoy

Please also refer to attached file: Exhibit 1-2 Eye Eye

Please also refer to attached file: Exhibit 1-3 Bananas

Online:

As an extension to the TV spots, a series of 20+ online videos have been developed to support Danny’s character and to further demonstrate the features and attributes of Optik TV. These videos are featured across online video ad units, YouTube and on TELUS.com.

Please also refer to attached file: Exhibit 2-1 Chicken Wings

Please also refer to attached file: Exhibit 2-2 Sofa Suit

Please also refer to attached file: Exhibit 2-3 Surf Zone

Social Media:

Danny has even found his voice across many TELUS Social Media Properties. In this example, Danny responds to Facebook post by a radio DJ in Red Deer Alberta who was expecting him to show up for his installation. Unfortunately Danny couldn’t make it, but he was sure to send a response to the DJ resulting in nearly three minutes of air-time conversation on Big 105.5 FM and over 1,000 views on YouTube.

Radio:

In Radio, we continue to position Danny as the expert installer who can always keep customers up-to-date on the latest features, offers and pricing of Optik TV. With to the introduction of Danny, radio for the Optik brand now has a thread of consistency across TV, online and other media where Danny continues to become a more recognizable voice enhancing message comprehension, branding and ad recall.

Please also refer to attached file: Exhibit 4-1 HD

Please also refer to attached file: Exhibit 4-3 Senses

Out of Home:

Danny’s visual presence has extended to Out-of-Home acting as a quick reminder to what people have seen online and on TV.

c)Media Discussion

Every dollar had to deliver results. Our message had to jump out at consumers, differentiate Optik from the previous TELUS TV service, and motivate them in a complacent category.

With our media partners, we landed on a media strategy of connecting with our target at all touch points. Since launch, we have highlighted the unique features of Optik TV to target people wherever and however they consume TV in today’s mobile and multiscreen world.

Section V — BUSINESS RESULTS

a) Sales/Share Results

We saw sales and profitability grow not just with the TV segment but across all TELUS home services and Wireline division. The launch of Optik TV was a runaway success. The campaign launched midway through the Q2 2010 reporting time frame and saw a record 29,000 net subscriber additions. Just six months after launch, by Q4 2010, Optik TV subscribers had risen to 266,000, a 56 per cent jump from the end of 2009. With TELUS recently reporting their Q1 2013 results, TELUS TV subscribers were 712,000, up 29% year over year and up 542,000 since the end of 2009. In this time frame, Optik TV was one of the fastest-growing TV services of its kind globally.

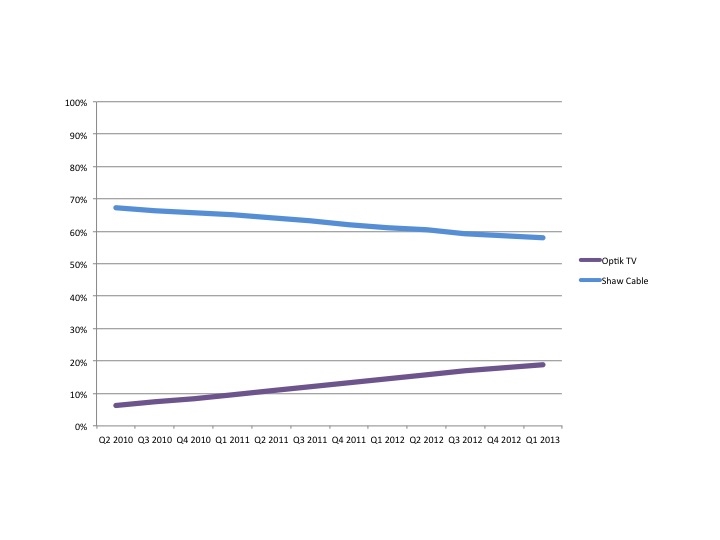

Market Share

Since the launch of Optik TV in summer of 2010, we have seen consistent market share growth predominantly by eroding Shaw’s cable TV customer base.

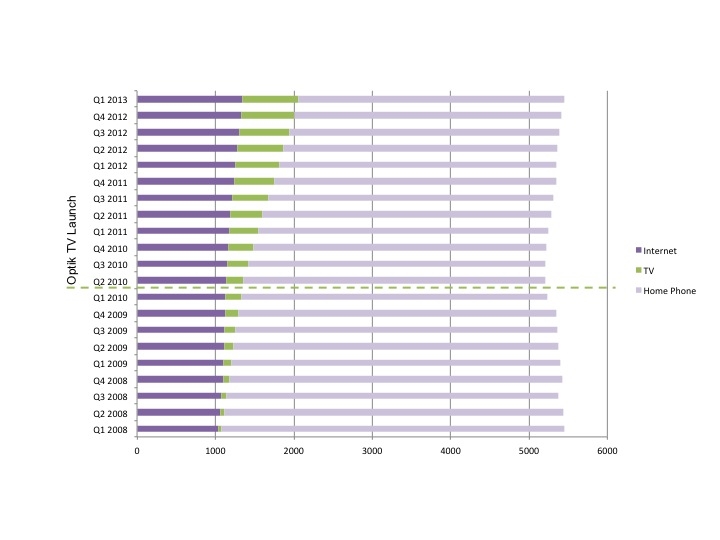

Subscriber Base

By leveraging TV as a pull-through tactic to grow and maintain Internet and home phone connections, we have successfully driven TELUS’ overall wireline customer growth amid home phone losses due to competition and mobile replacement.

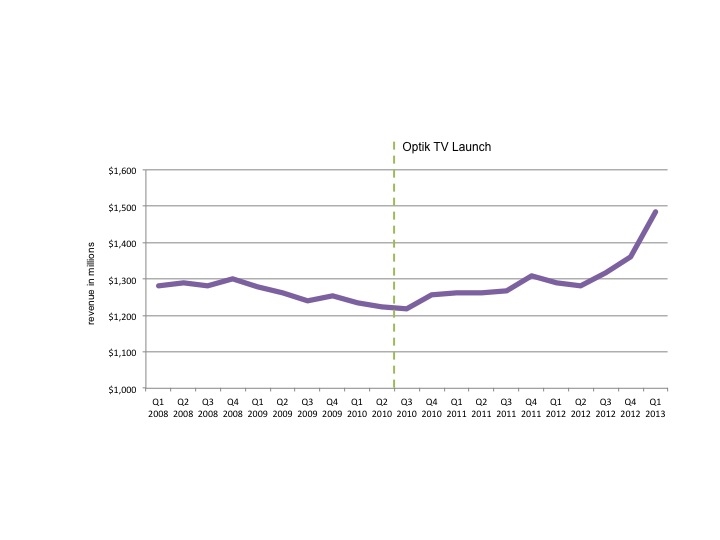

Wireline Revenue Growth

As indicated above, driving profitable growth through data services, such as TV and Internet, we have been able to slow home phone losses and offset declining revenues in home phone. This has made TELUS one of the few incumbent telcos globally to generate positive revenue growth from its Wireline business. In fact, TELUS has reported two consecutive quarters of year over year EBITDA growth, in Q4-12 and Q1-13, putting it into even more select company.

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

To break down the correlation of advertising to results is somewhat challenging in this case. Because the Optik TV service requires installation, managing capacity is also a challenge. We have never endeavoured to create spikes in our sales and thus a backlog for TELUS installers. Rather, we have maintained an “always on” approach, balancing growth with delivery.

In its most simplistic form, Optik TV did not exist before June 2010. In the 21-month reporting time frame in this case study, sales have increased 286%, we have aggressively stolen a 22% market share from our competition, and Optik TV has become one of the fastest-growing IPTV (Internet Protocol Television) services in world.

The success was inextricably linked to the brand communications. Our complacent consumers simply wouldn’t have known about it, and certainly wouldn’t have responded as they did, had it not resonated to the degree it did.

b)Excluding Other Factors

Spending Levels:

Both production and media budgets were consistent with typical communication plans from TELUS in previous years. In fact, overall cost per acquisition decreased by 14%.

Pricing:

In this highly competitive category in Western Canada, numerous pricing and promotional programs have been trialed and implemented to reflect and match the competition at the time. The overall value of the promotions has remained consistent during this timeframe and has been consistent with promotions prior to the Optik launch.

Distribution Changes:

There were no significant distribution changes during this time.

Unusual Promotional Activity:

Our promotional activity has remained consistent prior to and since launch of Optik TV.

Other Potential Causes:

No other potential causes have been identified.