Corona, Live Mas Fina

Off to a Good Start (BRONZE)

Client Credits: Modelo Molson Imports L.P.

Drew Munro, President & CEO

Stewart Priddle, Director of Marketing

Lindsay Wilson, Marketing Manager

Courtney Murgatroyd, Brand Manager

Agency Credits: Zulu Alpha Kilo

Zak Mroueh, Chief Creative Officer

Shane Ogilvie, Executive Creative Director

Jon Webber, Creative Director

Mooren Bofill, Jamie Mageau, Andrea Romanelli, Jenny Luong, Art Directors

Erin Beaupre, Kaidy Wong, Nick Asik, Writers

Shari Walczak, Strategic Planning Director

Kate Torrance, Group Account Director

Dic Dickerson, Account Director

David Isaac, Integrated Production Director

Melanie Lambertsen, Agency Producer

Ola Stodulska (digital) Kari Macknight Dearborn (print), Kate Spencer (print), Producers

Greg Heptinstall, Brandon Dyson, Heather Lee, Studio Artists

French Agency: Tank

French Agency Team: Valya Kruk, Sophie Gaudet, Jean-Philippe Marcoux

MEC, Media Agency

Marty Vaspa, David Stanton, Natalie Melanson, Media Team

The Hive, Event Company

Skye Brain, Lizzie Short, Stephanie Dowhy, Event Team

Boxer Films, Frank Content, Production House

Jonathan Hyde, Director

Keith Ohman, Engineer

Beth George, Danielle Kappy, Executive Producers

Maeliosa Tiernan, Production House Producer

Jonathan Hyde, Cinematographer

John Evans, Editor

The Vanity, Panic & Bob, Post Production House

Naveen Srivastava, Compositor

Eric Whipp, Alter Ego, Colourist/Transfer House

Pirate, Audio House

Chris Tait, Music Producer/Sound Design

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | January 2013 – July 2013 |

| Start of Advertising/Communication Effort: | March 2013 |

| Base Period as a Benchmark: | Calendar years 2009, 2010, 2011, 2012 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

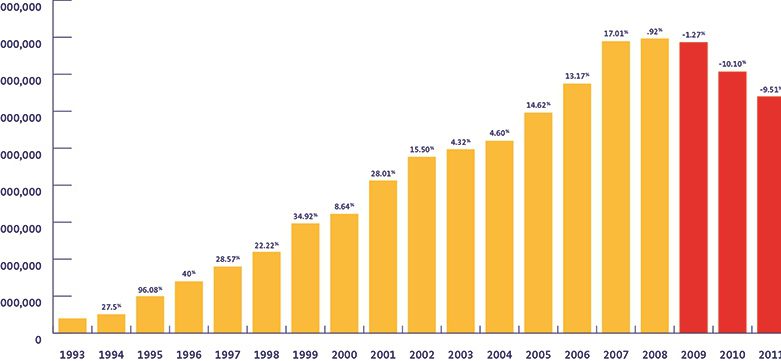

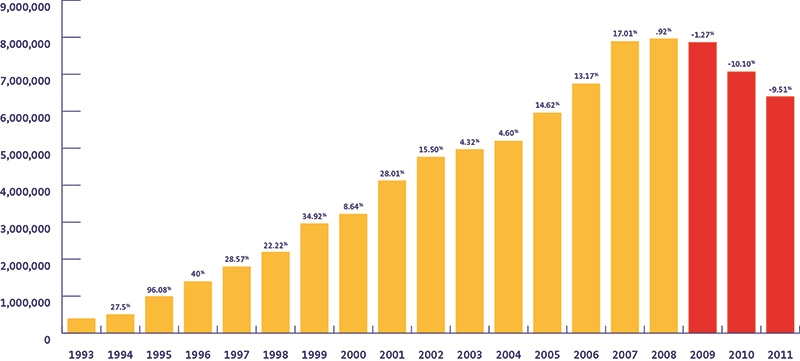

In the beer category where image plays a significant role in brand differentiation, Corona had spent 23 years positioned as the beer for beach-side enjoyment and relaxation. With this identity firmly entrenched, Corona rode on a wave of 22 years of consecutive growth, solidifying it as Canada’s #1 import beer brand against such well-known competitors as Heineken and Stella Artois.

Source: Corona Canada Historical Volume Data, 1993-2011

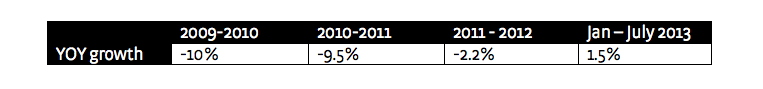

Yet, as the chart above shows, after non-stop year-over-year growth, the tide began to turn in 2008, sending the brand into a double-digit decline. From 2008-2011, Corona lost 20% of its total volume, equaling 38.7 million fewer bottles of Corona sold.

While Canada’s struggling economy was certainly a catalyst to the sudden reversal of fortune for the Corona brand, the situation was far more complicated than that, setting the stage for a pattern of decline that continued for the next 4 years.

- In the beverage alcohol category (beer, wine, and spirits), share of beer had dropped 2.8 points (from 52.1% to 49.3%) between 2006 and 2011, while wine and spirits were growing. To illustrate this more vividly: in 2010 alone, 100 million more glasses of wine were consumed by Canadians than the previous year, while 55 million fewer bottles of beer were consumed in this country. Were this trend to continue, it was forecast that total beer consumption in Canada could decline by 315 million bottles. A terrifying outlook for any business.

- Innovation in the category opened up a whole new competitive set against Corona beyond the import beer brands. Bud Light, Miller and even small brewers like Mill Street were encroaching on our sacred lime “ritual” by launching lime- flavoured extensions. By 2009/2010 these products – “the lime fakers” – had grown to a volume of 300,000 hls, cannibalizing from within the beer category rather than growing it. The most notable victim was Corona which attributed 50% of its volume loss to these product extensions.

- Finally, while Corona’s positioning continued to drive sales amongst an aging demographic, the passive, at-the-beach positioning was proving to be far less relevant to a younger demographic who, while familiar with Corona, perceived it as a special-occasion vacation beer (e.g. at a resort in Mexico), rather than being a brand connected to their social lives throughout the year.

In order to reverse what had become a dire situation in Canada, Corona knew it could no longer be business as usual. Not only was it keenly aware that it was time to recruit a new generation of drinkers to Corona, it was clear that this would require a significant reframing of the brand to steal back lost share, and become a brand that would appeal to the younger generation who account for a large amount of alcohol consumption.

b) Resulting Business Objectives

The challenge was a big one: uncover a motivating and credible brand positioning for Corona that would appeal to a younger audience. But, the job would not end with building awareness alone. This platform and the resulting communications would have to be motivating enough to get “liquid to lips”.

Ultimate success would be measured by reversing Corona’s negative volume and share results of the past few years, despite competing within a category that, itself, was in a state of decline. Over three years, the stake was put in the ground to achieve total volume growth of 9.6%, which translated into a compound annual growth rate of 3.1%. In order to maintain its position as a premium beer in the category, it was also important that this objective be achieved without buying Corona sales (promotion and feature pricing) – we needed Corona to be a brand people were willing to pay a bit more for.

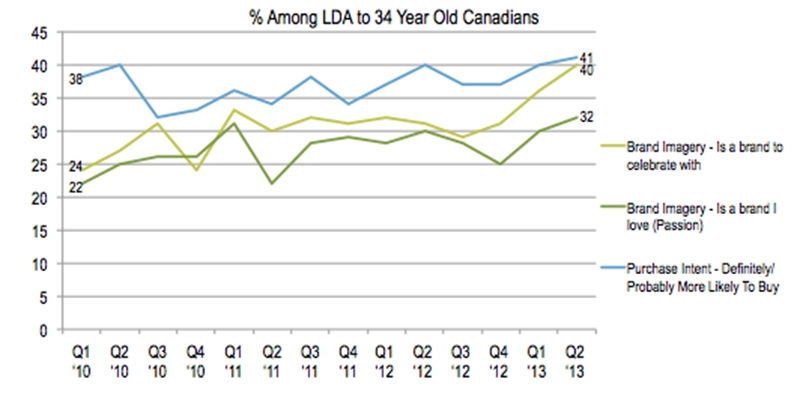

Advertising research and ongoing brand tracking would be used to determine the impact of brand messaging vis a vis category norms. Specifically, Corona expected to see an upward trend in purchase intent and positive brand imagery results with a younger target demographic (Legal Drinking Age (LDA) – 34).

c) Annual Media Budget

$4 – $5 million

d) Geographic Area

National

Section III — STRATEGIC THINKING

a) Analysis and Insight

For Corona, the greatest business opportunity was to appeal to the one million young Canadians (19-34) who had grown up hearing about the Corona brand, but had never tried it. For them, Corona was the “vacation beer” – a brand to consider when you were relaxing at an all-inclusive resort – creating a further marketing conundrum, as this generation was the least likely to view a Mexican resort vacation as an aspirational getaway.

The more we came to understand this younger consumer (the Millennials as they tend to be labeled), the more we heard that instead of striving for traditional material symbols of success, they are far more likely to seek out new, rich experiences that make them more interesting people. They want to be successful, but they refuse to do it according to the set formula followed by generations before them. In research we heard that the life they are striving for is not one full of stuff, but one that is filled with extraordinary moments and memories. And, the dreaded “comfort zone” is to be avoided at all costs.

And as we began to draw connections with the Corona brand, we learned that, for them, there was something unique, distinct and intriguing about Corona as a “cerveza”. The clear glass bottle, painted label and even our lime ritual signaled that Corona is no ordinary beer. The challenge was to find a way to bring this shared belief – never accept ordinary – to life for consumers in an authentic, inspiring way that would challenge their preconceived notions of Corona as the beach-side beer and re-establish our brand relevance.

b) Communication Strategy

To uncover a motivating consumer platform to express this shared belief, we had to look no further than the iconic label of Corona’s own bottle for our inspiration. From its earliest days, the idea of “Mas Fina” (loosely translated as ‘more fine’) has been fundamental to Corona. So much so that the words “La Cerveza Mas Fina” have been emblazoned on every bottle since 1925.

This observation formed the spark for Corona’s new “Live Mas Fina” platform, a rallying cry intended to redefine the finer life as one filled with rewarding and interesting experiences. A life lived outside of your comfort zone.

And, we knew instinctively that “Live Mas Fina” had to be far more than just an advertising campaign or a communications platform. It became a guiding philosophy that would dictate how Corona would behave as a brand in every environment, ensuring that all activities and initiatives it engaged in would push the organization outside of its own comfort zone.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

Video – TV/Online/Mobile/Tablet

- :60 :30 & :15 English and French

- YouTube

Online

- High impact and standard banner ad units

- Live Mas Fina microsite

Social Media

- Community cultivation and seeding

- Facebook ads

OOH

- Retail POS

- Small Ambient Posters

- Ambient Stunts

- Live Event Feed – Yonge & Dundas OOH Domination

Event/Experiential

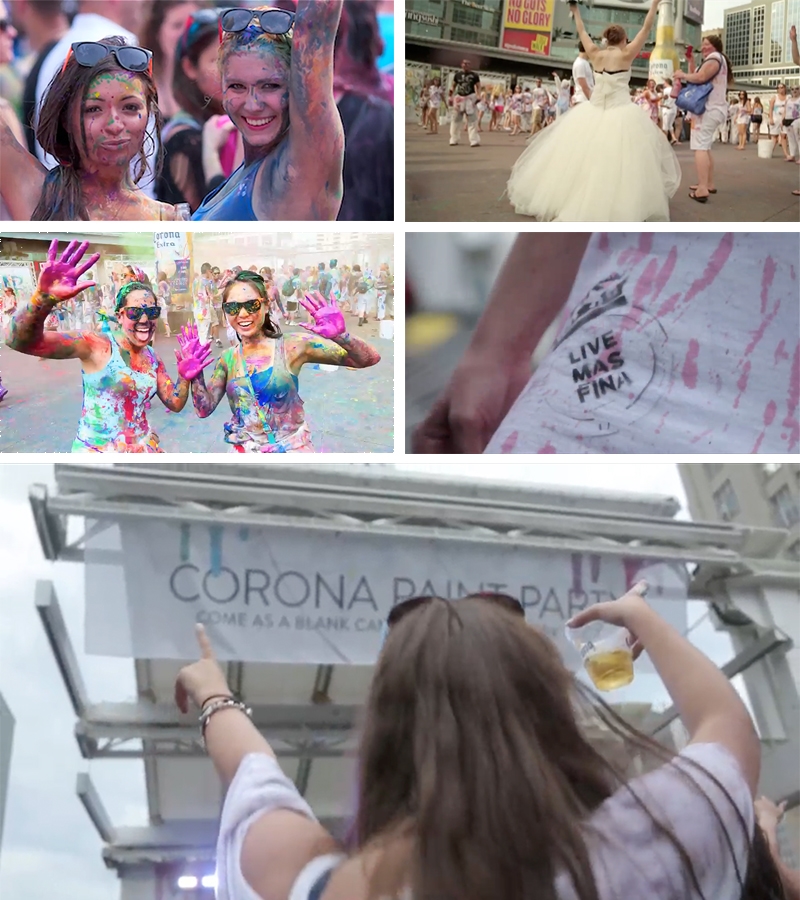

- 1st Annual Corona Paint Party (Toronto, Montreal)

- Online event video

In addition, we created a comprehensive visual identity system for the Corona brand that would influence and/or shape all in-market consumer communications, POS materials, packaging, internal corporate communications and all social/digital assets. This identity had to both embody the spirit of Live Mas Fina while also signaling a massive shift away from the beach heritage that Corona was so intrinsically connected to.

b)Creative Discussion

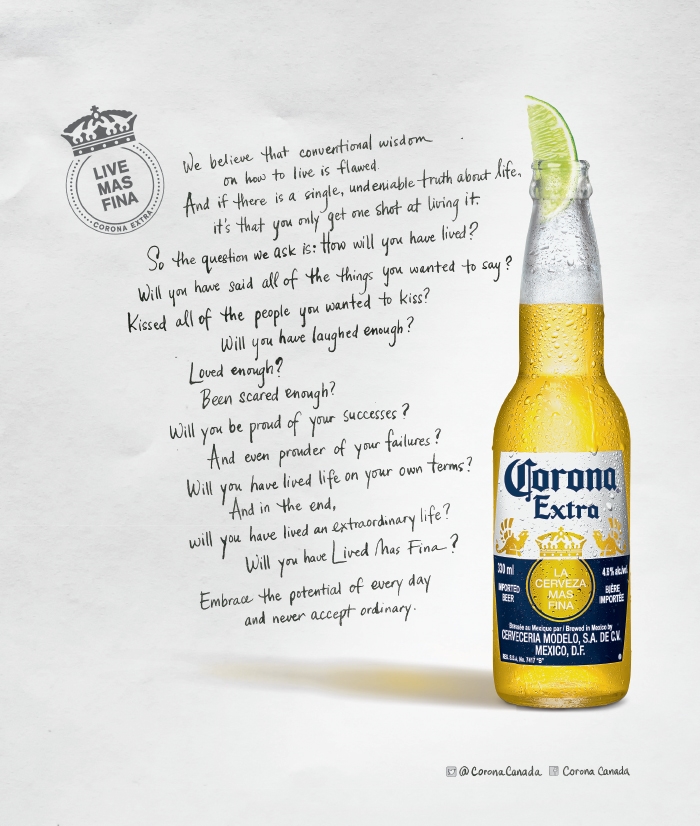

Given Corona’s drastic shift in brand messaging, we knew it would be important at launch to make it clear what we truly stand for by providing some context and dimension for “Live Mas Fina”. The first piece to do this was our written manifesto poster.

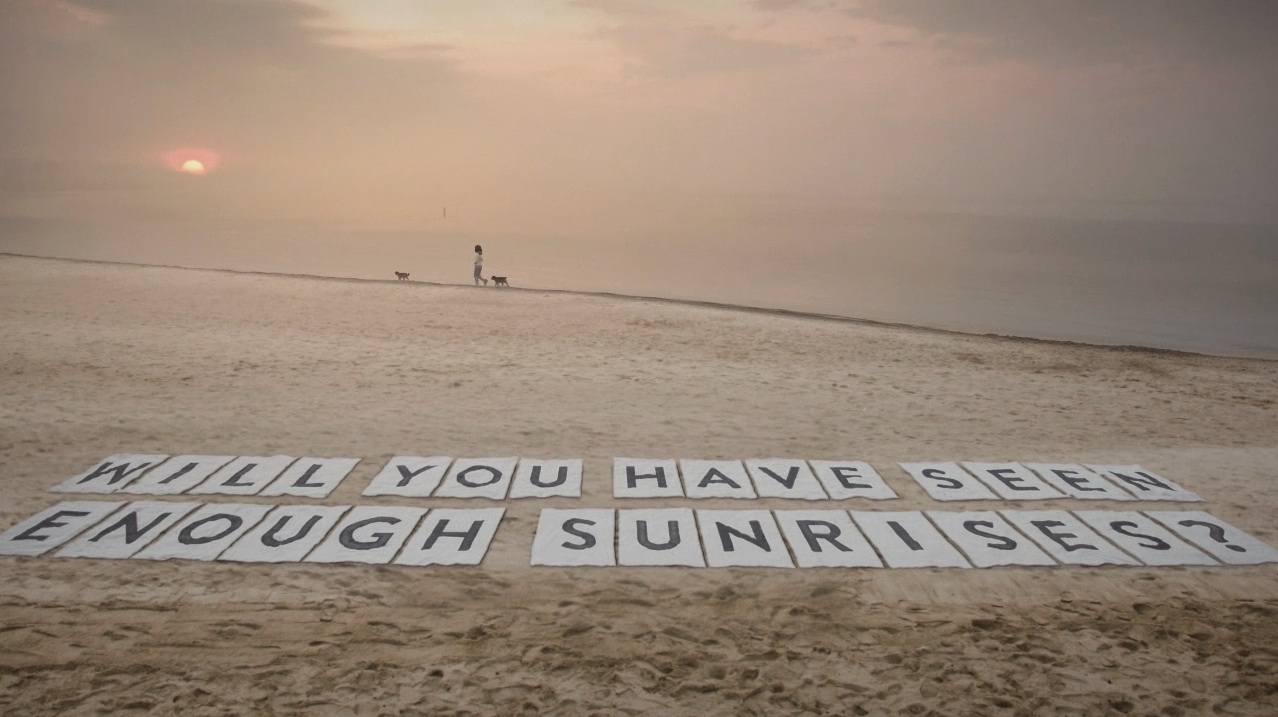

In order to truly signal a change and to pick Corona up and out of its beach chair once and for all, we needed to make a big statement. We launched with an anthemic :60 film manifesto on TV, crafted to inspire our target to take a second look at the way they are living each day. The creative doesn’t tell them how to live life (it’s really not our place to do that), but instead asks a series of provocative questions, urging them to reflect on the life they are living today. The goal was to spark them to step outside of their own comfort zone as they are challenged to consider “…In the end, will you have regrets or will you have lived an extraordinary life? Will you have Lived Mas Fina?”

The very same day of the launch, the Corona brand website changed over to reflect the new campaign featuring the :60 video. The new site would also act as the promotional hub for all brand activity and prompted visitors to get involved in the campaign across various brand social platforms.

The question “Will you have Lived Mas Fina?” was also posed in unique ways across other digital, social and OOH channels, provoking consumers to reconsider their actions, behaviours and even their desires.

The brand look and feel had to be transformed at every touchpoint, particularly those closest to consumer purchase and consumption. While there was no need to change the bottle – after all, it was the inspiration for our creative – it was important to streamline, simplify and optimize messaging in bars and at retail.

Retail POS

And, in our first physical demonstration of Living Mas Fina, we designed and hosted the first annual Corona Paint Party experience at Yonge-Dundas Square in Toronto, giving thousands of people the opportunity to let loose, try something new and experience what “Living Mas Fina” means. We rolled out the same event a week later in Montreal. And, we released an event video online in English and French to prompt our target to share their own stories and experiences.

c)Media Discussion

While traditional and digital media both figured prominently in this initial launch campaign, we started efforts several months prior to launch to establish and cultivate an active social community that would be our jumping off point to introduce the new Corona brand to Canadians. We knew that with this younger target, their social networks could prove to be a powerful touchpoint for Corona. Implementing a strategy that included an online outreach campaign and a content engagement plan, we increased our Facebook presence by 539%, rising from 26,498 to 169,332 total fans. Not only were we able to keep this fast-growing community engaged (our average weekly fan engagement rate was 11.5%), but the Corona page was recognized by Facebook as the most active community in the category in Canada.

On March 11, 2013, we released the new Corona Live Mas Fina anthem spot to our Facebook fans first, followed the next week with a national launch. In launching Corona’s new platform, it was important in year one to put a big stake in the ground. We needed to make media choices that would build awareness quickly. As such, a multi-screen video buy (TV, YouTube, mobile/tablet, pre-roll) was the best choice to establish the brand’s new voice after over 20 years “on the beach”. And because we’d spent such a concerted effort in the lead up to the launch to build our audience across the brand’s social platforms, our next priority was to engage with this community online. We couldn’t just “talk” about the Live Mas Fina philosophy, the brand needed to “walk the walk” and live the philosophy. For this reason, our next major investment was an ambient demonstration of Live Mas Fina. We invited our existing Corona fans and some new ones through targeted Facebook ads to RSVP for the Corona Paint Party in Toronto and Montreal. These events would act as a physical manifestation of the Live Mas Fina philosophy and an experience that could be shared as a social object by our beer drinkers. As part of the Toronto activation, a high impact OOH domination at the event location (Yonge & Dundas) was used to feed real-time event photos to the large digital screens. The overwhelming amount of social media activity that sparked during and after the event was enough to confirm that we’d made the right choice. But we knew we couldn’t stop there. Live Mas Fina needed to also be present at the point of purchase at both retail and the on-premise channel. Live Mas Fina posters and retail POS materials took the campaign to what we call “the last 10 yards”.

Section V — BUSINESS RESULTS

a) Sales/Share Results

Corona closed the first 6 1/2 months of 2013 (January – July 15) with YOY volume growth at 1.5% – the first period of growth in over 4 years despite an overall category decline of -4%.

Source: Molson Coors Sales Data 2009-2013 (Corona)

This growth is particularly impressive, given horrible June results across the entire category in Canada due to extremely adverse weather conditions (rain, lower than average temperatures, flooding, etc.).

Ongoing Brand Health Tracking showed that we were beginning to see an immediate impact on brand affinity and purchase intent among the LDA to 34 target – lifting Corona to its highest point in the past three and a half years.

Source:Molson Coors Brand Health Tracking (Corona), Millward Brown

In addition, LINK testing (Millward Brown) on the Live Mas Fina television spot concluded we had landed on a powerful new message with above-norm scores on 7 key brand metrics that showed our message was “interesting”, “unique”, “involving”, and “makes me feel differently about the brand” amongst the 19-34 target.

Our Facebook fan base surged 26% during the campaign introduction (to over 213,000). Additionally, the :60 Live Mas Fina film manifesto garnered over 1.35 million views on Corona’s YouTube channel.

Demand for the Corona Paint Party significantly exceeded capacity with almost 3x as many consumers showing up as the venue could accommodate. Our efforts leading up to and surrounding the event lead to 2,150 pieces of consumer-created content and generated more than 1.5 million social impressions. As well, The Most Watched Ads in Canada (a partnership between Marketing and Google to measure the branded video ads that Canadian consumers choose to watch most often) ranked The Corona Paint Party video at #4 in June/July, one of the few Canadian spots to make the list.

With much more activity planned for the coming months and years, Corona is well on its way to not only positive growth in the Canadian market, but to establishing itself as the beer for a younger generation who are truly embracing the call to Live Mas Fina

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

The new brand positioning and related communications can be correlated to the improvement in Corona’s business results as this was the only significant change that had been implemented since the beginning of the volume declines in 2009.

Further support for this argument is the fact that the campaign delivered the strongest measured result against Corona’s long-term brand health tracking in over 3.5 years.

b)Excluding Other Factors

Spending Levels:

Brand spending levels from 2009 through 2012 were flat. Success in 2013 was not attributed to unusual spending levels because, as a matter of fact, the total marketing spend (including media) which started 2013 as flat versus 2012, was cut by 20% in April 2013.

Pricing:

Corona has not taken any unusual pricing discounts. In fact, in 2013, there has been far less feature pricing which has contributed to even stronger topline growth.

Distribution Changes:

No changes in distribution. Corona continues to be distributed on a national basis.

Unusual Promotional Activity:

Similar to pricing, there has been no unusual price cutting or high-value promotional activity. The promotional activity calendar has been consistent with previous years.

Other Potential Causes:

n/a