Sponge Towels Paper Towel

Sustained Success (SILVER)

Client Credits: Kruger Products L.P.

Nancy Marcus – Corporate Vice-President Marketing

Stephen Blythe – Corporate Marketing Director

Wendy Mommersteeg – Category Director – Paper Towel

Humberto Baruzzi – Marketing Manager – Paper Towel

Agency Credits: john st.

Angus Tucker – Executive Creative Director

Stephen Jurisic – Executive Creative Director

Kyle Lamb – Art Director

Kurt Mills – Copywriter

Rob Trickey- Art Director

Neil Shapiro – Copywriter

Stuart Campbell – Art Director

Mia Thomsett – Copywriter

Emily Bain – Strategic Planning Director

Megan Towers – Senior Strategic Planner

Sarah Henderson – Senior Strategic Planner

Heather Crawley – Team Leader

Rena Bast – Team Leader

Ali Reid – Account Director

Madison Papple – Account Supervisor

Laura Rodriguez – Account Coordinator

Michelle Orlando – Executive Broadcast Producer

Dale Giffen – Producer

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | January 2007 – June 2013 |

| Start of Advertising/Communication Effort: | September 2006 |

| Base Period as a Benchmark: | 52 weeks ending December 24, 2006 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

In spring 2006, Kruger completed the transition of ScotTowels to SpongeTowels. Kimberly-Clark owned the brand name and had been licensing it to Kruger Products for use in Canada, but the license was not being renewed; that is where this case for Sustained Success begins.

At this point in time, the branded paper towel category was comprised of SpongeTowels and Procter & Gamble’s Bounty, with the expectation that Scott Towels would soon return to the category under Kimberly-Clark.

As a target for market share growth, the strength of the Bounty brand was undisputable and intimidating. Bounty was perceived to be the gold standard for quality in the category, the result of years of side-by-side demonstrations in their advertising promoting the superior efficacy of their many “new” and “improved” SKUs. Their commitment to product superiority was unfailing and the tagline, The Quicker Picker-Upper, was a well-known and believable signature for the brand evidenced in superior scores on all product quality attributes and its dominant market share.

Even more intimidating was Bounty’s overwhelming share of voice. Its North American marketing strategy resulted in all U.S. spill having a cumulative effect on advertising spend originating in Canada. It is estimated that the $75MM to $85MM U.S. advertising budget translated to an incremental $1.5MM to $2.0MM in value in the Canadian market. When added to an already healthy media presence in Canada, Bounty dominated the airwaves with 60-65% share of voice. (Footnote 1)

At the time of the SpongeTowels campaign launch, Bounty led the category with a 23.8% market share, which was almost double that of SpongeTowels at 12.7% share. Control Label was a formidable player in the category with 48.2% share and the balance was made up of very small branded players. (Footnote 2)

There was one chink in Bounty’s armour however. In unbranded consumer use testing conducted between 2003 and 2006, SpongeTowels Ultra outperformed Bounty on a number of measures, including overall performance. SpongeTowels trial was identified as key to repeat purchase and erosion of Bounty’s share. (Footnote 3)

b) Resulting Business Objectives

The SpongeTowels team had a long-term stretch goal and it was simple: Unseat Bounty as the branded paper towel market leader.

Our success in this effort would be judged over the upcoming years based on the following key performance indicators (KPIs):

- Sales & Market Share

- Product Trial, Loyalty & Quality Perceptions

- Brand Awareness and Differentiation

c) Annual Media Budget

$3 – $4 million

d) Geographic Area

English Canada

Footnote 1: Nielsen Media Canada, Paper Towel Category Spending, English Canada 2006 and Nielsen Company USA, Paper Towel Category Spending, 2006

Footnote 2: Nielsen MarketTrack, Equiv Case Volume, English Canada, 52 weeks ending December 2006

Footnote 3: Various Authors, SpongeTowels Consumer Use Testing, 2003 – 2006

Section III — STRATEGIC THINKING

a) Analysis and Insight

Even prior to transition, SpongeTowels had been positioned as the brand for “real-life messes.” This brand idea was developed based on consumer learning that indicated that all moms aren’t motivated by the clinical, scientific messaging in Bounty advertising.

SpongeTowels represented a real-life problem solver that helps moms clean up and get on with life, not a brand that was in the laboratory testing different scenarios to prove efficacy in the event that something needed to be wiped up. SpongeTowels just wiped it up and then got back to life.

This approach had really enhanced the likability of the brand but had not been as effective at building perceptions of product quality. We had to figure out how to continue to win the attention and hearts of women 25-54, but we also had to win over their more rational minds by demonstrating our product quality and efficacy in a more aggressive way.

The name SpongeTowels was inspired by the “sponge pocket embossing” descriptor given to the circular embossing pattern that was developed and named prior to transition. It had a definite connection with absorbency which was a key strength for SpongeTowels based on the previously mentioned consumer use testing. Given that Bounty focused on strength and speed for the most part in their messaging, absorbency was identified as an area of focus and an important driver in the category that we could own.

Sometimes powerful insights come from tapping a consumer attitude or behaviour. In this case, the insight also came from the product itself. These little sponge pockets, if properly leveraged, could give the brand a distinctive positioning and improve product performance perceptions – both key to making headway against the dominant presence of Bounty.

b) Communication Strategy

And so we gave life to the Sponge Pockets creating an army of thousands whose only purpose was to suck up spills and clean up messes.

We also used the fact that we were the only player in the market with our distinctive embossing pattern to elevate the competitiveness of our tagline without making an outright superiority claim that could lead to legal challenge. After all, “With thousands of super absorbent Sponge Pockets in every pack of SpongeTowels, nothing absorbs like it.”

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

Due to budget constraints, television has been the primary medium for this campaign over the years.

b)Creative Discussion

The campaign launched in the fall of 2006 and there have been multiple extensions since.

Launch (2006)

The first :30 ad was called Jug and launched in September 2006. The response to this ad was tremendous. It also set the stage for the Sponge Pockets as entertaining and memorable brand differentiators.

White World (2007-2008)

The next four :15 executions (Water Cooler, Water Gun, Bath Tub and Grape) were launched in early 2007 to run in rotation with Jug :30. These were produced on a shoestring budget in a very short period of time to more aggressively target Bounty’s product superiority and to proactively mitigate the impact of Scott Towels’ re-entry to the category later that year.

Based on the initial success we introduced two new :15s in 2008 (Pool and Wet Dog) extending the “White World” campaign of :15s from 2007.

Spokes-Pocket (2009)

Three years into launch we felt there was an opportunity to let our target get to know the Sponge Pockets on a more personal level and we launched the first ads featuring the Spokes-Pocket in 2009. The humour and fantasy in this creative enabled us to be more aggressive with respect to product efficacy than we ever had in the past.

For example, in Sponge :30, our Sponge Pocket challenges an actual sponge to an absorbency duel in the kitchen sink. And of course, the Sponge Pocket is victorious.

Epic Absorbency (2010/2011)

While the team was very pleased with the personality and efficacy communication achieved in the Spokes-Pocket creative, in the spring of 2010 there was a desire to return to the roots of the creative idea and demonstrate the power of a thousand Sponge Pockets. Production and talent budgets continued to pose a challenge and would not allow for the inclusion of thousands of Sponge Pockets in our advertising, so we created the “epic-ness” of thousands using three of the most motivated and enthusiastic we could find in Stampede :30.

Always There (2011/2012)

Sponge Pockets (and therefore SpongeTowels) are ready for anything. In fact, this round of creative demonstrated that they were always there at the ready no matter the time and place. They trace a puppy with dirty paws through the foyer, await a spilled drink under the dining table and lurk at the ready for the inevitable chip and dip mess prompted by an upset or celebration during the big game.

Sponge Pocket Training (2013)

How do Sponge Pockets get to be so good at what they do? Spill training! The current creative reinforces strength, speed and super absorbency by showing a selection of Sponge Pockets in simulated training exercises. While this campaign has only been on air for a few months, it has proven highly successful at driving advertising KPIs which will, based on past experience, deliver continued business success.

While the campaign has been a huge success from a business perspective, its success can also be measured in the creative strategy’s ability to extend into entertaining and fresh advertising year after year without getting stale. This consistency in brand cues but flexibility in message has been critical in our battle against the titan, Bounty and the increased competitive activity from the newer additions to the category such as Scott Towels and Cascades.

c)Media Discussion

Television has been the primary medium over the years as it was judged to be the best vehicle to showcase our creative strategy and bring the Sponge Pockets to life.

Within the Bounty-dominated media environment, we determined that it was more effective to focus our messaging in television rather than split our relatively small budget across multiple communication vehicles. We worked hard to stretch our media dollars further by utilizing a combination of :30 and :15 creative to extend media flights and increase frequency.

In recent years, the brand has achieved success with television media integrations that incorporate the SpongeTowels brand into relevant television programming, such as an ongoing partnership with Top Chef Canada where the creative and messaging is leveraged in a very appropriate exciting and unpredictable environment.

Section V — BUSINESS RESULTS

a) Sales/Share Results

The insight and effectiveness of this campaign continues to pay dividends.

1. Sales and Market Share

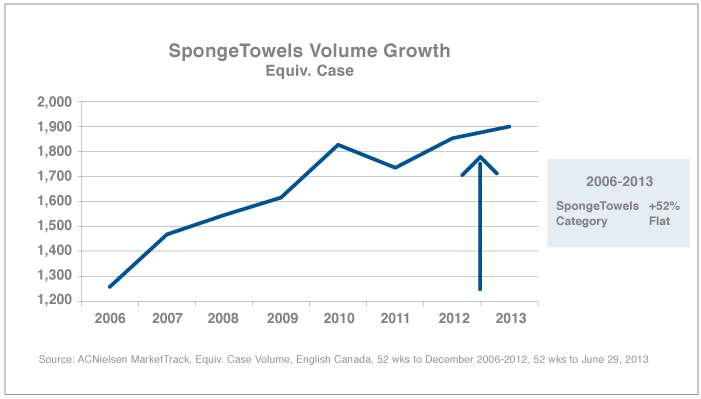

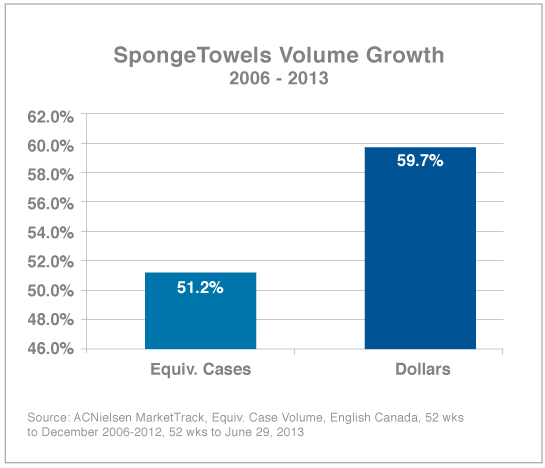

In the 7 years since the launch of the campaign, SpongeTowels has increased case volume by 52%, outpacing category growth by a substantial margin. In fact, over the past 7 years, SpongeTowels’ average annual volume growth has been +6.3% while the category has remained flat. (See SpongeTowels Volume Growth Chart; Footnote 4).

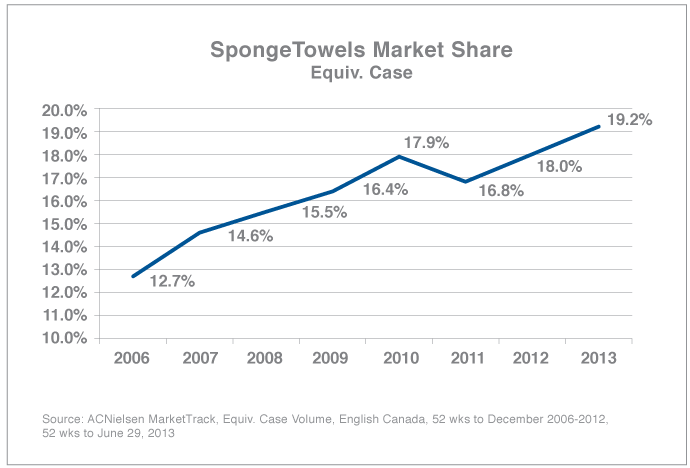

This has resulted in a huge leap in market share taking it from 12.7% to 19.2% in the most recent 52 week period – a 6.5 percentage point increase. This all in the context of a flat category and two new national players (Cascades and Scott Towels) entering the field. (See SpongeTowels Market Share Chart; Footnote 5)

This increase in volume and market share has also generated a substantial increase in dollar volume. Retail sales have increased by 60% since 2006, delivering an incremental $21.5MM in retail sales. (Footnote 6)

2. Trial, Loyalty and Product Quality Perceptions

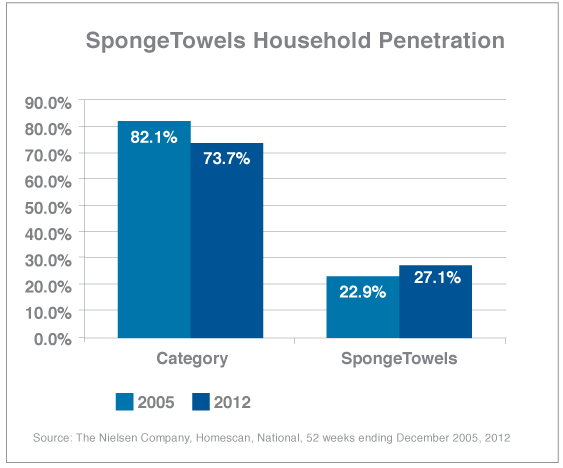

Over the course of this campaign, SpongeTowels has achieved an increase in household penetration of 4 points despite an 8.4-point decrease for the category as a whole. (See SpongeTowels Household Penetration Chart; Footnote 7)

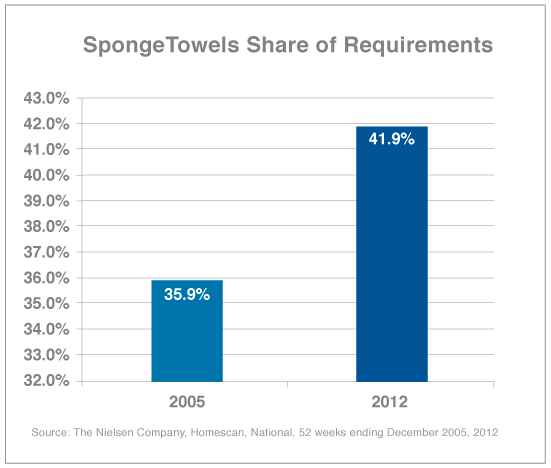

Additionally, SpongeTowels share of requirements (SOR) – a measure of loyalty – has improved from 35.9% in 2005 prior to the new campaign launch to 41.9% in 2013 an increase of 6 points. (See SpongeTowels Share of Requirements Chart; Footnote 8)

Clearly, our brand and efficacy messages have driven trial of the brand by new users and also prompted them to stick with the brand over time despite a reduction in engagement in the category overall.

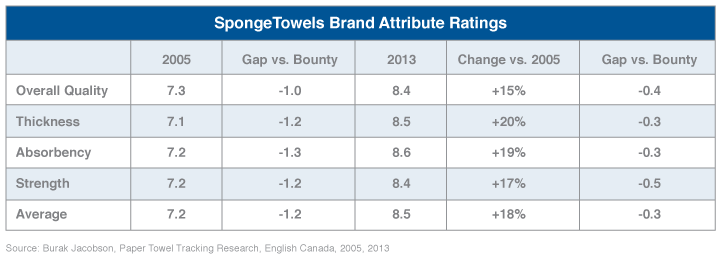

SpongeTowels has also made tremendous gains in improving consumer perceptions regarding product efficacy, both in comparison to where they were before the launch of the new campaign and relative to the category gold standard, Bounty. (See Brand Attribute Ratings Chart; Footnote 9).

3. Brand Awareness & Differentiation

Given Bounty’s dominance, top of mind awareness is a difficult metric to affect in this category so the KPI we measure is share of mind. Over the course of this campaign, SpongeTowels share of mind has increased by 5 points jumping from 8% to 13% – demonstrating that despite the increasingly competitive category environment, our brand message has not only gained traction but made significant strides.

Furthermore, despite a significantly smaller media presence, our advertising recall now matches Bounty at 52%. This is particularly significant given the fact that at the time of transition, Bounty led on this measure by 20 points.

Finally, Brand Tracking research also tells us that we have built this awareness through the distinction of the Sponge Pockets. Association of the Sponge Pockets with the SpongeTowels brand has doubled since transition going from 25% to 52%. This has directly contributed to the achievement of the above-norm advertising brand link measure of 43% in 2013, a 13-point improvement since prior to the launch of this campaign. (Footnote 10)

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Footnote 4: ACNielsen MarketTrack, Equiv. Case Volume, English Canada, 52 wks to December 2006-2012, 52 wks to June 29, 2013

Footnote 5: ACNielsen MarketTrack, Equiv. Case Volume, English Canada, 52 wks to December 2006-2012, 52 wks to June 29, 2013

Footnote 6: ACNielsen MarketTrack, Equiv. Case Volume, English Canada, 52 wks to December 2006-2012, 52 wks to June 29, 2013

Footnote 7: The Nielsen Company, Homescan, National, 52 weeks ending December 2006, 2012

Footnote 8: The Nielsen Company, Homescan, National, 52 weeks ending December 2006, 2012

Footnote 9: Burak Jacobson, Paper Towel Tracking Resarch, English Canada, Fall 2005, 2013

Footnote 10: Burak Jacobson, Paper Towel Tracking Resarch, English Canada, Fall 2005, 2013

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

|

Over the past 7 years, advertising has been the primary marketing activity supporting the SpongeTowels brand and has been the key driver of business results evidenced by significant sales success and improvements in key advertising metrics. As an indicator, advertising recall has continuously increased from a starting point of 62% in the fall of 2007, hitting 76% in the fall of 2012. Additionally, as indicated earlier, association of the Sponge Pockets with the SpongeTowels brand has doubled since 2005 a key driver in improved share of mind awareness, and key to driving selection at shelf. (Footnote 11) |

b)Excluding Other Factors

Spending Levels:

Category spending (including the influence of U.S. spill) has gone from approximately $9.4MM in 2006 split between two players to hitting $15.4MM in 2012 split between four primary competitors and a few smaller ones. During this time, the SpongeTowels budget did increase but not enough to protect its share of voice, which dropped from 35% in 2006 to 25% in 2012. This not only proves that increased spending was not a factor in the success of the business, but also reinforces the impact of the campaign given the positive results in a much more challenging environment (Footnote 12)

Pricing:

The paper towel category has always been very active with respect to promotional pricing and this has increased over the past several years as it has become more competitive among all of the branded players. No one player is more or less engaged in the pricing wars, so in that respect it truly is a level playing field.

During the period in question, SpongeTowels dollar volume increases actually outpaced case volume increases indicating that unit increases were not driven entirely by a reduction in price and therefore were not the result of deep discounting. (See SpongeTowels Case & Dollar Volume Growth Chart; Footnote 13)

Distribution Changes:

As a brand with a broad, national distribution at the start of the campaign, SpongeTowels has not achieved any new distribution in English Canada during the campaign period that could markedly affect sales.

Unusual Promotional Activity:

As indicated earlier, all available resources were focused on advertising efforts during the campaign given the share of voice challenges in the category. As such, there was no unusual promotional activity that could have been responsible for success.

Other Potential Causes:

There have been no other product, economic or consumer factors that would have positively affected SpongeTowels that would not have also influenced Bounty and the other competitors.

Footnote 11: Burak Jacobson, Paper Towel Tracking Resarch, English Canada, Fall 2005, 2013

Footnote 12: Nielsen Media Canada, Paper Towel Category Spending, English Canada 2006 and Nielsen Company USA, Paper Towel Category Spending, 2006, 2012

Footnote 13: ACNielsen MarketTrack, Equiv. Case Volume, English Canada, 52 wks to December 2006-2012, 52 wks to June 29, 2013