We Don’t Build Branches

Launch of New Product/Service (BRONZE)

Client Credits: EQ Bank

EQ Bank

Agency Credits: UNION Advertising Canada LP

UNION

Section I — CASE PARAMETERS

| Business Results Period (Consecutive Months): | January – February 2016 |

| Start of Advertising/Communication Effort: | January 18, 2016 |

| Base Period as a Benchmark: | N/A |

| Geographic Area: | Canada (excluding Quebec) |

| Budget for this effort: | $500,000 – $1 million |

Section IA — CASE OVERVIEW

Why should this case win in the category (ies) you have entered?

How do you launch a new bank when the bank itself doesn’t even exist? No branches, no tower on Bay Street, no proprietary ATMs, no nothing. When we launched EQ Bank, an entirely digital bank, we decided to turn its lack of branches into its biggest strength. Where does all that money we don’t spend on physical locations go? To our customers. We told people that EQ Bank would rather build their savings than an expensive bank branch.

From nothing, we created something big. After just five weeks, EQ Bank hit 170% of its customer signup target for the entire year, and deposits during the same period totaled 400% of first-year targets. Clearly, Canadians wanted their dollars to be Money Well Banked.

Section II — THE CLIENT’s BUSINESS ISSUES/OPPORTUNITIES

a) Describe the Client’s business, competition and relevant history:

In 2015, EQ Bank launched with a mission to reimagine the way we bank in Canada. Their digital-only solution was a simpler, more flexible way for Canadians to save money. With no bank branches or costly overhead, they were able to offer a savings account that was a no-fees, high interest alternative for today’s go-anywhere, always on world.

And whilst the banking market in Canada has traditionally been dominated by the so-called Big 5 (Scotiabank, TD Bank, BMO, Royal Bank, CIBC), EQ Bank weren’t the only ones with a mission to disrupt them. In 2015, there were 80 registered banks and thousands of credit unions competing for Canadians’ hard earned money.

b) Describe the Client’s Business Issues/Opportunities to be addressed by the campaign:

Being a brand new digital bank to the market, EQ Bank was starting off with zero brand recognition and awareness in a cluttered space. The primary challenge was to define and clearly articulate a key point of difference that would not only resonate with Canadian consumers, but would also gain their trust despite having zero brand recognition.

We also needed to do so in a cost-efficient way that allowed us to breakthrough amongst other small-to -medium-sized competitors and grab attention despite having a fraction of the budget of our Big 5 competitors.

c) Resulting Business Objectives: Include how these will be measured:

Our objective was straightforward: EQ Bank needed customers, so an acquisition target of 10,000 new accounts by the end of 2016 was set. In addition, these accounts needed to meet an appropriate cumulative first-year deposit target

Section III — YOUR STRATEGIC THINKING

a) What new learnings/insights did you uncover?

In today’s world, technology has powered a global evolution of services and products that genuinely make our lives easier – we carry computers in our pockets, Uber has revolutionized the taxi industry, driverless cars are no longer a futuristic fantasy. Yet, generally speaking, this hasn’t happened in banking and Canadians have learned to live within the structure forced upon them. In 2015, J.D. Power reported that only 9% of Canadians would consider switching banks despite satisfaction scores dropping year over year[1].

We knew we needed to wake Canadians up to the fact that there was a better way to bank and that they didn’t need to accept these behaviours any longer.

b) What was your Big Idea?

We celebrated how being a digital bank allows EQ Bank to give consumers more of what they want (easy access to their money, opportunities to see it grow) and less of what they don’t need (bank branches, fees). Simply put, we’d rather build your savings than build bank branches.

c) How did your Communication strategy evolve?

Our Communication Strategy was built around 3 key pillars:

Why: We knew Canadians needed a reason to break with complacency, so everything we did had to reinforce the benefits of choosing to bank with us over traditional banks: no fees, higher interest rate, free Interac transfers, no minimum deposit, and easy, 24/7 access.

How: We needed to speak and act bigger than we were in order to build credibility, but because EQ was different than the “big guys” we needed to use consumer language and a look and feel that was less corporate and more distinct

Where: We needed to be in places that we knew our target was and that were proven to be trusted mediums

d) How did you anticipate the communication would achieve the Business Objectives?

Given that our creative was attention grabbing but our budget smaller than competitors, the key was understanding the daily lives of our target and the places they spend their time. Depending on where they were in the funnel of consideration, we would serve them higher impact pieces to drive awareness and consideration or more tactical pieces closer to the point of conversion. We knew that frequency would be key to building familiarity, and that we had to choose only the most trusted channels.

Knowing that the majority of our target lived in major urban markets, we also maximized spend and drove impact by focusing on Toronto and Vancouver for our major outdoor takeovers.

[1] J.D. Power 2015 Canadian Retail Banking Satisfaction Study

Section IV — THE WORK

a) How, where and when did you execute it?

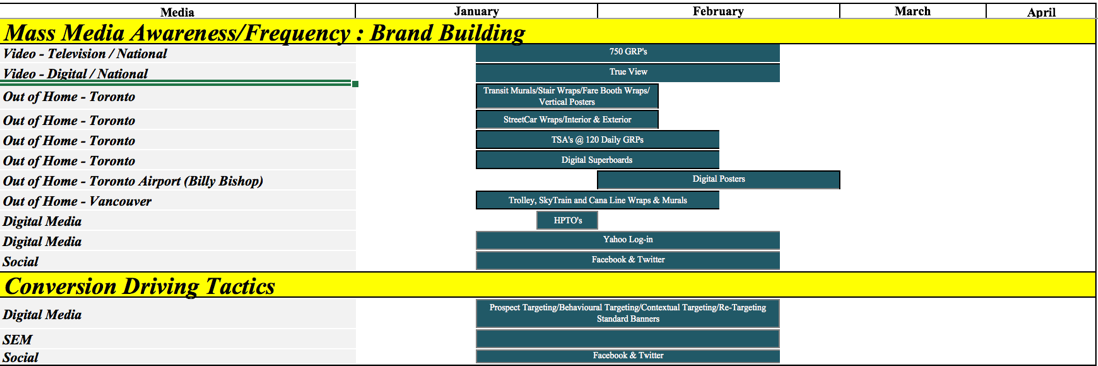

We drove awareness and impact using a combination of TV, digital media with high impact placements and widespread takeover-style out of home at launch.

Out of home:

To drive acquisition, at the same time we used a combination of highly targeted digital, SEM and social.

Social:

c) Media Plan Summary

Section V — THE RESULTS

a) How did the work impact attitudes and behaviour?

Interest in EQ Bank was instantly strong. Upon launch, traffic to the EQ Bank website grew 89%, boasting 650,000 visits and 3,700,000 page views. Demand for new accounts was immediately so high that additional support staff needed to be hired in order to process them.

b) What Business Results did the work achieve for the client?

Within a mere five weeks of launch, we exceeded our initial first-year acquisition target of opening 10,000 EQ Bank Savings Plus Accounts. We saw:

- 17,000 new customers, 170% of the first-year customer sign-up target a full 47 weeks ahead of schedule

- First-year deposit targets were surpassed by 400%.

c) Other Pertinent Results

N/A

d) What was the campaign’s Return on Investment?

Although we are unable to disclose an exact ROI, not only did we surpass our acquisition target, we did so with markedly lower financial investment thanks to a cost per sign-up of only 30% of the initial campaign benchmark.

Section VI — Proof of Campaign Effectiveness

a) Illustrate the direct cause and effect between the campaign and the results

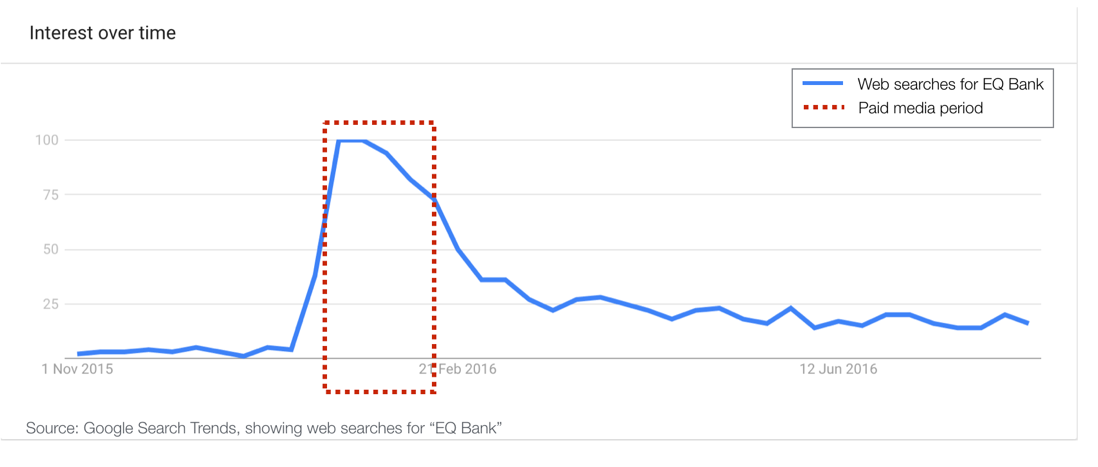

Before our campaign launched, EQ Bank had no awareness in the market. The communication strategy and supporting earned media were the only way consumers were made aware of the new bank.

The campaign’s paid media period corresponded directly with a rise in searches for the bank online, showing that we drove awareness and interest.

b) Prove the results were not driven by other factors

Campaign spend vs. history and competition:

Media budget for the campaign was less than $2,000,000 and was in market for only 5 weeks. By industry standards, our buy was significantly lower. According to their 2015 CASSIES submission, when Tangerine launched in 2013 their budget was $5 million.

Pre-existing Brand momentum:

This was a launch campaign with no prior communications.

Pricing:

Our non-promotional 3% interest rate, at time of launch, was .5% higher than the next best rate in market. However, rates are known to constantly fluctuate and shortly after launching competitors such as Tangerine offered existing customers rates up to 3% on new deposits.

Changes in Distribution/Availability:

N/A

Unusual Promotional Activity:

N/A

Any other factors:

N/A