Koodo Mobile

Technology (BRONZE)

Client Credits: Koodo Mobile

Koodo Mobile

Dan Quick- VP, Marketing Communications

Lise Doucet- Director, Marketing Communications

Dragana Simao- Manager, Marketing Communications

Jennifer Robertson- Manager Quebec, Marketing Communications

Agency Credits: Camp Jefferson

Peter Bolt- SVP, Managing Partner

Andre Louis- VP, Director of Strategic Planning

Paul Little- Executive Creative Director, Partner

Ian Barr- VP, Director of Social & Innovation

Edith Rosa- VP, Director of Client Services

Julie Nikolic- Associate Creative Director

Chris Obergfell- Associate Creative Director

Lisa Taylor- Account Director

Suyi Hua- Account Supervisor

Melanie Abbott- Account Supervisor

Sabrina Zavarise- Account Executive

Michelle Colistro- Copywriter

Caroline Friesen- Art Director

Andrew Passas- Designer

Mo Bofill- Designer

Jen Mete- Director of Integrated Production

Lily Tran- Production Coordinator

Mike Perry Studios w/ Suneeva, 1st Avenue Machine & MOM- Production Houses

Mike Perry, Karim Zariffa, Julien Vallee, Eve Duhamel- Directors

Geoff Cornish, Sam Penfield, Richard Ostiguy- Executive Producers

Ricart & Co- Transfer

Apollo Studios-Audio/Music House

Ransom Profit- Development

Cossette Media- Media Agency

Section I — CASE PARAMETERS

| Business Results Period (Consecutive Months): | April 2015-July 2016 |

| Start of Advertising/Communication Effort: | April 20, 2015 |

| Base Period as a Benchmark: | February 2014-April 2015 |

| Geographic Area: | National |

| Budget for this effort: | Over $5 million |

Section IA — CASE OVERVIEW

Why should this case win in the category (ies) you have entered?

Koodo competes in market where growth is starting to be a lot harder to come by given market saturation. More parity in terms of plans and pricing exists than ever before and differentiation is very difficult to attain and even harder to sustain.

Koodo was tackling these prevailing head winds with an advertising platform that quite frankly had run its course, a budget that was its lowest ever and a resulting share of voice that made it excruciating difficult to be heard.

Overcoming these difficult circumstances, the Choose Happy campaign changed the trajectory for the business and helped get more people considering Koodo and ultimately grew its total subscriber base.

Section II — THE CLIENT’s BUSINESS ISSUES/OPPORTUNITIES

a) Describe the Client’s business, competition and relevant history:

Koodo began in 2008, an era of the Canadian telecom industry when mobile phone adoption in Canada was strong and there was very little competition outside of the Big 3 national carriers with which to service it.

Unfortunately for Canadian mobile subscribers it was a market filled with complicated rate plans and overly restrictive contracts. Anyone looking for more basic service for a reasonable price was essentially left without an option. Until Koodo that is…a brand built to make mobile service fair, simple and less complicated. A position it has successfully owned for close to 7 years.

Fast-forward to 2015 and while Koodo’s mission hadn’t changed the market dynamic around it most certainly had.

b) Describe the Client’s Business Issues/Opportunities to be addressed by the campaign:

A saturated market

With 85.6%[1] of households now owning at least one mobile phone, the Canadian telecommunications industry is beginning to take on a new complexion. Telcos that have historically enjoyed years of rampant subscriber growth are now being forced to compete fiercely for each new customer.

Filled with parity plans and pricing

Fundamentally each telco offers the same range of phones, paired with plans that are remarkably similar. To attract new customers, aggressive pricing tactics have become commonplace. Advantage of any sort is hard to gain, and even harder to sustain.

A campaign that had run its course

Within this tough and getting tougher market, for 5 years the KOODO brand had ridden the back of a mini-mexican wrestler named El Tabador who fought to save Canadians from mobile injustices. While successful for the bulk of this time, the campaign was starting to show serious signs of declining salience and effectiveness.

c) Resulting Business Objectives: Include how these will be measured:

Our resulting objective within this saturated market was to;

Increase Consideration amongst prospects,

So that…

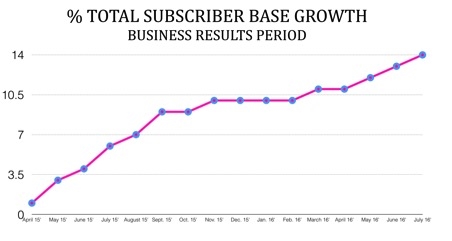

We could grow our total subscriber base by 10% during the business results period.

[1] SOURCE: Statistics Canada, Survey of Household Spending 2014

Section III — YOUR STRATEGIC THINKING

a) What new learnings/insights did you uncover?

A rising tide of discontent

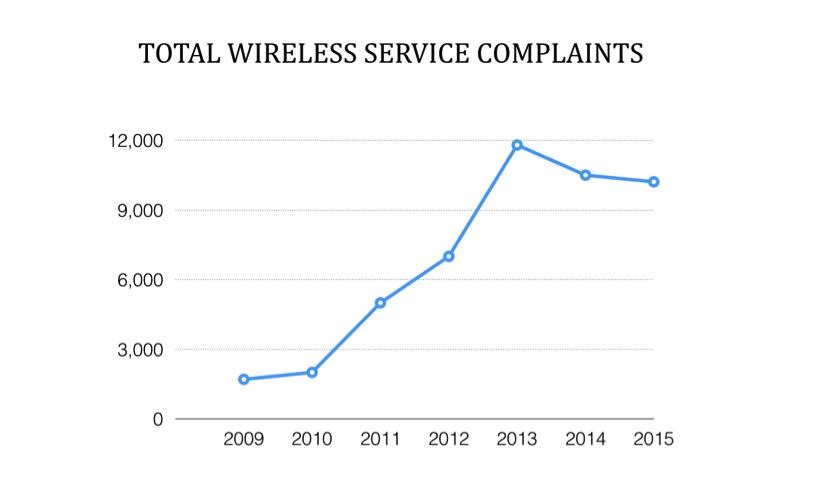

It’s common knowledge that the telecommunications industry has done itself no favours in years gone by. Profits were put first, and customers were taken for granted. To this day people feel frustrated by the shabby treatment they have endured, as evidenced by the dramatic rise in complaints to the CCTS (Commissioner for Complaints for Telecommunications Services) over the last 6 years. The view of the industry is uniformly dim, with consumers feeling like they have no real options or alternatives.

SOURCE: CCTS Annual Reports

One remarkable exception

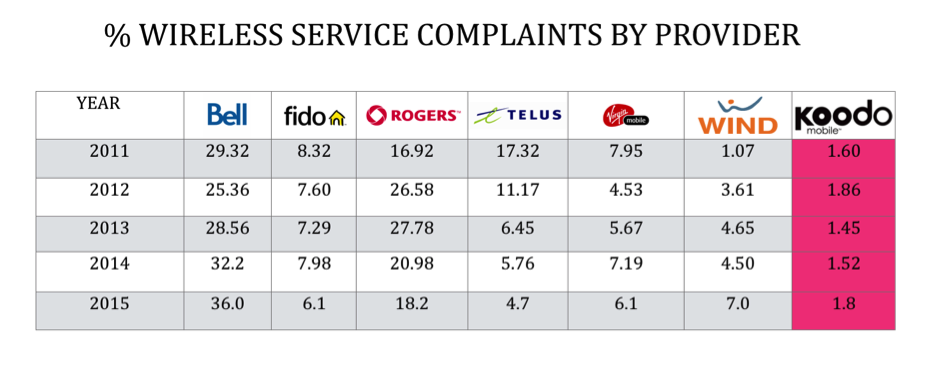

Against this stark backdrop, there is one notable exception. Koodo has managed to create the kind of relationship that people have been craving from their telco.

Koodo customers seem to be genuinely content, with fewer complaints than any other telco provider – a legacy of the brand consistently delivering upon its values of fairness, simplicity and dependability.

Koodo has been ranked “Highest in Customer Satisfaction With Stand Alone Wireless Service” by J.D. Power and Associates for four consecutive years (2012, 2013, 2014, 2015).

Koodo customers stay because they want to, not because they have to. Unlike most telcos, Koodo customers aren’t locked into a fixed-term contract. They can leave whenever they want.

All this is evidence of an unparalleled level of customer satisfaction. So if that’s the case, why aren’t people recognizing Koodo as the alternative they’ve been desperately seeking?

THE BRAND GAP

Looking into this question we discovered a startling dichotomy:

Koodo customers give the company a best-in-category 87% favourability score. Non-customers rate Koodo at 19% – the lowest score amongst all the telcos[2]. In the eyes of non-customers, Koodo literally falls from best in class to the very bottom of the pack.

Simply put, the experience being enjoyed by Koodo customers is not being externalized. This could be a legacy of years focused on communicating value, rather than values.

b) What was your Big Idea?

Choose Happy became our rallying cry. It was designed to shine a light on Koodo’s vastly superior customer experience and shift the prevailing conversation from a product and price focus, to an unmet emotional need that Koodo was uniquely positioned to fulfill.

c) How did your Communication strategy evolve?

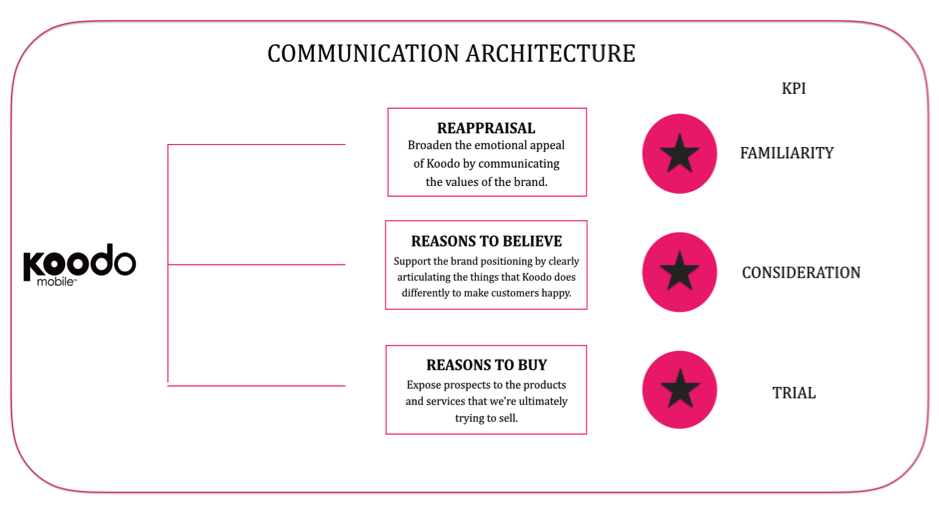

We created a three-tiered messaging approach.

The implication of this strategy is a requirement to take more messages to market than ever before. While in the past Koodo had focused on a single message throughout their communication there is no single message, no single reason to believe, no “silver bullet” that would close the Brand Gap (the difference between how customers and non-customers perceive Koodo) referenced earlier. We needed more messages in market but with less media investment we had to depend on the creative to break through in order to get noticed and have the impact we needed.

d) How did you anticipate the communication would achieve the Business Objectives?

Choose Happy ultimately was designed to directly resolve the high levels of customer dissatisfaction in the market by positioning Koodo as the home of Canada’s Happiest customers. Everything we did and said re-enforced this premise. Ultimately by taking this approach we anticipated we would get more disgruntled customers of the other mobile providers to consider us and ultimately choose us.

[2] Favourability scores are calculated on a scale of 1 – 7. A score of 5 or more is deemed as favourable.

SOURCE: TELUS Brand and Reputation Report, Q3 2014

Section IV — THE WORK

a) How, where and when did you execute it?

Core to the development of the Choose Happy creative elements is the belief that we can’t just tell people to be happy, we need to make them feel happy. The brand, and its creative messaging needed to exude fun and happiness.

At the same time we had a number of messages, some rather straight and uninspiring, to communicate. To truly generate re-appraisal we needed to very clearly communicate the many aspects of Koodo that makes customers so happy. Happiness couldn’t be at the expense of message clarity.

Finally, we recognized how people now predominantly consume their content. From the bottom up, the Choose Happy creative is mobile-optimized, engineered from the digital world to the traditional and inspired by the ‘bite-sized’ content people seek out and want to share. The result was a brand platform that references the responsive grid-based thinking of the digital realm, that’s highly flexible and can be sliced and diced in different ways, and easily deployed across a range of media.

When it came to media we employed a “swarming” approach our strategy. We selected mediums matching our target’s 18 – 34 years olds behaviour and then looked for multiple ways to create impressions for them in and around that medium. For example, we ran our ad in cinemas but in addition bought ad space in the washrooms and put up posters in and around the concessions. This allowed for the multiple messages of how Koodo makes their customers happy to be surrounding our target within one environment.

Establishing critical mass quickly was the other crucial media strategy. As outlined in the Communication Strategy we needed to create re-appraisal by creating an emotional connection in communicating the values that Koodo delivers. But the mobile industry moves fast and new subscriptions happen everyday so we didn’t have the luxury of time to seed those messages. Within four weeks we needed to be moving into the ‘reason to believe’ and ‘reasons to buy’ messaging to generate real subscription growth.

c) Media Plan Summary

– Television

– Cinema

– Out-of-home

– Newspaper

– In-store

– Digital pre-roll

– Digital display advertising

– Social

– Paid Search

Section V — THE RESULTS

a) How did the work impact attitudes and behaviour?

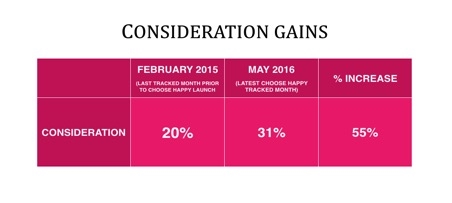

Our defining attitudinal metric for Choose Happy was consideration among our core target of 18 – 34 year olds. If more of them weren’t considering us more of them couldn’t ultimately choose us. On this metric we exceed our expectations with considerations levels rising 55%.

SOURCE: Koodo Brand Tracker Reports

Additionally, Koodo’s consideration levels are now on par with the big national providers, Bell, Rogers and Telus and significantly outpace those of the other value providers like Fido, Virgin and Wind.

b) What Business Results did the work achieve for the client?

These gains in consideration did not go unrealized. The first month after Choose Happy launched saw a 23.6% increase in new subscribers versus the month prior.

Most importantly however this momentum has carried through the entire business results period. Our goal was to increase our total overall subscriber base by 10% and as the chart below illustrates…we exceed that goal by 3% – achieving a 13% lift in our total number of subscribers post Choose Happy launch versus pre.

SOURCE: Koodo Proprietary Market Data

c) Other Pertinent Results

None.

d) What was the campaign’s Return on Investment?

Koodo does not publicize specific number of new subscriptions nor the lifetime value of customers so ROI calculations are impossible to make.

Section VI — Proof of Campaign Effectiveness

a) Illustrate the direct cause and effect between the campaign and the results

The section below clearly eliminates other factors that could have been responsible for our success. Further evidence of the fact that Choose Happy was primarily responsible for our success is that all of our consideration lifts we’ve seen have been timed when Choose Happy has been in more active in market.

b) Prove the results were not driven by other factors

Campaign spend vs. history and competition:

Koodo had no additional media money than it did in 2014 pre Choose Happy. In fact, it had less. This meant its share of voice among its ‘value’ competitors like Fido, Wind and Virgin in 2015 was only 16%.

Pre-existing Brand momentum:

As stated up front, the market in Canada had started to take on a new complexion after years of rapid mobile penetration gains. All providers, Koodo included, who once benefited from this growth were now being forced to work harder to gain ground.

Pricing:

Pricing among the value providers in the mobile industry is most often at parity. When one carrier changes their prices, the others typically react in very short order to match creating no lasting pricing advantage. This was the case during the case period.

Changes in Distribution/Availability:

There were limited to no changes to distribution during the case period with Koodo’s branded store count rising by merely a few and no new major 3rd party retailers being signed on as partners.

Unusual Promotional Activity:

The wireless category is extremely competitive and aggressive promotion activity is the norm. This was the case for all carriers, including Koodo during the case period.

Any other factors:

None.