Official Partner of Big Dreams

Services (BRONZE)

Client Credits: TD Bank

TD Bank

Agency Credits: Leo Burnett

Agency: Leo Burnett, Toronto

Chief Creative Officer: Judy John

Creative Director: Josh Budd, Dave Federico

Group Creative Director: Paul Giannetta, Stephen Stahl

Copywriter: Jason Soy

Art Director: Sally Fung

Group Account Director: Laurie Freeman

Account Supervisor: Kim Lazer

Account Executive: Alyssa Rossi

Planner: Kyle Fiore

Media Agency: Starcom

Section I — CASE PARAMETERS

| Business Results Period (Consecutive Months): | September 15 – October 30, 2015 |

| Start of Advertising/Communication Effort: | September 15, 2015 |

| Base Period as a Benchmark: | September 15 – October 30, 2015 |

| Geographic Area: | Canada |

| Budget for this effort: | Confidential |

Section IA — CASE OVERVIEW

Why should this case win in the category (ies) you have entered?

•Represents a completely new approach to Small Business Banking in the Financial Services category, never done before by any other bank in Canada

•Had a tremendous impact on overall consideration for TD, branch traffic and actual account sign-ups, driving the strongest business results of any Small Business campaign in TD’s history

•Driven by a strong and compelling insight that was at the centre of the campaign

•Strategic work has had positive operational implications, strongly influencing TD’s corporate direction for how they view and treat Small Business Banking

Section II — THE CLIENT’s BUSINESS ISSUES/OPPORTUNITIES

a) Describe the Client’s business, competition and relevant history:

“Banks don’t give a crap about us, probably because we don’t make them enough money”[1].. A common statement heard amongst Small Business owners in Canada, a group that contributes more than 30% to Canada’s GDP and employs nearly 70% of Canada’s workforce[2]. Despite their big contributions to Canada’s economy, there was a perception that banks made Small Businesses feel small with generic cookie cutter communications and services that further reinforced that they just didn’t get the challenges that Small Business Owners faced on a daily basis.

b) Describe the Client’s Business Issues/Opportunities to be addressed by the campaign:

Convincing Small Businesses that they are a big deal to TD

TD was facing dwindling consideration and account sign-ups with consideration dropping a sizeable 25% between 2013 and 2014, and total account sign-ups falling 6% in 2014[3]. This made TD realize that they had to prove, in a significant way, that Small Business mattered to them and their commitment was far more than just lip service.

c) Resulting Business Objectives: Include how these will be measured:

The challenge: How do you convince Small Business owners that they actually matter to a Big Bank?

Based TD-led attrition research[4], it was evident that Small Businesses not only felt that they didn’t matter to TD, but also to all banks in general. These perceptions and attitudes towards banks increasingly translated into negative business impact with declining consideration, account openings, consultation bookings and web visits.

We felt we needed to do something bold that no other bank had ever done in order to change the existing perceptions and alter the behaviours of small business customers, existing and potential. With this challenge in mind, we established three primary objectives for our campaign:

1.Increase incremental consideration for TD amongst Small Business owners

2.Drive an increase in online appointment bookings and incremental in-branch traffic

3.Increase account openings by 1% versus 2014 Fall Campaign

[1] Qualitative research with Small Business customers – Leo/TD Research 2015

[2] Start-up Canada: Statistics on Small Businesses in Canada 2013

[3] TD Small Business team – 2015

[4] 2014 Small Business attrition research

Section III — YOUR STRATEGIC THINKING

a) What new learnings/insights did you uncover?

Appealing to the heart, not the head

With competitors relying predominantly on offer-driven communication, we knew that if we were to change perceptions about TD and stand out from the rest, we would have to go deeper and attempt to mean something more to Small Business owners. With rate offers communicated ad nauseum across the category, banking relationships appeared transactional and almost commoditized, solidifying that banks weren’t there to add value, but to merely hold and dispense money. We knew that if we were going to actually matter to Small Businesses, we had to change the way we thought about them throughout the organization and go further to actually help our customers succeed.

Getting to the heart of the issue

While we had a very good grasp of the business problem that TD was facing, we realized that we did not actually truly understand the mindset of a Small Business owner, nor did we deeply understand their relationship with TD.

In order to understand this, we conducted a qualitative attitudinal analysis with 100+ Small Businesses and interviewed 20 business owners their place of work (ranging from co-working spaces to mom and pop shops) to gain an understanding of these entrepreneurs’ attitudes and values towards their businesses and their banks on a deeper level.

The Key Insight: Small Business owners believe that banks take more than they give

The attitude of a Small Business owner is completely unique. They see opportunity where others do not, they are driven by passion and independence, not by riches, and their primary barrier lies not with lack of funds but more in their lack of capacity to take on ten things at once.

When it came to banking, one thing became extremely clear – business owners didn’t believe banks were committed to them. While TD consistently advertised their commitment to helping small businesses grow, Small Business owners actually believed the opposite[5]. From lofty bank fees to blanket, business generic cookie–cutter offerings, Small Business owners simply didn’t believe banks understood the blood, sweat, tears and commitment it takes to run a business, leading them to outright dismiss most of what banks were saying as BS[6]. We knew that in order for Small Business owners to shift their perceptions and behaviours towards TD, we needed to marry our newfound understanding of how business owners perceive themselves and their perception of banks. In short, we needed to redefine commitment and do something that a Small Business owner would never expect from a bank, let alone TD.

b) What was your Big Idea?

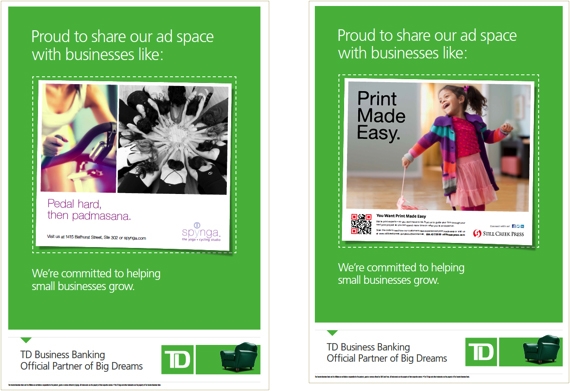

Idea: Demonstrate our commitment to Small Businesses by promoting them instead of ourselves.

As October is officially “Small Business Month’ in Canada, we decided to give our small business customers all over the country the exposure they deserved and spend our campaign dollars on promoting their products and services, not ours.

c) How did your Communication strategy evolve?

Our communication strategy had two phases:

- Cause reappraisal with current bank: Leverage our mass media buy in major markets around the country to actually demonstrate to Small Businesses that we are committed to them. By showing our dedication, the hope would be for existing customers to feel like they are with the right bank and to have non-customers begin questioning how much their bank actually values their business.

- Capitalize on reappraisal: Capitalize on the potential reappraisal and entice Small Business owners to come in and have a conversation leveraging more acquisition-based messaging.

d) How did you anticipate the communication would achieve the Business Objectives?

Given that we were the first bank in Canada to share our media space with our customers, we weren’t sure how that was going to impact business results. We had an educated feeling that overall consideration would increase given the initiative, however it was something that both the agency and client felt was worth the investment. To ensure that we weren’t putting all of our eggs in one basket, we peppered in some offer communication to ensure that we could capitalize on the increased consideration, acting as a one-two punch strategy.

[5] Qualitative research with Business customers – Leo/TD Research 2015

[6] Qualitative research Small Business customers – Leo/TD Research 2015

Section IV — THE WORK

a) How, where and when did you execute it?

To effectively promote our customers’ small businesses, we had to find them first. We had TD Small Business managers surprise longstanding Small Business customers across Canada and let them know that we were focusing $1,000,000 of our media budget advertising their business instead of our own in prime print, out-of-home and paid social media. To ensure optimal impact and relevance to TD’s small business customers, the media buy was organized so that Small Businesses would be featured throughout their key sales area.

All Small Business advertisements were tailored to fit within a TD template, allowing Small Businesses to benefit from TD’s existing brand awareness and recognition, and showcased their ads in spaces traditionally reserved for some of Canada’s leading brands. For the first time ever, cupcake shops, barbershops and pet stores from across the country were given the marketing exposure equivalent to that of a major national bank, benefiting from over 20 million weekly impressions across all media, making our TD Small Business customers the true stars of Small Business month.

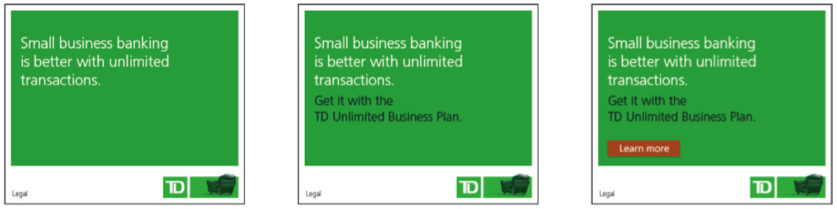

To round everything out, an additional $300,000 media budget was introduced to further entice Small Businesses to come in and have a conversation with Small Business Managers. Digital and in-branch signage were leveraged to communicate more tactical offerings which included:

- An offer of 60,000 Aeroplan points for any new account sign ups.

- An Unlimited Business Banking Account

The language leveraged in these offers remained consistent with the overall theme of the campaign around being a committed partner to our businesses success.

OOH

Social

Digital

c) Media Plan Summary

Media Used

- OOH

- Social Media

- Digital

A balancing act:

To make sure we were reaching both Small Businesses and potential consumers, the media buy was strategically purchased so it would reach both audiences simultaneously – resulting in buys that had high-traffic potential and were geographically relevant to the businesses being featured.

OOO and Print were leveraged in high-traffic areas in order to drive consideration for TD and awareness of the businesses being featured.

Digital and Social ads allowed us to be incredibly geo-targeted and promote businesses amongst consumers and small businesses alike. Aeroplan and account offers would sometimes accompany the ads to provide an additional nudge for businesses to come in and have a conversation.

Section V — THE RESULTS

a) How did the work impact attitudes and behaviour?

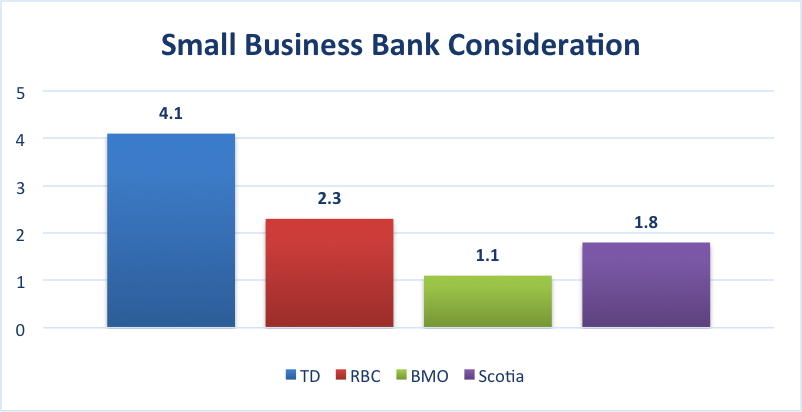

Objective 1: Increase incremental consideration for TD amongst Small Businesses

In promoting Small Businesses throughout the country, TD drove well above-average consideration amongst non-customers vs. the competition. Total consideration for TD increased 25% VYA from 3.1% to 4.1%[7].

b) What Business Results did the work achieve for the client?

Objective 2: Drive an increase in online appointment bookings and in-branch traffic

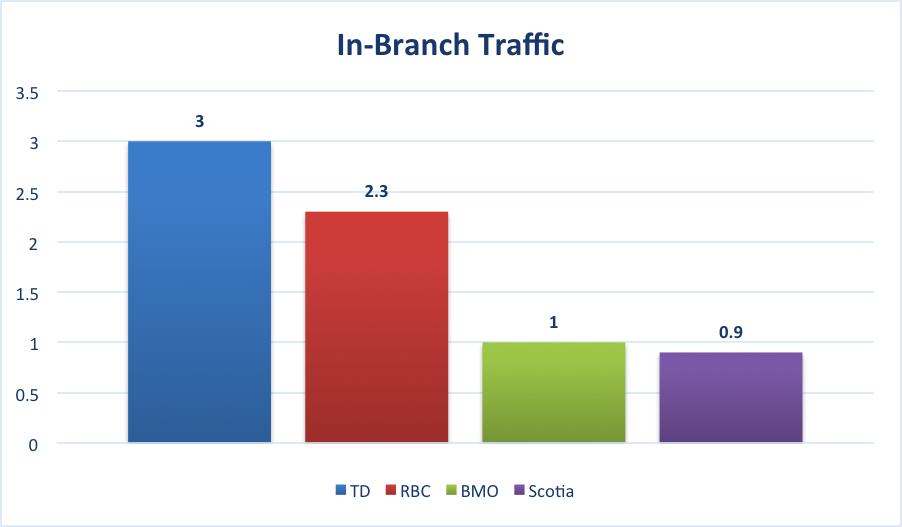

Online Appointment Bookings increased 300% VYA, increasing incremental in-branch traffic +43% from 1.7% to 3.0% VYA[8]. TD also drove more traffic than the other competitors[9].

Objective 3: Increase account openings by 1% versus 2014 Fall Campaign

The 2015 Fall Campaign drove a +7% lift in new account openings VYA, reversing year-to-date trends of -6%[10].

c) Other Pertinent Results

N/A

d) What was the campaign’s Return on Investment?

The campaign drove a Return on investment (ROI) of 4$ for every 1$ spent on the campaign. This took into consideration the incremental lift in new accounts (+962 total accounts) over run-rate we generated as a result of the campaign, in addition to the lifetime value of a new SBB customer on average that we acquired[11].

[7] SBB Month Marketing Campaign Final Results (Sep. 14th to Oct. 30th) TD Bank 2015

[8] SBB Month Marketing Campaign Final Results (Sep. 14th to Oct. 30th) TD Bank 2015

[9] SBB Month Marketing Campaign Final Results (Sep. 14th to Oct. 30th) TD Bank 2015

[10] SBB Month Marketing Campaign Final Results (Sep. 14th to Oct. 30th) TD Bank 2015

[11] SBB Month Marketing Campaign Final Results (Sep. 14th to Oct. 30th) TD Bank 2015

Section VI — Proof of Campaign Effectiveness

a) Illustrate the direct cause and effect between the campaign and the results

This was the first time TD featured the advertisements of their small businesses instead of promoting their own products.

b) Prove the results were not driven by other factors

Campaign spend vs. history and competition:

The media spend VYA was 1,300,000 representing a 0% increase from the year prior.

Pre-existing Brand momentum:

Momentum prior to the campaign was negative as evidenced by dwindling account sign ups and low consideration. This was all further exacerbated by the perception among Small Business owners that banks take more than they give.

Pricing:

The pricing of the products remained consistent with the previous year.

Changes in Distribution/Availability:

There were no distribution changes.

Unusual Promotional Activity:

We were also running a joint Aeroplan promotion, offering Small Businesses up to 60,000 Aeroplan points for signing up for a new TD Small Business account. A 5$ Business Account was in market the year before, however, more weight was placed on acquisition messaging in 2014 vs. 2015.

Any other factors:

As in every category, we do believe that our offer communication did have an impact on overall business results. It must be said, however, that the majority of the investment went into promoting our Small Business customers, which we believe is responsible for the sizeable increase in overall consideration, especially compared to our competitor.