#OwnIt

Brand Reawakening (BRONZE)

Client Credits: Kellogg’s

Kellogg’s

Agency Credits: Leo Burnett

Agency: Leo Burnett, Toronto

Chief Creative Officer: Judy John

Group Creative Director: Kelly Zettel, Sam Cerullo

Copywriter: Kelly Zettel, Jennifer Smith, Mike Johnson

Art Director: Sam Cerullo, Pedro Izzo, Jordan Gladman

Agency Producer: Melanie Palmer, Sabrina DeLuca

Group Account Director: David Moss

Account Director: Mandy Eaton

Account Supervisor: Jade Brent

Planner: Trevor Thomas

Production Company: Skin & Bones

Director: Mark Zibert

Photographer: Francisco Garcia

Editing Company: School Editing

Editor: Ryan J. Hunt

VFX: Fort York

Media Company: Starcom

Section I — CASE PARAMETERS

| Business Results Period (Consecutive Months): | September 21, 2015 – May 29, 2016 |

| Start of Advertising/Communication Effort: | September 21, 2015 |

| Base Period as a Benchmark: | September 21, 2014 – May 29, 2015 |

| Geographic Area: | Canada |

| Budget for this effort: | Over $5 million |

Section IA — CASE OVERVIEW

Why should this case win in the category (ies) you have entered?

Five years ago, Special K realized that the one thing it stood for – dieting – had become a dirty word. Canadian women were turning away from deprivation and guilt, and the brand was left without a true purpose in their lives.

While every global market scrambled for solutions, the Canadian team dug deep to gain a deeper understanding of their audience, and identified a hidden, universal enemy that became the fuel for our campaign: self-doubt.

This enemy allowed us to take a bold leap forward, re-defining the brand through an honest conversation with our audience. Gone were the iconic red dresses and scales – ever-present SPK brand assets – replaced by real women in real situations, talking about real issues and eating real food.

After 10 straight quarters of declines, hitting a low of -16% in Q1 2015, SPK saw it’s $VolChg grow for the first two quarters of 2016. With nearly 6 million online views of our launch spot, and a 21-point rise in our Brand Meaning, we didn’t just turn around sales, we radically altered the trajectory of this iconic brand by transforming it from the inside out.

Section II — THE CLIENT’s BUSINESS ISSUES/OPPORTUNITIES

a) Describe the Client’s business, competition and relevant history:

What happens when the one thing you stand for becomes a dirty word?

Through the 1980s, when nearly 60% of Canadian women dieted[1], Special K (SPK) – a leading cereal brand in Canada – had an important role in their lives.

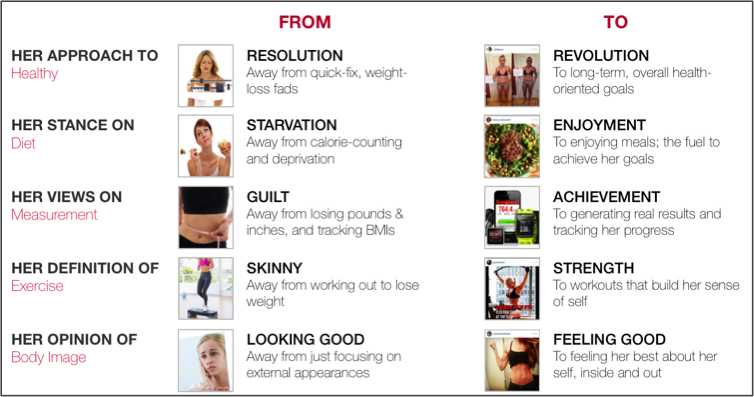

In 2003, however, the number of women actively dieting dropped to 27%[2], as women’s mindsets began to shift. Skinny turned into strong, enjoyment replaced starvation, and feeling good became as important as looking good.

b) Describe the Client’s Business Issues/Opportunities to be addressed by the campaign:

Typically, SPK ads presented two possible scenarios: 1) she’s a bundle of energy in a perfect world where cereal is presented as the magic potion fuelling her happiness, or 2) she is a bundle of doubt and guilt – likely caused by her weight – and cereal is presented as the solution to her problems.

Over time, the perfect SPK woman from these campaigns, in her red dress, smiling on a scale, looked very out of place. And, with this drop in relevance, sales in Canada fell for 10 straight quarters, hitting an ultimate low of -16%, in Q1 2015[3].

c) Resulting Business Objectives: Include how these will be measured:

We needed to return this iconic brand to growth by:

1.Stabilizing Sales & Penetration

With share dropping for ten consecutive quarters and household penetration falling for three straight years, our goal was to stabilize both share and penetration to position the brand for future growth.

2.Creating a Meaningful Connection

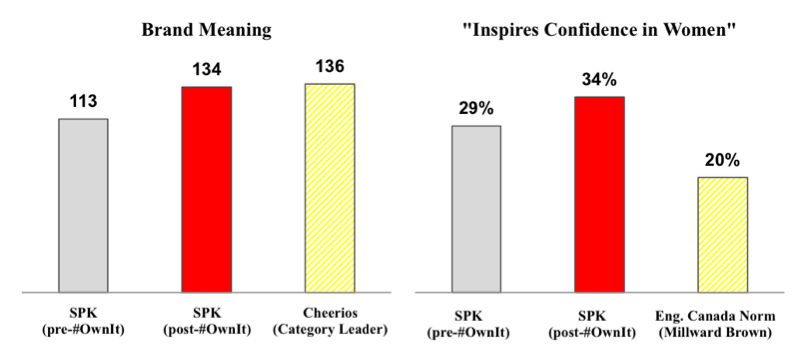

With this new campaign, we wanted to re-connect with our audience by breathing new meaning into the brand, looking to close the gap with category leader Cheerios, which had a 136 score, 23 points higher than SPK[4].

3.Driving Brand Popularity

The brand focused on two keys metrics to measure popularity: Unaided awareness, which they wanted to see rise to 10%, and online video views for the launch film, where they set a goal of 3 million views.

[1] Nielsen, 1979

[2] Gallup Canada, Telephone poll, Dec. 2003

[3] AC Nielsen PE Dec 26, 2015

[4] Millward Brown, Adult Band Dynamics, Nov. 2015

Section III — YOUR STRATEGIC THINKING

a) What new learnings/insights did you uncover?

Global Hypothesis: Strong is the new skinny

SPK’s sales had fallen sharply in every region, so globally Kellogg’s was paying close attention. A large global study had been commissioned to uncover what exactly was going wrong. The conclusion that Kellogg’s reached was that women were no longer into starvation and deprivation, and that strong had become the new skinny.

After reading the global report, we believed there was more to the story and that simply replacing “skinny” with “strong” would act as little more than a stopgap. We determined that more research should be completed to gain a deeper understanding of what was behind Canadian women’s shift from dieting and, ultimately, their departure from the brand.

A step back to better understand “strong”

Our research project began with extensive secondary research. We scoured news and media coverage from the past decade, looking at how different subjects like strength, diet, femininity and women’s relationship with food were discussed and portrayed. We then conducted an extensive scrape of Twitter and Instagram, looking at changing post topics, photo themes and hashtag usage, to see how everyday women were discussing these topics. Finally, we gathered dozens of 3rd-party studies on the issues we had encountered in the media and on social media.

We concluded that while strength had, in fact, taken on greater importance with women, it was really just one component of their new positive mindset. Based on this learning, we identified a new, psychographic target for the brand. We called this group The New Feminine.

The New Feminine

This group could not be easily categorized. They came in all different shapes and sizes and ethnicities, and they could be 18, or they could be 80. Demographically, they had very few similarities. Like all women, they shared a commitment to health, beauty, exercise and diet, but it was how they approached them that made these women stand out.

The ever-present caveat

With our new audience identified, we now wanted to speak to these women directly.

To do so, we arranged a series of 10 triads where we sat with groups of women who fit our profile to discuss our key topics: strength, body image, diet and their relationship with food.

To better understand all of these topics, we began by asking our groups how they felt when they were their “best self.” At first, the responses validated our hypothesis about the notion of “strong,” as they avoided the term in favour of other descriptors like “resilient,” “determined” or “courageous”[5]. But it was how they ended their sentences that became a key insight for our campaign.

At the end of every sentence about feeling like their “best self,” the women in our groups would add a caveat: “but not as courageous as my mom,” “but not as resilient as I’d like to be,” “but not as determined as my friend.”

While they all shared the new positive mindset, nearly every woman we spoke to relied on this caveat, which helped us uncover a hidden enemy.

The universal enemy within

In the second portion of our discussions, we exposed the groups to a series of stats and findings from our initial research. One of those studies found that “97% of women have at least one ‘I hate my body’ moment every day”[6]. The reactions we got to this stat were incredibly informative. First, women would reject the stat, then question its validity, then try to understand it, then relate it to others around them, until finally admitting that they too shared the feelings. Witnessing this cascade of emotions demonstrated not only the power of the stat, but – more importantly – helped us put a name to the universal enemy: self-doubt.

The insight: In spite of the positive shifts, women still face off against their harshest critics everyday: themselves.

b) What was your Big Idea?

#OwnIt: Focus on what you can change, accepting the things you can’t.

c) How did your Communication strategy evolve?

Based on our research into current conversations, we decided that we would no longer speak “to” women. Instead, with this new campaign, we would speak “with” them.

And, instead of inciting women to overcome self-doubt – which we knew would be unrealistic – we would rally them to fight it together.

To do so, we knew that being the leader – from the perspective of our communications tone – wouldn’t be appropriate. We were a supporter, or an ally in the fight. A key element of this approach came from our casting. We wanted to tell an authentic story, so we cast real women right off the street who had a compelling, personal story of self-doubt. In this way, the brand would not need to lead the story, but let women speak to each other, with the brand’s support.

d) How did you anticipate the communication would achieve the Business Objectives?

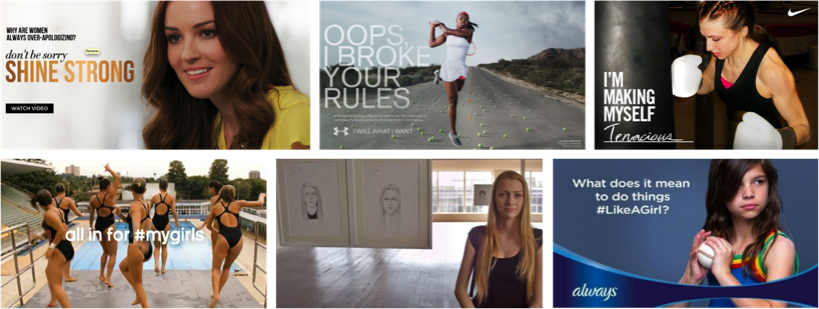

A fresh approach, not another “me too”

From Dove to Nike to Pantene, we knew that female empowerment was a hot topic for brands. But we believed that our unique approach – focusing on the enemy within – could be a key differentiator for SPK. And, of all the brands that had entered the empowerment conversation, there were no cereal brands – or even food brands.

In our triads we learned how big a role food played in women’s self-doubt, so we also believed there was a valid space for the brand to occupy.

Keen to take a positive new stand, we knew SPK could be the leader, but it would mean radically transforming what their advertising looked like and stood for.

[5] Leo Burnett, Qualitative Triads, Nov. 2014

[6] Ann Kearney-Cooke, Ph.D. (Psychologist), Glamour Magazine – Body Image Study, Feb 2011

Section IV — THE WORK

a) How, where and when did you execute it?

The new SPK story, #OwnIt, was built to expose women’s relationship with food and rally them to ditch the doubt.

The first two chapters in the story were an equity-focused launch, followed by a food-focused program.

Brand Re-Launch: Change

The centrepiece of the launch was a 60-second film called “Change”. The film depicted genuine moments of self-doubt being experienced by real women of all shapes, sizes and ethnicities (many of whom were street cast) in an authentic, gritty style. Launched during the Emmys to reach a mass audience that skewed heavily female, it kicked off a campaign that included striking magazine executions and a provocative, interactive social media program featuring our hashtag: #OwnIt.

On Instagram, for example, we created interactive posts that users could tag to change the story in the ad. Based on our research learnings, we wanted each execution – either through copy or media – to allow the brand to speak “with” women, rather than “to” them.

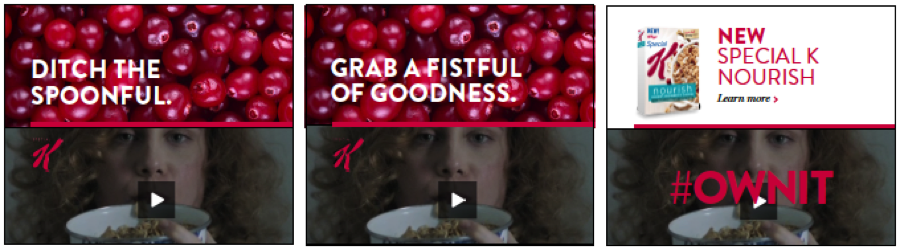

New Food Launch: Nourish

The second chapter was built to promote the brand’s new line of cereals and snacks: Nourish. This work was all about the food, but featured the same honest, authentic #OwnIt tone, this time focused on food-related doubt.

We combined bold, realistic imagery with snappy, attention grabbing copy lines in a :30 second video that launched on the Academy Awards broadcast, again, to reach a mass, female-skewed audience. This was supported online by :15 videos, display banners, Facebook GIFs and provocative shelf-blades to help drive purchase.

c) Media Plan Summary

Media Used:

- TV

- Pre-roll

- YouTube

- Online media

- Magazine

Based on our conversations with our audience, a primary goal of our media strategy was – either through copy or media – to allow the brand to speak “with” women, rather than “to” them.

Of course, the creative executions played a key role in delivering this tone, but we also looked for media opportunities that allowed us to bring this to life. Chief among them was our social media campaign, which was unlike anything Kellogg’s Canada had ever been a part of. Our initial research helped inform the type of messaging and imagery that would best serve these channels, and encourage our audience to participate in the conversation and share.

Section V — THE RESULTS

a) How did the work impact attitudes and behaviour?

Meaningful Connection

- #OwnIt increased brand affinity 38%, which helped increase Brand Meaning 21 points, from 113 to 134[7] (just 2 points behind Cheerios)

- Key brand attribute “Inspires confidence in women” increased from 29% to 34% (:60 Millward Brown, English Canada Norm 20%)[8]

- Canadians ranked SPK #1 for cereal brand “trying to make people’s lives better with their products, services, ways of doing business or their advertising” (137% higher than the category average)[9]

b) What Business Results did the work achieve for the client?

After 10 straight quarters of decline, the brand is back to growth.

1. Share

- After falling for 10 straight quarters, SPK’s $Vol %Chg has returned to growth[10]:

- $Vol %Chg for the campaign period grew 18 points VYA, and outpaced the cereal category by 5 points[11]

- After 3 years of declining household penetration, the brand saw positive growth in the first quarter of 2016[12] (*Full year 2016 data is not available, so Q1 is presented to show positive trend):

c) Other Pertinent Results

Popularity

- “Change” viewed online over 6 million times (5.7 million English, 1.35 French)[13] (Average YouTube video view-count for top 500 brands = 136,000[14])

- Unaided awareness jumped 2 points, from 8% to 10% VYA[15]

d) What was the campaign’s Return on Investment?

#OwnIt delivered a 324% ROMI[16], better than 53% of food-related cases in the Warc database[17].

[7] Millward Brown, “Own It Canadian Campaign Analysis,” Sept – Dec. 2015

[8] Millward Brown, “Own It Canadian Campaign Analysis,”

[9] Millward Brown, RTEC BrandDynamics, Nov. 2015

[10] AC Nielsen, PE Dec 26, 2015

[11] AC Nielsen, PE Dec 26, 2015, PE Apr 2, 2016

[12] AC Nielsen, PE Dec 26, 2015, PE Apr 2, 2016

[13] YouTube Analytics, Sept – Dec 2015

[14] OpenSlate, “Top 500 Brands on YouTube,” 2014

[15] Millward Brown, “Own It Canadian Campaign Analysis,” Sept – Dec. 2015

[16] AC Nielsen, PE Apr 2, 2016

[17] Warc.com, ROI Benchmarker

Section VI — Proof of Campaign Effectiveness

a) Illustrate the direct cause and effect between the campaign and the results

#OwnIt was a re-launch of the SPK brand, and Nourish was a brand new product launch, which represented a lot of new-news from the brand.

b) Prove the results were not driven by other factors

Campaign spend vs. history and competition:

The media spend VYA increased by $420,154, or 5%.

Pre-existing Brand momentum:

The brand was experiencing significant losses prior to launch.

Pricing:

SPK has two tiers of products.

- Tier 1 (Original, Vanilla Almost, Red Berries, Fruits & Yogurt, Oats & Honey) all saw no change to their list price during the campaign.

- Tier 2 (Nourish, Protein, Low-Fat Granola): Nourish was introduced at a higher list price, so Protein and Granola’s prices were increased by $0.50 to match.

Changes in Distribution/Availability:

Distribution for SPK products remained the same as the previous year.

Unusual Promotional Activity:

There was no other unusual promotional activity during this time.

Any other factors:

N/A