Super C – Zéro Compromis

Retail (BRONZE)

Client Credits: Super C

Marc Giroux, Merchandising VP (currently)

Jean-François Couture, Senior Marketing Director

Dominic Audry, Project Coordinator

Éric Guité, Marketing Manager

Jean-Claude Grenier, Marketing Director

Jean-Guy Tremblay, General Manager

Sophie Gélinas, Marketing Manager

Caroline Guilbault, Marketing Coordinator

Agency Credits: Publicis Montreal

Chantal Joly, Creative Director

Samuel Fontaine, Planning VP

Thomas Lecordier, Executive VP

Marie-Claude Bermard, Group Account Director

Marjorie Allard, Account Supervisor

Émilie Soutière, Account Supervisor

Mariève Blanchette-Guertin, Senior Copywriter

Frédéric Noiseux, Senior Artistic Director

Harry Bouchard, Shopper Marketing Creative Director

Carole Beauchamp, Executive Producer

Samantha Kelley, VP Group Director, Touché!

Alex Guimond, Superviseur média, Touché!

Stéphanie Boisvert, Stratège média, Touché!

Ève Aubry, Stratège média, Touché!

Section I — CASE PARAMETERS

| Business Results Period (Consecutive Months): | January 2015 – December 2015 |

| Start of Advertising/Communication Effort: | Jan 2015 |

| Base Period as a Benchmark: | 2014 |

| Geographic Area: | Quebec province, Canada |

| Budget for this effort: | Confidential |

Section IA — CASE OVERVIEW

Why should this case win in the category (ies) you have entered?

In a context where all the discount chains were engaged in a price war and the brand was suffering from weak brand perception, Super C created a break in the brand strategy based on a very real consumer insight: discount chain customers do not necessarily have low incomes, but are smart shoppers looking for the best value for their money.

We came up with a new brand purpose: Zero Compromise.

“When it comes to food, no one should have to compromise on quality and price.”

The Zero Compromise promise allowed for a new direction in communications that focused on engagement rather than price.

To give credence to the message, we called upon a well-loved Quebec celebrity to act as the spokesperson that would embody the message and break the taboo around going grocery shopping at a discount chain.

After 5 weeks, awareness of Zero Compromise was higher than Maxi’s slogan, which had been built over the last decade. With an unchanging offer, the campaign raised the perception of freshness, price and stock by 12,9%, 5.58% and 12.73% respectively. Sales were increased by 5% in 5 months (8 times the growth of the category). The market share also increased by 6.5%.

Section II — THE CLIENT’s BUSINESS ISSUES/OPPORTUNITIES

a) Describe the Client’s business, competition and relevant history:

A brand image and a perception of quality to be improved

Super C is a discount banner established and present in the Quebec food sector since 1982. Despite having improved its offer in recent years, the brand had retained a negative perception dating back to when it was called Super Carnaval and had a poor reputation regarding the quality of its products.

In 2014, the general satisfaction index of the banner was barely 58%, and over 40% of customers were not satisfied with the freshness of the food offered.

Strong competition in a stagnant market

The Quebec food sector is ultra-competitive and characterized by low growth (0.6% in 2015) and thin profit margins (almost always less than 1%). As the number of grocery stores continues to increase, an immense amount of pressure is put on prices and retailers.

Big box retailers like Walmart and Costco lead a fierce battle to grocers. In 2012, Quebecers bought close to 25%[1] of their food products at businesses that were not specialized in food sales. This percentage was higher than in the rest of Canada (20.4%). In addition to Costco and Walmart, Quebecers bought 6.8% of their groceries at pharmacy chains (such as Pharmaprix, which offers large grocery sections), a much higher percentage than in all of Canada (1.8%).

A real price war

In 2014, the Quebec market was dominated by two major, i.e. traditional, players: Metro and IGA. Super C found itself among the ranks of the “discounters”, alongside its main rival, Maxi. At the time (and for over a decade), Maxi communicated widely on the unbeatable concept, adopting the policy of the “lowest price guaranteed or your money back”. The category of discounters was thus based on price, and only price.

[1] La part de marché des épiceries recule au profit des Walmart, Costco et compagnie. http://www.lesaffaires.com/secteurs-d-activite/commerce-de-detail/la-part-de-marche-des-epiceries-recule-au-profit-des-walmart-costco-et-compagnie/563073

b) Describe the Client’s Business Issues/Opportunities to be addressed by the campaign:

A precarious situation for Super C

Addressing the negative perception of Super C held by consumers was a major challenge since the brand was known not only for low prices, but also for low quality food. And with Maxi (since 2011) and Walmart (since 1994) equalling advertised prices and accepting coupons from competing supermarkets, consumers didn’t see any added value in shopping at Super C, since neither the best ingredients nor the best prices could be found there.

A rapidly changing category

In Europe, we saw that the perception of the category was constantly changing in a positive direction. In fact, 78% of consumers found that the quality of products at European discount chains had improved.

The discount chain category in Quebec had also reinforced itself in recent years, and retailers had generally improved their offer. This is what Super C did in September 2013, but without enjoying increased sales. After all, no brands were even mentioning an improvement in their offers given the price war.

In Quebec and elsewhere, consumers were increasingly shopping at discount chains, not out of financial need, but because they could find freshness and lower prices there, as well as quality products.

Nonetheless, Quebec retailers continued to claim low prices, and only low prices.

The opportunity for Super C :

TAKE THE LEAD IN CHANGING THE PERCEPTION OF DISCOUNT CHAINS

We identified this focus on price/communications void as an opportunity for Super C to occupy a new spot in the market—smart shopping—and to take the lead in this new trend in food retail.

c) Resulting Business Objectives: Include how these will be measured:

Global

-Increase brand consideration towards Super C

Specific

-Increase perception on freshness by 5%

-Increase in store sales by 2%

– Increase market share by 3%

– Create a strategic break and change the perception of the brand in order to acquire new clients.

Section III — YOUR STRATEGIC THINKING

a) What new learnings/insights did you uncover?

Original insight: Discount chain customers don’t necessarily have lower incomes.

They are smart shoppers who do not want to pay more for an identical or almost identical product with no other added value.

We quantified this insight: for a price that was 30% lower, consumers were ready to accept a 10% decrease in quality.[1].

In search of the best value

In fact, smart shoppers aren’t only looking for the lowest prices. They are in search of the best value, which includes quality, freshness, food origins, availability, and price. Their perception of the value offered by a retailer strongly influences where they choose to shop, much more so than their perception of the price.

Beyond store choice, several discount chain customers experience a sense of satisfaction, recognition, and even a certain pride in being smart shoppers. They also feel gratified for having chosen the store that helped them save money. More and more often, consumers are proudly sharing with friends and family the details of their purchases and the deals they made.

As such, smart shoppers form a complex segment that is likely to respond to messages and offers based on value, rather than on price alone.

[1] Source: How the discounters are beating the supermarkets. http://www.bbc.com/news/business-34315643

b) What was your Big Idea?

The new Super C brand purpose: ZERO COMPROMISE.

“When it comes to food, no one should have to compromise on quality for price.”

c) How did your Communication strategy evolve?

The strategy was simple: Transform Super C from a “hard discount” to a “soft discount” retailer.

ALWAYS FRESH, ALWAYS IN STOCK, ALWAYS GREAT PRICES

The idea was to maintain a low price point (not THE lowest prices, which was Maxi’s territory) and offer, as a counter proposal, a guarantee of freshness and availability of products. The objective was to create an appealing value equation for smart shoppers.

The guarantee of freshness lent credibility to the discussion of the brand in a realm that was originally not its own.

Also, the guarantee of availability (stock) was crucial because one of the major frustrations of Maxi customers was that discounted products often sold out quickly. Customers would arrive at the store after seeing a deal in a flyer and realize that it was out of stock. Not only were customers unable to benefit from the offer, but they were left with a negative sentiment, that of being cheated by the brand.

In the end, the three guarantees acted as three strong pillars that supported the rest of the communication strategy, allowing for a greater sense of confidence in the brand based on the reliability of the offer and an unchanging and stable experience with every visit to the store.

d) How did you anticipate the communication would achieve the Business Objectives?

The Zero Compromise promise is compelling:

· It is cutting-edge for the food sector since it sides with consumers.

· It rests on a brand purpose that addresses a sensitive spot for consumers, who have the constant impression they are paying too much for too little.

· It creates a break with the usual tone of the brand.

· It is credible given the three tangibles claims: always fresh, always in stock, always great prices.

· It raises the value promise, and, consequently, the quality of the banner.

Above all, the Zero Compromise promise switched the focus from price to conviction and engagement.

Section IV — THE WORK

a) How, where and when did you execute it?

Context

To give credence to the message, we called upon a well-known and well-loved Quebec celebrity, Guy Jodoin[1] to act as a spokesperson, and we capitalized on the ambiguity surrounding his sexual orientation at the time to generate maximum interest and curiosity about the message. In 2014, Jodoin had publicly denied rumours of homosexuality after separating from his wife and kissing another male celebrity on the mouth. We thus used these rumours to launch our playful campaign.

We structured the campaign in three stages:

1. Creating a disruption: The coming out

In the first message, Guy Jodoin plays with the rumours and says it is time for him to come out of the closet, stating that he will no longer make any compromise and therefore go grocery shopping at Super C. An emphasis was placed on freshness in this first message, a determining factor for consumers when choosing where to shop.

In addition to revealing the new Zero Compromise platform, this message highlighted the new brand pillars (always fresh, always in stock, always great prices) supported by their guarantees, proof of the commitment of the brand to honour its new promises.

The 30-second spot aired for one week during all the major Quebec television programs, as well as those with a significant potential of sharing on social networks. It was the first time that a personality known by all asserted that he went grocery shopping at a discount chain.

The message was immediately a hot topic of discussion on social networks and was even parodied by a famous comedian.

2. The Zero Compromise movement

Following Guy Jodoin’s “coming out,” we created a second message that invited Quebecers to join the growing Zero Compromise movement in Quebec by getting out on the streets to show their disapproval on having to compromise on quality for price.

3. New characters = new followers

Lastly, to embody the new followers of the brand, we created another series of messages with new characters, including Guy Jodoin’s mother, stating that they too were making zero compromise and were now followers of the banner.

A spokesperson who made a difference

In the end, the use of a popular spokesperson was a double benefit. First, it brought credibility to the Zero Compromise conversation (the spokesperson as a client, speaking on his own behalf rather than on that of the brand) and, second, it shattered the existing stigma around shopping at Super C.

Promotional activity

The television campaign was supported by radio messages with price and product offers. In stores, point-of-sale marketing was developed along the lines of the Zero Compromise theme. A price program was also launched simultaneously to demonstrate all the ways in which consumers could save.

[1] Guy Jodoin is a Quebec host and actor, having appeared in children’s programs, game shows, and mainstream series for over 20 years.

c) Media Plan Summary

· Television

· Radio

· Stores/Flyers

· Digital

Section V — THE RESULTS

a) How did the work impact attitudes and behaviour?

Super C Perception

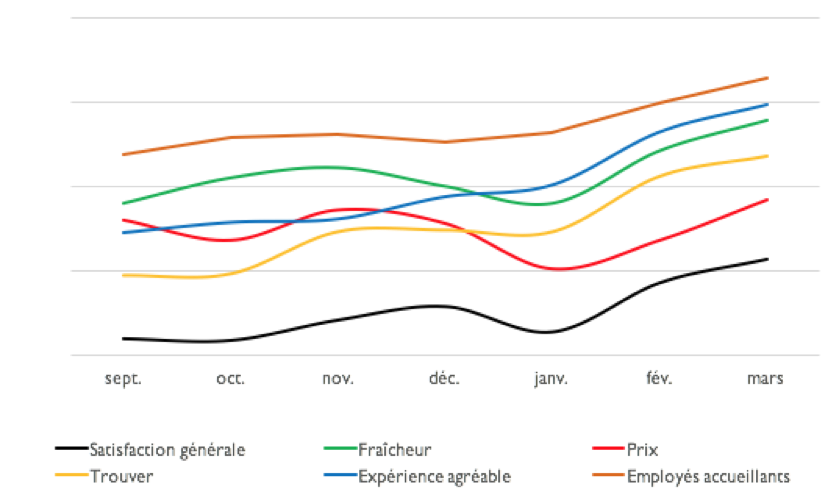

The indicators of the three promises significantly increased:

2014 vs. 2015

– Satisfaction – Freshness: 60.96% vs. 73.86% (+12.9%)

– Satisfaction – Price: 65.5% vs. 70.08% (+4.58%)

– Satisfaction – Stock: 59.19% vs. 71.92% (+12.73%)

– Other relevant indicators:

2014 vs. 2015

– Pleasant shopping experience: 60.82% vs. 74.97% (+14.15%)

– Welcoming employees: 64.04% vs. 78.29% (+14.25%)

– Freshness index in December 2015: 142 vs. 126 before the campaign (Ipsos Ad Post Testing, March 2015).

b) What Business Results did the work achieve for the client?

The banner saw a 5% increase in sales in five months, from January to May 2015.

A 5% increase is enormous for the industry, representing 8 times the growth of the category (0.6%). For a banner of this scale, an increase of a few decimal points can represent millions of dollars of revenue.

Super C market share increased by 6.5% yearly (source: Retail Track), 55% of which is attributable to an increase in basket size, and 45% to an increase in in-store transactions.

c) Other Pertinent Results

THE ADVERTISING PLATFORM LAUNCH OF ZERO COMPROMISE FOR SUPER C WAS A REMARKABLE SUCCESS. DATA OBTAINED AFTER THE FIRST FOUR WEEKS OF SALES REVEALED:

• Assisted recall: 50% higher than the norm (Ipsos Ad Post Testing, March 2015).

• Brand connection: 36% higher than the norm (Ipsos Ad Post Testing, March 2015).

• We observed an impact on the feeling of proximity among current customers and on the intention of non-customers to visit (Ipsos Ad Post Testing, March 2015).

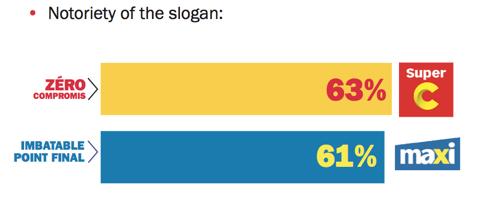

In 5 weeks, awareness of the Super C brand purpose Zero Compromise was higher than that of Maxi.

d) What was the campaign’s Return on Investment?

ROI: 1,272, 91% (for the period of January to May 2015).

Section VI — Proof of Campaign Effectiveness

a) Illustrate the direct cause and effect between the campaign and the results

After September 2013, food quality had improved to an acceptable level. However, this improvement was hardly noticed and generated no significant impact on sales.

b) Prove the results were not driven by other factors

Campaign spend vs. history and competition:

The media investment was lower in 2014-15 compared to the previous year:

2013/2014: 2,567K

2014/2015: 1,686K

Pre-existing Brand momentum:

N/A

Pricing:

No particular promotion or price change was in force.

Changes in Distribution/Availability:

Results are measured on a same-store basis and do not take into account store openings.

Unusual Promotional Activity:

No special promotional activity. Moreover, the brand’s strategy is to focus on low prices at all times, not on recurring promotions. This allows for a stable supply of goods, which strengthens the bond of trust with smart shoppers.

Any other factors:

N/A