chatr Brand Relaunch

Brand Reawakening (SILVER)

Targeting (SILVER)

Client Credits: chatr Mobile

Brand Director (chatr): Eric Yeung

Senior Brand Manager (chatr): Mimi Lam

Brand Manager (chatr): Sabrina Bambara

Brand Specialist (chatr): Suzanne Hood

Brand Specialist (chatr): Lauren Legrand

Senior Manager Field Activation, Event Production & Ops (chatr): Debbie Lasko

Agency Credits: BBDO / Balmoral Multicultural

Advertising Agency: BBDO

SVP, Executive Creative Director (BBDO): Mike Kasprow

Senior Copywriter (BBDO): Jeff Cheung

Senior Art Director (BBDO): Rana Chatterjee

Senior Designer (BBDO): Mike Nugent

SVP, Managing Director (BBDO): Diana Brink-Gourlay

Group Account Director (BBDO): Sandra Gin

Account Director (BBDO): Tania Montemarano

Account Director (BBDO): Gillian Shipman

Account Executive (BBDO): Sagi Mamalider

SVP, Director of Account Planning (BBDO): Ed Caffyn

Media Agency: OMD Canada

Section I — CASE PARAMETERS

| Business Results Period (Consecutive Months): | May 2015 – April 2016 |

| Start of Advertising/Communication Effort: | May 11, 2015 |

| Base Period as a Benchmark: | 1 year prior |

| Geographic Area: | Canada – National |

| Budget for this effort: | Over $5 million |

Section IA — CASE OVERVIEW

Why should this case win in the category (ies) you have entered?

This case demonstrates a major turnaround from problem child to Rogers fastest growing rising star. It’s a marketing-driven turnaround story that was the result of a sharp change in target, positioning and communications strategy.

chatr was launched by Rogers in 2010 as a price flanker in the pre-paid segment. While chatr grew in its first year, in year 2 customer growth leveled off and then began to slowly decline. In 2015, chatr went through a complete rebrand, including a new positioning that resulted in a refreshed brand identity, newly defined audience target and more target relevant communications. The rebrand turned the business around across all key metrics – gross activations, subscribers, brand perception and awareness.

Section II — THE CLIENT’s BUSINESS ISSUES/OPPORTUNITIES

a) Describe the Client’s business, competition and relevant history:

While the majority of the mobile phone market in Canada is post-paid, the pre-paid market was growing in 2010 when Rogers launched its pre-paid brand “chatr Wireless”. While a clear consumer target or position wasn’t articulated, stand-alone retail kiosks and low prices generated initial success. However, its share of the pre-paid market stalled at 13.5%. After sales began to decline in 2011, Rogers stopped supporting chatr and focused on its core post-paid brands. Out went the chatr kiosks, which further hurt the brand’s physical presence.

Our challenge was to regain growth without cannibalizing Rogers’ existing mobile brands and without a dedicated distribution system. It all had to be done through third-party sellers via marketing. chatr’s allocated marketing budget during the first year since the relaunch (May 2015 – April 2016) was $7.045 million. In comparison, chatr’s main competitor, Wind, had much more to work with and spent an estimated $22.7 million.

b) Describe the Client’s Business Issues/Opportunities to be addressed by the campaign:

Our challenge was to re-invigorate chatr and make it the preferred brand in the pre-paid segment. To do this, we had to overcome several major hurdles. We didn’t have dedicated kiosks anymore therefore we had to drive people to ask for chatr at third-party retailers who offered every competitor’s pre-paid products. While being a value brand, we had to differentiate ourselves without undercutting competitors’ prices. Finally, we had to turn chatr around despite being severely outspent by Wind, the leading brand in the pre-paid market.

c) Resulting Business Objectives: Include how these will be measured:

The key business objectives were to:

•Increase gross activations by 52% (over actual PY growth 0.07%)

•Increase subscribers by 26% (over actual PY growth 6%)

Section III — YOUR STRATEGIC THINKING

a) What new learnings/insights did you uncover?

As we dug into customer data, we found a recurring theme amongst chatr users: we had a high skew of people going through a significant life change. New Canadians formed more than 50% of our user base, people starting a new life here and many others were starting a new chapter in their life, be it a new job, or moving to a new city. We called them “Life Transitioners”. This was an under-targeted segment as our competitors were focused on millennials and disaffected post-paid consumers.

Our next insight was about our target’s behaviour. Our ethnographic research told us that they decide on a carrier within days of landing in Canada because they need it to get on with their lives. The implication for chatr is that it’s a new audience all the time with limited opportunity to build awareness and get on their consideration list. To win them over, we had to accept that they were in decision-mode upon arrival.

The third insight revealed a certain mindset. While people in life transition are by definition very price conscious, they resent feeling like they’re settling for the affordable second-tier offer. They want to be seen by others for their potential, not their current circumstances. Many immigrants are driven, ambitious people, some of whom left very comfortable lives abroad to move to Canada for the sake of their children. Suddenly, they have no credit, no history and no status. They want to feel like they have a choice and to be served according to their needs, not their current income.

b) What was your Big Idea?

For new immigrants to Canada, chatr will open doors for you providing the tools to help you land on your feet and hit the ground running.

c) How did your Communication strategy evolve?

Our findings dramatically shifted our brand position, our messaging and our media choices. It even caused us to modify the brand name and identity.

The rebrand began with the brand identity. The name “chat-r Wireless” was fundamentally flawed, given our newly defined core audience. The chat-r name was confusing to look at and the term “wireless” was also confusing – our core target came from parts of the world where “mobile” is the common descriptor for the category internationally. So we changed the name to chatr Mobile and cleaned up the brand identity.

Next we developed a visual language. To reinforce value graphically, we referenced the look of torn paper to create a visual connection to coupons and classified ads. We further defined ourselves from the competition by adopting a new colour that was unique to the mobile category and also suggested quality. The combination of the ‘torn paper’ motif and the strong purple colour created the right net impression of value and quality.

The creative strategy was to lead with offers and simple brand messages that would capture the attention of Life Transitioners in that short period before they made a purchase decision. Due to our limited budget and our immigrant audience, we pared everything down to the essentials: offer, tone and branding.

Next, we wanted to connect with the aspirational drivers of our core audience made up of new Canadians in life transition. chatr would be about ‘opening doors for all’, offering a helping hand to those on a new life path. Our brand would be built on the belief that everyone has the right to succeed and the right to an important tool to achieve it. “Let’s Get Going” became the brand’s new tagline that linked all communications.

Although we used various media channels, we restricted ourselves to three core messages that were most relevant to our target: value (price), long-distance plans and accessibility (no term contracts or credit checks). These core messages were used in all media with a friendly, approachable tone that was translated into Chinese, Tagalog, Hindi, Punjabi and French. Anything that could not be understood by everyone was eliminated. Every line was back-translated as a test of simplicity. Cleverness had to be forsaken for clarity.

d) How did you anticipate the communication would achieve the Business Objectives?

With China, India and the Philippines (CPI) making up the highest percentage of immigrants to Canada, we created a multi-lingual campaign to target these life transitioners which included a pre-arrival strategy to ensure that chatr was on their radar before they even landed in Canada.

Section IV — THE WORK

a) How, where and when did you execute it?

With less than 1/3rd of the budget that Wind had, we identified highly targeted media opportunities by developing a detailed consumer journey. We identified the key stages of a new immigrant’s or other non-immigrant Life Transitioners experience and built our channel strategy around that journey.

Pre-Arrival

We geo-targeted our customers in their home countries, before they even arrived in Canada with digital ad placements on Chinese, Indian and Filipino websites frequented by people interested in immigration, background info on Canada, Canadian education, etc. We targeted non-immigrant Life Transitioners with digital banners on job sites and Kijiji.

First 24 hours in Canada

Since a significant number of immigrants enter Canada through the Toronto Pearson International Airport, we had ad placements in pre-customs, baggage claim, and the meet-and-greet area, which lead to chatr kiosks manned by Brand Ambassadors who offered newcomers a free long-distance call home and information about our plans and activation centres. We also purchased ad placements at the Vancouver International Airport and Montreal-Pierre Elliott Trudeau International Airport, which are also major hubs for Canadian immigration.

First 48 hours – 1 month

Within the first 48 hours, newcomers to Canada frequent specific malls and supermarkets that are geared to their country-of-origin to gather the necessary essentials to start their new life. Public transit is the most common mode of transport to get them from point A to point B. Therefore, we purchased the following ad placements:

– Malls: Ad placements in key multicultural centres (floor decals, pillar wraps, posters)

– Supermarket: Grocery belt ad placements, in store video loop and posters

– Transit Shelter Ads surrounding the key shopping centers and neighbourhoods with a high concentration of new immigrants

– Bus Kings

– Interior Cards

– Commuter Daily papers

New immigrants seek out resources in their native tongue to keep their finger on the pulse of what is going on in their new country and native country. Therefore, ethnic media such as radio, print and digital (especially forum sites because they allow new immigrants to raise questions about the problems they face after landing) were also included in the campaign to ensure we reach our core group through various touch points.

Ongoing

chatr creative extended to retail: to drive consumer loyalty, we developed e-newsletters targeting current customers, offering them more suitable plans or alerting them to new offers.

To celebrate Multiculturalism Day in Canada and to promote our great international long-distance rates, we developed an online video that was shared on Facebook. The video targeted a diverse group of individuals and achieved approximately 269K views within 24 hours.

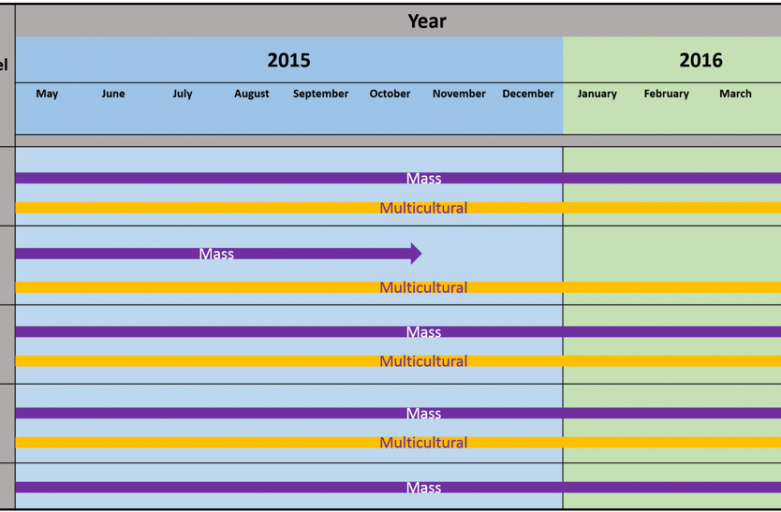

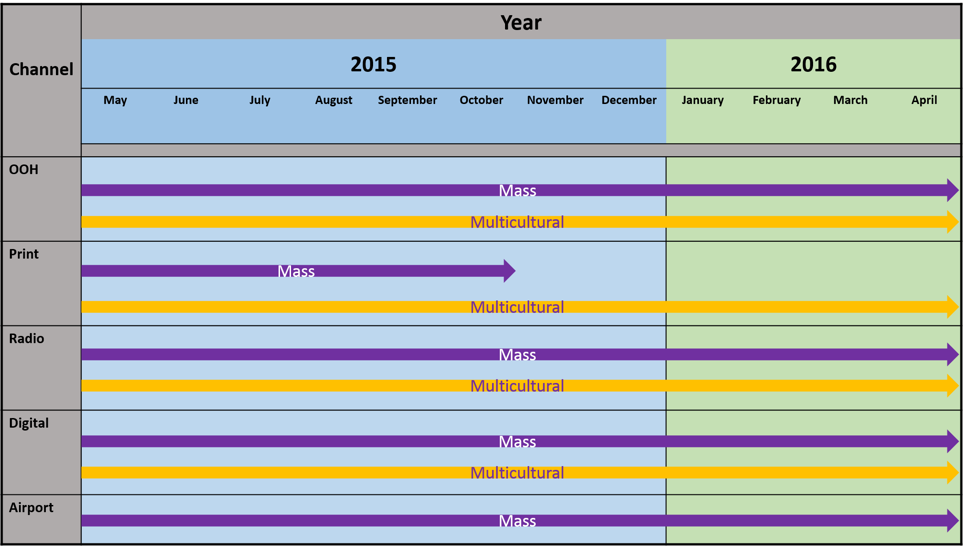

c) Media Plan Summary

Section V — THE RESULTS

a) How did the work impact attitudes and behaviour?

chatr significantly improved overall brand awareness as well as brand perception since it relaunched amongst our core Chinese/Philippine/Indian (CPI) target. While chatr and Wind score very similarly in their brand metrics, awareness and key brand perceptions are growing at a faster pace for chatr than Wind.

Awareness for chatr increased by 16 pts VYA while it only increased by 8 pts for Wind VYA.

chatr’s core brand attribute of a ‘Worry-Free’ solution saw a significant increase of 19 pts VYA while it only increased by 9 pts for Wind VYA while the brand attribute of ‘Best Value for Money’ saw a 5 pts increase VYA for chatr and decreased by 16 pts for Wind VYA.

All figures above are based on April 2016 VYA. Source: Rogers Quarterly Brand Tracker.

b) What Business Results did the work achieve for the client?

chatr successfully shifted the brand from being a generic player in the value segment to a vibrant, relevant and tightly targeted brand, and one of Rogers’ fastest growing businesses. All figures are based on April 2016 VYA. Source: Rogers

The key business results were as follows:

- Increased gross activations by 54% (over actual PY growth 0.07%): +2 points above their goal of 52%

- Increased subscribers by 30% (over actual PY growth 6%): +4 points above their goal of 26%

In addition, chatr’s ARPU (average revenue per user) increased by 4.27 pts VYA.

Lastly, chatr more than doubled their share of the Wireless Prepaid Subscribers market to 12%, growing by 140% VYA. No other wireless prepaid brand achieved this level of increase over the past year. Of particular note was Wind, who lost 1% share during this same time period even though they spent over 220% more than chatr did.

c) Other Pertinent Results

NONE

d) What was the campaign’s Return on Investment?

chatr will not disclose confidential ROI information.

Section VI — Proof of Campaign Effectiveness

a) Illustrate the direct cause and effect between the campaign and the results

The repositioning of chatr to the Life Transitioners audience, and the resulting highly targeted branding campaign has achieved significant growth with no significant change in pricing or distribution.

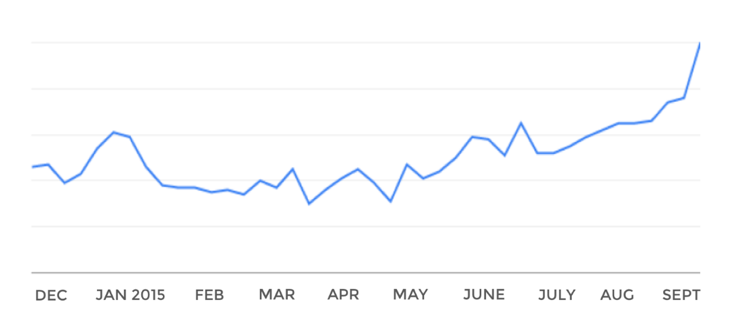

A key measure of increased brand interest in the mobile category is website traffic. Website traffic to chatr grew significantly as a result of our campaign: +205% in May 2015, +307% in June, +150% in July and +191% in August. These results align directly to our key in-market period, when newcomers are most likely to immigrate to Canada.

There was a positive search trend for chatr over the course of 2015 following the launch of the campaign. A steady increase in search interest from May-onward demonstrates the positive impact of rebranding and the Mass campaign in market.

b) Prove the results were not driven by other factors

Campaign spend vs. history and competition:

While network coverage following the relaunch expanded into more areas, the vast bulk of growth came from existing markets, not new markets. The positioning was attracting more business in markets we were already in.

Pricing for chatr’s mobile plans did not see any significant changes when they relaunched in 2015. The only change during this time period was the addition of the International Talk Saver which was specifically designed for new Canadians as a result of the new positioning. The plan provided added value in terms of long-distance rates. However, chatr achieved growth even outside of those opting for the International Talk Saver plan.

Pre-existing Brand momentum:

N/A

Pricing:

N/A

Changes in Distribution/Availability:

N/A

Unusual Promotional Activity:

N/A

Any other factors:

N/A