Seasonal (BRONZE)

Client Credits: Interac Association

Interac Association

Clients: Andrea Danovitch, Leslie Vera, Lauren McKay

Agency Credits: Zulu Alpha Kilo

Agency: Zulu Alpha Kilo

Chief Creative Officer: Zak Mroueh

Executive Creative Director: Ron Smrczek

ACD/Art Director: Noel Fenn

ACD/Writer: Andrew Caie

Art Directors: (Video) Shawn James, (Outdoor) Allan Mah, Curtis Denomme (Social)

Writers: (Video) Sean Atkinson, (Outdoor) Ron MacDonald, Joel Felker (Social)

Design Director: Omar Morson

Designer: Sherry Dubeau

Broadcast Producer: Tara Handley

Print Producer: Kate Spencer

Account Team: Rob Feightner, Laura Robinson, Adrian Goodgoll, Maegan Thomas

Strategic Planner: Emma Brooks, Ebrahim El Kalza

Production House: Adhoc

Director: Peter Martin

Production House Producer: Michel Korchinski

Director of Photography: Chris Mably

Casting Director: Shasta Lutz/Jigsaw Casting

Video Post Facility / Editing Company: School Editing/Zulu Editing (Toy Store/Carols)

Editor: Jon Devries/Michael Headford

Compositor / Online: James Andrews/Smith

Colourist/Transfer: Alter Ego/Pixel Underground

Audio Post Facility/Music House: Eggplant

Audio Director: Roc Gagliese

Producer: Nicola Treadgold

Engineer: Nathan Handy

Media Agency: Media Experts

Media Agency Planner: Jenna Bendavid / Daniel Mak

Section I — CASE PARAMETERS

| Business Results Period (Consecutive Months): | November to December 2015 (2 months) |

| Start of Advertising/Communication Effort: | November 2nd, 2015 |

| Base Period as a Benchmark: | November to December 2014 (2 months) |

| Geographic Area: | Canada (National) |

| Budget for this effort: | $4 – $5 million |

Section IA — CASE OVERVIEW

Why should this case win in the category (ies) you have entered?

During the holiday season, emotional purchases are at an all-time high. We humans put immense pressure on ourselves to find the perfect gifts, and ironically usually leave it to the last minute, adding limited time to the pressure cooker. More than any other time of year one would expect a message from INTERAC to spend responsibly would be ignored. o one likes to be told to spend responsibly at Christmas.

This holiday campaign had to be exceptional to have any business impact at all for INTERAC. This case deserves to be considered in this category not just because it drove a significant increase in transactions for INTERAC during the holidays versus previous years, but it also saw important increases in brand and ad tracking measures as a direct result of this campaign.

Section II — THE CLIENT’s BUSINESS ISSUES/OPPORTUNITIES

a) Describe the Client’s business, competition and relevant history:

As cash is fast becoming a thing of the past, Canadians have essentially two choices when it comes to how they pay for their purchases. They can use one of their credit cards or they can use their INTERAC Debit card.

Credit cards are highly appealing – they allow people to pay for things they want, when they don’t actually have the money to buy them. And when they do so, the credit card rewards them with points to get free stuff!

INTERAC Debit card, however, offers no rewards, unless you see watching your bank account depleting a reward! This means INTERAC constantly needs to find ways to persuade consumers to pay with their INTERAC Debit card rather than their credit card – to pay with their own money rather than someone else’s. No small feat. Except if you consider the rising level of household debt in Canada – now at an all-time high.

Which is why INTERAC is on a mission to help Canadians use their own money, reduce debt and live less stressful, happier lives.

b) Describe the Client’s Business Issues/Opportunities to be addressed by the campaign:

INTERAC is constantly fighting for its share of transactions and there is no time that Canadians pull out their credit card more often, and more mindlessly, than during the holiday season. This represents a good two to three months of the year when Canadians forget about the INTERAC Debit card in their wallets.

INTERAC needed to deliver a hard-hitting message without being a downer during one of the most joyful times of the year.

c) Resulting Business Objectives: Include how these will be measured:

To encourage Canadians to choose INTERAC during the holidays 4% more times than they did the previous holiday season. Based on the Interac data reports from previous base-market period (November to December 2014), this would translate into approximately 32 million more transactions.

Section III — YOUR STRATEGIC THINKING

a) What new learnings/insights did you uncover?

It happens virtually every year. Even though people are expecting it, the January credit card bill hits like a ton of bricks. The joy hangover from the holidays quickly becomes a debt hangover. And it can be significant.

b) What was your Big Idea?

Our big idea was to wish people a Merry January during the holiday season itself.

c) How did your Communication strategy evolve?

We decided to take our anti-debt message and wrap it in the context of the January holiday credit card bill, but do so during the pre-holiday spending frenzy.

d) How did you anticipate the communication would achieve the Business Objectives?

If we could get Canadians thinking about that January bill as they were creating it with Christmas spending, it would help them avoid or minimize the January bill by reaching for their INTERAC Debit card instead of their credit card.

Section IV — THE WORK

a) How, where and when did you execute it?

At the centre of the campaign was a richly cinematic 60-second film that ran in cinema, online and on television. It features a last-minute holiday shopper whose imagination runs wild in a toy store. To the tune of Tchaikovsky’s “Dance of the Sugar Plum Fairy”, the inanimate toys come to life singing “Debt, debt, debt, debt, debt.” Once back to reality, the shopper wisely decides to use her own money instead of credit, and pays with the convenience of her INTERAC Debit card. The film ends with INTERAC wishing holiday shopper a Merry January.

Additional online videos featured a festive, Griswold-like family putting a twist on two traditional carols: “Don’t debt the halls with credit follies” and “We wish you a Merry January”.

The campaign also included out-of-home, print and digital executions with the headlines: “Debt is a real nutcracker”; “You’re a foul one, Mr. Debt”; “Credit Card Fees? Humbug”; and “Sleigh interest fees”.

c) Media Plan Summary

The task was to compel Canadians to make the right decision and choose INTERAC Debit over Credit – during the incredibly hectic and media-heavy holiday season.

To raise awareness and engage consumers, we deployed television for a 6-week period with a total grp level of 1,125, allowing us to maintain a consistent, fluid in-market presence with increased weight during key weeks – Black Friday in particular.

We complemented this with targeted video for visibility, reach and cost-efficiency through all four video platforms: online, tablet, mobile, smart TV. Specifically, Boingo Shopping Centre Wi-Fi Sponsorship also drove our message within key retail environments.

At 163 Cineplex theatres coast to coast, we ran a :60s full-motion spot during pre-show for an 8-week period. The Cineplex plan also included magazine, digital lobby signage, box office wraps and hanging banner with a fully integrated experience.

We also used a combination of digital and static out-of-home in order to push awareness and promote use of INTERAC during the holiday period. Additional focus on malls and proximity based media allowed us to get as close as possible to the point of purchase, encouraging customers to reach for debit over credit.

Highlights of the media plan included

- TV delivered over 210,000,000 impressions

- Digital delivered over 85,332,058 impressions; 18,890,443 Video/Audi Plays with a completion rate of 42%.

Section V — THE RESULTS

a) How did the work impact attitudes and behaviour?

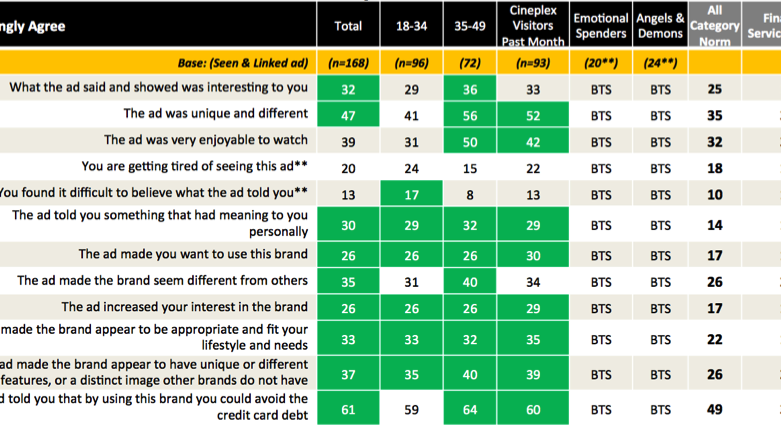

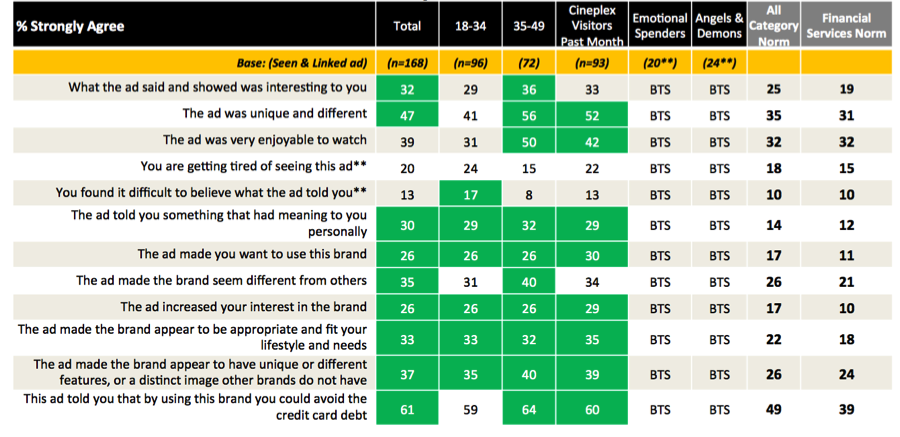

Almost all key brand and ad tracking measures increased significantly as a direct result of this campaign, showing a significant impact on people’s attitudes towards holiday spending and the INTERAC brand. (1) The following key measures performed more than double industry norm:

- “The ad told you something that had meaning to you personally” (30 vs. 12)

- “The ad increased your interest in the brand” (26 vs. 10)

- “The ad made you want to use this brand” (26 vs. 11)

Brand measures positively impacted by the campaign included (2):

- “Is a less stressful way to pay” (+2 pts)

- “Helps me control my finances” (+2 pts)

- “Puts me in control” (+1 pts)

b) What Business Results did the work achieve for the client?

Over the campaign period, there were 40 million more INTERAC transactions than during the same period in the previous year. This represents a 5.03% growth YOY which is 26% above objective. (2)

c) Other Pertinent Results

The :60 spot exceeded 3.4 million views on YouTube and Facebook.

d) What was the campaign’s Return on Investment?

ROI cannot be disclosed as INTERAC is not a public company. (3)

Footnotes

(1) Ipsos ASI Ad Tracking Results (February 2015)

(2) INTERAC Transactional Data Report (January 2015)

(3) Media Experts_Post-Campaign Analysis (January 2015)

Section VI — Proof of Campaign Effectiveness

a) Illustrate the direct cause and effect between the campaign and the results

There was no other INTERAC activity in market during the holiday season other than this holiday campaign. Campaign tracking shows how memorable the campaign was and its association with INTERAC, not surprising given the brand equity and purchase behaviour impact as stated above (1):

- Campaign recall: 43% of participants recalled the INTERAC holiday campaign when prompted.

- Brand Link: Brand recall scores exceeded Category norm for the TVC (0.68 vs. 0.59)

b) Prove the results were not driven by other factors

Campaign spend vs. history and competition:

Media and production spend was flat versus 2014.

Pre-existing Brand momentum:

While the ‘Be In The Black’ campaign has been building the INTERAC brand since 2014, this holiday campaign resulted in a significant jump in INTERAC Debit card usage during the 2015 holiday period versus previous year. (See Business Results section above)

Pricing:

There was no discount or cash incentive offered to consumers for choosing to pay with INTERAC.

Changes in Distribution/Availability:

INTERAC is always available on all Banking Debit Cards in Canada. There was no change to this (positive or negative) during the campaign period.

Unusual Promotional Activity:

There was no special promotional activity during the campaign period.

Any other factors:

None.

(1) Ipsos ASI Ad Tracking Results (February 2015)