Kraft “Guilty Pleasure”

Packaged Goods (BRONZE)

Client Credits: Kraft Canada

Brand Director: Kristen Eyre

Agency Credits: TAXI Canada

Executive Creative Director: Dominique Trudeau

Art Director: Nicolas Rivard

Copywriter: Martin Charron

Strategic Planner: Fanny Chabot

Client Services: Rachel McGibbon

Client Services: Rachel Desbiens-Després

Director of Production: Jacques Latreille

TV Production: Èmilie Trudeau

Mac Artist: Èric Lefevre

Print Production: Sophie Carrières

Media Agency: MediaVest

Production House: 401

Sound Studio: Sonart

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | May 1, 2013, to April 30, 2014 |

| Start of Advertising/Communication Effort: | May 27–September 29, 2013 |

| Base Period as a Benchmark: | May 2009–April 2013 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

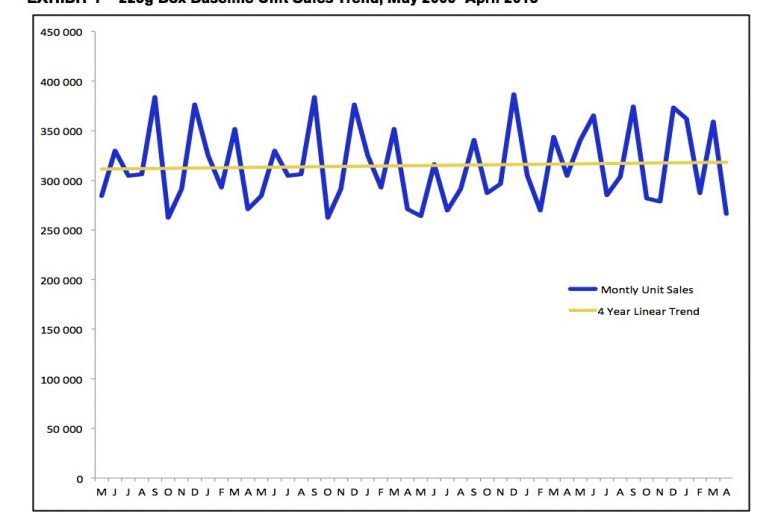

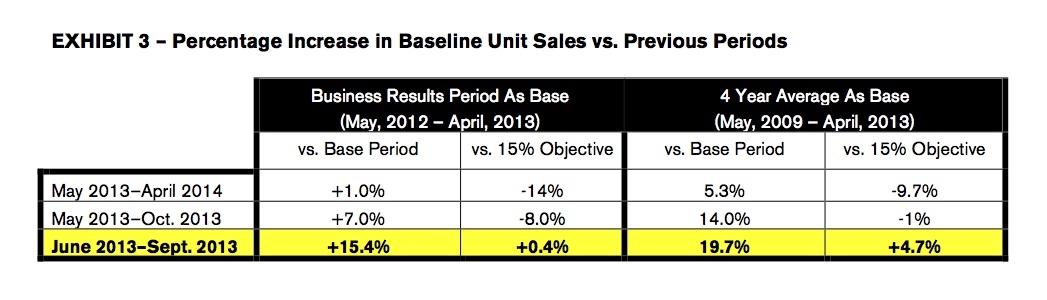

Kraft Dinner (KD) was at a standstill in Quebec (please see exhibit 1). Ten years with no consumer support will do that to a brand. Despite increased competition from premium macaroni and cheese brands and low-cost private label brands, KD was holding its own. Awareness and familiarity in Quebec were high, but KD’s equity was suffering. KD was KD; it was a pop-culture icon, but its ubiquity was also its greatest weakness. In a culture that prides itself on its epicurean nature and deep enjoyment of the whole meal experience, KD flew in the face of these values. It is shelf-stable, inexpensive, easy to prepare, and is often considered to be “student food.” But, KD is delicious! Its consumption was limited to young adults and young families with mouths to feed and little time to do so. KD owned its target niche, with consumers predictably coming and going according to their life stage, maintaining sales over time but limiting any growth potential.

Tactically, our goal was to increase year-over-year sales for their flagship product, the 225g box. However, we had bigger plans. Comfort had bred complacency; KD’s iconic brand status was the default driver of sales that kept the ship afloat, but not surprisingly, the brand equity was stayed, with no news or new messages over the previous decade. Our challenge was to reignite brand engagement in Quebec and earn back our title as the category reference, and in so doing, drive increased consumption.

b) Resulting Business Objectives

Increase Kraft Dinner Original 225g box baseline unit sales by 15% from May 2013 to April 2014.

c) Annual Media Budget

$1 – $2 million

d) Geographic Area

Province of Quebec

Section III — STRATEGIC THINKING

a) Analysis and Insight

At some point, you have to grow up. Your parents’ 20-year old couch, milk crate night tables, Pamela Anderson posters, and Kraft Dinner are all vestiges of student life that has long passed. You’re an adult now, with your own house, non-IKEA furniture, family, and a working kitchen – that bastion of Quebec-inspired, mouth-watering cuisine. You should be investing in your future, not relishing your past; you have the means and maturity to enjoy the spoils of adulthood. But, there are those few select things from your past that just never let go of you, nor you of them. You would never admit to it and certainly would never indulge your sentimentality – what would people think? Just once, though, wouldn’t it be great to take advantage of a night at home alone … turn the lights down, leave your apron hanging in the cupboard, and sneak that Kraft Dinner onto the stove. No one will see you. It’s just you, KD, and a mouthful of good … mmmmmm. And for a brief moment, you don’t need to be ashamed.

Insight: Shamefully good!

Getting to the “shamefully good” insight came from a deep dive into the consumer psyche. Any incremental sales could only come from a new segment of the market, so we looked to re-engage former KD-loving adults. Arguably, macaroni and cheese is a commodity product, with competitors offering variations on a theme with premium and private label brands alike. But none of these brands had the emotional equity of KD, despite KD’s equity being negative with adults – a particular challenge in Quebec given the province’s appreciation of food. We couldn’t simply accept that adults disliked KD, we had to understand why. As it turns out, they still loved KD, they were just too ashamed to admit it.

b) Communication Strategy

The communication strategy focused on calling out the ubiquity of people’s love of KD so that everyone would know they’re not alone, akin to public service campaigns that touch on an emotional heartstring to get the conversation going. Others just like them felt ashamed of their love of KD and stayed away from the brand. But there is strength in numbers; if others could embrace the shame and once again enjoy the taste and emotional comfort of KD, then so could they. We showcased everyday people like them, whom no one would ever expect to eat KD. The integrated campaign, built around the tagline “Shamefully Good” (Coupable d’être bon) was rolled out across out-of-home and print, as well as a TV spot and a stunt, with the goal of being at street level where everyday people could feel a connection.

Section IV — KEY EXECUTIONAL ELEMENTS

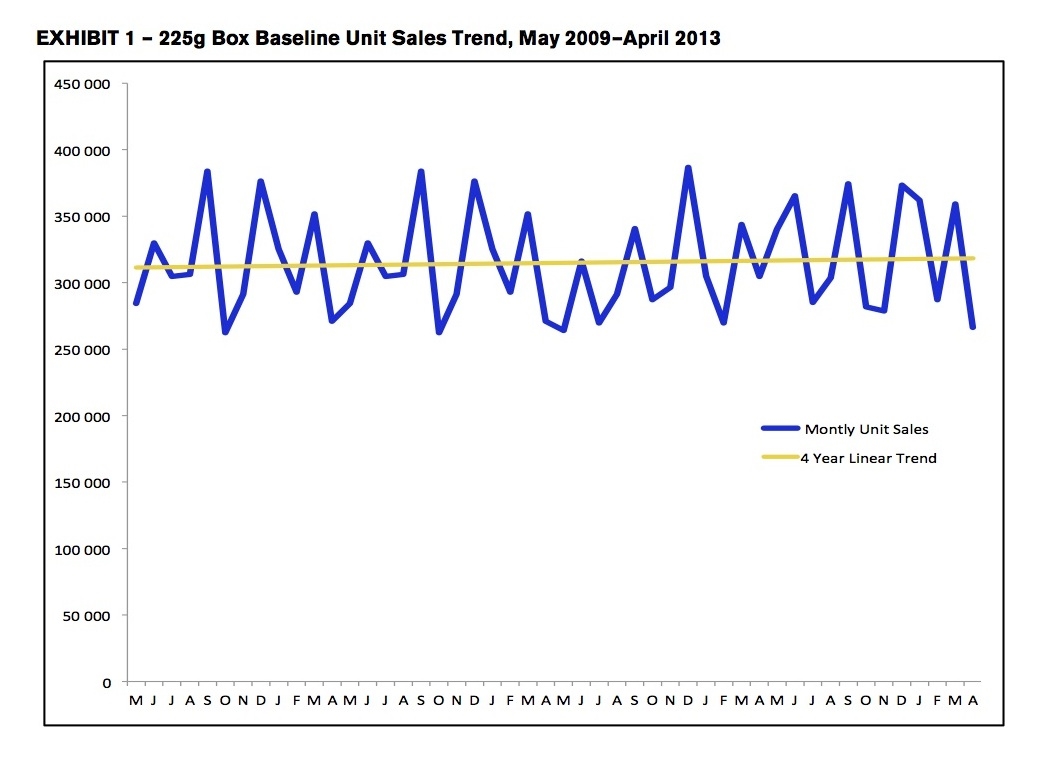

a)Media Used

- Television

- Out-of-home – Transit shelters, vertical boards, wild postings, backlit posters in subway stations, and a stunt (a bus converted to a branded distributor of free boxes of KD)

- Print – Magazine (with some newspaper)

(please see exhibit 2)

b)Creative Discussion

The creative came from marrying the negativity of people’s shame with a positive brand takeaway. Given the levity of the situation (after all, we weren’t out to cure world hunger), we decided to poke fun at ourselves and not hide from the shame. Instead, we put ourselves front and centre. The 225g Original KD box was used as a censor bar to cover the eyes of non-typical adult KD consumers to hide them from public scrutiny. To quickly gain traction in the province, Dany Turcotte, a well-known Quebec comedian, was the featured KD consumer across executions, in addition to the other people used. In line with the positioning, each creative element of the campaign was signed off with the Shamefully Good (Coupable d’être bon) tagline.

Television: The television spot featured an affluent man enjoying KD at home alone and then sneaking the empty box into his neighbour’s recycling bin so no one would know it was his.

Out-of-Home: All out-of-home executions featured non-typical KD consumers (including Dany Turcotte) on white backgrounds with the KD censor bar covering their eyes.

Magazine and Newspaper: The print ad in cooking magazines featured Dany Turcotte coming “out of the pantry” to share KD recipes.

Stunt: As a stunt, a bus shelter was turned into a KD dispenser, giving our shamed target a chance to sneak a box home.

c)Media Discussion

There was a broad-based approach to media with the objective of inserting ourselves into the day-to-day mindset of consumers. We wanted to “get them where they lived” and capitalize on finding them in this comfortable place to bring this sensitive subject to light. While television (used for mass exposure) spoke to people in their homes, the out-of-home caught people in their daily routines with consistent, simple, impactful creative to increase breakthrough and retention. The goal of magazine ads was to catch Quebecers, long known for their love of cuisine, while they were already thinking about food, and encourage them to break from their routines and secretly enjoy some KD.

Section V — BUSINESS RESULTS

a) Sales/Share Results

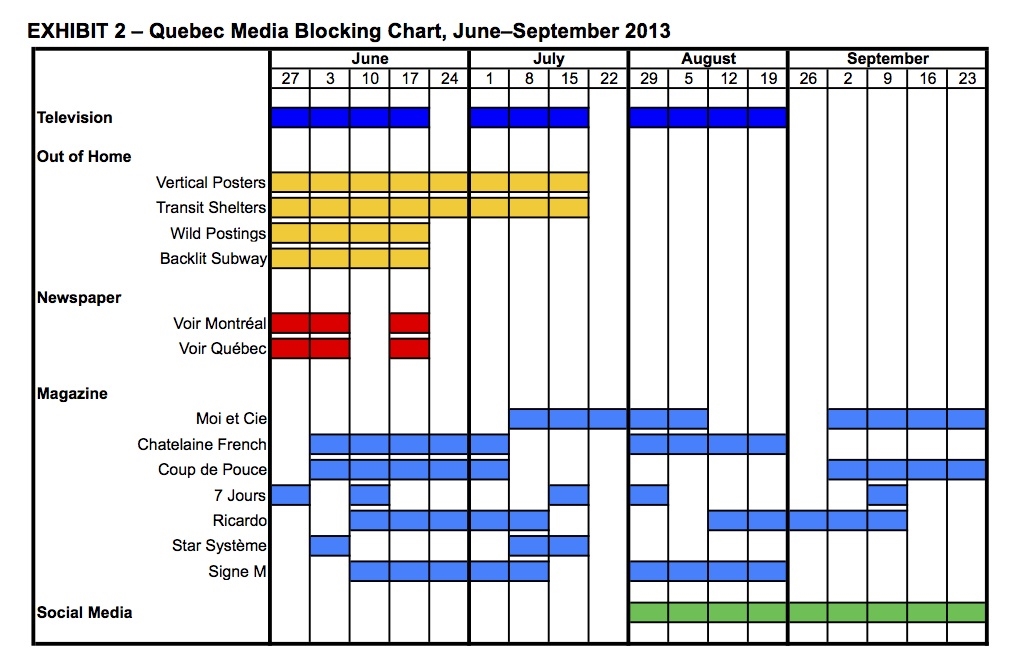

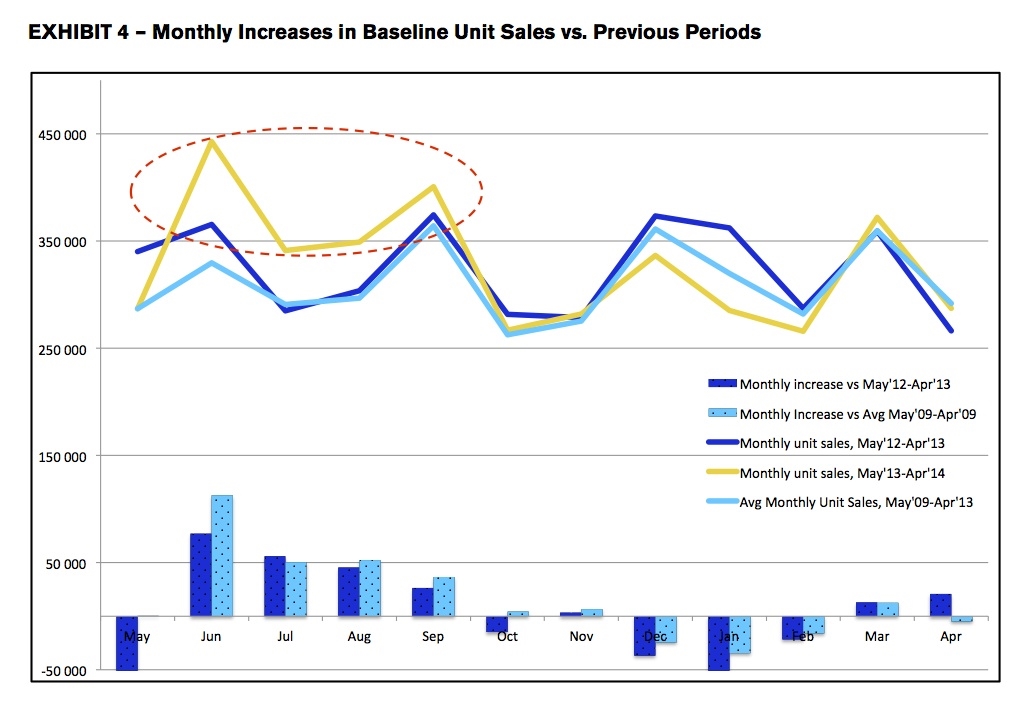

Baseline unit sales of KD Original 225g box increased 15.4%, versus the previous year and 19.7% versus the average of the previous four years, over the course of the campaign.

Taking into account that the agency consolidation caused the discontinuation of the campaign after only three months (see section 1A), we have broken down the results to offer a realistic view of the advertising’s cause and effect as follows:

- Against the Kraft business objective of a 15% unit volume increase versus the previous year (that is, May 2013–April 2014 versus May 2012–April 2013) – to specifically address advertising performance against stated objectives, as requested as part of this submission.

- Against the four-year average of 2009/2010 to 2012/2013 – to offer a more realistic and comprehensive portrayal of results (that is, to eliminate any one-time anomalies from comparison to the previous year only). As sales had been stagnant over the previous years, we were comfortable to use the average of the previous years as a better depiction of base sales.

Additionally, we have broken down the performance numbers in each of the above categories to twelve months (May–April, the Business Results Period), six months (May–October, to show advertising increases and immediate declines when the campaign ended in August), and four months (June–August, to show volume lift from the campaign).

We feel this breakdown is important:

- To show immediate cause and effect during the campaign (and eliminate monthly unit sales numbers from the months during which the campaign didn’t run to better isolate cause and effect).

- To show the sales decline that occurred once the campaign ended in August and past purchase behaviour resumed.

As shown in the exhibits 3 and 4 below, the three-month campaign produced a lift in sales that met Kraft’s 15% objective over the duration of the campaign. What’s more, when isolated to the period of the campaign, unit sales were higher than those of the previous year and the four-year average monthly sales (15.4% versus the previous year and 19.7% versus the four-year average).

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

With no support over the last 10 years, the previous year’s sales and the four-year average are strong baselines. Once the campaign began, monthly unit sales immediately increased over that of previous years, attributable to our attempts to broaden the appeal beyond KD’s traditional consumer and to reinforce top-of-mind awareness with our existing target.

Every effort has been made to eliminate any outside contributing factors that would bias the results, specifically:

- Baseline sales were used – Kraft tracks results in total sales and baseline sales. Kraft defines baseline sales as “normal expected volume for the product in the absence of any in-store pricing reductions, co-op advertising, or display activity.” We used baseline sales accordingly.

- Unit sales were used – Kraft further breaks down sales in dollar sales and unit sales. We chose to use unit sales because dollar-volume changes reflect many variables, including price increases and variances in trade dollars. Unit sales offer a more accurate look at actual performance.

- Average of four years was used – To isolate any single year’s variability that may have occurred in 2012/2013, we chose to use an average of the previous four years, while including growth from the previous year to be transparent.

- Four-month period was chosen as the focus – The campaign only ran for three months, so we focused on the four months that the campaign actually impacted. Looking at the subsequent eight months, during which the campaign had little to no impact, would skew the results downward, due to ten years of past stagnant performance and seasonal trends. That said, we have included the 12-month results as well to be transparent.

- Monthly data was tracked – In addition to accumulating four-month, six-month, and eight-month data, we looked at monthly increases versus that of previous years to identify and isolate any seasonality that could impact results. As shown in exhibits 1 and 4, there are obvious seasonal fluctuations, but the campaign results were over and above any of these fluctuations during each of the four months on which we focused.

The only additional support that the campaign received was through organic market visibility. When appearing on Quebec’s #1 show Tout le monde en parle, which attracts one million viewers each week, Dany Turcotte, our featured KD consumer, was greeted with a bowl of KD and a pair of glasses that mimicked the KD censor bar. Social media quickly picked this up and KD trended on Twitter, thanks in large part to Dany Turcotte (please see exhibit 5 and exhibit 6). Lastly, many Quebec, national, and international media bodies appreciated the Shamefully Good campaign and gave it prominent visibility on their sites.

b)Excluding Other Factors

Spending Levels:

Baseline units were used to eliminate any trade spending and/or pricing biases that may have occurred. The only spend was on mass media.

Pricing:

Baseline units were used to eliminate any trade spending and/or pricing biases that may have occurred. The only spend was on mass media.

Distribution Changes:

There were no distribution changes made by Kraft.

Unusual Promotional Activity:

Baseline units were used to eliminate any trade spending and/or pricing biases that may occur. The only spend was on mass media.

Other Potential Causes:

FAQ: What about product/service improvements?

We have only tracked the baseline unit sales of the 225g box of traditional KD, the only product featured in the campaign. No other pack sizes or brand extensions are included in the results. Additionally, there was no Quebec-based, marketing-communication support for other pack sizes or brand extensions that could have had a halo effect on the 225g box.