Tangerine: It’s That Simple

Off to a Good Start (SILVER)

Client Credits: Tangerine

Andrew Zimakas – Chief Marketing Officer – Tangerine

Mark Nicholson – Associate Vice President, Marketing – Tangerine

Gaurav Singh – Associate Vice President, Marketing – Tangerine

Agency Credits: john st.

Angus Tucker – Executive Creative Director – john st.

Stephen Jurisic – Executive Creative Director – john st.

Chris Hirsch – Creative Director /Writer – john st.

Nellie Kim – Creative Director/Art Director – john st.

Mike Hasinoff – Executive Producer – john st.

Heather Crawley – Account Lead – john st.

Ben Prout – Account Supervisor – john st.

Todd Bennie – Account Executive – john st.

Dashboard – Digital Agency

Initiative – Media Agency

Response Innovations – Direct Mail Agency

Apex PR – Public Relations Agency

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | November 5, 2013 to June 1, 2014 |

| Start of Advertising/Communication Effort: | November 5, 2013 |

| Base Period as a Benchmark: | Calendar 2013 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

In mid-2012, it was announced that ING DIRECT Canada was being put up for sale by its Netherlands-based parent company ING Groep N.V. as a result of their bailout deal with the Dutch government. There was reasonable uncertainty around the future of the bank amongst its clients and employees; ING DIRECT U.S.A. and United Kingdom had both been sold and swallowed up by larger banks earlier in the year. People weren’t sure what would become of a much-beloved brand that had been helping Canadians take control of their banking for over 15 years. Then, in August 2012 it was announced that ING DIRECT would be sold to Scotiabank. With that came a legal requirement to transition the brand and visual identity by May 2014. This meant developing a new name, logo, design system and creative platform. A very daunting task.

ING DIRECT had always been a challenger in Canadian banking; one that did things differently. We needed to ensure that the new name delivered that. With 6 major competitors that dominate the market, our new brand identity had to break through the banking clutter to grab attention. After 12 months of consumer research, name development and validation, we arrived at the new name: Tangerine. And it sure didn’t sound like one of the Big 6. Tangerine encapsulated everything ING DIRECT had stood for during the last 15 years; an innovator that offered simple, unique, progressive banking.

b) Resulting Business Objectives

Before the launch, aggressive business and campaign targets were put in place – and the stakes were very high. Three main objectives were identified to help the launch succeed:

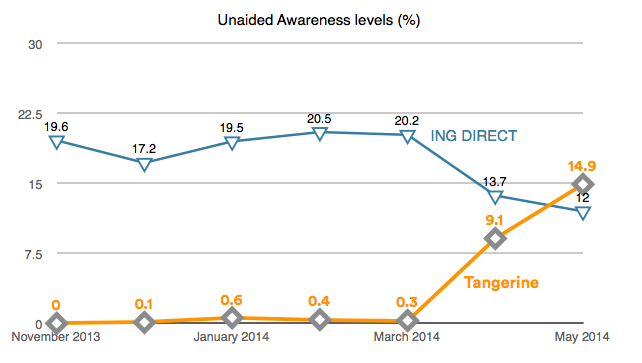

The first was to generate brand awareness for the name change and the new Tangerine brand on its own. A target of 7% unaided brand awareness was to be achieved within the first 6 months following the November 5 reveal. Considering we were starting from zero and facing major established competition, this was an ambitious target. ING DIRECT’s unaided awareness after 15 years hovered around the 12% mark, so we knew a 7% target was ambitious.

The second objective of the campaign was to drive customer acquisition; attracting new Clients to the bank based on the value proposition of Tangerine. The objective set for acquisition was to increase the monthly average by 10% compared to the 2013 average.

Our third objective was to ensure that our client base of almost 2 million Canadians was aware of the change and acclimatized to the transition before it happened. Nothing makes people more nervous about their money than to be surprised that their bank is no longer the same bank they signed up with. Our goal was to maintain – and not increase – the monthly average number of clients leaving the bank seen in 2013.

c) Annual Media Budget

Over $5 million

d) Geographic Area

Nationwide

Section III — STRATEGIC THINKING

a) Analysis and Insight

Tangerine is a no-fee, direct bank with innovative products and award-winning 24/7 customer service. Their mission is to make money simpler for people so they can move their financial future forward. The name Tangerine stands for accessibility, progressiveness, innovation and flexibility. But most of all, the name represents that the bank stands for simplicity and challenging the traditional. The name Tangerine is definitely atypical in the Canadian banking landscape, which is fitting because Tangerine is like no other bank in Canada.

The Big 6 have long been associated with complexity and doing things the old fashioned way; but they’re not the inflexible organizations they once were. They’re moving into digital, creating better mobile apps and streamlining their processes – but Canadians still perceive them as being unhelpful and difficult to navigate. We knew that the message of simplicity would resonate with our target, as traditional banking was anything but. Tangerine makes it simple to understand, simple to save, and simple for Canadians to take control of their own finances.

We also knew that if we could get Canadians to think about their bank – using the big six banks as a point of comparison – we could win the logic game every time. But first, we had to let Canadians know about the change and acknowledge that Tangerine isn’t a normal name for a bank. Which makes sense, because Tangerine is anything but your typical bank.

b) Communication Strategy

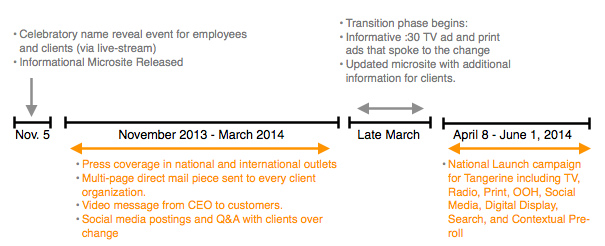

To create a smooth rebrand from ING DIRECT to Tangerine, we wanted to involve Clients and employees throughout the transition. Both groups are very active and engaged with their finances and the bank; and they would have been our first critics. Transparency was crucial throughout, as it helps set Tangerine from the other banks. So we started by revealing the new name and logo to employees, clients and the press in November, 2013; before it could be leaked.

Between November 2013 and late March 2014, we maintained the dialogue and engaged with these stakeholders at multiple touchpoints to ensure a smooth transition. We wanted to reassure employees and clients that even though our name and identity were changing, the core of the brand and what it stood for wouldn’t.

Once we had ensured our stakeholders were acclimatized to the changes, we officially started to launch Tangerine to the general public in late March. In order to successfully create the link between ING DIRECT and Tangerine for Canadians, we decided to launch the new brand in two phases:

The first phase explained the transition of ING DIRECT to Tangerine, and leveraged our more than 15 years of brand equity with an aim to help acclimatize Canadians to the change and establish Tangerine as a credible and trustworthy bank. Canadians take their banking seriously, so we knew that part of our success would hinge on consumers understanding the history of the bank in Canada and creating the link to Tangerine.

The second phase was to launch Tangerine in an impactful way to get Canadians to take notice. This was achieved via a nationwide integrated awareness campaign that would force consumers to stop and really think about how they were doing their banking.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

b)Creative Discussion

The transition to Tangerine was broken into two phases: the reveal phase and the launch phase, with the launch phase broken down into a “transition” phase (late March) and “awareness” phase (early April to June).

The reveal phase began on November 5, 2013. We invited every Tangerine employee to a venue in Toronto for an event where the name was revealed. Clients were invited to participate via exclusive livestream (with over 10,000 participating), so that they could hear the new name before the public did. The reveal event explained how we arrived at the name Tangerine, with senior leaders from both Tangerine and Scotiabank on hand to allay any concerns about the bank changing its DNA.

The event concluded with hit musicians Walk Off the Earth and Macklemore to help create buzz and excitement. On the same day, a microsite went live, explaining the change and showing that the new name was just the next chapter in the more than 15-year story of the bank. Articles in national and international media came out the next day once the embargo was lifted.

From November to late March, questions from clients were answered via social media with industry-leading response times. A multi-page DM piece was sent to every current client, informing them of the changes at the bank and how they’d be affected. On April 8 (the official date of the change) an email and video message was sent from the CEO to every customer, as well as being posted on the new website to welcome them to Tangerine and thank them for their business. Clients and employees were engaged every step of the way, and by the time the brand was ready for its April launch in mass advertising, people were already advocates of Tangerine.

The first phase of our launch campaign was the transition phase, the informed consumers of the name change and focused on what wasn’t changing. This was comprised of a :30-second TV ad supported by print ads, and a microsite, that launched in late March. The message was very un-bankish in that it spoke to the soul of ING DIRECT: “We’re changing our name, but we’ll never change who we are.”

In early April, once the name had officially changed over, our awareness campaign was launched in TV with :60 and :30-second ads, print, radio, OOH and digital. The intention was to get consumers to question why they were with their existing bank when Tangerine was such a simple and superior alternative. It was based on the thinking that if you thought about your finances for even a few seconds, Tangerine was the logical and better choice. Using a logic problem structure in TV and a multiple choice question approach in print we made a clear, simple case for choosing Tangerine. Contextual OOH in places like subway stations, parking lots, and Yonge and Dundas Square had relevant messages for our target based on where they were in their day.

In order to create meaningful online content, we worked with Google to develop contextual pre-roll on YouTube; taking our target’s 15 most popular video searches and producing a custom video for each to create a memorable impression. Masthead and video buys across multiple pages featured our TV ad to drive awareness of the brand alongside a targeted offer to stimulate customer conversions. We created a large-scale banner campaign that incorporated a re-marketing element in order to ensure we showed up for those clients who had interacted with us in some way before. A targeted search campaign bought against both ING DIRECT and Tangerine key words and phrases helped us to ensure we were capturing interest and conquesting competitors.

While definitely not your typical bank advertising, all communication leveraged a new creative platform with television, digital pre-roll and radio featuring the same character: a down-to-earth, approachable (and logical) advocate for the brand carrying an orange coffee mug, and the line “it’s that simple”. The coffee mug and tagline were carried into all channels ensuring impact, memorability and brand link which was so important in the early days of the new brand.

c)Media Discussion

The Tangerine campaign had multiple phases, each with its own objectives and media tactics.

In the period after the November 5 reveal event until late March 2014 we were relying on earned and owned media to share the news of Tangerine. The bank was still operating as ING DIRECT at this point, so mass media tactics were supporting RSP season under the ING DIRECT brand. We leveraged social media, client communications and press to help the news of the impending brand change spread.

From late March to Early April, our campaign was purely informative. Our objective was to leverage the brand equity of ING DIRECT to help ensure every Canadian knew about the name change to Tangerine. This meant putting ad placements in mediums that were traditionally used for information; including newspaper, digital banners on news and information sites as well as a national :30-second TV buy.

Based on the nature of our launch creative (April 8 onwards) which was all about driving awareness of the new brand, it was important for media to connect with the target in times when they would be thinking about their banking. This meant intercepting them at multiple points throughout their day when they were idle and we could get them to consider Tangerine. In TV to drive awareness we bought TV in :60 and :30 flights on various programs including season finales. For outdoor, this meant large-scale transit dominations and transit shelter advertising. In digital it manifested itself in digital display, page takeovers and pre-roll when people were browsing online. We also worked with Google to create contextual pre-roll on YouTube based on search data; a first for any Canadian brand. We took our target’s 15 most popular video searches and producing a custom video for each to create a memorable and personalized impression.

Since we were asking consumer a simple logic question, we wanted to do it when they’d have the time to think about the answer – and why they weren’t yet banking with Tangerine.

Section V — BUSINESS RESULTS

a) Sales/Share Results

The first two months following launch on April 8, 2014 have seen remarkable success.

As a focus of the launch campaign in April was acquisition, we saw sizeable upticks in new clients joining the bank. Client acquisition increased by a significant margin; with a 91% increase in new customer applications in the 8 weeks following the April brand launch compared to the period 8 weeks prior.

The rate of Client attrition also decreased upon presenting the new Brand to clients. In the two months following the transition, the monthly average number of clients closing accounts decreased by 25%. Brand sentiment numbers also exceeded pre-set targets as Canadians were left with a positive impression of the bank and what it stands for.

Awareness and earned media results from the launch campaign were also very encouraging:

Unaided brand awareness for the new Tangerine brand as of June 1 is at 15%; exceeding the 7% target by 100%. Even more impressive is the fact that awareness of Tangerine was 3 percentage points greater in the 2 months after launch than awareness of ING DIRECT. Despite ING DIRECT’s 15 year head start! We were also successful in ensuring our target knew who Tangerine was – awareness of the name change exceeded 70% among 25-34 year-olds.

Our video view-through rate for the specific YouTube content we created was 18%, which is two percentage points higher than the Canadian average. As further validation of the campaign’s efforts, an independent Ipsos Reid Study conducted in late May found that Tangerine was perceived as #1 in Digital Excellence by Canadians across all of the country’s banks.

News and media coverage was overwhelming, with 81.1 million earned media impressions, and 186 unique news stories covering the transition since the name was first revealed in November 2013. These included multiple page stories in national publications like the Toronto Star, Globe and Mail, and Macleans as well as coverage on major news channels, websites and blogs.

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

The cause and effect of advertising in this case is irrefutable. No other factors other than advertising were used to drive awareness or understanding of the brand transition. As a bank with no physical locations, Tangerine relied on advertising and communications to get their message out.

b)Excluding Other Factors

Spending Levels:

Spending levels for the campaign period were considerably less than those of the competition. The big 6 banks are amongst the biggest media spenders in Canada; they make up over 90% of SOV amongst all banks and we knew we couldn’t compete with them on budget alone. This drove the importance of creating a targeted and contextual media buy so that every connection we could make will be impactful. Renewed competition from President’s Choice Financial in the marketplace at the same time actually lowered our SOV during the campaign period.

Pricing:

N/A

Distribution Changes:

N/A

Unusual Promotional Activity:

During the campaign, we offered a promotional 2.50% interest rate on new deposits to saving accounts. This offer is consistent with activity from the same spring period in 2013 however, as we ran a campaign with the same offer in the same time period, which helps us to isolate these results.

Other Potential Causes:

N/A