Knorr ‘What’s for Dinner?’

Off to a Good Start (BRONZE)

Best Insight (BRONZE)

Client Credits: Unilever Canada

Sharon MacLeod, Vice President, Brand Building

Alison Leung, Director of Marketing, Foods

Brenda Demers, Marketing Manager, Savoury

Aaron Daniel, Senior Assistant Brand Building Manager

Jessica Van-Rooyen, Senior Assistant Brand Building Manager

Ashleigh Meilach, Senior Assistant Brand Building Manager

Izabella Veress, Assistant Brand Building Manager

Bill Carlson, Shopper Marketing Team Lead

Kristina Kovar, Shopper Marketing Manager

Toula Stathopoulos, Shopper Marketing Manager

Stephanie Lombardi, Shopper Marketing Manager

Marie-Pierre Mathieu, Shopper Marketing Manager, Quebec

Philippe Archambault, Assistant Shopper Marketing Manager, Quebec

Joseph Chen, Manager Consumer Marketing Insights

Steve Olsen, Associate Manager Consumer Marketing Insights

Sarah Page, Senior Consumer Culinary Professional

Carolyn Callio, Assistant Nutrition and Health Manager

Agency Credits: Ariad Communications

Baron Manett, Senior Vice President

Tracy Smith, Vice President

Josh MacKinnon, Account Director

Ashleigh Johnson, Account Manager

Danae Gagales, Account Executive

Rob Ciancamerla, Creative Director

Neil Woodley, Creative Director

Vince Rozas, Art Director

Mary Lynn Smith, Senior Editor

Teresa Baldesarra, Production Manager

PARTNER AGENCIES:

Media: Mindshare

James MacRae, Director, Invention/Digital

Andrea Miliauskas, Director, Invention

Janine Maillet, Director, Exchange Trading

Tommy Quach, Manager, Invention

Nicole Pella, Digital Manager

Social Media & PR: Edelman

Rob Manne, Vice President

Tricia Soltys, Account Director

Andrew Stewart, Senior Digital Account Manager

Christine Lu, Digital Account Executive

Shopper Marketing: Integrated

Yanna Boland, Senior Account Director

Sara White, Account Supervisor

Section I — BASIC INFORMATION

| Business Results Period (Consecutive Months): | Sept 2012 – June 2013 (latest Business Results) |

| Start of Advertising/Communication Effort: | September 2012 |

| Base Period as a Benchmark: | September 2011 – June 2012 |

Section II — SITUATION ANALYSIS

a) Overall Assessment

For 175 years, Knorr has shown home cooks around the world how much we love food. Our passion for crafting great tasting meals has earned Knorr a prominent place in family kitchens. Easy preparation and the unparalleled flavour of Knorr products – including Soups, Sauces, Seasonings, Bouillon, Stock, Broth and Side Dishes (known as the Savoury category) – make us a dinnertime favourite with moms across Canada.

However, in the years leading up to 2011, the Savoury category was declining, with Knorr declining faster than the category (double-digits each year), driven by three factors:

- Competitive promotions conditioned consumers to purchase on deals. For instance, more than 70% of the Knorr Sidekicks business was being sold on discount.

- Competitors like Kraft, Campbell’s and Uncle Ben’s were bringing new innovations to market more quickly – driving consumer appeal and retail display support.

- Brand Heath Checks told us that Brand Clarity was an issue, with consumers not knowing what Knorr stood for.

How could the business respond to these market challenges to turn this decline around?

Research became a crucial tool to answer that question.

Our first step was to focus and re-define our target audience. In place of multiple targets, we consolidated our focus behind one. Our new target was defined as the “Cooking Embracer”: women 25 to 49 with children under 12 years old. The primary cook in the household, she has a standard rotation of recipes, but finds it challenging to try new ones.

By learning about her daily cooking routine and grocery shopping habits, we could better understand her state of mind around mealtime, and ultimately help her discover new, inspiring meal solutions.

To drive growth for Knorr, an innovative solution was clearly needed. We would find the answer in the question: ‘What’s for Dinner?’.

b) Resulting Business Objectives

Without introducing new products, business growth would have to come from an impactful and integrated marketing program, designed to:

i. Turnaround lagging sales

ii. Create awareness of the ‘What’s for Dinner?’ program, and improve tracking ratings for key Brand Health criteria: “helps me create great tasting dishes.”

iii. Establish heightened Consumer Engagement all year.

iv. Regain the interest of retailers by solving their shoppers’ unmet needs, and growing their basket size through meal solutions.

c) Annual Media Budget

Over $5 million

d) Geographic Area

National (Canada)

Section III — STRATEGIC THINKING

a) Analysis and Insight

Qualitative and quantitative research was conducted with primary family cooks across the country to better understand their food preparation habits around dinnertime. TNS conducted a shopper-understanding study to examine Canadian consumers’ grocery shopping and meal preparation habits.

The results revealed four key insights:

- At 4 p.m. each day, three out of four Canadians don’t know what they’re having for dinner – though most consumers eat dinner at home (89% 5+ times/week).

- When searching for recipes online, on mobile, in magazines or in-store, the “Cooking Embracer” starts her search with a key dinnertime protein, next refining it to recipes calling for no more than 15 minutes prep time and 15 minutes cooking time.

- When deciding what to make for dinner spontaneously at the grocery store, she first shops the fresh perimeter – meat (76%) and produce (50%) departments – before targeting specific aisles according to need.

- Her pace quickens as she shops, so we have a short amount of time to capture her attention.

These insights would later inform how we went to market with the Knorr program, ‘What’s for Dinner?’.

One might ask why Knorr didn’t look for these insights sooner. There are a few reasons why it required a fresh approach.

Traditionally, we didn’t focus on Knorr as a masterbrand and rather, had a multi-category approach. With different consumer initiatives in each category – Soups vs. Side Dishes vs. Cooking Products – we lacked synergy. However, based on our new understanding of our target audience being the consumer and shopper, our positioning had to change to one that was holistic. This newly integrated solution would allow the program to continually evolve so that not only our target audience, but also retailers would: a) remain inspired b) have access to variety/customization and c) continue to engage with the program year round.

b) Communication Strategy

Once we learned more about our target audience, it became clear that she was searching for dinnertime solutions based on her needs. Knorr’s goal was to become her inspiring cooking partner.

At the centre of our communications strategy was a recipe content strategy: we took traditional, long-form, complicated recipes and simplified them. Easy-to-follow steps allowed her to re-create meals from memory, or share with family and friends through her medium of choice (phone, tablet, recipe card, etc.).

Knorr would offer a buffet of meal possibilities, positioning the brand as the go-to source for everyday meal solutions. Whenever she was looking for the answer to ‘What’s for Dinner?’, Knorr would be there. We communicated with her at the three phases in her path-to-purchase – Pre-shop, Shop, Post-shop – and across integrated channels.

Section IV — KEY EXECUTIONAL ELEMENTS

a)Media Used

The ‘What’s for Dinner?’ program is a full-year, fully-integrated, 360-degree marketing program, including TV, radio, direct-to-home, e-mail, social media, mobile, digital and in-store – with a strong focus on the latter two.

b)Creative Discussion

Our creative approach to providing the “Cooking Embracer” with a solution to ‘What’s for Dinner?’ was threefold:

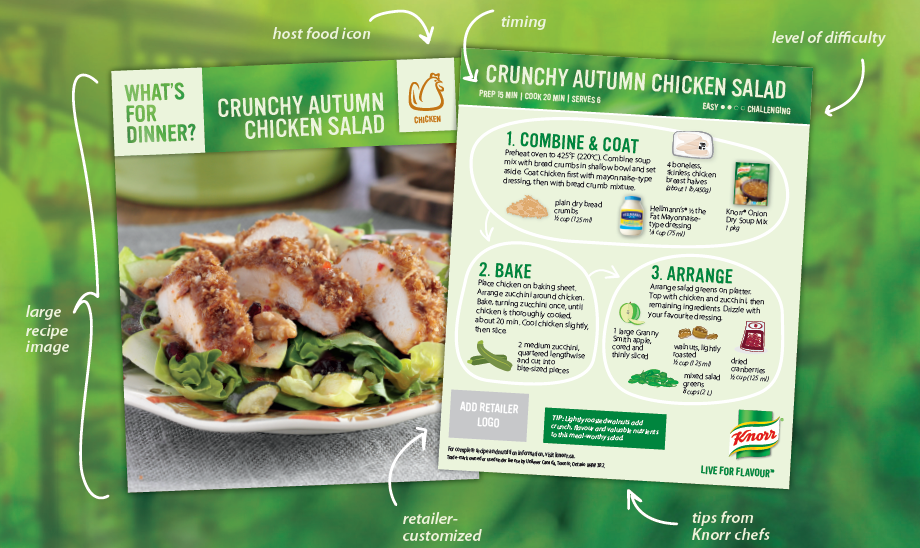

- The ‘What’s for Dinner?’ question was posed in all creative pieces; always accompanied by the answer in the form of original food photography and appetizing recipe.

- We reinvented the recipe; taking our easy-to-follow, short-form recipes and adding infographics that visualized ingredients. The format doubled as a shopping list, offering added utility in-store.

- Finally, the program creative and recipe cards were designed to be customizable by retailers, incorporating their own logos and products tailoring the ‘What’s for Dinner?’ program to their shopper.

Starting in September 2012, we began to implement these solutions across all three stages of her shopping journey – Pre-shop, Shop and Post-shop.

Pre-shop

Our goal was to get Knorr on her grocery list, and weeknight repertoire. The push into store with the solution already in her mind relied heavily on our digital initiatives. These included:

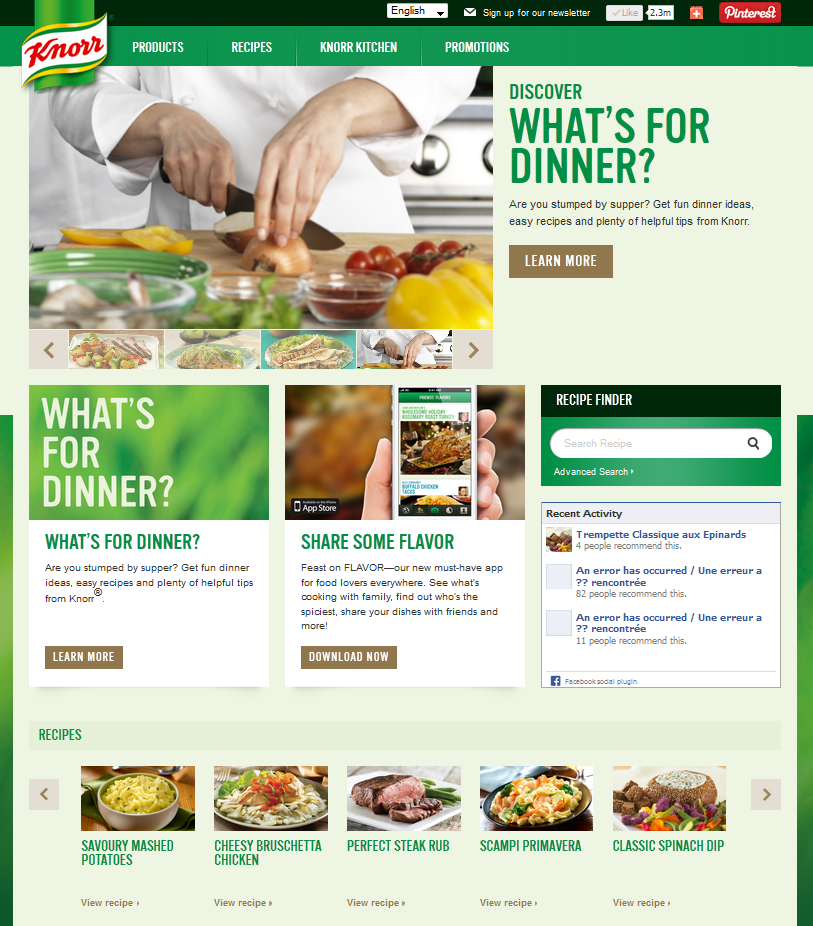

- A new website with regularly refreshed recipe content

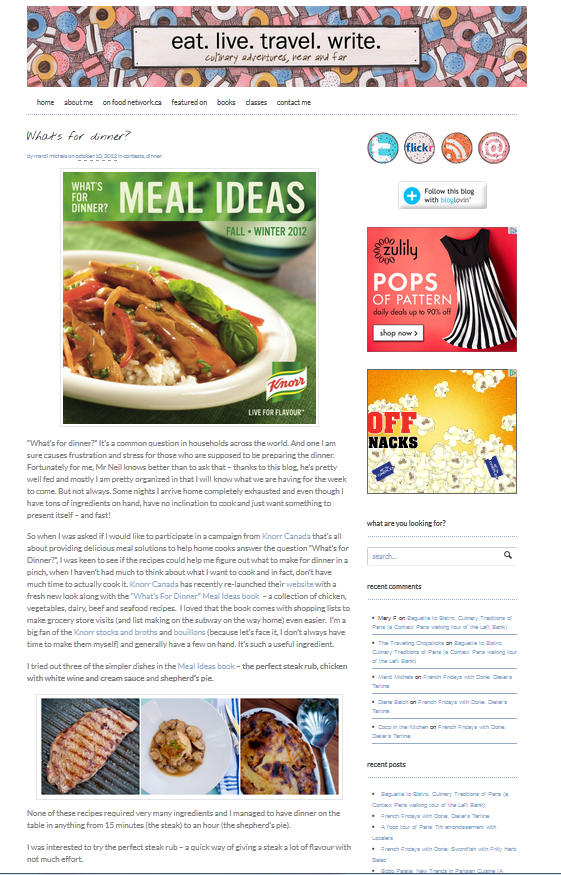

- Seasonal digital Meal Ideas recipe e-books

- A comprehensive Search program

- Unilever North America’s first Responsive Email program

- Knorr Canada’s first mobile iAd program

- Digital Rich Media advertising

- Social Media (Facebook, Pinterest & Blogger Outreach)

A direct-to-home piece was distributed to over 260,000 homes nationally; radius dropped around key grocery retail partners. The piece included a fridge magnet, reusable grocery bag (both with a QR code that drove to a new recipe suggestion every day of the year), recipe booklet, Knorr Homestyle Stock sample and a high-value coupon.

A six-city National PR Tour featuring North America’s leading meal planning expert, Sandi Richard, brought to life the ‘What’s for Dinner?’ dilemma in a way moms could relate to.

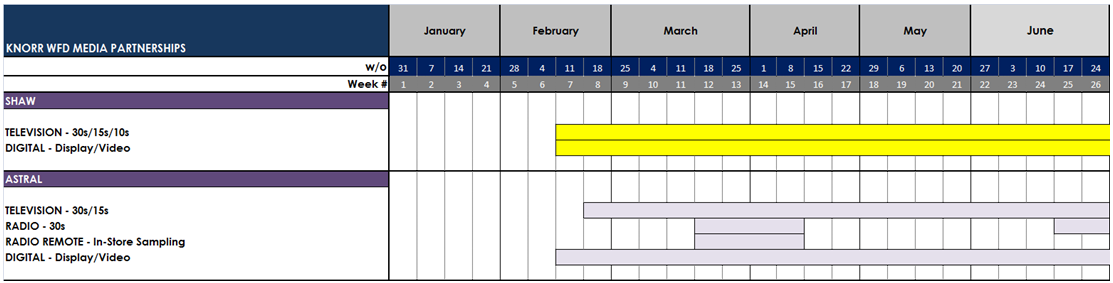

In February 2013, Knorr began a year-long partnership with Food Network (Shaw) and Canal Vie (Astral), with integrated communications across several of their media properties. The Food Network partnership included:

- Two TVCs leveraging our partnership with Sandi Richard.

- Sponsored TV menu boards at 3 p.m. daily during Food Network programming.

- Website integration (including banner ads, home page take-overs and recipe-of-the-day content) and participation in their email program.

A Quebec-specific program was built, partnering with Canal Vie, including:

- Two TVCs featuring Virginie Coossa

- TVC Billboard ads

- Radio

- Website integration (a dedicated ‘Qu’est-ce qu’on mange?’ recipe section and rich media ads) and participation in their email program.

Shop

Our goal was to establish the presence of ‘What’s for Dinner?’ in-store by maximizing touch points. Our mobile-integrated plan empowered her to access recipes and convenient shopping lists while shopping across all displays. Our menu of in-store tools included:

- Easy-to-follow, infographic recipe cards

- Semi-permanent meal solution centres positioned around store perimeters (produce and meat sections) with recipe cards

- Recipe card holders at the front of stores and in the meat section

- Temporary, corrugate displays with recipe pads

- At-shelf banners and recipe booklets

- In-store sampling demos

- On-pack meat stickering

- Customizable flyer templates for retailers

- Leveraging of the Food Network logo

Post-shop

Our goal was to establish loyalty and drive repeat purchases. Knorr connected with our target consumer where she already spent time – Facebook, Pinterest, and food blogs. Photo contests on Facebook engaged our community, having consumers submit photos of their answers to ‘What’s for Dinner?’. And, each page in digital Meal Ideas e-books included social integration to encourage sharing of recipes.

c)Media Discussion

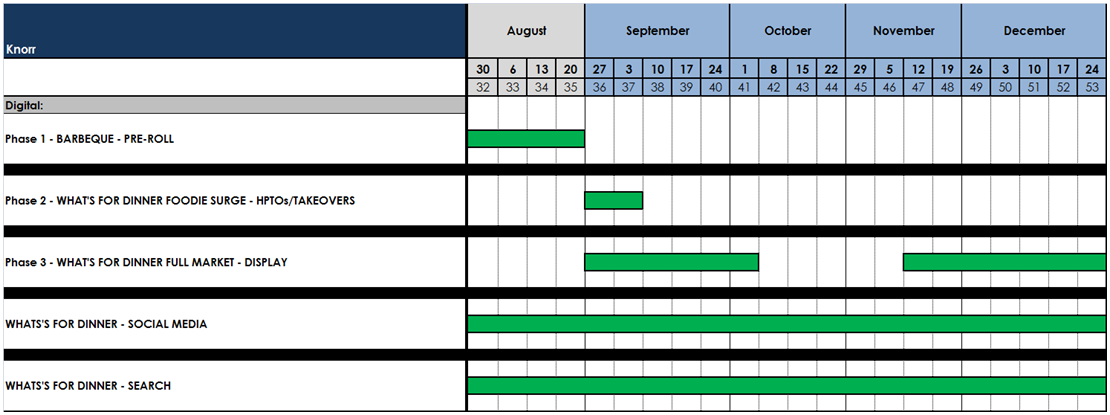

The campaign included two waves of advertising support.

The first wave (Q3/Q4 2012) focused on Pre-shop within the Digital space.

Wave two (Q1/Q2 2013), continued with Digital and additional media support in partnership with Food Network and Canal Vie.

Section V — BUSINESS RESULTS

a) Sales/Share Results

As consumer excitement for ‘What’s for Dinner?’ heated up, so did awareness and equity, share and engagement for Knorr.

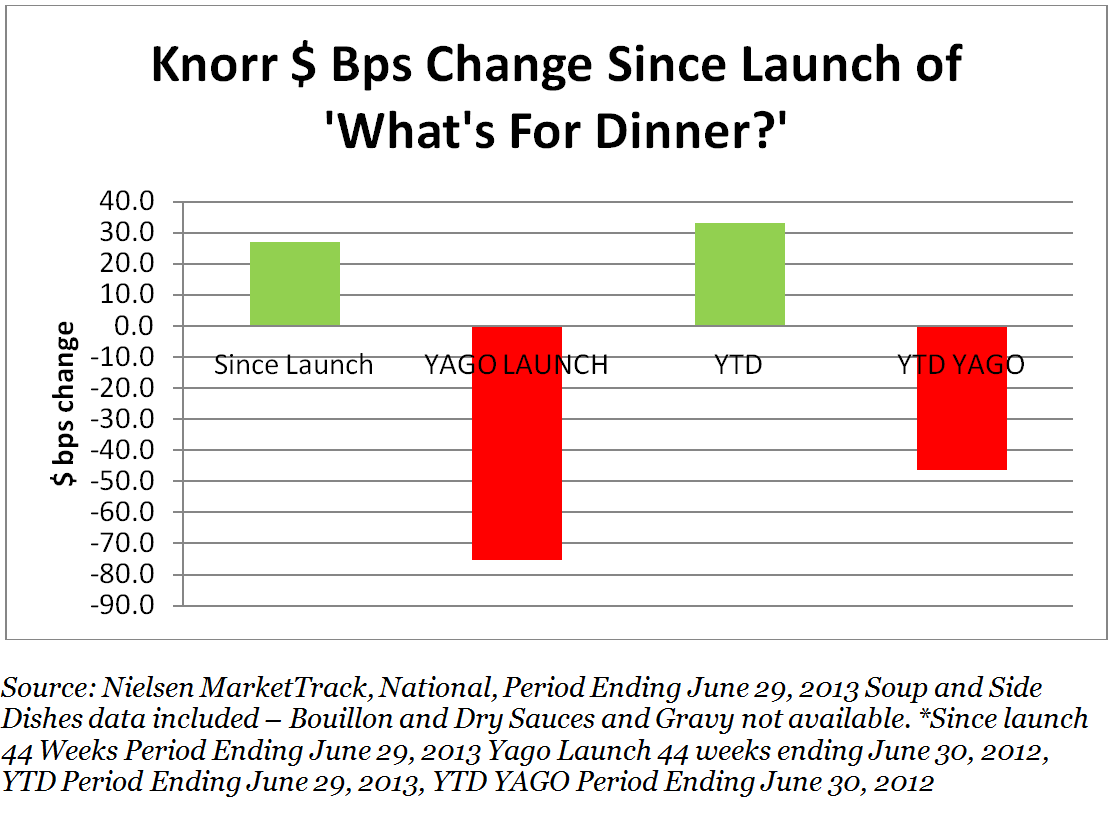

i. Share

Knorr competes in well-established, mature categories. Moving the needle even a few share points is considered a big victory. Prior to the launch of ‘What’s For Dinner?’, Knorr was losing significant share volumes. Through the ‘What’s For Dinner?’ program, Knorr moved the needle, and has either stabilized or grown market share while the categories have remained flat or declined. Knorr experienced gains in Repeat Rates and Loyalty, while Trips Per Buyer was maintained and categories experienced declines. This resulted in Knorr growing its share +27 bps since the launch of ‘What’s For Dinner?’ and growing even more YTD +33 bps.

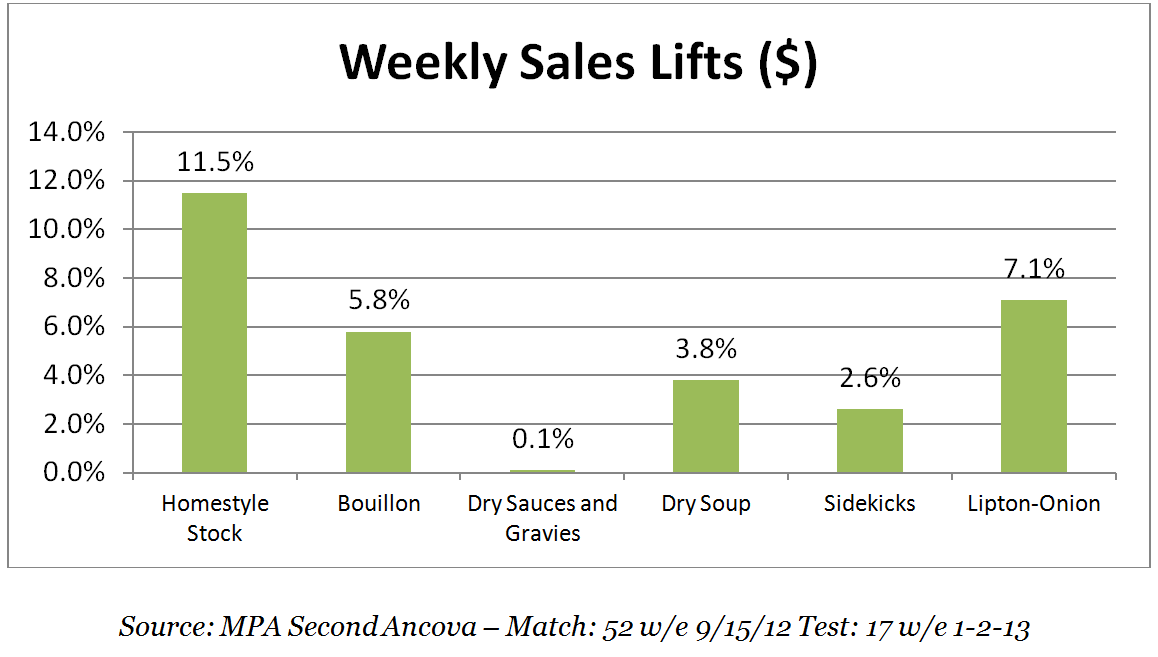

A Test & Control Study by Nielsen including a sample of retail outlets participating in ‘What’s for Dinner?’ with non-participating retail outlets yielded the below results (first 17 weeks of program vs. previous 52 weeks).

Baseline sales increased for all Knorr business categories over the same period, the strongest of which were:

- Knorr Homestyle Stock by 11.5%

- Knorr Lipton Onion Soup by 7.1%

- Knorr Bouillon by 5.8%

Given the flatness in the Savoury category, this is a significant increase for the Knorr business.

‘What’s For Dinner?’ helped partner retailer host foods with our recipes and the results show the program is helping Knorr and host food sales. Ultimately, the program is showing the trifecta – growing Knorr share, Knorr sales, and retailer host foods.

ii. Awareness and equity

‘What’s for Dinner?’ has achieved a 22% Aided Awareness Score to date (within our 10-month BRP) against a 24-month target of 25%. In a controlled study conducted by Neilsen, we learned consumers who were aware of ‘What’s for Dinner?’ were more likely to have a positive perception of both Knorr and the participating retailer: 80% in the Post-Wave vs. 65% in the Pre-Wave said Knorr “helps me create great tasting dishes.”

iii. Engagement

Consumer engagement across digital channels has been impressive:

- 70MM+ Digital Media Impressions served

- 2 MM+ Meal Ideas digital e-book Page Views with Average Issue Visit Duration 6+ minutes (triple the average duration of Knorr websites globally)

- 19,000+ Mobile App downloads (against a target of 10,000)

- 22% E-mail Engagement Rate (vs. CPG Industry Average of 15.8%)

- Doubled our Facebook Likes (over 100k by end of BRP)

- iAd Page Views 71% over Industry Benchmark

- 13+ MM Earned Media Impressions (vs. 4-10M target)

The Canadian ‘What’s for Dinner?’ program yielded such impressive results that Knorr will roll it out globally, starting with the U.S., Puerto Rico, Ireland, Germany and the U.K.

iiii. Provide value to participating retailers

The ‘What’s for Dinner?’ program proved to be compelling for the Savoury category allowing us to partner with all of the major grocery and mass merchant retailers in Canada, inclusive of Loblaws, Sobeys, Metro, Overwaitea, Safeway, Wal-Mart and Target. ‘What’s for Dinner?’ is now making its e-commerce debut through Grocery Gateway. We have established presence in over 60% of grocery stores across the country, with the implementation of over 10,000 Meal Solution Centres.

b) Consumption/ Usage Results

c) Other Pertinent Results

d) Return on Investment

Section VI — CAUSE & EFFECT BETWEEN ADVERTISING AND RESULTS

a)General Discussion

To determine whether or not the ‘What’s for Dinner?’ program was driving incremental sales for Knorr, Unilever challenged Nielsen to develop an innovative approach to measurement. Nielsen developed a custom solution for the Unilever team to measure the in-store campaign’s lifts through a Matched Panel Analysis (MPA).

Matched Panel Analysis Tool

Nielsen first collected a sample of participating retail outlets and matched them with non-participating retail outlets that shared similar sales trends and geographic proximities; this helped create a test and control scenario. Next, Nielsen ran an ANCOVA analysis across all Knorr’s categories to see if there was a significant lift in sales rates between the 17 weeks ‘What’s For Dinner?’ was in-market versus the 52 weeks prior.

The team found strong evidence that ‘What’s for Dinner?’ was driving incremental sales:

- Baseline sales increased for all of Knorr’s businesses over the same time period.

- Homestyle Stock saw an incremental 11.5%

- Lipton Onion Soup saw an incremental 7.1%

- Bouillon saw an incremental 5.8%

This approach was so innovative and successful that the Unilever Consumer & Market Insight Team won ‘Best in Class’ from the MRIA Excellence in Research Awards. Furthermore, the U.S. team will be adopting this approach and re-applying the methodology to begin measuring their in-store efforts; a true example of the exporting of leading-edge Canadian work.

Consumer Success & Engagement

To understand if the campaign was driving awareness and changing consumer perceptions and behaviour, the Knorr team again integrated TNS into its plans. TNS first ran a pre-wave survey in June 2012; several months before the ‘What’s for Dinner?’ program launched. The survey was fielded only in areas/cities where retailers would be participating. This served as the baseline to make future comparisons.

A post-wave survey was fielded in November 2012 to determine if there had been any changes with consumers; approximately six weeks after the campaign had started. The findings were extremely positive:

- A significant increase in Aided Awareness of the ‘What’s for Dinner?’ program (22% vs. 16%).

- Two-thirds of consumers who recalled seeing one of the in-store displays engaged with it in some way (40% picked up a product, 27% bought a featured product, 20% took a recipe card home).

- Consumers who were aware of the campaign were more likely to have more positive perceptions of Knorr and the participating retailer (80% vs. 65% said Knorr “Helps me create great tasting dishes,” 72% vs. 66% said Sobeys “Always has fresh meal ideas,” 65% vs. 52% said Loblaws “Is great for easy/convenient meal ideas”).

- Consumer behaviour had indeed shifted. There was a significant increase in the number of consumers who used Knorr Homestyle Stock when making Shepherd’s Pie – one of the ingredients in the ‘What’s for Dinner?’ Shepherd’s Pie recipe (44% vs. 9%).

We can conclude that ‘What’s for Dinner?’ indeed drove awareness and equity for the Knorr brand, as well as for participating retailers.

Talk Value – Media Coverage and Industry Recognition

Sandi Richard kick-started our media coverage in February 2013 by bringing awareness to the ‘What’s For Dinner?’ dilemma and Knorr’s accompanying solutions. During the PR tour, Sandi participated in Radio interviews and appeared on TV where she cooked some of the ‘What’s for Dinner?’ recipes, demonstrating product usage.

Industry buzz was notable; the ‘What’s for Dinner?’ program was mentioned in Strategy Magazine three months in a row. In the May 2013 Issue, ‘What’s for Dinner?’ was noted as a “Sizzling/Hot Trend,” with Jason Dubroy saying, “It’s all about in-store meal solutions, which Unilever’s Knorr’s ‘What’s for Dinner?’ campaign did pairing all ingredients (including non-Unilever products, like meat) next to recipe cards in a single display.”

b)Excluding Other Factors

Spending Levels:

Total Knorr Marketing spend was on par with previous years.

Pricing:

Total Knorr Pricing was on par with previous years.

Distribution Changes:

Distribution across retailers remained stable, with a few de-listings throughout the BRP, which is not uncommon for the business.

Unusual Promotional Activity:

No other Consumer Promotions were activated during the BRP.

Other Potential Causes:

No other potential causes are known.

Summary

Over a year ago, Knorr was a declining business; losing relevance with consumers and retailers. The push to turn things around resulted in gaining deeper consumer understanding, mining of richer shopper insights, a step-change in in-store marketing and best-in-class retail sell-in.

‘What’s for Dinner?’ was holistic, taking into account pre-shop, shop, and post-shop. It provided recipes and customized meal-solution centres.

‘What’s for Dinner?’ succeeded not just in terms of business objectives, but in delivering something that no other brand could: we delivered a mealtime solution inspiring Cooking Embracers across the country.