Building Brand Equity (BRONZE)

Long Term Success (SILVER)

Client Credits: Nissan Canada Inc

Steve Rhind, Director of Marketing, Nissan Canada

Jennifer Dobbs, Senior Manager, Marketing Communications, Nissan Canada

Tara Willis, Brand Manager, Marketing, Nissan Canada

Agency Credits: Juniper Park\TBWA

Alan Madill, Chief Creative Officer, Juniper Park\TBWA

Terry Drummond, Chief Creative Officer, Juniper Park\TBWA

Mark Tomblin, Chief Strategy Officer, Juniper Park\TBWA

Rodger Eyre, Group Creative Director, Juniper Park\TBWA

Gerald Kugler, Group Creative Director, Juniper Park\TBWA

Allen Oke, Group Creative Director, Juniper Park\TBWA

Susie Lee, Art Director, Juniper Park\TBWA

Luke Skinner, Art Director, Juniper Park\TBWA

Leonardo Gonzalez, Art Director, Juniper Park\TBWA

Marco Buchar, Copywriter, Juniper Park\TBWA

Jonah Flynn, Copywriter, Juniper Park\TBWA

Ryan Speziale, Copywriter, Juniper Park\TBWA

Karen Blazer, Producer, Juniper Park\TBWA

Janice Bisson, Producer, Juniper Park\TBWA

Alison Boudreau, Producer, Juniper Park\TBWA

Nadya MacNeil, Producer, Juniper Park\TBWA

Adam Lang, VP Group Account Director, Juniper Park\TBWA

Calvin Daniels, Account Director, Juniper Park\TBWA

Michael Fritzlar, Account Director, Juniper Park\TBWA

Rimi Singh, Account Director, Juniper Park\TBWA

Christine Rowe, Account Director, Juniper Park\TBWA

Mark Dicks, Account Director, Juniper Park\TBWA

Milly Benko, Account Supervisor, Juniper Park\TBWA

Deanna Coates, Account Coordinator, Juniper Park\TBWA

Josh Hansen, Planning Director, Juniper Park\TBWA

Sara Nancoo, Digital Strategist, Juniper Park\TBWA

Sequoia, Radke & Sons and Daughters – Production House

MPC – NY & The Vanity – Animation Company

The Mill & Saints Editorial – Post House

Eggplant – Music/Audio House

Section I — CASE PARAMETERS

| Business Results Period (Consecutive Months): | January 2014 – June 2017 |

| Start of Advertising/Communication Effort: | January 2014 |

| Base Period as a Benchmark: | January – December 2013 |

| Geographic Area: | Canada |

| Budget for this effort: | Over $5 million |

Section IA — CASE OVERVIEW

Why should this case win in the category (ies) you have entered?

What do you do if you have a new product that is really good – but not one that delivers an appreciably better experience than your better-known competitors? In a world of increasingly substitutable products with truly marginal differences, this is a situation that faces us all more often than perhaps we would like.

At end of 2013, Nissan and its agency, Juniper Park\TBWA, faced just such a challenge with the new-model Rogue, Nissan’s entrant in the most fiercely-contested part of the Canadian market.

This is the story of how together they developed Conquer All Conditions, an advertising campaign that quickly became one of the best-known and best-loved car campaigns of recent years; we will argue that it is also one of the most successful.

It’s also the story of how that success has continued to this day and how its strategic foundations, built on a deep understanding of the Canadian psyche, have led the brand from a position of relative weakness to one of real strength in what is now by far the most important segment of the car market in the country.

Section II — THE CLIENT’s BUSINESS ISSUES/OPPORTUNITIES

a) Describe the Client’s business, competition and relevant history:

In 2013, Nissan – historically better known as a car manufacturer – was in danger of missing out on a major shift that had been happening in the Canadian car market. Over the preceding few years, Crossover Utility Vehicles (CUVs) had become the biggest sellers in Canada, primarily driven by consumers wanting more space and versatility.

Indeed, since the launch of the original Nissan Rogue in September 2007, the CUV segment had grown 32% by the time communications planning took place in the Spring of 2013 for the launch of the new Rogue in January 2014.[1]

Nissan Canada were well aware that their marketing focus had to switch urgently from cars to CUVs to ensure continued business success, but the company faced a number of challenges in its desire to become a real player:

- The segment was crowded with nearly 90 similar offerings;

- The Nissan All-Wheel Drive (AWD) system, while good, was no better than that of the main competition;

- The brand itself scored less well in research on the quality, durability and reliability that CUV buyers sought;

- Its biggest three competitors (Ford, Honda and Toyota) had twice as much to spend as Nissan in this category;

- Rogue – the company’s flagship CUV product – held a segment share of just 4.4% by April 2013 – a situation made worse by the fact that it was also headed in the wrong direction: its share the year before had been 5.3%.[2]

Getting Rogue back on track was utterly crucial to Nissan Canada’s future.

b) Describe the Client’s Business Issues/Opportunities to be addressed by the campaign:

In January 2014, Nissan Canada was launching a new Rogue. This was, of course, a big event but this model, while undeniably almost completely revamped, would have nothing to make it really stand out from the already well-established competition. Despite this, It would be the basis for Nissan’s attempt to grab a significantly larger share of the fast-growing CUV segment.

A true challenge.

An indication of the scale of the problem was that it significantly lagged key competitors such as the Ford Escape, Honda CR-V, Toyota RAV4, and Hyundai Santa Fe, not only in sales performance, but also basic intermediate brand ‘purchase funnel’ measures such as awareness and familiarity.[3]

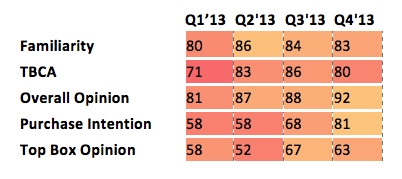

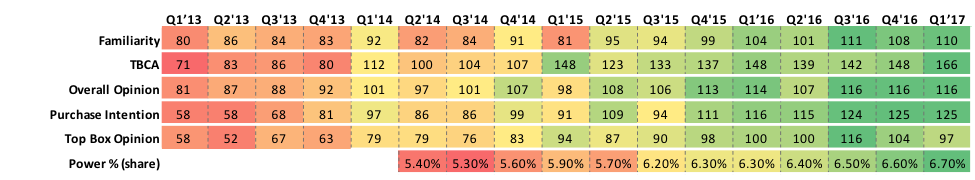

As the table below shows, none of the model’s key intermediate measures was in a good place in the year before the new Rogue was launched:

Table 1: Nissan Rogue key brand metrics, calendar 2013[4]

Simply put, Rogue was failing to get onto people’s radars and even when it did, it wasn’t standing out in any distinctive way.

Recent consumer research had, however, thrown up an intriguing finding: although in the real world Canadian CUV drivers rarely take their vehicles off-road, the perception of off-road capability had, somewhat paradoxically, become a key driver of purchase consideration.

Unfortunately for Nissan, previous globally-sourced advertising campaigns for Rogue had focused on the vehicle’s style and cargo space, rather than its off-road credentials, thus exacerbating its weak standing with potential buyers. Clearly an all-new, Canadian-specific campaign was needed, one that tackled this perception problem of Rogue’s poor off-road performance head-on.

c) Resulting Business Objectives: Include how these will be measured:

Nissan had an aggressive growth strategy for 2014 that hinged on the successful launch of the new Rogue. In particular, it depended on establishing it as the company’s #1 source of volume with annual unit sales averaging over 20,000 for its lifecycle. This was because Nissan’s ambitions stretched beyond the initial launch period and well into the future: despite the model’s less than stellar history in Canada, the company wanted to increase Rogue’s share of the small CUV segment dramatically, with a stretch share target of 8% in 2016.

Since Nissan’s share objective was a long-term one, it was also clearly important to build genuine demand by way of a real preference for the new Rogue, not just buy share using price discounts (a common tactic in the car market).

In sum, our business objectives for the new model were both clear and daunting.

[1] All sales and share numbers throughout the case are taken from the Polk sales and registrations database. All figures are volumes unless otherwise noted.

[2] Share figures refer respectively to the Nissan fiscal years ending March 2013 and March 2012.

[3] Tellingly, despite receiving consistent mass media advertising support since its launch, by the end of 2013, Rogue was the only one of Nissan’s core models that had an awareness score below its segment average.

[4] Awareness and attitude data sourced from Millward Brown’s Automotive Purchasing Dynamics (APD) survey. TBCA stands for Total Brand Communication Awareness. The darker the shade of red, the greater the competitive disadvantage.

Section III — YOUR STRATEGIC THINKING

a) What new learnings/insights did you uncover?

Our audience for the new campaign was a dual-income, suburban couple in their mid-30s who didn’t yet have children. They were self-reliant, open-minded, altruistic, and kept calm regardless of what life threw at them. They were – and are – the prime target for CUVs in Canada; their shift away from more traditional compact and mid-size cars to the versatility offered by CUVs has to a large degree driven the growth of the segment.

The research finding that was the starting point for our thinking was that Canadian CUV drivers purchase these vehicles specifically because of the AWD capability (despite, as we said earlier, almost never actually taking them off-road). It turns out that this is because it allows them to drive confidently in pretty much any adverse on-road conditions – including the often brutal Canadian winter – ensuring both their own safety and that of their passengers. Most interestingly – and this proved to be the pivotal insight – it instills in them a real sense of pride as they enjoy being relied upon when driving conditions are at their worst.

b) What was your Big Idea?

We would show Canadian drivers that they too could be winter heroes if they drove a Nissan Rogue.

And so the Conquer All Conditions campaign was born.

c) How did your Communication strategy evolve?

Recognizing the importance of establishing off-road credentials – and knowing that the campaign would run during the winter – we knew early on that the campaign would need to focus on winter driving. Although there are – famously – many aspects of winter that Canadians enjoy, when it comes to driving they have an essentially combative relationship with it.

Going deeper, we saw that when driving conditions become perilous, you’re only as strong as your vehicle. This is when Canadians turn to those vehicles that can be trusted to reach destinations safely, whether it’s work, dinner with friends, hockey practice or the hospital. When winter does its worst, our trust in a capable AWD vehicle provides us with great peace of mind – irrespective of whether we actually ever use its off-road capabilities.

We believed that a communications strategy built around this idea of ‘pride in the face of adversity’ would set us apart from our competitors who were all positioning their CUVs as versatile family vehicles, and communicating in a warm, folksy tone. In contrast, we deliberately chose to create work with a more aggressive, almost masculine tone to position the Nissan Rogue and its drivers as capable of taking on winter and winning.

d) How did you anticipate the communication would achieve the Business Objectives?

We needed to do two things for the launch of the new 2014 Rogue.

The first was to develop a creative approach that would stand out in a way that, to be honest, the car itself didn’t. This went beyond just being noticed in a crowded market: it was vital that we were truly distinctive.

The second was to create something that created a genuinely compelling emotional connection with Canadians drivers – whether or not they were in the market for a CUV in the immediate term. We wanted to achieve real long-term resonance in the market and make our substantial but smaller budget work as hard as it could.

(These imperatives have also informed all the subsequent executions in the campaign.)

Section IV — THE WORK

a) How, where and when did you execute it?

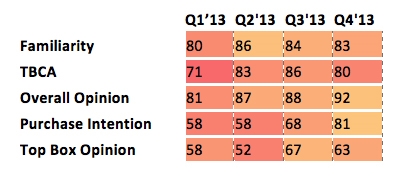

The first commercial, called ‘Winter Warrior’, launched in January 2014 and ran through March. It stood out from other automotive advertising as it deliberately set out to conjure the look and feel of a Hollywood superhero film. Winter was the villain – personified by sinister marauding snowmen in a snowy city streetscape threatening helpless civilians – vanquished by the hero Rogue and its drivers, who between them come to the rescue.

Media worked together to build a coherent, single-minded story focusing not only on Rogue itself, but also on the conflict with winter: behind-the-scenes interviews with the evil snowmen and the heroic driver were shared across social channels; the snowmen posed for photos at auto shows; and digital content was all tailored around the same message and look and feel as the primary broadcast execution.

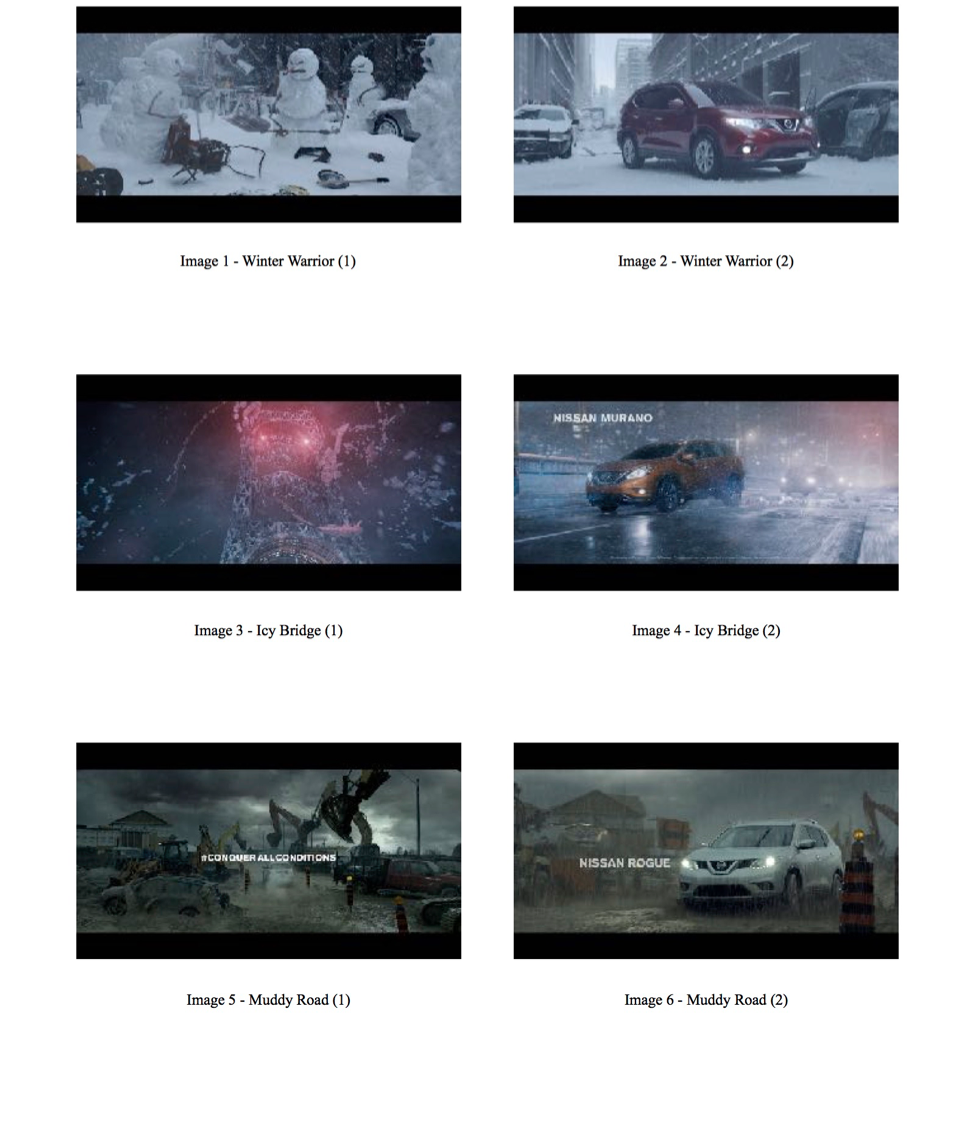

We repeated this approach in the three following winters; we just tended to start rather earlier (November as opposed to January). TV has always led the way, because of its high impact, emotional heft and unparalleled reach – often featuring programming that was ‘appointment to view’ thus giving us very high 1+ cover, such as The Super Bowl, the Grey Cup and major hockey games. Wrapped around this core, digital and social media were deployed in ways that evolved over the course of the campaign as new opportunities arose to engage our potential buyers via both established and emerging platforms.

As the campaign developed, we featured other models – and other hostile road conditions – alongside our Rogue flagship.

In 2014-15 we developed three more TV executions: ‘Icy Bridge’ (Murano), ‘Snowy Tree’ (Pathfinder) and ‘Muddy Road’ (Rogue). 2015-16 saw the arrival of ‘Rocky Road’ (Rogue) aimed at more temperate areas of the country. The most recent winter saw the ‘Return of the Snowmen’ (Rogue). In a sense, the hero was no longer just Rogue itself, but Nissan’s intuitive AWD system, which is fitted to all three models.[1]

c) Media Plan Summary

[1] This is why we have also included sales and share data for Murano and Pathfinder in the results section; although Rogue has had the lion’s share of the media support over the four winters, we believe that there was a clear halo effect on the other models – especially Murano, which is the other true CUV in the range.

Section V — THE RESULTS

a) How did the work impact attitudes and behaviour?

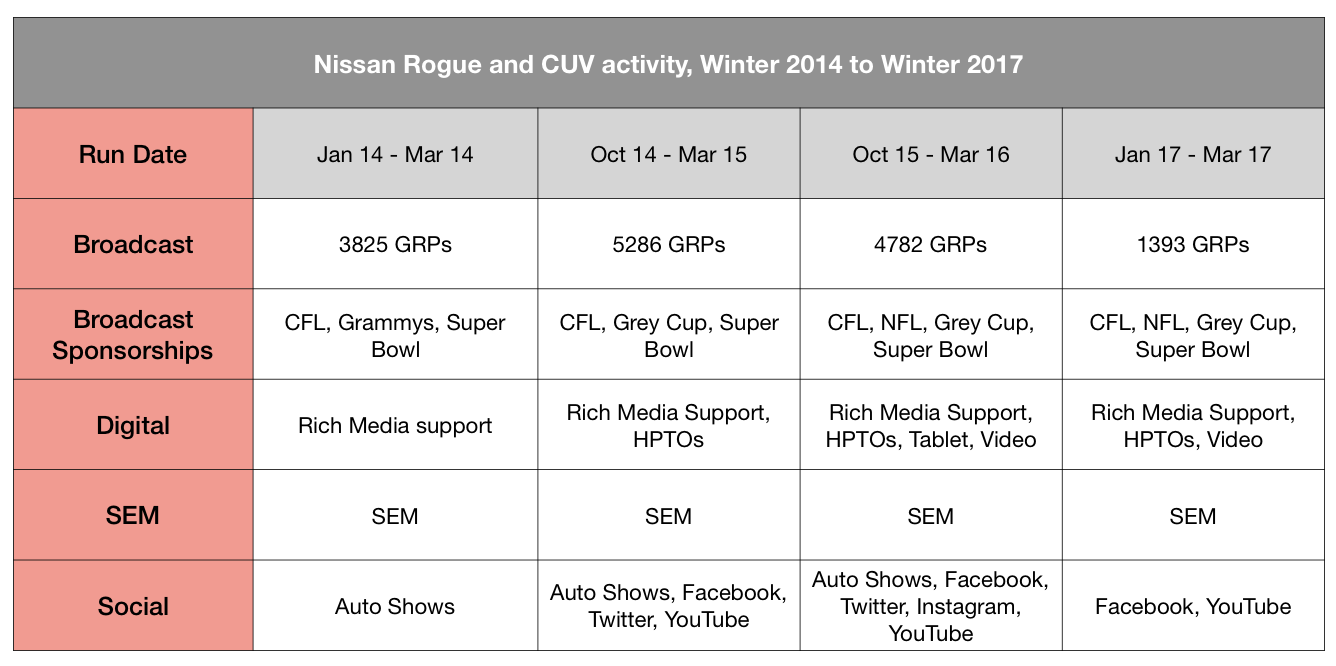

You will recall the Millward Brown brand metrics for Rogue in Table 1 and that they were uniformly red (bad) or orange (not much better).

The latest available APD figures show clear and continuous improvements across the board, suggesting that the advertising has played an effective and consistent role in increasing people’s perceptions of Rogue:

Table 2: Nissan Rogue key brand metrics, Q1 calendar 2013 to Q1 calendar 2017[1]

(We will see the efffects on behaviour in the following sections.)

b) What Business Results did the work achieve for the client?

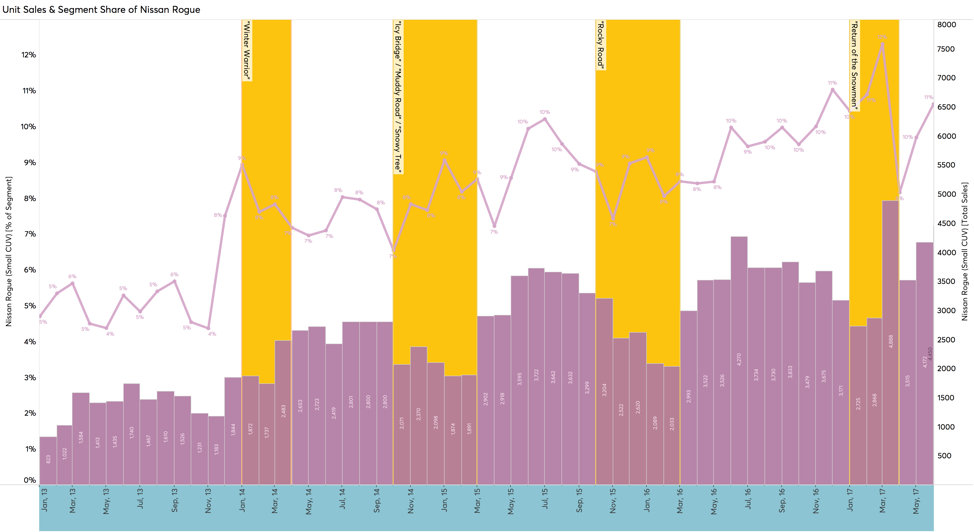

Given the business objectives referred to earlier, the key measure we were monitoring was of course Rogue’s market share.

The results have been little short of spectacular. (We are well aware that effectiveness cases often make assertions like this, but rarely is it as justified as here.)

When ‘Winter Warrior’ aired for the first time in January 2014, Rogue’s share leapt to an all-time monthly high of 8.9%.[2]

Gratifying as this was, this campaign was always about the longer term and establishing truly defensible brand equity – and we would argue that we succeeded in this.

In every single month of calendar 2014, Rogue broke its share record. As a result, its share for the year also set a record, ending at 7.6% – already well on the way to our 2016 target of 8%.

And as Table 3 above shows, share has continued to grow: to 8.8% in 2015 and 9.3% in 2016. In fact, there is little sign of this momentum abating: over the last twelve months, Rogue has set monthly share records in ten of them. And there are effects on other smaller-selling Nissan models we will see shortly.

c) Other Pertinent Results

- The ‘Winter Warrior’ campaign was picked up and used as the CUV campaign for the US – the first time this has ever happened to a Canadian-originated Nissan campaign. In addition, the latest commercial has aired in Japan and New Zealand.

- The campaign also played a large part in Nissan being recognized by the industry as the ‘Fastest-Growing Automotive Brand in Canada’.[3]

d) What was the campaign’s Return on Investment?

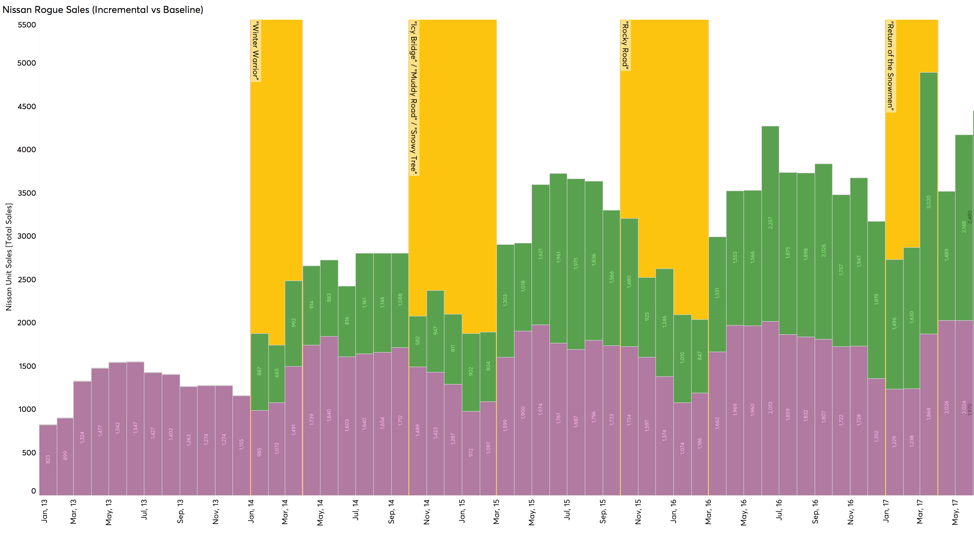

While no formal econometric modelling has been done, we believe that it is possible to estimate the incremental sales that have been generated since the campaign began.

Using the share that Rogue had in the twelve months prior to the campaign as a base level, we can impute the volume that it would have subsequently achieved, had the model not changed and the campaign not run. The difference between this imputed data and the actual sales achieved by Rogue is the incremental volume. As the chart below shows, the effect is dramatic:

Nissan expects a typical 15-20% uplift in sales when a new model launches. So far, on this calculation, we have achieved total incremental Rogue sales of 59,683 units, a 72% uplift on the imputed base volume figure (which already accounts for rapid segment growth) – a remarkable result.[4] In retail terms, this equates to approximately $1.7 billion in additional sales.[5] While Nissan does not disclose its margins, given the scale of the advertising budgets involved it is clear by any measure that this represents a very pleasing return on investment for the company.

[1] Millward Brown (APD) ibid. TBCA stands for Total Brand Communication Awareness. Brand Power is a proprietary measure of brand strength based on Meaningfulness, Differentiation and Strength. The darker the shade of green, the greater the competitive advantage.

[2] Full disclosure: Rogue sales in December 2013 were also up substantially. This was because – for obvious reasons – the new model was available for sale in showrooms ahead of the campaign launch. This high volume is partly due to suppressed demand with drivers of the old Rogue waiting for the new model to arrive so they can upgrade. What is striking is that in each December since, the figures (both volume and share) have been substantially higher than those of the previous year – despite the product being essentially unchanged since the campaign began.

[3] Based on full-line brands, MAT unit sales.

[4] For comparison, a 20% uplift on the imputed base would have been 16,578 units.

[5] 59,683 units @ $29,000 average per unit. Obviously, dealers and distribution costs take major chunks of this.

Section VI — Proof of Campaign Effectiveness

a) Illustrate the direct cause and effect between the campaign and the results

The chart below Rogue sales and segment share sets out the clear impact of the new campaign in graphic detail, impact that has clearly grown as time has gone on. In a world where more and more marketing activity seems to focus on the short-term, we are particularly pleased to have had such a positive effect on the brand and truly long-term success.

Our view is that the figures speak for themselves; the data just keep improving month by month and year by year.[1] Given that that the new vehicle a) wasn’t really innovative or different in the first place and b) has essentially stayed the same since its launch, one would expect demand to flatten off quickly when the initial novelty wore off. This clearly hasn’t happened.

While the effect is most noticeable for Rogue – unsurprising given that it has been the main focus of the marketing, both creatively and in media terms – the campaign also seems to have had a clearly positive effect on Murano, with a more subdued one on Pathfinder, which, strictly speaking, lies outside the CUV segment.[2]

Simply put, we believe we achieved what we originally set out to do: create truly sustainable brand distinctiveness and emotional resonance for the Nissan Rogue (and Nissan’s CUVs more broadly).

We did this by tapping into a truth deep in the Canadian psyche about driving in that most Canadian of seasons, the winter. We then brought this truth to light in a compelling set of stories that clearly caught the imagination of the public.

b) Prove the results were not driven by other factors

Campaign spend vs. history and competition:

Throughout the period under discussion, the budgets available to Nissan have been consistently smaller than those of its main competitors in this space, both generally and for this campaign in particular.

Pre-existing Brand momentum:

The whole premise for this campaign was that in its nearly seven years in Canada, Rogue had generated no real momentum. Bluntly, it was stuck in a rut. We believe that this campaign successfully addressed this.

Pricing:

Over the course of the period under discussion there were price fluctuations of the kind often seen in a fiercely competitive marketplace. Rogue was never the least expensive but nor was it the most expensive – we needed to be competitive, particularly with Ford, Honda, and Toyota.

Changes in Distribution/Availability:

There were no distribution changes of any significance during the period under discussion. Availability was good across the country.

Unusual Promotional Activity:

There were no unusual or overly generous promotions for Nissan CUVs during the period under discussion. (You will recall that one of the important factors behind our approach was to reduce the need for such things by making the brand’s emotional appeal more compelling.)

Any other factors:

In the car market, this would typically be the competitive launch of a completely new model or a major update of an existing one. Nothing like that happened in the period under discussion – though the Jeep Cherokee was launched in September 2013, which if anything made our job more challenging.

There were no other factors at play

[1] Which is not to say that Rogue’s share will climb forever – clearly that would be ridiculous. Indeed, the rate of increase is slowing (as you would expect in a competitive market) – but it is still going up.

[2] Murano and Pathfinder are classified in different segments, hence the higher share figures on lower volumes than Rogue. Murano did not feature in TV advertising until November 2014 (“Icy Bridge”). Likewise, Pathfinder (“Snowy Tree”) appeared in February 2015.